Mercado global de pneus e rodas OE para automóveis, por material das rodas (liga, fibra de carbono, aço, outros), tipo de veículo (veículos comerciais, veículos de passageiros), material dos pneus (borracha natural, borracha sintética), rácio de aspecto (70), Largura da secção (230 mm), Classe do veículo (veículos de luxo, veículos económicos, veículos de preço médio), Tamanho da roda ( 13-15 polegadas, 16-18 polegadas, 19 -21 polegadas, maior que 21 polegadas), país (EUA, Canadá, México, Brasil, Argentina, resto da América do Sul, Alemanha, Itália, Reino Unido, França, Espanha, Holanda, Bélgica, Suíça, Turquia, Rússia, resto da Europa , Japão, China, Índia, Coreia do Sul, Austrália, Singapura, Malásia, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico, Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África) Tendências da indústria e Previsão para 2028.

Análise e Insights do Mercado de Pneus e Jantes OE Automóvel: Mercado Global de Pneus e Jantes OE Automóvel

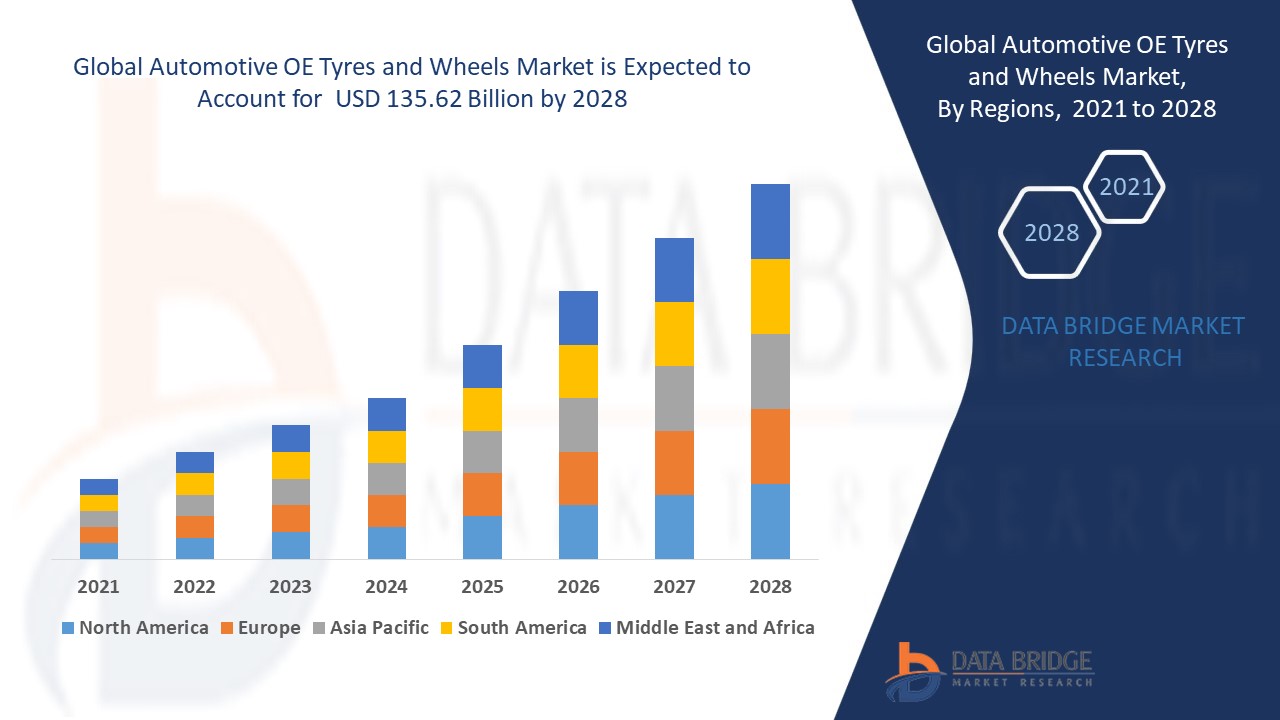

O mercado de pneus e rodas OE para automóveis atingirá um valor estimado de 135,62 mil milhões de dólares e crescerá a um CAGR de 3,25% no período previsto de 2021 a 2028. O crescente foco em inovações e avanços no mercado que exigem materiais leves é essencial fator que impulsiona o mercado de pneus e rodas automóveis OE.

Os pneus são estruturas de borracha que têm a forma de um anel e envolvem as rodas dos veículos. Estes pneus são responsáveis pela mobilidade do veículo e também ajudam a distribuir o peso do veículo dos eixos para o solo.

O aumento da produção e das vendas de automóveis em diferentes segmentos de veículos é um fator crucial que acelera o crescimento do mercado, aumenta também a concorrência entre os fabricantes de pneus, a crescente introdução de tecnologia avançada no processo de fabrico, o aumento dos custos de produção, a crescente disponibilidade de mão-de-obra económica e a redução das emissões e das normas de segurança, e o aumento das iniciativas governamentais para os IED são os principais fatores, entre outros, que impulsionam o mercado dos pneus e rodas automóveis OE. Além disso, as crescentes preocupações com a eficiência de combustível e a segurança, os crescentes avanços tecnológicos e a crescente modernização nas técnicas de produção, bem como o aumento das atividades de investigação e desenvolvimento no mercado criarão ainda mais novas oportunidades para o mercado de pneus e rodas originais automóveis no período de previsão acima mencionado.

No entanto, os preços voláteis das matérias-primas e o crescente desenvolvimento no mercado dos pneus recauchutados são os principais fatores, entre outros, que restringem o crescimento do mercado e desafiarão ainda mais o mercado dos pneus e jantes originais para automóveis no período de previsão mencionado acima.

Este relatório de mercado de pneus e jantes OE para automóveis fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado da categoria, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de pneus e rodas automóveis OE, contacte a Data Bridge Market Research para um briefing de analista.

Âmbito e dimensão do mercado de pneus e rodas originais automotivos

O mercado de pneus e rodas originais para automóveis é segmentado com base no material da roda, tipo de veículo, material do pneu, rácio, largura de seleção, classe do veículo e tamanho da roda. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no material das rodas, o mercado dos pneus e rodas automóveis originais está segmentado em liga leve, fibra de carbono , aço e outros.

- Com base no tipo de veículo, o mercado de pneus e rodas originais para automóveis está segmentado em veículos comerciais e veículos de passageiros.

- Com base no material do pneu, o mercado de pneus e rodas originais para automóveis está segmentado em borracha natural e borracha sintética.

- Com base na proporção, o mercado de pneus e rodas automóveis OE está segmentado em <60, 60-70 e >70.

- Com base na largura de seleção, o mercado de pneus e rodas originais para automóveis está segmentado em 200, 200-230 e >230 mm.

- Com base na classe do veículo, o mercado de pneus e rodas originais para automóveis está segmentado em veículos de luxo, veículos económicos e veículos de preço médio.

- O mercado de pneus e jantes OE para automóveis também está segmentado com base no tamanho das jantes em 13-15 polegadas, 16-18 polegadas e 19-21 polegadas e maiores que 21 polegadas.

Análise do âmbito do mercado de pneus e jantes originais para automóveis a nível de país

O mercado de pneus e rodas automóveis OE é analisado e o tamanho do mercado, as informações de volume são fornecidas por país, material das rodas, tipo de veículo, material dos pneus, proporção, largura de seleção, classe do veículo e tamanho das rodas, conforme acima referenciado.

Os países abrangidos pelo relatório de mercado de pneus e jantes OE para automóveis são os EUA, Canadá e México na América do Norte, Brasil, Argentina e resto da América do Sul como parte da América do Sul, Alemanha, Itália, Reino Unido, França, Espanha , Países Baixos, Bélgica, Suíça, Turquia, Rússia, Resto da Europa na Europa, Japão, China, Índia, Coreia do Sul, Austrália, Singapura, Malásia, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia- Pacífico (APAC), Arábia Saudita, Emirados Árabes Unidos, África do Sul, Egito, Israel, Resto do Médio Oriente e África (MEA) como parte do Médio Oriente e África (MEA).

A Ásia-Pacífico domina o mercado de pneus e rodas automóveis originais devido ao aumento do consumo doméstico, ao aumento da concorrência entre os fabricantes de pneus e à crescente introdução de tecnologia avançada no processo de fabrico nesta região. A Europa é a região esperada em termos de crescimento no mercado de pneus e rodas automóveis originais devido ao aumento da produção e vendas automóveis em diferentes segmentos de veículos nesta região.

A secção de países do relatório sobre o mercado de pneus e jantes originais para automóveis também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de pneus e rodas originais para automóveis

O panorama competitivo do mercado de pneus e rodas originais para automóveis fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença regional, pontos fortes e fracos da empresa, lançamento de produtos, amplitude e abrangência do produto , domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de pneus e jantes originais para automóveis.

Os principais participantes abrangidos pelo relatório de mercado de pneus e jantes OE para automóveis são a IOCHPE, Bridgestone Corporation, Superior Industries International, Inc., Apollo Tyres, MICHELIN, CITIC LIMITED, Steel Strips Wheels Limited, Hitachi Metals, Ltd., The Goodyear Tyres & Rubber Company , Wanfeng Group Co., Ltd., MANGELS, Rodas Accuride, Continental AG, RONAL GROUP, thyssenkrupp AG, TOPY INDUSTRIES LIMITED, Sumitomo Rubber Industries, Ltd., Pirelli & CSpA, ZC-RUBBER, THE YOKOHAMA RUBBER CO., LTD. , CST, MRF, TOYO TIRE & RUBBER CO., LTD. e Nokian Tyres plc, entre outros participantes nacionais e globais. Os dados de quota de mercado estão disponíveis para todo o mundo, América do Norte, Europa, Ásia-Pacífico (APAC), Médio Oriente e África (MEA) e América do Sul em separado. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.