Global Accounts Receivable Automation Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.30 Billion

USD

11.35 Billion

2024

2032

USD

4.30 Billion

USD

11.35 Billion

2024

2032

| 2025 –2032 | |

| USD 4.30 Billion | |

| USD 11.35 Billion | |

|

|

|

|

Segmentação do mercado global de automação de contas a receber, por componente (soluções, serviços), modo de implantação (local, nuvem), tamanho da organização (pequenas e médias empresas, grandes empresas), usuário final (BFSI, TI e telecomunicações, manufatura, saúde, outros) - tendências do setor e previsão até 2032

Tamanho do mercado global de automação de contas a receber

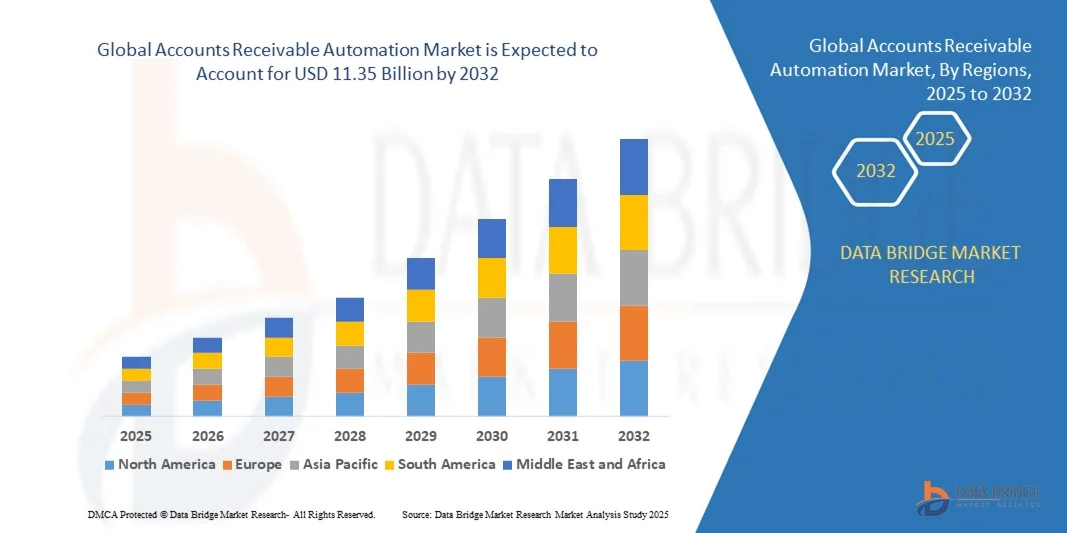

- O tamanho do mercado global de automação de contas a receber foi avaliado em US$ 4,30 bilhões em 2024 e deve atingir US$ 11,35 bilhões até 2032, crescendo a um CAGR de 12,90% durante o período previsto.

- A expansão do mercado é impulsionada pela crescente necessidade de operações financeiras simplificadas e melhor gestão do fluxo de caixa em empresas de todos os tamanhos, apoiadas por iniciativas de automação e transformação digital

- Além disso, a crescente demanda por acesso a dados em tempo real, redução de erros e processamento mais rápido de faturas está impulsionando a adoção de ferramentas de automação de contas a receber, o que está impulsionando significativamente o crescimento do mercado.

Análise do mercado global de automação de contas a receber

- O mercado global de automação de contas a receber está se tornando uma parte essencial das operações financeiras para empresas no mundo todo, oferecendo processamento automatizado de faturas, rastreamento de pagamentos e aplicação de dinheiro para aumentar a precisão, eficiência e visibilidade em tempo real dos recebíveis.

- A crescente adoção de soluções baseadas em nuvem, análises baseadas em IA e recursos de aprendizado de máquina está impulsionando a demanda por automação de contas a receber, à medida que as organizações buscam reduzir erros manuais, acelerar o fluxo de caixa e melhorar a gestão geral do capital de giro.

- A América do Norte liderou o mercado de automação de contas a receber com a maior participação de receita de 31,5% em 2024, apoiada pela adoção antecipada de tecnologias de automação, uma forte presença de fornecedores de software e a alta demanda por transformação digital entre empresas, especialmente nos EUA e Canadá.

- A Ásia-Pacífico deverá ser a região de crescimento mais rápido durante o período previsto, impulsionada pela rápida digitalização em todos os setores, pela expansão dos setores de PMEs e pelo aumento dos investimentos em infraestrutura de tecnologia financeira.

- O segmento de soluções dominou o mercado com a maior participação de receita de 73,7% em 2024, impulsionado principalmente por empresas que buscam ferramentas de automação que lidam com faturamento, cobranças, gerenciamento de crédito e resolução de disputas

Escopo do relatório e segmentação do mercado global de automação de contas a receber

|

Atributos |

Principais insights de mercado sobre automação de contas a receber |

|

Segmentos abrangidos |

|

|

Países abrangidos |

América do Norte

Europa

Ásia-Pacífico

Oriente Médio e África

Ámérica do Sul

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado global de automação de contas a receber

Eficiência aprimorada por meio de IA e automação inteligente de processos

- Uma tendência significativa e crescente no mercado global de automação de contas a receber é a crescente integração de inteligência artificial (IA) e automação inteligente de processos (IPA) em fluxos de trabalho de contas a receber. Essa fusão de tecnologias avançadas está transformando a gestão tradicional de recebíveis, aumentando a eficiência operacional, reduzindo a intervenção manual e melhorando a visibilidade do fluxo de caixa.

- Por exemplo, plataformas líderes em automação de RA, como HighRadius e YayPay, estão utilizando análises preditivas baseadas em IA para prever o comportamento de pagamento dos clientes, permitindo que as equipes financeiras gerenciem proativamente o risco de crédito e otimizem as estratégias de cobrança. Da mesma forma, a BlackLine utiliza IA para automatizar a conciliação de faturas e pagamentos, reduzindo significativamente o tempo de reconciliação.

- A integração de IA em soluções de contas a receber possibilita recursos como entrega automatizada de faturas com base nas preferências do cliente, assistência para resolução de disputas em tempo real e priorização inteligente de atividades de cobrança com base no risco e na probabilidade de pagamento. Por exemplo, algumas plataformas utilizam processamento de linguagem natural (PLN) para analisar as comunicações com os clientes e sinalizar possíveis atrasos nos pagamentos.

- A automação inteligente de processos simplifica ainda mais tarefas repetitivas, como entrada de dados, geração de faturas e lembretes de pagamento. Por meio de bots de RPA (Automação Robótica de Processos), as empresas podem automatizar processos de AR de ponta a ponta, permitindo que as equipes financeiras se concentrem em tarefas de maior valor, como planejamento estratégico e gestão de relacionamento com o cliente.

- A integração perfeita de ferramentas de automação de RA com sistemas de planejamento de recursos empresariais (ERP) e plataformas de gestão de relacionamento com o cliente (CRM) proporciona uma visão financeira centralizada e unificada. Esse ecossistema interconectado permite a colaboração em tempo real entre as equipes de finanças, vendas e operações, aprimorando a tomada de decisões e a experiência do cliente.

- Essa tendência em direção a sistemas de RA mais inteligentes, automatizados e integrados está remodelando fundamentalmente a forma como as organizações gerenciam o fluxo de caixa e o capital de giro. Como resultado, os fornecedores estão desenvolvendo soluções de automação de RA com foco em IA, que oferecem recursos como IA conversacional para interações com clientes, fluxos de trabalho de cobrança automatizados e pontuação de crédito dinâmica com base em análises de dados em tempo real.

- A demanda por ferramentas de automação de contas a receber com tecnologia de IA está se expandindo rapidamente em todos os setores e regiões, principalmente porque as empresas buscam melhorar a liquidez, reduzir o período de recebimentos (DSO) e obter uma vantagem competitiva por meio de maior agilidade financeira.

Dinâmica do mercado global de automação de contas a receber

Motorista

Necessidade crescente devido à demanda por eficiência operacional e transformação digital

-

A crescente pressão sobre as empresas para otimizar o capital de giro, reduzir a carga de trabalho manual e acelerar os ciclos de fluxo de caixa é um dos principais impulsionadores da demanda por soluções de automação de contas a receber (AR). À medida que as organizações enfrentam a incerteza econômica e a liquidez cada vez menor, processos eficientes de AR estão se tornando essenciais para sustentar as operações comerciais.

- Por exemplo, em março de 2024, a Billtrust lançou uma solução de aplicação de caixa aprimorada por IA, voltada para empresas de médio porte, permitindo correspondência de faturas mais rápida e processamento de pagamentos em tempo real. Esses desenvolvimentos destacam como as empresas estão inovando ativamente para lidar com as ineficiências operacionais dos sistemas tradicionais de AR.

- À medida que as equipes financeiras abandonam processos obsoletos e baseados em planilhas, as ferramentas de automação de RA oferecem recursos como faturamento automatizado, rastreamento de pagamentos em tempo real e fluxos de trabalho de cobrança inteligentes. Essas ferramentas ajudam a reduzir o prazo médio de recebimentos (DSO), diminuir o risco de inadimplência e aumentar a satisfação do cliente por meio de uma resolução mais rápida de disputas.

- Além disso, a onda mais ampla de transformação digital em todos os setores — incluindo manufatura, saúde, varejo e logística — está impulsionando o investimento em automação de back-office. À medida que os sistemas de ERP e CRM migram cada vez mais para a nuvem, a integração com plataformas de automação de RA se torna mais fácil e impactante, permitindo operações financeiras unificadas e orientadas por dados.

- O aumento do trabalho remoto e híbrido também acelerou a necessidade de soluções de RA baseadas em nuvem que permitam às equipes financeiras colaborar, monitorar recebíveis e gerenciar interações com clientes com segurança, de qualquer lugar. Essa flexibilidade se tornou um requisito fundamental para os departamentos financeiros modernos que buscam permanecer ágeis e resilientes em um ambiente de negócios dinâmico.

Restrição/Desafio

Preocupações com a segurança de dados, complexidades de integração e altos custos de implementação

- Apesar dos muitos benefícios da automação de RA, vários desafios continuam a restringir a adoção mais ampla — principalmente preocupações com a segurança dos dados, a complexidade da integração de sistemas e o custo inicial da implementação. Essas questões podem impactar particularmente pequenas e médias empresas (PMEs) com infraestrutura ou orçamento de TI limitados.

- Por exemplo, o uso crescente de plataformas de RA baseadas em nuvem gera receios em relação à privacidade de dados, especialmente em setores com requisitos de conformidade rigorosos, como finanças, saúde e jurídico. A preocupação com a exposição de dados confidenciais de clientes e pagamentos a possíveis violações ou acesso não autorizado pode fazer com que as empresas hesitem em migrar de sistemas legados.

- Desafios de integração também surgem ao conectar ferramentas de automação de RA com diversas plataformas de ERP legadas, especialmente em organizações com estruturas descentralizadas ou multientidades. Integrações personalizadas geralmente exigem tempo e conhecimento técnico consideráveis, resultando em ciclos de implementação mais longos e custos mais elevados.

- Além disso, embora as soluções de automação possam gerar ROI a longo prazo, o investimento inicial em licenças de software, personalização, treinamento e gestão de mudanças pode ser substancial, especialmente para empresas que operam com margens reduzidas ou em mercados emergentes. Essa barreira de custo pode atrasar ou impedir a adoção, apesar do forte interesse na modernização de processos.

- Superar esses desafios exigirá que os fornecedores de automação de RA ofereçam modelos de preços mais flexíveis, recursos robustos de segurança cibernética (como criptografia, autenticação multifator e certificações de conformidade) e simplifiquem a integração por meio de soluções plug-and-play baseadas em API. Iniciativas de educação lideradas pelos fornecedores sobre ROI e segurança também desempenharão um papel crucial no aumento das taxas de adoção.

Escopo do mercado global de automação de contas a receber

O mercado de automação de contas a receber é segmentado com base em componentes, implantação, tamanho da organização e usuário final.

- Por componente

Com base nos componentes, o mercado global de automação de contas a receber é segmentado em soluções e serviços. O segmento de soluções dominou o mercado, com a maior participação na receita, de 73,7% em 2024, impulsionado principalmente por empresas que buscam ferramentas de automação que lidam com faturamento, cobranças, gestão de crédito e resolução de disputas. Essas plataformas ajudam a otimizar as operações, reduzir o DSO (dias de vendas pendentes) e aprimorar a gestão geral do capital de giro. Os recursos de integração com sistemas ERP e análises em tempo real tornaram essas soluções altamente valiosas para grandes e médias empresas que buscam eficiência operacional e transparência financeira.

O segmento de serviços deverá apresentar o CAGR mais rápido entre 2025 e 2032, devido à crescente demanda por implementação, consultoria e serviços gerenciados. À medida que as empresas adotam ferramentas de automação de RA, elas dependem cada vez mais de fornecedores para integração, personalização de sistemas e suporte técnico. Serviços que facilitam a implantação contínua e proporcionam otimização contínua estão se tornando essenciais para o ROI a longo prazo.

- Por modo de implantação

Com base no modo de implantação, o mercado global de automação de contas a receber é segmentado em on-premises e na nuvem. O segmento de nuvem detinha a maior participação de mercado, de 64,3% em 2024, impulsionado por uma mudança em direção à transformação digital das finanças e pela crescente preferência por soluções financeiras baseadas em SaaS. A implantação na nuvem oferece infraestrutura escalável, atualizações automáticas e acessibilidade remota — recursos particularmente importantes para organizações que operam em ambientes de trabalho distribuídos ou híbridos. As plataformas baseadas na nuvem também aprimoram a colaboração e a visibilidade em tempo real entre os departamentos, tornando-as ideais para empresas com ritmo acelerado.

O segmento de nuvem também deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente adoção por PMEs e pela eficiência de custos. Embora alguns setores tradicionais ainda favoreçam modelos locais para controle de dados e conformidade com a segurança, a tendência está claramente mudando para soluções em nuvem devido à facilidade de integração, à redução da carga de TI e à melhoria dos recursos de recuperação de desastres.

- Por tamanho da organização

Com base no porte da organização, o mercado global de automação de contas a receber é segmentado em pequenas e médias empresas (PMEs) e grandes empresas. O segmento de grandes empresas dominou o mercado, com uma participação de 57,6% na receita em 2024, atribuída às suas operações complexas, grande base de clientes e maior volume de faturas. Essas organizações exigem ferramentas de automação robustas com recursos avançados, como pontuação dinâmica de risco de crédito, fluxos de trabalho de cobrança com tecnologia de IA e previsão de caixa em tempo real. Grandes empresas também são pioneiras na adoção de sistemas financeiros integrados e se beneficiam de soluções de RA com escala global.

O segmento de PMEs deverá crescer com a CAGR mais rápida entre 2025 e 2032, à medida que a automação se torna mais acessível por meio de ofertas acessíveis e baseadas em nuvem. As PMEs buscam cada vez mais maneiras de reduzir erros manuais, melhorar a eficiência das cobranças e aumentar a visibilidade do fluxo de caixa. Os fornecedores estão respondendo a isso oferecendo modelos de assinatura fáceis de usar que minimizam os custos iniciais e oferecem opções de implantação rápida, adaptadas a operações menores.

- Por usuário final

Com base no usuário final, o mercado global de automação de contas a receber é segmentado em BFSI (Instituto de Automação de Contas a Receber), TI e Telecom, Manufatura, Saúde e outros. O setor de BFSI detinha a maior participação de mercado, 31,4% em 2024, impulsionado pela necessidade do setor por cobranças pontuais, gestão de riscos e conformidade regulatória. Instituições financeiras utilizam ferramentas de automação de RA para agilizar transações de alto volume, monitorar pagamentos em atraso e automatizar a comunicação com clientes. A capacidade de integração com as principais plataformas bancárias e contábeis torna a automação de RA essencial para a resiliência operacional no setor de BFSI.

Espera-se que o segmento de saúde cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado pela transformação digital do faturamento de saúde e da gestão de contas de pacientes. A automação na área da saúde agiliza as solicitações de seguro, reduz a sobrecarga administrativa e melhora a gestão do ciclo de receita. À medida que os provedores buscam minimizar atrasos nos pagamentos e melhorar o engajamento financeiro dos pacientes, ferramentas de RA que oferecem automação inteligente e integração com sistemas de informação de saúde estão se tornando cada vez mais essenciais.

Análise regional do mercado global de automação de contas a receber

- A América do Norte dominou o mercado global de automação de contas a receber com a maior participação de receita de 31,5% em 2024, impulsionada por iniciativas generalizadas de transformação digital e forte demanda por automação de processos financeiros em todos os setores.

- As organizações da região priorizam eficiência, visibilidade financeira em tempo real e gerenciamento simplificado do fluxo de caixa, o que acelerou a adoção de ferramentas avançadas de automação de RA integradas com IA, aprendizado de máquina e sistemas ERP baseados em nuvem.

- O domínio da região é ainda apoiado por uma infraestrutura de TI madura, adoção antecipada de tecnologias de nuvem e uma alta concentração de grandes empresas e fintechs. Além disso, os requisitos de conformidade regulatória e a necessidade de trilhas de auditoria robustas têm incentivado empresas de setores como BFSI, saúde e manufatura a investir em automação de contas a receber, consolidando a posição da América do Norte como líder global neste mercado.

Participação no mercado global de automação de contas a receber

O setor de automação de contas a receber é liderado principalmente por empresas bem estabelecidas, incluindo:

- Oracle (EUA)

- SAP SE (Alemanha)

- Workday, Inc. (EUA)

- Bottomline Technologies (DE), Inc. (EUA)

- Comarch SA (Polônia)

- HighRadius (EUA)

- FinancialForce (EUA)

- Esker (França)

- Emagia Corporation (EUA)

- YayPay Inc. (EUA)

- VersaPay Corporation (Canadá)

- KOFAX, Inc. (EUA)

- Torque de escritório (EUA)

- Swiss Post Solutions Inc. (Suíça)

- API Outsourcing Inc (EUA)

- Coleta a qualquer momento (EUA)

- numberz (EUA)

- Soluções OnPay (EUA)

- Qvalia AB (Suécia)

- MYOB Technology Pty Ltd (Austrália)

Quais são os desenvolvimentos recentes no mercado global de automação de contas a receber?

- Em maio de 2023, a SAP SE, líder global em software de aplicativos empresariais, lançou uma atualização significativa em sua solução SAP S/4HANA Finance, introduzindo recursos aprimorados de automação de contas a receber, impulsionados por inteligência artificial. Os novos recursos incluem análise preditiva de comportamentos de pagamento, fluxos de trabalho automatizados para resolução de disputas e perfil de risco do cliente em tempo real. Essa inovação reforça o compromisso da SAP em otimizar as operações financeiras e permitir que as empresas alcancem cobranças mais rápidas, redução de DSO e maior visibilidade do fluxo de caixa em todos os setores.

- Em março de 2023, a HighRadius Corporation, fornecedora líder de software de finanças autônomas, anunciou a expansão de seu Accounts Receivable Suite com tecnologia de IA, com novas ferramentas focadas em previsão de caixa e pontuação de crédito dinâmica. Esses recursos permitem que as organizações avaliem o risco de crédito em tempo real e gerenciem os recebíveis de forma proativa. A atualização reflete o foco da HighRadius em impulsionar a automação inteligente e fornecer insights financeiros estratégicos para grandes e médias empresas.

- Em fevereiro de 2023, a Oracle Corporation introduziu funcionalidades avançadas de aprendizado de máquina em seu Oracle Fusion Cloud ERP para aprimorar os recursos de automação de contas a receber. A atualização inclui correspondência inteligente de pagamentos, segmentação de clientes para cobranças e campanhas automatizadas de cobrança por e-mail. Essas inovações visam reduzir a intervenção manual e melhorar a precisão e a velocidade dos processos de contas a receber. O investimento contínuo da Oracle em ferramentas de automação financeira demonstra sua visão de otimizar as operações de back-office e apoiar uma gestão financeira ágil.

- Em janeiro de 2023, a Billtrust, provedora de soluções B2B de pagamento por ordem, anunciou uma parceria estratégica com a Visa para permitir pagamentos B2B automatizados por meio de soluções integradas de RA. A colaboração visa acelerar a adoção de pagamentos digitais entre clientes corporativos, reduzindo o uso de cheques em papel e melhorando a precisão dos dados de remessa. Essa iniciativa está alinhada à missão da Billtrust de digitalizar e automatizar todo o ciclo de vida da RA, oferecendo aos clientes opções de processamento de pagamentos seguras, escaláveis e rápidas.

- Em dezembro de 2022, a Quadient, líder global em comunicação com clientes e automação de contas a receber (RA), lançou uma versão atualizada de sua plataforma YayPay, com painéis aprimorados, insights do cliente em tempo real e integrações expandidas com ERP. A nova versão permite que as equipes financeiras gerenciem melhor os fluxos de trabalho, acompanhem faturas antigas e aprimorem a colaboração com os clientes. A atualização reflete o investimento contínuo da Quadient na melhoria da experiência do usuário, transparência operacional e otimização do fluxo de caixa para PMEs e grandes empresas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.