Mercado de moagem húmida da Europa por equipamento (equipamento de moagem, equipamento de maceração, sistema de centrifugação, sistema de lavagem e filtragem, outros), tamanho do processamento (processamento de linha média, processamento de linha grande), fonte (milho, trigo , mandioca, batata, outros), Produto final (amido, adoçante, etanol, farinha de glúten de milho e ração com glúten, óleo de milho, licor de maceração de milho, proteínas, outros), aplicação (ração, alimentação, água de maceração, processamento de óleo, fermentação/bioprocessamento, tratamento de resíduos, moinho, refinaria , Produção de Etanol, Modificação de Amido, Outros) – Tendências e Previsão da Indústria até 2029

Análise e dimensão do mercado de moagem húmida na Europa

A produção de ração com glúten de milho húmido aumentou nos últimos anos, enquanto outros subprodutos diminuíram, de acordo com o US Census Bureau. De 2007 a 2009, a produção média mensal de farinha de glúten foi de 165 milhões de libras. As refinarias de milho fabricam uma variedade de produtos alimentares, incluindo farinha de glúten de milho, farinha de gérmen de milho e ração húmida de glúten de milho.

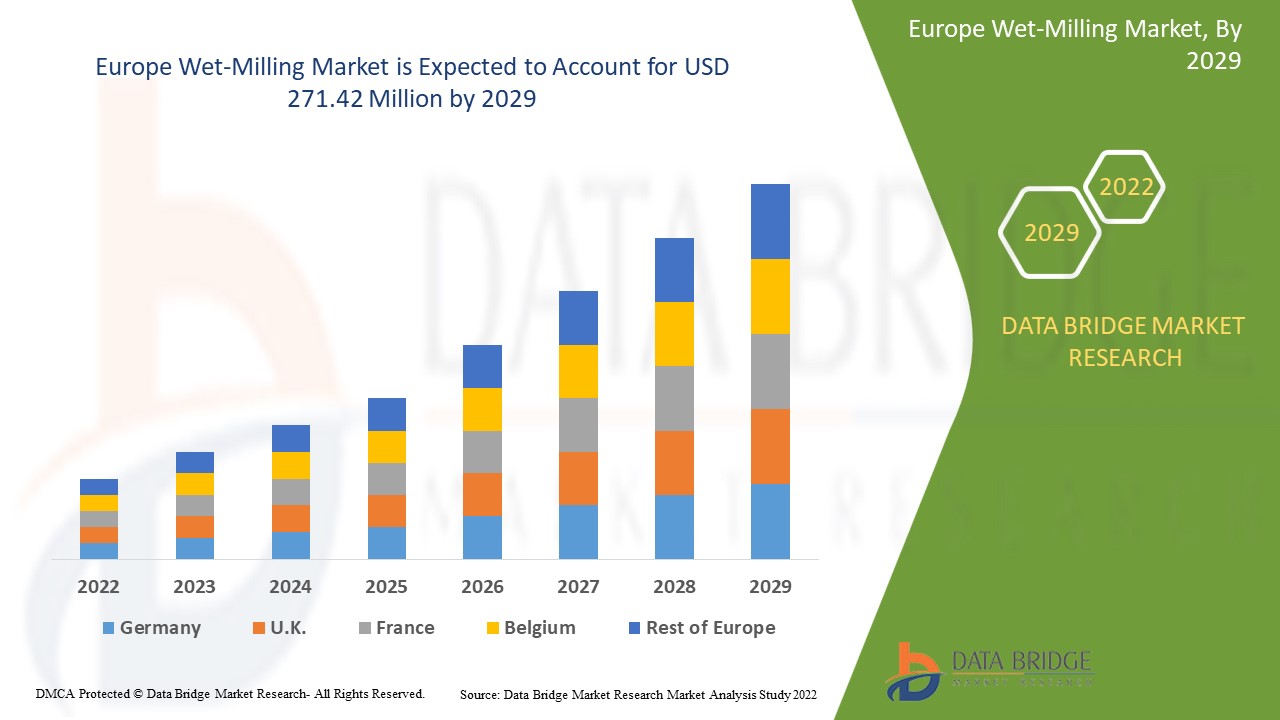

A Data Bridge Market Research analisa que o mercado de moagem húmida cresceu a um valor de 266,39 milhões em 2021 e deverá atingir o valor de 271,42 milhões de dólares até 2029, a um CAGR de 0,234% durante o período previsto de 2022 a 2029. . O relatório de mercado elaborado pela equipa de estudos de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção, análise de patentes e comportamento do consumidor.

Definição de Mercado

A moagem húmida é uma cadeia de processos dispendiosa, mas eficiente, na qual materiais como o milho e o trigo são embebidos para atingir o objetivo de amolecer o grão e segregar todos os componentes dessa fonte, de modo a que a utilização máxima de todos os componentes possa ser obtido. . No caso do milho, por exemplo, o processo de moagem húmida produz amido de milho, óleo de milho, glicose e uma variedade de outros componentes. A moagem húmida é uma parte importante de muitas indústrias, incluindo a farmacêutica, a alimentação e bebidas, a beleza e a cosmética, entre outras, porque fornece ingredientes como o amido e a proteína.

Âmbito e segmentação do mercado de moagem húmida na Europa

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2014 - 2019) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Equipamento (Equipamento de moagem, Equipamento de maceração, Sistema de centrifugação, Sistema de lavagem e filtragem e outros), Tamanho do processamento (processamento de linha média e processamento de linha grande), Fonte (milho, trigo, mandioca, batata e outros) , Produto final (amido , Adoçante, Etanol, Farelo de Glúten de Milho e Ração com Glúten, Óleo de Milho, Licor de Infusão de Milho, Proteínas e Outros), Aplicação (Ração, Alimentos, Água de Infusão, Processamento de Óleo, Fermentação /Bioprocessamento, Tratamento de Resíduos, Moinho, Refinaria, Produção de Etanol, Modificação de amido, outros) |

|

Países abrangidos |

Alemanha, Reino Unido, Itália, França, Espanha, Suíça, Países Baixos, Bélgica, Rússia, Dinamarca, Suécia, Polónia, Turquia, Resto da Europa |

|

Atores do mercado abrangidos |

Tate & Lyle PLC (Reino Unido), ADM (EUA), Cargill, Incorporated (EUA), Ingredion Incorporated (EUA), Agrana Beteiligungs-AG (Áustria), The Roquette Freres (França). Bunge Limited (EUA), China Agri-Industries Holding Limited (China), Global Bio-Chem Technology Group Company Limited (Hong Kong) e Grain Processing Corporation (EUA) |

|

Oportunidades |

|

Dinâmica do mercado de moagem húmida

Motoristas

- Elevada procura por xaropes ricos em frutose na indústria alimentar e de bebidas

O aumento da procura de xaropes de milho ricos em frutose na indústria de bebidas carbonatadas , devido ao seu teor de 55% de frutose, torna-o mais doce do que a sacarose e resulta em menores custos de fabrico para os fabricantes. Uma vez que os xaropes de milho com alto teor de frutose são o principal produto produzido no processo de moagem húmida, espera-se que um aumento da procura impulsione o mercado de moagem húmida de milho num futuro próximo. Independentemente da crise económica na Europa, prevê-se que a indústria europeia de bebidas cresça significativamente. O aumento das vendas de bebidas prontas a beber, que incluem bebidas gaseificadas e lácteas, chá, sumos de fruta e bebidas alcoólicas, como cerveja, sidras e bebidas maltadas, é o principal impulsionador do aumento da procura de xaropes de milho rico em frutose.

- Crescente importância da moagem húmida nas indústrias de rações para animais

Outros factores que deverão impulsionar o crescimento do mercado de moagem húmida de milho na Europa incluem o aumento da procura de etanol de milho, produtos de moagem húmida ricos em fibras digestíveis, aminoácidos e energia, proteínas, cisteína e metionina. A crescente procura de biocombustíveis beneficiará a indústria de moagem húmida e aumentará a procura de moagem húmida.

Oportunidade

Além disso, a crescente procura de carne e produtos cárneos nas regiões em crescimento proporcionará oportunidades de crescimento lucrativas para o mercado nos próximos anos. Além disso, a tendência europeia de consumo de dietas com proteína animal contribuirá para o crescimento do mercado.

Restrições

No entanto, controlos regulamentares governamentais rigorosos sobre a saúde e segurança, bem como padrões de qualidade crescentes, podem prejudicar o crescimento do mercado de moagem húmida de milho. Além disso, o custo de manutenção e assistência técnica do equipamento de moagem húmida é elevado. Como resultado, o mercado de moagem húmida é limitado.

Este relatório de mercado de moagem húmida fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado . Para mais informações sobre o mercado de moagem húmida, contacte a Data Bridge Market Research para obter um briefing de analista.

Impacto da COVID-19 no mercado da moagem húmida

Vários países impuseram bloqueios rigorosos para conter a infecção, resultando no encerramento de unidades de processamento de alimentos e bebidas e na interrupção da cadeia de abastecimento de alimentos e bebidas durante um período limitado. A escassez de produtos de F&B e de artigos essenciais, o pânico de compras por parte dos consumidores de todo o mundo, a perturbação das cadeias de abastecimento devido a restrições de viagens e a escassez de mão-de-obra impactaram significativamente a cadeia de abastecimento de F&B. As principais empresas de fabrico de robôs de todo o mundo reportaram um declínio na geração de receitas durante o primeiro e segundo trimestres de 2020 devido à queda das vendas causada pela desaceleração económica causada pelas restrições de bloqueio e quarentena impostas pelos governos de todo o mundo, bem como uma queda temporária na procura de automação.

Desenvolvimento recente

- A Tate & Lyle PLC (Tate & Lyle), fornecedor líder europeu de ingredientes e soluções para alimentos e bebidas, duplicou a capacidade da sua linha de produção de Maltodextrina MALTOSWEET não-OGM em Boleraz, Eslováquia, em outubro de 2019. A Maltodextrina MALTOSWEET é uma maltodextrina de elevado valor nutricional. Isto aumenta a capacidade de produção para satisfazer a crescente procura.

- Em janeiro de 2019, a ADM lançou uma nova linha de produtos denominada Amidos de Tapioca, que expandiu o portefólio de produtos da empresa e lhe permitirá satisfazer melhor as necessidades dos seus clientes no mercado europeu.

- A Tate & Lyle lançou a linha CLARIAEVERLAST® de amidos Clean Label em fevereiro de 2020, que prolonga a vida útil do produto e ainda preserva a qualidade dos alimentos em condições extremas de armazenamento. Isto alarga o seu portfólio de produtos, o que alarga as suas ofertas ao consumidor.

Âmbito do mercado de moagem húmida na Europa

O mercado da moagem húmida é segmentado com base no equipamento, tamanho do processamento, origem, produto final e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Equipamento

- Equipamento de moagem

- Equipamento de imersão

- Sistema de centrifugação

- Sistema de lavagem e filtragem

- Outros

Aplicação

- Alimentar

- Comida

- Água íngreme

- Processamento de óleo

- Fermentação/Bioprocessamento

- Tratamento de Resíduos

- Moinho

- Refinaria

- Produção de Etanol

- Modificação do amido

- Outros

Tamanho do processamento

- Processamento de linha média

- Processamento de linha grande

Fonte

- Milho

- Trigo

- Mandioca

- Batata

- Outros

Utilizador final

- Amido

- Adoçante

- Etanol

- Farinha de glúten de milho e ração sem glúten

- Óleo de milho

- Licor de infusão de milho

- Proteínas

- Outros

Análise/Insights regionais do mercado de moagem húmida

O mercado da moagem húmida é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, equipamento, tamanho do processamento, fonte, produto final e aplicação, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado da moagem húmida são a Alemanha, o Reino Unido, a Itália, a França, a Espanha, a Suíça, os Países Baixos, a Bélgica, a Rússia, a Dinamarca, a Suécia, a Polónia, a Turquia e o Resto da Europa.

A Alemanha tem um mercado de moagem húmida próspero devido à crescente procura de moagem húmida na indústria alimentar. À medida que as pessoas se tornam mais conscientes dos avanços tecnológicos, que resultaram num aumento dos produtos e subprodutos de moagem húmida na Alemanha e nos Países Baixos, os Países Baixos estão a crescer no mercado europeu de moagem húmida.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado da moagem húmida

O cenário competitivo do mercado de moagem húmida fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Europa, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e amplitude do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de moagem húmida.

Alguns dos principais participantes que operam no mercado da moagem húmida são:

- Tate & Lyle PLC (Reino Unido)

- ADM (EUA)

- Cargill, Incorporated (EUA)

- Ingredion Incorporated (EUA)

- Agrana Beteiligungs-AG (Áustria)

- Roquette Freres (França)

- Bunge Limited (EUA)

- China Agri-Industries Holding Limited (China)

- Global Bio-Chem Technology Group Company Limited (Hong Kong)

- Grain Processing Corporation (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WET-MILLING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 EQUIPMENT TIMELINE CURVE

2.1 MARKET APPLICATION COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 GROWING MULTI-FUNCTIONALITY OF starch in food and feed applications

5.1.2 risingdemand for fruit sugars in food & beverage industry

5.1.3 Technological advancement in the milling equipment

5.2 RESTRAINTS

5.2.1 HIGH CAPITAL INVESTMENT

5.2.2 lack of skilled labours in developing and underdeveloped countries

5.3 OPPORTUNITIES

5.3.1 INCREASED DEMAND FOR BIOFUEL

5.3.2 Scope of strategic development in the developing regions

5.3.3 Integrated Solutions for wet-milling process

5.4 CHALLENGES

5.4.1 Stringent government regulations

5.4.2 Market disruption by domestic players

6 IMPACT OF COVID-19

6.1 SUPPLY SIDE IMPACT:

6.2 DEMAND SIDE IMPACT:

7 EUROPE WET-MILLING MARKET, BY EQUIPMENT

7.1 OVERVIEW

7.2 MILLING EQUIPMENT

7.3 STEEPING EQUIPMENT

7.4 CENTRIFUGE SYSTEM

7.5 WASHING & FILTRATION SYSTEM

7.6 OTHERS

8 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE

8.1 OVERVIEW

8.2 LARGE LINE PROCESSING

8.3 MEDIUM LINE PROCESSING

9 EUROPE WET-MILLING MARKET, BY SOURCE

9.1 OVERVIEW

9.2 CORN

9.2.1 Dent Corn

9.2.2 Waxy Corn

9.3 WHEAT

9.4 CASSAVA

9.5 POTATO

9.6 OTHERS

10 EUROPE WET-MILLING MARKET, BY END-PRODUCT

10.1 OVERVIEW

10.2 STARCH

10.3 SWEETENER

10.4 ETHANOL

10.5 CORN GLUTEN MEAL& GLUTEN FEED

10.6 CORN OIL

10.7 CORN STEEP LIQUOR

10.8 PROTEINS

10.9 OTHERS

11 EUROPE WET-MILLING MARKET, BY APPLICATION

11.1 OVERVIEW

11.2 FEED

11.3 FOOD

11.4 STEEP WATER

11.5 OIL PROCESSING

11.6 FERMENTATION/BIOPROCESSING

11.7 WASTE TREATMENT

11.8 MILL

11.9 REFINERY

11.1 ETHANOL PRODUCTION

11.11 STARCH MODIFICATION

11.12 OTHERS

12 EUROPE WET-MILLING MARKET, BY REGION

12.1 EUROPE

12.1.1 gERMANY

12.1.2 U.K.

12.1.3 ITALY

12.1.4 france

12.1.5 SPAIN

12.1.6 SWITZERLAND

12.1.7 NETHERLANDS

12.1.8 BELGIUM

12.1.9 RUSSIA

12.1.10 DENMARK

12.1.11 SWEDEN

12.1.12 POLAND

12.1.13 TURKEY

12.1.14 REST OF EUROPE

13 EUROPE WET-MILLING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE WET-MILLING STARCH EQUIPMENT MANUFACTURERS

15.1 GEA GROUP AKTIENGESELLSCHAFT

15.1.1 COMPANY snapshot

15.1.2 Company share analysis

15.1.3 REVENUE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 recent DEVELOPMENT

15.2 ALFA LAVAL

15.2.1 COMPANY snapshot

15.2.2 Company share analysis

15.2.3 REVENUE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 recent DEVELOPMENT

15.3 BÜHLER AG

15.3.1 COMPANY snapshot

15.3.2 Company share analysis

15.3.3 REVENUE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 recent DEVELOPMENT

15.4 ANDRITZ

15.4.1 COMPANY snapshot

15.4.2 Company share analysis

15.4.3 REVENUE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 recent DEVELOPMENTS

15.5 HANNINGFIELD PROCESS SYSTEMS LTD

15.5.1 COMPANY snapshot

15.5.2 PRODUCT PORTFOLIO

15.5.3 recent DEVELOPMENT

15.6 HENAN YONGHAN MACHINERY EQUIPMENT CO., LTD.

15.6.1 COMPANY snapshot

15.6.2 PRODUCT PORTFOLIO

15.6.3 recent DEVELOPMENT

15.7 INGETECSA

15.7.1 COMPANY snapshot

15.7.2 PRODUCT PORTFOLIO

15.7.3 recent DEVELOPMENT

15.8 THAI GERMAN PROCESSING CO., LTD.

15.8.1 COMPANY snapshot

15.8.2 PRODUCT PORTFOLIO

15.8.3 recent DEVELOPMENT

15.9 NETZSCH-FEINMAHLTECHNIK GMBH

15.9.1 COMPANY snapshot

15.9.2 PRODUCT PORTFOLIO

15.9.3 recent DEVELOPMENTs

15.1 UNIVERSAL ENGINEERS

15.10.1 COMPANY snapshot

15.10.2 PRODUCT PORTFOLIO

15.10.3 recent DEVELOPMENT

15.11 WILLY A. BACHOFEN AG

15.11.1 COMPANY snapshot

15.11.2 PRODUCT PORTFOLIO

15.11.3 recent DEVELOPMENT

16 COMPANY PROFILE WET-MILLING STARCH MANUFACTURERS

16.1 ADM

16.1.1 COMPANY SNAPSHOT

16.1.2 Revenue Analysis

16.1.3 product PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 AGRANA BETEILIGUNGS-AG

16.2.1 COMPANY SNAPSHOT

16.2.2 Revenue Analysis

16.2.3 product PORTFOLIO

16.2.4 RECENT DEVELOPMENT

16.3 CARGILL, INCORPORATED.

16.3.1 COMPANY SNAPSHOT

16.3.2 product PORTFOLIO

16.3.3 RECENT DEVELOPMENTs

16.4 EUROPE BIO-CHEM TECHNOLOGY GROUP COMPANY LIMITED.

16.4.1 COMPANY SNAPSHOT

16.4.2 Revenue Analysis

16.4.3 product PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 GRAIN PROCESSING CORPORATION

16.5.1 COMPANY SNAPSHOT

16.5.2 product PORTFOLIO

16.5.3 RECENT DEVELOPMENT

16.6 INGREDION INCORPORATED

16.6.1 COMPANY SNAPSHOT

16.6.2 Revenue analysis

16.6.3 product PORTFOLIO

16.6.4 RECENT DEVELOPMENTs

16.7 ROQUETTE FRÈRES

16.7.1 COMPANY SNAPSHOT

16.7.2 Product portfolio

16.7.3 RECENT DEVELOPMENT

16.8 TATE & LYLE

16.8.1 COMPANY SNAPSHOT

16.8.2 Revenue Analysis

16.8.3 Product portfolio

16.8.4 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

LIST OF TABLES

TABLE 1 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 2 EUROPE MILLING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 3 EUROPE STEEPING EQUIPMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 4 EUROPE CENTRIFUGE SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 5 EUROPE WASHING & FILTRATION SYSTEM IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 6 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 7 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 8 EUROPE LARGE LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 9 EUROPE MEDIUM LINE PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 10 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 11 EUROPE CORN IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 12 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 13 EUROPE WHEAT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 14 EUROPE CASSAVA IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 15 EUROPE POTATO IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 17 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 18 EUROPE STARCH IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 19 EUROPE SWEETENER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 20 EUROPE ETHANOL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 21 EUROPE CORN GLUTEN MEAL & CORN GLUTEN FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 22 EUROPE CORN OIL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 23 EUROPE CORN STEEP LIQUOR IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 24 EUROPE PROTEINS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 25 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 26 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 27 EUROPE FEED IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 28 EUROPE FOOD IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 29 EUROPE STEEP WATER IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 30 EUROPE OIL PROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 31 EUROPE FERMENTATION/BIOPROCESSING IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 32 EUROPE WASTE TREATMENT IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 33 EUROPE MILL IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 34 EUROPE REFINERY IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 35 EUROPE ETHANOL PRODUCTION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 36 EUROPE STARCH MODIFICATION IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 37 EUROPE OTHERS IN WET-MILLING MARKET, BY REGION, 2018-2027 (USD MILLION)

TABLE 38 EUROPE WET-MILLING MARKET, BY COUNTRY, 2018-2027 (USD MILLION)

TABLE 39 EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 40 EUROPE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 41 EUROPE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 42 EUROPE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 43 EUROPE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 44 EUROPE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 45 GERMANY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 46 GERMANY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 47 GERMANY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 48 GERMANY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 49 GERMANY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 50 GERMANY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 51 U.K. WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 52 U.K. WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 53 U.K. WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 54 U.K. CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 55 U.K. WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 56 U.K. WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 57 ITALY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 58 ITALY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 59 ITALY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 60 ITALY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 61 ITALY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 62 ITALY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 63 FRANCE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 64 FRANCE WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 65 FRANCE WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 66 FRANCE CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 67 FRANCE WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 68 FRANCE WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 69 SPAIN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 70 SPAIN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 71 SPAIN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 72 SPAIN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 73 SPAIN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 74 SPAIN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 75 SWITZERLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 76 SWITZERLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 77 SWITZERLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 78 SWITZERLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 79 SWITZERLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 80 SWITZERLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 81 NETHERLANDS WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 82 NETHERLANDS WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 83 NETHERLANDS WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 84 NETHERLANDS CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 85 NETHERLANDS WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 86 NETHERLANDS WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 87 BELGIUM WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 88 BELGIUM WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 89 BELGIUM WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 90 BELGIUM CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 91 BELGIUM WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 92 BELGIUM WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 93 RUSSIA WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 94 RUSSIA WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 95 RUSSIA WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 96 RUSSIA CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 97 RUSSIA WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 98 RUSSIA WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 99 DENMARK WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 100 DENMARK WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 101 DENMARK WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 102 DENMARK CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 103 DENMARK WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 104 DENMARK WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 105 SWEDEN WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 106 SWEDEN WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 107 SWEDEN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 108 SWEDEN CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 109 SWEDEN WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 110 SWEDEN WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 111 POLAND WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 112 POLAND WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 113 POLAND WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 114 POLAND CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 115 POLAND WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 116 POLAND WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 117 TURKEY WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

TABLE 118 TURKEY WET-MILLING MARKET, BY PROCESSING SIZE, 2018-2027 (USD MILLION)

TABLE 119 TURKEY WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 120 TURKEY CORN IN WET-MILLING MARKET, BY SOURCE, 2018-2027 (USD MILLION)

TABLE 121 TURKEY WET-MILLING MARKET, BY END-PRODUCT, 2018-2027 (USD MILLION)

TABLE 122 TURKEY WET-MILLING MARKET, BY APPLICATION, 2018-2027 (USD MILLION)

TABLE 123 REST OF EUROPE WET-MILLING MARKET, BY EQUIPMENT, 2018-2027 (USD MILLION)

Lista de Figura

LIST OF FIGURES

FIGURE 1 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 2 EUROPE WET-MILLING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WET-MILLING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE WET-MILLING MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE WET-MILLING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WET-MILLING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE WET-MILLING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE WET-MILLING MARKET: DBMR VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE WET-MILLING MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 EUROPE WET-MILLING MARKET: SEGMENTATION

FIGURE 11 THE GROWING MULTI-FUNCTIONALITY OF STARCH IN FOOD AND FEED APPLICATIONS AND THE RISING DEMAND FOR FRUIT SUGARS IN FOOD & BEVERAGE INDUSTRY ARE EXPECTED TO DRIVE THE EUROPE WET-MILLING MARKET IN THE FORECAST PERIOD OF 2020 TO 2027

FIGURE 12 MILLING EQUIPMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE WET-MILLING MARKET IN 2020 & 2027

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE WET-MILLING MARKET

FIGURE 14 EUROPE WET-MILLING MARKET: BY EQUIPMENT, 2019

FIGURE 15 EUROPE WET-MILLING MARKET: BY PROCESSING SIZE, 2019

FIGURE 16 EUROPE WET-MILLING MARKET: BY SOURCE, 2019

FIGURE 17 EUROPE WET-MILLING MARKET: BY END-PRODUCT, 2019

FIGURE 18 EUROPE WET-MILLING MARKET: BY APPLICATION, 2019

FIGURE 19 EUROPE WET-MILLING MARKET: SNAPSHOT (2019)

FIGURE 20 EUROPE WET-MILLING MARKET: BY COUNTRY (2019)

FIGURE 21 EUROPE WET-MILLING MARKET: BY COUNTRY (2020 & 2027)

FIGURE 22 EUROPE WET-MILLING MARKET: BY COUNTRY (2019 & 2027)

FIGURE 23 EUROPE WET-MILLING MARKET: BY EQUIPMENT (2020-2027)

FIGURE 24 EUROPE WET-MILLING MARKET: COMPANY SHARE 2019 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.