Europe Weight Loss And Obesity Management Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4,487.80 Million

USD

9,103.10 Million

2021

2029

USD

4,487.80 Million

USD

9,103.10 Million

2021

2029

| 2022 –2029 | |

| USD 4,487.80 Million | |

| USD 9,103.10 Million | |

|

|

|

|

Mercado europeu de perda de peso e gestão da obesidade, por tipo de produto (suplementos alimentares e substitutos de refeições), forma de produto (géis moles, comprimidos, cápsulas, pós, gomas e geleias, pré-misturas, líquidos e outros), natureza (rótulo convencional e limpo) , categoria (prescrito e de venda livre (OTC)), demografia do utilizador final (menores de 18 anos, 18 a 35 anos, 35 a 50 anos e acima de 50 anos), canal de distribuição ( com base em lojas e não armazenadas), país (Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Turquia, Bélgica, Holanda, Suíça e resto da Europa) Tendências e previsões da indústria para 2029.

Análise de mercado e insights : Mercado europeu de perda de peso e gestão da obesidade

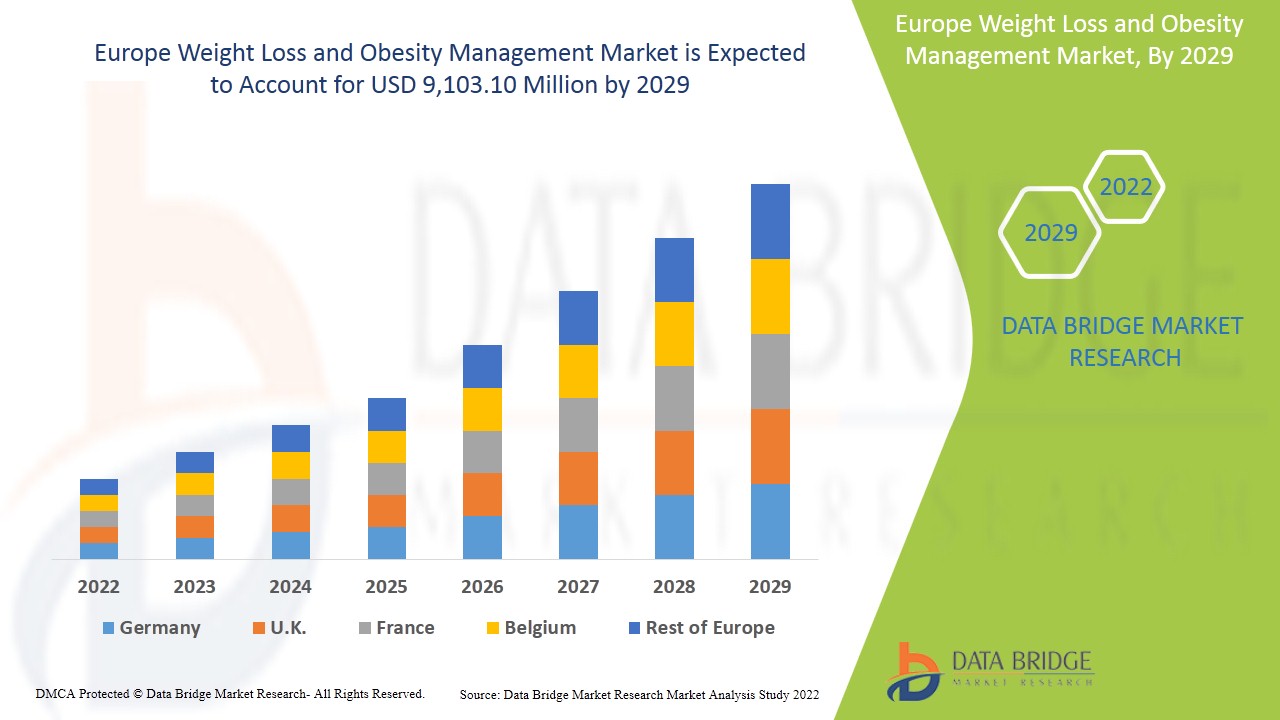

O mercado europeu deverá crescer no período de previsão de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 9,3% no período de previsão de 2022 a 2029 e deverá atingir os 9.103 dólares ,10 milhões até 2029 a partir de 4.487,80 milhões de dólares em 2021. Aumento da procura de bebidas não alcoólicas, incluindo sumos de fruta e bebidas energéticas, impulsionando assim o crescimento do mercado europeu de perda de peso e gestão da obesidade.

A obesidade impacta a saúde de um indivíduo de diversas formas, podendo aumentar os riscos de doenças crónicas diminuindo a esperança de vida dos indivíduos. Diversas dietas, dispositivos e medicamentos são utilizados com a finalidade de controlar ou reduzir o peso em indivíduos obesos nestes programas de maneio. É medido pelo Índice de Massa Corporal (IMC). Vários métodos usados para o controlo da perda de peso e obesidade são medicamentos, suplementos dietéticos , cirurgia para perda de peso e exercício. De acordo com informação da Organização Mundial de Saúde (OMS), quando o Índice de Massa Corporal é superior/igual a 25, a pessoa é categorizada como tendo excesso de peso e o Índice de Massa Corporal (IMC) acima de 30 é classificado como obeso.

Espera-se que o aumento do número de casos de obesidade entre a população da Europa impulsione o crescimento do mercado de perda de peso e gestão da obesidade. Espera-se que o aumento da prevalência de doenças crónicas, como a hipertensão e a diabetes, causado pelo aumento da adoção de padrões de estilo de vida pouco saudáveis e sedentários e pelo aumento do número de cirurgias bariátricas, acelere o crescimento do mercado de perda de peso e gestão da obesidade.

- Além disso, o aumento da preferência por junk food, a inatividade física, a rotina agitada e o stress crescente estão a fazer com que as pessoas consumam fast food, o que influenciará ainda mais o crescimento do mercado de perda de peso e gestão da obesidade. Além disso, a crescente adoção de programas de perda e controlo de peso online, as iniciativas governamentais para criar consciência e o aumento do rendimento disponível nas economias em desenvolvimento afetarão positivamente o crescimento do mercado de perda de peso e gestão da obesidade. Além disso, o aumento da taxa de obesidade infantil e as nações emergentes estendem oportunidades lucrativas ao mercado da perda de peso e da gestão da obesidade.

O relatório do mercado europeu de perda de peso e gestão da obesidade fornece detalhes da quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, o impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, mudanças nas regulamentações de mercado, aprovações de produtos, estratégias decisões, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado europeu de perda de peso e gestão da obesidade, contacte a Data Bridge Market Research para obter um resumo dos analistas; a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a meta desejada.

Âmbito do mercado europeu de perda de peso e gestão da obesidade e tamanho do mercado

O mercado europeu de perda de peso e gestão da obesidade está segmentado em seis segmentos notáveis com base no tipo de produto, forma do produto, natureza, categoria, demografia do utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de produto, o mercado europeu de perda de peso e gestão da obesidade está segmentado em suplementos alimentares e substitutos de refeição. Em 2022, prevê-se que o segmento dos suplementos alimentares domine o mercado devido ao aumento da população obesa, aumentando a consciencialização dos consumidores em relação aos alimentos e bebidas de baixas calorias nas economias em desenvolvimento.

- Com base na forma do produto, o mercado europeu de perda de peso e gestão da obesidade está segmentado em géis moles, comprimidos, cápsulas, pós, gomas e geleias, pré-misturas, líquidos, entre outros. Em 2022, prevê-se que o segmento do pó domine o mercado devido à natureza fácil de utilizar da forma em pó em comparação com outras formas de perda de peso e controlo da obesidade.

- Com base na natureza, o mercado europeu de perda de peso e gestão da obesidade está segmentado em rótulos convencionais e limpos. Em 2022, prevê-se que o segmento convencional domine o mercado devido à crescente procura de produtos biológicos cultivados naturalmente.

- Com base na categoria, o mercado europeu de perda de peso e controlo da obesidade está segmentado em prescrito e de venda livre (OTC). Em 2022, prevê-se que o segmento Over the Counter (OTC) domine o mercado devido à crescente popularidade dos OTC para a perda de peso e controlo da obesidade.

- Com base no utilizador final, o mercado europeu de perda de peso e gestão da obesidade está segmentado em menores de 18 anos, 18 a 35 anos, 35 a 50 anos e maiores de 50 anos. Em 2022, prevê-se que o segmento dos 18 aos 35 anos domine o mercado devido ao aumento da taxa de obesidade infantil.

- Com base no canal de distribuição, o mercado europeu de perda de peso e gestão da obesidade está segmentado em lojas e não armazenadas. Em 2022, prevê-se que o segmento não armazenado domine o mercado devido à pandemia emergente de COVID-19.

- Com base na geografia, o mercado de perda de peso e gestão da obesidade está segmentado em grandes países como Alemanha, Reino Unido, Itália, França, Espanha, Noruega, Suíça, Holanda, Bélgica, Rússia, Turquia, resto da Europa. Em 2022, prevê-se que a Alemanha domine o mercado devido ao aumento do rendimento disponível, juntamente com a mudança de estilo de vida devido à rápida urbanização.

Análise a nível de país do mercado europeu de perda de peso e gestão da obesidade

O mercado europeu de perda de peso e gestão da obesidade está segmentado em seis segmentos notáveis com base no tipo de produto, forma do produto, natureza, categoria, demografia do utilizador final e canal de distribuição.

Os países abrangidos no relatório do mercado europeu de perda de peso e gestão da obesidade são a Alemanha, França, Reino Unido, Itália, Espanha, Rússia, Turquia, Bélgica, Países Baixos, Suíça e Resto da Europa.

A Alemanha lidera o crescimento do mercado europeu, e o segmento do tipo de produto está a dominar neste país no período de previsão de 2022 a 2029 devido à crescente procura de agente espessante de ágar em produtos de panificação e confeitaria.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas europeias e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados ao mesmo tempo que fornecem uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais players do mercado para aumentar a consciencialização sobre a perda de peso e a gestão da obesidade está a impulsionar o crescimento do mercado europeu de perda de peso e gestão da obesidade

O mercado europeu de perda de peso e controlo da obesidade também fornece uma análise de mercado detalhada para o crescimento de cada país num mercado específico. Além disso, fornece informação detalhada sobre a estratégia dos intervenientes no mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2011 a 2020.

Cenário competitivo e análise da quota de mercado de gestão da obesidade e perda de peso na Europa

O panorama competitivo do mercado europeu de perda de peso e gestão da obesidade fornece detalhes do concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura do produto, e amplitude, domínio de aplicação, curva de segurança tecnológica. Os dados acima estão apenas relacionados com o foco da empresa no mercado europeu de perda de peso e controlo da obesidade.

Alguns dos principais players que operam no mercado europeu de perda de peso e gestão da obesidade são a Herbalife International of America, Inc., ABH Pharma Inc., Vitaco, Amway Corp., Stepan Company, GNC Holdings, LLC, GlaxoSmithKline plc., Glanbia PLC, Abbott, Shaklee Corporation, Nu Skin Enterprises, Atlantic Multipower UK Ltd., Nature’s Sunshine Products, Inc., Ajinomoto Co., Inc., Bionova, DSM, American Health, Omega Protein Corporation, Integrated BioPharma, Inc., Bio- Tech Pharmacal , The Himalaya Drug Company, Pharmavite, Ricola, BLACKMORES, entre outros.

Os analistas DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos lançamentos de produtos são também iniciados por empresas de todo o mundo, o que também acelera o mercado europeu de perda de peso e gestão da obesidade.

Por exemplo,

- Em julho de 2021, de acordo com a Cision US Inc., a Body Complete Rx (BCRX) lançou a sua linha TRIM, os seus suplementos veganos exclusivos para o controlo do peso à base de plantas na The Vitamin Shoppe. O suplemento oferece benefícios como melhorar a energia, a nutrição e ajuda no controlo do peso

- Em outubro de 2020, de acordo com a GlobeNewswire, Inc., a Meticore lançou um novo suplemento para emagrecer para homens e mulheres. O suplemento auxilia no aumento do metabolismo, uma vez que auxilia no aumento da temperatura das células internas, o que resulta na regeneração do metabolismo. A fórmula é feita com a ajuda de seis nutrientes vegetais e extratos de ervas de qualidade superior, juntamente com comprimidos Meticore.

A colaboração, o lançamento de produtos, a expansão do negócio, a atribuição de prémios e o reconhecimento, as joint ventures e outras estratégias do player de mercado aumentam a presença da empresa no mercado europeu de perda de peso e gestão da obesidade, o que também beneficia o crescimento do lucro da organização .

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 COMPARATIVE ANALYSIS (HERBAL SUPPLEMENTS VS SYNTHETIC SUPPLEMENTS)

4.2 PRICING ANALYSIS FOR WEIGHT LOSS & OBESITY MANAGEMENT SUPPLEMENTS-

4.3 VALUE CHAIN FOR EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

4.4 SUPPLY CHAIN OF EUROPE WEIGHT LOSS & OBESITY MANAGEMENT MARKET

4.5 BRAND COMPARATIVE ANALYSIS

4.6 CLEAN LABELED PRODUCT LAUNCHES

4.7 CONSUMER TRENDS

4.8 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- GROWTH STRATEGIES ADOPTED BY KEY PLAYERS

4.9 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- INDUSTRY TRENDS AND FUTURE PERSPECTIVES

5 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET- REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING RATES IN CHRONIC DISEASES

6.1.2 INCREASING PREVALENCE OF OBESITY

6.1.3 INCREASE IN GERIATRIC POPULATION

6.1.4 INCREASING BARIATRIC SURGERIES

6.2 RESTRAINTS

6.2.1 STRINGENT RULES & REGULATIONS

6.2.2 HIGH COST ASSOCIATED WITH THE LOW-CALORIE DIETS

6.3 OPPORTUNITIES

6.3.1 RISING DISPOSABLE INCOME ENHANCING THE PURCHASING POWER OF RELATED WEIGHT LOSS PRODUCTS

6.3.2 GROWING CONSUMPTION OF PROCESSED FOOD

6.3.3 RISE IN STRATEGIC INITIATIVES BY MARKET PLAYERS

6.4 CHALLENGES

6.4.1 LACK OF AWARENESS IN LOWER INCOME COUNTRIES

6.4.2 INCREASE IN PRODUCT RECALL

7 IMPACT OF COVID-19 ON THE EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

7.1 AFTERMATH OF COVID-19

7.2 IMPACT ON DEMAND AND SUPPLY CHAIN

7.3 IMPACT ON PRICE

7.4 CONCLUSION

8 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE

8.1 OVERVIEW

8.2 DIETARY SUPPLEMENTS

8.2.1 SUPPLEMENT TYPE

8.2.1.1 Herbal/Natural

8.2.1.2 Synthetic

8.2.2 ACTIVE INGREDIENT TYPE

8.2.2.1 Green Tea Extract

8.2.2.2 Chitosan

8.2.2.3 Pyruvate

8.2.2.4 Probiotics

8.2.2.5 Conjugated Linoleic Acid

8.2.2.6 Green Coffee Bean Extract

8.2.2.7 Caffeine

8.2.2.8 Chromium

8.2.2.9 Bitter Orange (Citrus Aurantium L.)

8.2.2.10 Carnitine

8.2.2.11 African Mango (Irvingia Gabonensis)

8.2.2.12 White Kidney Bean (Phaseolus Vulgaris)

8.2.2.13 Others

8.3 MEAL REPLACEMENTS

8.3.1 POWDERED MIXES

8.3.2 READY TO DRINK BEVERAGES/SHAKES

8.3.3 PROTEIN BARS

8.3.4 OTHERS

9 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM

9.1 OVERVIEW

9.2 POWDERS

9.3 CAPSULE

9.4 LIQUIDS

9.5 TABLETS

9.6 PREMIXES

9.7 SOFT GELS

9.8 GUMMIES & JELLIES

9.9 OTHERS

10 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 STORE BASED

10.2.1 PHARMACIES

10.2.2 SPECIALTY STORES

10.2.3 HEALTH AND BEAUTY STORES

10.2.4 CONVENIENCE STORE

10.2.5 SUPERMARKET/HYPERMARKET

10.2.6 OTHERS

10.3 NON STORED BASED

10.3.1 ONLINE (THIRD PARTY ONLINE RETAILERS)

10.3.2 COMPANY OWNED WEBSITE

11 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY

11.1 OVERVIEW

11.2 TO 35 YEARS

11.3 TO 50 YEARS

11.4 ABOVE 50 YEARS

11.5 UNDER 18 YEARS

12 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY

12.1.2 FRANCE

12.1.3 U.K.

12.1.4 SPAIN

12.1.5 BELGIUM

12.1.6 RUSSIA

12.1.7 NETHERLANDS

12.1.8 ITALY

12.1.9 TURKEY

12.1.10 SWITZERLAND

12.1.11 REST OF EUROPE

13 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 MOST OBESE COUNTRIES OF ASIA-PACIFIC 2020

TABLE 2 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 3 EUROPE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 EUROPE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 5 EUROPE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 7 EUROPE MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 9 EUROPE POWDERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE CAPSULE IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE LIQUIDS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE TABLETS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE PREMIXES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 EUROPE SOFT GELS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE GUMMIES & JELLIES IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE OTHERS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION))

TABLE 18 EUROPE STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 20 EUROPE NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 22 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 23 EUROPE 18 TO 35 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE 35 TO 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE ABOVE 50 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE UNDER 18 YEARS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 28 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 29 EUROPE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 30 EUROPE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 33 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 35 EUROPE STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 36 EUROPE NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 37 GERMANY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 GERMANY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 39 GERMANY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 40 GERMANY MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 GERMANY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 42 GERMANY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 43 GERMANY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 44 GERMANY STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 45 GERMANY NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 46 FRANCE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 FRANCE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 48 FRANCE DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 49 FRANCE MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 FRANCE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 51 FRANCE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 52 FRANCE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 53 FRANCE STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 54 FRANCE NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 55 U.K. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 U.K. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 57 U.K. DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 58 U.K. MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 U.K. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 60 U.K. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 61 U.K. WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 U.K. STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 63 U.K. NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 64 SPAIN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 SPAIN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 SPAIN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 69 SPAIN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 70 SPAIN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 SPAIN STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 72 SPAIN NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 73 BELGIUM WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 BELGIUM DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 75 BELGIUM DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 76 BELGIUM MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 BELGIUM WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 78 BELGIUM WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 79 BELGIUM WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 80 BELGIUM STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 81 BELGIUM NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 82 RUSSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 RUSSIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 84 RUSSIA DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 85 RUSSIA MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 RUSSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 87 RUSSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 88 RUSSIA WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 89 RUSSIA STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 90 RUSSIA NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 91 NETHERLANDS WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 NETHERLANDS DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 93 NETHERLANDS DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 94 NETHERLANDS MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 NETHERLANDS WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 96 NETHERLANDS WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 97 NETHERLANDS WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 98 NETHERLANDS STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 99 NETHERLANDS NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 100 ITALY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 ITALY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 102 ITALY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 103 ITALY MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 ITALY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 105 ITALY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 106 ITALY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 107 ITALY STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 108 ITALY NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 109 TURKEY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 112 TURKEY MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 114 TURKEY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 115 TURKEY WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 TURKEY STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 117 TURKEY NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 118 SWITZERLAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 119 SWITZERLAND DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY SUPPLEMENT TYPE, 2020-2029 (USD MILLION)

TABLE 120 SWITZERLAND DIETARY SUPPLEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY ACTIVE INGREDIENT TYPE, 2020-2029 (USD MILLION)

TABLE 121 SWITZERLAND MEAL REPLACEMENTS IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 SWITZERLAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT FORM, 2020-2029 (USD MILLION)

TABLE 123 SWITZERLAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2020-2029 (USD MILLION)

TABLE 124 SWITZERLAND WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 125 SWITZERLAND STORE BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 126 SWITZERLAND NON STORED BASED IN WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY DISTRIBUTION CHANNEL, 2020- 2029 (USD MILLION)

TABLE 127 REST OF EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 2 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET : DROC ANALYSIS

FIGURE 4 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: DBMR POSITION GRID

FIGURE 8 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SEGMENTATION

FIGURE 10 INCREASE IN OBESE POPULATION IS DRIVING THE GROWTH OF EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 DIETARY SUPPLEMENTS SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET IN 2022 & 2029

FIGURE 12 SUPPLY CHAIN OF WEIGHT LOSS & OBESITY MANAGEMENT MARKET

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET

FIGURE 14 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT FORM, 2021

FIGURE 16 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 17 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET, BY END-USER DEMOGRAPHY, 2021

FIGURE 18 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: SNAPSHOT (2021)

FIGURE 19 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021)

FIGURE 20 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2022 & 2029)

FIGURE 21 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY COUNTRY (2021 & 2029)

FIGURE 22 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 23 EUROPE WEIGHT LOSS AND OBESITY MANAGEMENT MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.