Europe Used Car Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

221,079.31 Billion

USD

371,418.43 Billion

2022

2030

USD

221,079.31 Billion

USD

371,418.43 Billion

2022

2030

| 2023 –2030 | |

| USD 221,079.31 Billion | |

| USD 371,418.43 Billion | |

|

|

|

|

Mercado de automóveis usados na Europa, por tipo de fornecedor (organizado, não organizado), propulsão (gasolina, gasóleo, GNC, GPL, elétrico e outros), capacidade do motor (tamanho normal (acima de 2500 CC), médio ( entre 1500-2499 CC) , Concessionário de pequena dimensão (abaixo de 1499 CC) (franquiado, independente), canal de vendas (online, offline), tipo de veículo (ligeiro, LCV, HCV e veículo elétrico ) - Tendências e previsões do setor até 2030.

Análise e dimensão do mercado de automóveis usados na Europa

O aumento do rendimento disponível dos trabalhadores está a aumentar o crescimento do mercado, uma vez que permite que os indivíduos comprem veículos dentro de um orçamento limitado. De acordo com o Statistics Canada, os rendimentos disponíveis nas famílias de classe baixa aumentaram 3% e 3,3% na fase inicial de 2021, respetivamente. Em contraste, o rendimento das famílias da classe alta foi reduzido em 6,4% e depois aumentado em 3,9% no mesmo período. O crescimento do mercado de automóveis usados tem testemunhado um crescimento substancial nos últimos anos devido à competitividade de custos entre os novos participantes no mercado, juntamente com a incapacidade de uma grande parte dos clientes em comprar um automóvel novo.

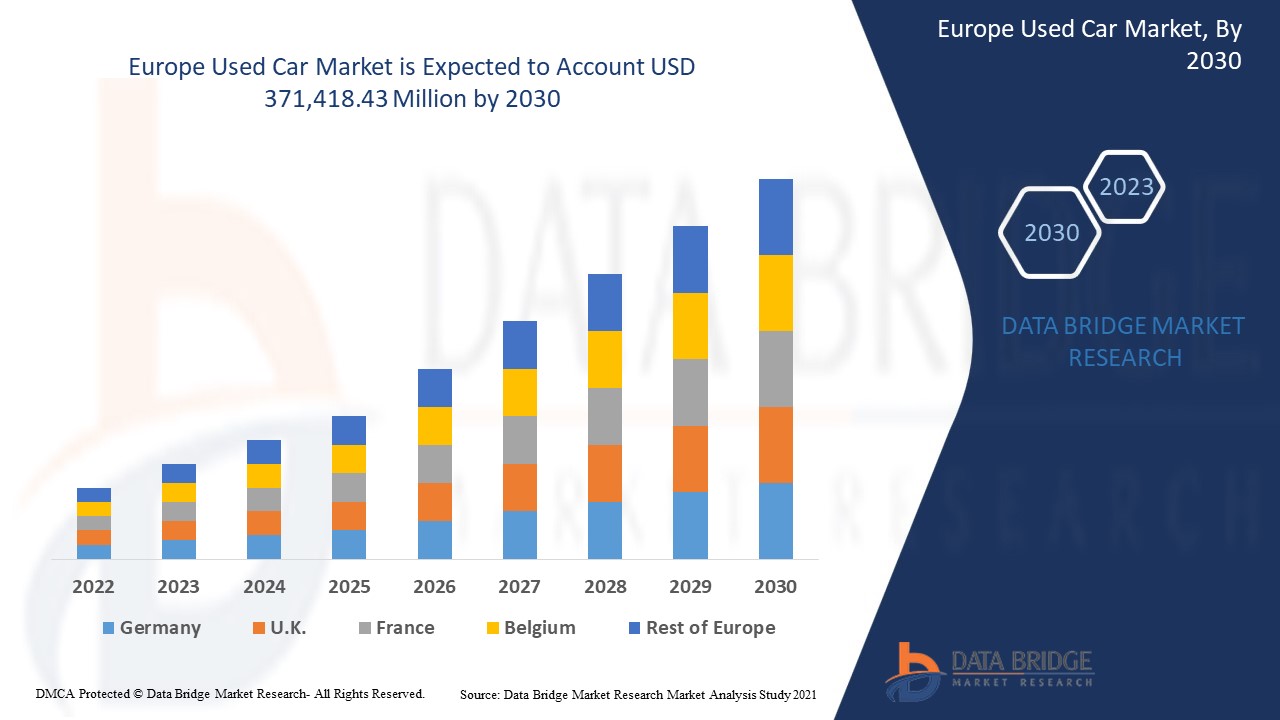

A Data Bridge Market Research analisa que o mercado de automóveis usados foi avaliado em 221.079,31 milhões de dólares em 2022 e deverá atingir o valor de 371.418,43 milhões de dólares até 2030, com um CAGR de 6,70% durante o período previsto. Além dos insights de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado com curadoria da equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas , análise de importação/exportação, análise de preços, análise de consumo de produção e análise Pilstle.

Âmbito e segmentação do mercado de automóveis usados na Europa

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2023 a 2030 |

|

Ano base |

2022 |

|

Anos históricos |

2021 (Personalizável para 2015 - 2020) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, volumes em unidades, preços em dólares americanos |

|

Segmentos abrangidos |

Tipo de fornecedor (organizado, não organizado), propulsão (gasolina, diesel, GNC, GPL, elétrico e outros), capacidade do motor (tamanho normal (acima de 2500 CC), médio (entre 1500-2499 CC), pequeno (abaixo de 1499 CC) )) Concessionário (franquiado, independente), canal de vendas (online, offline), tipo de veículo (ligeiro, LCV, HCV e veículo elétrico) |

|

Países abrangidos |

Alemanha, França, Reino Unido, Holanda, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia, Resto da Europa na Europa |

|

Atores do mercado abrangidos |

Group1 Automotive, Inc. (EUA), AutoNation (EUA), HELLMAN & FRIEDMAN LLC (EUA), PENDRAGON (Reino Unido), CarMax Business Services, LLC (EUA), Manheim (EUA), THE HERTZ CORPORATION (EUA), Cox Automotive (EUA), Sun Toyota (EUA), eBay Inc. (EUA), TrueCar, Inc. (EUA), VROOM (EUA), Asbury Automotive Group (EUA), MARUTI SUZUKI INDIA LIMITED (Índia), Mahindra First Choice ( Índia ), Scout24 SE (Alemanha), LITHIA MOTORS, INC. (EUA), Hendrick Automotive Group (EUA) |

|

Oportunidades de Mercado |

|

Definição de Mercado

Um carro que teve um ou mais proprietários de retalho no passado é chamado de carro usado, carro seminovo ou carro em segunda mão. Franquias de veículos e concessionários independentes, agências de aluguer de automóveis e compre aqui e pague aqui. Alguns concessionários de automóveis oferecem "preços sem pechincha", veículos usados certificados" e contratos de serviço prolongado ou garantias.

Dinâmica do mercado de automóveis usados

Motoristas

- Custo elevado do carro novo e preocupação com a acessibilidade

O setor automóvel tem observado uma procura crescente por características avançadas nos veículos, como direção hidráulica, controlo climático e sistemas de travagem antibloqueio. Agora o custo dos carros novos aumentou por causa disso. Além disso, os problemas de acessibilidade no novo mercado são indicados pelo aumento dos preços em 2019, que foi impulsionado pelos principais segmentos de automóveis de passageiros. Como resultado, as vendas de automóveis usados aumentaram em comparação com as vendas de automóveis novos na indústria automóvel. Espera-se que isto aumente a procura por carros antigos.

- Aumento da procura por carros hatchback versáteis

A Europa utiliza carros hatchbacks, que deverão crescer a um ritmo superior a 3,5% até 2028, impulsionada pela crescente procura de hatchbacks que ofereçam flexibilidade ao conduzir em espaços pequenos. O desenvolvimento do mercado de automóveis usados é auxiliado pela presença significativa dos principais fabricantes de automóveis, como a Audi AG, BMW AG, Mercedes-Benz e Volkswagen, porque estes fabricantes oferecem uma grande seleção de modelos de automóveis hatchback. Os players do mercado oferecem carros hatchback com um tejadilho alto e um design compacto.

Oportunidades

- Presença crescente de vários fabricantes de automóveis e revendedores de veículos usados

Como resultado da simples acessibilidade de financiamento para compras de automóveis usados, a receita do mercado de automóveis usados na Europa ultrapassou os 500 mil milhões de dólares em 2021 e continuará a aumentar de forma constante. A indústria transformadora é o maior investidor privado em I&D na Europa, a Europa é o maior fabricante mundial de automóveis. Para aumentar a competitividade do sector automóvel regional e manter a sua hegemonia tecnológica a nível global, a Comissão Europeia promove a normalização tecnológica global e o financiamento da I&D. Os concessionários de veículos usados na área oferecem uma variedade de opções tecnológicas para monitorizar o desempenho automóvel, incluindo aplicações para smartphones e pontos de venda virtuais na internet.

-

Crescimento das tecnologias online e do comércio eletrónico

Os desenvolvimentos tecnológicos no sector das telecomunicações, a melhoria da conectividade à Internet e a crescente urbanização são alguns dos principais factores através dos quais as pessoas podem agora aceder à informação de forma muito mais eficaz. Estas funcionalidades ajudam os proprietários de carros usados a anunciar rapidamente os seus veículos e a partilhar informações sobre os mesmos. Com a ajuda desta plataforma online, mais pessoas podem agora vender e comprar carros.

Restrições

- Questões associadas à expansão do mercado de automóveis usados

A expansão do mercado de automóveis usados será prejudicada pela ausência de leis e regulamentos rigorosos que regem a compra de automóveis usados. As elevadas taxas de depreciação dos carros usados dificultarão o crescimento do mercado. O surto de coronavírus impactou negativamente a procura global de veículos usados, reduzindo a procura de transportes públicos.

Este relatório de mercado de automóveis usados fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de automóveis usados, contacte a Data Bridge Market Research para um briefing de analista.

Impacto da Covid-19 no mercado de automóveis usados

A pandemia da COVID-19, que obrigou os governos a promulgar medidas rigorosas de contenção, bloqueios regionais, isolamento social e períodos de quarentena, impactou negativamente a procura do mercado em 2020. Como resultado do relaxamento do bloqueio e de uma mudança na preferência dos consumidor pela mobilidade pessoal. Isto inspirou os empresários a utilizar plataformas de internet para o mercado de automóveis usados com alternativas de financiamento flexíveis. Como resultado do crescente desejo do consumidor por automóveis usados em áreas sensíveis aos preços, prevê-se que o setor tenha um crescimento considerável num futuro próximo.

Desenvolvimento recente

- Em dezembro de 2019, a HELLMAN & FRIEDMAN LLC celebrou um contrato para adquirir a empresa à AutoScout24. Com esta aquisição, a empresa pretende fornecer soluções de marketing de valor acrescentado à medida que continua a digitalizar os seus modelos de negócio na indústria automóvel.

- Em dezembro de 2019, a Group1 Automotive, Inc. anunciou a sua aquisição de dois concessionários Lexus para aumentar a sua presença comercial no mercado do Novo México. Isto ajudou a empresa a destacar-se no mercado de rápido crescimento do Novo México.

Âmbito do mercado de automóveis usados na Europa

O mercado de automóveis usados está segmentado com base no tipo de fornecedor, propulsão, capacidade do motor, concessionário, canal de vendas e tipo de veículo. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de fornecedor

- Organizado

- Desorganizado

Propulsão

- Gasolina

- Diesel

- GNC

- GLP

- Elétrico

- Outros

Capacidade do motor

- Tamanho real ( acima de 2500 CC)

- Médio porte (entre 1500-2499 CC)

- Pequeno (abaixo de 1499 CC)

Concessionária

- Franqueado

- Independente

Canal de vendas

- Online

- Desligado

Tipo de veículo

- Carro de passeio

- VCL

- VHC

- Veículo elétrico

Análise regional/Insights do mercado de automóveis usados

O mercado de automóveis usados é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo de fornecedor, propulsão, capacidade do motor, concessionário, canal de vendas e tipo de veículo, conforme referenciado acima.

Os países abrangidos pelo relatório do mercado de automóveis usados são a Alemanha, França, Reino Unido, Países Baixos, Suíça, Bélgica, Rússia, Itália, Espanha, Turquia e Resto da Europa.

A Alemanha domina o mercado europeu de automóveis usados em termos de crescimento das receitas. Isto deve-se principalmente à disponibilidade de matérias-primas abundantes e de mão-de-obra barata. Além disso, a crescente utilização da internet, as garantias oferecidas em veículos usados, as ferramentas online para comprar ou pesquisar automóveis usados e diversas alternativas de compra são alguns dos outros fatores importantes que provavelmente impulsionarão o crescimento do mercado.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado de automóveis usados

O cenário competitivo do mercado de automóveis usados fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e amplitude do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de automóveis usados.

Alguns dos principais players que operam no mercado de automóveis usados são:

- Group1 Automotive, Inc. (EUA)

- AutoNation (EUA)

- HELLMAN & FRIEDMAN LLC (EUA)

- PENDRAGON (Reino Unido)

- CarMax Business Services, LLC (EUA)

- Manheim (EUA)

- A HERTZ CORPORATION (EUA)

- Cox Automotive (EUA)

- Sun Toyota (EUA)

- eBay Inc. (EUA)

- TrueCar, Inc. (EUA)

- VROOM (EUA)

- Asbury Automotive Group (EUA)

- MARUTI SUZUKI INDIA LIMITED (Índia)

- Mahindra First Choice (Índia)

- Scout24 SE (Alemanha)

- LITHIA MOTORS, INC. (EUA)

- Hendrick Automotive Group (EUA)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF EUROPE USED CAR MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- vendor type timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- DRIVERS

- EMERGENCE OF DIFFERENT E-COMMERCE PLATFORM

- INCREASE IN TRANSPARENCY & SYMMETRY OF INFORMATION BETWEEN DEALERS AND CUSTOMERS

- RISE IN DEMAND FOR OFF-LEASE CARS & SUBSCRIPTION SERVICE BY THE FRANCHISE

- RISE IN DEMAND FOR THE PERSONAl TRANSPORT MOBILITY

- UPSURGE DEMAND FOR THE VEHICLE WITH GREATER VALUE AT LOWER COST

- RESTRAINTS

- EVER INCREASE IN COST OF OWNERSHIP

- STRINGENT GOVERNMENT REGULATIONS FOR CAR DEALERS

- HIGHER MAINTENANCE AND SERVICE COST

- OPPORTUNITIES

- RISE IN STRATEGIC PARTNERSHIP AND ACquisitions BETWEEN TWO COMPANIES

- Original equipment manufacturers (oems) INVOLVEMENT IN CERTIFICATION AND MARKETING PROGRAMS

- RISE IN THE INVESTMENT BY GOVERNMENT IN AUTOMOBILE SECTOR

- AVAILABILITY OF THE REIMBURSED POLICY FOR THE USED CAR

- CHALLENGES

- LACK OF POST-Sale SERVICES OF USED CAR

- INCLINATION OF OEMS (ORIGINAL EQUIPMENT MANUFACTURERS) IN SALE OF ONLY NEW CAR

- IMPACT OF COVID ON THE EUROPE USED CAR MARKET

- IMPACT ON SUPPLY CHAIN & DEMAND ON USED CAR MARKET

- STRATEGIC DECISIONS OF MANUFACTURERS AFTER COVID 19 TO GAIN COMPETITIVE MARKET SHARE

- CONCLUSION

- EUROPE used car MARKET, BY vendor TYPE

- overview

- ORGANIZED

- UNORGANIZED

- EUROPE used car MARKET, BY PROPULSION TYPE

- overview

- PETROL

- Diesel

- ELECTRIC

- LPG

- CNG

- others

- EUROPE used car MARKET, BY engine capacity

- overview

- SMALL (BELOW 1499 CC)

- MID-SIZE (BETWEEN 1500-2499 CC)

- FULL SIZE (ABOVE 2500 CC)

- EUROPE used car MARKET, BY dealership

- overview

- franchised

- independent

- EUROPE used car MARKET, BY sales channel

- overview

- offline

- online

- EUROPE used car MARKET, BY vehicle type

- overview

- passenger cars

- SUV

- SEDAN

- CROSSOVER

- Coupe

- HATCHBACK

- MPV

- CONVERTIBLE

- OTHERS

- lcv

- PICKUP TRUCKS

- VANS

- CARGO VANS

- PASSENGER VANS

- MINI BUS

- COACHES

- OTHERS

- ELECTRIC VEHICLE

- BATTERY OPERATED VEHICLES

- PLUGIN VEHICLES

- HYBRID VEHICLES

- HCV

- TRUCKS

- DUMP TRUCKS

- TOW TRUCKS

- CEMENT TRUCKS

- BUSES

- Europe Used Car Market, by REGION

- EUROPE

- GERMANY

- FRANCE

- U.K.

- ITALY

- SPAIN

- RUSSIA

- TURKEY

- BELGIUM

- NETHERLANDS

- SWITZERLAND

- REST OF EUROPE

- EUROPE Used car market: COMPANY landscape

- company share analysis: EUROPE

- swot

- company profile

- CARMAX BUSINESS SERVICES, LLC

- COMPANY SNAPSHOT

- REVENNUE ANALYSIS

- COMPANY SHARE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- AUTONATION, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- LITHIA MOTORS, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SONIC AUTOMOTIVE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- GROUP1 AUTOMOTIVE, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTTFOLIO

- RECENT DEVELOPMENTS

- ALIBABA GROUP HOLDING LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- ASBURY AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIG BOY TOYZ

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- CARS24

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- CHEHAODUOJIAO MOTOR VEHICLE BROKER (BEIJING) CO., LTD.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- HELLMAN & FRIEDMAN LLC

- COMPANY SNAPSHOT

- BRAND PORTFOLIO

- RECENT DEVELOPMENTS

- HENDRICK AUTOMOTIVE GROUP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- KAIXIN AUTO HOLDINGS

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- LEITHCARS

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- MAHINDRA FIRST CHOICE

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MARUTI SUZUKI INDIA LIMITED

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- OLX GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- PENDRAGON

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- TRUECAR, INC.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- UXIN GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Lista de Tabela

TABLE 1 Scale of Used Vehicle Exports in the Year 2017 (USD Million)

TABLE 2 Comparison of the Brand and Estimated Maintenance Cost over 10 Years (approx.)

TABLE 3 EUROPE USED CAR MARKET, BY VENDOR TYPE, 2019-2028 (USD MILLION)

TABLE 4 Europe organized in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 5 Europe UNORgANIZED in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 6 EUROPE USED CAR MARKET, BY propulsion TYPE, 2019-2028 (USD MILLION)

TABLE 7 Europe petrol in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 8 Europe diesel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 9 Europe electric in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 10 Europe lpg in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 11 Europe cng in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 12 Europe others in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 13 EUROPE USED CAR MARKET, BY ENGINE CAPACITY, 2019-2028 (UsD MILLION)

TABLE 14 Europe small (below 1499 CC) engine capacity in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 15 Europe mid-size (between 1500-2499 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 16 Europe full size (above 2500 cc) in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 17 EUROPE USED CAR MARKET, BY dealership, 2019-2028 (USD MILLION)

TABLE 18 Europe franchised in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 19 Europe independent in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 20 EUROPE USED CAR MARKET, BY sales channel, 2019-2028 (USD MILLION)

TABLE 21 Europe offline sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 22 Europe online sales channel in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 23 EUROPE used car market, BY vehicle type, 2019-2028 (USD million)

TABLE 24 Europe passenger cars in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 25 Europe passenger cars in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 26 EUROPE lcv in used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 27 Europe LCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 28 Europe Vans in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 29 Europe ELECTRIC VEHICLE IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 30 Europe electric vehicle in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 31 Europe HCV IN used car Market, By Region, 2019-2028 (USD MILLION)

TABLE 32 Europe HCV in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 33 Europe Trucks in used car Market, By TYPE, 2019-2028 (USD MILLION)

TABLE 34 EUROPE Used Car Market, By Country, 2019-2028 (USD Million)

TABLE 35 EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 36 EUROPE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 37 EUROPE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 38 EUROPE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 39 EUROPE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 40 EUROPE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 41 EUROPE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 42 EUROPE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 43 EUROPE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 44 EUROPE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 45 EUROPE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 46 EUROPE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 47 GERMANY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 48 GERMANY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 49 GERMANY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 50 GERMANY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 51 GERMANY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 52 GERMANY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 53 GERMANY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 54 GERMANY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 55 GERMANY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 56 GERMANY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 57 GERMANY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 58 GERMANY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 59 FRANCE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 62 FRANCE Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 63 FRANCE Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 64 FRANCE Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 65 FRANCE Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 66 FRANCE LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 67 FRANCE Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 68 FRANCE HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 69 FRANCE Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 70 FRANCE Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 71 U.K. Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 72 U.K. Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 73 U.K. Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 74 U.K. Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 75 U.K. Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 76 U.K. Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 77 U.K. Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 78 U.K. LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 79 U.K. Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 80 U.K. HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 81 U.K. Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 82 U.K. Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 83 ITALY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 84 ITALY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 85 ITALY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 86 ITALY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 87 ITALY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 88 ITALY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 89 ITALY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 90 ITALY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 91 ITALY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 92 ITALY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 93 ITALY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 94 ITALY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 95 SPAIN Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 96 SPAIN Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 97 SPAIN Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 98 SPAIN Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 99 SPAIN Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 100 SPAIN Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 101 SPAIN Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 102 SPAIN LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 103 SPAIN Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 104 SPAIN HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 105 SPAIN Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 106 SPAIN Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 107 RUSSIA Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 108 RUSSIA Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 109 RUSSIA Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 110 RUSSIA Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 111 RUSSIA Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 112 RUSSIA Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 113 RUSSIA Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 114 RUSSIA LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 115 RUSSIA Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 116 RUSSIA HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 117 RUSSIA Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 118 RUSSIA Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 119 TURKEY Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 120 TURKEY Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 121 TURKEY Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 122 TURKEY Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 123 TURKEY Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 124 TURKEY Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 125 TURKEY Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 126 TURKEY LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 127 TURKEY Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 128 TURKEY HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 129 TURKEY Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 130 TURKEY Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 131 BELGIUM Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 132 BELGIUM Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 133 BELGIUM Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 134 BELGIUM Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 135 BELGIUM Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 136 BELGIUM Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 137 BELGIUM Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 138 BELGIUM LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 139 BELGIUM Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 140 BELGIUM HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 141 BELGIUM Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 142 BELGIUM Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 143 NETHERLANDS Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 144 NETHERLANDS Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 145 NETHERLANDS Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 146 NETHERLANDS Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 147 NETHERLANDS Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 148 NETHERLANDS Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 149 NETHERLANDS Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 150 NETHERLANDS LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 151 NETHERLANDS Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 152 NETHERLANDS HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 153 NETHERLANDS Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 154 NETHERLANDS Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 155 SWITZERLAND Used Car Market, By Vendor Type, 2019-2028 (USD Million)

TABLE 156 SWITZERLAND Used Car Market, By Propulsion Type, 2019-2028 (USD Million)

TABLE 157 SWITZERLAND Used Car market, By Engine Capacity, 2019-2028 (USD Million)

TABLE 158 SWITZERLAND Used Car Market, By Dealership, 2019-2028 (USD Million)

TABLE 159 SWITZERLAND Used Car Market, By Sales Channel, 2019-2028 (USD Million)

TABLE 160 SWITZERLAND Used Car Market, By Vehicle Type, 2019-2028 (USD Million)

TABLE 161 SWITZERLAND Passenger Cars in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 162 SWITZERLAND LCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 163 SWITZERLAND Vans in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 164 SWITZERLAND HCV in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 165 SWITZERLAND Trucks in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 166 SWITZERLAND Electric Vehicle in Used Car Market, By Type, 2019-2028 (USD Million)

TABLE 167 Rest of EUROPE Used Car Market, By Vendor Type, 2019-2028 (USD Million)

Lista de Figura

FIGURE 1 EUROPE USED CAR MARKET segmentation

FIGURE 2 EUROPE used car MARKET: data triangulation

FIGURE 3 EUROPE used car MARKET: DROC ANALYSIS

FIGURE 4 EUROPE used car MARKET: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE used car MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE used car MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE used car MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE used car MARKET: vendor share analysis

FIGURE 9 EUROPE used car market SEGMENTATION

FIGURE 10 THE Emergence of different ecommerce platformS is EXPECTED TO DRIVE THE EUROPE used car market THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 ORGANIZED segment is expected to account for the largest share of THE Europe used car market IN 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES FOR EUROPE USED CAR MARKET

FIGURE 13 Monthly Passenger Car Sales in Europe between August 2020 and June 2021 (1,000 Units)

FIGURE 14 Vehicle share per month in the year 2019 (%)

FIGURE 15 Europe USEd CAR MARKET: BY VENDOR TYPE, 2020

FIGURE 16 Europe USED CAR MARKET: BY PROPULSION TYPE, 2020

FIGURE 17 Europe USEd CAR MARKET: BY ENGINE capacity, 2020

FIGURE 18 Europe USEd CAR MARKET: BY DEALERSHIP, 2020

FIGURE 19 Europe USEd CAR MARKET: BY sales channel, 2020

FIGURE 20 Europe used car MARKET: BY VEHICLE type, 2020

FIGURE 21 EUROPE USED CAR MARKET: SNAPSHOT (2020)

FIGURE 22 EUROPE USED CAR MARKET: by Country (2020)

FIGURE 23 EUROPE USED CAR MARKET: by Country (2021 & 2028)

FIGURE 24 EUROPE USED CAR MARKET: by Country (2020 & 2028)

FIGURE 25 EUROPE USED CAR MARKET: by Vendor Type (2021-2028)

FIGURE 26 Europe used car Market: company share 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.