Europe Torque Vectoring Market, By Component (Hardware, Services), Technology (Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS)), Clutch Actuation Type (Electric, Hydraulic), Driving Wheel Type (Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD)), Vehicle Type (Passenger CarsCommercial Vehicles, Off Road Vehicle), Propulsion Type (Diesel/Petrol/CNG, Electric Vehicle) Industry Trends and Forecast to 2029

Market Analysis and Insights

Torque vectoring solutions are most important and crucial systems which ensure safety and help in improving the car’s performance. These systems basically provide or distribute torque between the wheels which allows the vehicle to effectively turn over a bend or curve. Torque vectoring is a holistic, predictive approach to vehicle dynamics using a combination of hardware and electronic systems. The Global torque vectoring market is growing rapidly due to emergence of EVS & and its torque vectoring system. The companies are even launching new products to gain a larger market share.

Increase in population, rapid urbanization and industrialization has propositional impact on the growth and adoption of torque vectoring, as in recent torque vectoring systems are widely used in improving vehicle dynamics and safety features. Data Bridge Market Research analyses that the torque vectoring market will grow at a CAGR of 17.4% during the forecast period of 2022 to 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019 - 2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Component (Hardware, Services), Technology (Active Torque Vectoring System (ATVS), Passive Torque Vectoring System (PTVS)), Clutch Actuation Type (Electric, Hydraulic), Driving Wheel Type (Rear-Wheel Drive (RWD), Front-Wheel Drive (FWD)), Vehicle Type (Passenger Cars, Commercial Vehicles, Off Road Vehicle), Propulsion Type (Diesel/Petrol/CNG, Electric Vehicle) |

|

Countries Covered |

Germany, Spain, France, Russia, Turkey, Czech Republic, U.K., Italy, Poland, Romania, Hungary, Belgium, Sweden, Netherlands, Finland, Belarus, Switzerland, and Rest of Europe |

|

Market Players Covered |

BorgWarner Inc., Eaton, American Axle & Manufacturing, Inc., Dana Limited, JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean, Hewland Engineering Ltd, Continental AG, Modelon, GKN Automotive Limited, Inc., Prodrive Holdings Limited, MITSUBISHI MOTORS CORPORATION, Haldex, Schaeffler AG, THE TIMKEN COMPANY, Linamar Corporation, Ricardo, ZF Friedrichshafen AG among others. |

Market Definition

Torque vectoring solutions are most important and crucial systems which ensure the safety and help in improving the car’s performance. These systems basically provide or distribute torque between the wheels which allows the vehicle to effectively turn over a bend or curve. Torque vectoring is a holistic, predictive approach to vehicle dynamics using a combination of hardware and electronic systems. It provides the most suitable distribution of torque to a wheel at any point based on the driver’s intentions and the driving conditions. There are basically two types of torque vectoring techniques which are prominently used, one is brake-based torque vectoring and the other one is electric-based torque vectoring.

Torque Vectoring Market Dynamics

Drivers

- Increase in population & rapid urbanization

Rapid urbanization, population, emergence of mobility as a service (MaaS) technologies and change in consumer behaviour pattern is forcing the major players to offer subscription based services for consumer to gain market advantage.

- Emergence of EV’s and its torque vectoring system

In recent times, automotive industry has been showing enormous growth over the years owing to the rising demand for luxurious electric vehicles. All-electric vehicles (EVs) are referred to as battery electric vehicles which use a battery to store the electrical energy that powers the vehicles

- Intelligent torque vectoring approach for ADAS vehicles

Advanced driver-assistance systems (ADAS) is an electronic systems implanted in automobiles for the assistance of driving vehicles or self-driving cars. This system uses sensors such as radars, cameras for analysis and takes automatic action based on the surroundings of the vehicle

- Upsurge in demand for luxury and performance vehicles

The concept of connected vehicles with advanced safety features and telematics is possible due to the advancement in the technology. Technologies such as AI, big data, advanced network connectivity and IoT. Moreover, torque vectoring is a computer driven control system that controls power car’s engine or motors can generated and send to each individual wheel based on the data available on the performance.

Opportunity

-

Heaving adoption of torque vectoring system in off-road vehicles

An off-highway vehicle (OHV) or an off road vehicle is a type of vehicle designed specifically for off-road use basically in rough terrains. These vehicles are specifically developed for consumers whom prefer off road vehicles for accessibility in their area of residence or for recreational purpose.

Restraint/Challenge

However, high carbon footprint of automotive sector will force government bodies to take strict government actions and regulation to control emission level which may reduce the torque vectoring solutions adoption. Moreover, limited supply for vehicles due semiconductor chip and controller’s shortage has a direct correlation with the sales and availability of new torque vectoring systems.

Covid-19 Impact on Torque Vectoring Market

The COVID-19 has negatively affected the market. As torque vectoring systems were on high demand companies such JTEKT Corporation, Magna International Inc., Robert Bosch GmbH, Protean and others in Europe face absolute difficulty in providing advanced systems for new vehicles and old vehicles due to shortage of semiconductor control chips and controllers, this was due to strict regulations were imposed by government. Moreover limited supply of semiconductor chips and gadgets has significantly affected the supply of vehicles in the market.

Recent Development

- In March 2022, Prodrive Holdings Limited launched world’s first all-terrain Hyper Car. The keay feature of this car launch was its 600 bhp four-wheel drive all-terrain adventure vehicle with an unrivalled ability and performance across any landscape. Through this company expanded its market by offering innovative solution for its consumer.

Europe Torque Vectoring Market Scope

The torque vectoring market is segmented on the basis of component, technology, clutch actuation type, driving wheel type, vehicle type, propulsion type. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Services

On the basis of component, Europe torque vectoring market has been segmented into hardware, and services.

Technology

- Active Torque Vectoring System (ATVS)

- Passive Torque Vectoring System (PTVS)

On the basis of technology, Europe torque vectoring market has been segmented into active torque vectoring system (ATVS), and passive torque vectoring system (PTVS).

Clutch Actuation Type

- Electric

- Hydraulic

On the basis of clutch actuation type, Europe torque vectoring market has been segmented into electric, and hydraulic.

Driving Wheel Type

- Rear-Wheel Drive (RWD)

- Front-Wheel Drive (FWD)

- All-Wheel Drive/Four-Wheel Drive (AWD/4WD)

On the basis of driving wheel type, Europe torque vectoring market has been segmented into rear-wheel drive (RWD), front-wheel drive (FWD), and all-wheel drive/four-wheel drive (AWD/4WD).

Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Off Road Vehicle

On the basis of vehicle type, Europe torque vectoring market has been segmented into passenger cars, commercial vehicles, and off road vehicle.

Propulsion Type

- Diesel/Petrol/CNG

- Electric Vehicle

On the basis of propulsion type, Europe torque vectoring market has been segmented into diesel/petrol/CNG and electric vehicle.

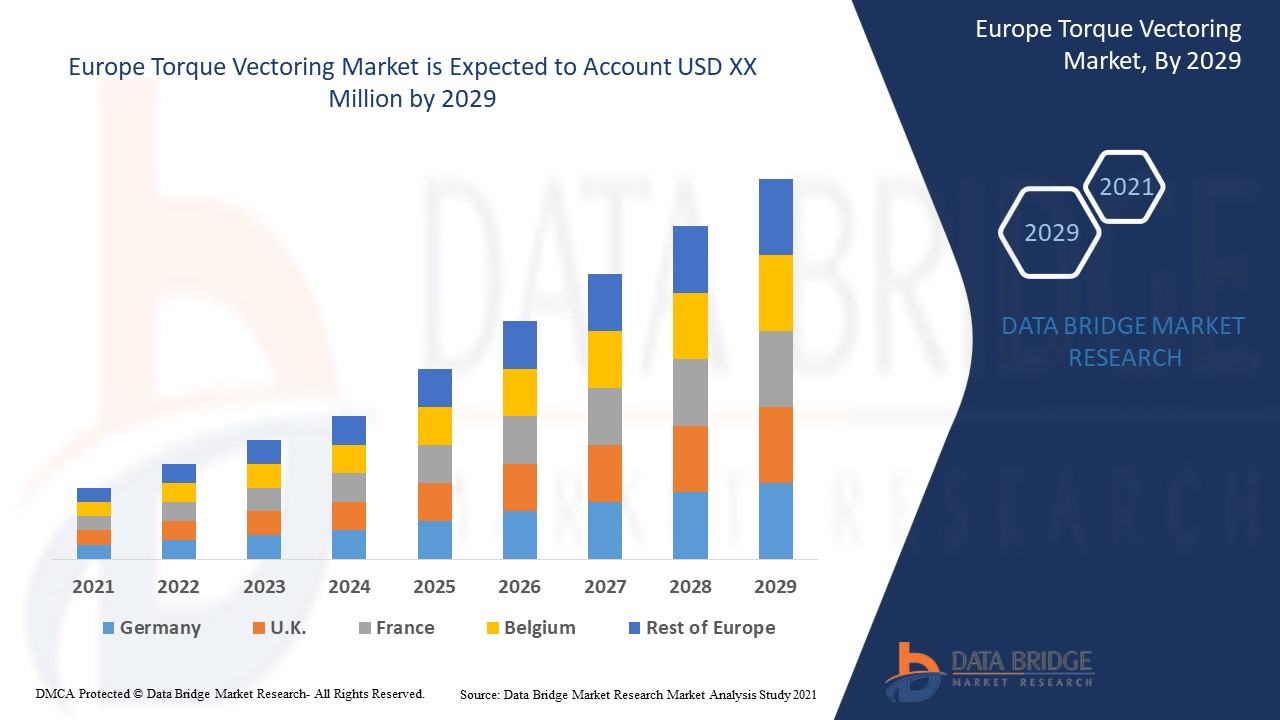

Europe Torque Vectoring Market Regional Analysis/Insights

The torque vectoring market is analysed and market size insights and trends are provided by country, component, technology, clutch actuation type, driving wheel type, vehicle type, and propulsion type as referenced above. Europe market is further segmented into Germany, Spain, France, Russia, Turkey, Czech Republic, U.K., Italy, Poland, Romania, Hungary, Belgium, Sweden, Netherlands, Finland, Belarus, Switzerland, Rest of Europe.

Germany is expected to dominate in Europe, due to the need of torque vectoring market as it is has major manufacturers and high demands.

The country section of the report also provides individual market impacting factors and changes in regulations in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, disease epidemiology and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Torque Vectoring Market Share Analysis

The torque vectoring market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, solution launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to torque vectoring market.

Some of the major players operating in the torque vectoring market are Continental AG, Schaeffler AG, Robert Bosch GmbH, GKN Automotive Limited, ZF Friedrichshafen AG, BorgWarner Inc., Eaton, Magna International Inc., Dana Limited among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE TORQUE VECTORING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMRMARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 COMPONENT TIMELINE CURVE

2.1 SECONDARY SOURCES

2.11 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER FIVE FORCES ANALYSIS

4.2 REGULATORY FRAMEWORK

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN POPULATION & RAPID URBANIZATION

5.1.2 EMERGENCE OF EVS & AND ITS TORQUE VECTORING SYSTEM

5.1.3 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES

5.1.4 UPSURGE IN DEMAND FOR LUXURY AND PERFORMANCE VEHICLES

5.2 RESTRAINTS

5.2.1 HIGH COST ASSOCIATED WITH IMPLEMENTING TORQUE VECTORING/AWD/4WD SYSTEMS

5.2.2 HIGH CARBON FOOTPRINT OF THE AUTOMOTIVE SECTOR

5.3 OPPORTUNITIES

5.3.1 HEAVING ADOPTION OF TORQUE VECTORING SYSTEM IN OFF-ROAD VEHICLES

5.3.2 GROWING AWARENESS ABOUT ENHANCED SAFETY AND VEHICLE DYNAMICS

5.4 CHALLENGES

5.4.1 HAMPERED SUPPLY OF SEMICONDUCTOR EQUIPMENT LIMITS TORQUE VECTORING SYSTEM

5.4.2 CHANGING AUTOMOTIVE PRODUCT LIFE CYCLE AND LONG PRODUCTION CYCLE OF AUTOMOTIVE VEHICLES

6 EUROPE TORQUE VECTORING MARKET, BY COMPONENT

6.1 OVERVIEW

6.2 HARDWARE

6.2.1 DRIVE CONTROL UNIT (DCU)

6.2.2 MOTOR CONTROLLERS

6.2.3 SENSORS

6.2.4 MOTOR

6.2.5 CAN BUS

6.2.6 OTHERS

6.3 SERVICES

7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY

7.1 OVERVIEW

7.2 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

7.3 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

8 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE

8.1 OVERVIEW

8.2 ELECTRIC

8.3 HYDRAULIC

9 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE

9.1 OVERVIEW

9.2 FRONT-WHEEL DRIVE (FWD)

9.3 ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD)

9.4 REAR-WHEEL DRIVE (RWD)

10 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE

10.1 OVERVIEW

10.2 PASSENGER CARS

10.2.1 BY TYPE

10.2.1.1 SEDAN

10.2.1.2 HATCHBACK

10.2.1.3 CROSSOVERS

10.2.1.4 SUV

10.2.1.5 OTHERS

10.2.2 BY TECHNOLOGY

10.2.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.2.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.3 COMMERCIAL VEHICLES

10.3.1 BY TYPE

10.3.1.1 LIGHT COMMERCIAL VEHICLE

10.3.1.2 HEAVY COMMERCIAL VEHICLE

10.3.1.2.1 BUS

10.3.1.2.2 TRUCKS

10.3.2 BY TECHNOLOGY

10.3.2.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.3.2.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

10.4 OFF ROAD VEHICLE

10.4.1 BY TECHNOLOGY

10.4.1.1 ACTIVE TORQUE VECTORING SYSTEMS (ATVS)

10.4.1.2 PASSIVE TORQUE VECTORING SYSTEMS (PTVS)

11 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE

11.1 OVERVIEW

11.2 DIESEL/PETROL/CNG

11.3 ELECTRIC VEHICLE

11.3.1 BATTERY ELECTRIC VEHICLE (BEV)

11.3.2 HYBRID ELECTRIC VEHICLE (HEV)

12 EUROPE TORQUE VECTORING MARKET, BY REGION

12.1 EUROPE

12.1.1 GERMANY (LEFT HAND DRIVE)

12.1.2 SPAIN (LEFT HAND DRIVE)

12.1.3 FRANCE (LEFT HAND DRIVE)

12.1.4 RUSSIA (LEFT HAND DRIVE)

12.1.5 TURKEY (LEFT HAND DRIVE)

12.1.6 CZECH REPUBLIC (LEFT HAND DRIVE)

12.1.7 U.K. (RIGHT HAND DRIVE)

12.1.8 ITALY (LEFT HAND DRIVE)

12.1.9 POLAND (LEFT HAND DRIVE)

12.1.10 ROMANIA (LEFT HAND DRIVE)

12.1.11 HUNGARY (LEFT HAND DRIVE)

12.1.12 BELGIUM (LEFT HAND DRIVE)

12.1.13 SWEDEN (LEFT HAND DRIVE)

12.1.14 NETHERLANDS (LEFT HAND DRIVE)

12.1.15 FINLAND (LEFT HAND DRIVE)

12.1.16 BELARUS (LEFT HAND DRIVE)

12.1.17 SWITZERLAND (LEFT HAND DRIVE)

12.1.18 REST OF EUROPE

13 EUROPE TORQUE VECTORING MARKET, COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: EUROPE

14 SWOT ANALYSIS

15 COMPANY PROFILE

15.1 AMERICAN AXLE & MANUFACTURING, INC.

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY PROFILE

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 CONTINENTAL AG

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENT

15.3 EATON

15.3.1 COMPANY SNAPSHOT

15.3.2 REVENUE ANALYSIS

15.3.3 COMPANY SHARE ANALYSIS

15.3.4 PRODUCT PORTFOLIO

15.3.5 RECENT DEVELOPMENTS

15.4 SCHAEFFLER AG

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 JTEKT CORPORATION

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 BORGWARNER INC.

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 DANA LIMITED

15.7.1 COMPANY SNAPSHOT

15.7.2 REVENUE ANALYSIS

15.7.3 PRODUCT PORTFOLIO

15.7.4 RECENT DEVELOPMENTS

15.8 DRAKO MOTORS, INC.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCTS PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 GKN AUTOMOTIVE LIMITED

15.9.1 COMPANY SNAPSHOT

15.9.2 REVENUE ANALYSIS

15.9.3 PRODUCTS PORTFOLIO

15.9.4 RECENT DEVELOPMENTS

15.1 HALDEX

15.10.1 COMPANY SNPASHOT

15.10.2 REVENUE ANALYSIS

15.10.3 PRODUCT PORTFOLIO

15.10.4 RECENT DEVELOPMENT

15.11 HEWLAND ENGINEERING LTD

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 LINAMAR CORPORATION

15.12.1 COMPANY SNAPSHOT

15.12.2 REVENUE ANALYSIS

15.12.3 PRODUCT PORTFOLIO

15.12.4 RECENT DEVELOPMENTS

15.13 MAGNA INTERNATIONAL INC.

15.13.1 COMPANY SNAPSHOT

15.13.2 REVENUE ANALYSIS

15.13.3 PRODUCT PORTFOLIO

15.13.4 RECENT DEVELOPMENTS

15.14 MITSUBISHI MOTORS CORPORATION

15.14.1 COMPANY SNAPSHOT

15.14.2 REVENUE ANALYSIS

15.14.3 PRODUCTS PORTFOLIO

15.14.4 RECENT DEVELOPMENT

15.15 MODELON

15.15.1 COMPANY SNAPSHOT

15.15.2 REVENUE ANALYSIS

15.15.3 PRODUCT PORTFOLIO

15.15.4 RECENT DEVELOPMENT

15.16 PRODRIVE HOLDINGS LIMITED

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCTS PORTFOLIO

15.16.3 RECENT DEVELOPMENT

15.17 PROTEAN

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENTS

15.18 RICARDO

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 ROBERT BOSCH GMBH

15.19.1 COMPANY SNAPSHOT

15.19.2 REVENUE ANALYSIS

15.19.3 PRODUCT PORTFOLIO

15.19.4 RECENT DEVELOPMENT

15.2 THE TIMKEN COMPANY

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 UNIVANCE CORPORATION

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENT

15.22 ZF FRIEDRICHSHAFEN AG

15.22.1 COMPANY SNAPSHOT

15.22.2 SOLUTION PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 PERFORMANCE TABLE

TABLE 2 CARBON EMISSION LEVEL OF VARIOUS TYPES OF CARS & SUVS

TABLE 3 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 4 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE SERVICES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 8 EUROPE ACTIVE TORQUE VECTORING SYSTEMS (ATVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 EUROPE PASSIVE TORQUE VECTORING SYSTEMS (PTVS) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 EUROPE ELECTRIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 EUROPE HYDRAULIC IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE FRONT-WHEEL DRIVE (FWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 EUROPE ALL-WHEEL DRIVE/FOUR-WHEEL DRIVE (AWD/4WD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 EUROPE REAR-WHEEL DRIVE (RWD) IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 18 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 20 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 21 EUROPE COMMERCIAL VEHICLES IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 23 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 24 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 25 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 27 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 28 EUROPE DIESEL/PETROL/CNG IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 31 EUROPE TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 32 EUROPE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 33 EUROPE (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 34 EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 35 EUROPE HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 36 EUROPE TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 37 EUROPE TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 38 EUROPE TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 39 EUROPE TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 40 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 41 EUROPE PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 42 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 EUROPE HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 EUROPE COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 45 EUROPE OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 46 EUROPE TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 47 EUROPE ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 48 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 49 GERMANY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 50 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 51 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 52 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 53 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 54 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 55 GERMANY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 56 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 57 GERMANY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 GERMANY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 59 GERMANY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 60 GERMANY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 61 GERMANY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 62 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 63 SPAIN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 64 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 65 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 66 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 67 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 68 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 69 SPAIN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 70 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 71 SPAIN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 72 SPAIN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 73 SPAIN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 74 SPAIN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 75 SPAIN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 76 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 77 FRANCE (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 78 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 79 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 80 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 81 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 82 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 83 FRANCE (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 84 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 85 FRANCE (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 86 FRANCE (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 87 FRANCE (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 88 FRANCE (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 89 FRANCE (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 90 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 91 RUSSIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 92 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 93 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 94 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 95 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 96 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 97 RUSSIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 98 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 99 RUSSIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 100 RUSSIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 101 RUSSIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 102 RUSSIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 103 RUSSIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 104 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 105 TURKEY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 106 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 107 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 108 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 109 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 110 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 111 TURKEY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 112 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 113 TURKEY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 114 TURKEY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 115 TURKEY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 116 TURKEY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 117 TURKEY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 118 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 119 CZECH REPUBLIC (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 120 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 121 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 122 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 123 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 124 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 125 CZECH REPUBLIC (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 126 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 127 CZECH REPUBLIC (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 128 CZECH REPUBLIC (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 129 CZECH REPUBLIC (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 130 CZECH REPUBLIC (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 131 CZECH REPUBLIC (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 132 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 133 U.K. (RIGHT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 135 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 136 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 137 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 138 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 139 U.K. (RIGHT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 140 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 141 U.K. (RIGHT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 142 U.K. (RIGHT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 143 U.K. (RIGHT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 144 U.K. (RIGHT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 145 U.K. (RIGHT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 146 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 ITALY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 149 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 150 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 151 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 152 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 153 ITALY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 154 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 155 ITALY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 156 ITALY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 157 ITALY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 158 ITALY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 159 ITALY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 160 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 161 POLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 162 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 163 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 164 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 165 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 166 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 167 POLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 168 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 169 POLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 170 POLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 171 POLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 172 POLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 173 POLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 174 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 175 ROMANIA (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 176 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 177 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 178 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 179 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 180 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 181 ROMANIA (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 182 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 183 ROMANIA (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 184 ROMANIA (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 185 ROMANIA (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 186 ROMANIA (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 187 ROMANIA (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 188 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 189 HUNGARY (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 190 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 191 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 192 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 193 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 194 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 195 HUNGARY (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 196 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 197 HUNGARY (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 198 HUNGARY (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 199 HUNGARY (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 200 HUNGARY (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 201 HUNGARY (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 202 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 203 BELGIUM (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 204 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 205 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 206 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 207 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 208 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 209 BELGIUM (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 210 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 211 BELGIUM (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 212 BELGIUM (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 213 BELGIUM (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 214 BELGIUM (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 215 BELGIUM (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 216 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 217 SWEDEN (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 218 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 219 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 220 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 221 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 222 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 223 SWEDEN (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 224 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 225 SWEDEN (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 226 SWEDEN (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 227 SWEDEN (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 228 SWEDEN (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 229 SWEDEN (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 230 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 231 NETHERLANDS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 232 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 233 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 234 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 235 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 236 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 237 NETHERLANDS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 238 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 239 NETHERLANDS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 240 NETHERLANDS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 241 NETHERLANDS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 242 NETHERLANDS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 243 NETHERLANDS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 244 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 245 FINLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 246 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 247 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 248 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 249 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 250 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 251 FINLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 252 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 253 FINLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 254 FINLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 255 FINLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 256 FINLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 257 FINLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 258 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 259 BELARUS (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 260 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 261 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 262 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 263 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 264 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 265 BELARUS (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 266 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 267 BELARUS (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 268 BELARUS (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 269 BELARUS (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 270 BELARUS (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 271 BELARUS (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 272 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 273 SWITZERLAND (LEFT HAND DRIVE) HARDWARE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 274 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 275 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY CLUTCH ACTUATION TYPE, 2020-2029 (USD MILLION)

TABLE 276 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY DRIVING WHEEL TYPE, 2020-2029 (USD MILLION)

TABLE 277 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY VEHICLE TYPE, 2020-2029 (USD MILLION)

TABLE 278 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 279 SWITZERLAND (LEFT HAND DRIVE) PASSENGER CARS IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 280 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 281 SWITZERLAND (LEFT HAND DRIVE) HEAVY COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 282 SWITZERLAND (LEFT HAND DRIVE) COMMERCIAL VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 283 SWITZERLAND (LEFT HAND DRIVE) OFF ROAD VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 284 SWITZERLAND (LEFT HAND DRIVE) TORQUE VECTORING MARKET, BY PROPULSION TYPE, 2020-2029 (USD MILLION)

TABLE 285 SWITZERLAND (LEFT HAND DRIVE) ELECTRIC VEHICLE IN TORQUE VECTORING MARKET, BY TECHNOLOGY, 2020-2029 (USD MILLION)

TABLE 286 REST OF EUROPE TORQUE VECTORING MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 2 EUROPE TORQUE VECTORING MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE TORQUE VECTORING MARKET: DROC ANALYSIS

FIGURE 4 EUROPE TORQUE VECTORING MARKET: EUROPE VS REGIONAL ANALYSIS

FIGURE 5 EUROPE TORQUE VECTORING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE TORQUE VECTORING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE TORQUE VECTORING MARKET: DBMRMARKET POSITION GRID

FIGURE 8 EUROPE TORQUE VECTORING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 EUROPE TORQUE VECTORING MARKET: SEGMENTATION

FIGURE 10 INTELLIGENT TORQUE VECTORING APPROACH FOR ADAS VEHICLES IS EXPECTED TO DRIVE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 11 HARDWARE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF EUROPE TORQUE VECTORING MARKET IN 2022 & 2029

FIGURE 12 NORTH AMERICA IS EXPECTED TO DOMINATE AND ASIA-PACIFIC IS THE FASTEST GROWING REGION IN THE EUROPE TORQUE VECTORING MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE EUROPE TORQUE VECTORING MARKET

FIGURE 14 PERCENTAGE OF URABANIZATION ACROSS THE GLOBE

FIGURE 15 AVAILABILITY OF ADAS TECHNOLOGY IN NEW VEHICLE MODELS

FIGURE 16 ROAD TRANSPORT EMISSIONS

FIGURE 17 EUROPE TORQUE VECTORING MARKET: BY COMPONENT, 2021

FIGURE 18 EUROPE TORQUE VECTORING MARKET: BY TECHNOLOGY, 2021

FIGURE 19 EUROPE TORQUE VECTORING MARKET: BY CLUTCH ACTUATION TYPE, 2021

FIGURE 20 EUROPE TORQUE VECTORING MARKET: BY DRIVING WHEEL TYPE, 2021

FIGURE 21 EUROPE TORQUE VECTORING MARKET: BY VEHICLE TYPE, 2021

FIGURE 22 EUROPE TORQUE VECTORING MARKET: BY PROPULSION TYPE, 2021

FIGURE 23 EUROPE TORQUE VECTORING MARKET: SNAPSHOT (2021)

FIGURE 24 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021)

FIGURE 25 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2022 & 2029)

FIGURE 26 EUROPE TORQUE VECTORING MARKET: BY COUNTRY (2021 & 2029)

FIGURE 27 EUROPE TORQUE VECTORING MARKET: BY COMPONENT (2022-2029)

FIGURE 28 EUROPE TORQUE VECTORING MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.