Europe Plant Based Eggs Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

366.31 Million

USD

5,594.22 Million

2024

2032

USD

366.31 Million

USD

5,594.22 Million

2024

2032

| 2025 –2032 | |

| USD 366.31 Million | |

| USD 5,594.22 Million | |

|

|

|

|

Segmentação do mercado de ovos vegetais na Europa, por tipo de ovo vegetal (ovo inteiro, clara e gema), forma (pó, líquido e outros), ingrediente base (farinha de algas, farinha de trigo, farinha de soja, sementes de chia, grão-de-bico, amido, feijão-mungo, ervilha e outros), função (substituição parcial do ovo, substituição total do ovo, substituto da lavagem do ovo e outros), aplicação (aplicação para café da manhã, aplicações de panificação caseira e outros), tipo de embalagem (garrafas, sachês, embalagens tetrapack e outros) e canal de distribuição (varejista com loja e varejista sem loja) - Tendências do setor e previsão até 2032

Qual é o tamanho e a taxa de crescimento do mercado europeu de ovos de origem vegetal?

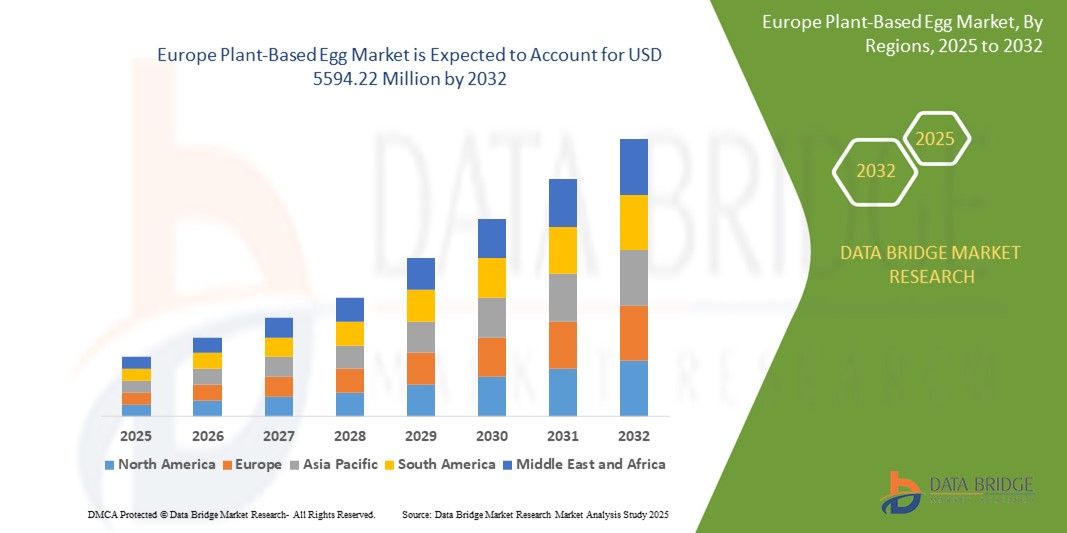

- O tamanho do mercado europeu de ovos de origem vegetal foi avaliado em US$ 366,31 milhões em 2024 e deve atingir US$ 5.594,22 milhões até 2032 , com um CAGR de 3,90% durante o período previsto.

- O mercado de ovos de origem vegetal está crescendo, oferecendo benefícios como redução do impacto ambiental, bem-estar animal e vantagens para a saúde. Com aplicações versáteis na culinária e panificação, os ovos de origem vegetal atendem a diversas necessidades alimentares, atraindo veganos, vegetarianos e consumidores preocupados com a saúde que buscam alternativas sustentáveis sem comprometer o sabor ou a nutrição.

Quais são os principais resultados do mercado de ovos de origem vegetal?

- Iniciativas governamentais que promovam a produção sustentável de alimentos e reduzam a dependência da pecuária podem impulsionar o crescimento do mercado de ovos de origem vegetal. Políticas e regulamentações favoráveis incentivam os fabricantes a investir em alternativas, expandindo sua presença. Isso promove a inovação e a acessibilidade, em linha com as preferências dos consumidores por escolhas alimentares sustentáveis, éticas e saudáveis.

- À medida que a conscientização sobre a saúde aumenta, os consumidores recorrem a dietas à base de plantas, buscando alternativas aos produtos de origem animal. Os ovos à base de plantas, isentos de colesterol e com menor teor de gordura, atendem a essa tendência, atraindo pessoas que priorizam a saúde. Seu perfil nutricional se alinha às preferências dos consumidores preocupados com a saúde, impulsionando a demanda pelo mercado de ovos à base de plantas.

- O Reino Unido dominou o mercado europeu de ovos de origem vegetal com uma participação de 42,8% em 2024, liderado pela alta conscientização do consumidor sobre consumo ético, bem-estar animal e sustentabilidade ambiental, o que está impulsionando a demanda por alternativas aos ovos.

- Espera-se que a Alemanha testemunhe a maior taxa de crescimento no mercado europeu de ovos de origem vegetal, com uma sólida base em tecnologia alimentar e sustentabilidade. Uma grande base de consumidores veganos e ambientalmente conscientes alimenta uma demanda consistente nos canais de varejo e foodservice.

- O segmento de ovos inteiros dominou o mercado com a maior participação na receita de 44,1% em 2024, impulsionado por sua versatilidade em replicar ovos tradicionais em várias receitas, incluindo assar, cozinhar e mexer

Escopo do Relatório e Segmentação do Mercado de Ovos Vegetais

|

Atributos |

Principais insights do mercado de ovos vegetais |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de ovos de origem vegetal?

“ Rótulo limpo e personalização baseada em IA em produtos de ovos à base de plantas ”

- Uma tendência importante no mercado de ovos de origem vegetal é a fusão de formulações de rótulos limpos com personalização baseada em IA, ajudando as marcas a atender às necessidades diversificadas e preocupadas com a saúde dos consumidores.

- Por exemplo, a Eat Just, Inc. e a Simply Eggless estão investindo em IA e análise de dados para desenvolver produtos que imitam de perto a textura, o sabor e o desempenho de cozimento de ovos reais para vários perfis alimentares.

- As marcas estão usando IA para prever as preferências do consumidor com base em hábitos alimentares regionais, permitindo recomendações personalizadas de produtos e marketing direcionado

- Plataformas baseadas em IA também estão sendo exploradas para otimizar a previsão da cadeia de suprimentos, reduzir o desperdício e aprimorar os ciclos de desenvolvimento de produtos

- As empresas de ovos de origem vegetal agora estão incorporando ingredientes naturais, como feijão-mungo, proteína de grão-de-bico e algas, ao mesmo tempo que eliminam alérgenos e aditivos sintéticos.

- À medida que a procura por alimentos mais saudáveis e transparentes cresce, a integração da IA e dos padrões de rótulos limpos está a remodelar a inovação dos produtos e a confiança do consumidor na categoria

Quais são os principais impulsionadores do mercado de ovos de origem vegetal?

- A crescente conscientização sobre o bem-estar animal, as mudanças climáticas e os riscos à saúde associados aos produtos de origem animal está impulsionando a mudança para alternativas aos ovos

- Por exemplo, a Follow Your Heart e a Vegg estão a expandir a sua presença no retalho por toda a Europa e para satisfazer a procura de fontes de proteína éticas e sustentáveis.

- O aumento de dietas veganas, flexitarianas e sem alérgenos está apoiando o crescimento da categoria em canais de serviços de alimentação, varejo e online

- Os governos de regiões como a Europa e a Índia estão a promover ativamente a nutrição à base de plantas através de subsídios, diretrizes e fundos de inovação

- Os fabricantes de alimentos estão fazendo parcerias com marcas alternativas aos ovos para formular produtos de panificação, maionese e massas sem ovos, ampliando a aplicação comercial de ovos de origem vegetal.

- O crescimento das plataformas de comércio eletrônico tornou mais fácil para marcas de nicho alcançarem diretamente os consumidores preocupados com a saúde, acelerando a penetração no mercado

Qual fator está desafiando o crescimento do mercado de ovos de origem vegetal?

- Os elevados custos de formulação e processamento, aliados à familiaridade limitada do consumidor em algumas regiões, continuam a ser grandes obstáculos ao crescimento

- De acordo com a Iniciativa FAIRR, a produção de ovos à base de plantas pode custar de 20% a 40% mais do que os ovos convencionais devido à P&D, aos desafios de escala e aos ingredientes premium.

- Inconsistências de sabor e textura entre as marcas reduzem as compras repetidas e limitam a aceitação entre os consumidores tradicionais de ovos

- Por exemplo, vários usuários em plataformas como Amazon e Reddit compartilharam feedback misto sobre o desempenho do produto em aplicações de panificação e fritura

- A incerteza regulatória sobre a rotulagem (por exemplo, usando o termo “ovo”) também cria barreiras legais em mercados como os EUA, França e Austrália

- Para superar esses obstáculos, as empresas devem se concentrar na educação do consumidor, na otimização de custos e em uma conformidade regulatória mais clara para escalar de forma eficaz e sustentável.

Como o mercado de ovos de origem vegetal é segmentado?

O mercado é segmentado com base em ofertas, tipo de produto, modo de implantação e uso final.

- Por tipo

Com base no tipo, o mercado de ovos vegetais é segmentado em ovo inteiro, clara e gema. O segmento de ovos inteiros dominou o mercado, com a maior participação na receita, de 44,1% em 2024, impulsionado por sua versatilidade na replicação de ovos tradicionais em diversas receitas, incluindo assados, cozidos e mexidos. Sua ampla aceitação entre consumidores veganos e o aumento das aplicações em serviços de alimentação comercial reforçam ainda mais seu domínio de mercado.

Espera-se que o segmento de ovos brancos testemunhe o CAGR mais rápido durante o período previsto devido ao seu uso crescente em merengues, sobremesas e aplicações específicas de proteínas.

- Por Formulário

Com base na forma, o mercado é segmentado em Pó, Líquido e Outros. O segmento de Pó detinha a maior participação de mercado, 51,7% em 2024, devido à sua maior vida útil, facilidade de armazenamento e transporte e alta compatibilidade com as indústrias de panificação e alimentos embalados.

A projeção é de que o segmento de líquidos cresça na maior taxa entre 2025 e 2032, impulsionado pela crescente demanda por formatos prontos para cozinhar e pela conveniência em ambientes de cozinha doméstica e comercial.

- Por ingrediente base

Com base no ingrediente base, o mercado é segmentado em farinha de algas, farinha de trigo, farinha de soja, sementes de chia, grão-de-bico, amido, feijão-mungo, ervilha e outros. O segmento de feijão-mungo dominou o mercado, com uma participação de mercado de 27,9% em 2024, atribuída à sua emulsificação, ligação e teor proteico superiores, que imitam de perto a funcionalidade do ovo real.

Espera-se que o segmento à base de ervilha cresça rapidamente devido ao seu perfil hipoalergênico e apelo de rótulo limpo entre consumidores preocupados com a saúde.

- Por função

Com base na função, o mercado é segmentado em Substituição Parcial de Ovos, Substituição Total de Ovos, Substituição de Ovos para Lavagem e Outros. O segmento de Substituição Total de Ovos liderou o mercado com uma participação dominante de 59,6% em 2024, impulsionado pelo crescente veganismo, preocupações com a sustentabilidade ambiental e a mudança para alternativas sem colesterol.

O segmento de substitutos para lavagem de ovos deve ganhar força devido ao aumento de aplicações em panificação e confeitaria que precisam de acabamentos brilhantes e agentes de ligação.

- Por aplicação

Com base na aplicação, o mercado de ovos de origem vegetal é categorizado em aplicações para café da manhã, aplicações para panificação caseira e outras. O segmento de aplicações para panificação caseira dominou o mercado, com a maior participação na receita, de 46,3% em 2024, impulsionado pelo aumento nas tendências de panificação caseira e pela demanda por ingredientes de panificação com rótulos limpos.

O segmento de aplicativos de café da manhã deverá crescer mais rapidamente, impulsionado por inovações de produtos em misturas para ovos mexidos, omeletes e quiches que reproduzem as ofertas tradicionais de café da manhã.

- Por tipo de embalagem

Com base no tipo de embalagem, o mercado é segmentado em garrafas, sachês, embalagens tetrapack e outros. O segmento de sachês deteve a maior participação de mercado, com 39,5% em 2024, pois oferece soluções leves, ecológicas e econômicas, ideais tanto para uso no varejo quanto em instituições.

Espera-se que o segmento Tetra Packs testemunhe um crescimento significativo devido à sua maior vida útil e funcionalidade de fácil despejo para substitutos líquidos de ovos.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é dividido em varejistas com sede em loja e varejistas sem sede em loja. O segmento de varejistas com sede em loja dominou o mercado, com uma participação de receita de 63,8% em 2024, atribuída à forte preferência do consumidor por compras presenciais e à ampla disponibilidade de ovos de origem vegetal em supermercados, hipermercados e lojas de produtos naturais.

Espera-se que o segmento de varejistas sem loja (e-commerce) cresça mais rapidamente, impulsionado pela expansão de plataformas digitais de supermercados, kits de refeição por assinatura e pelo aumento de pesquisas on-line sobre produtos veganos.

Qual região detém a maior fatia do mercado de ovos de origem vegetal?

- O Reino Unido dominou o mercado europeu de ovos de origem vegetal com uma participação de 42,8% em 2024, liderado pela alta conscientização do consumidor sobre consumo ético, bem-estar animal e sustentabilidade ambiental, o que está impulsionando a demanda por alternativas aos ovos.

- As colaborações no setor do varejo e de serviços de alimentação, incluindo grandes redes de supermercados e restaurantes de fast-food, estão acelerando a acessibilidade e a adoção de produtos

- Um número crescente de startups e incubadoras de tecnologia alimentar estão investindo em produtos inovadores à base de ovos de origem vegetal, adaptados às preferências de gosto locais e aplicações de panificação.

Visão geral do mercado de ovos vegetais na Alemanha

Espera-se que a Alemanha testemunhe a maior taxa de crescimento no mercado europeu de ovos de origem vegetal, com uma sólida base em tecnologia alimentar e sustentabilidade. Uma grande base de consumidores veganos e ambientalmente conscientes alimenta uma demanda consistente nos canais de varejo e foodservice. O país abriga uma alta concentração de fabricantes de alimentos de origem vegetal e centros de P&D, tornando-se um ponto de acesso para desenvolvimento e lançamentos de produtos. O apoio governamental a sistemas alimentares voltados para o desenvolvimento de plantas, dietas ecologicamente corretas e políticas de compras públicas está acelerando a penetração no mercado. A combinação de consumidores progressistas, inovação de ponta e um cenário político proativo posiciona a Alemanha como um mercado central para o crescimento de ovos de origem vegetal na Europa.

Visão geral do mercado de ovos vegetais na França

O mercado francês de ovos à base de plantas está ganhando força constante, impulsionado pela inovação culinária, tendências de alimentação limpa e apoio político. O crescente interesse por assados sem ovos, ingredientes naturais e dietas flexitarianas está alimentando a demanda por alternativas à base de plantas, especialmente em centros urbanos como Paris e Lyon. Startups do setor alimentício estão experimentando substitutos de ovos de qualidade culinária que atendem à culinária francesa, especialmente doces, quiches e molhos. Estratégias nacionais que promovem a agricultura sustentável, a inovação alimentar e refeições escolares à base de plantas estão contribuindo para uma maior adoção pelo consumidor. A ênfase francesa na qualidade e tradição dos alimentos está se cruzando com as mudanças dietéticas modernas, criando um nicho de mercado em rápida evolução para soluções à base de ovos à base de plantas.

Quais são as principais empresas no mercado de ovos de origem vegetal?

A indústria de ovos de origem vegetal é liderada principalmente por empresas bem estabelecidas, incluindo:

- Simply Eggless Inc. (EUA)

- Siga seu coração (EUA)

- Nabati (Canadá)

- Vegg (EUA)

- Eat Just, Inc. (EUA)

- Eggcitables (Canadá)

- Peggs (EUA)

- EVO Foods (Índia)

- ORGRAN (Austrália)

- Terra Vegane (Alemanha)

- Vezlay Foods Private Limited (Índia)

- Now Foods (EUA)

- Glanbia PLC (Irlanda)

- Noblegen Inc. (Canadá)

- Grupo Mantiqueira (Brasil)

- Le Papondu (França)

Quais são os desenvolvimentos recentes no mercado europeu de ovos de origem vegetal?

- Em maio de 2022, a Evo Foods firmou parceria com a Ginkgo Bioworks para lançar produtos à base de ovos sem ingredientes de origem animal, visando atender à crescente demanda por alternativas de origem vegetal. Essa colaboração busca lançar substitutos de proteína que atendam aos gostos dos consumidores, em linha com o crescente interesse por opções de alimentos sem ingredientes de origem animal.

- Em abril de 2022, a Eat Just obteve aprovação da Comissão Europeia para lançar sua linha de ovos à base de plantas na Europa, impulsionando o crescimento do mercado de ovos à base de plantas. Ao oferecer opções versáteis, como ovos dobrados, mexidos e em conserva, a Eat Just visa capitalizar a crescente demanda por alternativas à base de plantas na região.

- Em outubro de 2021, a EVO Foods lançou seu ovo líquido à base de plantas, derivado de leguminosas, com planos de expansão para o mercado americano até o final do ano. Essa iniciativa fortaleceu a base de clientes da empresa e contribuiu para sua trajetória de crescimento.

- Em outubro de 2021, a Nestlé expandiu seu portfólio de alimentos à base de plantas com o lançamento de alternativas de ovos à base de plantas, elevando a concorrência no mercado de ovos à base de plantas. Com a marca Garden Gourmet vEGGie, esses produtos oferecem uma opção nutritiva e sustentável.

- Em junho de 2020, a The Veggletto Company Pty Ltd lançou o sistema Veggletto, revolucionando a culinária alternativa ao ovo. Essa inovação revolucionária impulsionou as vendas da empresa, oferecendo aos consumidores uma solução inovadora para incorporar substitutos de ovo em suas atividades culinárias.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.