Europe Leak Detection Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

611.26 Million

USD

1,082.09 Million

2025

2033

USD

611.26 Million

USD

1,082.09 Million

2025

2033

| 2026 –2033 | |

| USD 611.26 Million | |

| USD 1,082.09 Million | |

|

|

|

|

Europe Leak Detection Market, By Type (Upstream, Midstream and Downstream), Product Type (Handheld Gas Detectors, UAV-Based Detectors, Manned Aircraft Detectors and Vehicle-Based Detectors), Technology (Acoustic/Ultrasound, Pressure-Flow Deviation Methods, Extended Real-Time Transient Model (E-RTTM), Thermal Imaging, Mass/Volume Balance, Vapor Sensing, Laser Absorption and Lidar, Hydraulic Leak Detection, Negative Pressure Valves and Others), End User (Oil and Gas, Chemical Plant, Water Treatment Plant, Thermal Power Plant, Mining and Slurry and Others), Country (Germany, France, U.K., Italy, Spain, Russia, Turkey, Belgium, Netherlands, Switzerland, Rest of Europe) Industry Trends and Forecast to 2028

Market Analysis and Insights: Europe Leak Detection Market

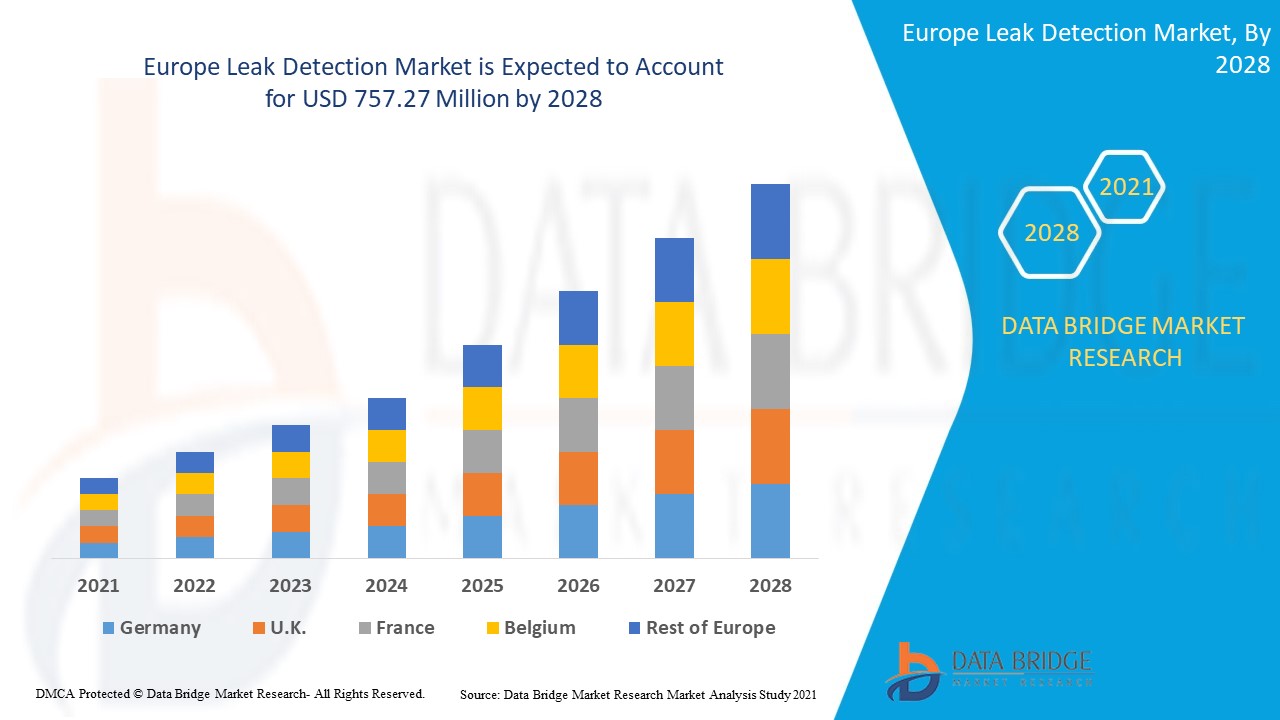

Europe leak detection market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with the CAGR of 7.4% in the forecast period of 2021 to 2028 and expected to reach USD 757.27 million by 2028. Increasing growth in oil and gas pipeline and storage plant infrastructure is the prominent factors that drive growth of the market.

The term leak or leakage means an unintended crack, hole or porosity in an enveloping wall or joint of the pipes, batteries, sealed products, chambers or storage containers which must contain/transfer different fluids and gases. These cracks or holes allow the escape of fluids and gases from closed medium. The leakages must be identified at earliest to decrease the loss and harm causing to the environment, for which various leak detection sensors and instruments are used. The main function of leak detection system is the localization and size measurement of leaks in sealed products.

High number of pipeline leakages incidents and increasing integration of advanced technology in leak detectors are augmenting the leak detection market. For instance, In January 2020, FLIR Systems Inc. has launched FLIR GF77a, its first uncooled, fixed-mount, connected thermal camera for detecting methane and other industrial gases. With this new launch of optical gas imaging (OGI) series product, company has extended their product portfolio and will increase their customer base.

This leak detection market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographical expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Europe Leak Detection Market Scope and Market Size

Leak detection market is segmented on the basis of type, product type, technology and end user. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the leak detection market is segmented into upstream, midstream and downstream. In 2021, the midstream segment accounted largest market share as midstream segment basically deals with the transportation of crude oil and natural gas through various modes of transportation such as pipeline. These pipelines are needed to be protected against leakages to avoid leak incidents and cause loss of life and property. Thus, the midstream is dominating the type segment.

- On the basis of product type, the leak detection market is segmented into handheld gas detectors, UAV-based detectors, manned aircraft detectors and vehicle-based detectors. In 2021, vehicle-based detectors accounted largest market share as it can be easily mounted on a vehicle and be used for monitoring the pipelines through the moving vehicle. This is the most economical and fast way of detecting leaking and is therefore dominating the product type segment.

- On the basis of technology, the leak detection market is segmented into acoustic / ultrasound, fiber optic, pressure-flow deviation methods, extended real-time transient model (E-RTTM), thermal imaging, mass/volume balance, vapor sensing, laser absorption and LIDAR, hydraulic leak detection, negative pressure waves and others. In 2021, acoustic / ultrasound accounted largest market share as it offers faster detection of leakage and is low cost solution, moreover, it provides early detection and the loss can be prevented at an early stage, these factors lead to highest growth of acoustic/ultrasound in technology segment.

- On the basis of end user, the leak detection market is segmented into oil and gas, chemical plant, water treatment plants, thermal power plant, mining and slurry and others. In 2021, oil and gas accounted largest market share as this industry is a major user of leak detection system in order to prevent leakage of crude oil and gas and methane emission. The leakage can lead to severe loss of life and property. Moreover, several government regulations to prevent leak incidents have increased the demand of leak detection in oil and gas industry.

Europe Leak Detection Market Country Level Analysis

Leak detection market is analysed and market size information is provided by country, type, product type, technology and end user.

The countries covered in Europe leak detection market report are Germany, U.K., France, Switzerland, Italy, Spain, Netherlands, Russia, Belgium, Turkey and Rest of Europe.

Russia accounted largest market share owing to large number of oil and gas production and transferring pipeline projects in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

High Number of Pipeline Leakages Incidents

Leak detection market also provides you with detailed market analysis for every country growth in industry with sales, components sales, impact of technological development in leak detection and changes in regulatory scenarios with their support for the leak detection market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Leak Detection Market Share Analysis

Leak detection market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to leak detection market.

The major players covered in the report are FLIR SYSTEMS, Inc., ABB, Honeywell International Inc., Siemens Energy, Pentair, ClampOn AS, Schneider Electric, Atmos International, Xylem, Emerson Electric Co., KROHNE Messtechnik GmbH, PERMA-PIPE International Holdings, Inc., TTK, PSI Software AG, MSA, HIMA, AVEVA Group plc, Yokogawa Electric Corporation, INFICON, Fotech Group Ltd., Asel-Tech Inc., MAGNUM Pirex AG / MAGNUM LEO-Pipe GmbH and OptaSense Ltd. among others. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide which are also accelerating the growth of leak detection market.

For instance,

- In October 2020, ABB has launched the new ABB MicroGuard, a first comprehensive gas leak detection system solution for utility industry to help safeguard city populations. The MicroGuard will work alongside ABB’s MobileGuard to pinpoint dangerous gas leaks faster and in easier way. Through this new product launch the company has expanded their product line.

- In December 2019, Honeywell International Inc. has announced that it has acquired Rebellion Photonics, a provider of innovative, intelligent, visual gas monitoring solutions which helps in maximizing safety, operational performance and emissions mitigation in oil & gas, petrochemicals and power industries. This acquisition will help company to expand their product portfolio.

Production expansion, new product development and other strategies enhances the company market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for leak detection.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.