Europe Lanolin Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

281.70 Million

USD

422.59 Million

2024

2032

USD

281.70 Million

USD

422.59 Million

2024

2032

| 2025 –2032 | |

| USD 281.70 Million | |

| USD 422.59 Million | |

|

|

|

|

Europe Lanolin Market Segmentation, By Type (Hydrous and Anhydrous), Composition (Natural Composition and Chemical Composition), Product (Fatty Acid Alcohols and Others), Derivative (Lanolin Alcohol, Cholesterin, Acetylated Lanolin, Ethoxylated Lanolin, Isopropyl Lanolate, Lanolin Wax, Laneth, Lanogene, Lanosterols, Quaternium 33, Peg-75, Lanolin Fatty Acid, Technical Wool Grease, Crude Wool Grease, Lanolin Oil, and Others), End-User (Pharmaceuticals, Personal Care and Cosmetics, Industrial, Baby Care, Animal Care, and Others) – Industry Trends and Forecast to 2032.

Lanolin Market Analysis

Europe lanolin market is highly fragmented, with numerous Europe and local players. Furthermore, the market is expected to witness increased consumer awareness of organic ingredients in various personal care products, as well as key firms' rapid expansion of distribution channels, which will alter market dynamics throughout the forecast period. At the moment, the industry is characterized by a large number of new entrants looking for ways to enter the local market.

Europe Lanolin Market Size

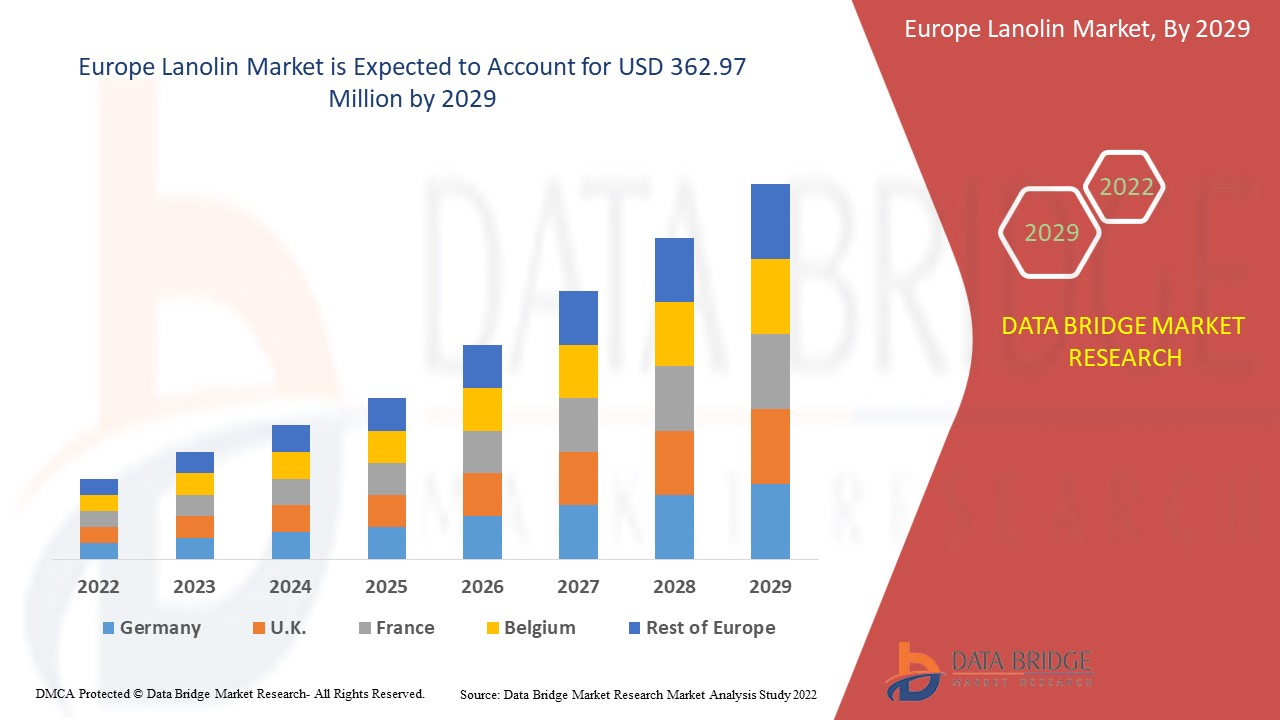

Europe lanolin market size was valued at USD 281.70 million in 2024 and is projected to reach USD 422.59 million by 2032, with a CAGR of 5.20% during the forecast period of 2025 to 2032.

Report Scope and Market Segmentation

|

Attributes |

Lanolin Key Market Insights |

|

Segmentation |

|

|

Countries Covered |

Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe |

|

Key Market Players |

Global seven agency (U.S.), SOLVAY (Belgium), Halocarbon, LLC (U.S.), BASF SE(Germany), Nippon Fine Chemical (Japan), Croda International Plc (UK), Zhejiang Garden Biochemical High-tech Co., Ltd., (Japan), The Lubrizol Corporation (U.S.), Dupont (U.S.), FENCHEM (U.S.), Wellman Advanced Materials (U.S.), Tallow Products Pty Ltd., (U.S.), Nanjing Duoyuan Biochemistry Co.,Ltd. (China), Heessoils (Germany), Zhonglan Industry Co.,Ltd. (China) and Charkit Chemical Company LLC (U.S.) |

|

Market Opportunities |

|

Lanolin Market Definition

Lanolin is a wax that is produced by the sebaceous glands of wool-bearing animals. Wool grease, wool wax, and wool yolk are other names for it. Lanolin is derived from a variety of domestic sheep breeds raised solely for their wool. It is commonly used to prevent or treat itching, dry skin, and other skin irritations caused by a variety of conditions, such as radiation therapy skin burns, diaper rash, and others.

Lanolin Market Dynamics

Drivers

- High adoption rate from various end user sectors

Increased end-use sectors such as personal care and cosmetics, baby care goods, and pharmaceuticals are the primary drivers driving market expansion. Lanolin is used in industries other than pharmaceuticals and cosmetics. Lanolin's potential applications have grown as a result of its use in critical industrial processes. Furthermore, major cosmetics and personal care companies are increasingly using lanolin oils and wax to increase total product value and sensory appeal. These oils increase suppleness, cleanse the skin, and moisturize the body's various parts. Lanolin has exceptional properties, including excellent biocompatibility, because it is very similar to the oils produced by human skin. As a result, lanolin is in high demand across a wide range of industries.

- High prevalence of bio-based lubricants among end users

Several end-use sectors that use lubricants have shown signs of shifting away from mineral oil-based lubricants to bio-based lubricants, which is encouraging. This trend shows that the industrial sector has a high demand for lanolin as a lubricant in many applications. The growing awareness of natural resource depletion, particularly of mineral oil, drives up demand, which is bolstered further by the economic feasibility of using lanolin. As a result, increased interest in bio-based lubricants accelerates overall market growth. Furthermore, the rapid expansion of distribution channels by the market's key players will accelerate the lanolin market's growth rate.

Opportunities

- Key manufacturers are focusing on product expansions

Growing consumer awareness of organic ingredients in various personal care products expands profitable opportunities for market players in the forecast period of 2025 to 2032. Furthermore, key businesses are focusing on introducing private labels, professional product launches, and the research of new ingredients in order to attract a larger consumer base, which will further expand the lanolin market's future growth.

Restraints/ Challenges

- Side effects and complications in refining process

The various side effects associated with lanolin will impede the growth of the lanolin market. The complicated refining procedure and the possibility of contaminants remaining in the end product can pose a significant health risk to humans. This factor will put pressure on the lanolin market's growth rate.

This lanolin market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the lanolin market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Lanolin Market Scope

The lanolin market is segmented on the basis of type, composition, product, derivative and end-user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Hydrous

- Anhydrous

Composition

- Natural Composition

- Chemical Composition

Product

- Fatty Acid

- Alcohols

- Others

Derivative

- Lanolin Alcohol

- Cholesterin

- Acetylated Lanolin

- Ethoxylated Lanolin

- Isopropyl Lanolate

- Lanolin Wax

- Laneth

- Lanogene

- Lanosterols

- Quaternium 33

- Peg-75

- Lanolin Fatty Acid

- Technical Wool Grease

- Crude Wool Grease

- Lanolin Oil

- Others

End-User

- Pharmaceuticals

- Personal Care and Cosmetics

- Industrial

- Baby Care

- Animal Care

- Others

Lanolin Market Regional Analysis

The lanolin market is analyzed and market size insights and trends are provided by country, type, composition, product, derivative and end-user as referenced above.

The countries covered in the lanolin market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey and rest of Europe in Europe.

Germany dominates the Europe Lanolin market because of the increasing awareness of bio-based and natural based products among the customers along with the high utilization of anhydrous type within the region during the forecast period of 2025-2032.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Lanolin Market Share

The lanolin market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to lanolin market.

Lanolin Market Leaders Operating in the Market Are:

- Europe seven agency (U.S.)

- SOLVAY (Belgium)

- Halocarbon, LLC (U.S.)

- BASF SE (Germany)

- Nippon Fine Chemical (Japan)

- Croda International Plc (U.K.)

- Zhejiang Garden Biochemical High-tech Co., Ltd., (Japan)

- The Lubrizol Corporation (U.S.)

- Dupont (U.S.)

- FENCHEM (U.S.)

- Wellman Advanced Materials (U.S.)

- Tallow Products Pty Ltd., (U.S.)

- Nanjing Duoyuan Biochemistry Co., Ltd. (China)

- Heessoils (Germany)

- Zhonglan Industry Co.,Ltd. (China)

- Charkit Chemical Company LLC (U.S.)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.