Europe Heat Shrink Tubing Market, By Type (Single Wall and Dual Wall), Product Type (Spools, Pre-Cut Length, and Others), Voltage (Low, Medium, and High), Shrink Ratio (2:01, 3:01, 4:01, 6:01, and Others), Material (Polyolefin, Perfluoroalkoxy Alkanes (PFA), Polytetrafluoroethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyetheretherketone (PEEK) and Others), End User (Utilities, IT and Telecommunication, Automotive, Electronics, Aerospace, Healthcare, Oil and Gas, Marine, Food and Beverages, Construction, Chemical, and Others) Industry Trends and Forecast to 2030.

Europe Heat Shrink Tubing Market Analysis and Size

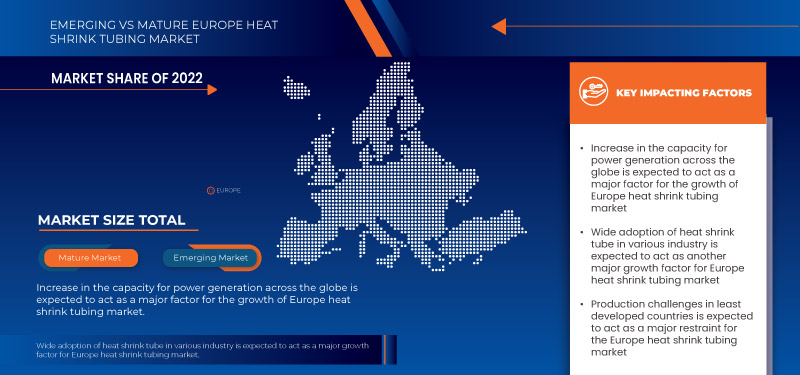

The increase in the capacity for power generation across the globe drives the Europe heat shrink tubing market. However, the up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents). These materials are currently available but are not widely used because it is difficult to take lines out of service to reconduct new materials. Furthermore, when weather conditions are favorable, all overhead lines can carry current higher than their nominal rating and a real-time rating that could be continuously adjusted would increase available capacity.

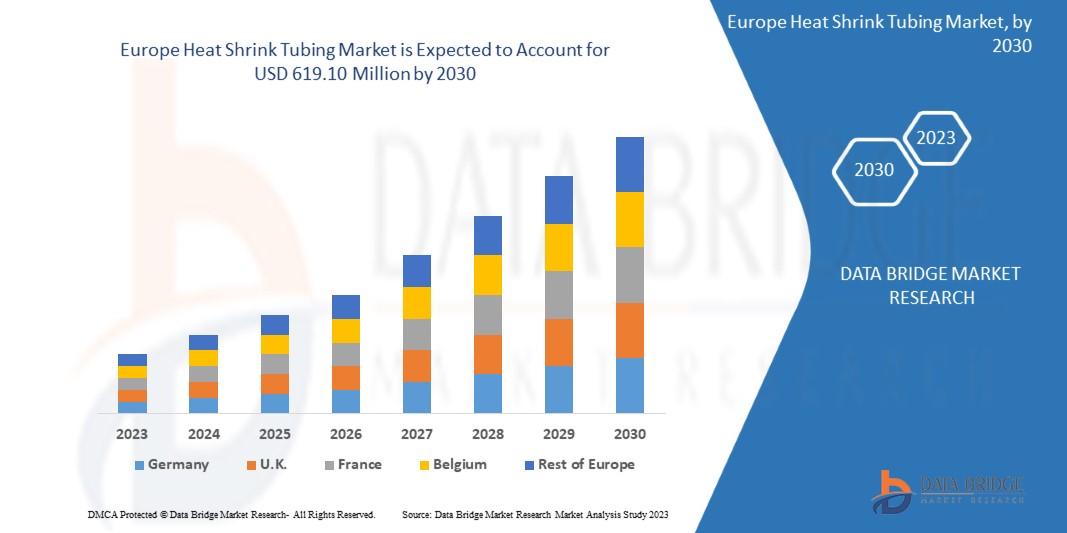

Data Bridge Market Research analyses that the Europe heat shrink tubing market is expected to grow at a CAGR of 5.8% in the forecast period of 2023 to 2030 and is expected to reach USD 619.10 million by 2030. The Europe heat shrinks tubing market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Single Wall and Dual Wall), Product Type (Spools, Pre-Cut Length, and Others), Voltage (Low, Medium, and High), Shrink Ratio (2:01, 3:01, 4:01, 6:01, and Others), Material (Polyolefin, Perfluoroalkoxy Alkanes (PFA), Polytetrafluoroethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyetheretherketone (PEEK) and Others), End User (Utilities, IT and Telecommunication, Automotive, Electronics, Aerospace, Healthcare, Oil and Gas, Marine, Food and Beverages, Construction, Chemical, and Others) |

|

Countries Covered |

Germany, France, U.K., Italy, Spain, Netherlands, Belgium, Russia, Switzerland, Turkey, and the Rest of Europe |

|

Market Players Covered |

ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd.(China) among others |

Market Definition

Heat shrink tubing is used to insulate wire providing abrasion resistance and environmental protection for the stranded solid wire conductors with connections, joints, and terminals in electrical work. In general, a tube with a lower shrink temperature will shrink faster. When heat shrink tubing is wrapped around wire arrays and electrical components, it collapses radially to fit the contours of the equipment, forming a protective layer.

Moreover, these tubings use various materials such as Perfluoroalkoxy alkanes (PFA), Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), and others, to manufacture heat shrink tubings. The heat shrink tubings with different materials have different protection features against abrasion, low impact, cuts, moisture, and dust by covering individual wires or encasing entire arrays. In addition, material is decided based on end usage such as electronics, automotive, aerospace, and others. Plastic manufacturers begin by extruding a thermoplastic tube to create heat-shrink tubing. Heat shrink tubing materials vary depending on the intended application.

Europe Heat Shrink Tubing Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail as below:

Drivers

- Role of Government in Supporting and Expansion of Transmission & Distribution Systems in the Heat Shrink Tubing Market Across the Region

The role of electric power transmission and distribution (T&D) plays an important link between generating stations and customers. Growing loads and stress created by the aging equipment and increasing the risk of widespread blackouts are a few of the factors which help generates the need for heat shrink tubes. Electricity delivery that is both dependable and cost-effective is critical in today's society. The U.S. transmission and distribution (T&D) is comprised of numerous economic drivers, organizational structures, technologies, and forms of regulatory oversight. Federal, and municipal governments and state and customer-owned cooperatives are all part of these systems. However, about 80 percent of power transactions occur on lines owned by investor-owned regulated utilities (IOUs). These fully integrated utilities own both the generating plants and the transmission and distribution systems that deliver their customers' power. This was among the dominant model in the past but deregulation in some states has transformed the industry. Transmission, generation, and distribution may be handled by different entities in deregulated areas.

- Increase in the Capacity for Power Generation Across the Globe

A two-step process is used to create heat shrink tubing. The first step is standard extrusion followed by a secondary process that makes the tubing heat-shrinkable. Although this secondary process's specifics are kept confidential, heat and force are used to expand the tubing's diameter. While still expanded, the tubing is cooled to room temperature. If the tubing is rigid, it is going to shrink down to its original size. The up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents).

Opportunity

- Wide Adoption of Heat Shrink Tubes in Various Industries

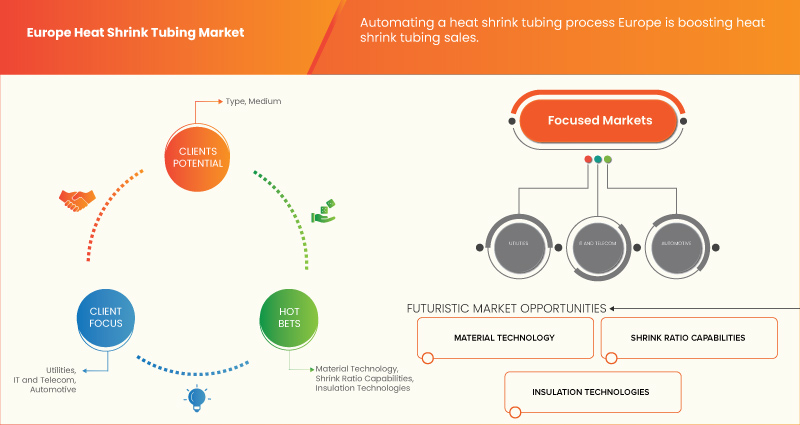

AI The heat shrink tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology with product design that provides a repeatable, reliable, and shrink-to-fit installation compatible with many manufacturing processes. These products are in service throughout the world in automotive, telecommunications, power distribution, aerospace, defense, industrial and commercial applications. The tubing application in under bonnet cable protection, hoses, brake pipes, air conditioning, diesel injection clusters, connectors, inline splice, wire bundles, ring terminals, seat belt stalks, gas springs, antennas, and others are further enhancing the application capabilities in the automobile industry. The tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology. The easy-to-use products provide cost-effective, proven solutions in various automotive applications, from sealing and protecting electrical splices to providing mechanical protection for fluid management systems in harsh surroundings.

Restraints/Challenges

- Government Regulation On the Emission of Toxic Gases

The environmental significance of rapid industrialization has brought about uncountable air, land, and water resource sites being contaminated with toxic materials and other pollutants, threatening humans and ecosystems with serious health risks. More extensive and intensive use of materials and energy has created cumulative pressures on the quality of local, regional, and Europe ecosystems. Before there was a concerted effort to restrict the impact of pollution, environmental management extended little beyond laissez-faire tolerance, tempered by the disposal of wastes to avoid disruptive local nuisance conceived of in a short-term perspective. The need for remediation was recognized by exception in instances where damage was determined to be unacceptable. As the pace of industrial activity intensified and the understanding of cumulative effects grew, a pollution control paradigm became the dominant method of environmental management.

- Rising Prices of Raw Materials for Tubing

The price fluctuations affect the cable, wire, and connectivity products and materials being purchased or affect the outlook on budget projections in procurement, finance, supply chain management, or product development. Thanks to rising industrial production and aggressive sustainable energy initiatives, China is the world's largest consumer of copper. Europe, the U.S., and China pursue aggressive renewable energy initiatives to sustain greener economies and copper's high thermal and electric conductivity will help them get there. The largest copper-producing countries such as Chile, Peru, China, and the United States are struggling to meet the high demand for countries to meet their green economic initiative, contributing to the price of copper skyrocketing. There is also speculation that as the U.S. dollar weakens against other Europe currencies, there will be more opportunities for users of other currencies to increase their purchasing power with copper and other commodities.

Recent Developments

- In April 2023, TE Connectivity announced the new EV Single Wall (EVSW) tubing specifically designed for high voltage applications and safely insulating and protecting conductive components and cables. This product is a single wall tube with the prime focus of providing electrical insulation and protection for high-voltage components in electric vehicles. This will help the company to diversify its product portfolio and meets the unique challenges of EV applications.

- In February 2023, Molex released a miniaturization report, stating expert insights and innovations in product design engineering and leading-edge connectivity. Through this miniaturization, the company has increased the effectiveness of products and their safety too. This development enhanced the company’s product line and it made a positive impact on the growth of the Europe heat shrink tubing market.

Europe Heat Shrink Tubing Market Scope

The Europe heat shrink tubing market Scope is segmented into six notable segments which are based on the type, product type, material, voltage, shrink ratio, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Single Wall

- Dual Wall

On the basis of type, the Europe heat shrink tubing market is segmented into single wall and dual wall.

Product Type

- Spools

- Pre-Cut Lengths

- Others

On the basis of product type, the Europe heat shrink tubing market is segmented into spools, pre-cut lengths, and others.

Voltage

- Low

- Medium

- High

On the basis of voltage, the Europe heat shrink tubing market is segmented into Low, Medium, and High.

Shrink Ratio

- 2:01

- 3:01

- 4:01

- 6:01

- Others

On the basis of shrink ratio, the Europe heat shrink tubing market is segmented into 2:01, 3:01, 4:01, 6:01, and others.

Material

- Polyolefin

- Per Fluoroalkoxy Alkane (PFA)

- Poly Tetra Fluoro Ethylene (PTFE)

- Ethylene Tetra Fluoro Ethylene (ETFE)

- Fluorinated Ethylene Propylene (FEP)

- Polyether Ether Ketone (PEEK)

- Others

On the basis of material, the Europe heat shrink tubing market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (PEEK), and others.

End User

- Utilities

- It And Telecommunication

- Automotive

- Electronics

- Aerospace

- Healthcare

- Oil And Gas

- Marine

- Food And Beverages

- Construction

- Chemical

- Others

On the basis of end user, the Europe heat shrink tubing market is segmented into utilities, IT and telecommunication, automotive, electronics, aerospace, healthcare, oil and gas, marine, food and beverages, construction, chemical and others.

Europe Heat Shrink Tubing Market Regional Analysis/Insights

Europe heat shrink tubing market is analysed, and market size insights and trends are provided by type, product type, voltage, shrink ratio, material, and end user as referenced above.

The countries covered in the Europe heat shrink tubing market report are Germany, France, U.K., Italy, Spain, Netherlands, Belgium, Russia, Switzerland, Turkey, and the Rest of Europe.

Germany dominates in the Europe region owing to the region's advanced software sector.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Europe Heat Shrink Tubing Market Share Analysis

Europe heat shrink tubing market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Europe heat shrink tubing market.

Some of the major players operating in the Europe heat shrink tubing market are ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd. (China) among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW OF EUROPE HEAT SHRINK TUBING MARKET

- Currency and Pricing

- LIMITATIONS

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographicAL scope

- years considered for the study

- DBMR TRIPOD DATA VALIDATION MODEL

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- Multivariate Modeling

- type timeline curve

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- premium insights

- market overview

- drivers

- Role of government in supporting and expansion of Transmission & Distribution Systems across the region

- Increase in the capacity for power generation across the globe

- Rising usage of products with advanced infrastructure and technology

- Number and penetration of Electric Vehicles

- RESTRAINTs

- Government regulation on emission of toxic gases

- production challenges in the least developed countries

- Involvement of plastic has direct impact on the cost as well as environment

- OPPoRTUNITies

- Wide adoption of heat shrink tube in various industries

- Easy production of the heat shrinkable tubing

- Automating a heat shrink tubing process

- CHALLENGES

- RISING PRICES OF COPPER SILVER AND RAW MATERIALS FOR TUBING

- Poor installation of heat-shrink tubes

- Availability of duplicate and inexpensive products in the market

- IMPACT OF COVID-19 ON THE EUROPE HEAT SHRINK TUBING MARKET

- ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

- STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

- IMPACT ON PRICE

- IMPACT ON DEMAND

- IMPACT ON SUPPLY CHAIN

- CONCLUSION

- Europe heat shrink tubing market, BY Type

- overview

- Single wall

- Dual wall

- Europe heat shrink tubing market, BY Product Type

- overview

- Spools

- Pre-cut Length

- others

- Europe heat shrink tubing market, BY Voltage

- overview

- Low

- Medium

- High

- Europe heat shrink tubing market, BY Material

- overview

- Polyolefin

- Perfluoroalkoxy alkanes (PFA)

- Polytetrafluoroethylene (PTFE)

- Fluorinated Ethylene Propylene (FEP)

- Ethylene tetrafluoroethylene (ETFE)

- Polyether Ether Ketone (PEEK)

- Others

- Europe heat shrink tubing market, BY shrink ratio

- overview

- 2:1

- 3:1

- 4:1

- 6:1

- Others

- Europe heat shrink tubing market, BY END USER

- overview

- Utilities

- IT and Telecommunication

- Automotive

- Electronics

- Aerospace

- Healthcare

- oil and gas

- Marine

- Food and Beverages

- Construction

- Commercial

- Residential

- Chemical

- Others

- EUROPE Heat Shrink Tubing Market, by geography

- EUrope

- Germany

- France

- U.K.

- Italy

- Spain

- Netherlands

- Belgium

- Russia

- Switzerland

- Turkey

- Rest of Europe

- Europe Heat Shrink Tubing Market: COMPANY landscape

- company share analysis: EUROPE

- swot analysis

- company profile

- TE Connectivity

- COMPANY snapshot

- revenue analysis

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENTS

- Sumitomo Electric Industries, Ltd.

- COMPANY snapshot

- revenue analysis

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENTs

- PRYSMIAN GROUP

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- ABB

- COMPANY snapshot

- revenue analysis

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENTs

- 3M

- COMPANY snapshot

- revenue analysis

- company share analysis

- product PORTFOLIO

- recent DEVELOPMENT

- Alpha Wire

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENT

- ASSEMBLY FASTENERS, INC.

- COMPANY PROFILE

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- CHANGCHUN IAC TECHNOLOGY CO., LTD.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- DASHENG GROUP

- COMPANY SNAPSHOT

- COMPANY PORTFOLIO

- RECENT DEVELOPMENT

- HILLTOP

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO.,LTD.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- GREMCO GMBH

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- HellermannTyton

- COMPANY snapshot

- product PORTFOLIO

- recent DEVELOPMENT

- molex

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTs

- PEXCO

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTs

- QUALTEK ELECTRONICS CORP.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- SHAWCOR

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- TECHFLEX, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- THERMOSLEEVE usa

- COMPANY snapshot

- PRODUCT PORTFOLIO

- recent DEVELOPMENTs

- ZEUS INDUSTRIAL PRODUCTS, INC.

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- questionnaire

- related reports

Lista de Tabela

TABLE 1 Europe Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 2 Europe Single Wall in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 3 Europe Dual Wall in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 4 Europe heat shrink tubing market, By Product Type, Market Forecast 2019-2028 (USD Million)

TABLE 5 Europe Single wall in Automotive Magnet Wire Market, By Region, 2019-2028, (USD Million)

TABLE 6 Europe Pre-cut Length in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 7 Europe Others in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 8 Europe heat shrink tubing market, By voltage, Market Forecast 2019-2028 (USD Million)

TABLE 9 Europe Low in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 10 Europe Medium in Automotive Magnet Wire Market, By Region, 2019-2028, (USD Million)

TABLE 11 Europe High in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 12 Europe Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 13 Europe Polyolefin in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 14 Europe Perfluoroalkoxy alkanes (PFA) in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 15 Europe Polytetrafluoroethylene (PTFE) in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 16 Europe Fluorinated Ethylene Propylene (FEP) in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 17 Europe Ethylene tetrafluoroethylene (ETFE) in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 18 Europe Polyetheretherketone (PEEK) in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 19 Europe Others in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 20 Europe Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 21 Europe 2:1 in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 22 Europe 3:1 in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 23 Europe 4:1 in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 24 Europe 6:1 in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 25 Europe Others in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 26 Europe Heat Shrink Tubing Market, BY END USER, 2019-2028 (USD Million)

TABLE 27 Europe Utilities in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 28 Europe IT and Telecommunication in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 29 Europe Automotive in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 30 Europe Electronics in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 31 Europe Aerospace in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 32 Europe Healthcare in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 33 Europe Oil and Gas in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 34 Europe Marine in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 35 Europe Food and Beverages in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 36 Europe Construction in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 37 Europe Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 38 Europe Chemical in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 39 Europe Others in Heat Shrink Tubing Market, By Region, 2019-2028, (USD Million)

TABLE 40 Europe heat shrink tubing Market, By Country, 2019-2028 (USD MILLION)

TABLE 41 Europe Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 42 Europe Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 43 Europe Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 44 Europe Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 45 Europe Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 46 Europe Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 47 Europe Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 48 Germany Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 49 Germany Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 50 Germany Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 51 Germany Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 52 Germany Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 53 Germany Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 54 Germany Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 55 France Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 56 France Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 57 France Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 58 France Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 59 France Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 60 France Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 61 France Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 62 U.K. Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 63 U.K. Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 64 U.K. Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 65 U.K. Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 66 U.K. Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 67 U.K. Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 68 U.K. Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 69 Italy Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 70 Italy Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 71 Italy Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 72 Italy Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 73 Italy Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 74 Italy Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 75 Italy Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 76 Spain Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 77 Spain Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 78 Spain Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 79 Spain Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 80 Spain Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 81 Spain Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 82 Spain Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 83 Netherlands Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 84 Netherlands Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 85 Netherlands Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 86 Netherlands Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 87 Netherlands Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 88 Netherlands Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 89 Netherlands Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 90 Belgium Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 91 Belgium Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 92 Belgium Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 93 Belgium Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 94 Belgium Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 95 Belgium Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 96 Belgium Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 97 Russia Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 98 Russia Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 99 Russia Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 100 Russia Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 101 Russia Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 102 Russia Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 103 Russia Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 104 Switzerland Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 105 Switzerland Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 106 Switzerland Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 107 Switzerland Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 108 Switzerland Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 109 Switzerland Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 110 Switzerland Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 111 Turkey Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 112 Turkey Heat shrink tubing Market, By Product Type, 2019-2028 (USD Million)

TABLE 113 Turkey Heat Shrink Tubing Market, By Voltage, 2019-2028 (USD Million)

TABLE 114 Turkey Heat Shrink Tubing Market, By Shrink Ratio, 2019-2028 (USD Million)

TABLE 115 Turkey Heat Shrink Tubing Market, By Material, 2019-2028 (USD Million)

TABLE 116 Turkey Heat Shrink Tubing Market, By End-User, 2019-2028 (USD Million)

TABLE 117 Turkey Construction in Heat Shrink Tubing Market, By Type, 2019-2028 (USD Million)

TABLE 118 Rest of Europe Heat shrink tubing Market, By Type, 2019-2028 (USD Million)

Lista de Figura

FIGURE 1 EUROPE HEAT SHRINK TUBING MARKET: segmentation

FIGURE 2 Europe heat shrink tubing market: data triangulation

FIGURE 3 Europe heat shrink tubing market: DROC ANALYSIS

FIGURE 4 Europe heat shrink tubing market: EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe heat shrink tubing market: COMPANY RESEARCH ANALYSIS

FIGURE 6 Europe heat shrink tubing market: INTERVIEW DEMOGRAPHICS

FIGURE 7 Europe heat shrink tubing market: DBMR MARKET POSITION GRID

FIGURE 8 Europe heat shrink tubing market: vendor share analysis

FIGURE 9 Europe heat shrink tubing market: SEGMENTATION

FIGURE 10 Increasing Role of government in supporting and expansion of Transmission & Distribution Systems across the region is EXPECTED TO DRIVE EUROPE HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 11 single wall segment is expected to account for the largest share of Europe heat shrink tubing market in 2021 & 2028

FIGURE 12 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF EUROPE HEAT SHRINK TUBING MARKET

FIGURE 13 Europe heat shrink tubing market: BY Type, 2020

FIGURE 14 Europe heat shrink tubing market: BY Product Type, 2020

FIGURE 15 Europe heat shrink tubing market: BY voltage, 2020

FIGURE 16 Europe heat shrink tubing market: BY Material, 2020

FIGURE 17 Europe heat shrink tubing market: BY SHRINK RATIO, 2020

FIGURE 18 Europe heat shrink tubing market: BY end user, 2020

FIGURE 19 EUROPE heat shrink tubing MARKET: SNAPSHOT (2020)

FIGURE 20 EUROPE heat shrink tubing MARKET: by Country (2020)

FIGURE 21 EUROPE heat shrink tubing MARKET: by Country (2021 & 2028)

FIGURE 22 EUROPE heat shrink tubing MARKET: by Country (2020 & 2028)

FIGURE 23 EUROPE heat shrink tubing MARKET: by Type (2019-2028)

FIGURE 24 Europe heat shrink tubing market: company share 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.