Europe Fraud Detection Transaction Monitoring Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

5.11 Billion

USD

24.47 Billion

2024

2032

USD

5.11 Billion

USD

24.47 Billion

2024

2032

| 2025 –2032 | |

| USD 5.11 Billion | |

| USD 24.47 Billion | |

|

|

|

|

Segmentação do mercado de monitoramento de transações de detecção de fraude na Europa, por oferta (solução e serviços), função (KYC/integração de clientes, gerenciamento de casos, triagem de lista de observação, painel e relatórios e outros), implantação (local e na nuvem), tamanho da organização (organizações de grande e médio porte), aplicação (detecção de fraude de pagamento, detecção de lavagem de dinheiro, proteção contra apropriação indébita de conta, prevenção de roubo de identidade e outros), vertical (bancos, serviços financeiros e seguros (BFSI), varejo, TI e telecomunicações, governo e defesa, saúde, manufatura, energia e serviços públicos e outros) - tendências do setor e previsão para 2032

Tamanho do mercado de monitoramento de transações de detecção de fraudes na Europa

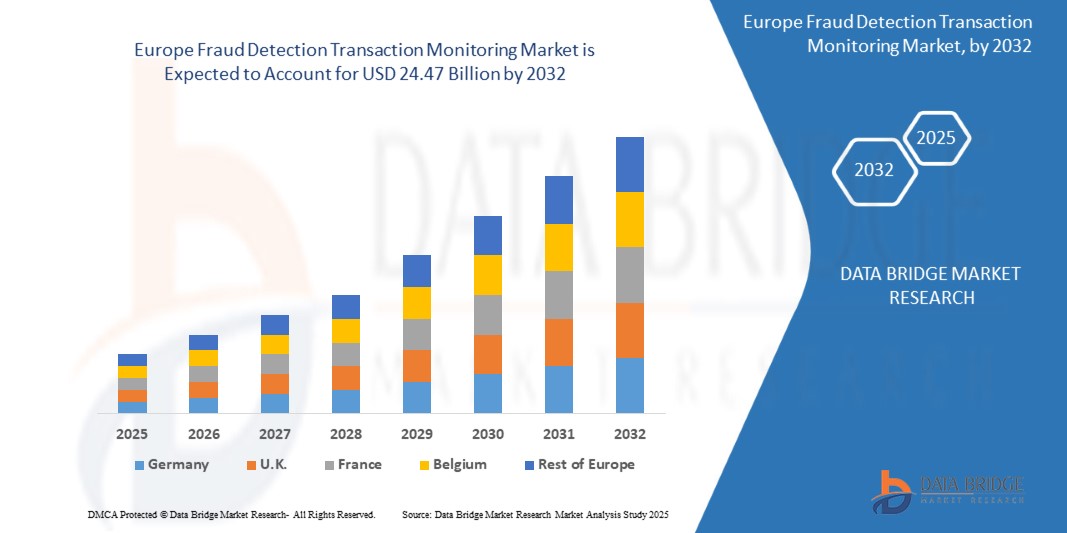

- O tamanho do mercado de monitoramento de transações de detecção de fraudes na Europa foi avaliado em US$ 5,11 bilhões em 2024 e deve atingir US$ 24,47 bilhões até 2032 , com um CAGR de 21,6% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente digitalização das transações financeiras, pela crescente adoção de serviços bancários on-line e plataformas de pagamento digital e pela integração de tecnologias de IA e aprendizado de máquina para detecção de fraudes em tempo real nos setores de BFSI, varejo e comércio eletrônico.

- Além disso, os crescentes requisitos de conformidade regulatória, incluindo KYC, AML e mandatos antifraude, juntamente com a crescente necessidade de sistemas de monitoramento de transações seguros, eficientes e automatizados, estão levando as organizações a adotar soluções avançadas de detecção de fraudes. Esses fatores convergentes estão acelerando a implantação de plataformas de monitoramento abrangentes, impulsionando significativamente o crescimento do setor.

Análise de Mercado de Detecção de Fraudes e Monitoramento de Transações na Europa

- Soluções de monitoramento de transações para detecção de fraudes ajudam organizações a identificar, prevenir e mitigar atividades fraudulentas, analisando transações em tempo real com IA, aprendizado de máquina e análise preditiva. Esses sistemas fornecem alertas, pontuação de risco automatizada e relatórios de conformidade para proteger ativos financeiros e operacionais.

- A crescente demanda por essas soluções é alimentada principalmente pelo aumento nas transações on-line, pela sofisticação crescente dos esquemas de fraude cibernética e pela necessidade crítica de as organizações garantirem a conformidade regulatória, ao mesmo tempo em que protegem os dados dos clientes e mantêm a confiança.

- A Alemanha dominou o mercado de monitoramento de transações de detecção de fraudes em 2024, devido ao seu setor bancário e de serviços financeiros maduro, infraestrutura digital avançada e alta adoção de fintech e soluções de pagamento digital

- Espera-se que o Reino Unido seja o país com crescimento mais rápido no mercado de monitoramento de transações de detecção de fraudes durante o período previsto devido à crescente adoção de serviços bancários digitais, pagamentos móveis e soluções de detecção de fraudes habilitadas por IA.

- O segmento de soluções dominou o mercado, com uma participação de mercado de 62,9% em 2024, devido à crescente necessidade de softwares avançados de detecção de fraudes que integrem IA, aprendizado de máquina e análises em tempo real. Organizações nos setores de BFSI, varejo e telecomunicações implementam cada vez mais plataformas de detecção de fraudes para proteger transações, reduzir perdas financeiras e garantir a conformidade regulatória. A escalabilidade das soluções, sua capacidade de fornecer insights preditivos e a integração perfeita com sistemas corporativos as tornam a escolha preferida para empresas que priorizam segurança e eficiência operacional.

Escopo do Relatório e Segmentação do Mercado de Monitoramento de Transações de Detecção de Fraudes na Europa

|

Atributos |

Principais insights de mercado sobre detecção de fraudes e monitoramento de transações na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências de mercado de monitoramento de transações e detecção de fraudes na Europa

Adotando IA para detecção de fraudes em tempo real

- A crescente adoção de inteligência artificial para detecção de fraudes em tempo real está remodelando o mercado de monitoramento de transações de detecção de fraudes. Instituições financeiras e empresas estão utilizando sistemas baseados em IA para identificar atividades suspeitas instantaneamente, reduzir falsos positivos e melhorar a precisão geral da detecção em redes de transações cada vez mais complexas.

- Por exemplo, a Mastercard utiliza ferramentas de detecção de fraudes baseadas em IA que analisam padrões de transações em tempo real para interceptar atividades fraudulentas antes que sejam concluídas. Da mesma forma, a Featurespace utiliza análise comportamental adaptativa com tecnologia de aprendizado de máquina para permitir que bancos e empresas de pagamento identifiquem anomalias em transações financeiras de grande porte com maior precisão.

- O uso de IA aprimora significativamente as capacidades de detecção de fraudes, analisando enormes volumes de dados estruturados e não estruturados em segundos, algo que os sistemas tradicionais baseados em regras têm dificuldade em alcançar. Isso permite que as organizações combatam com eficácia táticas avançadas de fraude, como identidades sintéticas, apropriação indébita de contas e fraudes em transações internacionais.

- As tecnologias de IA também ajudam a reduzir a taxa de falsas recusas, que podem impactar negativamente a experiência do cliente no setor financeiro. Ao melhorar a precisão da detecção, os sistemas de IA em tempo real protegem as instituições de perdas financeiras e também salvaguardam a confiança e a fidelidade do consumidor.

- A expansão dos ecossistemas de pagamento digital, incluindo carteiras móveis, plataformas de e-commerce e transferências ponto a ponto, aumentou a necessidade de prevenção instantânea de fraudes. Os sistemas de monitoramento de transações baseados em IA oferecem recursos adaptáveis e em tempo real que permitem integração perfeita com redes financeiras de alta velocidade.

- Em conclusão, a adoção da IA para detecção de fraudes em tempo real está impulsionando uma rápida transformação no setor. Essa tendência ressalta a crescente necessidade de estruturas de monitoramento ágeis, inteligentes e preditivas que possam se adaptar às táticas de fraude em evolução e proporcionar transações financeiras seguras e integradas em todo o mundo.

Dinâmica de Mercado de Detecção de Fraudes e Monitoramento de Transações na Europa

Motorista

Maior foco na verificação e autenticação de identidade

- A crescente ênfase na verificação e autenticação de identidade é um fator-chave que acelera a adoção de sistemas de monitoramento de transações. Com o aumento das transações digitais, as instituições financeiras estão priorizando métodos avançados de autenticação de identidade para proteger os usuários contra roubo de identidade, fraude de apropriação indébita de conta e acesso não autorizado.

- Por exemplo, a Experian integrou ferramentas avançadas de verificação de identidade em suas soluções de detecção de fraudes, utilizando autenticação biométrica e verificação multifator para fortalecer a segurança das transações. Da mesma forma, empresas como a LexisNexis Risk Solutions utilizam IA e big data para permitir que organizações financeiras validem as identidades dos clientes em tempo real, reduzindo o atrito na experiência do usuário.

- A integração de fatores biométricos, como reconhecimento facial, digitalização de impressões digitais e análise comportamental, aprimora ainda mais a mitigação de riscos em serviços bancários, de comércio eletrônico e de telecomunicações. Essas medidas fornecem recursos de verificação robustos para complementar o monitoramento de transações e reduzir vulnerabilidades em contas de usuários.

- O cenário regulatório, especialmente com estruturas como os requisitos de Conheça Seu Cliente (KYC) e Prevenção à Lavagem de Dinheiro (AML), também reforça a necessidade de ferramentas robustas de verificação e autenticação de identidade. As organizações financeiras devem adotar soluções avançadas de monitoramento para permanecer em conformidade e minimizar as multas regulatórias.

- De modo geral, a ênfase crescente na verificação e autenticação de identidade está reforçando a confiança global nos canais digitais. Esse fator garante que os sistemas de monitoramento de transações para detecção de fraudes continuem a evoluir como ferramentas indispensáveis para a segurança de serviços financeiros e a proteção do relacionamento com os clientes.

Restrição/Desafio

Alto investimento inicial e custos de manutenção contínua

- Um desafio significativo no mercado de monitoramento de transações para detecção de fraudes é o alto investimento financeiro necessário para implementação e manutenção contínua. A implantação de sistemas avançados de monitoramento com tecnologia de IA exige investimentos substanciais em plataformas de software, tecnologias de integração e pessoal qualificado, o que cria barreiras para instituições financeiras e empresas de menor porte.

- Por exemplo, grandes bancos como o JPMorgan Chase podem se dar ao luxo de implementar plataformas de monitoramento de fraudes em tempo real, orientadas por IA e com recursos preditivos. No entanto, instituições de médio porte e regionais frequentemente enfrentam altos custos de implementação e têm dificuldade em justificar despesas, especialmente em mercados com margens de lucro reduzidas.

- A complexidade de gerenciar e manter esses sistemas aumenta ainda mais os custos a longo prazo. Atualizações contínuas são necessárias para manter os modelos de ameaças atualizados, enquanto despesas operacionais, como ajuste de sistemas, capacidade de armazenamento em nuvem e ferramentas avançadas de análise, aumentam o ônus financeiro das organizações.

- Além disso, surgem desafios de escalabilidade quando os volumes de transações aumentam, exigindo que as instituições invistam mais em infraestrutura e sistemas de suporte. Isso afeta organizações com orçamentos limitados que já estão equilibrando os custos de conformidade e as pressões sobre os lucros.

- Como resultado, os altos custos iniciais, combinados com as despesas contínuas de manutenção, limitam a adoção generalizada de soluções de monitoramento de transações para detecção de fraudes. Superar esse desafio exigirá o desenvolvimento de plataformas com boa relação custo-benefício, modelos de assinatura baseados em nuvem e ofertas de serviços compartilhados para expandir a acessibilidade para instituições de todos os portes.

Escopo de mercado de monitoramento de transações de detecção de fraude na Europa

O mercado é segmentado com base na oferta, função, implantação, tamanho da organização, aplicação e vertical.

- Ao oferecer

Com base na oferta, o mercado é segmentado em soluções e serviços. O segmento de soluções dominou a maior fatia de mercado da receita, com 62,9% em 2024, impulsionado pela crescente necessidade de softwares avançados de detecção de fraudes que integrem IA, aprendizado de máquina e análises em tempo real. Organizações nos setores de BFSI, varejo e telecomunicações implementam cada vez mais plataformas de detecção de fraudes para proteger transações, reduzir perdas financeiras e garantir a conformidade regulatória. A escalabilidade das soluções, sua capacidade de fornecer insights preditivos e a integração perfeita com sistemas corporativos as tornam a escolha preferida para empresas que priorizam segurança e eficiência operacional.

O segmento de serviços deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda por serviços gerenciados, consultoria e suporte técnico. As empresas estão cada vez mais terceirizando o monitoramento de fraudes para provedores de serviços devido à falta de expertise interna e à complexidade de lidar com as crescentes ameaças cibernéticas. O aumento nas ofertas de detecção de fraudes por assinatura, serviços de treinamento e suporte de monitoramento 24 horas por dia, 7 dias por semana, está acelerando ainda mais a adoção. Provedores de serviços que oferecem consultoria personalizada e soluções focadas em conformidade estão ganhando força, especialmente entre PMEs que buscam prevenção de fraudes escalável e com boa relação custo-benefício.

- Por função

Com base na função, o mercado é segmentado em KYC/Onboarding de Clientes, Gestão de Casos, Triagem de Listas de Observação, Dashboard e Relatórios, entre outros. O segmento KYC/Onboarding de Clientes deteve a maior fatia de receita de mercado em 2024, devido aos crescentes mandatos regulatórios e requisitos de conformidade em todo o setor financeiro. Instituições financeiras, fintechs e bancos digitais contam com soluções robustas de KYC para autenticar identidades, prevenir aberturas fraudulentas de contas e fortalecer a confiança do cliente. A adoção de plataformas de verificação biométrica, e-KYC e onboarding digital impulsionou sua posição dominante, garantindo eficiência operacional e redução da exposição a riscos financeiros.

O segmento de triagem de listas de observação deverá apresentar a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente pressão global para cumprir as regulamentações de combate à lavagem de dinheiro (AML) e ao financiamento do terrorismo (CTF). As instituições estão implementando ferramentas avançadas de triagem para monitorar transações em relação a sanções globais, bancos de dados de pessoas politicamente expostas (PEP) e mídia adversa. O aumento dos pagamentos internacionais e do comércio internacional está levando as empresas a priorizar soluções de triagem automatizadas e em tempo real que minimizem o risco de conformidade e as penalidades regulatórias.

- Por implantação

Com base na implantação, o mercado é segmentado em on-premise e na nuvem. O segmento on-premise dominou a maior fatia da receita de mercado em 2024, à medida que grandes empresas e organizações governamentais continuam a priorizar o máximo controle de dados, a personalização do sistema e a segurança aprimorada. A implantação on-premise continua popular em setores altamente regulamentados, como bancos e defesa, onde existem requisitos rigorosos de soberania e confidencialidade de dados. A capacidade de integrar firmemente ferramentas de monitoramento de fraudes on-premise com sistemas de TI legados também contribui para seu amplo uso.

Prevê-se que o segmento de nuvem apresente o CAGR mais rápido entre 2025 e 2032, impulsionado por sua escalabilidade, custo-benefício e capacidade de suportar monitoramento em tempo real em redes distribuídas. Soluções de detecção de fraudes baseadas em nuvem oferecem às organizações atualizações instantâneas de software, análises baseadas em IA e flexibilidade para se adaptarem à evolução dos padrões de fraude. A rápida adoção de pagamentos digitais, trabalho remoto e serviços bancários online acelerou a adoção da nuvem, especialmente entre PMEs que buscam plataformas seguras de monitoramento de fraudes baseadas em assinatura, com custos iniciais mínimos de infraestrutura.

- Por tamanho da organização

Com base no porte da organização, o mercado é segmentado em grandes empresas e pequenas e médias empresas (PMEs). O segmento de grandes empresas representou a maior fatia de mercado em 2024, visto que corporações globais enfrentam riscos significativos com tentativas de fraude em larga escala, esquemas de lavagem de dinheiro e ataques cibernéticos. Essas organizações investem fortemente em plataformas de monitoramento de fraudes baseadas em IA, análises avançadas e sistemas de gerenciamento de riscos corporativos. A disponibilidade de orçamentos mais elevados, prioridades voltadas para conformidade e integração com operações multicanal garantem que as grandes empresas continuem sendo as principais adotantes de soluções de detecção de fraudes.

A previsão é de que o segmento de PMEs cresça ao ritmo mais acelerado entre 2025 e 2032, impulsionado por sua crescente vulnerabilidade a fraudes cibernéticas, phishing e sequestros de contas. As PMEs estão adotando ferramentas de detecção de fraudes baseadas em nuvem e com boa relação custo-benefício, que oferecem proteção automatizada sem a necessidade de uma ampla infraestrutura de TI. A crescente adoção de soluções de pagamento digital, aliada à crescente conscientização sobre as obrigações de conformidade, está levando as PMEs a adotar plataformas de monitoramento de fraudes. Modelos de preços baseados em assinaturas e serviços gerenciados de detecção de fraudes estão tornando essas soluções altamente atraentes para empresas de menor porte.

- Por aplicação

Com base na aplicação, o mercado é segmentado em detecção de fraudes em pagamentos, detecção de lavagem de dinheiro, proteção contra sequestro de contas, prevenção de roubo de identidade, entre outros. O segmento de detecção de fraudes em pagamentos dominou o mercado em 2024, devido ao rápido crescimento dos pagamentos digitais, transações de e-commerce e serviços bancários móveis. O aumento dos casos de transações não autorizadas, fraudes com cartões e ataques de phishing levou bancos e varejistas a adotar sistemas de detecção de fraudes com tecnologia de IA. A análise de transações em tempo real, a pontuação preditiva de fraudes e a integração com gateways de pagamento tornaram esse segmento a aplicação mais amplamente adotada em todos os setores.

Espera-se que o segmento de proteção contra roubo de contas registre a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente sofisticação do roubo de credenciais, golpes de phishing e ataques de engenharia social. Fraudadores têm como alvo contas de usuários em bancos, varejo e telecomunicações, tornando o roubo de contas uma preocupação significativa. As empresas estão adotando autenticação multifator, biometria comportamental e monitoramento baseado em IA para detectar anomalias nos padrões de acesso dos usuários. O aumento no número de contas online, carteiras digitais e serviços baseados em nuvem está impulsionando ainda mais a adoção de soluções de proteção contra roubo de contas.

- Por Vertical

Com base na vertical, o mercado é segmentado em bancos, serviços financeiros e seguros (BFSI), varejo, TI e telecomunicações, governo e defesa, saúde, manufatura, energia e serviços públicos, entre outros. O segmento BFSI dominou a maior fatia da receita de mercado em 2024, já que bancos e instituições financeiras continuam sendo os principais alvos de fraudadores. O setor investe fortemente em plataformas de detecção de fraudes para proteger transações digitais, combater a lavagem de dinheiro e cumprir com estruturas regulatórias rigorosas, como AML e KYC. A rápida expansão das inovações em bancos online e fintechs continua a impulsionar a adoção de soluções avançadas de monitoramento de fraudes no BFSI.

O segmento de saúde deverá apresentar o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente incidência de roubo de identidade médica, fraudes em seguros e violações de dados. Com a crescente digitalização de registros médicos e sistemas de cobrança de pacientes, os provedores de saúde estão implantando plataformas de detecção de fraudes para proteger dados sensíveis. Sistemas de análise e monitoramento baseados em IA estão sendo adotados para detectar reivindicações fraudulentas e impedir o acesso não autorizado a informações médicas. A crescente pressão regulatória para proteger os dados dos pacientes também está acelerando a adoção do monitoramento de fraudes neste setor.

Análise regional do mercado de monitoramento de transações e detecção de fraudes na Europa

- A Alemanha dominou o mercado de monitoramento de transações de detecção de fraudes com a maior participação na receita em 2024, impulsionada por seu setor bancário e de serviços financeiros maduro, infraestrutura digital avançada e alta adoção de fintech e soluções de pagamento digital.

- A liderança da Alemanha é reforçada pela crescente adoção de sistemas de monitoramento de fraudes com tecnologia de IA, pelo aumento das transações digitais e pela integração de análises automatizadas em tempo real para conformidade e mitigação de riscos. A ênfase do país em segurança cibernética, o investimento em tecnologias avançadas de análise e a colaboração entre instituições financeiras e provedores de tecnologia estão acelerando ainda mais a adoção pelo mercado.

- A posição da Alemanha é ainda mais fortalecida por investimentos contínuos em plataformas de monitoramento baseadas em nuvem e no local, foco em modelos de detecção preditiva de fraudes e expansão contínua de ecossistemas de pagamento digital e soluções de verificação de identidade em aplicativos empresariais e governamentais.

Visão do mercado de monitoramento de transações de detecção de fraudes no Reino Unido

O mercado do Reino Unido deverá registrar o CAGR mais rápido da Europa entre 2025 e 2032, impulsionado pela crescente adoção de serviços bancários digitais, pagamentos móveis e soluções de detecção de fraudes com IA. A crescente demanda por sistemas de monitoramento em tempo real, a preferência do consumidor por transações digitais seguras e fluidas e a forte penetração de plataformas fintech estão acelerando a implantação de soluções. A expansão de iniciativas de open banking, as colaborações entre bancos e provedores de tecnologia e os investimentos em análise preditiva e modelos de aprendizado de máquina estão impulsionando ainda mais o crescimento do mercado.

França Detecção de Fraudes Monitoramento de Transações Visão de Mercado

A França deverá crescer de forma constante entre 2025 e 2032, apoiada por um setor financeiro robusto, foco crescente na prevenção de fraudes e ênfase regulatória em conformidade com KYC e AML. A crescente integração de softwares avançados de detecção de fraudes nos setores bancário e de e-commerce, os investimentos em ferramentas de monitoramento baseadas em IA e aprendizado de máquina e a promoção de sistemas de transações seguras estão impulsionando a demanda do mercado. P&D localizado, parcerias com provedores de tecnologia e foco em soluções de detecção de fraudes confiáveis e de alta qualidade apoiam ainda mais a expansão do mercado.

Participação no mercado de monitoramento de transações de detecção de fraudes na Europa

O setor de monitoramento de transações de detecção de fraudes é liderado principalmente por empresas bem estabelecidas, incluindo:

- Amazon Web Services, Inc. (EUA)

- LexisNexis (EUA)

- Mastercard (EUA)

- TATA Consultancy Services Limited (Índia)

- Fiserv, Inc. (EUA)

- SAS Institute Inc. (EUA)

- ACI Worldwide (EUA)

- Oracle (EUA)

- NICE (Israel)

- FICO (EUA)

- SymphonyAI (EUA)

- UBIQUITY (EUA)

- Verafin Solutions ULC (Canadá)

- GB Group plc ('GBG') (Reino Unido)

- INFORM SOFTWARE (Alemanha)

- Quantexa (Reino Unido)

- Sum and Substance Ltd (Reino Unido)

- DataVisor, Inc. (EUA)

- Hawk (Alemanha)

- Featurespace Limited (Inglaterra)

- INETCO Systems Ltd. (Canadá)

- Abra Innovations, Inc. (EUA)

- Seon Technologies Ltd. (Hungria)

- Feedzai (Portugal)

- Scanner de Sanções (Reino Unido)

Últimos desenvolvimentos no mercado europeu de monitoramento de transações de detecção de fraudes

- Em junho de 2024, a American Express acelerou a detecção de fraudes usando modelos de memória de longo prazo (LSTM) com tecnologia de IA. Ao utilizar computação paralela em GPUs, a empresa processou e analisou rapidamente grandes quantidades de dados transacionais, permitindo a detecção de fraudes em tempo real. Essa abordagem ajudou a American Express a lidar com as complexidades decorrentes do seu alto volume de transações. A integração da computação acelerada e da IA aumentou sua capacidade de detectar anomalias rapidamente, melhorando a eficiência operacional e reduzindo potenciais perdas devido a fraudes.

- Em junho de 2024, a DataVisor, Inc. aprimorou seus recursos de multilocação para fornecer soluções escaláveis, seguras e flexíveis de prevenção à fraude e combate à lavagem de dinheiro. A atualização permitiu que as organizações personalizassem estratégias de combate à fraude e combate à lavagem de dinheiro e as implementassem em sublocatários com recursos como modelos de aprendizado de máquina e regras de negócios. Essas melhorias apoiaram os bancos patrocinadores em sua conformidade e permitiram que grandes instituições financeiras centralizassem os dados, oferecendo, ao mesmo tempo, a tomada de decisões em sublocação. Esse desenvolvimento beneficiou a DataVisor, fortalecendo sua posição de mercado e aumentando a adoção de suas soluções entre instituições bancárias e financeiras, aumentando a satisfação e a retenção de clientes.

- Em junho de 2024, a ACI Worldwide e a RS2 lançaram uma solução de pagamento abrangente no Brasil, combinando suas tecnologias de adquirência e emissão. Essa plataforma em nuvem permitiu que instituições financeiras e provedores de serviços de pagamento introduzissem novos produtos e serviços com eficiência, aumentando a segurança e reduzindo custos. A integração de gerenciamento avançado de fraudes e análises em tempo real beneficiou as empresas, expandindo seu alcance de mercado e aumentando as oportunidades de receita.

- Em outubro de 2023, a ACI Worldwide firmou uma parceria com a Nymcard para aprimorar seus recursos de combate à fraude e à lavagem de dinheiro. Essa parceria permitiu à Nymcard detectar e prevenir fraudes financeiras de forma rápida e eficiente, utilizando aprendizado de máquina e análises avançadas. A implantação por meio da nuvem pública da ACI melhorou a escalabilidade, a segurança e a eficiência operacional, fortalecendo significativamente a posição de mercado da Nymcard na região MENA.

- Em julho de 2023, de acordo com o blog publicado pela BluEnt, as empresas enfrentaram desafios crescentes na detecção de fraudes devido ao alto volume de transações. Tecnologia avançada e sistemas automatizados foram adotados para analisar grandes conjuntos de dados e identificar tendências e anomalias de alto risco. Apesar das dificuldades no gerenciamento de dados não estruturados, onde ocorre a maioria das fraudes, a análise de dados de crimes financeiros permitiu a revisão eficaz de dados estruturados e não estruturados. Essa abordagem ajudou a prevenir atividades fraudulentas e a integrar diversas fontes de dados para aprimorar a detecção.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.