Europe Foundry Chemicals Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.69 Billion

USD

3.80 Billion

2025

2033

USD

2.69 Billion

USD

3.80 Billion

2025

2033

| 2026 –2033 | |

| USD 2.69 Billion | |

| USD 3.80 Billion | |

|

|

|

|

Segmentação do Mercado Europeu de Produtos Químicos para Fundição, por Tipo (Benzeno, Formaldeído, Naftaleno, Fenol, Xileno e Outros), Tipo de Produto (Aglutinantes, Aditivos, Revestimentos, Fluxos e Outros), Tipo de Fundição (Ferrosos e Não Ferrosos), Tipo de Ferramenta de Fundição (Espátula, Colher de Pedreiro, Levantador, Misturador Manual, Arame de Ventilação, Socadores, Escova, Pinos e Cortadores de Canais de Alimentação e Outros), Tipo de Processo de Fundição (Galvanização Térmica e Niquelagem Química), Tipo de Sistema de Fundição (Sistemas de Fundição em Areia e Sistemas de Fundição em Areia com Ligação Química), Aplicação (Ferro Fundido, Aço, Alumínio e Outros), Canal de Distribuição (Comércio Eletrônico, Lojas Especializadas, Distribuidores B2B/Terceiros e Outros) - Tendências e Previsões do Setor até 2033

Qual é o tamanho e a taxa de crescimento do mercado europeu de produtos químicos para fundição?

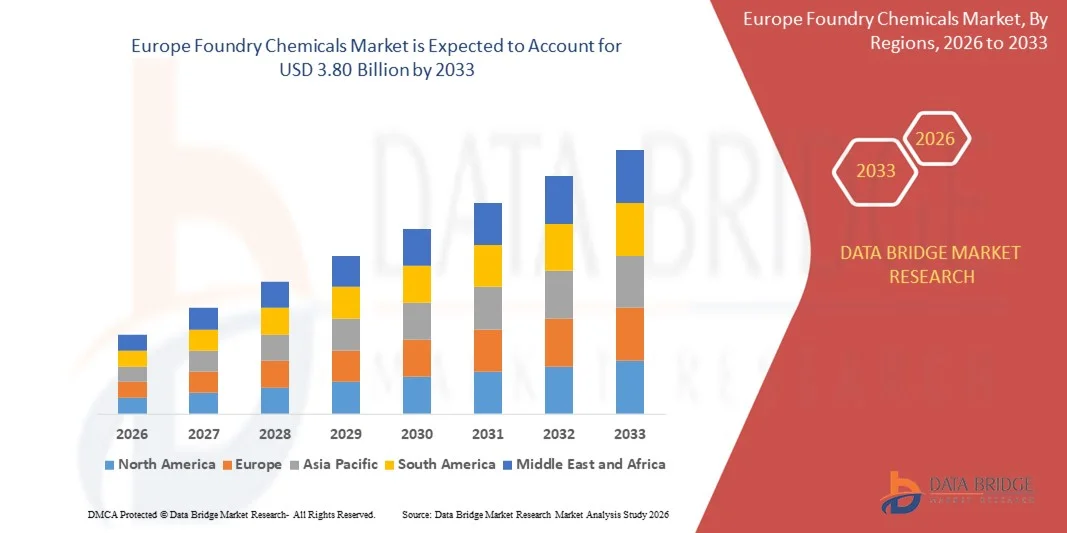

- O mercado europeu de produtos químicos para fundição foi avaliado em US$ 2,69 bilhões em 2025 e deverá atingir US$ 3,80 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,1% durante o período de previsão.

- A crescente demanda por fundição de metais na fabricação de máquinas pesadas está impulsionando o crescimento do mercado de produtos químicos para fundição.

- A corrosividade dos metais ferrosos em condições ambientais está prejudicando a demanda no mercado de produtos químicos para fundição.

Quais são os principais pontos a serem considerados no mercado de produtos químicos para fundição?

- O aumento da demanda por aço no mercado representa uma oportunidade para o mercado de produtos químicos para fundição. Por outro lado, as rigorosas regulamentações ambientais relativas aos produtos químicos liberados pelas fundições representam um desafio que pode prejudicar o crescimento desse mercado.

- A Alemanha dominou o mercado europeu de produtos químicos para fundição, com uma participação de mercado estimada em 48,7% em 2025, impulsionada pela forte automação industrial, pela fabricação de automóveis e máquinas e pela alta adoção nos setores de construção, energias renováveis e equipamentos pesados.

- Prevê-se que a Itália registe a taxa de crescimento anual composta (CAGR) mais rápida, de 9,8%, entre 2026 e 2033, impulsionada pelo aumento do uso em componentes automotivos, máquinas de construção e automação industrial.

- O segmento de formaldeído dominou o mercado com uma participação estimada em 41,2% em 2025, impulsionado por sua alta reatividade, excelentes propriedades de ligação e ampla aplicação nas indústrias de fundição ferrosa e não ferrosa.

Escopo do relatório e segmentação do mercado de produtos químicos para fundição

|

Atributos |

Principais informações de mercado sobre produtos químicos para fundição |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de produtos químicos para fundição?

Adoção crescente de produtos químicos avançados, leves e de alta durabilidade para fundição.

- O mercado de produtos químicos para fundição está experimentando uma crescente demanda por materiais leves, resistentes à corrosão e de alto desempenho, utilizados nos setores automotivo, aeroespacial, de máquinas industriais e de energias renováveis.

- Os fabricantes estão introduzindo cada vez mais compósitos poliméricos, ligas revestidas com PTFE e soluções metal-cerâmicas reforçadas com fibras para melhorar a resistência ao desgaste, a capacidade de carga e a confiabilidade operacional.

- A ênfase na eficiência energética, na redução da manutenção e no maior ciclo de vida útil está impulsionando a adoção em ambientes de alta exigência e operação contínua.

- Por exemplo, empresas como SKF, Schaeffler, Trelleborg, GGB e RBC Bearings estão expandindo seu portfólio de rolamentos compostos avançados e revestimentos redutores de atrito para veículos elétricos, turbinas eólicas, automação industrial e equipamentos pesados.

- A alta adoção de produtos químicos para fundição em veículos elétricos, robótica industrial, sistemas de manuseio de fluidos e componentes aeroespaciais está sustentando a expansão do mercado.

- À medida que as indústrias se concentram na durabilidade, na otimização do peso e na redução do custo do ciclo de vida, espera-se que os produtos químicos para fundição continuem sendo essenciais nos sistemas mecânicos e industriais de próxima geração.

Quais são os principais fatores que impulsionam o mercado de produtos químicos para fundição?

- A crescente demanda por rolamentos que não necessitam de manutenção, lubrificação e capacidade de suportar altas cargas está impulsionando significativamente a adoção de produtos químicos para fundição nos setores automotivo, aeroespacial e industrial.

- Por exemplo, entre 2024 e 2025, a SKF, a Schaeffler e a Trelleborg lançaram soluções avançadas em compósitos e polímeros, projetadas para temperaturas extremas, cargas pesadas e vida útil prolongada.

- A crescente implantação de veículos elétricos, sistemas de energia eólica, máquinas automatizadas e robôs industriais está aumentando a necessidade de rolamentos leves, duráveis e energeticamente eficientes.

- Os avanços na engenharia de polímeros, em compósitos e na fabricação de precisão estão aprimorando a resistência ao atrito, o desempenho ao desgaste e a capacidade de suportar cargas.

- O crescente foco na sustentabilidade e na economia de energia está promovendo a substituição de mancais metálicos convencionais por alternativas de compósitos ou polímeros.

- Impulsionado pela automação industrial, expansão de energias renováveis e crescimento da infraestrutura, o mercado de produtos químicos para fundição está preparado para um crescimento constante a longo prazo.

Qual fator está desafiando o crescimento do mercado de produtos químicos para fundição?

- Os custos mais elevados de polímeros avançados, fibras e materiais fabricados com precisão limitam a adoção em aplicações sensíveis ao preço.

- A volatilidade nos preços das matérias-primas e as interrupções na cadeia de suprimentos durante 2024-2025 aumentaram os custos operacionais para os principais fabricantes.

- As limitações de desempenho sob cargas de choque extremas ou condições de desalinhamento podem restringir a aplicação em certos sistemas industriais de alta exigência.

- O conhecimento limitado entre os pequenos fabricantes sobre os benefícios do ciclo de vida e a eficiência de custos a longo prazo retarda a penetração no mercado.

- A concorrência de rolamentos metálicos tradicionais e substitutos de baixo custo exerce pressão sobre os preços e reduz a diferenciação.

- Para superar esses desafios, as empresas estão se concentrando em projetos com boa relação custo-benefício, aplicações específicas e educação do cliente para impulsionar uma adoção mais ampla de produtos químicos para fundição.

Como o mercado de produtos químicos para fundição está segmentado?

O mercado é segmentado com base no tipo, tipo de produto, tipo de fundição, tipo de ferramenta de fundição, tipo de processo de fundição, tipo de sistema de fundição, canal de distribuição e aplicação.

- Por tipo

O mercado de produtos químicos para fundição é segmentado em benzeno, formaldeído, naftaleno, fenol, xileno e outros. O segmento de formaldeído dominou o mercado com uma participação estimada em 41,2% em 2025, impulsionado por sua alta reatividade, excelentes propriedades de ligação e ampla aplicação nas indústrias de fundição de metais ferrosos e não ferrosos. Os produtos químicos à base de formaldeído são amplamente utilizados em formulações de resinas, revestimentos e aglutinantes de núcleos, proporcionando resistência e durabilidade em operações de alta temperatura.

Prevê-se que o segmento de Fenóis apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela crescente demanda por resinas fenólicas em processos avançados de fundição, aplicações aeroespaciais e automotivas. Sua resistência superior ao calor, estabilidade química e capacidade de produzir núcleos com baixa emissão estão acelerando sua adoção. O foco crescente na produção sustentável e na melhoria da qualidade da fundição reforça ainda mais as oportunidades de crescimento para produtos químicos de fundição à base de fenol em todo o mundo.

- Por tipo de produto

Com base no tipo de produto, o mercado é segmentado em aglutinantes, aditivos, revestimentos, fluxos e outros. O segmento de aglutinantes dominou o mercado com 38,5% de participação em 2025, impulsionado pela forte demanda em fundição em areia, fabricação de machos e sistemas de areia com ligação química. Os aglutinantes aumentam a resistência dos moldes, reduzem defeitos e melhoram o acabamento superficial em aplicações automotivas, de construção e industriais.

O segmento de Revestimentos deverá registrar a taxa de crescimento anual composta (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente adoção de revestimentos resistentes ao calor e protetores em fundições de alta precisão, aeroespacial e máquinas industriais. Os avanços tecnológicos em formulações de revestimentos que melhoram o isolamento térmico, a resistência ao desgaste e a redução de defeitos estão fortalecendo ainda mais a expansão do mercado globalmente.

- Por tipo de fundição

Com base no tipo de fundição, o mercado é segmentado em Ferroso e Não Ferroso. O segmento Ferroso dominou o mercado com uma participação de 56,7% em 2025, devido ao seu amplo uso em fundições de aço, ferro e ligas para os setores automotivo, de construção e de máquinas pesadas. As fundições de metais ferrosos exigem soluções químicas robustas para moldagem em alta temperatura, desempenho do aglutinante e qualidade do acabamento superficial.

Prevê-se que o segmento de metais não ferrosos apresente o crescimento mais rápido em termos de taxa composta de crescimento anual (CAGR) entre 2026 e 2033, impulsionado pelo aumento da fundição de alumínio, cobre e ligas especiais para aplicações em eletrônica, aeroespacial e automotiva de baixo peso. A crescente industrialização e a demanda por componentes de precisão e leves também contribuem para a adoção de produtos químicos para fundição de metais não ferrosos.

- Por tipo de ferramenta de fundição

Com base no tipo de ferramenta, o mercado é segmentado em pás, colheres de pedreiro, levantadores, peneiras manuais, arames de ventilação, socadores, escovas, pinos e cortadores de canais de alimentação e outros. O segmento de socadores dominou com 33,4% de participação em 2025, sendo amplamente utilizado para compactar moldes e machos em operações de fundição de alta qualidade. Os socadores garantem densidade uniforme, redução de defeitos e maior resistência do molde, principalmente em fundições industriais e automotivas de grande porte.

Prevê-se que o segmento de swabs apresente o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, devido ao aumento do seu uso em revestimento de núcleos, limpeza de precisão e preparação de moldes sem defeitos em fundição de metais ferrosos e não ferrosos. O aumento da automação e a demanda por peças fundidas de alta qualidade aceleram a adoção de swabs.

- Por tipo de processo de fundição

Com base no tipo de processo, o mercado é segmentado em Galvanização Térmica e Niquelagem Química. O segmento de Galvanização Térmica dominou com uma participação de 59,1% em 2025, impulsionado pela forte aplicação na proteção contra corrosão, endurecimento superficial e resistência a altas temperaturas em componentes industriais.

O segmento de niquelagem química deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, devido à sua deposição uniforme, maior resistência ao desgaste e ampla adoção nas indústrias aeroespacial, automotiva e de fundição de precisão. A ênfase regulatória na sustentabilidade e o aprimoramento das tecnologias de revestimento também contribuem para esse crescimento.

- Por tipo de sistema de fundição

O mercado está segmentado em Sistemas de Fundição em Areia e Sistemas de Fundição em Areia com Ligação Química. O segmento de Sistemas de Fundição em Areia dominou com uma participação de 52,6% em 2025, devido ao seu uso generalizado na fundição de metais ferrosos e não ferrosos, à sua relação custo-benefício e à compatibilidade com fundições tradicionais.

Prevê-se que o segmento de Sistemas de Fundição em Areia com Ligação Química apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por peças fundidas de alta precisão e com poucos defeitos nos setores automotivo, aeroespacial e de máquinas industriais. Tecnologias de ligantes avançadas e produtos químicos de alto desempenho estão acelerando a sua adoção.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em Ferro Fundido, Aço, Alumínio e Outros. O segmento de Ferro Fundido dominou com uma participação de 44,3% em 2025, impulsionado pelo uso extensivo em motores automotivos, máquinas industriais e equipamentos pesados. As fundições de ferro fundido exigem aglutinantes, revestimentos e fluxos de alto desempenho para precisão, estabilidade térmica e produção sem defeitos.

Prevê-se que o segmento de alumínio apresente o crescimento anual composto mais rápido entre 2026 e 2033, devido ao aumento de componentes leves para os setores automotivo e aeroespacial, à crescente automação industrial e à demanda por peças fundidas sustentáveis e de alta precisão.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em comércio eletrônico, lojas especializadas, distribuidores B2B/terceiros e outros. O segmento de distribuidores B2B/terceiros dominou o mercado com 61,8% de participação em 2025, devido a fortes relações com fornecedores, compras em grande volume por usuários industriais e soluções personalizadas para fundições de alto volume.

Espera-se que o segmento de comércio eletrônico cresça à taxa composta de crescimento anual (CAGR) mais rápida de 2026 a 2033, impulsionado pela crescente digitalização, pelo acesso online a produtos químicos padrão e especiais e pela adoção por fundições de pequeno e médio porte. Entregas mais rápidas, preços competitivos e maior disponibilidade de produtos sustentam a expansão do mercado globalmente.

Qual região detém a maior participação no mercado de produtos químicos para fundição?

- A Alemanha dominou o mercado europeu de produtos químicos para fundição, com uma participação de mercado estimada em 48,7% em 2025, impulsionada pela forte automação industrial, pela fabricação de automóveis e máquinas e pela alta adoção nos setores de construção, energias renováveis e equipamentos pesados.

- A crescente demanda por produtos químicos para fundição de alto desempenho, baixa manutenção e resistentes ao desgaste reforça a liderança da Alemanha no mercado.

- Colaborações sólidas com fabricantes de equipamentos originais (OEMs), tecnologias de fabricação avançadas e investimentos contínuos em pesquisa e desenvolvimento fortalecem ainda mais as perspectivas de crescimento a longo prazo.

Análise do Mercado de Produtos Químicos para Fundição na França

Na França, o crescimento do mercado é impulsionado pelas aplicações nos setores automotivo, aeroespacial e de máquinas industriais. Os produtos químicos para fundição são amplamente utilizados em fundição de precisão, turbinas eólicas e equipamentos pesados devido ao baixo atrito, alta resistência ao desgaste e operação livre de manutenção. O foco em soluções sustentáveis e energeticamente eficientes, juntamente com a forte produção nacional e parcerias com fabricantes de equipamentos originais (OEMs), sustenta a adoção constante e garante a expansão do mercado a longo prazo em segmentos industriais-chave.

Análise do Mercado de Produtos Químicos para Fundição na Itália

Prevê-se que a Itália registre a taxa de crescimento anual composta (CAGR) mais rápida, de 9,8%, entre 2026 e 2033, impulsionada pelo aumento do uso em componentes automotivos, máquinas de construção e automação industrial. A crescente adoção de métodos de produção com eficiência energética, projetos de energia renovável e componentes para veículos elétricos acelera a demanda por produtos químicos para fundição de fibras e matrizes metálicas. A expansão dos polos de produção nacionais e o crescimento industrial voltado para a exportação sustentam ainda mais o desenvolvimento do mercado a longo prazo.

Análise do Mercado de Produtos Químicos para Fundição no Reino Unido

No Reino Unido, o crescimento é impulsionado por investimentos nos setores automotivo, aeroespacial e industrial, onde os produtos químicos para fundição são preferidos para aplicações de alta carga, resistentes à corrosão e que não exigem manutenção. A crescente adoção em instalações de energia renovável e manufatura avançada é incentivada por normas regulatórias de eficiência. A colaboração entre fabricantes, OEMs e instituições de pesquisa fomenta a inovação em materiais e processos, aumentando a competitividade regional.

Análise do Mercado de Produtos Químicos para Fundição na Espanha

A Espanha apresenta um crescimento constante impulsionado por projetos de construção, automotivos e de energias renováveis. Os produtos químicos para fundição são cada vez mais utilizados em equipamentos industriais, turbinas eólicas e máquinas pesadas para melhorar o desempenho sob carga, a durabilidade e a vida útil. Iniciativas governamentais que promovem a modernização industrial, soluções de eficiência energética e o crescimento da produção local apoiam a adoção regional. A expansão das exportações e as colaborações industriais transfronteiriças fortalecem ainda mais o crescimento do mercado a longo prazo.

Quais são as principais empresas no mercado de produtos químicos para fundição?

A indústria de produtos químicos para fundição é liderada principalmente por empresas consolidadas, incluindo:

- Vesúvio (Reino Unido)

- Imerys (França)

- Saint Gobain Cerâmicas e Refratários de Alto Desempenho (França)

- Produtos Químicos da Georgia Pacific (EUA)

- DuPont (EUA)

- ASK Chemicals (EUA)

- Shandong Crownchem Industries Co., Ltd (China)

- Compax Industrial Systems Pvt. Ltd (Índia)

- CS ADDITIVE GMBH (Alemanha)

- CAGroup (EAU)

- Ultraseal India Pvt. Ltd. (Índia)

- Hüttenes Albertus (Alemanha)

- CERAFLUX INDIA PVT.LTD. (Índia)

- Forçace Polymers (P) Ltd. (Índia)

- Scottish Chemical (Reino Unido)

Quais são os desenvolvimentos recentes no mercado global de produtos químicos para fundição?

- Em agosto de 2025, a Vesuvius adquiriu a Molten Metal Systems da Morgan Advanced para fortalecer sua receita de metais não ferrosos, elevando-a para 27%, com foco na expansão na Índia. As sinergias de custos devem gerar um aumento de mais de 50% no EBITDA, reforçando a posição da empresa no mercado global.

- Em março de 2025, a ASK Chemicals lançou uma nova gama de aglutinantes para fundição a frio com baixas emissões, reduzindo a emissão de COVs em 30% para promover operações de fundição sustentáveis em aplicações automotivas, apoiando práticas de produção ambientalmente responsáveis.

- Em janeiro de 2024, a Hüttenes-Albertus International desenvolveu agentes desmoldantes de base biológica em conformidade com as diretivas ambientais da UE, visando o crescimento no setor da construção civil e reforçando ainda mais o compromisso da empresa com soluções sustentáveis e ecológicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.