Europe Excipients Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.89 Billion

USD

2.96 Billion

2024

2032

USD

1.89 Billion

USD

2.96 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.96 Billion | |

|

|

|

|

Segmentação do mercado europeu de excipientes por origem (orgânica e inorgânica), categoria (excipientes primários e secundários), produtos (polímeros, açúcares, álcoois, minerais, gelatina e outros), tipo de composição química (vegetal, animal, sintética e mineral), síntese química (monoidratação de lactose, sucralose, polissorbato, álcool benzílico, álcool cetostearílico, lecitina de soja, amido pré-gelatinizado e outros), funcionalidade (aglutinantes e adesivos, desintegrantes, materiais de revestimento, solubilizantes, aromatizantes, adoçantes, diluentes, lubrificantes, tampões, emulsificantes, conservantes, antioxidantes, sorventes, solventes, emolientes, deslizantes, agentes quelantes, antiespumantes e outros), forma farmacêutica (sólida, semissólida e líquida). Líquido), Via de Administração (Excipientes Orais, Excipientes Tópicos, Excipientes Parenterais e Outros Excipientes), Usuário Final (Empresas Farmacêuticas e Biofarmacêuticas , Formuladores Contratados, Organizações de Pesquisa e Acadêmicos, e Outros), Canal de Distribuição (Licitação Direta, Vendas no Varejo e Outros) - Tendências e Previsões do Setor até 2032

Tamanho do mercado de excipientes na Europa

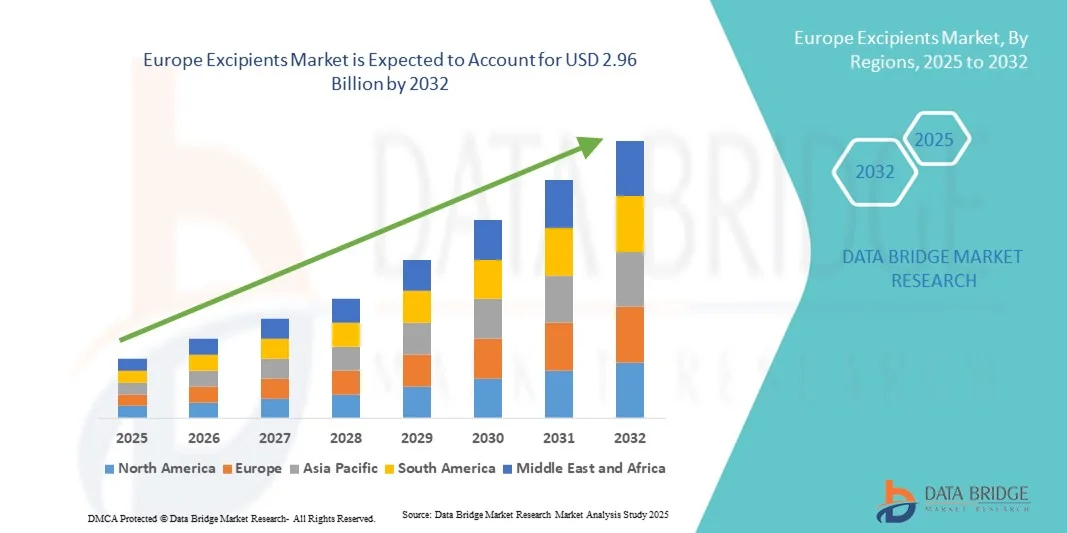

- O mercado europeu de excipientes foi avaliado em US$ 1,89 bilhão em 2024 e deverá atingir US$ 2,96 bilhões em 2032 , com uma taxa de crescimento anual composta (CAGR) de 5,80% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por formulações farmacêuticas e pela adoção cada vez maior de tecnologias avançadas de administração de medicamentos, tanto em mercados desenvolvidos quanto emergentes.

- Além disso, a crescente ênfase na melhoria da estabilidade, eficácia e adesão do paciente ao tratamento está impulsionando a adoção de soluções de excipientes, aumentando significativamente o crescimento do setor.

Análise do Mercado de Excipientes na Europa

- O mercado de excipientes, que engloba substâncias utilizadas para melhorar a estabilidade, a biodisponibilidade e a eficácia de formulações farmacêuticas, está apresentando um crescimento significativo devido à crescente demanda por sistemas otimizados de administração de medicamentos e à expansão da indústria farmacêutica.

- A crescente demanda por excipientes é impulsionada principalmente pelo aumento da produção de medicamentos orais e injetáveis, pelo foco cada vez maior em novos sistemas de administração de fármacos e pela necessidade crescente de soluções de formulação com boa relação custo-benefício.

- A Alemanha dominou o mercado de excipientes com a maior participação de receita, de 41,5% em 2024, caracterizada por uma forte base de fabricação farmacêutica, altos gastos com saúde e presença de importantes players do setor. O país tem experimentado um crescimento substancial nas aplicações de excipientes em formulações orais, injetáveis e tópicas.

- Prevê-se que a França seja a região de crescimento mais rápido no mercado de excipientes durante o período de previsão, devido ao aumento da produção farmacêutica, à adoção de tecnologias avançadas de administração de medicamentos e aos crescentes investimentos em infraestrutura de saúde.

- O segmento de excipientes primários detinha a maior participação na receita, com 47,3% em 2024, devido ao seu papel essencial nas formulações farmacêuticas, incluindo aglutinantes, diluentes e desintegrantes. Os excipientes primários formam a base das formulações de medicamentos, oferecendo estabilidade, melhor manuseio e biodisponibilidade otimizada.

Escopo do relatório e segmentação do mercado de excipientes

|

Atributos |

Principais informações de mercado sobre excipientes |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de excipientes na Europa

Crescente demanda por excipientes funcionais e de alto desempenho

- Uma tendência significativa e crescente no mercado global de neuropatia amilóide é a ênfase cada vez maior no diagnóstico precoce e no desenvolvimento de terapias personalizadas para melhorar os resultados dos pacientes.

- Por exemplo, em março de 2023, a Ionis Pharmaceuticals relatou progresso em seus ensaios clínicos de Fase 2 para terapia com oligonucleotídeos antisense direcionada à neuropatia amilóide hereditária, destacando o foco do mercado em terapias direcionadas.

- Os avanços nas tecnologias de diagnóstico, como testes genéticos e biópsia de tecido, estão permitindo a detecção precoce e uma melhor caracterização das neuropatias amilóides.

- As abordagens da medicina personalizada estão impulsionando regimes de tratamento sob medida, baseados em perfis genéticos e clínicos específicos de cada paciente.

- Os médicos estão adotando cada vez mais estratégias de tratamento multimodais, combinando medicamentos, intervenções no estilo de vida e cuidados de suporte para otimizar os resultados dos pacientes.

- Há uma tendência crescente em direção a opções terapêuticas menos invasivas e mais seguras, que reduzem os efeitos colaterais e aumentam a adesão do paciente ao tratamento.

- A pesquisa e o desenvolvimento contínuos estão focados no desenvolvimento de novas moléculas e sistemas de administração de medicamentos direcionados especificamente à deposição de amiloide e à degeneração nervosa. A tendência de mercado também inclui terapias combinadas e protocolos de tratamento em várias etapas, projetados para melhorar a eficácia em diversas populações de pacientes.

- Estudos de evidências do mundo real e dados de ensaios clínicos estão influenciando as decisões médicas e incentivando a adoção de opções de tratamento avançadas. Iniciativas de educação do paciente estão melhorando a conscientização sobre a progressão da doença e a importância da intervenção oportuna.

- Os profissionais de saúde estão colaborando com empresas farmacêuticas para integrar a triagem genética e a análise de biomarcadores na prática clínica de rotina. Essa tendência é impulsionada pelo aumento dos investimentos em saúde e pelo desenvolvimento de centros de neurologia especializados em regiões-chave.

Dinâmica do mercado de excipientes na Europa

Motorista

A crescente prevalência de neuropatias amilóides e a maior conscientização dos pacientes estão aumentando.

- A melhoria das capacidades de diagnóstico e o aumento das atividades de pesquisa clínica incentivam a detecção e intervenção precoces.

- Por exemplo, em junho de 2022, a Alnylam Pharmaceuticals recebeu aprovação da FDA para o Onpattro (patisiran), um tratamento para a neuropatia amilóide hereditária mediada pela transtirretina, o que destaca o impacto de terapias inovadoras no crescimento do mercado.

- A expansão de clínicas especializadas e centros de neurologia melhora o acesso ao tratamento e aos cuidados para os pacientes. A adoção de terapias avançadas que têm como alvo proteínas amiloides específicas está acelerando o crescimento do mercado.

- Políticas de saúde que promovem a conscientização sobre doenças raras estão contribuindo para taxas de diagnóstico mais altas. O aumento da renda disponível em regiões desenvolvidas permite que os pacientes acessem tratamentos avançados com mais facilidade. As empresas farmacêuticas estão investindo fortemente em pesquisa e desenvolvimento para criar medicamentos mais seguros e eficazes.

- A crescente colaboração entre hospitais, institutos de pesquisa e empresas de biotecnologia fomenta a inovação. Modelos de atendimento centrados no paciente estão impulsionando a demanda por terapias personalizadas. A telemedicina e as soluções de saúde digital estão facilitando o gerenciamento e o monitoramento do tratamento.

Restrição/Desafio

Altos custos associados a diagnósticos avançados e terapias direcionadas.

- A disponibilidade limitada de centros neurológicos especializados em certas áreas representa um desafio de acesso. Os complexos processos regulatórios para tratamentos de doenças raras podem atrasar a aprovação de produtos. A variabilidade na resposta dos pacientes às terapias pode dificultar a padronização dos protocolos de tratamento.

- Garantir a adesão a regimes de tratamento de longo prazo é um desafio tanto para pacientes quanto para profissionais de saúde. O conhecimento limitado entre os médicos de clínica geral pode resultar em atrasos no diagnóstico e no tratamento. Problemas na cadeia de suprimentos de medicamentos especializados e produtos biológicos podem afetar a disponibilidade.

- Por exemplo, em setembro de 2021, o acesso limitado ao tafamidis em vários países europeus devido ao seu alto custo evidenciou problemas de acessibilidade e custo-benefício no mercado de medicamentos para neuropatia amilóide.

- Os planos de saúde podem impor restrições ou exigir comprovação de custo-efetividade antes de cobrir novas terapias. Questões de reembolso para tratamentos inovadores podem criar barreiras para pacientes em algumas regiões. A inovação contínua exige investimentos substanciais em ensaios clínicos e produção. A falta de dados epidemiológicos em larga escala em algumas regiões dificulta a previsão de mercado e o planejamento de ensaios clínicos.

- Os potenciais efeitos colaterais e as preocupações com a segurança de novas terapias podem retardar a adoção por parte de pacientes e médicos cautelosos. Os desafios éticos e logísticos na realização de ensaios clínicos para formas raras e hereditárias de neuropatia amilóide podem atrasar o desenvolvimento de novas terapias.

- A população limitada de pacientes em estudos clínicos pode reduzir a significância estatística e atrasar a aprovação de medicamentos. Disparidades na infraestrutura de saúde entre regiões urbanas e rurais podem restringir o acesso ao diagnóstico e tratamento. Lacunas na cobertura de planos de saúde e altos custos diretos para o paciente podem desencorajar a busca por atendimento oportuno.

- A relutância dos médicos em adotar terapias recentemente aprovadas se deve à insuficiência de dados de segurança a longo prazo. A variabilidade na progressão da doença complica a criação de diretrizes de tratamento padronizadas. A coordenação entre equipes multidisciplinares de saúde pode ser um desafio no manejo das manifestações sistêmicas da doença.

Escopo do mercado de excipientes na Europa

O mercado de excipientes é segmentado com base na origem, categoria, produtos, tipo de química, síntese química, funcionalidade, forma farmacêutica, via de administração, usuário final e canal de distribuição.

- Por origem

Com base na origem, o mercado europeu de excipientes é segmentado em orgânicos e inorgânicos. O segmento orgânico dominou a maior participação de mercado em receita, com 45,1% em 2024, impulsionado pela crescente preferência por excipientes de origem natural em formulações farmacêuticas. Fabricantes e formuladores preferem excipientes orgânicos devido à sua biocompatibilidade, efeitos colaterais mínimos e conformidade com os padrões de segurança do paciente. A crescente demanda por produtos farmacêuticos sustentáveis e com rótulo limpo reforça ainda mais o crescimento desse segmento. Os excipientes orgânicos também oferecem versatilidade em diversas formas farmacêuticas, incluindo formulações sólidas, semissólidas e líquidas. O apoio regulatório a ingredientes naturais em medicamentos tem influenciado positivamente a adoção, especialmente na Europa. Além disso, os excipientes orgânicos contribuem para a melhoria da biodisponibilidade, estabilidade e adesão do paciente ao tratamento, tornando-os altamente favoráveis tanto para medicamentos genéricos quanto para medicamentos inovadores. Os principais players estão investindo ativamente em P&D para otimizar a extração e purificação de excipientes de origem vegetal e animal. Essa tendência é particularmente proeminente no desenvolvimento de formulações orais e parenterais. A crescente tendência de formulações de medicamentos centradas no paciente e ecologicamente corretas está sustentando o domínio dos excipientes orgânicos. Por exemplo, em 2023, um dos principais fornecedores europeus expandiu seu portfólio de polímeros orgânicos para atender à demanda farmacêutica.

O segmento de excipientes inorgânicos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22,4%, entre 2025 e 2032, impulsionado pelo aumento da utilização em formulações especializadas, como antiácidos, agentes tamponantes e revestimentos de comprimidos. Os excipientes inorgânicos oferecem estabilidade química precisa, custo-benefício e vantagens de escalabilidade. O crescente uso na produção em larga escala de medicamentos genéricos e nutracêuticos impulsiona a adoção de excipientes inorgânicos. Além disso, a crescente conscientização sobre a funcionalidade dos excipientes na melhoria da solubilidade e dos perfis de dissolução está impulsionando a demanda. Os excipientes inorgânicos são preferidos em aplicações que exigem alta pureza e conformidade regulatória. Os fabricantes estão inovando com minerais e sais modificados para expandir a funcionalidade em formas farmacêuticas sólidas e semissólidas. O aumento da produção farmacêutica em países emergentes da Europa contribui ainda mais para o crescimento. As aprovações regulatórias e a padronização de excipientes inorgânicos para uso terapêutico aumentam a confiança e a aceitação entre os formuladores.

- Por categoria

Com base na categoria, o mercado é segmentado em Excipientes Primários e Excipientes Secundários. O segmento de Excipientes Primários detinha a maior participação na receita, com 47,3% em 2024, devido ao seu papel essencial em formulações farmacêuticas, incluindo aglutinantes, diluentes e desintegrantes. Os excipientes primários formam a base das formulações de medicamentos, oferecendo estabilidade, melhor manuseio e biodisponibilidade otimizada. Os fabricantes dependem dos excipientes primários para garantir a consistência, a eficácia e a vida útil dos produtos. A crescente demanda por formas farmacêuticas sólidas, como comprimidos e cápsulas, fortaleceu esse segmento. Os excipientes primários também apoiam o desenvolvimento de formulações de liberação controlada e de liberação imediata. O segmento se beneficia do foco regulatório em matérias-primas de alta qualidade. As empresas farmacêuticas priorizam os excipientes primários para atender às Boas Práticas de Fabricação (BPF). Inovações em excipientes à base de polímeros e aglutinantes de origem natural estão impulsionando ainda mais o crescimento. Por exemplo, em 2022, um fornecedor europeu de polímeros expandiu seu portfólio com foco em formulações sólidas orais.

O segmento de excipientes secundários deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,9%, entre 2025 e 2032, impulsionado pelo uso crescente em formulações avançadas, como revestimentos, solubilizantes, aromatizantes e conservantes. Os excipientes secundários proporcionam maior estabilidade, aceitabilidade pelo paciente e liberação direcionada do fármaco. O crescimento é impulsionado por inovações em excipientes funcionais para mascaramento de sabor e aumento da solubilidade. Fabricantes terceirizados e empresas biofarmacêuticas estão incorporando excipientes secundários para melhorar a diferenciação de seus produtos. O uso crescente em formulações pediátricas e geriátricas contribui para o aumento da demanda. A aprovação regulatória e a necessidade de dados de segurança dos excipientes aceleram a adoção. Tendências emergentes em terapias combinadas e formas farmacêuticas multicomponentes impulsionam ainda mais o segmento. Por exemplo, em março de 2023, uma empresa europeia lançou um novo excipiente de revestimento para melhorar a estabilidade em comprimidos pediátricos.

- Por produtos

Com base nos produtos, o mercado é segmentado em Polímeros, Açúcares, Álcoois, Minerais, Gelatina e Outros. O segmento de Polímeros dominou a maior participação na receita, com 44,7% em 2024, devido à sua multifuncionalidade como aglutinantes, revestimentos e matrizes de liberação controlada. Os polímeros melhoram a estabilidade, a solubilidade e a capacidade de fabricação das formulações, tornando-os altamente procurados por empresas farmacêuticas. A crescente adoção em formas farmacêuticas orais, tópicas e parenterais impulsiona o segmento. Os excipientes poliméricos também facilitam o desenvolvimento de sistemas de liberação inovadores, como nanopartículas e hidrogéis. O forte investimento em P&D em polímeros biocompatíveis sustenta sua demanda contínua. A aceitação regulatória para polímeros de grau farmacêutico incentiva ainda mais a adoção. A capacidade de adequar as características do polímero às propriedades do medicamento aumenta a flexibilidade da formulação. Os polímeros são cada vez mais utilizados em terapias de alto valor agregado, incluindo produtos biológicos. Por exemplo, em 2022, um fornecedor europeu expandiu seu portfólio de hidroxipropilmetilcelulose para aplicações orais e tópicas.

O segmento de açúcares deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 23,1%, entre 2025 e 2032, devido ao seu uso crescente como adoçantes, excipientes e estabilizantes em formulações orais. A crescente demanda por formulações mais amigáveis ao paciente, incluindo comprimidos mastigáveis e xaropes, impulsiona esse crescimento. Os açúcares também melhoram a palatabilidade e aumentam a estabilidade dos ingredientes ativos. A crescente prevalência de medicamentos pediátricos e geriátricos contribui para a expansão do segmento. As empresas farmacêuticas europeias estão focando em açúcares de origem natural devido às tendências de sustentabilidade. Os açúcares funcionais estão ganhando destaque por sua capacidade de modular a liberação e melhorar a solubilidade. O crescimento do mercado também é impulsionado pelo uso de açúcares em nutracêuticos e suplementos alimentares. Em 2023, um fabricante lançou um excipiente de açúcar pré-gelatinizado desenvolvido especificamente para comprimidos mastigáveis.

- Por tipo de química

Com base no tipo de composição química, o mercado é segmentado em Vegetal, Animal, Sintético e Mineral. O segmento de origem vegetal detinha a maior participação na receita, com 45,8% em 2024, devido à crescente preferência por excipientes naturais e biocompatíveis em formulações farmacêuticas e nutracêuticas. Os excipientes de origem vegetal oferecem segurança, facilidade de regulamentação e compatibilidade em diversas formas farmacêuticas. A alta preferência do consumidor por ingredientes com rótulo limpo e ecologicamente corretos impulsiona o crescimento. O forte investimento em P&D em técnicas de extração e estabilização aprimora a usabilidade. As aplicações em comprimidos, cápsulas e formas semissólidas reforçam a adoção. A crescente conscientização sobre a segurança do paciente e a redução de reações adversas apoia os excipientes de origem vegetal. O apoio governamental e regulatório aos excipientes naturais impulsiona a aceitação. Por exemplo, em 2023, uma empresa europeia expandiu seu portfólio de polímeros derivados de plantas para formulações orais.

O segmento de sintéticos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22,7%, entre 2025 e 2032, impulsionado por vantagens como escalabilidade, estabilidade química e custo-benefício. Os excipientes sintéticos são amplamente utilizados na produção em larga escala e em formulações de liberação controlada. Inovações em polímeros e surfactantes sintéticos impulsionam ainda mais o crescimento. A adoção é acelerada por empresas farmacêuticas que buscam um desempenho preciso em suas formulações. A aprovação regulatória de excipientes sintéticos para novas terapias apoia a expansão. Os excipientes sintéticos são cada vez mais aplicados em formas farmacêuticas sólidas e líquidas. A crescente demanda em organizações de fabricação por contrato também contribui para esse crescimento. Por exemplo, em 2024, um excipiente polimérico sintético foi lançado na Europa para comprimidos de liberação imediata.

- Por síntese química

Com base na síntese química, o mercado é segmentado em Lactose Monoidratada, Sucralose, Polissorbato, Álcool Benzílico, Álcool Cetostearílico, Lecitina de Soja, Amido Pré-gelatinizado e Outros. O segmento de Lactose Monoidratada dominou a maior participação na receita, com 43,5% em 2024, devido à sua ampla aplicação como excipiente, diluente e estabilizante em comprimidos e cápsulas. Sua compatibilidade com diversos tipos de medicamentos e excelentes propriedades de fluxo a tornam uma escolha preferencial para fabricantes farmacêuticos. A lactose monoidratada também é altamente valorizada por seu papel na melhoria da compressibilidade, garantindo dosagem consistente e aumentando a estabilidade do produto. O segmento se beneficia da aceitação regulatória consolidada na Europa, reduzindo os riscos de formulação. Sua versatilidade em formas farmacêuticas sólidas e semissólidas impulsiona ainda mais sua adoção. Os fabricantes também preferem a lactose monoidratada para medicamentos pediátricos e geriátricos devido à sua baixa toxicidade e alta palatabilidade. Por exemplo, em 2023, um dos principais fornecedores europeus expandiu seu portfólio de lactose monoidratada para atender à produção de alto volume de dosagens orais.

O segmento de sucralose deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 24,0%, entre 2025 e 2032, impulsionado pelo aumento do uso em formulações adoçadas, comprimidos mastigáveis e xaropes. A sucralose oferece vantagens funcionais, incluindo mascaramento de sabor, melhor adesão do paciente ao tratamento e estabilidade em diversas condições de processamento. A crescente demanda por formulações pediátricas e geriátricas impulsiona ainda mais a sua adoção. Os fabricantes europeus estão incorporando cada vez mais sucralose em nutracêuticos e produtos de venda livre. Inovações em derivados de sucralose permitem melhor solubilidade e liberação controlada em formas farmacêuticas orais. A aprovação regulatória para uso em formulações farmacêuticas aumenta a confiança do mercado. A expansão das aplicações em alimentos funcionais e suplementos alimentares também impulsiona o crescimento. Por exemplo, em 2024, uma empresa europeia de excipientes lançou um excipiente adoçante à base de sucralose desenvolvido especificamente para comprimidos mastigáveis.

- Por funcionalidade

Com base na funcionalidade, o mercado é segmentado em aglutinantes e adesivos, desintegrantes, revestimentos, solubilizantes, aromatizantes, adoçantes, diluentes, lubrificantes, tampões, emulsificantes, conservantes, antioxidantes, sorventes, solventes, emolientes, deslizantes, agentes quelantes, antiespumantes e outros. O segmento de aglutinantes e adesivos dominou a maior participação na receita, com 44,9% em 2024, devido ao seu papel essencial na manutenção da integridade dos comprimidos, no controle da liberação do fármaco e no aumento da estabilidade da formulação. Os aglutinantes garantem a compactação e a coesão ideais, fatores críticos para a produção de comprimidos em larga escala. A crescente adoção de formas farmacêuticas sólidas orais, juntamente com a conformidade regulatória para a qualidade dos excipientes, impulsiona esse segmento. As empresas farmacêuticas concentram-se em aglutinantes poliméricos para alcançar a liberação controlada e a melhoria da biodisponibilidade. A crescente preferência por formulações sólidas orais na Europa reforça a demanda. Por exemplo, em 2023, um dos principais fornecedores europeus expandiu seu portfólio de aglutinantes para comprimidos de liberação imediata e modificada.

O segmento de desintegrantes deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 23,5%, entre 2025 e 2032, impulsionado pela crescente demanda por dissolução rápida de medicamentos e melhor biodisponibilidade em formulações orais. Os desintegrantes facilitam a rápida quebra e absorção dos comprimidos, aumentando a eficácia terapêutica. O crescimento é impulsionado pela crescente prevalência de doenças crônicas que requerem terapias orais e pela necessidade de formulações mais amigáveis ao paciente. Os formuladores europeus estão adotando superdesintegrantes inovadores para um desempenho aprimorado. A expansão do uso em comprimidos mastigáveis, efervescentes e de dissolução rápida acelera o crescimento. A conformidade regulatória e a qualidade consistente estão impulsionando ainda mais a adoção. Em 2024, um importante fabricante de excipientes lançou um novo desintegrante otimizado para comprimidos pediátricos.

- Por forma farmacêutica

Com base na forma farmacêutica, o mercado é segmentado em Sólido, Semissólido e Líquido. O segmento de formas farmacêuticas sólidas dominou a maior participação de receita, com 46,2% em 2024, devido ao seu uso generalizado, custo-benefício e conveniência no armazenamento, transporte e administração. Comprimidos e cápsulas são altamente preferidos por profissionais de saúde e pacientes devido à facilidade de dosagem e adesão ao tratamento. As formas farmacêuticas sólidas se beneficiam de uma vida útil estável e escalabilidade na fabricação, tornando-as adequadas para formulações de medicamentos genéricos e inovadores. A forte demanda por medicamentos orais e terapias para o tratamento de doenças crônicas sustenta a dominância do segmento. Por exemplo, em 2023, um fornecedor europeu de excipientes expandiu suas linhas de produção de polímeros e excipientes de açúcar para a fabricação de comprimidos.

O segmento de formulações líquidas deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 24,1%, entre 2025 e 2032, impulsionado pela crescente demanda por xaropes pediátricos, soluções injetáveis e suspensões orais. As formulações líquidas melhoram a adesão do paciente ao tratamento, principalmente entre crianças e idosos. A maior adoção de medicamentos parenterais e tópicos contribui para o crescimento. Inovações em solubilizantes, adoçantes e estabilizantes aumentam ainda mais o potencial de mercado. A aprovação regulatória de excipientes seguros em líquidos acelera a adoção. A expansão do mercado também é sustentada pela crescente prevalência de doenças crônicas e suplementos nutricionais em forma líquida. No início de 2024, uma empresa europeia lançou um novo excipiente solubilizante otimizado para xaropes e suspensões orais.

- Por via administrativa

Com base na via de administração, o mercado é segmentado em excipientes orais, excipientes tópicos, excipientes parenterais e outros excipientes. O segmento de excipientes orais dominou a maior participação na receita, com 45,6% em 2024, impulsionado pela preferência generalizada por medicamentos orais, comprimidos, cápsulas e xaropes. Os excipientes orais auxiliam na mascaramento do sabor, estabilidade, liberação controlada e aumento da biodisponibilidade. O aumento da prevalência de doenças crônicas e as preocupações com a adesão do paciente ao tratamento impulsionam a dominância do segmento. Inovações em polímeros, açúcares e desintegrantes aprimoram a qualidade das formulações orais. Por exemplo, em 2023, uma empresa europeia lançou um excipiente oral à base de polímero que aumenta a solubilidade em comprimidos.

O segmento de excipientes parenterais deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 23,8%, entre 2025 e 2032, impulsionado pela crescente demanda por produtos biológicos injetáveis, vacinas e terapias de alto valor agregado. Os excipientes parenterais garantem a esterilidade, a estabilidade e a compatibilidade das formulações. O crescimento é sustentado pelo aumento dos investimentos em pesquisa e desenvolvimento biofarmacêutico e na fabricação por contrato. As diretrizes regulatórias sobre a segurança de excipientes injetáveis aumentam a confiança do mercado. A crescente adoção em hospitais, clínicas especializadas e assistência domiciliar impulsiona ainda mais a expansão do segmento. No início de 2024, um fornecedor europeu lançou um novo excipiente estabilizante otimizado para produtos biológicos parenterais.

- Por usuário final

Com base no usuário final, o mercado europeu de excipientes é segmentado em Empresas Farmacêuticas e Biofarmacêuticas, Formuladores por Contrato, Organizações de Pesquisa e Acadêmicas e Outros. O segmento de Empresas Farmacêuticas e Biofarmacêuticas detinha a maior participação na receita, com 47,0% em 2024, refletindo seu papel dominante na produção de medicamentos em larga escala, incluindo formulações orais, injetáveis e tópicas. Essas empresas dependem fortemente de excipientes de alta qualidade para garantir a estabilidade do produto, a conformidade regulatória e a biodisponibilidade ideal, fatores críticos tanto para medicamentos genéricos quanto para medicamentos inovadores. A crescente demanda global por genéricos, aliada ao aumento de terapias inovadoras, reforça ainda mais a liderança desse segmento. Investimentos contínuos em pesquisa e desenvolvimento, particularmente em sistemas avançados de administração de medicamentos e tecnologias de formulação, impulsionaram a adoção de excipientes especializados. Por exemplo, em 2023, uma importante empresa farmacêutica europeia expandiu estrategicamente seu fornecimento de excipientes para aprimorar a qualidade e o desempenho de formas farmacêuticas sólidas orais.

Prevê-se que o segmento de Formuladores por Contrato apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,9%, entre 2025 e 2032, impulsionado pela crescente tendência de terceirização do desenvolvimento e fabricação farmacêutica. Os formuladores por contrato necessitam de excipientes versáteis e multifuncionais para atender às diversas necessidades de formulação específicas de cada cliente, incluindo funções estabilizadoras, solubilizantes e funcionais. A expansão das operações de fabricação por contrato em toda a Europa, apoiada por estruturas regulatórias favoráveis e padrões de qualidade rigorosos, está impulsionando ainda mais o crescimento do segmento. Além disso, a crescente demanda por soluções com tempo de lançamento no mercado mais rápido, juntamente com a ênfase da indústria em formas farmacêuticas inovadoras e medicina personalizada, está incentivando os formuladores por contrato a adotarem soluções avançadas em excipientes. Esses fatores, em conjunto, posicionam os formuladores por contrato como o segmento de usuários finais de crescimento mais rápido no mercado europeu de excipientes.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em Licitação Direta, Vendas no Varejo e Outros. O segmento de Licitação Direta representou a maior participação na receita, com 46,5% em 2024, principalmente devido à aquisição em grande escala por empresas farmacêuticas e biofarmacêuticas. Essa abordagem garante um fornecimento consistente, reduz custos por meio de economias de escala e permite um rigoroso controle de qualidade. Contratos de longo prazo com fabricantes de excipientes confiáveis fortalecem ainda mais a estabilidade das cadeias de suprimentos. O aumento da escala da produção farmacêutica e a expansão de empresas europeias para mercados emergentes reforçam a dominância desse canal. Por exemplo, em 2023, um importante fabricante europeu de excipientes firmou múltiplos contratos de fornecimento direto com empresas farmacêuticas líderes, reforçando sua posição e confiabilidade no mercado.

Prevê-se que o segmento de Vendas no Varejo apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 23,3%, entre 2025 e 2032, impulsionado pela crescente demanda por medicamentos isentos de prescrição, nutracêuticos e aplicações em pesquisa. Os canais de varejo proporcionam acesso a excipientes funcionais para produção em menor escala, pesquisa acadêmica e requisitos de formulação específicos. O rápido crescimento das plataformas de e-commerce e distribuidores especializados expandiu ainda mais o alcance dos canais de varejo, tornando os excipientes mais acessíveis a empresas menores no ecossistema farmacêutico. As aprovações regulatórias para excipientes em produtos de saúde do consumidor e produtos isentos de prescrição também aumentam a confiança e a adoção. No início de 2024, um fornecedor europeu lançou uma linha de excipientes voltada para o varejo, projetada especificamente para laboratórios de pesquisa e desenvolvedores de formulações em pequena escala, destacando a crescente importância da distribuição no varejo no mercado.

Análise Regional do Mercado de Excipientes na Europa

- Prevê-se que o mercado europeu de excipientes cresça a uma taxa composta de crescimento anual (CAGR) substancial durante o período de previsão, impulsionado pelo aumento das atividades de fabricação farmacêutica, pela crescente demanda por excipientes de alta qualidade em formulações orais, injetáveis e tópicas e pela crescente adoção de tecnologias avançadas de administração de medicamentos.

- A região beneficia de uma infraestrutura de saúde robusta, de marcos regulatórios bem estabelecidos e de um forte foco em pesquisa e desenvolvimento, o que impulsiona a inovação em aplicações de excipientes em diversas formas farmacêuticas.

- Os países europeus estão testemunhando investimentos significativos em excipientes especiais para liberação controlada, aumento da solubilidade e melhoria da estabilidade, o que está impulsionando ainda mais o crescimento do mercado.

Análise do Mercado de Excipientes na Alemanha:

Os excipientes alemães dominaram o mercado com a maior participação de receita, de 41,5% em 2024, impulsionados por uma forte base de fabricação farmacêutica, altos gastos com saúde e a presença de importantes players do setor. O país apresenta um crescimento substancial nas aplicações de excipientes em formulações orais, injetáveis e tópicas. A ênfase da Alemanha na conformidade com os padrões de qualidade, a inovação contínua em tecnologias de formulação e as cadeias de suprimentos bem estabelecidas fortalecem ainda mais sua posição no mercado. A crescente demanda por excipientes especiais em terapias avançadas, combinada com parcerias e colaborações estratégicas entre empresas farmacêuticas, acelera a adoção de soluções inovadoras em excipientes.

Análise do Mercado de Excipientes na França:

Prevê-se que a França seja a região com o crescimento mais rápido no mercado de excipientes durante o período de previsão, impulsionada pelo aumento da produção farmacêutica, pela crescente adoção de tecnologias avançadas de administração de medicamentos e pela expansão dos investimentos em infraestrutura de saúde. O foco do país na inovação e no desenvolvimento de novos excipientes para formulações de alto valor agregado está impulsionando a penetração no mercado. Além disso, o apoio governamental à pesquisa biotecnológica e farmacêutica, juntamente com a crescente demanda por formulações genéricas e especializadas, alimenta o crescimento. A França está testemunhando um rápido crescimento nas aplicações de excipientes para liberação controlada, administração direcionada e biodisponibilidade aprimorada, posicionando-se como um importante mercado emergente na Europa.

Participação de mercado de excipientes na Europa

O setor de excipientes é liderado principalmente por empresas consolidadas, incluindo:

- Croda Internacional (Reino Unido)

- Corporação ABITEC (Países Baixos)

- Roquette Frères (França)

- DuPont Nutrição e Biociências (França)

- BASF SE (Alemanha)

- Produtos nutricionais DSM (Países Baixos)

- Ingredion Incorporated (Alemanha)

- Corporação FMC (Alemanha)

- Signet Chemical Corporation (Reino Unido)

- JRS Pharma GmbH & Co. KG (Alemanha)

- Merck KGaA (Alemanha)

- Azelis (Bélgica)

- Gattefossé (França)

- Grupo IMCD (Países Baixos)

- Ingredion Deutschland GmbH (Alemanha)

Novidades no mercado de excipientes na Europa

- Em outubro de 2025, a Organização Central de Controle de Padrões de Medicamentos da Índia (CDSCO) emitiu uma diretiva a todos os órgãos reguladores de medicamentos estaduais para garantir que as matérias-primas utilizadas na fabricação de medicamentos, incluindo excipientes e ingredientes ativos, atendam aos padrões prescritos. Essa medida foi tomada após a morte de várias crianças associada a xaropes tóxicos para tosse, o que ressaltou a importância de rigorosos controles de qualidade dos excipientes.

- Em outubro de 2025, a Asahi Kasei anunciou planos para fornecer excipientes farmacêuticos fabricados em conformidade com as Boas Práticas de Fabricação (BPF) até 2027. A empresa visa atender às diretrizes internacionais para excipientes e impurezas farmacêuticas, apoiando formulações de medicamentos injetáveis. Amostras de ambos os graus de pureza, com valores analíticos garantidos, já estão disponíveis para desenvolvimento pré-clínico, estabelecendo as bases para uma adoção mais ampla no desenvolvimento clínico.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.