Europe Eclinical Solutions Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.85 Billion

USD

7.75 Billion

2024

2032

USD

2.85 Billion

USD

7.75 Billion

2024

2032

| 2025 –2032 | |

| USD 2.85 Billion | |

| USD 7.75 Billion | |

|

|

|

|

Segmentação do mercado de soluções clínicas eletrônicas na Europa, por produto (sistemas de captura eletrônica de dados e gerenciamento de dados de ensaios clínicos, sistemas de gerenciamento de ensaios clínicos, plataformas de análise clínica, registros médicos de coordenação de cuidados (CCMR), gerenciamento de fornecimento de ensaios e randomização, plataformas de integração de dados clínicos, soluções eletrônicas de avaliação de resultados clínicos, soluções de segurança, sistemas de arquivos mestres de ensaios eletrônicos, soluções de gerenciamento de informações regulatórias e outros), modo de entrega (soluções hospedadas na Web (sob demanda), soluções corporativas licenciadas (no local) e soluções baseadas em nuvem (SAAS)), fase do ensaio clínico (fase I, fase II, fase III e fase IV), tamanho da organização (pequena, média e grande), dispositivo do usuário (desktop, tablet, dispositivo PDA portátil, smartphone e outros), usuário final (empresas farmacêuticas e biofarmacêuticas, organizações de pesquisa contratadas, empresas de serviços de consultoria, fabricantes de dispositivos médicos, hospitais e institutos de pesquisa acadêmica) - Tendências do setor e previsão para 2032

Tamanho do mercado de soluções clínicas eletrônicas na Europa

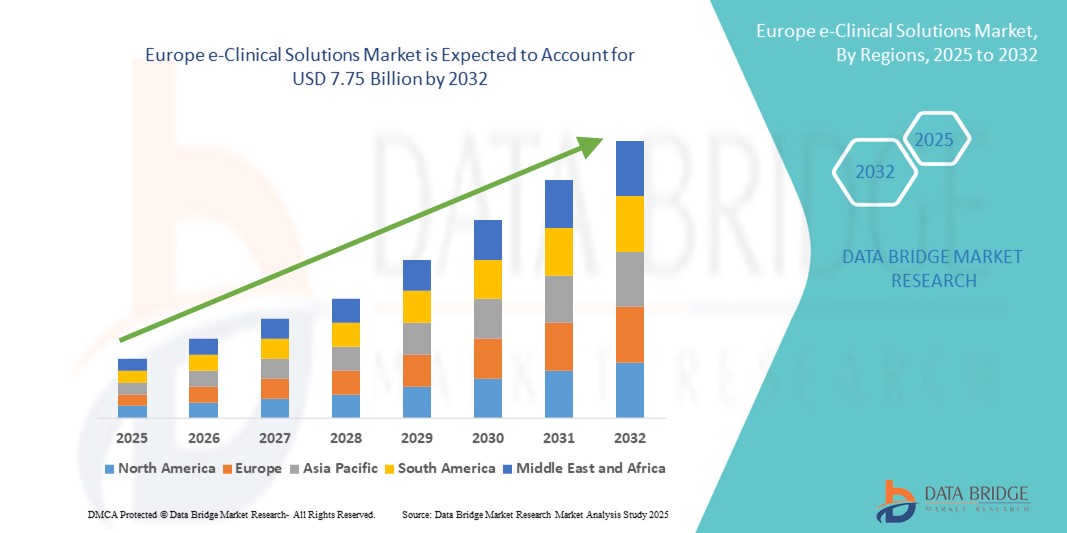

- O tamanho do mercado de soluções clínicas eletrônicas na Europa foi avaliado em US$ 2,85 bilhões em 2024 e deve atingir US$ 7,75 bilhões até 2032 , com um CAGR de 13,3% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de tecnologias de ensaios clínicos digitais, pelo aumento do volume de ensaios clínicos e pelos rigorosos requisitos regulatórios que impulsionam o gerenciamento eficiente de dados em empresas farmacêuticas e Organizações de Pesquisa Contratadas (CROs).

- Além disso, os avanços tecnológicos, como a computação em nuvem, a inteligência artificial e os modelos de ensaios descentralizados, combinados com o apoio regulamentar, como o Espaço Europeu de Dados de Saúde (EHDS), estão a melhorar a eficiência dos ensaios e a acessibilidade dos dados, impulsionando significativamente a adopção de soluções e-clínicas em toda a Europa.

Análise de Mercado de Soluções Clínicas Eletrônicas na Europa

- As soluções e-Clinical, que abrangem a captura eletrônica de dados (EDC), sistemas de gerenciamento de ensaios clínicos (CTMS) e outras plataformas digitais, são cada vez mais essenciais para agilizar os ensaios clínicos e garantir a conformidade regulatória em toda a Europa devido à sua eficiência, acesso a dados em tempo real e capacidades de integração com modelos de ensaios descentralizados.

- A crescente demanda por soluções e-clínicas é impulsionada principalmente pelo número crescente de ensaios clínicos, foco crescente em pesquisas centradas no paciente, requisitos regulatórios rigorosos e crescente adoção de tecnologias de saúde digital entre empresas farmacêuticas e Organizações de Pesquisa Contratadas (CROs).

- A Alemanha dominou o mercado de soluções e-Clinical com a maior participação na receita de 28,5% em 2024, caracterizada por uma indústria farmacêutica madura, adoção antecipada de soluções digitais e forte suporte regulatório, com empresas líderes implantando plataformas de gerenciamento de testes baseadas em nuvem e orientadas por IA.

- Espera-se que a França seja o país com crescimento mais rápido durante o período previsto devido à expansão das atividades de ensaios clínicos, ao aumento dos investimentos em saúde e à maior participação em estudos de pesquisa multinacionais.

- O segmento de sistemas de gerenciamento de ensaios clínicos (CTMS) dominou o mercado europeu de soluções e-Clinical com uma participação de mercado de 38,5% em 2024, impulsionado por sua capacidade de planejar, rastrear e gerenciar ensaios complexos de forma eficiente, garantindo a conformidade com os padrões regulatórios em evolução.

Escopo do Relatório e Segmentação do Mercado de Soluções Clínicas Eletrônicas na Europa

|

Atributos |

Principais insights de mercado da Europe e-Clinical Solutions |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de soluções clínicas eletrônicas na Europa

Transformação digital e ensaios clínicos baseados em IA

- Uma tendência significativa e crescente no mercado europeu de soluções e-Clinic é a crescente adoção de inteligência artificial (IA) e aprendizado de máquina na gestão de ensaios clínicos, recrutamento de pacientes e análise de dados. Essas tecnologias estão melhorando significativamente a eficiência, a precisão e os insights preditivos dos ensaios clínicos.

- Por exemplo, plataformas como a Medidata Rave e a EDC da Oracle Health Sciences integram IA para identificar a elegibilidade do paciente, monitorar a adesão ao protocolo e sinalizar anomalias em tempo real, reduzindo erros e acelerando os prazos dos testes.

- A análise orientada por IA em soluções e-Clinical permite modelagem preditiva, monitoramento baseado em risco e suporte à decisão em tempo real. Por exemplo, alguns sistemas Medidata e Veeva utilizam IA para otimizar a seleção de locais e prever as taxas de abandono de pacientes, aumentando as taxas de sucesso dos ensaios clínicos. Além disso, plataformas avançadas baseadas em nuvem permitem o compartilhamento integrado de dados entre centros de estudo, patrocinadores e reguladores, garantindo uma execução mais rápida e em conformidade com as normas.

- A integração de soluções e-Clinical com modelos de ensaios descentralizados e híbridos facilita o monitoramento remoto do paciente, o consentimento eletrônico e os acompanhamentos baseados em telemedicina, criando uma experiência de ensaio digital unificada.

- Esta tendência em direção a ensaios clínicos inteligentes, interconectados e centrados no paciente está remodelando as expectativas para o gerenciamento de ensaios, com empresas como a Veeva Systems e a Oracle Health Sciences expandindo ofertas habilitadas para IA para melhor eficiência operacional e conformidade regulatória.

- A demanda por plataformas e-clínicas totalmente integradas e aprimoradas por IA está crescendo rapidamente em toda a Europa, impulsionada por empresas farmacêuticas, empresas de biotecnologia e Organizações de Pesquisa Contratadas (CROs) que buscam operações de ensaios clínicos mais rápidas, precisas e compatíveis.

Dinâmica do Mercado de Soluções Clínicas Eletrônicas na Europa

Motorista

Aumento dos ensaios clínicos e da pressão regulatória

- O número crescente de ensaios clínicos em toda a Europa, juntamente com requisitos regulamentares rigorosos, como as diretrizes da Agência Europeia de Medicamentos (EMA) e a conformidade com o RGPD, é um impulsionador significativo para a adoção de soluções e-Clinical

- Por exemplo, em março de 2025, a iniciativa do Espaço Europeu de Dados de Saúde (EHDS) enfatizou o uso padronizado de dados eletrônicos de saúde, levando as empresas farmacêuticas a adotar plataformas e-clínicas integradas para gerenciamento eficiente de ensaios e relatórios regulatórios.

- À medida que as organizações buscam ensaios mais rápidos, seguros e econômicos, as soluções e-Clinical oferecem recursos como monitoramento em tempo real, gerenciamento de site baseado em risco e verificação eletrônica de dados de origem, oferecendo vantagens claras sobre os processos manuais tradicionais.

- Além disso, a adoção de modelos de ensaios descentralizados e híbridos está tornando as soluções e-Clinical essenciais para permitir o monitoramento remoto de pacientes, visitas virtuais e rastreamento de conformidade em tempo real.

- A combinação de pressão regulatória, avanços tecnológicos e a necessidade de eficiência operacional está acelerando a adoção de plataformas e-clínicas baseadas em nuvem, habilitadas por IA e totalmente integradas nos setores farmacêutico e biotecnológico europeus.

Restrição/Desafio

Preocupações com a privacidade de dados e altos custos de implementação

- Preocupações com a privacidade dos dados dos pacientes, a conformidade com o GDPR e vulnerabilidades de segurança cibernética em plataformas digitais de ensaios clínicos representam um desafio significativo para uma adoção mais ampla pelo mercado. Como as soluções e-Clinical envolvem o tratamento de dados de saúde sensíveis, as empresas devem implementar criptografia robusta, protocolos de acesso seguros e auditorias regulares.

- Por exemplo, incidentes de grande visibilidade relacionados com violações de dados de saúde na Europa fizeram com que algumas organizações hesitassem em digitalizar totalmente a gestão de ensaios, especialmente para estudos multinacionais.

- Abordar essas questões de privacidade e segurança de dados por meio de criptografia avançada, armazenamento seguro em nuvem e treinamento de equipe é crucial para construir confiança entre patrocinadores e reguladores. Além disso, o custo inicial relativamente alto de plataformas e-Clinical sofisticadas pode ser uma barreira para pequenas empresas de biotecnologia e CROs com orçamentos limitados.

- Embora as soluções escaláveis baseadas na nuvem estejam gradualmente a reduzir as barreiras, as funcionalidades premium, como a análise preditiva orientada por IA, a monitorização integrada do paciente ou as ferramentas de resultados eletrónicos reportados pelo paciente (ePRO), têm frequentemente um preço mais elevado.

- Superar esses desafios por meio de medidas aprimoradas de segurança cibernética, suporte à conformidade e modelos de plataforma com boa relação custo-benefício será vital para o crescimento sustentado do mercado europeu de soluções e-clínicas.

Escopo do mercado de soluções clínicas eletrônicas na Europa

O mercado é segmentado com base no produto, modo de entrega, fase do ensaio clínico, tamanho da organização, dispositivo do usuário e usuário final.

- Por produto

Com base no produto, o mercado europeu de soluções e-Clinical é segmentado em sistemas de captura eletrônica de dados e gerenciamento de dados de ensaios clínicos, sistemas de gerenciamento de ensaios clínicos (CTMS), plataformas de análise clínica, registros médicos de coordenação de cuidados (CCMR), randomização e gerenciamento de suprimentos para ensaios, plataformas de integração de dados clínicos, soluções eletrônicas de avaliação de resultados clínicos, soluções de segurança, sistemas eletrônicos de arquivos mestres de ensaios, soluções de gerenciamento de informações regulatórias e outros. O segmento de sistemas de gerenciamento de ensaios clínicos (CTMS) dominou o mercado com a maior participação na receita de 38,5% em 2024, impulsionado por sua capacidade de planejar, rastrear e gerenciar ensaios complexos com eficiência, garantindo a conformidade regulatória. Empresas farmacêuticas e CROs frequentemente priorizam o CTMS por sua supervisão abrangente de ensaios, gerenciamento centralizado de dados e integração com outros sistemas e-Clinical. O segmento também se beneficia da crescente adoção em ensaios multinacionais de larga escala, onde a automação robusta do fluxo de trabalho e o monitoramento baseado em risco são essenciais.

Prevê-se que o segmento de plataformas de análise clínica apresente o CAGR mais rápido, de 17,5%, entre 2025 e 2032, impulsionado pela crescente demanda por insights baseados em IA, análise preditiva e suporte à decisão em tempo real em ensaios clínicos. A capacidade de analisar grandes conjuntos de dados, identificar tendências e otimizar o desempenho dos ensaios clínicos torna essas plataformas altamente atraentes para patrocinadores que buscam maior eficiência operacional e taxas de sucesso nos ensaios. Com a crescente complexidade dos ensaios clínicos e o vasto volume de dados gerados, as soluções de análise clínica estão se tornando indispensáveis para aprimorar os resultados dos ensaios e a eficiência operacional.

- Por modo de entrega

Com base no modo de entrega, o mercado europeu de soluções e-Clinical é segmentado em soluções hospedadas na web (sob demanda), soluções corporativas licenciadas (no local) e soluções baseadas em nuvem (SaaS). As soluções baseadas em nuvem (SaaS) detinham a maior participação de mercado, 42% em 2024, devido à sua escalabilidade, menores custos iniciais, acessibilidade remota e integração perfeita com operações de ensaios descentralizadas. Essas soluções são particularmente populares entre CROs e empresas farmacêuticas de médio porte que buscam implantação rápida e modelos de assinatura flexíveis.

Espera-se que as soluções hospedadas na web (sob demanda) apresentem o crescimento mais rápido entre 2025 e 2032, impulsionadas pela necessidade de implantação ágil e econômica e pela crescente adoção de modelos de ensaios clínicos híbridos e descentralizados em toda a Europa. Essas soluções permitem que as partes interessadas, incluindo patrocinadores, pesquisadores e pacientes, acessem os dados dos ensaios com segurança de qualquer lugar, melhorando a eficiência dos ensaios e reduzindo atrasos operacionais.

- Por fase de ensaio clínico

Com base na fase do ensaio clínico, o mercado europeu de soluções e-Clinical é segmentado em ensaios de fase I, fase II, fase III e fase IV. Os ensaios de fase III dominaram o mercado, com uma participação de 40% em 2024, devido à sua maior escala, às necessidades complexas de gerenciamento de dados e ao maior escrutínio regulatório. Soluções e-Clinical eficientes são essenciais em ensaios de fase III para garantir o monitoramento em tempo real, a qualidade dos dados e a conformidade com as regulamentações da EMA. As soluções e-Clinical facilitam a garantia robusta da qualidade dos dados, a conformidade com as regulamentações da EMA e locais, e a simplificação dos relatórios, todos essenciais para a execução bem-sucedida de ensaios clínicos em estágio avançado.

Espera-se que os ensaios de fase II cresçam com a CAGR mais rápida entre 2025 e 2032, impulsionados pelo número crescente de ensaios em estágio inicial e pela crescente adoção de plataformas digitais para recrutamento de pacientes, adesão a protocolos e análise de resultados. Essas intervenções digitais reduzem os tempos de ciclo dos ensaios, aumentam a precisão e permitem que os patrocinadores tomem decisões mais rápidas sobre a aprovação ou não dos programas de desenvolvimento de medicamentos.

- Por tamanho da organização

Com base no porte da organização, o mercado europeu de soluções e-Clinical é segmentado em pequenas, médias e grandes organizações. As grandes organizações dominaram o mercado com uma participação de 55% em 2024, beneficiando-se de orçamentos maiores para plataformas e-Clinical avançadas, amplos portfólios de ensaios clínicos e requisitos de conformidade regulatória mais rigorosos. Essas organizações têm capacidade para investir em plataformas integradas, habilitadas para IA, baseadas em nuvem e multifuncionais para garantir a eficiência dos ensaios clínicos, manter os padrões regulatórios e gerenciar altos volumes de dados.

Prevê-se que pequenas e médias empresas testemunhem o crescimento mais rápido durante o período previsto, impulsionado por soluções em nuvem e SaaS que reduzem os custos iniciais e permitem uma implantação flexível para ensaios de menor escala. O crescimento das soluções em nuvem e SaaS reduziu as barreiras de entrada para PMEs, permitindo-lhes implantar plataformas e-Clinical com investimentos iniciais mínimos, acessar ferramentas avançadas de análise e conduzir ensaios descentralizados ou híbridos com eficiência.

- Por dispositivo do usuário

Com base no dispositivo do usuário, o mercado europeu de soluções e-Clinical é segmentado em desktops, tablets, PDAs portáteis, smartphones e outros. As soluções para desktop detinham a maior fatia de mercado, 45% em 2024, devido à sua confiabilidade, acesso completo aos recursos e adequação a tarefas abrangentes de gerenciamento de ensaios clínicos realizadas em centros de pesquisa e escritórios de patrocinadores. Os desktops continuam sendo essenciais para tarefas como design de protocolos, configuração de ensaios clínicos, relatórios regulatórios e análises avançadas.

Espera-se que smartphones e tablets apresentem o crescimento mais rápido entre 2025 e 2032, impulsionados por modelos de ensaios clínicos descentralizados, monitoramento remoto, coleta de dados ePRO e pela necessidade de comunicação em tempo real entre pacientes, pesquisadores e patrocinadores. Soluções e-Clinical habilitadas para dispositivos móveis melhoram o engajamento do paciente, a adesão aos protocolos dos ensaios clínicos e permitem uma tomada de decisão mais rápida.

- Por usuário final

Com base no usuário final, o mercado europeu de soluções e-Clinical é segmentado em empresas farmacêuticas e biofarmacêuticas, organizações de pesquisa contratadas (CROs), empresas de serviços de consultoria, fabricantes de dispositivos médicos, hospitais e institutos de pesquisa acadêmica. As empresas farmacêuticas e biofarmacêuticas dominaram o mercado com uma participação de 50% em 2024, devido a extensos portfólios de ensaios clínicos, obrigações regulatórias e à necessidade de plataformas e-Clinical robustas e integradas.

Espera-se que as organizações de pesquisa contratadas (CROs) cresçam com a CAGR mais rápida entre 2025 e 2032, impulsionadas pela crescente terceirização das operações de ensaios clínicos, pela demanda por gestão centralizada de ensaios e pela adoção de soluções baseadas em nuvem e habilitadas por IA para otimizar a eficiência e a relação custo-benefício dos ensaios. As CROs dependem cada vez mais de soluções e-Clinical para gerenciar ensaios para vários patrocinadores simultaneamente, otimizar fluxos de trabalho e garantir a conformidade com as normas regulatórias europeias.

Análise regional do mercado de soluções clínicas eletrônicas na Europa

- A Alemanha dominou o mercado de soluções e-Clinical com a maior participação na receita de 28,5% em 2024, caracterizada por uma indústria farmacêutica madura, adoção antecipada de soluções digitais e forte suporte regulatório, com empresas líderes implantando plataformas de gerenciamento de testes baseadas em nuvem e orientadas por IA.

- As organizações do país valorizam muito a eficiência, o monitoramento em tempo real e a conformidade regulatória oferecidos pelas soluções e-Clinical, permitindo um gerenciamento mais rápido e preciso de ensaios clínicos complexos em vários locais.

- Essa ampla adoção é ainda apoiada por uma infraestrutura tecnológica avançada, uma alta concentração de Organizações de Pesquisa Contratadas (CROs) e um crescente investimento em ensaios clínicos descentralizados e híbridos, estabelecendo soluções e-Clinical como uma escolha preferencial para instituições de pesquisa farmacêutica, biotecnológica e acadêmica em toda a Alemanha.

Visão do mercado de soluções clínicas eletrônicas da Alemanha

A Alemanha dominou o mercado europeu de soluções e-Clinical, com a maior participação na receita, de 28,5% em 2024, impulsionada por um forte setor farmacêutico e de biotecnologia, infraestrutura avançada em saúde e adoção antecipada de plataformas e-Clinical baseadas em nuvem e IA. As organizações alemãs valorizam muito soluções seguras e em conformidade com a privacidade, além da integração de modelos de ensaios clínicos descentralizados e híbridos, apoiando ensaios clínicos de Fase II e Fase III. A ênfase em inovação e conformidade regulatória continua a fazer da Alemanha o principal contribuinte para o mercado europeu.

Visão do mercado de soluções clínicas eletrônicas da França

Espera-se que a França seja o país com crescimento mais rápido no mercado europeu de soluções e-Clinical durante o período previsto, impulsionado pelo aumento das atividades de ensaios clínicos, iniciativas regulatórias de apoio e maior adoção de plataformas de análise e gestão de ensaios com IA. Empresas farmacêuticas e CROs francesas estão cada vez mais utilizando soluções e-Clinical para otimizar o recrutamento de pacientes, a adesão ao protocolo e a geração de relatórios em tempo real. O foco crescente na digitalização e na tomada de decisões baseada em dados está impulsionando a rápida expansão do mercado na França.

Visão do mercado de soluções clínicas eletrônicas do Reino Unido

Prevê-se que o mercado de soluções e-Clinical do Reino Unido cresça a um CAGR notável durante o período previsto, impulsionado pela adoção de ensaios descentralizados, um ecossistema robusto de ciências da vida e a conformidade com as regulamentações da MHRA e da EMA. Empresas farmacêuticas e CROs no Reino Unido utilizam cada vez mais IA, análises em tempo real e monitoramento remoto para otimizar a eficiência dos ensaios e reduzir custos operacionais.

Visão do mercado de soluções clínicas eletrônicas da Itália

O mercado italiano de soluções e-Clinical deverá crescer de forma constante durante o período previsto, impulsionado pela expansão das atividades de ensaios clínicos, pelo aumento do investimento em tecnologias de saúde digital e pela participação em estudos multinacionais. Plataformas baseadas em nuvem, EDC e soluções de análise clínica estão aprimorando a eficiência operacional de empresas farmacêuticas, CROs e institutos de pesquisa acadêmica.

Visão do mercado de soluções clínicas eletrônicas da Espanha

O mercado espanhol de soluções e-Clinical está crescendo devido à crescente adoção de plataformas integradas de gestão de ensaios clínicos, análises baseadas em IA e ênfase regulatória na segurança dos dados dos pacientes. O foco em operações clínicas eficientes e na colaboração transfronteiriça dentro da UE está sustentando a demanda do mercado, particularmente em ensaios de Fase II e Fase III.

Participação no mercado de soluções clínicas eletrônicas na Europa

O setor de soluções clínicas eletrônicas da Europa é liderado principalmente por empresas bem estabelecidas, incluindo:

- eClinical Solutions LLC (EUA)

- Oracle Corporation (EUA)

- Anju Software, Inc. (EUA)

- Castor EDC (Holanda)

- Signant Health (EUA)

- Dassault Systèmes SE (França)

- Medidata Solutions, Inc. (EUA)

- Parexel International (MA) Corporation (EUA)

- IQVIA (EUA)

- Veeva Systems (EUA)

- RealTime Software Solutions, LLC (EUA)

- Bioclinica (EUA)

- CRF Health (EUA)

- eClinicalWorks (EUA)

- Maxisit (Alemanha)

- Clario (EUA)

- Fountayn (EUA)

- ICON plc (Irlanda)

- Mediterrâneo (EUA)

Quais são os desenvolvimentos recentes no mercado europeu de soluções clínicas eletrônicas?

- Em abril de 2025, a Veeva Systems anunciou o lançamento do seu novo Veeva SiteVault CTMS, um sistema de gerenciamento de ensaios clínicos projetado especificamente para centros de pesquisa. O lançamento inicial está previsto para agosto de 2025. Este desenvolvimento é significativo, pois fornece aos centros de pesquisa um sistema dedicado e integrado para gerenciar ensaios, simplificando os fluxos de trabalho específicos de cada centro e aprimorando a colaboração com os patrocinadores.

- Em dezembro de 2024, a eClinical Solutions anunciou uma nova colaboração com a Snowflake, uma empresa de Nuvem de Dados de IA. A parceria estabelece uma integração bidirecional entre a Nuvem de Dados Clínicos Elluminate da eClinical e a plataforma Snowflake. Esta colaboração visa otimizar a troca de dados para organizações de ciências biológicas, ajudando-as a gerenciar e analisar o crescente volume de dados complexos de ensaios clínicos com mais eficiência. Esta parceria destaca o foco crescente na criação de ecossistemas de dados integrados em diferentes plataformas.

- Em setembro de 2024, a eClinical Solutions, fornecedora líder de software e serviços clínicos digitais, anunciou um investimento majoritário da GI Partners, uma empresa de investimento privado. Este movimento estratégico visa acelerar o crescimento da empresa e aprimorar seus produtos de dados e serviços biométricos baseados em IA. Este investimento destaca uma tendência mais ampla do setor, na qual empresas de private equity estão investindo pesadamente em empresas de tecnologia e-clínica para capitalizar a crescente demanda por ensaios clínicos eficientes e baseados em dados.

- Em junho de 2024, a Medidata, uma empresa do grupo Dassault Systèmes, anunciou o lançamento do seu Clinical Data Studio. Esta nova plataforma de software com tecnologia de IA foi projetada para otimizar a gestão de dados de ensaios clínicos. Ao utilizar IA e automação, o estúdio centraliza dados de ensaios de diversas fontes, ajudando a reduzir os ciclos de revisão em até 80% e a melhorar a qualidade dos dados. Este lançamento representa um passo significativo na mudança do setor em direção ao uso de IA para modernizar e acelerar os processos relacionados a dados em ensaios clínicos.

- Em fevereiro de 2021, a eClinical Solutions lançou o elluminate CTMS, uma plataforma baseada em nuvem projetada para acelerar o desenvolvimento de medicamentos, simplificando os processos de ensaios clínicos. O sistema oferece acesso a dados em tempo real, análises avançadas e colaboração aprimorada entre equipes clínicas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.