Europe Digital Health Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

69.61 Billion

USD

304.46 Billion

2024

2032

USD

69.61 Billion

USD

304.46 Billion

2024

2032

| 2025 –2032 | |

| USD 69.61 Billion | |

| USD 304.46 Billion | |

|

|

|

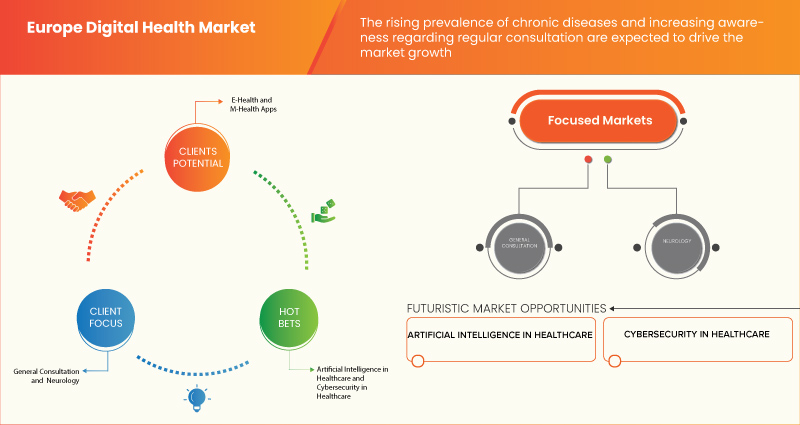

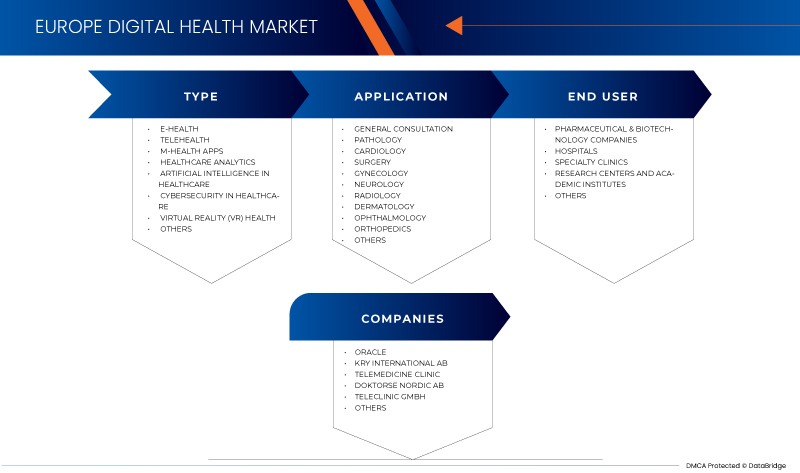

Europe Digital Health Market, By Type (E-Health, Telehealth, M-Health Apps, Healthcare Analytics, Artificial Intelligence in Healthcare, Cybersecurity in Healthcare, Virtual Reality (VR) Health, and Others), Application (General Consultation, Pathology, Cardiology, Surgery, Gynecology, Neurology, Radiology, Dermatology, Ophthalmology, Orthopedics, and Others), End User (Pharmaceutical & Biotechnology Companies, Hospitals, Specialty Clinics, Research Centers and Academic Institutes, and Others) – Industry Trends and Forecast to 2031.

Europe Digital Health Market Analysis and Size

The Europe digital health market is growing in the forecast year for several reasons, such as the growing prevalence of chronic diseases and conditions, rise in technological advancements in e-health. Along with this, the rising demand for mental health services is driving the market growth.

Data Bridge Market Research analyzes that the Europe digital health market is expected to reach USD 253.18 billion by 2031, from USD 58.75 billion in 2023, growing at a CAGR of 20.3% in the forecast period of 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016–2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Type (E-Health, Telehealth, M-Health Apps, Healthcare Analytics, Artificial Intelligence in Healthcare, Cybersecurity in Healthcare, Virtual Reality (VR) Health, and Others), Application (General Consultation, Pathology, Cardiology, Surgery, Gynecology, Neurology, Radiology, Dermatology, Ophthalmology, Orthopedics, and Others), End User (Pharmaceutical & Biotechnology Companies, Hospitals, Specialty Clinics, Research Centers and Academic Institutes, and Others) |

|

Countries Covered |

Denmark, Spain, U.K., Sweden, Netherlands, Austria, Italy, Belgium, France, Germany, and the Rest of Europe |

|

Market Players Covered |

Oracle, KRY International AB, Telemedicine Clinic, TeleClinic GmbH, Doktorse Nordic AB, ORTIVUS AB, Nia Health GmbH, and MedKitDoc, Medloop Ltd. among others |

Market Definition

The term "digital health" refers to the extensive multidisciplinary field that encompasses ideas from the intersection of technology and healthcare. Digital health brings digital transformation to the healthcare industry by combining software, hardware, and services. Digital health encompasses wearable technology, telehealth and telemedicine, Mobile Health (mHealth) apps, Electronic Health Records (EHRs), Electronic Medical Records (EMRs), and personalized medicine. A modern digital health system increases access to health information for patients and providers, strengthens the bond between patients and their physicians, and promotes preventative disease strategies and value-based care.

Europe Digital Health Market Dynamics

This section deals with understanding the market drivers, opportunities, challenges, and restraints. All of this is discussed in detail below:

Drivers

- Growing Prevalence of Chronic Diseases and Conditions

Factors such as demographic shifts towards an aging population and changes in lifestyle behaviors contribute to the rising incidence of chronic illnesses such as diabetes, cardiovascular diseases, and respiratory conditions. This demographic trend underscores the pressing need for effective solutions to manage chronic diseases and improve patient outcomes.

Moreover, difficulties related to healthcare accessibility, particularly in rural or underserved areas, further emphasize the importance of digital health technologies in providing remote access to healthcare services. These technologies enable patients to access healthcare professionals, monitor their health status, and adhere to treatment plans from the convenience of their homes, which is driving the market growth.

- Rising Demand for Mental Health Services

The rising demand for mental health services in Europe, coupled with the increasing acceptance of digital health technologies, has created significant opportunities for innovation and growth in the digital health market. By leveraging technology to improve access, convenience, and effectiveness of mental health support services, digital health solutions have the potential to enhance the overall well-being of individuals and address the evolving mental health needs of the population. Factors such as increased awareness, reduced stigma surrounding mental health issues, and the psychological impact of events such as the COVID-19 pandemic have contributed to a surge in demand for mental health support across the continent. However, traditional mental health services often face challenges such as long wait times, limited access to specialists, and barriers to seeking help due to social stigma, which is driving market growth.

Opportunity

- Enhancing Public Sector Contributions for Strengthening the Growth Initiatives

The government is promoting the use of digital applications for healthcare and support. Governments all across the world are starting to realize how digital health technologies may improve patient outcomes, save costs, and improve healthcare delivery. Consequently, they have several funding initiatives, programs, and policies to encourage the creation and uptake of digital health solutions. Thus, enhancing public sector contributions for strengthening the growth initiatives is expected to act as an opportunity for market growth.

Restraints/Challenges

- Increase in Healthcare Fraud

The rise in healthcare fraud poses a significant constraint on the digital health market, particularly in the realm of digital health. Instances of fraudulent activities within healthcare undermine the trust and reliability of digital health solutions, deterring potential users and investors alike. The prevalence of fraudulent practices, ranging from false insurance claims to identity theft, creates a barrier to the widespread adoption and growth of digital health technologies. As stakeholders become cautious of potential risks associated with fraudulent activities, the pace of innovation and investment in digital health initiatives may be hampered. Consequently, the potential benefits of digital health solutions, such as improved accessibility, efficiency, and patient outcomes, may not be fully realized.

The increase in healthcare fraud presents a significant obstacle for the digital health market. The prevalence of fraudulent activities undermines trust in digital health solutions, discouraging both users and investors. This creates a barrier to the widespread adoption and growth of digital health technologies. Innovation and investment in digital health initiatives may be hindered as stakeholders become more cautious of the risks associated with fraud, which is restraining the market growth.

- Shortage of Proficient Experts for Handling the Software

One of the most rapidly developing fields in management software involves developing and using various technological-based applications such as Artificial Intelligence (AI). The advancement of technology has made it possible to reach the level of healthcare-providing facilities from conventional healthcare methods. The advancement of healthcare technology requires various skill sets for its handling. As technology-based healthcare is highly automated and has costly software, improperly handling such systems can damage them and hamper achieving accurate and perfect data. Thereby it will proportionally hamper the result of data processing. The shortage of skilled professionals with adequate skills and knowledge to handle such highly innovative technology-based software is expected to challenge market growth.

The shortage of qualified IT workers capable of creating, deploying, and maintaining these technologies hinders innovation and makes it more difficult for the sector to adapt to changing healthcare demands as the demand for digital health solutions rises. Healthcare organizations may find it difficult to improve patient care, streamline operations, and adjust to shifting regulatory requirements if they lack the talent to drive technology innovations and promote the adoption of digital health solutions. Thus, the shortage of proficient experts for handling the software is expected to challenge market growth.

Recent Developments

- In December 2023, Oracle Health collaborated with General Dynamics Information Technology (GDIT), a business unit of General Dynamics, to modernize the Electronic Health Record (EHR) system of the Indian Health Service (IHS). This collaboration has helped Oracle Health expand its reach and impact in the healthcare industry by partnering with a respected organization like General Dynamics Information Technology

- In December 2023, KRY International AB collaborated with the prominent insurtech firm, SideCare, in France. This new partnership involves integrating its teleconsultation services to enhance access to primary care, specialty services, and psychology services. It enhanced and broaden their market presence

- In July 2023, Medloop Ltd. Announced that they have shortlisted for the 2023 BusinessCloud HealthTech 50 awards. This has helped the company to position its product and has also provided recognition

- In February 2023, Doktorse Nordic AB announced that it opened a new health center in Nacka Strand in Stockholm. Through the new establishment, Doktor.se strengthens its offer of more accessible care with good quality for patients in Stockholm

- In July 2020, TeleClinic GmbH made a significant announcement regarding its acquisition by the Zur Rose Group. This acquisition not only boosted TeleClinic GmbH's market image but also expanded its market presence. By joining forces with the Zur Rose Group, TeleClinic GmbH gained access to a larger customer base and enhanced its capabilities to deliver telemedicine services

Europe Digital Health Market Scope

The Europe digital health market is categorized into three notable segments based on type, application, and end user. The growth amongst these segments will help you analyze major growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Type

- E-Health

- Telehealth

- M-Health Apps

- Healthcare Analytics

- Artificial Intelligence in Healthcare

- Cybersecurity in Healthcare

- Virtual Reality (VR) Health

- Others

On the basis of type, the Europe digital health market is segmented into e-health, telehealth, m-health apps, healthcare analytics, artificial intelligence in healthcare, cybersecurity in healthcare, Virtual Reality (VR) health, and others.

Application

- General Consultation

- Pathology

- Cardiology

- Surgery

- Gynecology

- Neurology

- Radiology

- Dermatology

- Ophthalmology

- Orthopedics

- Others

On the basis of application, the Europe digital health market is segmented into general consultation, pathology, cardiology, surgery, gynecology, neurology, radiology, dermatology, ophthalmology, orthopedics, and others.

End User

- Pharmaceutical & Biotechnology Companies

- Hospitals

- Specialty Clinics

- Research Centers and Academic Institutes

- Others

On the basis of end user, the Europe digital health market is segmented into pharmaceutical & biotechnology companies, hospitals, specialty clinics, research centers and academic institutes, and others.

Europe Digital Health Market Regional Analysis/Insights

The Europe digital health market is categorized into three notable segments based on type, application, and end user.

The countries covered in the market is Denmark, Spain, U.K., Sweden, Netherlands, Austria, Italy, Belgium, France, Germany, and rest of Europe.

Denmark is expected to dominate the Europe digital health market due to the rising technological advancement of e-health in the country.

The country section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data point downstream and upstream value chain analysis, technical trends porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and the challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Europe Digital Health Market Share Analysis

The Europe digital health market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the digital health market.

Some of the major players operating in the Europe digital health market are Oracle, KRY International AB, Telemedicine Clinic, TeleClinic GmbH, Doktorse Nordic AB, ORTIVUS AB, Nia Health GmbH, MedKitDoc, and Medloop Ltd. among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.