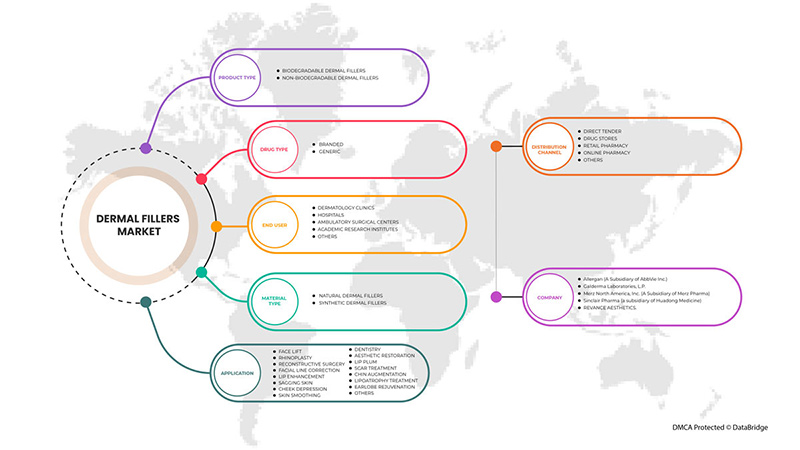

Europe Dermal Fillers Market, By Product Type (Biodegradable Dermal Fillers, Non-Biodegradable Dermal Fillers), Material Type (Natural Dermal Fillers, Synthetic Dermal Fillers), Application (Face Lift, Rhinoplasty, Reconstructive Surgery, Facial Line Correction, Lip Enhancement, Sagging Skin, Cheek Depression, Skin Smoothing, Dentistry, Aesthetic Restoration, Lip Plum, Scar Treatment, Chin Augmentation, Lipoatrophy Treatment, Earlobe Rejuvenation and Others), Drug Type (Branded, Generic), End User (Dermatology Clinics, Ambulatory Surgical Centers, Hospitals, Academic Research Institutes And Others), Distribution Channel (Direct Tender, Drug Stores, Retail Pharmacy, Online Pharmacy and Others)- Industry Trends and Forecast to 2029.

Europe Dermal Fillers Market Analysis and Insight

The dermal filler is gel-like substances that are injected underneath the skin to restore lost volume, often creases and smooth lines or enhance facial contours. Dermal fillers usage has rapidly grown in recent years because of various offerings in the enhancing aesthetic and rejuvenate improvements that were previously only achievable with surgeries. These are becoming very popular for facial rejuvenation methods. Being minimally invasive dermal filler shows instantaneous results in cosmetic volume replacement therapies. These devices provide volume to the face, boost and enhance the quality of the skin. Various methods such as injections are used for augmentation. These fillers can give fuller, plumper lips for aesthetic purposes. There are many types of dermal fillers that can be injected in lips and around mouth that keep the volume of lips either temporally or permanently depending on the type of product used. Some market players are involved in the new and innovative products, and their products are under pipelines. During the last few years, new innovative dermal fillers products have been developed for increasing the market growth of the dermal fillers market, and the market players are enhancing their product portfolio. Many market players are involved in the manufacturing of dermal fillers with innovations that pave the way for market growth.

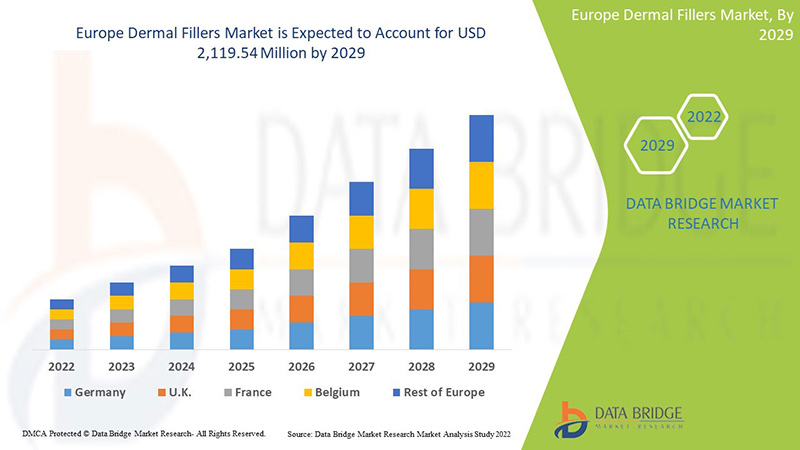

Data Bridge Market Research analyses that the dermal fillers market is expected to reach the value of USD 2,119.54 million by 2029, at a CAGR of 10.0% during the forecast period 2022-2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Year |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

By Product Type (Biodegradable Dermal Fillers, Non-Biodegradable Dermal Fillers), Material Type (Natural Dermal Fillers, Synthetic Dermal Fillers), Application (Face Lift, Rhinoplasty, Reconstructive Surgery, Facial Line Correction, Lip Enhancement, Sagging Skin, Cheek Depression, Skin Smoothing, Dentistry, Aesthetic Restoration, Lip Plum, Scar Treatment, Chin Augmentation, Lipoatrophy Treatment, Earlobe Rejuvenation and Others), Drug Type (Branded, Generic), End User (Dermatology Clinics, Ambulatory Surgical Centers, Hospitals, Academic Research Institutes And Others), Distribution Channel (Direct Tender, Drug Stores, Retail Pharmacy, Online Pharmacy and Others) |

|

Countries Covered |

Germany, Italy, France, U.K., Spain, Russia, Netherlands, Switzerland, Belgium, Turkey and Rest Of Europe |

|

Market Players Covered |

Allergan(A Subsidiary of Abbvie, Inc.), Prollenium Medical Technologies, Suneva Medical, Revance Therapeutics, Inc., FillMed Laboratories, Anika Therapeutics, Inc, Ipsen Pharma, BIOXIS Pharmaceuticals, Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (A subsidiary of HUONS GLOBAL),Galderma Laboratories, L.P., Merz North America, Inc. (A Subsidiary of Merz Pharma),Croma-Pharma GmbH, Sinclair Pharma (A Subsidiary of Huadong Medicine Co., Ltd.),Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS,among others. |

Market Definition

Dermal fillers are substances designed to be injected into the skin to add fullness and volume. The substances used in dermal fillers include Calcium hydroxylapatite (a mineral-like compound found in bones), Hyaluronic acid, Polyalkylimide, Polylactic acid, Polymethyl-methacrylate microspheres (PMMA). Dermal fillers can be classified based on several criteria, including the deep dermis, depth of implantation (a superficial midterms and upper, and subcutaneous levels); longevity of correction (temporary and permanent); allergenicity, the composition of the agent (allografts, semi/fully synthetic, xenografts, or autologous); and stimulatory behavior (physiologic processes of endogenous tissue proliferation) versus replacement fillers (space-replacing effect).

Temporary dermal fillers such as HA and collagen are biodegradable and last from 4 to 9 months. The prospective side effects and dissatisfaction are also short-lived. Therefore, temporary fillers are always used as the first line of therapy to save long-lasting fillers for future patient visits.

Permanent fillers are essentially used in the alteration of deep lines and furrows of the skin, which are beyond normal facial wrinkles. They are considered an excellent option in facial rejuvenation, especially in HIV lipodystrophy. Polymethyl methacrylate (PMMA) is mostly used for safe, effective, and long-lasting effects.

Dinâmica do mercado de preenchimentos dérmicos

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- Prevalência crescente de procedimentos minimamente invasivos

O uso de procedimentos minimamente invasivos foi alterado em comparação com os métodos tradicionais de cirurgias estéticas e cosméticas, incluindo laser e outros dispositivos baseados em energia. Para a utilização de procedimentos cirúrgicos ou não cirúrgicos, foram desenvolvidos instrumentos especialmente concebidos para procedimentos de utilização mínima. Estes dispositivos antienvelhecimento ajudam a reduzir os efeitos visuais do envelhecimento da pele, revitalizando e esticando a pele, o que proporciona um aspeto mais jovem.

A cirurgia minimamente invasiva é um procedimento realizado com o auxílio de um endoscópio e de instrumentos cirúrgicos especialmente equipados. Atua nas irregularidades faciais, incluindo rugas e linhas finas, e diminui o volume, o contorno e a gordura indesejada. Estes procedimentos não apresentam essencialmente qualquer risco de eventos adversos graves, uma vez que não permitem cortes nem permitem cortes mínimos com um tempo de recuperação mais curto, o que está a aumentar a procura pela utilização de procedimentos minimamente invasivos. Os tratamentos minimamente invasivos baseados em energia para o endurecimento da pele, redução de rugas, contorno facial e rejuvenescimento da pele têm uma grande procura no mundo. Outras razões que impulsionam a procura destes procedimentos são o aumento do envelhecimento da população e a crescente necessidade de unidades de saúde, o que pode resultar numa redução ainda maior da carga sobre as unidades de saúde.

Com os crescentes avanços tecnológicos e de comunicação, as pessoas estão mais conscientes dos dispositivos e procedimentos estéticos que são bem executados na área da saúde, impactando positivamente a adoção de procedimentos minimamente invasivos na próxima era. Desta forma, espera-se que a crescente prevalência de procedimentos minimamente invasivos impulsione o crescimento do mercado dos preenchimentos dérmicos.

- Aumento da população geriátrica

A população geriátrica está a expandir-se para uma esperança de vida mais longa e há relatos de que apresenta condições crescentes de envelhecimento da pele. A velocidade do envelhecimento populacional está a aumentar exponencialmente no mundo, enquanto os países europeus têm em comum certas características culturais, sociais e económicas, com aspirações semelhantes. À medida que as pessoas envelhecem, a sua aparência melhora e parecem mais jovens, o que acaba por desenvolver interesse na utilização de procedimentos estéticos.

A crescente melhoria na prestação de cuidados de saúde e o seu cenário nos países do Médio Oriente entre a percentagem de idosos resultaram em melhores serviços para os doentes.

Oportunidades

- Aumento das atividades de financiamento para a investigação estética

Cirurgia plástica, remoção de pelos indesejados, endurecimento da pele, antienvelhecimento, remoção de excesso de gordura, contorno corporal e vários outros procedimentos cosméticos que devem ser realizados através de procedimentos minimamente invasivos seguem sob dispositivos estéticos médicos que são utilizados para melhorar a aparência, embelezamento e outras melhorias. Várias fundações e organizações governamentais estão a investir muito em investigação estética.

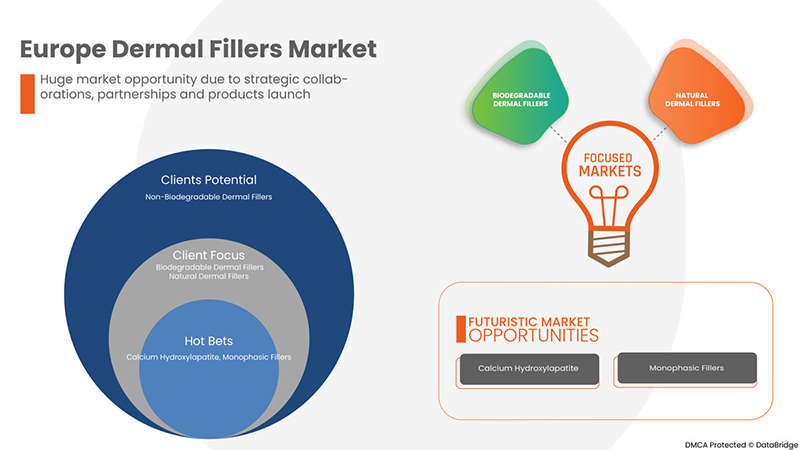

- Avanços nos novos preenchimentos dérmicos

Os preenchimentos dérmicos são substâncias semelhantes a gel, que são injetadas sob a pele para restaurar o volume perdido, suavizar os vincos e as linhas. Também é utilizado para melhorar os contornos faciais; todos os anos, mais de 1 milhão de pessoas preferem este popular tratamento de transformação facial para restaurar as rugas e a aparência das linhas faciais. Os preenchimentos dérmicos são um tratamento eficaz para parecer mais jovem sem tempo de recuperação ou cirurgia. O medicamento de preenchimento dérmico é injetado na pele, o que ajuda a preencher as rugas faciais. Existem diferentes tipos de medicamentos para o preenchimento dérmico disponíveis, os tipos mais comuns são a hidroxiapatite de cálcio, o ácido hialurónico, a polialquilimida, o ácido polilático e outros. O avanço nas marcas de preenchimentos dérmicos ajudará a aumentar a procura do mercado.

Restrições/Desafios

- Elevado custo dos procedimentos estéticos

O custo é sempre uma consideração no procedimento eletivo. O custo do preenchimento dérmico depende do tipo de preenchimento e da quantidade utilizada no tratamento. Além disso, o custo do tratamento é baseado nas qualificações e na experiência da pessoa que realiza o tratamento de preenchimento dérmico. O tratamento cosmético de preenchimento dérmico é um procedimento seguro em ambulatório e é um tratamento muito popular para restaurar o volume perdido e tratar alguns sinais de envelhecimento, mas o elevado custo dos procedimentos deve prejudicar a procura do mercado.

- Falta de profissionais qualificados

Os procedimentos de tratamento estético são de diferentes tipos: tecnologia baseada em laser, tecnologia baseada em energia e luz pulsada intensa, entre outros. Todas estas técnicas exigem competências interpessoais qualificadas para realizar um tratamento eficaz.

Além disso, o rápido avanço tecnológico neste campo leva também à falta de profissionais qualificados. A falta de profissionais qualificados representa um grande desafio durante o manuseamento do dispositivo e a realização de procedimentos cirúrgicos.

Desenvolvimentos recentes

- Em abril de 2022, a Sinclair Pharma anunciou que a empresa recebeu a marcação CE europeia para a Perfectha Lidocaína no tratamento de correção de rugas, contorno facial e restauração de volume. Este certificado CE resulta no lançamento do Perfectha Lidocaine no Reino Unido e em todos os principais mercados europeus.

Segmentação do mercado de preenchimentos dérmicos

O mercado dos preenchimentos dérmicos está segmentado com base no tipo de produto, tipo de material, aplicação, tipo de medicamento, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

Por tipo de produto

- Preenchimentos Dérmicos Biodegradáveis

- Preenchimentos dérmicos não biodegradáveis

Com base no tipo de produto, o mercado dos preenchimentos dérmicos está segmentado em preenchimentos dérmicos biodegradáveis e preenchimentos dérmicos não biodegradáveis.

Por tipo de material

- Preenchimentos dérmicos naturais

- Preenchimentos Dérmicos Sintéticos

Com base no tipo de material, o mercado está segmentado em preenchimentos dérmicos naturais e preenchimentos dérmicos sintéticos.

Por aplicação

- Lifting facial

- Rinoplastia

- Cirurgia Reconstrutiva

- Correção de linhas faciais

- Aumento dos lábios

- Pele flácida

- Depressão na bochecha

- Suavização da pele

- Odontologia

- Restauração Estética

- Batom Ameixa

- Tratamento de cicatrizes

- Aumento do queixo

- Tratamento da Lipoatrofia

- Rejuvenescimento do lóbulo da orelha

- Outros

Com base na aplicação, o mercado está segmentado em lifting facial, rinoplastia, cirurgia reconstrutiva, correção da linha facial, aumento dos lábios, flacidez da pele, depressão das bochechas, suavização da pele, medicina dentária, restauração estética, tratamento de cicatrizes, aumento do queixo, tratamento de lipoatrofia, lóbulo da orelha.

Por tipo de droga

- De marca

- Genérico

Com base no tipo de medicamento, o mercado está segmentado em medicamentos de marca e genéricos.

Por utilizador final

- Clínicas de Dermatologia

- Hospitais

- Centros Cirúrgicos Ambulatoriais

- Institutos de Investigação Académica

- Outros

Com base no utilizador final, o mercado está segmentado em clínicas dermatológicas, centros de cirurgia ambulatória, hospitais, institutos de investigação académica e outros.

Por canal de distribuição

- Licitação Direta

- Farmácias

- Farmácia de retalho

- Farmácia Online

- Outros

Com base no canal de distribuição, o mercado está segmentado em licitação direta, farmácias, farmácias de retalho, farmácias online e outros.

Análise regional/perspetivas do mercado de preenchimentos dérmicos

O mercado dos preenchimentos dérmicos é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, tipo de produto, tipo de material, aplicação, tipo de medicamento, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de preenchimentos dérmicos são a Alemanha, Itália, França, Reino Unido, Espanha, Rússia, Países Baixos, Suíça, Bélgica, Turquia e Resto da Europa.

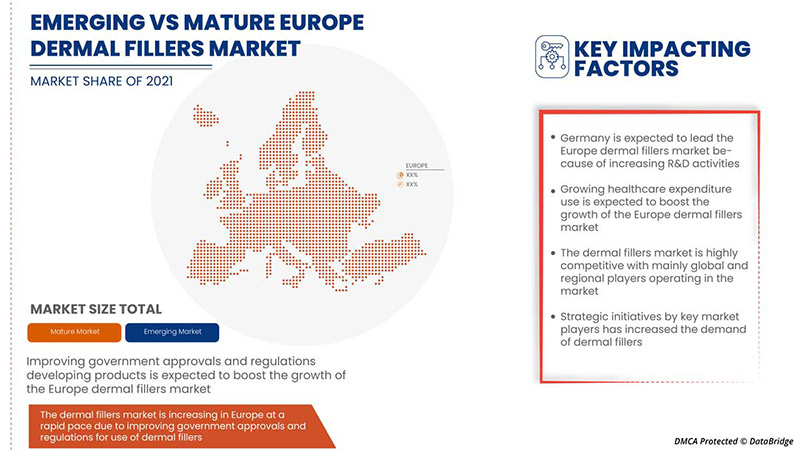

Espera-se que a Alemanha domine o mercado devido à crescente tecnologia e fiabilidade dos dispositivos de preenchimento dérmico.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado dos preenchimentos dérmicos

O panorama competitivo do mercado de preenchimentos dérmicos fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa , lançamento do produto, amplitude e abrangência do produto, aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado dos preenchimentos dérmicos.

Alguns dos principais participantes que operam no mercado são a Allergan (uma subsidiária da Abbvie, Inc.), a Prollenium Medical Technologies, a Suneva Medical, a Revance Therapeutics, Inc., a FillMed Laboratories, a Anika Therapeutics, Inc, a Ipsen Pharma, a BIOXIS Pharmaceuticals, a Zimmer Aesthetic, Zhejiang Jingjia Medical Technology Co. Ltd., Medytox, Contura International ltd., Shanghai Reyoungel Medical Technology Company Limited, Humedix (uma subsidiária da HUONS GLOBAL),Galderma Laboratories, LP, Merz North America, Inc. (uma subsidiária da Merz Pharma) , Croma-Pharma GmbH, Sinclair Pharma (uma subsidiária da Huadong Medicine Co., Ltd.), Teoxane, BioPlus Co., Ltd., Amalian, Givaudan, Mesoestetic, Sosum Global, DSM, IBSA Nordic ApS, entre outras.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF EUROPE DERMAL FILLERS MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCTS LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

4.3 EPIDEMIOLOGY PROCEDURES PER COUNTRY

5 REGULATIONS OF EUROPE DERMAL FILLERS MARKET

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 RISING PREVALENCE OF MINIMALLY INVASIVE PROCEDURES

6.1.2 INCREASING GERIATRIC POPULATION

6.1.3 TECHNOLOGICAL ADVANCEMENTS IN DERMAL FILLERS

6.1.4 STRATEGIC INITIATIVES BY MARKET PLAYERS

6.2 RESTRAINTS

6.2.1 HIGH COST OF AESTHETIC PROCEDURES

6.2.2 ESCALATING PRODUCT RECALL

6.2.3 FDA GUIDELINES FOR ADVANCED DERMAL FILLER INJECTORS

6.3 OPPORTUNITIES

6.3.1 INCREASING HEALTHCARE EXPENDITURE

6.3.2 INCREASING FUNDING ACTIVITIES FOR AESTHETIC RESEARCH

6.3.3 ADVANCEMENT IN THE NEW DERMAL FILLERS

6.3.4 INCREASING COMPENSATION AND ACCIDENTAL CLAIMS FOR DERMAL FILLER

6.4 CHALLENGES

6.4.1 LACK OF SKILLED PROFESSIONALS

6.4.2 AVAILABILITY OF ALTERNATIVES

7 EUROPE DERMAL FILLERS MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 BIODEGRADABLE DERMAL FILLERS

7.2.1 TEMPORARY BIODEGRADABLE

7.2.2 SEMI-PERMANENT BIODEGRADABLE

7.3 NON-BIODEGRADABLE DERMAL FILLERS

8 EUROPE DERMAL FILLERS MARKET, BY MATERIAL TYPE

8.1 OVERVIEW

8.2 NATURAL DERMAL FILLERS

8.2.1 HYALURONIC ACID

8.2.1.1 BY TYPE

8.2.1.1.1 MONOPHASIC FILLERS

8.2.1.2 BY TYPE

8.2.1.2.1 MONODENSIFIED

8.2.1.2.2 POLYDENSIFIED

8.2.1.2.3 BIPHASIC FILLERS

8.2.1.3 BY MATERIAL TYPE

8.2.1.3.1 SINGLE-PHASE

8.2.1.3.2 DUPLEX-PHASE

8.2.1.4 BY APPLICATION

8.2.1.4.1 FACE LIFT

8.2.1.4.2 RHINOPLASTY

8.2.1.4.3 RECONSTRUCTIVE SURGERY

8.2.1.4.4 FACIAL LINE CORRECTION

8.2.1.4.5 LIP ENHANCEMENT

8.2.1.4.6 SAGGING SKIN

8.2.1.4.7 CHEEK DEPRESSION

8.2.1.4.8 SKIN SMOOTHING

8.2.1.4.9 DENTISTRY

8.2.1.4.10 AESTHETIC RESTORATION

8.2.1.4.11 SCAR TREATMENT

8.2.1.4.12 CHIN AUGMENTATION

8.2.1.4.13 LIPOATROPHY TREATMENT

8.2.1.4.14 EARLOBE REJUVENATION

8.2.1.4.15 OTHERS

8.2.2 FAT

8.2.2.1 BY APPLICATION

8.2.2.1.1 FACE LIFT

8.2.2.1.2 RHINOPLASTY

8.2.2.1.3 RECONSTRUCTIVE SURGERY

8.2.2.1.4 FACIAL LINE CORRECTION

8.2.2.1.5 LIP ENHANCEMENT

8.2.2.1.6 SAGGING SKIN

8.2.2.1.7 CHEEK DEPRESSION

8.2.2.1.8 SKIN SMOOTHING

8.2.2.1.9 DENTISTRY

8.2.2.1.10 AESTHETIC RESTORATION

8.2.2.1.11 SCAR TREATMENT

8.2.2.1.12 CHIN AUGMENTATION

8.2.2.1.13 LIPOATROPHY TREATMENT

8.2.2.1.14 EARLOBE REJUVENATION

8.2.2.1.15 OTHERS

8.2.3 COLLAGEN

8.2.3.1 BY APPLICATION

8.2.3.1.1 FACE LIFT

8.2.3.1.2 RHINOPLASTY

8.2.3.1.3 RECONSTRUCTIVE SURGERY

8.2.3.1.4 FACIAL LINE CORRECTION

8.2.3.1.5 LIP ENHANCEMENT

8.2.3.1.6 SAGGING SKIN

8.2.3.1.7 CHEEK DEPRESSION

8.2.3.1.8 SKIN SMOOTHING

8.2.3.1.9 DENTISTRY

8.2.3.1.10 AESTHETIC RESTORATION

8.2.3.1.11 SCAR TREATMENT

8.2.3.1.12 CHIN AUGMENTATION

8.2.3.1.13 LIPOATROPHY TREATMENT

8.2.3.1.14 EARLOBE REJUVENATION

8.2.3.1.15 OTHERS

8.2.4 OTHERS

8.3 SYNTHETIC DERMAL FILLERS

8.3.1 POLY-L-LACTIC ACID

8.3.1.1 BY APPLICATION

8.3.1.1.1 FACE LIFT

8.3.1.1.2 RHINOPLASTY

8.3.1.1.3 RECONSTRUCTIVE SURGERY

8.3.1.1.4 FACIAL LINE CORRECTION

8.3.1.1.5 LIP ENHANCEMENT

8.3.1.1.6 SAGGING SKIN

8.3.1.1.7 CHEEK DEPRESSION

8.3.1.1.8 SKIN SMOOTHING

8.3.1.1.9 DENTISTRY

8.3.1.1.10 AESTHETIC RESTORATION

8.3.1.1.11 SCAR TREATMENT

8.3.1.1.12 CHIN AUGMENTATION

8.3.1.1.13 LIPOATROPHY TREATMENT

8.3.1.1.14 EARLOBE REJUVENATION

8.3.1.1.15 OTHERS

8.3.2 CALCIUM HYDROXYLAPATITE

8.3.2.1 BY APPLICATION

8.3.2.1.1 FACE LIFT

8.3.2.1.2 RHINOPLASTY

8.3.2.1.3 RECONSTRUCTIVE SURGERY

8.3.2.1.4 FACIAL LINE CORRECTION

8.3.2.1.5 LIP ENHANCEMENT

8.3.2.1.6 SAGGING SKIN

8.3.2.1.7 CHEEK DEPRESSION

8.3.2.1.8 SKIN SMOOTHING

8.3.2.1.9 DENTISTRY

8.3.2.1.10 AESTHETIC RESTORATION

8.3.2.1.11 SCAR TREATMENT

8.3.2.1.12 CHIN AUGMENTATION

8.3.2.1.13 LIPOATROPHY TREATMENT

8.3.2.1.14 EARLOBE REJUVENATION

8.3.2.1.15 OTHERS

8.3.3 POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA)

8.3.3.1 BY APPLICATION

8.3.3.1.1 FACE LIFT

8.3.3.1.2 RHINOPLASTY

8.3.3.1.3 RECONSTRUCTIVE SURGERY

8.3.3.1.4 FACIAL LINE CORRECTION

8.3.3.1.5 LIP ENHANCEMENT

8.3.3.1.6 SAGGING SKIN

8.3.3.1.7 CHEEK DEPRESSION

8.3.3.1.8 SKIN SMOOTHING

8.3.3.1.9 DENTISTRY

8.3.3.1.10 AESTHETIC RESTORATION

8.3.3.1.11 SCAR TREATMENT

8.3.3.1.12 CHIN AUGMENTATION

8.3.3.1.13 LIPOATROPHY TREATMENT

8.3.3.1.14 EARLOBE REJUVENATION

8.3.3.1.15 OTHERS

8.3.4 POLYALKYLIMIDE

8.3.4.1 BY APPLICATION

8.3.4.1.1 FACE LIFT

8.3.4.1.2 RHINOPLASTY

8.3.4.1.3 RECONSTRUCTIVE SURGERY

8.3.4.1.4 FACIAL LINE CORRECTION

8.3.4.1.5 LIP ENHANCEMENT

8.3.4.1.6 SAGGING SKIN

8.3.4.1.7 CHEEK DEPRESSION

8.3.4.1.8 SKIN SMOOTHING

8.3.4.1.9 DENTISTRY

8.3.4.1.10 AESTHETIC RESTORATION

8.3.4.1.11 SCAR TREATMENT

8.3.4.1.12 CHIN AUGMENTATION

8.3.4.1.13 LIPOATROPHY TREATMENT

8.3.4.1.14 EARLOBE REJUVENATION

8.3.4.1.15 OTHERS

8.3.5 OTHERS

9 EUROPE DERMAL FILLERS MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 FACE LIFT

9.2.1 DEEP PLANE/SMAS FACE

9.2.2 MINI FACE LIFT

9.2.3 MID-FACE LIFT

9.2.4 JAW LINE

9.2.5 CUTANEOUS LIFT

9.2.6 TEMPORAL OR BROW LIFT

9.2.7 LIQUID FACE LIFT

9.2.8 OTHERS

9.2.8.1 JUVEDERM

9.2.8.2 RESTYLANE

9.2.8.3 SCULPTRA

9.2.8.4 DYSPORT

9.2.8.5 OTHERS

9.3 RHINOPLASTY

9.3.1 JUVEDERM

9.3.1.1 JUVEDERM XC

9.3.1.2 JUVEDERM ULTRA XC

9.3.1.3 JUVEDERM VOLUMA

9.3.1.4 JUVEDERM VOLBELLA

9.3.1.5 JUVEDERM VOLLURE XC

9.3.2 RESTYLANE

9.3.2.1 RESTYLANE SILK

9.3.2.2 RESTYLANE LYFT

9.3.2.3 RESTYLANE REFYNE

9.3.2.4 RESTYLANE DEFYNE

9.3.2.5 RESTYLANE-L

9.3.3 OTHERS

9.4 RECONSTRUCTIVE SURGERY

9.4.1 JUVEDERM

9.4.2 RESTYLANE

9.4.3 OTHERS

9.5 FACIAL LINE CORRECTION

9.5.1 DYNAMIC WRINKLES

9.5.2 STATIC WRINKLES

9.5.3 WRINKLE FOLDS

9.5.3.1 FOREHEAD LINES

9.5.3.2 WORRY LINES

9.5.3.3 BUNNIES

9.5.3.4 CROW’S FEET

9.5.3.5 LAUGH LINES

9.5.3.6 LIP LINES

9.5.3.7 MARIONETTE LINES

9.5.3.8 OTHERS

9.5.3.8.1 JUVEDERM

9.5.3.8.2 RESTYLANE

9.5.3.8.3 RADIESSE

9.5.3.8.4 BELOTERO

9.5.3.8.5 OTHERS

9.6 LIP ENHANCEMENT

9.6.1 JUVEDERM

9.6.1.1 JUVÉDERM XC

9.6.1.2 JUVÉDERM ULTRA XC

9.6.1.3 JUVÉDERM VOLUMA

9.6.1.4 JUVÉDERM VOLBELLA

9.6.1.5 JUVÉDERM VOLLURE XC

9.6.2 RESTYLANE

9.6.2.1 RESTYLANE SILK

9.6.2.2 RESTYLANE LYFT

9.6.2.3 RESTYLANE REFYNE

9.6.2.4 RESTYLANE DEFYNE

9.6.2.5 RESTYLANE-L

9.6.3 BELOTERO BALANCE

9.6.4 REVANESSE VERSA

9.6.5 HYLAFORM

9.6.6 PREVELLE SILK

9.6.7 OTHERS

9.7 SAGGING SKIN

9.7.1 JUVEDERM

9.7.2 RESTYLANE

9.7.3 BELOTERO

9.7.4 OTHERS

9.8 CHEEK DEPRESSION

9.8.1 JUVEDERM VOLUMA

9.8.2 RESTYLANE-LYFT

9.8.3 SCULPTRA

9.8.4 RADIESSE

9.8.5 OTHERS

9.9 SKIN SMOOTHENING

9.9.1 RESTYLANE

9.9.2 BELOTERO

9.9.3 BELLAFIL

9.9.4 OTHERS

9.1 DENTISTRY

9.10.1 JUVEDERM

9.10.2 RESTYLANE

9.10.3 RADIESSE

9.10.4 OTHERS

9.11 AESTHETIC RESTORATION

9.11.1 JUVEDERM

9.11.1.1 JUVEDERM ULTRA XC

9.11.1.2 JUVEDERM VOLLURE XC

9.11.1.3 JUVEDERM VOLBELLA XC

9.11.2 RESTYLANE

9.11.2.1 RESTYLANE-L

9.11.2.2 RESTYLANE SILK

9.11.2.3 RESTYLANE REFYNE AND DEFYNE

9.11.2.4 RESTYLANE LYFT

9.12 REVANESSE VERSA

9.13 SCULPTRA

9.14 RHA

9.14.1 RHA 2

9.14.2 RHA 3

9.14.3 RHA 4

9.15 BELLAFIL

9.16 BELOTERO BALANCE

9.17 OTHERS

9.18 LIP PLUM

9.18.1 RESTYLANE

9.18.2 BELOTERO

9.18.3 OTHERS

9.19 SCAR TREATMENT

9.19.1 JUVEDERM

9.19.2 RESTYLANE

9.19.3 RADIESSE

9.19.4 BELOTERO

9.19.5 PERLANE

9.19.6 OTHERS

9.19.6.1 KELOID SCARS

9.19.6.2 CONTRACTURE SCARS

9.19.6.3 HYPERTROPHIC SCARS

9.19.6.4 ACNE SCARS

9.19.6.5 OTHERS

9.2 CHIN AUGMENTATION

9.20.1 JUVEDERM VOLUMA XC

9.20.2 RESTYLANE

9.20.3 OTHERS

9.21 LIPOATROPHY TREATMENT

9.21.1 SCULPTRA

9.21.2 OTHERS

9.22 EARLOBE REJUVENATION

9.22.1 JUVEDERM

9.22.2 RESTYLANE

9.22.3 SCULPTRA

9.22.4 BELOTERO

9.22.5 ELLANSE

9.22.6 OTHERS

9.23 OTHERS

10 EUROPE DERMAL FILLERS MARKET, BY DRUG TYPE

10.1 OVERVIEW

10.2 BRANDED

10.2.1 JUVEDERM

10.2.1.1 JUVÉDERM XC

10.2.1.2 JUVÉDERM ULTRA XC

10.2.1.3 JUVÉDERM ULTRA PLUS XC

10.2.1.4 JUVÉDERM VOLBELLA

10.2.1.5 JUVÉDERM VOLUMA

10.2.1.6 JUVÉDERM VOLLURE

10.2.2 RESTYLANE

10.2.2.1 RESTYLANE-L

10.2.2.2 RESTYLANE REFYNE

10.2.2.3 RESTYLANE DEFYNE

10.2.2.4 RESTYLANE LYFT

10.2.2.5 RESTYLANE SILK

10.2.2.6 RESTYLANE KYSSE

10.2.2.7 RESTYLANE CONTOUR

10.2.3 RADIESSE

10.2.4 SCULPTRA

10.2.5 ELLANSE

10.2.5.1 ELLANSE-S

10.2.5.2 ELLANSE-M

10.2.5.3 ELLANSE-L

10.2.5.4 ELLANSE-E

10.2.6 BELLAFILL

10.2.7 AQUAMID

10.2.8 OTHERS

10.3 GENERIC

11 EUROPE DERMAL FILLERS MARKET, BY END USER

11.1 OVERVIEW

11.2 DERMATOLOGY CLINICS

11.3 HOSPITALS

11.4 AMBULATORY SURGICAL CENTERS

11.5 ACADEMIC RESEARCH INSTITUTES

11.6 OTHERS

12 EUROPE DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL

12.1 OVERVIEW

12.2 DIRECT TENDER

12.3 DRUG STORES

12.4 RETAIL PHARMACY

12.5 ONLINE PHARMACY

12.6 OTHERS

13 EUROPE DERMAL FILLERS MARKET, BY GEOGRAPHY

13.1 EUROPE

13.1.1 GERMANY

13.1.2 ITALY

13.1.3 FRANCE

13.1.4 U.K.

13.1.5 SPAIN

13.1.6 RUSSIA

13.1.7 NETHERLANDS

13.1.8 SWITZERLAND

13.1.9 BELGIUM

13.1.10 TURKEY

13.1.11 REST OF EUROPE

14 EUROPE DERMA FILLERS MARKET: COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: EUROPE

15 SWOT ANALYSIS

16 COMPANY PROFILE

16.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 COMPANY SHARE ANALYSIS

16.1.4 PRODUCT PORTFOLIO

16.1.5 RECENT DEVELOPMENTS

16.2 GALDERMA LABORATORIES, L.P

16.2.1 COMPANY SNAPSHOT

16.2.2 COMPANY SHARE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 MERZ NORTH AMERICA, INC (A SUBSIDIARY OF MERZ PHARMA)

16.3.1 COMPANY SNAPSHOT

16.3.2 COMPANY SHARE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 SINCLAIR PHARMA (A SUBSIDIARY OF HUADONG MEDICINE)

16.4.1 COMPANY SNAPSHOT

16.4.2 COMPANY SHARE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENT

16.5 REVANCE THERAPEUTICS, INC.

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 COMPANY SHARE ANALYSIS

16.5.4 PRODUCT PORTFOLIO

16.5.5 RECENT DEVELOPMENTS

16.6 AMALIAN

16.6.1 COMPANY SNAPSHOT

16.6.2 PRODUCT PORTFOLIO

16.6.3 RECENT DEVELOPMENTS

16.7 ANIKA THERAPEUTICS, INC.

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 BIOPLUS CO., LTD.

16.8.1 COMPANY SNAPSHOT

16.8.2 PRODUCT PORTFOLIO

16.8.3 RECENT DEVELOPMENTS

16.9 BIOXIS PHARMACEUTICALS

16.9.1 COMPANY SNAPSHOT

16.9.2 PRODUCT PORTFOLIO

16.9.3 RECENT DEVELOPMENTS

16.1 CONTURA INTERNATIONAL LTD.

16.10.1 COMPANY SNAPSHOT

16.10.2 PRODUCT PORTFOLIO

16.10.3 RECENT DEVELOPMENTS

16.11 CROMA-PHARMA GMBH

16.11.1 COMPANY SNAPSHOT

16.11.2 PRODUCT PORTFOLIO

16.11.3 RECENT DEVELOPMENT

16.12 DSM

16.12.1 COMPANY SNAPSHOT

16.12.2 PRODUCT PORTFOLIO

16.12.3 RECENT DEVELOPMENT

16.13 FILLMED

16.13.1 COMPANY SNAPSHOT

16.13.2 PRODUCT PORTFOLIO

16.13.3 RECENT DEVELOPMENT

16.14 GIVAUDAN

16.14.1 COMPANY SNAPSHOT

16.14.2 RECENT FINANCIALS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENT

16.15 HUMEDIX (A SUBSIDIARY OF HUONS EUROPE)

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 IBSA FARMACEUTICI ITALIA SRL (A SUBSIDIARY OF IBSA INSTITUT BIOCHIMIQUE SA)

16.16.1 COMPANY SNAPSHOT

16.16.2 PRODUCT PORTFOLIO

16.16.3 RECENT DEVELOPMENT

16.17 IPSEN PHARMA.

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENT

16.18 MEDYTROX

16.18.1 COMPANY SNAPSHOT

16.18.2 PRODUCT PORTFOLIO

16.18.3 RECENT DEVELOPMENTS

16.19 MESOESTETIC

16.19.1 COMPANY SNAPSHOT

16.19.2 PRODUCT PORTFOLIO

16.19.3 RECENT DEVELOPMENTS

16.2 PROLLENIUM MEDICAL TECHNOLOGIES

16.20.1 COMPANY SNAPSHOT

16.20.2 PRODUCT PORTFOLIO

16.20.3 RECENT DEVELOPMENT

16.21 SHANGHAI REYOUNGEL MEDICAL TECHNOLOGY COMPANY LIMITED

16.21.1 COMPANY SNAPSHOT

16.21.2 PRODUCT PORTFOLIO

16.21.3 RECENT DEVELOPMENTS

16.22 SOSUM EUROPE

16.22.1 COMPANY SNAPSHOT

16.22.2 PRODUCT PORTFOLIO

16.22.3 RECENT DEVELOPMENT

16.23 SUNEVA MEDICAL

16.23.1 COMPANY SNAPSHOT

16.23.2 PRODUCT PORTFOLIO

16.23.3 RECENT DEVELOPMENT

16.24 TEOXANE SA

16.24.1 COMPANY SNAPSHOT

16.24.2 PRODUCT PORTFOLIO

16.24.3 RECENT DEVELOPMENTS

16.25 ZHEJIANG JINGJIA MEDICAL TECHNOLOGY CO., LTD

16.25.1 COMPANY SNAPSHOT

16.25.2 PRODUCT PORTFOLIO

16.25.3 RECENT DEVELOPMENT

16.26 ZIMMER AESTHETICS

16.26.1 COMPANY SNAPSHOT

16.26.2 PRODUCT PORTFOLIO

16.26.3 RECENT DEVELOPMENTS

17 QUESTIONNAIRE

18 RELATED REPORTS

Lista de Tabela

TABLE 1 COST OF DERMAL FILLERS

TABLE 2 COST OF PROCEDURE

TABLE 3 ASAPS PROCEDURE FACTS

TABLE 4 COMPENSATION COST FOR DERMAL FILLERS

TABLE 5 EUROPE DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 EUROPE DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 7 EUROPE BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 EUROPE BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 9 EUROPE BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY PRODUCT TYPE, VOLUME, 2020-2029 (UNITS)

TABLE 10 EUROPE NON-BIODEGRADABLE DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 EUROPE DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 12 EUROPE NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 EUROPE NATURAL DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 14 EUROPE HYALURONIC ACID IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 15 EUROPE MONOPHASIC FILLERS IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 16 EUROPE HYALURONIC ACID IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 17 EUROPE HYALURONIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 EUROPE FAT IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 19 EUROPE COLLAGEN IN DERMAL FILLERS MARKET, BY APPLICATION, 2022-2029 (USD MILLION)

TABLE 20 EUROPE SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 EUROPE SYNTHETIC DERMAL FILLERS IN DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2020-2029 (USD MILLION)

TABLE 22 EUROPE POLY-L-LACTIC ACID IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 23 EUROPE CALCIUM HYDROXYLAPATITE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 24 EUROPE POLYMETHYL-METHACRYLATE MICROSPHERES (PMMA) IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 25 EUROPE POLYALKYLIMIDE IN DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 26 EUROPE DERMAL FILLERS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 27 EUROPE FACE LIFT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 EUROPE FACE LIFT IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 29 EUROPE FACE LIFT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 30 EUROPE RHINOPLASTY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 EUROPE RHINOPLASTY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 32 EUROPE JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 33 EUROPE RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 34 EUROPE RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 EUROPE RECONSTRUCTIVE SURGERY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 36 EUROPE FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 EUROPE FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 38 EUROPE FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY TYPE, 2020- 2029 (USD MILLION)

TABLE 39 EUROPE FACIAL LINE CORRECTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 40 EUROPE LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 41 EUROPE LIP ENHANCEMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 42 EUROPE JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 43 EUROPE RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 44 EUROPE SAGGING SKIN IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 45 EUROPE SAGGING SKIN IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 46 EUROPE CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 47 EUROPE CHEEK DEPRESSION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 48 EUROPE SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 49 EUROPE SKIN SMOOTHENING IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 50 EUROPE DENTISTRY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 51 EUROPE DENTISTRY IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 52 EUROPE AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 53 EUROPE AESTHETIC RESTORATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 54 EUROPE JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 55 EUROPE RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 56 EUROPE RHA IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 57 EUROPE LIP PLUM IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 58 EUROPE LIP PLUM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 59 EUROPE SCAR TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 60 EUROPE SCAR TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 61 EUROPE SCAR TREATMENT IN DERMAL FILLERS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 62 EUROPE CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 63 EUROPE CHIN AUGMENTATION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 64 EUROPE LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 65 EUROPE LIPOATROPHY TREATMENT IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 66 EUROPE EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 67 EUROPE EARLOBE REJUVENTION IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 68 EUROPE OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 69 EUROPE DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 70 EUROPE BRANDED IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 71 EUROPE BRANDED IN DERMAL FILLERS MARKET, BY DRUG TYPE, 2020-2029 (USD MILLION)

TABLE 72 EUROPE JUVEDERM IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 73 EUROPE RESTYLANE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 74 EUROPE ELLANSE IN DERMAL FILLERS MARKET, BY BRAND, 2020-2029 (USD MILLION)

TABLE 75 EUROPE GENERIC IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 76 EUROPE DERMAL FILLERS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 77 EUROPE DERMATOLOGY CLINICS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 78 EUROPE HOSPITALS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 79 EUROPE AMBULATORY SURGICAL CENTERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 80 EUROPE ACADEMIC RESEARCH INSTITUTES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 81 EUROPE OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 82 EUROPE DERMAL FILLERS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 83 EUROPE DIRECT TENDER IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 84 EUROPE DRUG STORES IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 85 EUROPE RETAIL PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 86 EUROPE ONLINE PHARMACY IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 87 EUROPE OTHERS IN DERMAL FILLERS MARKET, BY REGION, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 EUROPE DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 2 EUROPE DERMAL FILLERS MARKET: DATA TRIANGULATION

FIGURE 3 EUROPE DERMAL FILLERS MARKET: DROC ANALYSIS

FIGURE 4 EUROPE DERMAL FILLERS MARKET : EUROPE VS REGIONAL MARKET ANALYSIS

FIGURE 5 EUROPE DERMAL FILLERS MARKET : COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE DERMAL FILLERS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 EUROPE DERMAL FILLERS MARKET: DBMR MARKET POSITION GRID

FIGURE 8 EUROPE DERMAL FILLERS MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 EUROPE DERMAL FILLERS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE DERMAL FILLERS MARKET: SEGMENTATION

FIGURE 11 RISING DEMAND FOR ANTI-AGING DRUGS, AND GROWING POPULARITY OF NON-SURGICAL OR MINIMALLY INVASIVE AESTHETICS PROCEDURES ARE EXPECTED TO DRIVE THE EUROPE DERMAL FILLERS MARKET IN THE FORECAST PERIOD 2022 TO 2029

FIGURE 12 BIODEGRADABLE DERMAL FILLER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE EUROPE DERMAL FILLERS MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF EUROPE DERMAL FILLERS MARKET

FIGURE 14 EUROPE DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 EUROPE DERMAL FILLERS MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 EUROPE DERMAL FILLERS MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 EUROPE DERMAL FILLERS MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 EUROPE DERMAL FILLERS MARKET: BY MATERIAL TYPE, 2021

FIGURE 19 EUROPE DERMAL FILLERS MARKET, BY MATERIAL TYPE, 2022-2029 (USD MILLION)

FIGURE 20 EUROPE DERMAL FILLERS MARKET: BY MATERIAL TYPE, CAGR (2022-2029)

FIGURE 21 EUROPE DERMAL FILLERS MARKET: BY MATERIAL TYPE, LIFELINE CURVE

FIGURE 22 EUROPE DERMAL FILLERS MARKET : BY APPLICATION, 2021

FIGURE 23 EUROPE DERMAL FILLERS MARKET : BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 EUROPE DERMAL FILLERS MARKET : BY APPLICATION, CAGR (2022-2029)

FIGURE 25 EUROPE DERMAL FILLERS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 EUROPE DERMAL FILLERS MARKET: BY DRUG TYPE, 2021

FIGURE 27 EUROPE DERMAL FILLERS MARKET, BY DRUG TYPE, 2022-2029 (USD MILLION)

FIGURE 28 EUROPE DERMAL FILLERS MARKET: BY DRUG TYPE, CAGR (2022-2029)

FIGURE 29 EUROPE DERMAL FILLERS MARKET: BY DRUG TYPE, LIFELINE CURVE

FIGURE 30 EUROPE DERMAL FILLERS MARKET: BY END USER, 2021

FIGURE 31 EUROPE DERMAL FILLERS MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 32 EUROPE DERMAL FILLERS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 33 EUROPE DERMAL FILLERS MARKET: BY END USER, LIFELINE CURVE

FIGURE 34 EUROPE DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 35 EUROPE DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 36 EUROPE DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 37 EUROPE DERMAL FILLERS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 38 EUROPE DERMAL FILLERS MARKET: SNAPSHOT (2021)

FIGURE 39 EUROPE DERMAL FILLERS MARKET: BY COUNTRY (2021)

FIGURE 40 EUROPE DERMAL FILLERS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 41 EUROPE DERMAL FILLERS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 42 EUROPE DERMAL FILLERS MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 43 EUROPE DERMA FILLERS MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.