Europe Courier Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

103.62 Million

USD

171.49 Million

2025

2033

USD

103.62 Million

USD

171.49 Million

2025

2033

| 2026 –2033 | |

| USD 103.62 Million | |

| USD 171.49 Million | |

|

|

|

|

Segmentação do mercado de entregas expressas na Europa, por tipo (saída e entrada), modalidade de entrega (entrega normal e entrega expressa), tipo de cliente (B2B (Business-to-Business), B2C (Business-to-Consumer) e C2C (Consumer-to-Consumer)), destino (nacional e internacional/transfronteiriço), usuário final (comércio atacadista e varejista (e-commerce), entregas médicas, indústria, serviços (BFSI), construção, serviços públicos e setores primários) - Tendências e previsões do setor até 2033

Qual é o tamanho e a taxa de crescimento do mercado de entregas expressas na Europa?

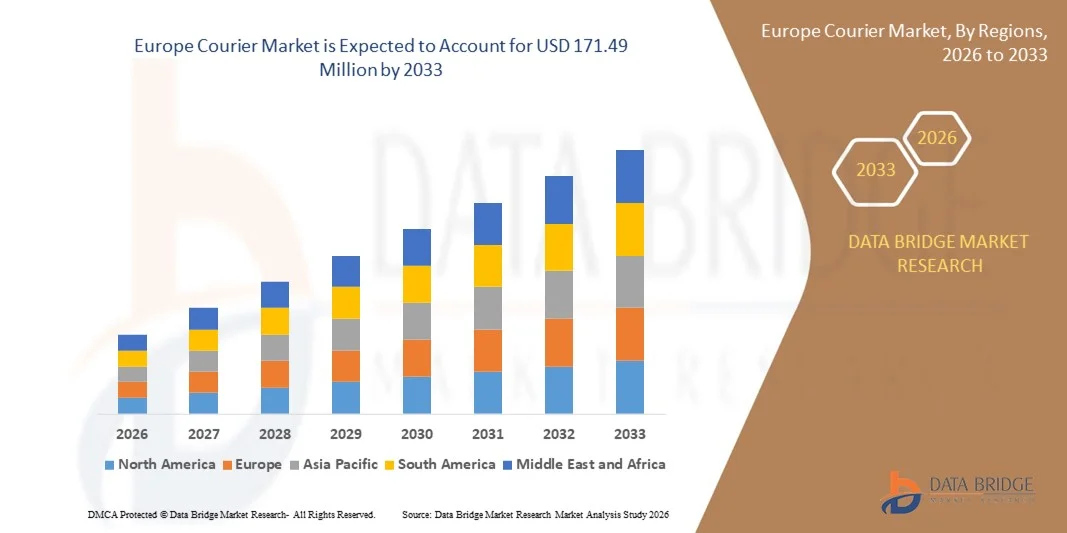

- O mercado de serviços de entrega expressa na Europa foi avaliado em US$ 103,62 milhões em 2025 e deverá atingir US$ 171,49 milhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,50% durante o período de previsão.

- Os principais fatores que impulsionam o crescimento do mercado de entregas expressas são a crescente adoção da fabricação por contrato, a adoção de novas tecnologias nos sistemas de rede da cadeia de suprimentos de entregas expressas, o aumento das atividades de importação e exportação na Europa e a adoção de múltiplos serviços por meio de smartphones e uso de serviços de internet.

Quais são os principais pontos a serem destacados do mercado de entregas expressas?

- O crescente movimento de europeização está impulsionando os serviços de entrega expressa transfronteiriços e criando oportunidades para o crescimento do mercado. A falta de infraestrutura adequada representa a principal restrição para o mercado de entregas expressas. Os congestionamentos associados às rotas comerciais constituem um grande desafio para o crescimento do mercado.

- A Alemanha dominou o mercado europeu de entregas expressas, com uma participação estimada de 41,8% da receita em 2025, impulsionada pelo forte crescimento do comércio eletrônico, infraestrutura urbana consolidada e crescente demanda por entregas de encomendas rápidas e confiáveis em toda a Alemanha.

- Prevê-se que a Itália registe a taxa de crescimento anual composta (CAGR) mais rápida, de 7,32%, entre 2026 e 2033, impulsionada pela crescente adoção do comércio eletrônico, pela expansão das remessas de encomendas de pequenas e médias empresas (PMEs) e pela demanda crescente por entregas urgentes.

- O segmento de remessas de saída dominou o mercado com uma participação estimada em 61,3% em 2025, impulsionado pelo alto volume de envios realizados por empresas, plataformas de e-commerce, fabricantes e prestadores de serviços para clientes finais.

Escopo do relatório e segmentação do mercado de entregas expressas

|

Atributos |

Principais informações de mercado para serviços de entrega |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de entregas expressas?

Crescente tendência para serviços de entrega expressa digitalizados, de alta velocidade e impulsionados pela tecnologia.

- O mercado de entregas expressas está passando por uma forte transformação em direção a plataformas digitais, rastreamento em tempo real e sistemas automatizados de gerenciamento de entregas para melhorar a velocidade, a transparência e a experiência do cliente.

- As empresas de entrega expressa estão adotando cada vez mais a otimização de rotas com inteligência artificial, o rastreamento de remessas via IoT e a análise de dados para aumentar a eficiência operacional e reduzir os prazos de entrega.

- A crescente demanda por entregas no mesmo dia, no dia seguinte e com horário definido, impulsionada pelo comércio eletrônico e pelos serviços sob demanda, está remodelando os modelos de serviço em toda a Europa.

- Por exemplo, empresas como FedEx, UPS, DHL, SF Express e Delhivery estão investindo em plataformas digitais de frete, centros de triagem automatizados e soluções logísticas inteligentes.

- A crescente adoção de entregas sem contato, aplicativos móveis e integração de pagamentos digitais está acelerando a modernização dos serviços.

- Com a expansão do volume do comércio eletrônico e do comércio internacional, os serviços de entrega expressa com suporte tecnológico continuarão sendo essenciais para operações logísticas rápidas, confiáveis e escaláveis.

Quais são os principais fatores que impulsionam o mercado de entregas expressas?

- O rápido crescimento do comércio eletrônico, do varejo online e dos modelos de negócios de venda direta ao consumidor está impulsionando significativamente o volume de encomendas.

- Por exemplo, em 2025, as principais empresas de entregas expressas expandiram suas redes de entrega de última milha e automatizaram seus centros de distribuição para gerenciar com eficiência o crescente volume de remessas.

- A crescente demanda por comércio transfronteiriço, transporte marítimo internacional e serviços de entrega expressa impulsiona a expansão do mercado europeu.

- Os avanços na automação logística, na robótica de armazéns e nas tecnologias de gestão de frotas estão a melhorar a velocidade e a eficiência de custos.

- A crescente urbanização e a preferência do consumidor por opções de entrega rápidas, rastreáveis e flexíveis estão fortalecendo a demanda por serviços de entrega expressa.

- Impulsionado pelo crescimento da infraestrutura digital e pelos investimentos em logística, o mercado de entregas expressas deverá apresentar um crescimento sustentado a longo prazo.

Que fator está desafiando o crescimento do mercado de entregas expressas?

- O aumento dos custos de combustível, a escassez de mão de obra e as elevadas despesas de entrega na última milha continuam a pressionar as margens de lucro.

- Por exemplo, durante o período de 2024-2025, as flutuações nos preços dos combustíveis e o aumento dos custos salariais impactaram a eficiência operacional de diversas empresas de entrega expressa na Europa.

- A crescente complexidade da gestão de grandes volumes de entregas, logística reversa e congestionamento urbano adiciona desafios operacionais.

- Requisitos regulatórios rigorosos relacionados ao comércio internacional, desembaraço aduaneiro e conformidade ambiental atrasam a execução dos serviços.

- A intensa concorrência de startups de entrega local, plataformas de entrega colaborativa e redes logísticas internas de comércio eletrônico gera pressão sobre os preços.

- Para enfrentar esses desafios, as empresas estão se concentrando em automação, veículos elétricos de entrega, otimização de rotas e integração digital para aumentar a eficiência e expandir a adoção de serviços de entrega expressa na Europa.

Como o mercado de entregas expressas é segmentado?

O mercado está segmentado com base no tipo, modo de entrega, tipo de cliente, destino e usuário final .

- Por tipo

Com base no tipo, o mercado de entregas expressas é segmentado em serviços de saída e de entrada. O segmento de saída dominou o mercado com uma participação estimada em 61,3% em 2025, impulsionado pelo alto volume de remessas enviadas por empresas, plataformas de comércio eletrônico, fabricantes e prestadores de serviços a clientes finais. O crescimento do varejo online, do comércio internacional e dos modelos de negócios de venda direta ao consumidor continua a impulsionar o transporte de encomendas de saída na Europa. As empresas de entregas expressas concentram-se fortemente na otimização da logística de saída para garantir a entrega pontual, a eficiência de custos e a satisfação do cliente.

O segmento de entregas de entrada deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pelo aumento de devoluções, logística reversa, entregas de fornecedores e reposição de estoques. O crescente foco na gestão eficiente da cadeia de suprimentos e na otimização de estoques está acelerando a demanda por serviços de entrega de entrada.

- Por modalidade de entrega

Com base na modalidade de entrega, o mercado de entregas expressas é segmentado em Entrega Normal e Entrega Expressa. O segmento de Entrega Normal detinha a maior participação de mercado, com 54,8% em 2025, devido à sua relação custo-benefício e ampla utilização para remessas não urgentes nos setores de varejo, manufatura e serviços. As empresas continuam a optar pelas modalidades de entrega padrão para gerenciar os custos logísticos, garantindo, ao mesmo tempo, um serviço confiável.

Prevê-se que o segmento de Entregas Expressas registre a taxa de crescimento mais rápida durante o período de 2026 a 2033, impulsionado pela crescente demanda do consumidor por entregas no mesmo dia, no dia seguinte e com horário definido. A expansão do comércio eletrônico, da entrega de alimentos, da logística na área da saúde e dos serviços premium está impulsionando significativamente a adoção de soluções de entrega expressa.

- Por tipo de cliente

Com base no tipo de cliente, o mercado de entregas expressas é segmentado em B2B (Business-to-Business), B2C (Business-to-Consumer) e C2C (Consumer-to-Consumer). O segmento B2B dominou o mercado com uma participação de 46,5% em 2025, impulsionado pelos altos volumes de remessas nos setores de manufatura, comércio atacadista, farmacêutico, serviços financeiros e cadeias de suprimentos industriais. Serviços de entrega expressa confiáveis, programados e baseados em contratos continuam a impulsionar a forte demanda B2B.

O segmento B2C deverá apresentar o crescimento mais rápido em termos de CAGR (Taxa de Crescimento Anual Composta) entre 2026 e 2033, impulsionado pela rápida expansão do comércio eletrônico, marketplaces digitais e marcas de venda direta ao consumidor. As crescentes expectativas dos consumidores por opções de entrega rápidas, rastreáveis e flexíveis estão acelerando o crescimento dos serviços de entrega expressa B2C.

- Por destino

Com base no destino, o mercado de entregas expressas é segmentado em entregas domésticas e internacionais/transfronteiriças. O segmento doméstico representou a maior participação de mercado, com 63,9% em 2025, impulsionado pelo alto volume de encomendas dentro do país, entregas urbanas e expansão das redes nacionais de comércio eletrônico e varejo. Infraestrutura eficiente de última milha e redes locais de entregas expressas sustentam uma forte demanda doméstica.

Prevê-se que o segmento Internacional/Transfronteiriço apresente o crescimento anual composto mais rápido entre 2026 e 2033, impulsionado pelo aumento do comércio com a Europa, pelo comércio eletrônico transfronteiriço e pelo envio internacional de documentos e encomendas. As melhorias nos processos aduaneiros, na documentação digital e nas redes logísticas internacionais estão acelerando o crescimento do serviço de entregas expressas transfronteiriças.

- Por usuário final

Com base no usuário final, o mercado de entregas expressas é segmentado em Comércio Atacadista e Varejista (E-commerce), Entregas Médicas, Manufatura, Serviços (BFSI), Construção, Serviços Públicos e Indústrias Primárias. O segmento de Comércio Atacadista e Varejista (E-commerce) dominou o mercado com uma participação de 49,2% em 2025, impulsionado pelo enorme volume de encomendas gerado por plataformas de compras online, varejo omnichannel e marketplaces digitais. O crescimento contínuo dos gastos online do consumidor sustenta a demanda.

O segmento de entregas expressas médicas deverá apresentar o maior crescimento anual composto (CAGR) entre 2026 e 2033, impulsionado pela crescente demanda por entregas urgentes de produtos farmacêuticos, amostras para diagnóstico, equipamentos médicos e suprimentos para a área da saúde. O foco cada vez maior na confiabilidade e conformidade da logística na área da saúde está fortalecendo a adoção desse serviço.

Qual região detém a maior participação no mercado de entregas expressas?

- A Alemanha dominou o mercado europeu de entregas expressas, com uma participação estimada de 41,8% da receita em 2025, impulsionada pelo forte crescimento do comércio eletrônico, infraestrutura urbana consolidada e crescente demanda por entregas de encomendas rápidas e confiáveis em todo o país. O alto volume de remessas nacionais e internacionais, aliado à crescente adoção de plataformas digitais de logística e rastreamento, está impulsionando a demanda por serviços de entrega expressa em toda a região.

- As principais empresas de entrega expressa da Europa estão investindo fortemente em centros de triagem automatizados, otimização de rotas baseada em IA e soluções de entrega de última milha ecologicamente corretas, reforçando a eficiência logística regional. A expansão do varejo online, do comércio B2B e das parcerias entre empresas de entrega expressa e marketplaces de e-commerce continua a fortalecer a liderança de mercado da Europa.

- Bases industriais e de manufatura robustas, alto poder de compra do consumidor e projetos de infraestrutura logística apoiados pelo governo consolidam ainda mais o domínio da Europa no mercado global de entregas expressas.

Mercado de entregas da Itália

Prevê-se que a Itália registe a taxa de crescimento anual composta (CAGR) mais rápida, de 7,32%, entre 2026 e 2033, impulsionada pela crescente adoção do comércio eletrônico, pela expansão das remessas de encomendas de pequenas e médias empresas (PMEs) e pela demanda crescente por entregas urgentes. Soluções de logística digital e melhorias na distribuição regional sustentam a expansão do mercado a longo prazo.

Análise do Mercado de Serviços de Entrega Expressa no Reino Unido

O Reino Unido contribui de forma constante devido à forte demanda por remessas B2C e B2B, redes de distribuição urbana avançadas e crescente adoção do comércio eletrônico. O foco em soluções de entrega rápidas, confiáveis e no mesmo dia impulsiona a expansão do mercado.

Análise do Mercado de Correios na França

A França contribui significativamente, impulsionada pelos elevados volumes de vendas online, pelas remessas transfronteiriças dentro da UE e pela procura por serviços de entrega expressa premium e refrigerada. Os investimentos em centros de triagem regionais e em inovação logística reforçam o crescimento.

Quais são as principais empresas no mercado de entregas expressas?

O setor de entregas expressas é liderado principalmente por empresas consolidadas, incluindo:

- FedEx (EUA)

- Deutsche Post AG (Alemanha)

- United Parcel Service of America, Inc. (UPS) (EUA)

- SF Express (China)

- Royal Mail Group Limited (Reino Unido)

- Yamato Transport Co., Ltd. (Japão)

- Koninklijke PostNL (Holanda)

- Aramex (Emirados Árabes Unidos)

- Singapore Post Limited (Singapura)

- Sagawa Express Co., Ltd. (Japão)

- Qantas Airways Limited (Austrália)

- Allied Express (Austrália)

- Expresso Aéreo Único (Índia)

- Gati-Kintetsu Express Private Limited (Índia)

- DTDC Express Limited (Índia)

- Hermes Europe GmbH (Alemanha)

- GO! Express & Logistics (Deutschland) GmbH (Alemanha)

- GEODIS (França)

- Delhivery Pvt Ltd (Índia)

- LaserShip Inc (EUA)

Quais são os desenvolvimentos recentes no mercado de entregas expressas na Europa?

- Em junho de 2025, a JD.com lançou seu primeiro serviço expresso internacional próprio para fortalecer sua presença logística na Europa e competir diretamente com as principais empresas de entrega expressa. Essa iniciativa reflete a ambição da JD.com de expandir suas capacidades de entrega internacional e aprimorar o controle sobre as cadeias de suprimentos internacionais.

- Em maio de 2025, a DHL eCommerce UK fundiu-se com a Evri para criar uma rede de entregas em larga escala, responsável por mais de um milhão de encomendas anualmente em todo o país. Esta fusão destaca a consolidação do setor, visando aprimorar a eficiência da última milha, a velocidade de entrega e a cobertura nacional.

- Em fevereiro de 2024, o Emirates Post Group, agora com a marca 7X, lançou a EMX como uma nova subsidiária focada na transformação do setor de entregas expressas, de encomendas e de pacotes nos Emirados Árabes Unidos por meio de tecnologias avançadas e soluções logísticas centradas no cliente. Essa iniciativa reforça a estratégia do grupo de modernizar os serviços de entrega expressa, de encomendas e de pacotes e fortalecer a competitividade regional.

- Em maio de 2023, a Interroll lançou sua Plataforma de Esteiras Transportadoras de Alto Desempenho, projetada especificamente para operações de entrega expressa, correio e encomendas, apresentando módulos de desvio inteligentes e recursos de triagem de alto rendimento. Esse desenvolvimento demonstra a crescente importância da automação e da eficiência em ambientes de manuseio de encomendas em larga escala.

- Em novembro de 2022, a DHL Express inaugurou um ponto de atendimento digital totalmente automatizado no Dubai Digital Park, a primeira instalação desse tipo no Oriente Médio e na rede europeia da DHL. Esse lançamento estabeleceu um novo padrão para o atendimento automatizado ao cliente e reforçou a liderança da DHL em inovação logística.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.