Europe Closed System Transfer Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

302.78 Million

USD

1,169.33 Million

2025

2033

USD

302.78 Million

USD

1,169.33 Million

2025

2033

| 2026 –2033 | |

| USD 302.78 Million | |

| USD 1,169.33 Million | |

|

|

|

|

Mercado de dispositivos de transferência de sistema fechado na Europa, por tipo (sistemas de membrana para membrana e dispositivo de transferência de sistema fechado sem agulha), componente (dispositivos e acessórios), mecanismo de fecho (sistemas de empurrar para rodar, sistemas de alinhamento de cor para cor, Sistema Luer-Lock e sistemas Click-To-Lock), Tecnologia (Dispositivos baseados em diafragma, dispositivos compartimentados e dispositivos de limpeza/filtragem de ar), Utilizador final ( hospitais , centros e clínicas de oncologia , centros cirúrgicos ambulatório, institutos académicos e de investigação), Canal de distribuição (venda direta e retalho), país (Alemanha, França, Reino Unido, Itália, Espanha, Países Baixos, Suíça, Rússia, Turquia, Bélgica e resto da Europa), tendências e previsões do setor até 2028.

Análise de Mercado e Insights: Mercado de Dispositivos de Transferência de Sistema Fechado na Europa

Análise de Mercado e Insights: Mercado de Dispositivos de Transferência de Sistema Fechado na Europa

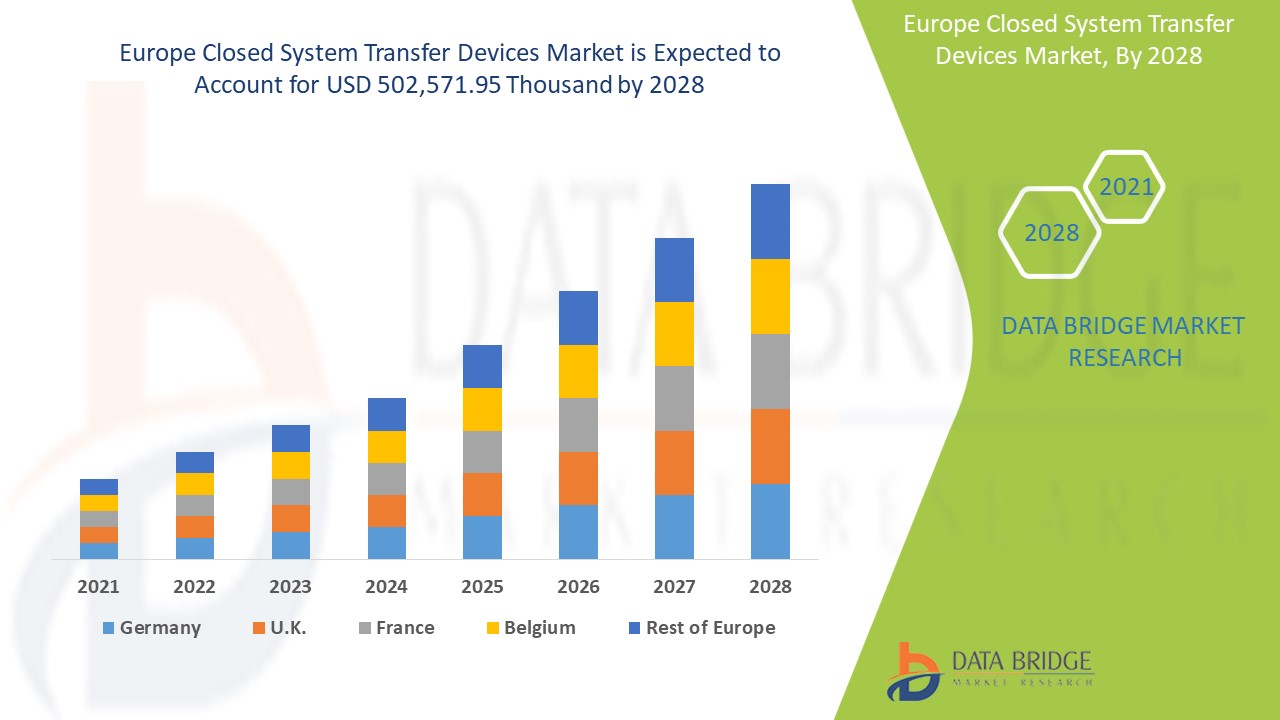

Espera-se que o mercado europeu de dispositivos de transferência de sistema fechado ganhe um crescimento significativo no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 18,4% no período previsto de 2021 a 2028 e prevê-se que atinja os 502.571,95 mil dólares até 2028. Os avanços tecnológicos na prestação de serviços de saúde eficazes estão a impulsionar o mercado.

Dispositivo de transferência de sistema fechado ou "CSTD" é um dispositivo de transferência de medicamentos que proíbe mecanicamente a transferência de contaminação ambiental no sistema médico e a fuga de concentrações perigosas de medicamentos ou vapores para fora do sistema. Os sistemas abertos e fechados são comummente aplicados em dispositivos médicos para manter a esterilidade de uma via de fluido. Os CSTD atuam impedindo a entrada e saída descontrolada de contaminantes e medicamentos, preservando a qualidade da solução a infundir no doente. Estes dispositivos garantem a segurança dos profissionais de saúde durante a utilização de medicamentos ou produtos químicos perigosos. Os projetos e modelos de dispositivos de transferência de sistema fechado têm mudado rapidamente nos últimos anos, resultando no desenvolvimento de uma série de metodologias de teste independentes para avaliar o desempenho de dispositivos de transferência de sistema fechado. Atualmente, os fabricantes no mercado de dispositivos de transferência de sistema fechado estão a concentrar-se mais na adesão aos requisitos de desempenho, que se concentram principalmente na segurança do paciente e em práticas estéreis .

O aumento das preocupações com a segurança dos profissionais de saúde é o principal fator impulsionador do mercado. A escassez de pessoal qualificado no sector da saúde pode ser o maior desafio para o crescimento do mercado. No entanto, projectos extensivos de financiamento de investigação governamental sobre o manuseamento seguro de medicamentos revelam-se uma oportunidade para o mercado. Por outro lado, espera-se que a falta de compatibilidade entre o material biológico e o material de construção dos CSTDs restrinja o crescimento do mercado. Além disso, espera-se que os desafios enfrentados devido ao impacto da Covid-19 na cadeia de fornecimento de matérias-primas limitem ainda mais o crescimento do mercado.

O relatório de mercado de dispositivos de transferência de sistema fechado fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, produtos lançamentos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado dos dispositivos de transferência de sistema fechado, contacte a Data Bridge Market Research para obter um briefing de analista. .

Âmbito e dimensão do mercado de dispositivos de transferência de sistema fechado na Europa

Âmbito e dimensão do mercado de dispositivos de transferência de sistema fechado na Europa

O mercado europeu de dispositivos de transferência de sistema fechado está segmentado com base no tipo, componente, mecanismo de fecho, tecnologia, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo, o mercado europeu de dispositivos de transferência de sistema fechado está segmentado em sistemas de membrana para membrana e dispositivos de transferência de sistema fechado sem agulha. Em 2021, prevê-se que o segmento dos sistemas de membrana para membrana domine o mercado devido à sua maior utilização e eficácia. Este tipo é altamente preferido pelos produtores populares.

- Com base no componente, o mercado europeu de dispositivos de transferência de sistema fechado foi segmentado em dispositivos e acessórios. Em 2021, espera-se que o segmento dos dispositivos domine o mercado porque gera maiores receitas quando comparado com os acessórios.

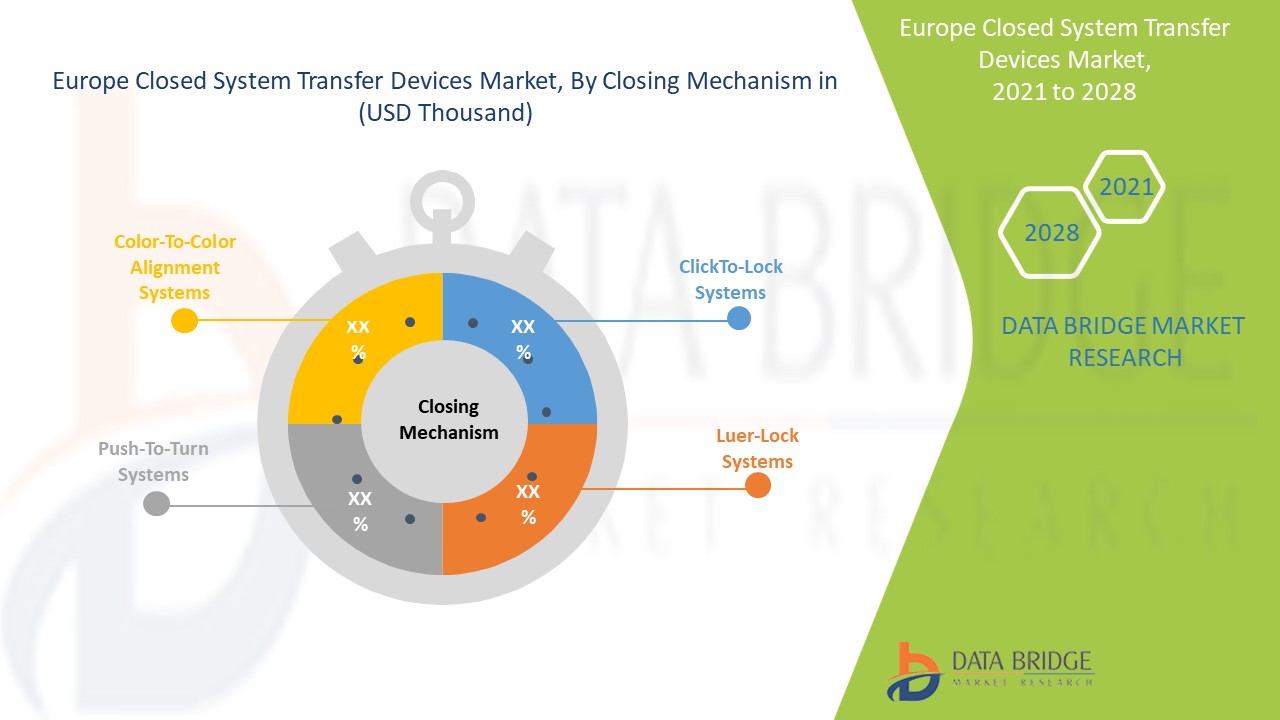

- Com base no mecanismo de fecho, o mercado europeu de dispositivos de transferência de sistema fechado foi segmentado em sistemas push-to-turn, sistemas de alinhamento cor a cor, sistema luer-lock e sistemas click-to-lock. Em 2021, espera-se que o segmento de clique para travar domine o mercado, uma vez que é altamente eficaz na eliminação de problemas de contaminação. Além disso, o seu mecanismo mais simples torna-o mais popular entre os consumidores.

- Com base na tecnologia, o mercado europeu de dispositivos de transferência de sistema fechado foi segmentado em dispositivos baseados em diafragmas, dispositivos compartimentados e dispositivos de limpeza/filtragem de ar. Em 2021, prevê-se que o segmento dos dispositivos baseados em diafragmas domine o mercado, uma vez que esta tecnologia é amplamente utilizada pela maioria das marcas dominantes de CSTDs devido à sua capacidade de vedação, o que a torna menos propensa à contaminação.

- Com base no utilizador final, o mercado europeu de dispositivos de transferência de sistema fechado está categorizado em hospitais, centros e clínicas de oncologia, centros de cirurgia ambulatória, institutos académicos e de investigação. Em 2021, espera-se que o segmento hospitalar domine o mercado, uma vez que os hospitais estão a utilizar mais produtos CSTD para proteger o seu pessoal, conforme instruído por vários organismos reguladores na Europa.

- Com base no canal de distribuição, o mercado europeu de dispositivos de transferência de sistema fechado está segmentado em licitação direta e vendas a retalho. Em 2021, prevê-se que o segmento de vendas a retalho domine o mercado porque os produtores estão a utilizar amplamente este canal de vendas para expandir os seus negócios pelo mundo.

Análise ao nível do país do mercado europeu de dispositivos de transferência de sistema fechado

O mercado de dispositivos de transferência de sistema fechado é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo, componente, mecanismo de fecho, tecnologia, utilizador final e canal de distribuição, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de dispositivos de transferência de sistema fechado são a Alemanha, França, Reino Unido, Itália, Espanha, Países Baixos, Suíça, Rússia, Turquia, Bélgica e Resto da Europa. A Alemanha domina o mercado devido à sua infraestrutura de saúde avançada e à investigação relacionada com o tratamento oncológico.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas europeias e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

O número crescente de aprovações de medicamentos oncológicos está a impulsionar o crescimento do mercado de dispositivos de transferência de sistema fechado.

O mercado europeu de dispositivos de transferência de sistema fechado também fornece análises de mercado detalhadas para o crescimento de cada país num mercado específico. Além disso, fornece informações detalhadas sobre a estratégia dos participantes do mercado e a sua presença geográfica. Os dados estão disponíveis para o período histórico de 2010 a 2019.

Análise da Quota de Mercado de Dispositivos de Transferência de Sistema Fechado e Cenário Competitivo

O panorama competitivo do mercado de dispositivos de transferência de sistema fechado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, largura do produto e amplitude, domínio da aplicação e curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado europeu de dispositivos de transferência de sistema fechado.

As principais empresas que operam no mercado de dispositivos de transferência de sistema fechado são a ICU Medical, Inc., BD, B. Braun Medical Inc., EQUASHIELD, YUKON MEDICAL, Simplivia, Caragen Ltd., Vygon, Epic Medical e outras. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Muitos contratos e acordos são também iniciados por empresas de todo o mundo, o que está também a acelerar o mercado dos dispositivos de transferência de sistema fechado.

Por exemplo,

- Em maio de 2021, a BD anunciou o seu plano de construir uma unidade de fabrico de alta tecnologia de 200 milhões de dólares em Espanha. Irá também cumprir elevados padrões de sustentabilidade e ecoeficiência e incorporar as mais recentes tecnologias autónomas conhecidas como soluções da indústria 4.0. Isto ajudará a empresa a produzir dispositivos de fácil administração de medicamentos, principalmente para as empresas farmacêuticas que fornecem os produtos para todo o mercado europeu.

- Em outubro de 2020, a Vygon anunciou a distribuição do dispositivo SAFIRA (SAFer Injection for Regional Anaesthesia) da Medovate em 60 países. O SAFIRA foi criado em parceria com médicos do Serviço Nacional de Saúde do Reino Unido para tornar o bloqueio do nervo periférico um procedimento realizado por apenas uma pessoa, permitindo ao anestesiologista um controlo total sobre a injeção em todos os momentos. Com esta aquisição, a empresa alcançou um marco significativo no lançamento do SAFIRA na Europa, nos EUA e em vários outros mercados, tendo sido também reconhecida como um dos principais desenvolvedores e fabricantes de dispositivos médicos no mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.