Europe Anti Money Laundering Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.71 Billion

USD

5.46 Billion

2024

2032

USD

1.71 Billion

USD

5.46 Billion

2024

2032

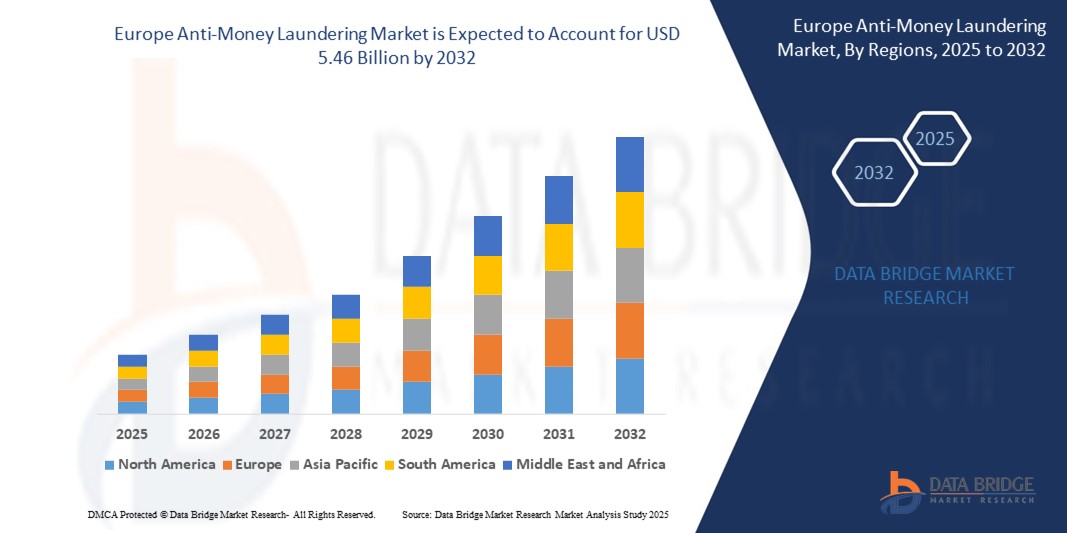

| 2025 –2032 | |

| USD 1.71 Billion | |

| USD 5.46 Billion | |

|

|

|

|

Segmentação do mercado europeu de combate à lavagem de dinheiro, por oferta (solução e serviços), função (gerenciamento de conformidade, gerenciamento de identidade do cliente, monitoramento de transações, relatórios de transações monetárias e outros), implantação (nuvem e local), tamanho da empresa (grandes empresas e pequenas e médias empresas), uso final (bancos e instituições financeiras, provedores de seguros, governo, jogos e apostas e outros) - Tendências do setor e previsão até 2032.

Tamanho do mercado de combate à lavagem de dinheiro

- O tamanho do mercado europeu de combate à lavagem de dinheiro foi avaliado em US$ 1,71 bilhão em 2024 e deve atingir US$ 5,46 bilhões até 2032 , com um CAGR de 15,6% durante o período previsto.

- O crescimento do mercado é impulsionado principalmente por estruturas regulatórias rigorosas, aumento de crimes financeiros e adoção de tecnologias avançadas, como IA e aprendizado de máquina para detecção e conformidade aprimoradas.

- A crescente demanda por soluções automatizadas e integradas para combater a lavagem de dinheiro e o financiamento do terrorismo, aliada à crescente digitalização dos serviços financeiros, está acelerando a adoção de sistemas de combate à lavagem de dinheiro (AML) em vários setores.

Análise de Mercado de Combate à Lavagem de Dinheiro

- Soluções de combate à lavagem de dinheiro, abrangendo software e serviços para detectar e prevenir atividades financeiras ilícitas, são essenciais para a conformidade com os mandatos regulatórios e a proteção dos sistemas financeiros na Europa.

- A demanda por soluções de combate à lavagem de dinheiro é alimentada pelo aumento do escrutínio regulatório, pelo aumento de crimes financeiros sofisticados e pela necessidade de monitoramento de transações em tempo real e diligência do cliente.

- O Reino Unido dominou o mercado europeu de combate à lavagem de dinheiro com a maior participação de receita de 38,5% em 2024, impulsionado por seu robusto setor financeiro, regulamentações rigorosas de combate à lavagem de dinheiro e pela presença de grandes participantes do mercado.

- Espera-se que a Alemanha seja o país com crescimento mais rápido no mercado europeu de combate à lavagem de dinheiro durante o período previsto, impulsionada pela rápida transformação digital no setor bancário, pelo aumento dos investimentos em fintech e por políticas governamentais de apoio.

- O segmento de soluções deteve a maior participação de mercado na receita, de 60,2% em 2024, impulsionado pela crescente demanda por software avançado de combate à lavagem de dinheiro que permite monitoramento de transações em tempo real, gerenciamento de conformidade e verificação de identidade do cliente.

Escopo do Relatório e Segmentação do Mercado de Combate à Lavagem de Dinheiro

|

Atributos |

Principais Insights de Mercado sobre Combate à Lavagem de Dinheiro |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do Mercado Antilavagem de Dinheiro

“Aumento da integração de tecnologias de IA e aprendizado de máquina”

- O mercado europeu de combate à lavagem de dinheiro (AML) está vivenciando uma tendência significativa de integração de tecnologias de inteligência artificial (IA) e aprendizado de máquina (ML)

- Essas tecnologias permitem o processamento e a análise avançados de dados, fornecendo insights mais profundos sobre transações financeiras, comportamento do cliente e padrões potenciais de lavagem de dinheiro.

- Soluções de combate à lavagem de dinheiro baseadas em IA facilitam a identificação proativa de atividades suspeitas, permitindo que as instituições financeiras detectem crimes financeiros, como financiamento do terrorismo, fraude e lavagem de dinheiro, antes que eles se agravem.

- Por exemplo, empresas como a ThetaRay estão a desenvolver plataformas baseadas em IA que analisam padrões transacionais para melhorar a precisão da triagem e otimizar os processos de conformidade, reduzindo falsos positivos e melhorando a eficiência.

- Esta tendência está a fortalecer a proposta de valor dos sistemas de combate ao branqueamento de capitais, tornando-os mais apelativos para os bancos, as seguradoras e outras entidades regulamentadas.

- Os algoritmos de IA podem analisar vastos conjuntos de dados, incluindo históricos de transações, perfis de clientes e atividades transfronteiriças, para identificar padrões complexos indicativos de crimes financeiros

Dinâmica do Mercado Antilavagem de Dinheiro

Motorista

“Crescente demanda por conformidade regulatória e prevenção de crimes financeiros”

- O crescente escrutínio regulatório e a procura por estruturas de conformidade robustas, impulsionadas por diretivas como a 6.ª Diretiva Anti-Branqueamento de Capitais da UE (6AMLD), são os principais impulsionadores do mercado europeu de combate ao branqueamento de capitais.

- Os sistemas de combate à lavagem de dinheiro aumentam a segurança financeira ao fornecer recursos como monitoramento de transações em tempo real, verificação Conheça seu Cliente (KYC) e relatórios automatizados de atividades suspeitas.

- Os mandatos governamentais, especialmente no Reino Unido, que domina o mercado, estão pressionando as instituições financeiras a adotar soluções avançadas de combate à lavagem de dinheiro para atender aos rigorosos requisitos de conformidade.

- A proliferação de serviços bancários digitais, criptomoedas e transações transfronteiriças, apoiada pelos avanços na computação em nuvem e na tecnologia 5G, está expandindo as aplicações de combate à lavagem de dinheiro, permitindo um processamento de dados mais rápido e detecção de riscos em tempo real.

- As instituições financeiras estão adotando cada vez mais sistemas de combate à lavagem de dinheiro como soluções padrão para atender às expectativas regulatórias e aumentar a integridade operacional

Restrição/Desafio

“Altos custos de implementação e preocupações com a privacidade de dados”

- O investimento inicial substancial necessário para software, hardware e integração de combate à lavagem de dinheiro representa uma barreira significativa à adoção, especialmente para pequenas e médias empresas (PMEs) em mercados europeus emergentes

- A integração de sistemas de combate à lavagem de dinheiro em infraestruturas financeiras existentes pode ser complexa e dispendiosa, exigindo conhecimentos e recursos especializados

- As preocupações com a segurança e a privacidade dos dados são grandes desafios, uma vez que os sistemas de combate ao branqueamento de capitais recolhem e processam grandes quantidades de dados sensíveis de clientes e transacionais, aumentando os riscos de violações ou utilização indevida.

- O panorama regulatório fragmentado em toda a Europa, com diferentes leis de proteção de dados, como o RGPD, complica a conformidade para provedores internacionais e instituições financeiras.

- Estes fatores podem impedir a adoção, especialmente em regiões como a Alemanha, o mercado com crescimento mais rápido, onde a sensibilidade aos custos e a maior conscientização sobre a privacidade dos dados podem limitar a expansão do mercado.

Âmbito do mercado de combate à lavagem de dinheiro

O mercado é segmentado com base na oferta, função, implantação, tamanho da empresa e uso final.

- Ao oferecer

Com base na oferta, o mercado europeu de combate à lavagem de dinheiro é segmentado em soluções e serviços. O segmento de soluções deteve a maior participação de mercado, com 60,2% da receita em 2024, impulsionado pela crescente demanda por softwares avançados de combate à lavagem de dinheiro que permitem o monitoramento de transações em tempo real, a gestão de conformidade e a verificação da identidade do cliente. Essas soluções utilizam IA e aprendizado de máquina para aprimorar a detecção de crimes financeiros, como lavagem de dinheiro e financiamento do terrorismo.

Espera-se que o segmento de serviços apresente a taxa de crescimento mais rápida, de 15,8%, entre 2025 e 2032, impulsionado pela crescente necessidade de orientação especializada e serviços gerenciados para navegar pelas complexas regulamentações de combate à lavagem de dinheiro. As instituições financeiras estão cada vez mais terceirizando tarefas de conformidade para garantir a aderência regulatória com melhor custo-benefício e reduzir os riscos operacionais.

- Por função

Com base na função, o mercado europeu de combate à lavagem de dinheiro é segmentado em gestão de conformidade, gestão de identidade de clientes, monitoramento de transações, relatórios de transações cambiais e outros. O segmento de gestão de conformidade dominou o mercado, com uma participação de 32,6% na receita em 2024, devido a regulamentações rigorosas e à necessidade de as instituições financeiras fortalecerem suas estruturas de combate à lavagem de dinheiro para evitar penalidades e garantir a conformidade regulatória.

Espera-se que o segmento de monitoramento de transações experimente a taxa de crescimento mais rápida de 16,4% entre 2025 e 2032, impulsionado pela crescente adoção de sistemas baseados em IA que melhoram a detecção de transações suspeitas e reduzem falsos positivos, melhorando a eficiência no combate a crimes financeiros.

- Por implantação

Com base na implantação, o mercado europeu de combate à lavagem de dinheiro é segmentado em nuvem e on-premise. O segmento de nuvem deteve a maior participação de mercado na receita, 54,4% em 2024, devido à sua flexibilidade, escalabilidade e custo-benefício, permitindo que instituições financeiras integrem tecnologias avançadas, como IA e análises em tempo real, sem investimentos significativos em infraestrutura.

Espera-se que o segmento on-premise testemunhe um crescimento significativo entre 2025 e 2032, impulsionado por organizações que priorizam o controle e a segurança em detrimento de seus sistemas de conformidade. Soluções on-premise oferecem personalização e integração com a infraestrutura de TI existente, o que é crucial para grandes empresas com necessidades regulatórias complexas.

- Por tamanho da empresa

Com base no porte das empresas, o mercado europeu de combate à lavagem de dinheiro é segmentado em grandes empresas e pequenas e médias empresas (PMEs). O segmento de grandes empresas dominou o mercado, com uma participação de 56,8% na receita em 2024, impulsionado pelo foco em sistemas de pagamento digital e pela necessidade de soluções robustas de combate à lavagem de dinheiro para atender aos requisitos de monitoramento de transações e conformidade em operações financeiras de alto volume.

Espera-se que o segmento de PMEs cresça rapidamente a um CAGR de 17,2% entre 2025 e 2032, impulsionado pela crescente conscientização sobre regulamentações contra lavagem de dinheiro e pela adoção de soluções baseadas em nuvem com boa relação custo-benefício, que atendem a organizações menores com recursos limitados.

- Por uso final

Com base no uso final, o mercado europeu de combate à lavagem de dinheiro é segmentado em bancos e instituições financeiras, seguradoras, governo, jogos e apostas, entre outros. O segmento de bancos e instituições financeiras deteve a maior participação de mercado, com 45,3% da receita em 2024, impulsionado pela necessidade crítica de soluções de combate à lavagem de dinheiro para combater crimes financeiros, como fraude, financiamento do terrorismo e lavagem de dinheiro no setor bancário.

Espera-se que o segmento de jogos e apostas testemunhe a taxa de crescimento mais rápida de 18,1% entre 2025 e 2032, impulsionado pela crescente adoção de soluções de combate à lavagem de dinheiro para monitorar transações de alto risco e garantir a conformidade com as regulamentações, especialmente em plataformas de jogos de azar on-line, onde fluxos financeiros ilícitos são uma preocupação.

Análise regional do mercado de combate à lavagem de dinheiro

- O Reino Unido dominou o mercado europeu de combate à lavagem de dinheiro com a maior participação de receita de 38,5% em 2024, impulsionado por seu robusto setor financeiro, regulamentações rigorosas de combate à lavagem de dinheiro e pela presença de grandes participantes do mercado.

- A tendência de maior conformidade e o aumento da regulamentação que promove padrões mais rigorosos de monitoramento financeiro impulsionam ainda mais a expansão do mercado. A integração de tecnologias avançadas de combate à lavagem de dinheiro (AML) em instituições bancárias e órgãos governamentais complementa a crescente demanda por soluções abrangentes de conformidade, criando um ecossistema de mercado robusto.

Visão do mercado de combate à lavagem de dinheiro na Alemanha

Espera-se que a Alemanha testemunhe a maior taxa de crescimento no mercado europeu de combate à lavagem de dinheiro, devido ao seu avançado setor financeiro e ao alto foco em conformidade regulatória e segurança financeira. As instituições financeiras alemãs preferem soluções de combate à lavagem de dinheiro tecnologicamente avançadas, como monitoramento de transações com tecnologia de IA e plataformas baseadas em nuvem, que aprimoram a detecção de atividades suspeitas e contribuem para a eficiência operacional. A integração dessas soluções em instituições financeiras premium e serviços de pós-venda apoia o crescimento sustentado do mercado.

Participação de mercado de combate à lavagem de dinheiro

O setor de combate à lavagem de dinheiro é liderado principalmente por empresas bem estabelecidas, incluindo:

- NICE (Israel)

- IBM (EUA)

- sanções.io (EUA)

- Intel Corporation (EUA)

- Oracle (EUA)

- SAP SE (Alemanha)

- Accenture (EUA)

- Solução de Informação Experian

- Inc. (Irlanda)

- Open Text Corporation (Canadá)

- BAE Systems (Reino Unido)

- SAS Institute Inc (EUA)

- ACI Worldwide (EUA)

- Cognizant (EUA)

- Trulioo (Canadá)

- Sede da Temenos SA (Suíça)

- WorkFusion, Inc, (EUA)

- Vixio Regulatory Intelligence (Inglaterra)

Quais são os desenvolvimentos recentes no mercado europeu de combate à lavagem de dinheiro?

- Em maio de 2025, a União Europeia estabeleceu formalmente a Autoridade Antilavagem de Dinheiro (AMLA), marcando uma mudança crucial em direção à supervisão centralizada de PLD/CFT em todo o bloco. Criada ao abrigo do Regulamento (UE) 2024/1620, a AMLA visa harmonizar a aplicação da lei, reduzir a fragmentação e reforçar a supervisão de instituições financeiras de alto risco que operam em pelo menos seis Estados-Membros. Embora a AMLA tenha iniciado as suas operações no verão de 2025, a sua implementação completa – incluindo a substituição de diretivas anteriores de PLD – está prevista para julho de 2029. Com sede em Frankfurt, a AMLA supervisionará diretamente entidades selecionadas a partir de 2028, coordenará as autoridades nacionais e liderará investigações transfronteiriças, estabelecendo um novo padrão para a integridade financeira em toda a UE.

- Em abril de 2025, a FIS anunciou a aquisição da unidade Issuer Solutions da Global Payments por um valor empresarial de US$ 13,5 bilhões, reforçando seu papel como líder global em fintech. A Issuer Solutions processa mais de 40 bilhões de transações anualmente em mais de 75 países, oferecendo serviços avançados de processamento de crédito, detecção de fraudes e fidelidade. Essa mudança estratégica complementa as capacidades existentes de processamento de débito da FIS e expande seu alcance entre grandes instituições financeiras, aprimorando sua capacidade de apoiar a conformidade com a legislação antilavagem de dinheiro por meio do monitoramento integrado de transações e análise de risco. A aquisição também desbloqueia sinergias em EBITDA e espera-se que seja um acréscimo ao EPS ajustado e ao fluxo de caixa livre já no primeiro ano.

- Em fevereiro de 2025, a LexisNexis Risk Solutions, subsidiária da RELX, concluiu a aquisição da IDVerse™, uma provedora de autenticação de documentos e detecção de fraudes com tecnologia de IA. A tecnologia proprietária da IDVerse utiliza redes neurais profundas e algoritmos biométricos para verificar mais de 16.000 tipos de documentos de identidade em todo o mundo, detectar deepfakes e realizar verificações de autenticidade. A solução está sendo integrada ao RiskNarrative®, IDU® e Dynamic Decision Platform® da LexisNexis, aprimorando os recursos de prevenção a fraudes e verificação de identidade em toda a Europa e em outros países. Este movimento estratégico destaca a crescente dependência de ferramentas de identidade baseadas em IA para apoiar a conformidade com as normas antilavagem de dinheiro, a inclusão financeira e a gestão de riscos em setores regulamentados.

- Em dezembro de 2024, a Autoridade Bancária Europeia (EBA) avançou em seu trabalho sobre Normas Técnicas de Regulamentação (RTS) no âmbito do novo quadro de combate à lavagem de dinheiro (AML) da UE, apoiando a transição para a supervisão centralizada por meio da Lei de Luta contra a Lavagem de Dinheiro (AMLA). Essas RTS visam esclarecer as obrigações dos grupos financeiros multinacionais, incluindo a identificação da entidade controladora, o compartilhamento transfronteiriço de informações e os protocolos de conformidade. A iniciativa faz parte de um esforço mais amplo para harmonizar as práticas de AML/CFT entre os Estados-Membros, reduzir a fragmentação e garantir uma aplicação consistente. Essas normas sustentarão o regime de AML em evolução da UE e orientarão as instituições antes da implementação operacional completa da AMLA.

- Em abril de 2024, o Parlamento Europeu adotou o novo Pacote Antilavagem de Dinheiro (AML), concluindo cinco anos de trabalho legislativo para fortalecer a integridade financeira em toda a UE. As principais reformas incluem o registro obrigatório de beneficiário efetivo para empresas e fundos estrangeiros que possuam imóveis na UE desde 2014, um teto para transações comerciais e o reforço da due diligence para compras de bens de luxo. O pacote também amplia as obrigações de AML para provedores de serviços de criptomoedas, clubes de futebol e plataformas de financiamento coletivo, e cria a Autoridade Antilavagem de Dinheiro da UE (AMLA) para supervisão centralizada.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.