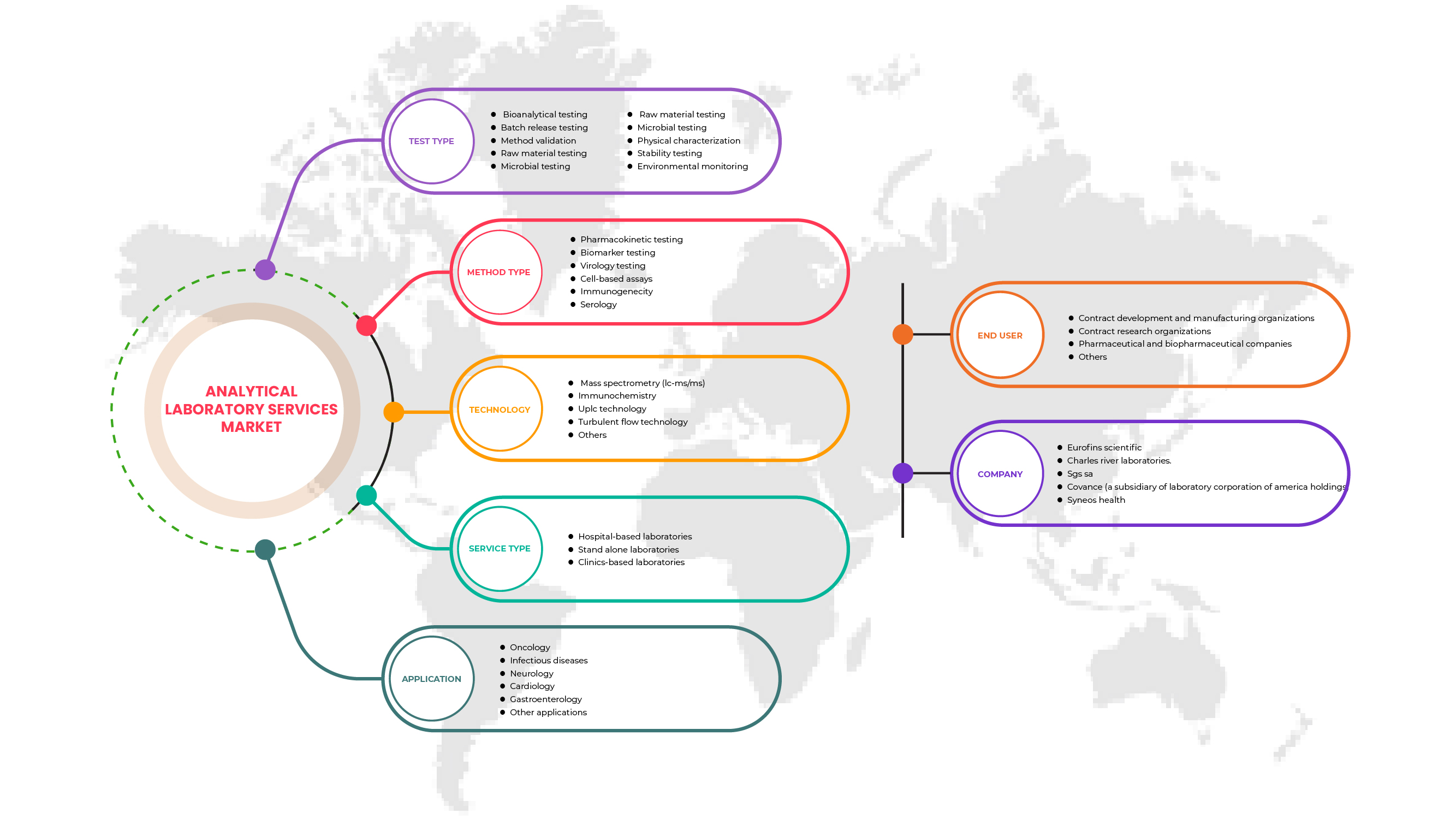

Europe Analytical Laboratory Services Market, By Test Type (Bioanalytical Testing, Batch Release Testing, Stability Testing, Raw Material Testing, Physical Characterization, Method Validation, Microbial Testing, Environmental Monitoring), Service Type (Hospital-Based Laboratories, Stand-Alone Laboratories and Clinics-Based Laboratories), Method Type (Cell-Based Assays, Virology Testing, Biomarker Testing, Pharmacokinetic Testing, Immunogenicity and Serology), Application (Oncology, Neurology, Infectious disease, Gastroenterology, Cardiology and Other Applications), Technology (Mass Spectroscopy (LC-MS/MS), Immunochemistry, UPLC Technology, Turbulent Flow Technology, Others), End User Channel (Pharmaceutical and Biopharmaceutical Companies, Contract Development and Manufacturing Organizations, Contract Research Organizations and Others) -Industry Trends and Forecast to 2029.

Europe Analytical Laboratory Services Market Analysis and Size

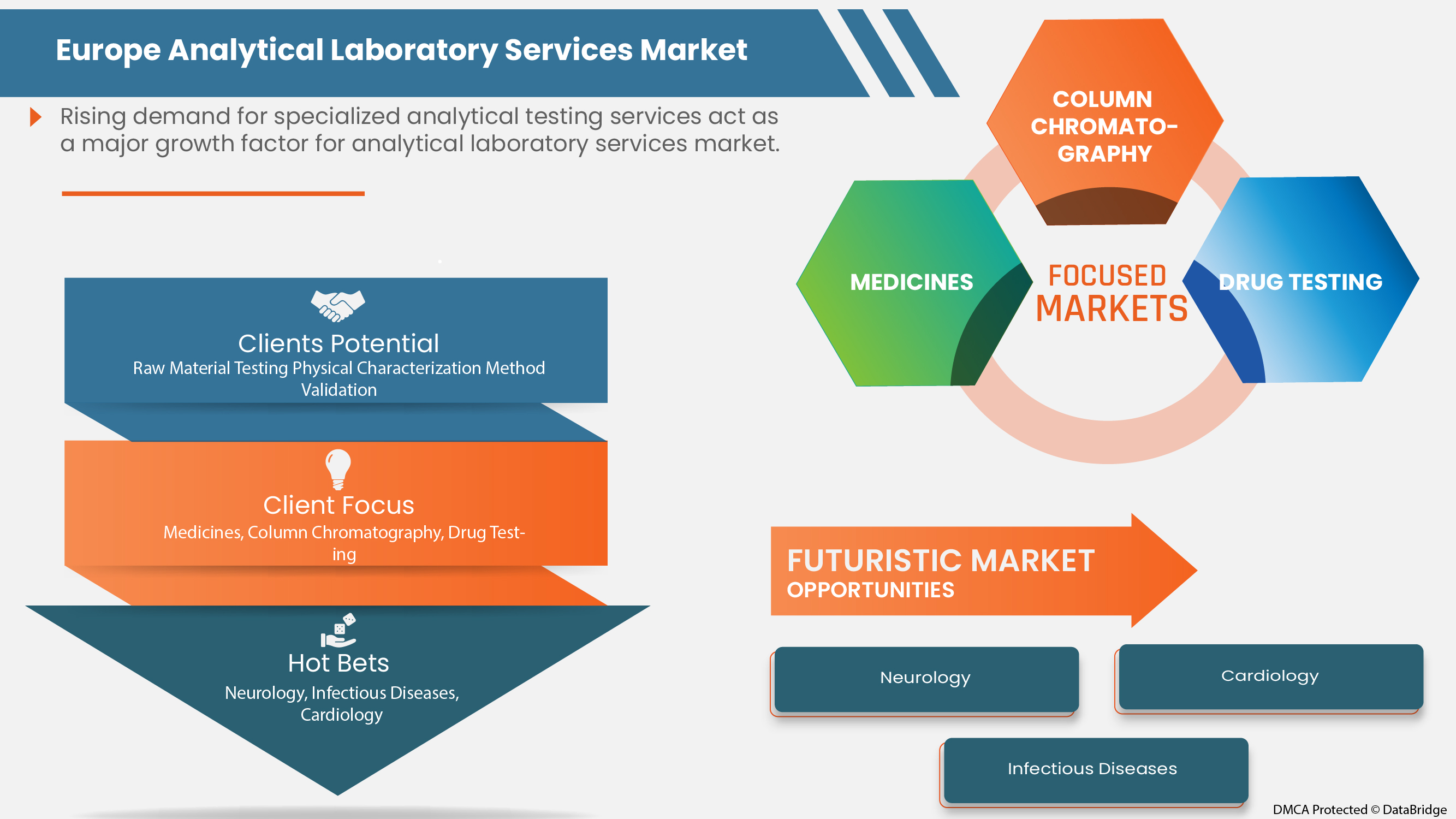

A number of analytical services are provided in the market, such as bioanalytical testing, raw material testing, batch release testing, product validation, physical characterization and others. These services are widely employed in the healthcare sector, including pharmaceutical companies, biopharmaceutical companies and medical device companies. These services provide a reliable source for accuracy, quality and efficiency. They have applications in areas such as oncology, neurology, infectious diseases, cardiology and others. The Europe analytical laboratory services market is growing with the rise in government initiatives to strengthen analytical testing capabilities and the growing number of drug approvals and clinical trials. Moreover, rising usage and development of a large number of macromolecules and biosimilar for various therapeutic areas and increased spending by governments to set up new laboratories are other factors accelerating the laboratory services market growth.

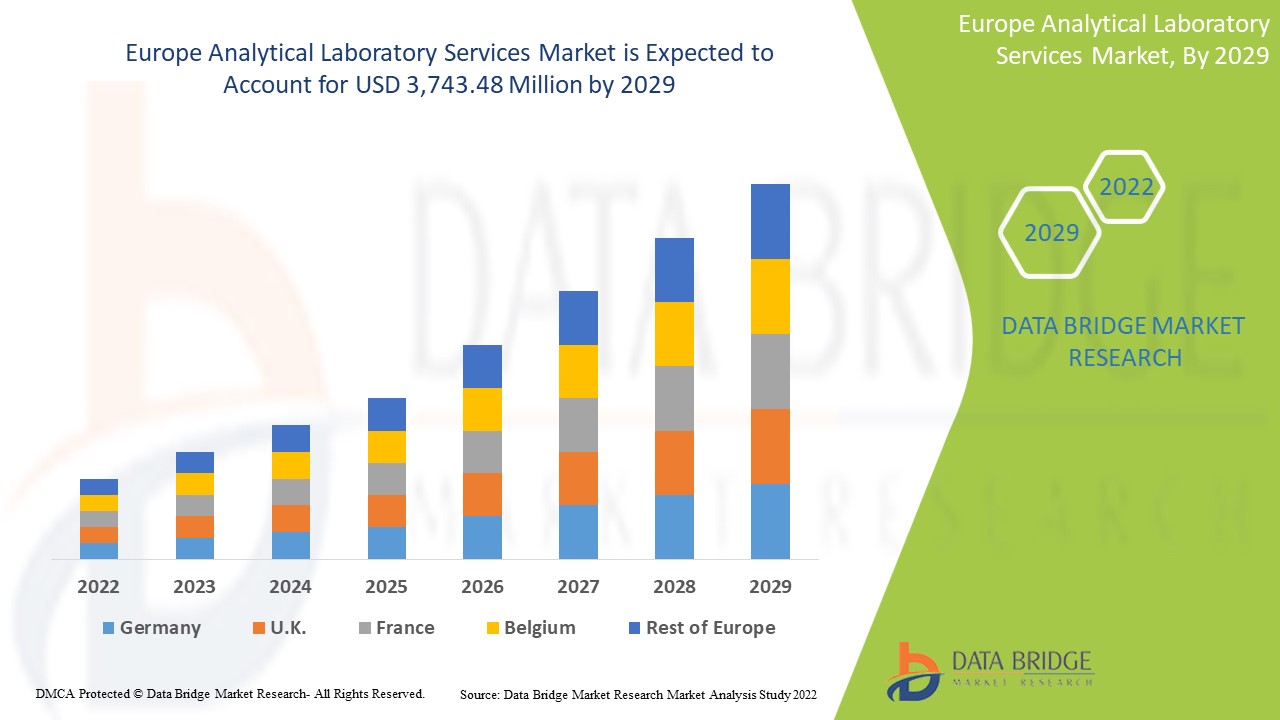

Data Bridge Market Research analyses that the Europe analytical laboratory services market is expected to reach USD 3,743.48 million by 2029, at a CAGR of 14.8% during the forecast period. The bioanalytical testing segment accounts for the largest offering segment in the Europe analytical laboratory services market. The Europe analytical laboratory services market report also covers pricing analysis, patent analysis, and technological advancements in depth.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customisable 2019-2014) |

|

Quantitative Units |

Revenue in USD Million, Pricing in USD |

|

Segments Covered |

By Test Type (Bioanalytical Testing, Batch Release Testing, Stability Testing, Raw Material Testing, Physical Characterization, Method Validation, Microbial Testing, Environmental Monitoring), Service Type (Hospital-Based Laboratories, Stand-Alone Laboratories and Clinics-Based Laboratories), Method Type (Cell-Based Assays, Virology Testing, Biomarker Testing, Pharmacokinetic Testing, Immunogenicity and Serology), Application (Oncology, Neurology, Infectious disease, Gastroenterology, Cardiology and Other Applications), Technology (Mass Spectroscopy (LC-MS/MS), Immunochemistry, UPLC Technology, Turbulent Flow Technology, Others), End User Channel (Pharmaceutical and Biopharmaceutical Companies, Contract Development and Manufacturing Organizations, Contract Research Organizations and Others) |

|

Countries Covered |

Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Ireland, Turkey and rest of Europe |

|

Market Players Covered |

Eurofins Scientific, Q2 Solutions (a subsidiary of IQVIA), SGS SA, SOLVIAS AG, Syneos Health, ICON plc, BioAgilytix Labs, Pharmaceutical Research Associates Inc., ALS Limited, Covance (a subsidiary of Laboratory Corporation of America Holdings), Intertek Group plc, Evotec SE, Charles River Laboratories, Medpace, WuXi AppTec, and PPD Inc. (a subsidiary of Thermo Fisher Scientific Inc.) among others |

Market Definition

Analytical laboratory services are concerned with a wide range of chemical and microbiological assays. Analytical laboratory services include method development and validation, sample analysis for concentration confirmation, purity, homogeneity, and stability assays on preliminary formulations and finalized drug products for IND, NDA, and ANDA submissions. Analytical services, also referred to as "materials testing," is used to describe various techniques used to identify the chemical makeup or characteristics of a particular sample. Manufacturers in industries such as pharmaceuticals, food, electronics, and plastics often use analytical testing for reverse engineering or failure analysis and identifying contaminants or stains on products

Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

-

Growing expenditure on drugs and medical devices

The rise of pharmaceutical and biotechnological industries will increase the market for these analytical services as they are dependent on drug markets to provide services such as pharmacokinetic testing and other batch testing and microbial testing. Therefore, it is expected to act as a driver for the growth of the Europe analytical laboratory services market in the forecast period.

-

Government initiatives to strengthen analytical testing capabilities

Government funding and initiative to expand the analytical services will help the market grow and increase the market players in the forecast period. This is expected to increase the market size and act as a driver for the growth of the Europe analytical laboratory services market in the forecast period.

-

Increasing number of drug approvals and clinical trials

The market players give the analytical testing process under contract research. Furthermore, the increasing biopharmaceutical industry with increased drug production and research for novel products is expected to act as a driver for the growth of the Europe analytical laboratory services market in the forecast period.

Opportunities

-

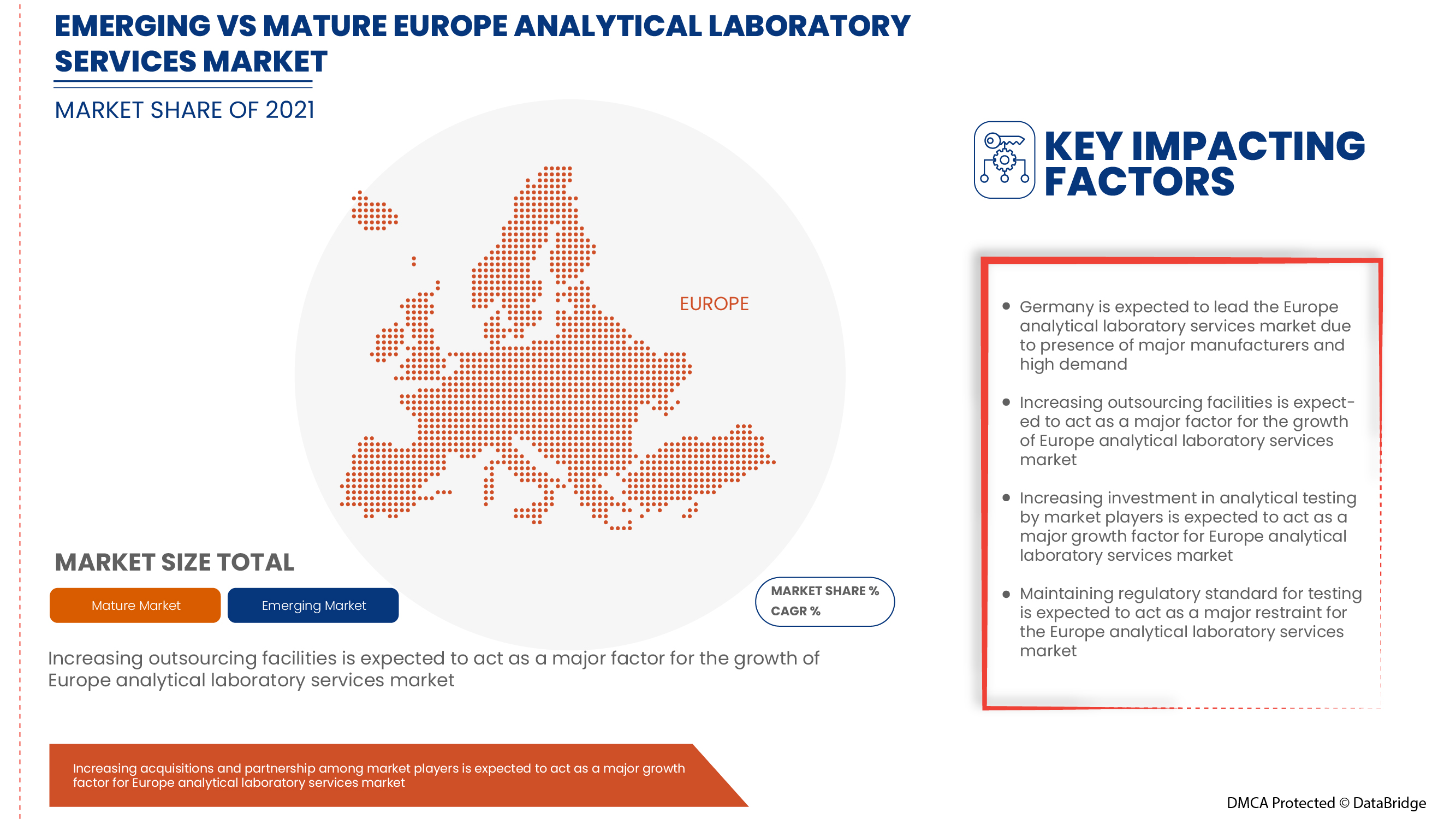

Increasing collaboration among market players

Collaborations in the market is the primary factor that is expected to create opportunities in the market. Agreements, partnerships, and collaborations are performed to overcome hurdles such as limited Europe presence and supply chain and to increase the service portfolio. In the Europe analytical laboratory services market, various market players have performed this, creating opportunities in the market.

Restraints/Challenges

- High cost setting of an advanced analytical lab

The considerable investment needed to set up a bioanalytical facility with a limited and highly efficient instrument is expected to limit the market growth due to high investment costs. This is expected to act as a restraint on the growth of the Europe analytical laboratory services market in the forecast period.

COVID-19 Impact on Europe Analytical Laboratory Services Market

COVID-19 created a major impact on various industries as almost every country has opted for the shutdown of every facility except the ones dealing in the essential goods. The government took some strict actions, such as the shutdown of facilities and sale of non-essential goods, blocked international trade and many more, to prevent the spread of COVID-19. The only business dealing with this pandemic situation were the essential services allowed to open and run the processes.

COVID-19 has impacted the market of analytical laboratory services negatively. Due to the cancellation of the clinical trial, the demand for analytical services was also disrupted. The major portion of these analytical services comes from the clinical trials and CRO, which get badly impacted. However, some of the market players, such as Eurofins Scientific, which can provide analytical support, were successful in minimizing the loss during COVID-19. The supply chain was disrupted as the material and solvent that were mandatory for these analytical testing faced challenges in the customs department and were not allowed to cross international borders.

Hence, COVID-19 has negatively impacted the analytical testing business, but the strategic initiative of the market players is somehow gaining success in minimizing the loss in the net revenue or segmental revenue.

Recent Developments

- In February 2021, Eurofins Scientific announced that they had acquired Beacon Discovery, preeminent drug discovery and contract research organization (CRO). This will increase the company's access to contract research and will increase its revenue for the company

- In April 2021, SGS SA announced that the company SYNLAB Analytics & Services is now be called SGS Analytics which is due to the acquisition of the leading European environmental, food & health sciences testing and tribology services company. The acquisition will continue growth and innovation by helping businesses to comply with ever increasing regulations designed to ensure food, pharmaceutical, and environmental safety

Europe Analytical Laboratory Services Market Scope

The Europe analytical laboratory services market is segmented on the basis of test type, service type, method type, application, technology, and end users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

By Test Type

- Bioanalytical testing

- Batch release testing

- Method validation

- Raw material testing

- Microbial testing

- Physical characterization

- Stability testing

- Environmental monitoring

On the basis of test type, the Europe analytical laboratory services market is segmented into bioanalytical testing, batch release testing, stability testing, raw material testing, physical characterization, method validation, microbial testing and environmental monitoring.

By Service Type

- Hospital-based laboratories

- Stand-alone laboratories

- Clinics-based laboratories

On the basis of service type, the Europe analytical laboratory services market is segmented into hospital-based laboratories, stand-alone laboratories and clinic-based laboratories.

By Method Type

- Pharmacokinetic testing

- Biomarker testing

- Virology testing

- Cell-based assays

- Immunogenicity

- Serology

On the basis of method type, the Europe analytical laboratory services market is segmented into cell-based assays, virology testing, biomarker testing, pharmacokinetic testing, immunogenicity and serology.

By Application

- Oncology

- Neurology

- Infectious diseases

- Cardiology

- Gastroenterology

- Others

On the basis of application, the Europe analytical laboratory services market is segmented into oncology, neurology, infectious diseases, gastroenterology, cardiology and other applications.

By Technology

- Mass spectroscopy

- Immunochemistry

- UPLC technology

- Turbulent flow technology

- Others

On the basis of technology, the Europe analytical laboratory services market is segmented into mass spectroscopy, immunochemistry, UPLC technology, turbulent flow technology and others.

By End-User

- Pharmaceutical and biopharmaceutical companies

- Contract development and manufacturing organizations

- Contract research organizations

- Others

On the basis of end user, the Europe analytical laboratory services market is segmented into pharmaceutical & biopharmaceutical industries, contract development & manufacturing organizations, contract research organizations and others.

Europe Analytical Laboratory Services Market Regional Analysis/Insights

The Europe analytical laboratory services market is analysed, and market size insights and trends are provided by country, test type, service type, method type, application, technology, and end user as referenced above.

The countries covered in the Europe analytical laboratory services market report are Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Ireland, Turkey and rest of Europe.

Germany is likely to be the fastest-growing Europe Analytical laboratory services market due to the increasing biopharmaceutical industry with increased drug production.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, porter's five forces analysis, and case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Europe brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing a forecast analysis of the country data.

Competitive Landscape and Europe Analytical Laboratory Services Market Share Analysis

The Europe analytical laboratory services market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Europe presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus related to the Europe analytical laboratory services market.

Some of the major companies providing analytical laboratory services in the Europe analytical laboratory services market are Eurofins Scientific, Q2 Solutions (a subsidiary of IQVIA), SGS SA, SOLVIAS AG, Syneos Health, ICON plc, BioAgilytix Labs, Pharmaceutical Research Associates Inc., ALS Limited, Covance (a subsidiary of Laboratory Corporation of America Holdings), Intertek Group plc, Evotec SE, Charles River Laboratories, Medpace, WuXi AppTec, and PPD Inc. (a subsidiary of Thermo Fisher Scientific Inc.) among others

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

- introduction

- OBJECTIVES OF THE STUDY

- MARKET DEFINITION

- OVERVIEW of Europe ANALYTICAL LABORATORY SERVICES MARKET

- LIMITATIONs

- MARKETS COVERED

- MARKET SEGMENTATION

- MARKETS COVERED

- geographical scope

- years considered for the study

- currency and pricing

- DBMR TRIPOD DATA VALIDATION MODEL

- MULTIVARIATE MODELLING

- Method type LIFELINE CURVE

- primary interviews with key opinion leaders

- DBMR MARKET POSITION GRID

- vendor share analysis

- MARKET APPLICATION COVERAGE GRID

- secondary sourcEs

- assumptions

- EXECUTIVE SUMMARY

- PREMIUM INSIGHTS

- REGULATORY SCENARIO IN EUROPE ANALYTICAL LABORATORY SERVICES MARKET

- Qualification of Analytical Instruments in the QC

- Validation of Analytical Procedures

- REGULATORY GUIDELINES FOR CHINA

- REGULATORY GUIDELINES FOR EMA GMP REQUIREMENT (FOR QUALITY)

- Market Overview

- drivers

- growing expenditure on drugs and medical devices

- government initiatives to strengthen analytical testing capabilities

- increasing number of drug approvals & clinical trials

- rising demand for specialized analytical testing services

- increasing investment in analytical testing by market players

- Restraints

- Limitation in analyzing novel complex products

- Cost of laboratory testing for drug development

- maintenance and updating of equipment

- High cost setting an advanced analytical lab

- opportunities

- Increasing collaboration among market players

- IncreAsing outsourcing facilities

- Increasing trend of artificial intelligence in testing services

- challenges

- Maintaining regulatory standard for testing

- development and maintenance of expertise

- IMPACT OF COVID-19 ON THE EUROPE ANALYTICAL LABORATORY SERVICES MARKET

- IMPACT ON PRICE

- IMPACT IN DEMAND

- IMPACT ON SUPPLY

- STRATEGIC INITIATIVES

- CONCLUSION

- Europe analytical laboratory services MARKET, BY test type

- overview

- bioanalytical testing

- Pharmacokinetic test

- Pharmacodynamic test

- bioequivalence test

- bioavailability test

- other test

- batch release testing

- method validation

- raw material testing

- microbial testing

- physical characterization

- stability testing

- environmental monitoring

- EUROPE ANALYTICAL LABORATORY SERVICES MARKET, BY service type

- overview

- hospital-based laboratories

- standalone laoratories

- clinics-based laboratories

- Europe Analytical laboratory services MARKET, BY method type

- overview

- Pharmacokinetic Testing

- Biomarker Testing

- Virology Testing

- In Vitro Virology Testing

- In Vivo Virology Testing

- Species-Specific Viral PCR Assays

- Cell-Based Assays

- Viral Cell-Based Assays

- Bacterial Cell-Based Assays

- Immunogenicity

- Serology

- Europe Analytical laboratory services MARKET, BY Application

- overview

- Oncology

- Infectious Diseases

- Neurology

- Cardiology

- Gastroenterology

- Other Applications

- Europe Analytical laboratory services MARKET, BY technology

- overview

- Mass Spectrometry (LC-MS/MS)

- Immunochemistry

- UPLC Technology

- Turbulent Flow Technology

- others

- Europe analytical laboratory services Market, By end user

- overview.

- contract development and manufacturing organizations

- contract research organizations

- pharmaceutical and biopharmaceutical companies

- others

- EUROPE ANALYTICAL LABORATORY SERVICES MARKET, by Geography

- Europe

- Germany

- france

- u.k.

- ITALY

- Spain

- RUSSIA

- turkey

- Ireland

- BElgium

- Netherlands

- switzerland

- rest of europe

- Europe Analytical Laboratory Services Market: COMPANY landscape

- company share analysis: Europe

- SWOT

- company profiles

- eurofins scientific

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- charles river Laboratories

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- SGS SA

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- covance (A subsidiary of Laboratory Corporation of America Holdings)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- company share analysis

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- wuxi apptec

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- Syneos Health

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- Pharmaceutical Research Associates Inc.

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- AGENZIA ITALIANA DEL FARMACO - AIFA

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- ALS Limited

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- BIOAGILYTIX LABS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Central drugs standard control organization

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- EUROPEAN MEDICINES AGENCY

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- evotec se

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- FEDERAL INSTITUTE FOR DRUGS & MEDICAL DEVICES (BFARM)

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- FOOD SAFETY AND DRUG ADMINISTRATION DEPARTMENT

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- Frontage Labs

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SERVICE & SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- ICON PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- INTERTEK GROUP PLC

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- INDUSTRY & SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- MEDPACE

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENTS

- National Medical Products administration

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- Pace Analytical Services, LLC

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- pharmaceuticals and medical devices agency

- COMPANY SNAPSHOT

- PRODUCT PORTFOLIO

- RECENT DEVELOPMENT

- q2 solutions (a subsidiary of iqvia)

- COMPANY SNAPSHOT

- REVENUE ANALYSIS

- SOLUTION PORTFOLIO

- RECENT DEVELOPMENTS

- SHANGHAI MEDICILON INC.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- SPANISH AGENCY FOR MEDICINES AND HEALTH PRODUCTS

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- solvias Ag

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- toxikon

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENTS

- VxP Pharma, Inc.

- COMPANY SNAPSHOT

- SERVICE PORTFOLIO

- RECENT DEVELOPMENT

- questionnaire

- related reports

Lista de Tabela

TABLE 1 Europe ANALYTICAL LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 2 Europe Bioanalytical testing in Analytical Laboratory Services Market, By Region, 2019-2028 (USD Million)

TABLE 3 Europe BioANALYTICAL testing in analytical LABORATORY SERVICES Market, By test type 2019-2028 (USD Million)

TABLE 4 Europe batch release testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 5 Europe method validation in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 6 Europe raw material testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 7 Europe microbial testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 8 Europe physical characterization in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 9 Europe stability testing in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 10 Europe environmental monitoring in ANALYTICAL LABORATORY SERVICES Market, By Region, 2019-2028 (USD Million)

TABLE 11 Europe ANALYTICAL LABORATORY SERVICES Market, By DIAGNOSTICS TYPE, 2019-2028 (USD Million)

TABLE 12 Europe Hospital-Based Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 13 Europe standalone Laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 14 Europe clinics-based laboratories in Analytical Laboratories Services Market, By Region, 2019-2028 (USD Million)

TABLE 15 Europe Pharmacokinetic Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 16 Europe Biomarker Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 17 Europe Virology Testing in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 18 Europe Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 19 Europe Cell-Based Assays in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 20 Europe Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 21 Europe Immunogenicity in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 22 Europe Serology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 23 Europe oncology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 24 Europe infectious diseases in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 25 Europe neurology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 26 Europe Cardiology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 27 Europe gastroenterology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 28 Europe other applications in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 29 Europe Mass Spectrometry (LC-MS/MS) in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 30 Europe immunochemistry in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 31 Europe UPLC Technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 32 Europe turbulent flow technology in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 33 Europe others in Analytical laboratory services Market, By Region, 2019-2028 (USD Million)

TABLE 34 Europe analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 35 Europe contract development and manufacturing organizations in analytical laboratory services market, By end user, 2019-2028 (USD Million), By Region

TABLE 36 Europe contract research organizations in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 37 Europe pharmaceutical and biopharmaceutical companies in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 38 Europe others in analytical laboratory services market, By end user, 2019-2028 (USD million)

TABLE 39 Europe analytical laboratory services market, By Country, 2019-2028 (USD Million)

TABLE 40 Europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 41 Europe Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 42 Europe Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 43 Europe Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 44 Europe Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 45 Europe Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 46 Europe Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 47 Europe Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 48 Europe Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 49 GERMANY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 50 GERMANY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 51 GERMANY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 52 GERMANY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 53 GERMANY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 54 GERMANY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 55 GERMANY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 56 GERMANY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 57 GERMANY Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 58 FRANCE Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 59 FRANCE Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 60 FRANCE Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 61 FRANCE Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 62 FRANCE Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 63 FRANCE Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 64 FRANCE Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 65 FRANCE Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 66 FRANCE Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 67 U.K. Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 68 U.K. Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 69 U.K. Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 70 U.K. Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 71 U.K. Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 72 U.K. Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 73 U.K. Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 74 U.K. Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 75 U.K. Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 76 ITALY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 77 ITALY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 78 ITALY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 79 ITALY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 80 ITALY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 81 ITALY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 82 ITALY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 83 ITALY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 84 italy Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 85 SPAIN Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 86 SPAIN Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 87 SPAIN Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 88 SPAIN Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 89 SPAIN Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 90 SPAIN Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 91 SPAIN Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 92 SPAIN Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 93 SPAIN Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 94 RUSSIA Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 95 RUSSIA Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 96 RUSSIA Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 97 RUSSIA Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 98 RUSSIA Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 99 RUSSIA Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 100 RUSSIA Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 101 RUSSIA Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 102 russia Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 103 TURKEY Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 104 TURKEY Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 105 TURKEY Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 106 TURKEY Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 107 TURKEY Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 108 TURKEY Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 109 TURKEY Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 110 TURKEY Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 111 turkey Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 112 IRELAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 113 IRELAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 114 IRELAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 115 IRELAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 116 IRELAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 117 IRELAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 118 IRELAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 119 IRELAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 120 ieland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 121 BELGIUM Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 122 BELGIUM Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 123 BELGIUM Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 124 BELGIUM Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 125 BELGIUM Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 126 BELGIUM Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 127 BELGIUM Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 128 BELGIUM Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 129 belgium Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 130 NETHERLANDS Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 131 NETHERLANDS Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 132 NETHERLANDS Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 133 NETHERLANDS Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 134 NETHERLANDS Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 135 NETHERLANDS Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 136 NETHERLANDS Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 137 NETHERLANDS Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 138 Netherlands Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 139 SWITZERLAND Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 140 SWITZERLAND Bioanalytical Testing in Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

TABLE 141 SWITZERLAND Analytical Laboratory Services Market, By Service Type, 2019-2028 (USD Million)

TABLE 142 SWITZERLAND Analytical Laboratory Services Market, By Method Type, 2019-2028(USD Million)

TABLE 143 SWITZERLAND Cell Based Assays in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 144 SWITZERLAND Virology Testing in Analytical Laboratory Services Market, By Method Type, 2019-2028 (USD Million)

TABLE 145 SWITZERLAND Analytical Laboratory Services Market, By Application, 2019-2028 (USD Million)

TABLE 146 SWITZERLAND Analytical Laboratory Services Market, By Technology, 2019-2028 (USD Million)

TABLE 147 switzerland Analytical Laboratory Services Market, By End User, 2019-2028 (USD Million)

TABLE 148 rest of europe Analytical Laboratory Services Market, By Test Type, 2019-2028 (USD Million)

Lista de Figura

FIGURE 1 Europe analytical laboratory services MARKET: SEGMENTATION

FIGURE 2 EUROPE ANALYTICAL LABORORATORY SERVICES MARKET: DATA TRIANGULATION

FIGURE 3 Europe ANALYTICAL LABORATORY SERVICES Market: DROC ANALYSIS

FIGURE 4 Europe ANALYTICAL LABORATORY SERVICES market: Europe VS REGIONAL MARKET ANALYSIS

FIGURE 5 Europe ANALYTICAL LABORATORY SERVICES Market: COMPANY RESEARCH ANALYSIS

FIGURE 6 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: MULTIVARIATE MODELLING

FIGURE 7 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: DBMR MARKET POSITION GRID

FIGURE 9 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 EUROPE ANALYTICAL LABORATORY SERVICES MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 Europe ANALYTICAL LABORATORY SERVICES market: SEGMENTATION

FIGURE 12 GROWING EXPENDITURE ON DRUGS and medical devices is DRIVing THE Europe ANALYTICAL LABORATORY SERVICES MARKET IN THE FORECAST PERIOD OF 2021 to 2028

FIGURE 13 Bioanalytical Testing SEGMENT is expected to account for the largest share of the Europe ANALYTICAL LABORATORY SERVICES MARKET in 2021 & 2028

FIGURE 14 OVERVIEW OF DIFFERENT GUIDELINES AROUND THE GLOBE

FIGURE 15 CGMP REQUIREMENT FOR ANALYTICAL LABORATORY INCLUDES:

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGEs OF EUROPE ANALYTICAL LABORATORY SERVICES MARKET

FIGURE 17 Increasing Prescription of Drugs

FIGURE 18 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, 2020

FIGURE 19 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, 2020-2028 (USD Million)

FIGURE 20 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, CAGR (2021-2028)

FIGURE 21 Europe ANALYTICAL LABORATORY SERVICES market: BY test type, LIFELINE CURVE

FIGURE 22 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, 2020

FIGURE 23 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE 2020-2028 (USD Million)

FIGURE 24 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, CAGR (2021-2028)

FIGURE 25 Europe ANALYTICAL LABORATORY SERVICES market: BY service TYPE, LIFELINE CURVE

FIGURE 26 Europe Analytical laboratory services market: BY method type, 2020

FIGURE 27 Europe Analytical laboratory services market: BY method type, 2020-2028 (USD Million)

FIGURE 28 Europe Analytical laboratory services market: BY method type, CAGR (2020-2028)

FIGURE 29 Europe Analytical laboratory services market: BY method type, LIFELINE CURVE

FIGURE 30 Europe Analytical laboratory services market: BY application, 2020

FIGURE 31 Europe Analytical laboratory services market: BY application, 2020-2028 (USD Million)

FIGURE 32 Europe Analytical laboratory services market: BY application, CAGR (2020-2028)

FIGURE 33 Europe Analytical laboratory services market: BY application, LIFELINE CURVE

FIGURE 34 Europe Analytical laboratory services market: BY technology, 2020

FIGURE 35 Europe Analytical laboratory services market: BY technology, 2020-2028 (USD Million)

FIGURE 36 Europe Analytical laboratory services market: BY technology, CAGR (2020-2028)

FIGURE 37 Europe Analytical laboratory services market: BY technology, LIFELINE CURVE

FIGURE 38 Europe analytical laboratory services market: By end user, 2020

FIGURE 39 Europe analytical laboratory services market: By end user, 2020-2028 (USD Million)

FIGURE 40 Europe analytical laboratory services market: By end user, CAGR (2020-2028)

FIGURE 41 Europe analytical laboratory services market: By end user, LIFELINE CURVE

FIGURE 42 Europe ANALYTICAL LABORATORY SERVICES MARKET: SNAPSHOT (2020)

FIGURE 43 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2020)

FIGURE 44 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 45 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY COUNTRY (2021 & 2028)

FIGURE 46 Europe ANALYTICAL LABORATORY SERVICES MARKET: BY type (2021-2028)

FIGURE 47 Europe Analytical Laboratory Services Market: company share 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.