Europe Abrasive Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.51 Billion

USD

13.06 Billion

2025

2033

USD

8.51 Billion

USD

13.06 Billion

2025

2033

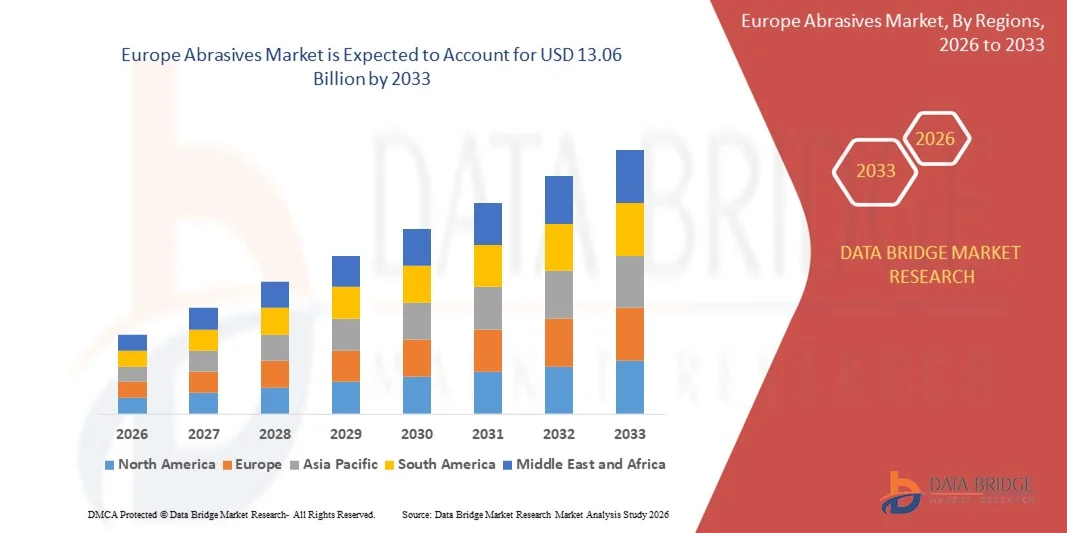

| 2026 –2033 | |

| USD 8.51 Billion | |

| USD 13.06 Billion | |

|

|

|

|

Segmentação do mercado europeu de abrasivos por matéria-prima (natural e sintética), tipo (abrasivo revestido, abrasivo aglomerado, superabrasivo e outros), produto (disco, copo, cilindro e outros), forma (bloco e pó), aplicação (desbaste, corte, polimento, perfuração, acabamento e outras) e usuário final (automotivo, máquinas, aeroespacial e defesa, fabricação de metais, construção civil, dispositivos médicos, petróleo e gás, elétrica e eletrônica e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de abrasivos na Europa

- O mercado europeu de abrasivos foi avaliado em US$ 8,51 bilhões em 2025 e deverá atingir US$ 13,06 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,50% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda de setores como o automotivo, fabricação de metais, máquinas, construção e eletrônica.

- Os avanços tecnológicos em materiais abrasivos, como superabrasivos e abrasivos revestidos, estão contribuindo para o aumento da eficiência e da produtividade.

Análise do Mercado de Abrasivos na Europa

- O mercado está vivenciando um forte crescimento impulsionado pela rápida industrialização, expansão da capacidade produtiva e crescente adoção de tecnologias avançadas de acabamento superficial e usinagem de precisão.

- O aumento dos investimentos em desenvolvimento de infraestrutura e atividades de construção está impulsionando a demanda por abrasivos em diversas aplicações.

- A Alemanha dominou o mercado europeu de abrasivos em 2025 devido à sua avançada expertise em engenharia e à forte presença das indústrias automotiva, de máquinas e de fabricação de metais. A forte ênfase do país na manufatura de precisão e na usinagem de alto desempenho impulsiona a ampla adoção de abrasivos revestidos e aglomerados.

- Prevê-se que o Reino Unido registre a maior taxa de crescimento anual composta (CAGR) no mercado europeu de abrasivos , devido à crescente adoção de soluções avançadas de usinagem, à demanda cada vez maior por ferramentas de acabamento superficial de alto desempenho e à expansão de suas aplicações nos setores aeroespacial, automotivo e de manufatura industrial.

- O segmento de abrasivos sintéticos detinha a maior participação na receita de mercado em 2025, impulsionado por sua maior durabilidade, estrutura granular uniforme e desempenho consistente em aplicações industriais de alta exigência. Os abrasivos sintéticos são amplamente preferidos em ambientes de usinagem modernos devido à sua eficiência de corte superior e adequação a processos de precisão.

Escopo do relatório e segmentação do mercado de abrasivos na Europa

|

Atributos |

Principais informações sobre o mercado de abrasivos na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de abrasivos na Europa

Adote soluções abrasivas de precisão e alto desempenho.

- A crescente demanda por acabamento de precisão em setores como o automotivo, aeroespacial e de manufatura em geral está acelerando a adoção de produtos abrasivos avançados. Abrasivos de alto desempenho proporcionam remoção de material superior, tolerâncias mais rigorosas e melhor qualidade de superfície, tornando-os essenciais para os processos de produção modernos. Essa mudança também é impulsionada pela necessidade de ferramentas altamente confiáveis que possam manter a consistência em operações complexas e de grande escala.

- O uso crescente de máquinas automatizadas de retificação e polimento está impulsionando a necessidade de abrasivos projetados que ofereçam consistência, durabilidade e maior eficiência operacional. Essas soluções ajudam a reduzir o tempo de inatividade e a manter a qualidade da produção em ambientes altamente automatizados, garantindo interrupções mínimas no processo. Elas também melhoram o desempenho de sistemas robóticos e CNC modernos que exigem um comportamento abrasivo uniforme.

- A crescente preferência por abrasivos revestidos e superabrasivos está remodelando os fluxos de trabalho de fabricação, especialmente em tarefas que exigem baixa geração de calor e danos mínimos à superfície. Sua maior vida útil e melhor eficiência de corte os tornam adequados para aplicações de alta precisão que exigem desempenho estável em ciclos prolongados. Essas propriedades ajudam os fabricantes a reduzir a frequência de troca de ferramentas e a aumentar a produtividade.

- Por exemplo, em 2023, diversas fábricas relataram melhorias na relação custo-benefício e maior precisão de usinagem após a adoção de cintas abrasivas revestidas de cerâmica para o acabamento de componentes de precisão. Essas cintas proporcionaram maior durabilidade e um acabamento mais uniforme em grandes ciclos de produção, reduzindo as taxas de retrabalho. Sua maior resistência ao desgaste também minimizou atrasos operacionais e custos de substituição de ferramentas.

- Embora os abrasivos de alto desempenho estejam transformando a produção, o progresso sustentado depende da inovação contínua de produtos, do treinamento de operadores e da otimização de custos. Os fabricantes devem priorizar soluções específicas para cada aplicação, a fim de atender às necessidades em constante evolução do setor e garantir a melhor adequação a diversos ambientes de usinagem. A colaboração entre produtores de abrasivos e usuários finais está se tornando cada vez mais importante para o desenvolvimento de soluções personalizadas.

Dinâmica do mercado de abrasivos na Europa

Motorista

Crescimento da industrialização e expansão das atividades de manufatura

- A expansão das atividades de manufatura, metalurgia e construção civil está aumentando a demanda por abrasivos utilizados em operações de retificação, corte, polimento e acabamento. À medida que a produção aumenta, as ferramentas abrasivas tornam-se essenciais para melhorar a eficiência e manter a qualidade do produto em diversos materiais. Essa tendência é ainda mais reforçada pela crescente adoção de técnicas avançadas de usinagem.

- As indústrias estão reconhecendo cada vez mais os benefícios dos abrasivos avançados na redução do tempo de usinagem, no aumento da vida útil dos equipamentos e na garantia de resultados de acabamento consistentes. Essa conscientização está impulsionando uma maior adoção em unidades de produção de pequeno, médio e grande porte que buscam maior eficiência operacional. A confiabilidade dos abrasivos de alta qualidade também reduz o risco de variabilidade na produção.

- O desenvolvimento industrial favorável, as atualizações tecnológicas e os investimentos em processos de fabricação modernos estão impulsionando ainda mais a necessidade de produtos abrasivos confiáveis. O uso crescente de máquinas CNC e ferramentas de usinagem de precisão está reforçando a demanda por abrasivos que suportem operações de alta velocidade. A integração de sistemas de manufatura digital também está contribuindo para um uso mais preciso dos abrasivos.

- Por exemplo, em 2022, diversas fábricas relataram aumento de produtividade após a integração de abrasivos aglomerados e revestidos de alto desempenho em seus processos de usinagem, melhorando a produção sem grandes modificações nos equipamentos. Essas melhorias ajudaram a otimizar as operações e reduzir os custos totais de usinagem. As fábricas também observaram melhor desempenho das ferramentas e redução na necessidade de manutenção.

- Embora o crescimento industrial esteja impulsionando o mercado, padrões de qualidade consistentes, suporte técnico e maior disponibilidade de abrasivos avançados continuam sendo essenciais para a adoção a longo prazo. Os fabricantes também precisam atender às crescentes expectativas em relação à eficiência operacional e à sustentabilidade. Garantir a confiabilidade do produto é fundamental para construir a confiança dos usuários finais.

Restrição/Desafio

Flutuação dos preços das matérias-primas e custos de conformidade ambiental

- Os produtores de abrasivos enfrentam desafios devido às flutuações nos preços de matérias-primas como óxido de alumínio, carboneto de silício, zircônia-alumina e diamantes sintéticos. Essas variações afetam os custos gerais de fabricação e influenciam o preço final para os usuários, especialmente em setores sensíveis a custos. Gerenciar essas flutuações exige um fornecimento estratégico e um planejamento de produção eficiente.

- O cumprimento de normas rigorosas de meio ambiente, segurança do trabalho e gestão de resíduos aumenta os custos operacionais dos fabricantes de abrasivos. Os produtores menores muitas vezes têm dificuldades para atender a esses padrões, o que limita sua competitividade e capacidade de expansão. Essas exigências também impulsionam as empresas a adotarem tecnologias de produção mais limpas e sustentáveis.

- Inconsistências na cadeia de suprimentos e o acesso variável a matérias-primas essenciais contribuem para atrasos na produção, afetando a disponibilidade e a confiabilidade dos produtos. Essas interrupções podem dificultar a penetração no mercado, principalmente para produtos abrasivos especializados que exigem qualidade consistente do material. Garantir a estabilidade da matéria-prima está se tornando um foco crítico para os fabricantes.

- Por exemplo, em 2023, diversos fabricantes de abrasivos relataram aumento nos custos de produção decorrentes da alta dos preços da energia e de exigências de conformidade mais rigorosas, o que impactou a acessibilidade de soluções abrasivas premium. Esses aumentos de custos também influenciaram os cronogramas de desenvolvimento de produtos e as estratégias de precificação de mercado. Muitas empresas expressaram preocupação com a sustentabilidade dos custos a longo prazo.

- Embora os desafios de custo e regulamentação persistam, aprimorar a resiliência da cadeia de suprimentos, promover práticas de produção sustentáveis e otimizar o uso de matérias-primas são cruciais para desbloquear o potencial de crescimento a longo prazo. As empresas também devem investir em inovação para desenvolver alternativas economicamente viáveis sem comprometer o desempenho. O planejamento estratégico será essencial para manter a competitividade em um mercado desafiador.

Escopo do mercado de abrasivos na Europa

O mercado é segmentado com base em matérias-primas, tipo, produto, forma, aplicação e usuário final.

- Por matérias-primas

Com base nas matérias-primas, o mercado europeu de abrasivos é segmentado em naturais e sintéticos. O segmento sintético detinha a maior participação na receita de mercado em 2025, impulsionado por sua maior durabilidade, estrutura granular uniforme e desempenho consistente em aplicações industriais de alta exigência. Os abrasivos sintéticos são amplamente preferidos em ambientes de usinagem modernos devido à sua eficiência de corte superior e adequação a processos de precisão.

Espera-se que o segmento de abrasivos naturais apresente um crescimento constante entre 2026 e 2033, impulsionado pelo uso crescente de materiais abrasivos ecológicos e econômicos para tarefas de acabamento leve a médio. Os abrasivos naturais estão ganhando espaço em indústrias que buscam alternativas sustentáveis com desempenho adequado para aplicações não críticas.

- Por tipo

Com base no tipo, o mercado europeu de abrasivos é segmentado em abrasivos revestidos, abrasivos aglomerados, superabrasivos e outros. O segmento de abrasivos aglomerados detinha a maior participação na receita de mercado em 2025, devido ao seu uso extensivo em retificação, corte e remoção de grandes quantidades de material em operações de manufatura e metalurgia. Sua resistência estrutural e longa vida útil o tornam a escolha preferencial para aplicações de alta carga.

O segmento de superabrasivos deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente demanda por usinagem de precisão em setores como aeroespacial, automotivo e eletrônico. Superabrasivos como diamante e CBN oferecem dureza, estabilidade térmica e precisão superiores, tornando-os ideais para processos de alta tolerância.

- Por produto

Com base no produto, o mercado europeu de abrasivos é segmentado em discos, copos, cilindros e outros. O segmento de discos dominou o mercado em 2025 devido ao seu uso generalizado na fabricação de metais, marcenaria e preparação de superfícies. Os abrasivos em disco oferecem versatilidade, facilidade de instalação e compatibilidade com diversas ferramentas manuais e automatizadas.

Prevê-se que o segmento de cilindros apresente a taxa de crescimento mais rápida entre 2026 e 2033, impulsionado pela crescente adoção em aplicações que exigem remoção uniforme de material e acabamento de superfície interna. Seu formato cilíndrico proporciona controle e estabilidade superiores, tornando-os adequados para operações industriais de retificação e rebarbação.

- Por formulário

Com base na forma, o mercado europeu de abrasivos é segmentado em blocos e pó. O segmento de blocos detinha a maior participação na receita de mercado em 2025, impulsionado pela alta demanda em aplicações de polimento, afiação e acabamento manual. Os abrasivos em bloco são valorizados por sua durabilidade, facilidade de manuseio e adequação tanto para ambientes industriais quanto para oficinas.

O segmento de abrasivos em pó deverá apresentar um crescimento substancial entre 2026 e 2033, impulsionado pelo seu uso crescente em processos de lapidação, microacabamento e polimento de precisão. Os abrasivos em pó oferecem um controle excepcional sobre a distribuição do tamanho dos grãos, permitindo o acabamento de alta precisão exigido nas áreas de eletrônica, óptica e manufatura avançada.

- Por meio de aplicação

Com base na aplicação, o mercado europeu de abrasivos é segmentado em retificação, corte, polimento, perfuração, acabamento e outros. O segmento de retificação detinha a maior participação na receita de mercado em 2025, devido ao seu papel fundamental na conformação de materiais, preparação de superfícies e remoção de material em grandes quantidades em diversos setores industriais. Os abrasivos para retificação são essenciais para alcançar precisão dimensional e superfícies lisas.

O segmento de polimento deverá registrar um forte crescimento de 2026 a 2033, impulsionado pela crescente demanda por acabamento superficial de alta qualidade nos setores automotivo, eletrônico e de bens de consumo. Os abrasivos de polimento aprimoram o apelo estético e o desempenho funcional, tornando-os cruciais nos processos de fabricação da etapa final.

- Por usuário final

Com base no usuário final, o mercado europeu de abrasivos é segmentado em automotivo, máquinas, aeroespacial e defesa, fabricação de metais, construção civil, dispositivos médicos, petróleo e gás, elétrico e eletrônico, e outros. O segmento de fabricação de metais detinha a maior participação na receita de mercado em 2025, impulsionado pelo uso extensivo de abrasivos em soldagem, corte, retificação e preparação de superfícies. Os abrasivos desempenham um papel fundamental na melhoria da eficiência da produção e na manutenção da qualidade estrutural.

O segmento automotivo deverá apresentar um crescimento significativo entre 2026 e 2033, impulsionado pela crescente demanda por componentes de precisão, materiais leves e padrões de acabamento superiores na fabricação de veículos. Abrasivos avançados permitem usinagem de alta precisão, preparação de pintura e correção de superfície, tornando-os indispensáveis na produção automotiva.

Análise Regional do Mercado de Abrasivos na Europa

- A Alemanha dominou o mercado europeu de abrasivos em 2025 devido à sua avançada expertise em engenharia e à forte presença das indústrias automotiva, de máquinas e de fabricação de metais. A forte ênfase do país na manufatura de precisão e na usinagem de alto desempenho impulsiona a ampla adoção de abrasivos revestidos e aglomerados.

- A demanda por ferramentas de retificação, polimento e corte de alta qualidade é impulsionada pelo ecossistema de produção automotiva e de construção de máquinas de classe mundial da Alemanha. Usuários industriais dependem cada vez mais de soluções abrasivas duráveis e de alta precisão para dar suporte a operações de fabricação complexas.

- A sólida capacidade de P&D da Alemanha e a forte ênfase na inovação tecnológica permitem o desenvolvimento de materiais abrasivos avançados. A presença de fabricantes líderes globais de abrasivos impulsiona a inovação contínua de produtos e a otimização de desempenho.

Análise do Mercado de Abrasivos no Reino Unido

O mercado de abrasivos do Reino Unido deverá apresentar o crescimento mais rápido na Europa entre 2026 e 2033, impulsionado pelo aumento dos investimentos em aeroespacial, dispositivos médicos e usinagem de precisão. As empresas estão priorizando soluções abrasivas de alta eficiência para aumentar a produtividade e atender aos requisitos avançados de acabamento de superfícies. O crescimento das atividades de renovação e desenvolvimento de infraestrutura impulsiona ainda mais o uso de abrasivos revestidos e aglomerados. Além disso, a crescente adoção de tecnologias de fabricação modernas e práticas de manufatura sustentáveis contribui significativamente para a rápida expansão do mercado de abrasivos no Reino Unido.

Participação de mercado de abrasivos na Europa

A indústria europeia de abrasivos é liderada principalmente por empresas consolidadas, incluindo:

• Saint-Gobain Abrasives / Norton (França)

• Tyrolit Schleifmittelwerke Swarovski (Áustria)

• Klingspor AG (Alemanha)

• Hermes Schleifmittel GmbH (Alemanha)

• VSM AG (Alemanha)

• Winoa (França)

• PFERD-Werkzeuge / August Rüggeberg GmbH & Co. KG (Alemanha)

• Imerys Fused Minerals (França)

• RHODIUS Abrasivos (Alemanha)

• SAIT Abrasivi SpA (Itália)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.