Europe 3d Printing Materials Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

901.50 Million

USD

3,850.54 Million

2024

2032

USD

901.50 Million

USD

3,850.54 Million

2024

2032

| 2025 –2032 | |

| USD 901.50 Million | |

| USD 3,850.54 Million | |

|

|

|

|

Segmentação do mercado de materiais de impressão 3D na Europa, por tipo (plásticos/polímeros, metal, cerâmica e outros), forma (pó, filamento e líquido), tecnologia (modelagem por deposição fundida (FDM), sinterização seletiva a laser (SLS), estereolitografia (SLA), sinterização direta a laser de metais (DMLS), manufatura aditiva de grande área (BAAM), manufatura aditiva por arco elétrico (WAAM), ColorJet e outros), uso final (manufatura industrial, automotiva, aeroespacial e defesa, saúde, bens de consumo, eletrônicos, educação, construção e outros) - tendências e previsões do setor até 2032

Qual é o tamanho e a taxa de crescimento do mercado de materiais de impressão 3D na Europa?

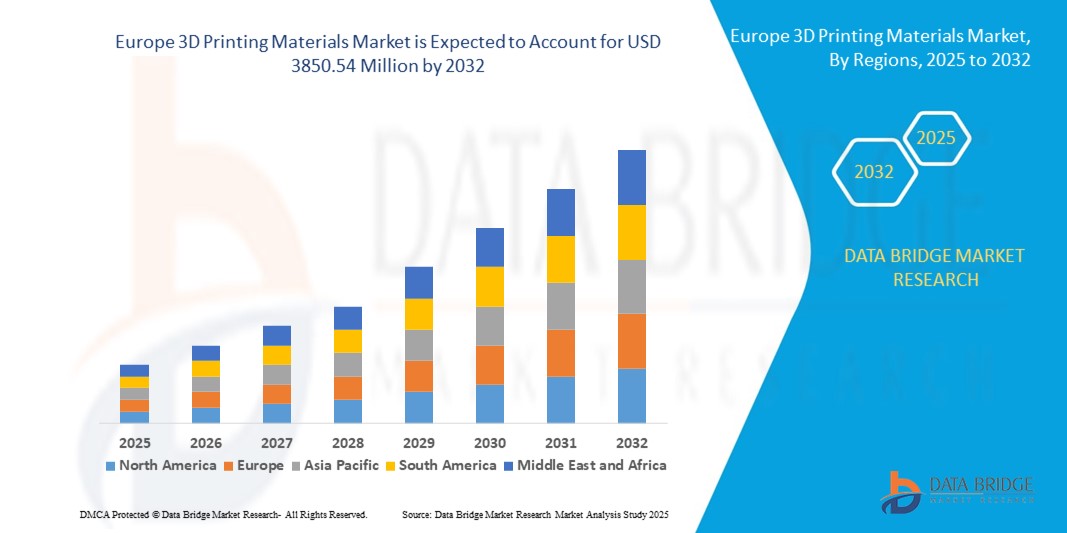

- O tamanho do mercado de materiais de impressão 3D da Europa foi avaliado em US$ 901,50 milhões em 2024 e deve atingir US$ 3.850,54 milhões até 2032 , com um CAGR de 19,90% durante o período previsto.

- A crescente adoção da impressão 3D em vários setores, o aumento da prototipagem e da ferramentaria rápida e a crescente acessibilidade e acessibilidade das tecnologias de impressão 3D universalmente são alguns dos fatores que devem impulsionar o crescimento do mercado.

Quais são os principais resultados do mercado europeu de materiais de impressão 3D?

- Há um aumento correspondente na demanda por materiais que atendam aos diversos requisitos desse processo de fabricação inovador, à medida que as indústrias adotam os recursos revolucionários da impressão 3D. A versatilidade da impressão 3D, também conhecida como manufatura aditiva, abrange setores como aeroespacial, saúde, automotivo e bens de consumo, onde a tecnologia é empregada para prototipagem rápida, produção personalizada e fabricação de designs complexos.

- O fator que contribui para a demanda por materiais de impressão 3D é a capacidade da tecnologia de produzir componentes complexos e altamente personalizados. Os métodos tradicionais de fabricação não são muito eficientes e rápidos, pois as indústrias buscam peças mais complexas e com design preciso. A impressão 3D preenche essa lacuna, permitindo a criação de estruturas geometricamente complexas com maior eficiência.

- A demanda por materiais especializados está aumentando com a evolução das necessidades de setores industriais como aeroespacial, saúde, automotivo e bens de consumo, implementando essa tecnologia transformadora, à medida que a impressão 3D continua a revolucionar os processos de fabricação. Portanto, a crescente adoção da impressão 3D em diversos setores está impulsionando o crescimento do mercado.

- O mercado alemão de materiais de impressão 3D deteve a maior fatia da receita regional na Europa, com 28,11% em 2024. O crescimento é impulsionado pela demanda por sistemas de segurança de alta tecnologia, casas inteligentes com eficiência energética e atualizações de infraestrutura digital.

- Espera-se que o mercado de materiais de impressão 3D do Reino Unido cresça a um CAGR robusto de 12,23% durante o período previsto, impulsionado pelas crescentes preocupações com a segurança residencial e comercial, pela popularidade de configurações de casas inteligentes do tipo "faça você mesmo" e pela forte penetração no varejo e online.

- O segmento de plásticos/polímeros dominou o mercado com a maior participação na receita de 45,8% em 2024, devido à sua versatilidade, acessibilidade e ampla adoção em prototipagem e aplicações industriais

Escopo do relatório e segmentação do mercado de materiais de impressão 3D na Europa

|

Atributos |

Principais insights do mercado de materiais de impressão 3D na Europa |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Europa

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado europeu de materiais de impressão 3D?

Mudança para materiais funcionais e de alto desempenho

- Uma tendência definidora no mercado de materiais de impressão 3D é o crescente desenvolvimento e adoção de materiais funcionais e de alto desempenho, incluindo compósitos, ligas metálicas e polímeros de base biológica, que expandem a gama de aplicações industriais, médicas e de consumo.

- Por exemplo, empresas como a Markforged e a EOS estão a introduzir filamentos reforçados com fibra de carbono e pós de polímeros de alta temperatura que permitem a produção de peças leves, mas duráveis, para máquinas aeroespaciais, automóveis e industriais.

- Os materiais de impressão 3D funcionais estão cada vez mais permitindo a impressão multimaterial, incorporando eletrônicos ou caminhos condutores, transformando assim os fluxos de trabalho de fabricação convencionais em processos aditivos integrados

- A tendência também inclui biotintas e polímeros biocompatíveis para impressão 3D médica, incluindo estruturas de tecido, implantes e próteses personalizadas, proporcionando maior precisão, designs específicos para o paciente e ciclos de produção mais rápidos.

- À medida que as indústrias avançam em direção à fabricação digital e à produção sob demanda, empresas como a Formlabs e a 3D Systems estão desenvolvendo resinas e pós especializados para prototipagem avançada, ferramentas e aplicações de uso final, impulsionando a inovação em todos os setores

- A crescente adoção de materiais de impressão 3D funcionais, duráveis e prontos para a indústria está remodelando as expectativas do usuário e expandindo as aplicações nos setores automotivo, de saúde, aeroespacial e de eletrônicos de consumo.

Quais são os principais impulsionadores do mercado europeu de materiais de impressão 3D?

- A crescente demanda por peças leves, de alta resistência e personalizadas em setores como aeroespacial, automotivo e de saúde é um dos principais impulsionadores do mercado de materiais de impressão 3D

- Por exemplo, em março de 2024, a Stratasys lançou termoplásticos de alta temperatura e retardantes de chamas, projetados para ferramentas aeroespaciais e industriais, aumentando a durabilidade e a conformidade regulatória.

- A crescente adoção da manufatura aditiva em prototipagem, produção em pequenos lotes e geometrias complexas está alimentando a inovação de materiais, permitindo personalização precisa e reduzindo o desperdício e os prazos de entrega.

- Além disso, as iniciativas de sustentabilidade estão a impulsionar a utilização de filamentos de base biológica e polímeros recicláveis, alinhando-se com os objetivos ESG e reduzindo o impacto ambiental.

- A integração de materiais de impressão 3D com impressoras 3D automatizadas e em escala industrial, incluindo sistemas de fibras contínuas e multimateriais, está impulsionando eficiência, custo-benefício e adoção mais ampla em vários setores de uso final

Qual fator está desafiando o crescimento do mercado europeu de materiais de impressão 3D?

- O alto custo e a disponibilidade limitada de materiais avançados de impressão 3D, particularmente compósitos funcionais, pós metálicos e resinas biocompatíveis, são barreiras significativas à adoção generalizada

- Por exemplo, pós metálicos premium para aplicações aeroespaciais e médicas geralmente apresentam altos custos de aquisição e exigem armazenamento e manuseio especializados, limitando o uso a aplicações de alto valor.

- A consistência do desempenho do material, o controle de qualidade e a padronização continuam sendo desafios, especialmente para peças de nível industrial que exigem conformidade regulatória rigorosa e integridade mecânica

- Além disso, a falta de profissionais treinados e de conhecimento técnico no manuseio de materiais especializados de impressão 3D restringe a adoção em mercados emergentes e empresas menores.

- Superar esses desafios por meio da redução de custos, inovação de materiais e programas de treinamento será fundamental para permitir uma adoção mais ampla e um crescimento sustentado do mercado globalmente.

Como o mercado de materiais de impressão 3D da Europa é segmentado?

O mercado é segmentado com base no tipo, forma, tecnologia e uso final.

- Por tipo

Com base no tipo, o mercado de materiais de impressão 3D é segmentado em Plásticos/Polímeros, Metal, Cerâmica e Outros. O segmento de Plásticos/Polímeros dominou o mercado com a maior participação na receita, de 45,8% em 2024, devido à sua versatilidade, acessibilidade e ampla adoção em prototipagem e aplicações industriais. Plásticos/Polímeros são preferidos para peças leves, protótipos funcionais e produtos de consumo devido ao fácil processamento, boas propriedades mecânicas e compatibilidade com diversas tecnologias de impressão 3D.

O segmento de metais deverá crescer com a CAGR mais rápida entre 2025 e 2032, impulsionado pela demanda nas indústrias aeroespacial, automotiva e médica por componentes de alta resistência, resistentes ao calor e duráveis. Pós e ligas metálicas permitem a produção de estruturas complexas e resistentes a cargas que a fabricação tradicional não consegue facilmente alcançar. Materiais cerâmicos, por sua vez, estão ganhando força para aplicações de alta temperatura e biocompatíveis em saúde e eletrônica, embora a adoção permaneça limitada por custos mais altos e requisitos de equipamentos especializados.

- Por Formulário

Com base na forma, o mercado de materiais de impressão 3D é segmentado em Pó, Filamento e Líquido. O segmento de Filamentos deteve a maior participação de mercado, com 52,3% de receita em 2024, impulsionado por seu amplo uso em impressoras de Modelagem por Deposição Fundida (FDM), facilidade de manuseio e preço acessível para aplicações industriais e de consumo. Os filamentos estão disponíveis em termoplásticos, compósitos e polímeros de base biológica, oferecendo versatilidade para prototipagem, ferramentaria e peças funcionais para uso final.

Espera-se que a forma em pó apresente o CAGR mais rápido entre 2025 e 2032, em grande parte devido ao seu papel crítico na Sinterização Seletiva a Laser (SLS), Sinterização Direta a Laser de Metais (DMLS) e outros processos de manufatura aditiva de alta precisão em metais e polímeros. Materiais de impressão 3D líquidos, usados principalmente em estereolitografia (SLA) e impressoras à base de resina, são preferidos para peças de alta resolução e geometrias complexas, mas são limitados pelo custo e pelos requisitos de pós-processamento.

- Por Tecnologia

Com base na tecnologia, o mercado de materiais de impressão 3D é segmentado em Modelagem por Deposição Fundida (FDM), Sinterização Seletiva a Laser (SLS), Estereolitografia (SLA), Sinterização Direta a Laser de Metais (DMLS), Manufatura Aditiva de Grandes Áreas (BAAM), Manufatura Aditiva por Arco de Fio (WAAM), ColorJet e outros. O segmento FDM dominou o mercado com a maior participação na receita, 40,9% em 2024, impulsionado por sua acessibilidade, preço acessível e capacidade de processar uma ampla variedade de termoplásticos e compósitos. O FDM é amplamente utilizado para prototipagem, testes funcionais e fins educacionais, tornando-o popular em diversos setores.

Espera-se que SLS e DMLS apresentem o crescimento mais rápido entre 2025 e 2032, dada sua capacidade de produzir peças complexas e de alta resistência para aplicações aeroespaciais, automotivas e médicas. SLA, BAAM, WAAM e ColorJet atendem a aplicações de nicho que exigem alta precisão, velocidade ou produção em larga escala, expandindo ainda mais o alcance tecnológico do mercado.

- Por uso final

Com base no uso final, o mercado de materiais de impressão 3D é segmentado em Manufatura Industrial, Automotivo, Aeroespacial e Defesa, Saúde, Bens de Consumo, Eletrônicos, Educação, Construção e Outros. O segmento de Manufatura Industrial deteve a maior participação de mercado, com 38,6% de receita em 2024, impulsionado pela rápida adoção da manufatura aditiva para prototipagem, ferramentaria, gabaritos e peças de produção. As indústrias utilizam materiais de impressão 3D para reduzir prazos de entrega, otimizar projetos e aumentar a eficiência.

Os segmentos de Saúde e Aeroespacial e Defesa devem crescer com a CAGR mais rápida entre 2025 e 2032, impulsionados pela crescente demanda por implantes personalizados, próteses, componentes estruturais leves e peças de missão crítica. Os setores de educação e consumo estão apoiando a conscientização e a adoção da impressão 3D, enquanto os segmentos de eletrônica e construção estão gradualmente integrando a impressão 3D para componentes especializados, estruturas de grande porte e produtos personalizados.

Qual região detém a maior fatia do mercado europeu de materiais de impressão 3D?

- O mercado alemão de materiais de impressão 3D deteve a maior fatia da receita regional na Europa, com 28,11% em 2024. O crescimento é impulsionado pela demanda por sistemas de segurança de alta tecnologia, casas inteligentes com eficiência energética e atualizações de infraestrutura digital.

- Os consumidores preferem produtos compatíveis com plataformas populares de casas inteligentes, como Alexa e Google Assistant, enquanto a ênfase do país em sustentabilidade e inovação acelera ainda mais a adoção pelo mercado

Visão do mercado de materiais de impressão 3D na França

O mercado francês de materiais de impressão 3D está em constante expansão, impulsionado pela urbanização, pela adoção de casas inteligentes e pela conscientização do consumidor sobre soluções de segurança digital. Os incentivos governamentais para modernização de edifícios com eficiência energética e a crescente presença de integradores de casas inteligentes incentivam a adoção tanto residencial quanto comercial.

Visão do mercado de materiais de impressão 3D na Itália

O mercado italiano de materiais de impressão 3D deve registrar um crescimento significativo, impulsionado pelo uso crescente de dispositivos domésticos conectados, pelo crescente interesse do consumidor em automação residencial e pela modernização de edifícios residenciais antigos. A integração com plataformas controladas por voz e aplicativos para smartphones aumenta o apelo do mercado.

Qual país tem o crescimento mais rápido no mercado de materiais de impressão 3D da Europa?

O mercado de materiais de impressão 3D do Reino Unido deve crescer a uma CAGR robusta de 12,23% durante o período previsto, impulsionado pelas crescentes preocupações com a segurança residencial e comercial, pela popularidade de configurações de casas inteligentes "faça você mesmo" e pela forte penetração no varejo e na internet. A adoção de sistemas de entrada sem chave e conectados em escritórios, apartamentos e residências multifamiliares está impulsionando ainda mais a demanda.

Visão do mercado de materiais de impressão 3D na Polônia

O mercado polonês está ganhando força devido à expansão urbana, à crescente adoção de casas inteligentes e ao crescente interesse por sistemas de acesso seguros e energeticamente eficientes. Os consumidores poloneses estão cada vez mais integrando materiais de impressão 3D com dispositivos habilitados para IoT para maior conveniência e segurança.

Quais são as principais empresas do mercado europeu de materiais de impressão 3D?

A indústria de materiais de impressão 3D da Europa é liderada principalmente por empresas bem estabelecidas, incluindo:

- Formlabs (EUA)

- EOS (Alemanha)

- ENVISIONTEC US LLC (EUA)

- Elementos Americanos (EUA)

- Höganäs AB (Suécia)

- UltiMaker (Holanda)

- Carbon, Inc. (EUA)

- KRAIBURG TPE GmbH & Co. KG (Alemanha)

- Covestro AG (Alemanha)

- Markforged, Inc. (EUA)

- Stratasys (EUA)

- ExOne (EUA)

- Arkema (França)

- 3D Systems, Inc. (EUA)

- Evonik Industries AG (Alemanha)

- Materialise (Bélgica)

- BASF SE (Alemanha)

- Sandvik AB (Suécia)

- Solvay (Bélgica)

Quais são os desenvolvimentos recentes no mercado europeu de materiais de impressão 3D?

- Em outubro de 2023, a EOS lançou sua rede Digital Foam Architects, projetada para acelerar o desenvolvimento e a manufatura aditiva (MA) de produtos de consumo, médicos e industriais com aplicações de espuma digital. A espuma digital não é um produto, mas sim uma abordagem para a impressão 3D de produtos semelhantes a espuma. Ela dará um novo rumo à empresa na área de materiais de impressão 3D.

- Em outubro de 2023, a Arkema anunciou novas parcerias com líderes do setor, como EOS, HP e Stratasys, para projetar a próxima geração de materiais e soluções impressas em 3D. Isso favorecerá suas capacidades inovadoras e aprimorará seu portfólio de produtos.

- Em fevereiro de 2023, a Bauer Hockey, líder europeia em inovação em equipamentos de hóquei, e a EOS, pioneira e líder de mercado em impressão 3D industrial, colaboraram para incorporar a manufatura aditiva (MA, ou impressão 3D) ao programa de equipamentos personalizados MyBauer da Bauer. A EOS e sua abordagem patenteada de espuma digital para polímeros de impressão deram à Bauer uma vantagem distinta. Isso fortalecerá a presença da EOS no mercado europeu de materiais para impressão 3D.

- Em novembro de 2021, a Covestro AG apresentou quatro novos materiais para impressão 3D na Formnext 2021, abrangendo diversas tecnologias. Entre eles está o Addigy FPC SOL1 HT, um material de suporte solúvel para impressão FDM de materiais de alta temperatura, oferecendo fácil remoção e sustentabilidade. O Arnitel AM3001 (P) para SLS, um material macio com alto retorno de energia, alcançou sucesso na impressão 3D em conformidade com os padrões de segurança para brinquedos. A Covestro também lançou as versões SLS e HSS de seu pó de TPU, Addigy PPU 86AW6, conhecido por seu rebote, fácil pós-processamento e alta taxa de reutilização. Essas adições expandem as opções de polímeros da Covestro para impressão 3D, após a aquisição da unidade de manufatura aditiva da DSM no início deste ano.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.