Asia Pacific Xylose Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

2.10 Billion

USD

3.47 Billion

2024

2032

USD

2.10 Billion

USD

3.47 Billion

2024

2032

| 2025 –2032 | |

| USD 2.10 Billion | |

| USD 3.47 Billion | |

|

|

|

|

Segmentação do mercado de xilose na região Ásia-Pacífico, por tipo de produto (L-xilose, D-xilose, DL-xilose), aplicações (alimentos e bebidas, cosméticos/cuidados pessoais, produtos farmacêuticos, indústria de biocombustíveis e outros) - Tendências e previsões do setor até 2032.

Tamanho do mercado de xilose na região Ásia-Pacífico

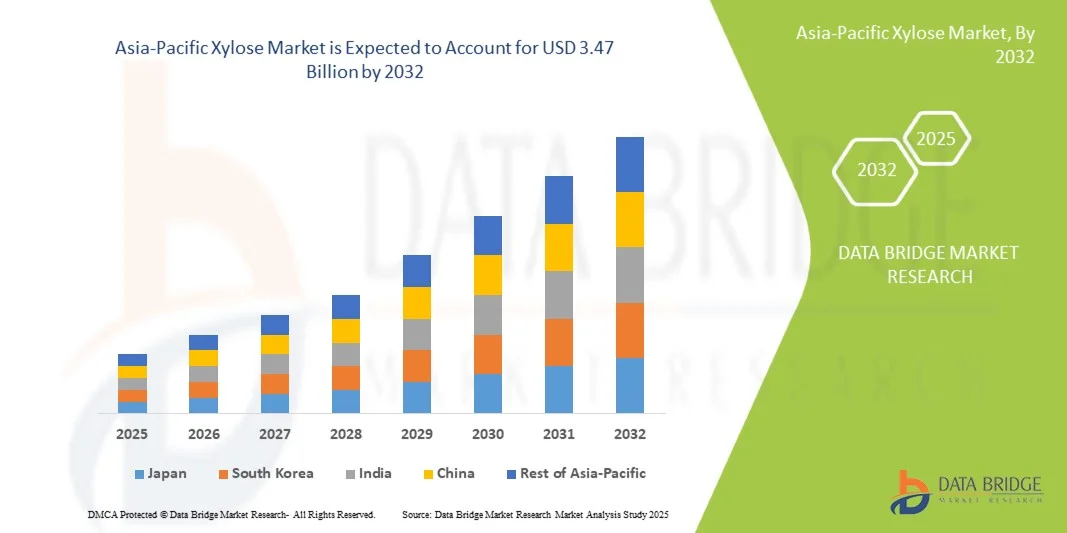

- O mercado de xilose na região Ásia-Pacífico foi avaliado em US$ 2,10 bilhões em 2024 e projeta-se que alcance US$ 3,47 bilhões até 2032 , apresentando uma taxa de crescimento anual composta (CAGR) de 6,50% durante o período de previsão.

- A expansão do mercado é impulsionada principalmente pela crescente demanda por adoçantes naturais e pela maior conscientização dos consumidores em relação à saúde, incentivando a mudança para alternativas de açúcar com baixo teor calórico e à base de plantas em toda a indústria de alimentos e bebidas.

- Além disso, os avanços tecnológicos na extração e no processamento da xilose, juntamente com as crescentes aplicações nas indústrias farmacêutica e cosmética, estão ampliando a utilização do produto. Essas tendências, em conjunto, impulsionam o crescimento do mercado, fortalecendo a posição da região no setor global da xilose.

Análise do Mercado de Xilose na Ásia-Pacífico

- A xilose, um açúcar natural derivado de fontes vegetais como madeira e biomassa agrícola, está se tornando um ingrediente cada vez mais crucial nas indústrias alimentícia, de bebidas e farmacêutica devido ao seu baixo teor calórico, origem natural e versatilidade em aplicações de formulação.

- A crescente demanda por xilose é impulsionada principalmente pela preferência cada vez maior do consumidor por adoçantes naturais, pela crescente preocupação com a saúde e pelo uso cada vez maior de ingredientes de base biológica no processamento de alimentos, nutracêuticos e produtos de higiene pessoal.

- A China dominou o mercado de xilose na região Ásia-Pacífico, com a maior participação na receita, de 33,8% em 2024, devido à sua sólida base industrial, à abundante disponibilidade de matéria-prima e à forte presença de fabricantes importantes, além da expansão das aplicações em aditivos alimentares e bioquímicos, impulsionada por avanços tecnológicos e iniciativas governamentais de apoio.

- Prevê-se que a Índia seja o país de crescimento mais rápido no mercado de xilose da região Ásia-Pacífico durante o período de previsão, devido à crescente conscientização sobre saúde, à expansão da indústria de processamento de alimentos e à crescente adoção de ingredientes naturais em alimentos e bebidas embalados.

- O segmento de D-xilose dominou o mercado com a maior participação na receita, de 68,5% em 2024, impulsionado por seu uso extensivo como adoçante natural e intensificador de sabor na indústria de alimentos e bebidas.

Escopo do relatório e segmentação do mercado de xilose na região Ásia-Pacífico

|

Atributos |

Principais informações sobre o mercado de xilose na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de xilose na região Ásia-Pacífico

“Crescente adoção de avanços biotecnológicos na produção de xilose”

- Uma tendência significativa e crescente no mercado global de xilose na região Ásia-Pacífico é a integração cada vez maior de processos biotecnológicos avançados, incluindo hidrólise enzimática e fermentação microbiana, para aumentar o rendimento e a eficiência da produção de xilose a partir de biomassa lignocelulósica. Essa abordagem inovadora está melhorando significativamente a qualidade do produto, a sustentabilidade e a relação custo-benefício em diversos setores.

- Por exemplo, a Shandong Longlive Bio-Technology Co., Ltd. implementou técnicas de conversão enzimática que permitem taxas de extração de xilose mais elevadas a partir de resíduos agrícolas, minimizando o desperdício e reduzindo o impacto ambiental. Da mesma forma, o Grupo Futaste utiliza tecnologia avançada de fermentação para produzir xilose de alta pureza, adequada para aplicações alimentares e farmacêuticas.

- Os avanços biotecnológicos também possibilitam o desenvolvimento de derivados de xilose personalizados para aplicações especializadas em nutracêuticos, cuidados pessoais e bioquímicos. Por exemplo, empresas estão utilizando cepas microbianas geneticamente modificadas para aumentar a eficiência de conversão, reduzindo os custos de produção e viabilizando a comercialização em larga escala.

- A integração da biotecnologia na produção de xilose facilita uma maior otimização do processo e sustentabilidade ambiental. Por meio dessas inovações, os produtores podem utilizar matérias-primas renováveis, como sabugo de milho, bagaço de cana-de-açúcar e lascas de madeira, alinhando-se às metas globais de sustentabilidade e às iniciativas de bioeconomia circular.

- Essa tendência em direção a métodos de produção tecnologicamente avançados e ecoeficientes está remodelando o cenário competitivo da indústria da xilose. Consequentemente, empresas como a Zhejiang Huakang Pharmaceutical Co., Ltd. e a Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. estão expandindo seus esforços de pesquisa para desenvolver xilose de alto desempenho à base de substâncias biológicas e derivados de açúcares relacionados.

- A demanda por xilose refinada biotecnologicamente está aumentando rapidamente nos setores de alimentos, bebidas e farmacêutico, à medida que consumidores e fabricantes priorizam ingredientes naturais, sustentáveis e de alta qualidade, em consonância com os padrões de saúde e ambientais em constante evolução.

Dinâmica do mercado de xilose na região Ásia-Pacífico

Motorista

“A crescente demanda é impulsionada pela conscientização sobre saúde e pela mudança em direção a adoçantes naturais”

- A crescente preferência do consumidor por alternativas mais saudáveis e com baixo teor calórico aos açúcares tradicionais, aliada à maior conscientização sobre os efeitos adversos do consumo excessivo de açúcar, é um fator-chave para o aumento da demanda por xilose em toda a região da Ásia-Pacífico.

- Por exemplo, em 2024, a Shandong Longlive Bio-Technology Co., Ltd. expandiu sua capacidade de produção para atender à crescente demanda por adoçantes naturais derivados de fontes vegetais, alinhando-se às tendências globais em direção a produtos alimentícios com rótulos limpos e foco na saúde. Espera-se que essas expansões estratégicas por parte de fabricantes importantes acelerem ainda mais o crescimento do mercado durante o período de previsão.

- À medida que os consumidores se tornam mais conscientes da importância da saúde e buscam ingredientes naturais em alimentos, bebidas e nutracêuticos, a xilose surge como uma alternativa promissora devido ao seu menor valor calórico e propriedades não cariogênicas. Isso a torna particularmente atraente para alimentos funcionais, suplementos alimentares e formulações adequadas para diabéticos.

- Além disso, a crescente aplicação da xilose em produtos farmacêuticos, cosméticos e químicos de base biológica contribui para o aumento de sua presença no mercado. Sua versatilidade em formulações e compatibilidade com diversas indústrias de uso final reforçam seu apelo como um ingrediente sustentável derivado de plantas.

- O crescente foco em formulações de produtos naturais, o aumento da renda disponível e a urbanização em economias emergentes como China, Índia e Indonésia estão impulsionando ainda mais a demanda por xilose. A tendência em direção a uma alimentação saudável e o apoio regulatório a ingredientes naturais continuam a fortalecer as perspectivas de crescimento do setor.

Restrição/Desafio

“Altos custos de produção e disponibilidade limitada de matéria-prima”

- Apesar do seu potencial promissor, o mercado da xilose enfrenta desafios relacionados aos elevados custos de produção e à disponibilidade limitada de matérias-primas adequadas para extração em larga escala. Os processos complexos e que demandam muitos recursos, envolvidos na obtenção de xilose a partir de biomassa lignocelulósica, frequentemente resultam em custos de fabricação elevados.

- Por exemplo, flutuações no fornecimento de resíduos agrícolas e o alto consumo de energia durante as etapas de hidrólise e purificação podem afetar a eficiência da produção e a rentabilidade geral, desencorajando a entrada de pequenos e médios produtores no mercado.

- Para superar esses desafios de custo, é necessário adotar processos biotecnológicos avançados, como hidrólise enzimática e fermentação microbiana, que podem melhorar o rendimento e reduzir o desperdício. Empresas como o Grupo Futaste e a Zhejiang Huakang Pharmaceutical Co., Ltd. estão investindo ativamente em P&D para aprimorar a eficiência dos processos e reduzir os custos operacionais.

- Além disso, a dependência de matérias-primas específicas, como sabugo de milho e lascas de madeira, limita a escalabilidade, especialmente em regiões com disponibilidade inconsistente de biomassa. O desenvolvimento de fontes alternativas de matéria-prima e a melhoria da gestão da cadeia de suprimentos são essenciais para garantir uma produção sustentável.

- Embora se espere que o progresso tecnológico e o apoio governamental às indústrias de base biológica reduzam gradualmente os custos de produção, a superação das limitações de matérias-primas e a ampliação de processos de fabricação eficientes continuam sendo cruciais para o crescimento e a competitividade a longo prazo do mercado de xilose na região Ásia-Pacífico.

Escopo do mercado de xilose na região Ásia-Pacífico

O mercado de xilose na região Ásia-Pacífico está segmentado em dois segmentos principais, com base no tipo de produto e nas aplicações.

• Por tipo de produto

Com base no tipo de produto, o mercado de xilose na região Ásia-Pacífico é segmentado em L-xilose, D-xilose e DL-xilose. O segmento de D-xilose dominou o mercado com a maior participação de receita, de 68,5% em 2024, impulsionado por seu amplo uso como adoçante natural e intensificador de sabor na indústria de alimentos e bebidas. A D-xilose é amplamente utilizada em formulações de panificação, confeitaria e bebidas devido ao seu baixo teor calórico e à capacidade de reter o sabor doce durante o processamento em altas temperaturas. Além disso, serve como um intermediário fundamental na produção de xilitol, impulsionando ainda mais sua demanda.

O segmento de L-xilose deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2025 e 2032, devido à sua crescente utilização em pesquisas farmacêuticas e bioquímicas. O crescimento do segmento é impulsionado pelo aumento dos investimentos em pesquisa e desenvolvimento de produtos de base biológica e pela crescente aplicação em formulações médicas, onde a L-xilose serve como precursor para compostos biotecnológicos avançados e suplementos nutricionais.

• Mediante inscrição

Com base na aplicação, o mercado de xilose na região Ásia-Pacífico é segmentado em Alimentos e Bebidas, Cosméticos/Cuidados Pessoais, Produtos Farmacêuticos, Indústria de Biocombustíveis e Outros. O segmento de Alimentos e Bebidas detinha a maior participação de mercado, com 52,4% em 2024, devido à crescente preferência dos consumidores por adoçantes naturais e ingredientes com rótulo limpo. A xilose é comumente utilizada em produtos alimentícios por seu sabor adocicado agradável, capacidade de retenção de umidade e propriedades de douramento, realçando o sabor e a textura em aplicações de panificação e confeitaria. A crescente preocupação com a saúde e a demanda por alternativas ao açúcar estão impulsionando ainda mais o crescimento do segmento.

Prevê-se que o segmento da Indústria de Biocombustíveis registre a taxa de crescimento anual composta (CAGR) mais rápida de 2025 a 2032, impulsionado pelos crescentes esforços para produzir combustíveis renováveis a partir de biomassa lignocelulósica. A xilose desempenha um papel crucial como açúcar fermentável na produção de bioetanol, alinhando-se com as metas regionais de sustentabilidade e as iniciativas governamentais que promovem soluções energéticas de base biológica. O aumento dos investimentos em pesquisa e desenvolvimento (P&D) em tecnologias de conversão de biomassa impulsiona ainda mais a rápida expansão deste segmento.

Análise Regional do Mercado de Xilose na Ásia-Pacífico

- A China dominou o mercado de xilose na região Ásia-Pacífico, com a maior participação na receita, de 33,8% em 2024, impulsionada por sua forte base industrial, abundante disponibilidade de biomassa agrícola e infraestrutura de fabricação bem estabelecida para xilose e derivados de açúcar relacionados.

- Consumidores e indústrias da região demonstram crescente preferência por adoçantes naturais de baixa caloria e ingredientes de base biológica, impulsionando a adoção da xilose nos setores alimentício, de bebidas e farmacêutico. O foco cada vez maior em formulações de produtos sustentáveis e que priorizam a saúde também contribui para o aumento da utilização da xilose em diversas aplicações finais.

- Essa ampla adoção é ainda mais impulsionada por iniciativas governamentais que promovem indústrias de base biológica, avanços na biotecnologia e a expansão das exportações de produtos derivados da xilose. Juntos, esses fatores posicionam a China como um importante centro de produção e consumo na região da Ásia-Pacífico, impulsionando o crescimento e a competitividade do mercado de xilose.

Análise do Mercado de Xilose na China

O mercado chinês de xilose detinha a maior participação de mercado em receita na região Ásia-Pacífico em 2024, com 58%, impulsionado pela abundante disponibilidade de matéria-prima, capacidade de produção com boa relação custo-benefício e forte demanda interna por adoçantes naturais. A China se destaca como um importante polo de produção de xilose e seus derivados, sustentada por uma indústria de biotecnologia e processamento de alimentos bem desenvolvida. A crescente base de consumidores preocupados com a saúde e a preferência por ingredientes de origem vegetal e com baixo teor calórico são os principais fatores de crescimento. Além disso, espera-se que os avanços contínuos nas tecnologias de extração e o aumento das exportações para os mercados globais sustentem a posição dominante da China no mercado regional de xilose.

Análise do Mercado de Xilose no Japão

Prevê-se que o mercado japonês de xilose cresça a uma taxa composta de crescimento anual (CAGR) notável durante o período de 2025 a 2032, impulsionado pelo forte foco do país em saúde, bem-estar e inovação de produtos. O setor de alimentos e bebidas do Japão está adotando cada vez mais a xilose por seus benefícios funcionais, incluindo baixo teor calórico e capacidade de melhorar a estabilidade do sabor em alimentos processados. A crescente preferência do consumidor por alternativas ao açúcar, juntamente com o uso de xilose em formulações farmacêuticas e de cuidados pessoais, impulsiona ainda mais a expansão do mercado. Além disso, a avançada capacidade de pesquisa do Japão e a ênfase em ingredientes de base biológica de alta qualidade contribuem para o crescimento da demanda interna.

Análise do Mercado de Xilose na Índia

Prevê-se que o mercado de xilose na Índia apresente a taxa de crescimento anual composta (CAGR) mais rápida durante o período de previsão, impulsionado pela crescente conscientização sobre saúde, urbanização e expansão do setor de processamento de alimentos. O aumento da renda disponível e o crescente interesse do consumidor por adoçantes naturais estão impulsionando a adoção da xilose em produtos de panificação, bebidas e confeitaria. Além disso, iniciativas governamentais que promovem indústrias de base biológica e manufatura sustentável estão incentivando a produção nacional. A expansão das indústrias nutracêutica e farmacêutica na Índia cria ainda mais oportunidades significativas para aplicações da xilose, particularmente em formulações para diabéticos e com baixo teor calórico.

Análise do Mercado de Xilose na Coreia do Sul

O mercado de xilose na Coreia do Sul deverá apresentar um crescimento substancial durante o período de previsão, impulsionado pelo crescente foco do país no consumo consciente em relação à saúde e pela inovação em ingredientes alimentares funcionais. As indústrias alimentícia e cosmética locais estão incorporando cada vez mais a xilose como adoçante e umectante natural. Além disso, o compromisso da Coreia do Sul com a sustentabilidade e o desenvolvimento da biotecnologia está fomentando a adoção de alternativas de açúcar de base biológica. A crescente colaboração em P&D e a demanda do consumidor por produtos com rótulos limpos devem impulsionar ainda mais o crescimento do mercado em diversos setores.

Participação de mercado da xilose na região Ásia-Pacífico

A indústria da xilose é liderada principalmente por empresas consolidadas, incluindo:

- Grupo Futaste (China)

- Shandong Longlive Bio-Technology Co., Ltd. (China)

- Zhejiang Huakang Farmacêutica Co., Ltd. (China)

- Mitsubishi Chemical Corporation (Japão)

- Towa Chemical Industry Co., Ltd. (Japão)

- Sanyo Chemical Industries, Ltd. (Japão)

- Dongguan Xiangsheng Chemical Co., Ltd.

- Shandong Bailong Chuangyuan Bio-Tech Co., Ltd.

- Nichirei Foods Inc. (Japão)

- Hubei Xingfa Chemicals Co., Ltd. (China)

- Corporação Nacional de Produtos Químicos da China (ChemChina) (China)

- Daicel Corporation (Japão)

- Gujarat State Fertilizers & Chemicals Ltd. (Índia)

- Lenzing AG (Áustria, operações na região da Ásia-Pacífico)

- Anhui Sunhere Biotech Co., Ltd.

- Shandong Jincheng Biotecnologia Co., Ltd.

- Changsha Tianjia Biochemical Co., Ltd. (China)

- Hangzhou Xinghe Chemical Co., Ltd. (China)

- Tianjin Bohai Chemical Co., Ltd. (China)

- Jiangsu Guotai International Group Co., Ltd. (China)

Quais são os desenvolvimentos recentes no mercado de xilose na região Ásia-Pacífico?

- Em abril de 2024, a Shandong Longlive Bio-Technology Co., Ltd., uma empresa líder em biotecnologia na China, anunciou a expansão de sua unidade de produção de xilose na província de Shandong para atender à crescente demanda global por adoçantes naturais. Essa medida estratégica visa aumentar a capacidade e a eficiência da produção por meio da integração da tecnologia de hidrólise enzimática. Ao utilizar técnicas avançadas de bioprocessamento, a empresa reforça sua posição como um dos principais players no mercado de xilose da região Ásia-Pacífico, que está em rápido crescimento, ao mesmo tempo em que apoia práticas de fabricação sustentáveis alinhadas com as metas ambientais globais.

- Em março de 2024, o Grupo Futaste, um dos principais fabricantes de xilose e xilitol da China, lançou uma nova linha de produtos de D-xilose de alta pureza, desenvolvida para uso nas indústrias alimentícia, farmacêutica e nutracêutica. A nova formulação prioriza a estabilidade do sabor doce e a resistência térmica, atendendo à crescente demanda por adoçantes naturais e de baixa caloria em produtos voltados para a saúde. Essa inovação reforça o compromisso da Futaste com o desenvolvimento de produtos baseado em pesquisa e com a promoção de alternativas mais saudáveis ao açúcar para consumidores em todo o mundo.

- Em março de 2024, a Zhejiang Huakang Pharmaceutical Co., Ltd. iniciou uma colaboração em P&D com a Towa Chemical Industry Co., Ltd. (Japão) para desenvolver processos avançados de extração de xilose baseados em fermentação. Essa parceria visa otimizar a utilização de recursos e aumentar a pureza de açúcares de base biológica, apoiando a produção em larga escala para os setores alimentício e farmacêutico. A iniciativa reflete a crescente cooperação regional em biotecnologia e inovação em ingredientes sustentáveis no mercado da Ásia-Pacífico.

- Em fevereiro de 2024, a Shandong Bailong Chuangyuan Bio-Tech Co., Ltd. anunciou a conclusão de seu projeto piloto para a produção de xilose e xilitol a partir de resíduos agrícolas, incluindo sabugo de milho e bagaço de cana-de-açúcar. Essa iniciativa apoia as políticas de economia circular e manufatura verde da China, reduzindo o desperdício e utilizando matérias-primas de biomassa renováveis. O sucesso deste projeto destaca a crescente adoção de métodos de produção ecologicamente corretos na indústria da xilose e estabelece um precedente para futuras inovações de base biológica.

- Em janeiro de 2024, a Mitsubishi Chemical Group Corporation (Japão) lançou um sistema de extração de xilose baseado em biotecnologia, projetado para melhorar o rendimento da produção e reduzir o impacto ambiental. Essa tecnologia permite a conversão eficiente de biomassa lignocelulósica em xilose de alta qualidade para uso em alimentos funcionais, produtos farmacêuticos e formulações cosméticas. O desenvolvimento reforça o foco estratégico da Mitsubishi Chemical em inovação sustentável e posiciona o Japão como líder regional em tecnologia de materiais de base biológica no mercado de xilose da Ásia-Pacífico.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.