Mercado de painéis à base de madeira da Ásia-Pacífico por produto (contraplacado, painel de fibras, painel de fios orientados, painel de partículas aglomeradas com cimento, painéis de madeira serrada, painéis de vigas em T, painéis de revestimento tensionado e outros) , espessura (9 mm, 10 mm, 18 mm , 20 MM, 40 MM, 50 MM e outros), Canal de distribuição (B2B, OEMS, lojas especializadas, comércio eletrónico e outros), Aplicação (porta exterior, guarnição de janela, parede de teto, lareira, chão e outros) , Utilizador final (edifícios residenciais, edifícios comerciais, hotéis, vilas, hospitais, escolas, centros comerciais e outros) – Tendências e previsões do setor até 2029

Análise e tamanho do mercado de painéis à base de madeira da Ásia-Pacífico

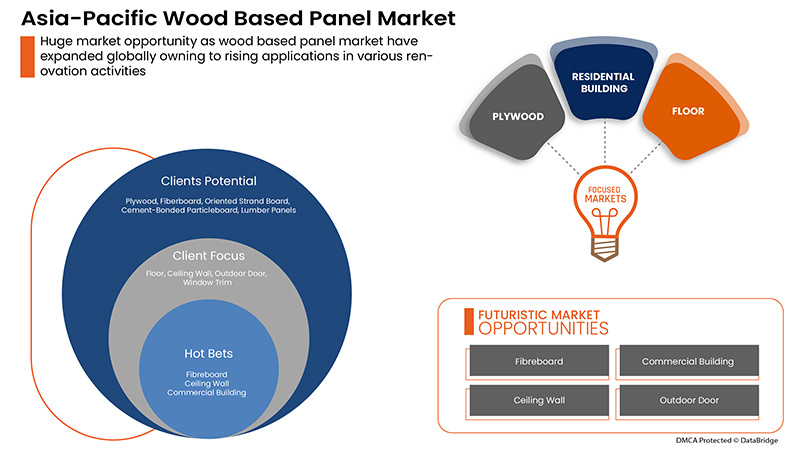

Os painéis à base de madeira são amplamente utilizados em tetos, revestimentos, coberturas , pavimentos e mobiliário devido à sua resistência e durabilidade. A crescente procura de produtos à base de madeira por parte das indústrias de utilização final está a acelerar o crescimento do mercado a nível mundial. A adaptação destas tecnologias à indústria de painéis à base de madeira foi estimulada pela necessidade de melhorar a qualidade do produto e de reduzir os custos de fabrico simultaneamente ou, melhor dizendo, de garantir a competitividade dos produtores de painéis à base de madeira. Consequentemente, a crescente procura de painéis de madeira irá provavelmente impulsionar o crescimento do mercado no período projetado.

A Data Bridge Market Research analisa que o mercado de painéis à base de madeira deverá atingir o valor de 77.677,64 milhões de dólares até ao ano de 2029, com um CAGR de 3,7% durante o período previsto. "Piso" representa o segmento de aplicação mais proeminente no respetivo mercado devido ao aumento do painel à base de madeira. O relatório de mercado com curadoria da equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e cenário da cadeia climática.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos |

|

Segmentos abrangidos |

Por produto (contraplacado, painel de fibras, painel de fios orientados, painel de partículas aglomeradas com cimento, painéis de madeira serrada, painéis de vigas em T, painéis de revestimento tensionado e outros), espessura (9 mm, 10 mm, 18 mm , 20 mm, 40 mm, 50 MM e outros), canal de distribuição (B2B, OEMS, lojas especializadas, comércio eletrónico e outros), aplicação (porta exterior, guarnição de janela, parede de teto, lareira, pavimento e outros), utilizador final (edifício residencial , Edifício Comercial, Hotéis, Vila, Hospitais, Escola, Shoppings e Outros). |

|

Países abrangidos |

Japão, China, Coreia do Sul, Índia, Singapura, Tailândia, Indonésia, Hong Kong, Malásia, Filipinas, Austrália e Nova Zelândia, Taiwan e restante Ásia-Pacífico. |

|

Atores do mercado abrangidos |

West Fraser, Dongwha Group, DARE panel group co., ltd., Canfor, Evergreen Fibreboard Berhad, Mieco Chipboard Berhad, Green River Holding Co., Ltd. e Kastamonu Entegre, entre outros. |

Definição de Mercado

Painel à base de madeira é um termo comum para uma variedade de produtos de placas diferentes, que têm uma boa variedade de propriedades de engenharia. Embora alguns tipos de painéis sejam relativamente novos no mercado, outros foram desenvolvidos e introduzidos com sucesso há mais de cem anos. No entanto, os tipos de painéis têm um longo historial de otimização contínua que ainda está longe de estar totalmente desenvolvido, e podem sempre ter uma hipótese de melhoria. Por um lado, os desenvolvimentos tecnológicos, as novas exigências regulamentares e de mercado, juntamente com uma situação de matéria-prima em constante mudança, impulsionam melhorias contínuas nos painéis à base de madeira e nos seus processos de fabrico.

Dinâmica do mercado do mercado de painéis de madeira da Ásia-Pacífico

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motores/Oportunidades enfrentadas pelo mercado de painéis à base de madeira da Ásia-Pacífico

- Aumento do consumo de painéis de madeira na renovação de casas e mobiliário

A indústria de painéis de madeira inclui chapas de contraplacado, painéis de madeira projetada, MDF (painéis de fibra de média densidade), painéis para mobiliário, aglomerados e produtos de superfície decorativos, como laminados. Espera-se que o aumento dos gastos dos consumidores com painéis de madeira na renovação de casas e mobiliário aumente a procura de painéis de madeira em edifícios comerciais e residenciais. A melhoria e o aumento das atividades de renovação de edifícios com a adoção de painéis de madeira para o aumento da estética são outros fatores que impulsionam o crescimento do mercado. Além disso, o aumento da construção de edifícios públicos, grandes hotéis e resorts com painéis decorativos de madeira levou ao crescimento do mercado.

- Procedimentos equilibrados de importação e exportação de painéis de madeira entre países

O comércio global de produtos de madeira é altamente regionalizado, com a Europa, América do Norte e Ásia. Nos últimos anos, o comércio global de produtos de madeira mudou muito com o aumento da procura de painéis de madeira e o aumento dos mercados emergentes de painéis de madeira. Nos últimos anos, o aumento da produção e do comércio de produtos de painéis à base de madeira, como contraplacado, aglomerado, painel de fibras, painéis de fios orientados e painéis de madeira serrada, aumentou devido ao aumento da procura do mercado imobiliário e à aumento global da população.

- Baixo custo do produto aliado às propriedades superiores dos painéis de madeira, incluindo resistência e durabilidade

Os painéis à base de madeira são produtos especiais que proporcionam um desempenho avançado, desempenho a longo prazo e durabilidade melhorada, além de serem mais baratos de produzir e utilizar. Os painéis de madeira oferecem uma incrível variedade de possibilidades em termos de aplicações estruturais e estéticas. Devido à sua acessibilidade, desempenho superior e flexibilidade no design, construção e renovação, a utilização de painéis de madeira está a aumentar nas construções residenciais. A construção com estrutura de madeira melhorou drasticamente com uma construção mais rápida, melhor utilização da fibra, menos desperdício e melhor controlo de qualidade. Os novos avanços tecnológicos em EWPs e ligações estão a posicionar a indústria de produtos de madeira para competir com sucesso na construção de estruturas muito maiores e mais complexas.

- Aumento de investimentos e iniciativas em atividades de construção tanto para fins comerciais como residenciais

O setor da construção civil tornou-se um setor transformador robusto e eficiente em todo o mundo. Em todos os países, o crescimento da procura de projetos de construção e imobiliários é impulsionado por megatendências macroeconómicas e disruptivas, como o aumento da urbanização, a expansão do comércio, tendências demográficas, como o aumento dos níveis de rendimento, e tecnologia e ambientes sustentáveis. . Com isto, foram iniciados vários projetos para criar comunidades socialmente inclusivas e sustentáveis, uma vez que o crescimento económico de qualquer país depende principalmente do desenvolvimento das suas infraestruturas.

Restrições/Desafios enfrentados pelo mercado de painéis à base de madeira da Ásia-Pacífico

- Aumento das preocupações com o pó causado pelo uso de painéis de madeira

Os painéis à base de madeira abrangem a produção de diversos produtos. Embora o fluxo de produção seja diferente de produto para produto, existem algumas características comuns em termos dos principais problemas ambientais. As emissões de poeiras, compostos orgânicos e formaldeído são as principais preocupações crescentes durante o fabrico de produtos de painéis de madeira. As emissões de partículas finas contribuem para as emissões de poeiras provenientes da produção de painéis à base de madeira, onde as partículas abaixo de 3 µm podem constituir até 50% do total de poeiras medidas devido às emissões de poeiras provenientes do fabrico de painéis à base de madeira, causando problemas de saúde e ambientais, o que está no topo da agenda da política ambiental.

- Flutuação nos preços da pasta de madeira

A flutuação do preço das matérias-primas afetará o custo de produção dos produtos de painéis à base de madeira. A alteração do custo de produção irá alterar a receita dos fabricantes. A pasta de madeira é retirada das árvores, mas devido à maior procura nas diferentes regiões, a importação e exportação da pasta de madeira são feitas dentro da quantidade especificada. A matéria-prima está disponível em diversas qualidades e a diferentes taxas, o que torna a produção à base de madeira muito difícil para os fabricantes. Custos de matérias-primas altamente flutuantes e uma gestão de preços ineficaz podem colocar um fabricante em grande risco no mercado. Devido à flutuação do preço da matéria-prima, os fabricantes podem agora fixar o custo do produto, resultando em prejuízos para os fabricantes.

- Flutuação dos preços das matérias-primas e inconsistência da cadeia de abastecimento

O ecossistema da cadeia de abastecimento tem-se tornado cada vez mais volátil devido à escassez de fatores como os elevados custos dos produtos, os custos de transporte, etc. Cada etapa do processamento no fabrico impacta a utilização do material e a eficiência de custos, o que é a razão do maior custo do material. O desafio mais comum para o fabricante de produtos de madeira é obter lucro e executar o processo de fabrico a baixo custo, mas com matéria-prima variável de alto custo.

Impacto pós-COVID-19 no mercado de painéis de madeira da Ásia-Pacífico

A COVID-19 impactou vários setores de manufatura no ano 2020-2021, uma vez que levou ao encerramento de locais de trabalho, à interrupção das cadeias de abastecimento e a restrições ao transporte. Devido ao bloqueio, o mercado sofreu uma quebra nas vendas devido ao encerramento de lojas de retalho e às restrições de acesso dos clientes nos últimos anos.

No entanto, o crescimento do mercado no período pós-pandemia é atribuído ao aumento de pessoas a trabalhar a partir de casa e ao maior rendimento disponível. Isto levou ao aumento da procura de mobiliário. Os principais participantes do mercado estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os jogadores estão a conduzir diversas atividades de I&D para melhorar as suas ofertas. Estão a aumentar a sua quota de mercado explorando diferentes canais de retalho e expandindo-se para novas regiões.

Este relatório sobre o mercado de painéis de madeira da Ásia-Pacífico fornece detalhes sobre os novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado , analisa as oportunidades em termos de bolsos emergentes receitas, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado da categoria, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado. Para mais informações sobre o mercado de painéis de madeira, contacte a Data Bridge Market Research para obter um resumo analítico. A nossa equipa irá ajudá-lo a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Desenvolvimentos recentes

- Em junho de 2021, a Canfor investiu aproximadamente 160 milhões de dólares para construir uma serração perto de DeRidder, Louisiana. Esta nova serração terá capacidade de fabrico e flexibilidade para produzir variedades de produtos de madeira de alto valor. Isto ajudará a empresa a aumentar a sua presença operacional e capacidade de produção para crescer no mercado.

- Em fevereiro de 2021, a Weyerhaeuser Company anunciou um acordo para comprar 69.200 acres de terras florestais de alta qualidade do Alabama à Soterra. A empresa comprou estas terras florestais por aproximadamente 149,00 milhões de dólares. A empresa irá melhorar as suas operações florestais e expandir a sua base de clientes e futuras oportunidades de exportação.

Âmbito do mercado de painéis à base de madeira da Ásia-Pacífico

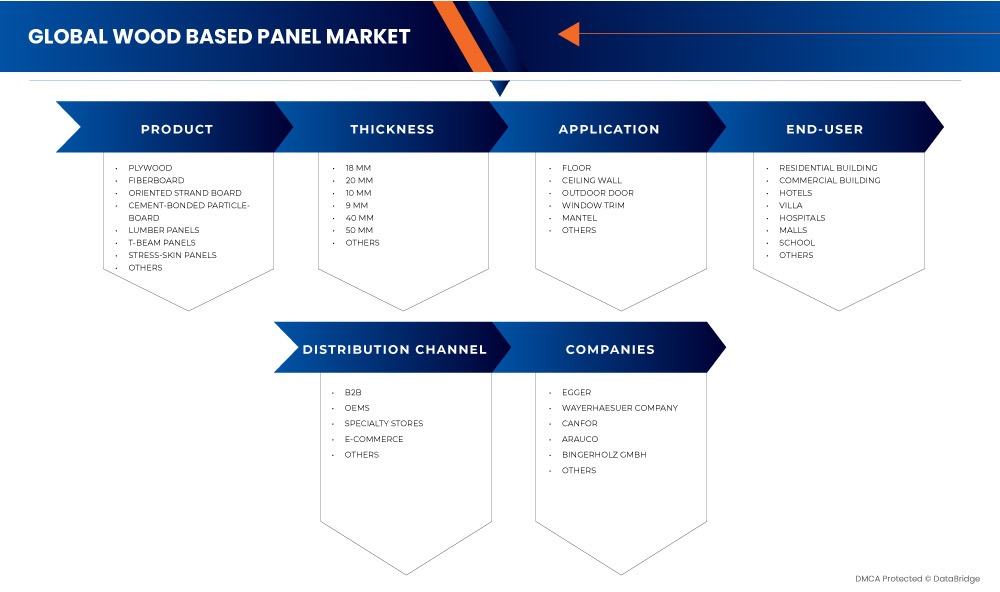

O mercado de painéis à base de madeira da Ásia-Pacífico está segmentado com base no produto, canal de distribuição, espessura, aplicação e utilizadores finais. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Produto

- Madeira compensada

- Painel de fibras

- Aglomerado de partículas aglomeradas com cimento

- Painel de fios orientados

- Painéis de madeira

- Painéis de viga T

- Painéis Stress-Skin

- Outros

Com base no produto, o mercado de painéis de madeira da Ásia-Pacífico está segmentado em contraplacado, painel de fibras, painel de fios orientados, painel de partículas aglomeradas com cimento, painéis de madeira serrada, painéis de vigas T, painéis de revestimento tensionado e outros.

Canal de Distribuição

- Comércio eletrónico

- OEM (fabricante de equipamento original)

- B2B

- Lojas especializadas

- Outros

Com base no canal de distribuição, o mercado de painéis de madeira da Ásia-Pacífico está segmentado em B2B, OEMS, lojas especializadas, comércio eletrónico e outros.

Grossura

- 9 MILÍMETROS

- 10 MILÍMETROS

- 18 MILÍMETROS

- 20 MILÍMETROS

- 40 MILÍMETROS

- 50 MILÍMETROS

- Outros

Com base na espessura, o mercado de painéis de madeira da Ásia-Pacífico está segmentado em 9 MM, 10 MM, 18 MM, 20 MM, 40 MM, 50 MM e outros.

Aplicação

- Porta externa

- Guarnição de janela

- Parede do teto

- Manto

- Andar

- Outros

Com base nas aplicações, o mercado de painéis de madeira da Ásia-Pacífico está segmentado em portas exteriores, guarnições de janelas, paredes de teto, lareiras, pavimentos e outros.

Utilizador final

- Edifício residencial

- Edifício comercial

- Hotéis

- Vila

- Hospitais

- Escola

- Shoppings

- Outros

Com base nos utilizadores finais, o mercado de painéis de madeira da Ásia-Pacífico está segmentado em edifícios residenciais, edifícios comerciais, hotéis, vilas, hospitais, escolas, centros comerciais e outros.

Análise/Insights regionais do mercado de painéis à base de madeira da Ásia-Pacífico

O mercado de painéis de madeira da Ásia-Pacífico é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado por produto, canal de distribuição, espessura, aplicação e utilizadores finais, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de painéis à base de madeira da Ásia-Pacífico são o Japão, a China, a Coreia do Sul, a Índia, Singapura, a Tailândia, a Indonésia, Hong Kong, a Malásia, as Filipinas, a Austrália e Nova Zelândia, Taiwan e o resto da Ásia-Pacífico.

A China está a dominar o mercado devido ao aumento dos gastos dos consumidores em painéis de madeira na renovação de casas e móveis na região. O aumento dos investimentos e das iniciativas orientadas para as atividades de construção, tanto comerciais como residenciais, está a impulsionar a procura da região por painéis de madeira.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas, análise das cinco forças de Porter e estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do panorama competitivo e da quota de mercado dos painéis à base de madeira da Ásia-Pacífico

O panorama competitivo do mercado de painéis de madeira da Ásia-Pacífico fornece detalhes dos concorrentes. Os detalhes incluem a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença global, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto e aplicação domínio. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de painéis de madeira da Ásia-Pacífico.

Alguns dos principais participantes que operam no mercado de painéis à base de madeira são West Fraser, Dongwha Group, DARE panel group co., ltd., Canfor, EVERGREEN FIBREBOARD BERHAD, Mieco Chipboard Berhad, Green River Holding Co., Ltd., Kastamonu Entegre entre outros.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC WOOD BASED PANELS MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 DISTRIBUTION CHANNEL LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 VENDOR SHARE ANALYSIS

2.13 IMPORT-EXPORT DATA

2.14 SECONDARY SOURCES

2.15 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTLE ANALYSIS

4.1.1 POLITICAL FACTORS

4.1.2 ECONOMIC FACTORS

4.1.3 SOCIAL FACTORS

4.1.4 TECHNOLOGICAL FACTORS

4.1.5 LEGAL FACTORS

4.1.6 ENVIRONMENTAL FACTORS

4.2 IMPORT EXPORT SCENARIO

4.3 PORTER’S FIVE FORCES:

4.3.1 THREAT OF NEW ENTRANTS:

4.3.2 THREAT OF SUBSTITUTES:

4.3.3 CUSTOMER BARGAINING POWER:

4.3.4 SUPPLIER BARGAINING POWER:

4.3.5 INTERNAL COMPETITION (RIVALRY):

4.4 PRICING TREND SCENARIO

4.5 PRODUCTION & CONSUMPTION ANALYSIS

4.6 RAW MATERIAL PRODUCTION COVERAGE

4.7 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

4.8 VENDOR SELECTION CRITERIA

4.9 REGULATORY FRAMWORK

5 CLIMATE CHANGE SCENARIO

5.1 ENVIRONMENTAL CONCERNS

5.2 INDUSTRY RESPONSE

5.3 GOVERNMENT’S ROLE

5.4 ANALYST RECOMMENDATION

6 SUPPLY CHAIN ANALYSIS

6.1 OVERVIEW

6.2 LOGISTIC COST SCENARIO

6.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 RISE IN CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE

7.1.2 BALANCED IMPORT AND EXPORT PROCEDURES OF WOOD PANELS AMONG THE COUNTRIES

7.1.3 LOW PRODUCT COST COUPLED WITH SUPERIOR PROPERTIES OF WOOD PANELS, INCLUDING STRENGTH AND DURABILITY

7.2 RESTRAINTS

7.2.1 STRINGENT RULES AND NORMS BY THE GOVERNMENT REGARDING DEFORESTATION

7.2.2 RISE IN CONCERNS OF DUST BY WOOD PANEL USAGE

7.2.3 FLUCTUATION IN THE PRICES OF WOOD PULP

7.3 OPPORTUNITIES

7.3.1 RISE IN INVESTMENTS AND INITIATIVES TOWARDS CONSTRUCTION ACTIVITIES FOR BOTH COMMERCIAL AND RESIDENTIAL

7.3.2 INCREASE IN PARTNERSHIPS FOR THE GROWTH OF CONSTRUCTION SECTOR IN EMERGING COUNTRIES

7.3.3 INCORPORATION OF APA STANDARDS FOR MANUFACTURERS AIDS THE PRODUCT ENTRY INTO THE MARKET

7.4 CHALLENGES

7.4.1 SHORTAGE OF TIMBER AND CLIMATE CHANGE

7.4.2 FLUCTUATION OF RAW MATERIAL PRICES AND SUPPLY CHAIN INCONSISTENCY

7.4.3 SHORTAGE IN LABOR AND FINANCIAL LOSSES

8 IMPACT OF COVID-19 ON THE ASIA PACIFIC WOOD BASED PANEL MARKET

8.1 ANALYSIS ON IMPACT OF COVID-19 ON ASIA PACIFIC WOOD BASED PANEL MARKET

8.2 AFTERMATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

8.3 STRATEGIC DECISION FOR MANUFACTURES AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

8.4 IMPACT ON PRICE

8.5 IMPACT ON DEMAND

8.6 IMPACT ON SUPPLY CHAIN

8.7 CONCLUSION

9 ASIA PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT

9.1 OVERVIEW

9.2 PLYWOOD

9.2.1 SOFTWOOD PLYWOOD

9.2.2 HARDWOOD PLYWOOD

9.2.3 OTHERS

9.3 FIBERBOARD

9.3.1 MDF

9.3.2 HDF

9.3.3 PARTICLEBOARD

9.3.4 HARDBOARD

9.3.5 OTHERS

9.4 ORIENTED STRAND BOARD

9.5 CEMENT-BONDED PARTICLEBOARD

9.6 LUMBER PANELS

9.7 T-BEAM PANELS

9.8 STRESS-SKIN PANELS

9.9 OTHERS

10 ASIA PACIFIC WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL

10.1 OVERVIEW

10.2 B2B

10.3 OEMS

10.4 SPECIALTY STORES

10.5 E-COMMERCE

10.6 OTHERS

11 ASIA PACIFIC WOOD BASED PANEL MARKET, BY THICKNESS

11.1 OVERVIEW

11.2 18 MM

11.3 20 MM

11.4 10 MM

11.5 9 MM

11.6 40 MM

11.7 50 MM

11.8 OTHERS

12 ASIA PACIFIC WOOD BASED PANEL MARKET, BY APPLICATION

12.1 OVERVIEW

12.2 FLOOR

12.3 CEILING WALL

12.4 OUTDOOR DOOR

12.5 WINDOW TRIM

12.6 MANTEL

12.7 OTHERS

13 ASIA PACIFIC WOOD BASED PANEL MARKET, BY END-USER

13.1 OVERVIEW

13.2 RESIDENTIAL BUILDING

13.2.1 PLYWOOD

13.2.2 FIBERBOARD

13.2.3 ORIENTED STRAND BOARD

13.2.4 CEMENT-BONDED PARTICLEBOARD

13.2.5 LUMBER PANELS

13.2.6 T-BEAM PANELS

13.2.7 STRESS-SKIN PANELS

13.2.8 OTHERS

13.3 COMMERCIAL BUILDING

13.3.1 PLYWOOD

13.3.2 FIBERBOARD

13.3.3 ORIENTED STRAND BOARD

13.3.4 CEMENT-BONDED PARTICLEBOARD

13.3.5 LUMBER PANELS

13.3.6 T-BEAM PANELS

13.3.7 STRESS-SKIN PANELS

13.3.8 OTHERS

13.4 HOTELS

13.4.1 PLYWOOD

13.4.2 FIBERBOARD

13.4.3 ORIENTED STRAND BOARD

13.4.4 CEMENT-BONDED PARTICLEBOARD

13.4.5 LUMBER PANELS

13.4.6 T-BEAM PANELS

13.4.7 STRESS-SKIN PANELS

13.4.8 OTHERS

13.5 VILLA

13.5.1 PLYWOOD

13.5.2 FIBERBOARD

13.5.3 ORIENTED STRAND BOARD

13.5.4 CEMENT-BONDED PARTICLEBOARD

13.5.5 LUMBER PANELS

13.5.6 T-BEAM PANELS

13.5.7 STRESS-SKIN PANELS

13.5.8 OTHERS

13.6 HOSPITALS

13.6.1 PLYWOOD

13.6.2 FIBERBOARD

13.6.3 ORIENTED STRAND BOARD

13.6.4 CEMENT-BONDED PARTICLEBOARD

13.6.5 LUMBER PANELS

13.6.6 T-BEAM PANELS

13.6.7 STRESS-SKIN PANELS

13.6.8 OTHERS

13.7 MALLS

13.7.1 PLYWOOD

13.7.2 FIBERBOARD

13.7.3 ORIENTED STRAND BOARD

13.7.4 CEMENT-BONDED PARTICLEBOARD

13.7.5 LUMBER PANELS

13.7.6 T-BEAM PANELS

13.7.7 STRESS-SKIN PANELS

13.7.8 OTHERS

13.8 SCHOOL

13.8.1 PLYWOOD

13.8.2 FIBERBOARD

13.8.3 ORIENTED STRAND BOARD

13.8.4 CEMENT-BONDED PARTICLEBOARD

13.8.5 LUMBER PANELS

13.8.6 T-BEAM PANELS

13.8.7 STRESS-SKIN PANELS

13.8.8 OTHERS

13.9 OTHERS

13.9.1 PLYWOOD

13.9.2 FIBERBOARD

13.9.3 ORIENTED STRAND BOARD

13.9.4 CEMENT-BONDED PARTICLEBOARD

13.9.5 LUMBER PANELS

13.9.6 T-BEAM PANELS

13.9.7 STRESS-SKIN PANELS

13.9.8 OTHERS

14 ASIA PACIFIC WOOD BASED PANEL MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 JAPAN

14.1.4 SOUTH KOREA

14.1.5 THAILAND

14.1.6 MALAYSIA

14.1.7 INDONESIA

14.1.8 AUSTRALIA & NEW ZEALAND

14.1.9 HONG KONG

14.1.10 TAIWAN

14.1.11 SINGAPORE

14.1.12 PHILIPPINES

14.1.13 REST OF ASIA-PACIFIC

15 ASIA PACIFIC WOOD BASED PANEL MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

15.2 MERGER & ACQUISITION

15.3 PRODUCT LAUNCH

15.4 PARTNERSHIP

15.5 EXPANSIONS

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 WEST FRASER

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENT

17.2 WEYERHAEUSER COMPANY

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENTS

17.3 CANFOR

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 EGGER GROUP

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ARAUCO

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 BINDERHOLZ GMBH

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 BOISE CASCADE

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DARE PANEL GROUP CO., LTD.

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 DONGWHA GROUP

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENTS

17.1 EVERGREEN FIBREBOARD BERHAD

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT DEVELOPMENTS

17.11 GEORGIA-PACIFIC

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENT

17.12 GREEN RIVER HOLDING CO., LTD.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENTS

17.13 KASTAMONU ENTEGRE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 KRONOPLUS LIMITED

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENTS

17.15 MIECO CHIPBOARD BERHAD

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT DEVELOPMENTS

17.16 PFEIFER GROUP

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 SONAE INDUSTRIA

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 STARBANK PANEL PRODUCTS LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 TIMBER PRODUCTS COMPANY

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 IMPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 2 EXPORT DATA OF FLOORING PANELS, ASSEMBLED, OF WOOD (EXCLUDING MULTILAYER PANELS AND FLOORING PANELS FOR MOSAIC FLOORS; HS CODE - 441879 (USD THOUSAND)

TABLE 3 EXPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 4 IMPORT OF WOOD BASED PANEL (1,000 M3)

TABLE 5 ASIA PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 7 ASIA PACIFIC PLYWOOD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC FIBERBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ORIENTED STRAND BOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC CEMENT-BONDED PARTICLEBOARD IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LUMBER PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC T-BEAM PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC STRESS-SKIN PANELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC B2B IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC OEMS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC SPECIALTY STORES IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC E-COMMERCE IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC 18 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC 20 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC 10 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC 9 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC 40 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC 50 MM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC FLOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC CEILING WALL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OUTDOOR DOOR IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC WINDOW TRIM IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC MANTEL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA PACIFIC RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 41 ASIA PACIFIC COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 42 ASIA PACIFIC COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 43 ASIA PACIFIC HOTELS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 44 ASIA PACIFIC HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 45 ASIA PACIFIC VILLA IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 46 ASIA PACIFIC VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 47 ASIA PACIFIC HOSPITALS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 48 ASIA PACIFIC HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 49 ASIA PACIFIC MALLS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 50 ASIA PACIFIC MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 51 ASIA PACIFIC SCHOOL IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 52 ASIA PACIFIC SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 53 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 54 ASIA PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 56 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY COUNTRY, 2020-2029 (MILLION CUBIC METERS)

TABLE 57 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 58 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 59 ASIA-PACIFIC PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 60 ASIA-PACIFIC FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 61 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 62 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 63 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 ASIA-PACIFIC WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 65 ASIA-PACIFIC RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 66 ASIA-PACIFIC COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 67 ASIA-PACIFIC HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 68 ASIA-PACIFIC VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 69 ASIA-PACIFIC HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 70 ASIA-PACIFIC MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 71 ASIA-PACIFIC SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 72 ASIA-PACIFIC OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 73 CHINA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 74 CHINA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 75 CHINA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 76 CHINA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 77 CHINA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 78 CHINA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 79 CHINA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 80 CHINA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 81 CHINA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 82 CHINA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 83 CHINA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 84 CHINA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 85 CHINA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 86 CHINA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 87 CHINA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 88 CHINA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 89 INDIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 90 INDIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 91 INDIA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 92 INDIA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 93 INDIA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 94 INDIA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 95 INDIA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 96 INDIA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 97 INDIA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 98 INDIA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 99 INDIA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 100 INDIA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 101 INDIA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 102 INDIA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 103 INDIA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 104 INDIA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 105 JAPAN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 106 JAPAN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 107 JAPAN PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 108 JAPAN FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 109 JAPAN WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 110 JAPAN WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 111 JAPAN WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 112 JAPAN WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 113 JAPAN RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 114 JAPAN COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 115 JAPAN HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 116 JAPAN VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 117 JAPAN HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 118 JAPAN MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 119 JAPAN SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 120 JAPAN OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 121 SOUTH KOREA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 122 SOUTH KOREA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 123 SOUTH KOREA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 124 SOUTH KOREA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 125 SOUTH KOREA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 126 SOUTH KOREA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 127 SOUTH KOREA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 SOUTH KOREA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 129 SOUTH KOREA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 130 SOUTH KOREA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 131 SOUTH KOREA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 132 SOUTH KOREA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 133 SOUTH KOREA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 134 SOUTH KOREA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 135 SOUTH KOREA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 136 SOUTH KOREA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 137 THAILAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 138 THAILAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 139 THAILAND PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 140 THAILAND FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 141 THAILAND WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 142 THAILAND WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 143 THAILAND WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 144 THAILAND WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 145 THAILAND RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 146 THAILAND COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 147 THAILAND HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 148 THAILAND VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 149 THAILAND HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 150 THAILAND MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 151 THAILAND SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 152 THAILAND OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 155 MALAYSIA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 161 MALAYSIA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 162 MALAYSIA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 163 MALAYSIA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 164 MALAYSIA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 166 MALAYSIA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 167 MALAYSIA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 168 MALAYSIA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 169 INDONESIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 170 INDONESIA WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 171 INDONESIA PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 172 INDONESIA FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 173 INDONESIA WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 174 INDONESIA WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 175 INDONESIA WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 185 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 186 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 187 AUSTRALIA & NEW ZEALAND PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 188 AUSTRALIA & NEW ZEALAND FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 189 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 190 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 191 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 192 AUSTRALIA & NEW ZEALAND WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 193 AUSTRALIA & NEW ZEALAND RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 194 AUSTRALIA & NEW ZEALAND COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 195 AUSTRALIA & NEW ZEALAND HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 196 AUSTRALIA & NEW ZEALAND VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 197 AUSTRALIA & NEW ZEALAND HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 198 AUSTRALIA & NEW ZEALAND MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 199 AUSTRALIA & NEW ZEALAND SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 200 AUSTRALIA & NEW ZEALAND OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 201 HONG KONG WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 202 HONG KONG WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 203 HONG KONG PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 204 HONG KONG FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 205 HONG KONG WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 HONG KONG WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 207 HONG KONG WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 208 HONG KONG WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 209 HONG KONG RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 210 HONG KONG COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 211 HONG KONG HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 212 HONG KONG VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 213 HONG KONG HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 214 HONG KONG MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 215 HONG KONG SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 216 HONG KONG OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 217 TAIWAN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 218 TAIWAN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 219 TAIWAN PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 220 TAIWAN FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 221 TAIWAN WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 222 TAIWAN WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 223 TAIWAN WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 224 TAIWAN WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 225 TAIWAN RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 226 TAIWAN COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 227 TAIWAN HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 228 TAIWAN VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 229 TAIWAN HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 230 TAIWAN MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 231 TAIWAN SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 232 TAIWAN OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 233 SINGAPORE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 234 SINGAPORE WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 235 SINGAPORE PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 236 SINGAPORE FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 237 SINGAPORE WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 238 SINGAPORE WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 239 SINGAPORE WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 240 SINGAPORE WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 241 SINGAPORE RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 242 SINGAPORE COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 243 SINGAPORE HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 244 SINGAPORE VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 245 SINGAPORE HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 246 SINGAPORE MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 247 SINGAPORE SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 248 SINGAPORE OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 249 PHILIPPINES WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 250 PHILIPPINES WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

TABLE 251 PHILIPPINES PLYWOOD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 252 PHILIPPINES FIBERBOARD IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 253 PHILIPPINES WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 254 PHILIPPINES WOOD BASED PANEL MARKET, BY THICKNESS, 2020-2029 (USD MILLION)

TABLE 255 PHILIPPINES WOOD BASED PANEL MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 256 PHILIPPINES WOOD BASED PANEL MARKET, BY END-USER, 2020-2029 (USD MILLION)

TABLE 257 PHILIPPINES RESIDENTIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 258 PHILIPPINES COMMERCIAL BUILDING IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 259 PHILIPPINES HOTELS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 260 PHILIPPINES VILLA IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 261 PHILIPPINES HOSPITALS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 262 PHILIPPINES MALLS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 263 PHILIPPINES SCHOOL IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 264 PHILIPPINES OTHERS IN WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 265 REST OF ASIA-PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (USD MILLION)

TABLE 266 REST OF ASIA-PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2020-2029 (MILLION CUBIC METERS)

Lista de Figura

FIGURE 1 ASIA PACIFIC WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC WOOD BASED PANEL MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC WOOD BASED PANELS MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC WOOD BASED PANELS MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC WOOD BASED PANELS MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC WOOD BASED PANELS MARKET: THE DISTRIBUTION CHANNEL LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC WOOD BASED PANELS MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 8 ASIA PACIFIC WOOD BASED PANELS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC WOOD BASED PANELS MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC WOOD BASED PANELS MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 11 ASIA PACIFIC WOOD BASED PANELS MARKET: VENDOR SHARE ANALYSIS

FIGURE 12 ASIA PACIFIC WOOD BASED PANELS MARKET: SEGMENTATION

FIGURE 13 RISING CONSUMER SPENDING ON WOOD BASED PANELS IN THE RENOVATION OF HOMES AND FURNITURE EXPECTED TO DRIVE THE ASIA PACIFIC WOOD BASED PANELS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 PLYWOOD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC WOOD BASED PANELS MARKET IN 2022 & 2029

FIGURE 15 IMPORT EXPORT SCENARIO (USD THOUSAND)

FIGURE 16 PRICE ANALYSIS FOR ASIA PACIFIC WOOD BASED PANEL MARKET, 2018-2022

FIGURE 17 EUROPE, EECCA, NORTH AMERICA WOOD BASED PANELS PRODUCTION, AND NET APPARENT CONSUMPTION, 2018-2020 FROM 2018-2020 (1,000 M3)

FIGURE 18 VENDOR SELECTION CRITERIA

FIGURE 19 SUPPLY CHAIN ANALYSIS- ASIA PACIFIC WOOD BASED PANEL MARKET

FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC WOOD BASED PANEL MARKET

FIGURE 21 EUROPE WOOD BASED PANEL PRODUCTION, IN 2018

FIGURE 22 EXPENDITURE ON FURNISHINGS, EQUIPMENT AND ROUTINE MAINTENANCE

FIGURE 23 WOOD PULP PRICE IN 2020 (USD DOLLAR)

FIGURE 24 ASIA PACIFIC WOOD BASED PANEL MARKET, BY PRODUCT, 2021

FIGURE 25 ASIA PACIFIC WOOD BASED PANEL MARKET, BY DISTRIBUTION CHANNEL, 2021

FIGURE 26 ASIA PACIFIC WOOD BASED PANEL MARKET, BY THICKNESS, 2021

FIGURE 27 ASIA PACIFIC WOOD BASED PANEL MARKET, BY APPLICATION, 2021

FIGURE 28 ASIA PACIFIC WOOD BASED PANEL MARKET, BY END-USER, 2021

FIGURE 29 ASIA-PACIFIC WOOD BASED PANEL MARKET: SNAPSHOT (2021)

FIGURE 30 ASIA-PACIFIC WOOD BASED PANEL MARKET: BY COUNTRY (2021)

FIGURE 31 ASIA-PACIFIC WOOD BASED PANEL MARKET: BY COUNTRY (2022 & 2029)

FIGURE 32 ASIA-PACIFIC WOOD BASED PANEL MARKET: BY COUNTRY (2021 & 2029)

FIGURE 33 ASIA-PACIFIC WOOD BASED PANEL MARKET: BY PRODUCT (2022-2029)

FIGURE 34 ASIA PACIFIC WOOD BASED PANEL MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.