Asia Pacific Unmanned Ground Vehicle Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

1.82 Billion

USD

3.44 Billion

2025

2033

USD

1.82 Billion

USD

3.44 Billion

2025

2033

| 2026 –2033 | |

| USD 1.82 Billion | |

| USD 3.44 Billion | |

|

|

|

|

Segmentação do mercado de veículos terrestres não tripulados na região Ásia-Pacífico, por aplicação (militar, comercial e de segurança pública federal), tamanho (grande (227 a 454 kg), médio (90 a 227 kg), muito grande (454 a 907 kg), extremamente grande (907 kg) e pequeno (4,5 a 907 kg)), sistema (cargas úteis, unidades de controle, conectores, fios elétricos, atuadores e componentes mecânicos), mobilidade (sobre esteiras, rodas, pernas e outros), modo de operação (teleoperado, autônomo e com cabo) - Tendências e previsões do setor até 2032.

Qual é o tamanho e a taxa de crescimento do mercado de veículos terrestres não tripulados na região Ásia-Pacífico?

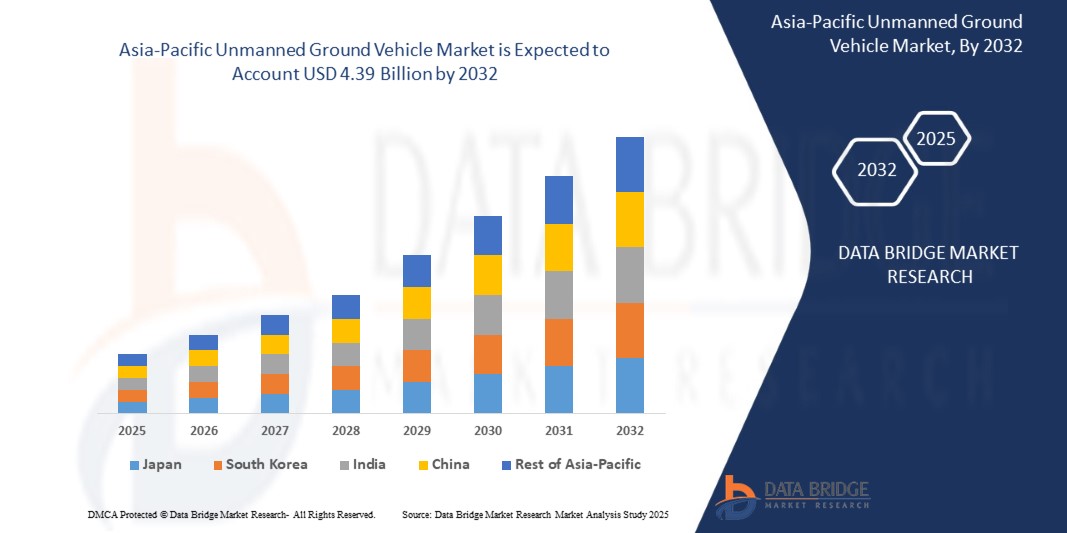

- O mercado de veículos terrestres não tripulados na região Ásia-Pacífico foi avaliado em US$ 1,50 bilhão em 2024 e deverá atingir US$ 4,39 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 14,30% durante o período de previsão.

- A crescente demanda por veículos terrestres não tripulados para o setor agrícola é um dos principais fatores que impulsionam o crescimento do mercado. A indústria está oferecendo novos produtos para aprimorar a conectividade de rede dos veículos e plataformas robóticas, o que também impulsiona o crescimento do mercado.

- A crescente demanda por sistemas autônomos nos setores de defesa e comercial está impulsionando o crescimento do mercado.

Quais são os principais pontos a serem considerados no mercado de veículos terrestres não tripulados?

- Programas crescentes de modernização da defesa, um forte foco na redução de baixas e a aceleração da automação nos setores de logística e mineração expandem conjuntamente a demanda potencial. O mercado de veículos terrestres não tripulados também se beneficia da queda nos custos de sensores e computação, o que possibilita uma autonomia sofisticada sem aumentos proporcionais de preço.

- O mercado chinês de veículos terrestres não tripulados detinha a maior participação na região Ásia-Pacífico em 2024, impulsionado pela expansão do complexo militar-industrial do país, pelos grandes investimentos em inteligência artificial e robótica e pela crescente ênfase em sistemas não tripulados para logística e vigilância.

- Prevê-se que o mercado de veículos terrestres não tripulados na Índia cresça a uma taxa composta de crescimento anual robusta até 2032, impulsionado pela iniciativa "Make in India", pelo aumento dos gastos com defesa e pelas necessidades urgentes de vigilância de fronteiras e capacidades de contra-insurgência.

- O segmento militar dominou o mercado com a maior participação na receita, de 61,5% em 2024, impulsionado pelo aumento da implantação de veículos terrestres não tripulados para vigilância, apoio ao combate, logística e desativação de explosivos.

Escopo do relatório e segmentação do mercado de veículos terrestres não tripulados

|

Atributos |

Principais informações de mercado sobre veículos terrestres não tripulados |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marcas, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de veículos terrestres não tripulados?

“ Capacidades autônomas e integração de IA redefinem as operações terrestres ”

- Uma tendência dominante que molda o mercado de veículos terrestres não tripulados (UGV) é a rápida integração de inteligência artificial (IA) , aprendizado de máquina e tecnologias de navegação autônoma, permitindo mapeamento avançado de terreno, desvio de obstáculos e tomada de decisões em tempo real em cenários de missão crítica.

- Por exemplo, em fevereiro de 2024, a Rheinmetall AG apresentou seu mais recente modelo de veículo terrestre autônomo não tripulado, com reconhecimento de alvos baseado em inteligência artificial e adaptação ao terreno, projetado para missões de logística e vigilância em zonas de conflito.

- Os veículos terrestres não tripulados (UGVs) estão sendo cada vez mais equipados com sistemas de fusão de sensores, combinando LiDAR , radar, GPS e imagens térmicas para melhorar o conhecimento situacional, especialmente em ambientes sem GPS e terrenos complexos.

- Agências de defesa e empresas do setor privado estão focando em plataformas modulares de veículos terrestres não tripulados, que permitem a troca de cargas úteis, como armas, sensores ou módulos de logística, para se adaptarem a diferentes requisitos de missão.

- Além disso, os avanços na comunicação V2X (veículo para tudo) estão permitindo o compartilhamento de dados em tempo real entre veículos terrestres não tripulados e centros de comando, aprimorando a coordenação e a eficácia das operações com múltiplas unidades.

- Essa transição para veículos terrestres não tripulados mais inteligentes e autônomos está transformando as operações militares, de mineração e agrícolas, reduzindo o risco humano, melhorando a eficiência e aumentando as taxas de sucesso das missões.

Quais são os principais fatores que impulsionam o mercado de veículos terrestres não tripulados?

- A crescente demanda por sistemas automatizados de defesa e vigilância, aliada à necessidade de reduzir a exposição dos soldados em ambientes hostis, é um fator crucial para a adoção de veículos terrestres não tripulados nos setores militar e de segurança interna.

- Em outubro de 2023, a Northrop Grumman Corporation anunciou testes de campo bem-sucedidos de um sistema de veículo terrestre não tripulado semiautônomo para vigilância perimetral e tarefas autônomas de reabastecimento, destacando o crescente investimento em sistemas robóticos na área de defesa.

- A crescente utilização de veículos terrestres não tripulados em setores comerciais como agricultura, mineração e petróleo e gás também impulsiona o crescimento do mercado, com esses veículos auxiliando no monitoramento de plantações, mapeamento de terrenos e manuseio de materiais perigosos.

- Iniciativas governamentais e programas de modernização da defesa em países da OTAN e da região Ásia-Pacífico estão impulsionando a demanda por sistemas não tripulados capazes de desempenhar funções de logística, reconhecimento e apoio ao combate.

- A crescente ênfase na segurança de fronteiras, operações antiterroristas e aplicações de resposta a desastres está incentivando ainda mais a aquisição de veículos terrestres não tripulados com mobilidade avançada e capacidades de sensoriamento.

- Em conjunto, esses fatores estão acelerando a integração de veículos terrestres não tripulados (UGVs) em operações multidomínio, transformando o cenário da automação terrestre e das estratégias de defesa.

Qual fator está desafiando o crescimento do mercado de veículos terrestres não tripulados?

- Um dos principais desafios que dificultam a adoção generalizada de veículos terrestres não tripulados é a infraestrutura de recarga limitada, especialmente em regiões rurais ou subdesenvolvidas. A ansiedade em relação à autonomia continua sendo uma preocupação para os consumidores acostumados com postos de gasolina em cada esquina.

- Por exemplo, apesar dos avanços, muitos países ainda não possuem as redes de carregamento rápido necessárias para suportar a adoção em larga escala, o que afeta a viabilidade de viagens de longa distância e a utilização de frotas.

- Além disso, o alto custo inicial dos Veículos Terrestres Não Tripulados (UTVs) premium, devido ao uso de baterias e sistemas de motores avançados, pode ser uma barreira, principalmente em mercados sensíveis a preços, como a Índia e o Sudeste Asiático.

- Preocupações relacionadas à vida útil da bateria, ao custo de substituição e ao impacto ambiental do descarte da bateria também representam obstáculos à sustentabilidade.

- Além disso, alguns consumidores são dissuadidos pela variedade e disponibilidade limitadas de modelos em comparação com as motocicletas tradicionais, especialmente nas categorias esportiva e touring.

- Superar esses desafios exigirá esforços colaborativos entre governos, fabricantes e fornecedores de energia para melhorar a infraestrutura, reduzir custos por meio da inovação e aumentar a educação do consumidor sobre os benefícios e a usabilidade de veículos terrestres não tripulados.

Como está segmentado o mercado de veículos terrestres não tripulados?

O mercado está segmentado com base no tipo de acionamento, tipo de bateria e uso final.

• Mediante inscrição

Com base na aplicação, o mercado de Veículos Terrestres Não Tripulados (UTVs) é segmentado em Militar, Comercial e de Segurança Pública Federal. O segmento Militar dominou o mercado com a maior participação na receita, de 61,5% em 2024, impulsionado pelo aumento da implantação de UTVs para vigilância, apoio em combate, logística e desativação de explosivos. As forças armadas em todo o mundo estão investindo em sistemas robóticos para aprimorar as capacidades de missão e reduzir o risco para o pessoal em ambientes hostis.

Prevê-se que o segmento Comercial apresente a taxa de crescimento anual composta (CAGR) mais rápida entre 2025 e 2032, impulsionado pela crescente adoção em setores como mineração, agricultura e inspeção de infraestrutura. Com o avanço das tecnologias autônomas, os veículos terrestres não tripulados (UGVs) são cada vez mais utilizados para tarefas que exigem muita mão de obra ou que sejam perigosas em diversos setores comerciais.

• Por tamanho

Com base no tamanho, o mercado é segmentado em Pequeno (4,5–90 kg), Médio (90–225 kg), Grande (225–450 kg), Muito Grande (450–900 kg) e Extremamente Grande (>900 kg). O segmento de VANTs pequenos detinha a maior participação de mercado, com 38,2% em 2024, devido à sua versatilidade, preço acessível e adequação para reconhecimento, vigilância e aplicações táticas em contextos militares e civis.

Prevê-se que o segmento de veículos extremamente grandes (acima de 2.000 libras) registre a taxa de crescimento mais rápida durante o período de previsão, devido ao aumento da demanda por veículos autônomos pesados utilizados em logística, missões de reabastecimento e operações de construção.

• Por sistema

Com base no sistema, o mercado de VANTs (Veículos Terrestres Não Tripulados) é segmentado em Cargas Úteis, Unidades de Controle, Conectores, Fios Elétricos, Atuadores e Componentes Mecânicos. O segmento de Cargas Úteis detinha a maior participação na receita, com 33,7% em 2024, impulsionado pela necessidade de sensores avançados, câmeras, sistemas de armas e ferramentas de comunicação integrados em veículos terrestres não tripulados para diversas funções operacionais.

O segmento de Unidades de Controle deverá apresentar o maior crescimento anual composto (CAGR) entre 2025 e 2032, impulsionado por inovações em tecnologias de controle remoto e autônomo, incluindo navegação orientada por IA e interfaces de comando em tempo real.

• Por Mobilidade

Com base na mobilidade, o mercado é segmentado em veículos sobre esteiras, sobre rodas, sobre pernas e outros. O segmento de veículos terrestres não tripulados sobre esteiras representou a maior participação de mercado em 2024, com 45,1%, devido às suas capacidades superiores em terrenos acidentados, estabilidade e capacidade de carga em operações de defesa e mineração.

Prevê-se que o segmento de veículos terrestres não tripulados com pernas apresente o crescimento mais rápido durante o período de previsão, devido aos avanços na robótica biomimética e à demanda por sistemas capazes de navegar em terrenos complexos, onde os sistemas com rodas ou esteiras são menos eficazes.

• Por Modo de Operação

Com base no modo de operação, o mercado de Veículos Terrestres Não Tripulados (UTVs) é segmentado em Teleoperados, Autônomos e Conectados por Cabo. O segmento Teleoperado dominou o mercado com a maior participação na receita, de 52,6% em 2024, devido ao uso generalizado em aplicações militares e industriais, onde o controle humano permanece crucial para a flexibilidade da missão e a capacidade de resposta situacional.

O segmento de veículos autônomos deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2025 e 2032, impulsionado pelos rápidos avanços em inteligência artificial (IA), visão computacional e sistemas de navegação autônoma. A crescente confiança em sistemas não tripulados e seu uso cada vez maior em logística, agricultura e defesa são fatores-chave que impulsionam esse crescimento.

Qual país detém a maior participação no mercado de veículos terrestres não tripulados?

- O mercado chinês de veículos terrestres não tripulados detinha a maior participação na região Ásia-Pacífico em 2024, impulsionado pela expansão do complexo militar-industrial do país, pelos grandes investimentos em inteligência artificial e robótica e pela crescente ênfase em sistemas não tripulados para logística e vigilância.

- O Exército de Libertação Popular (ELP) está testando e implantando ativamente veículos terrestres não tripulados para patrulhamento de fronteiras e treinamento em guerra urbana.

- Além disso, o setor comercial da China está integrando veículos terrestres não tripulados à agricultura inteligente e à inspeção industrial, impulsionando a adoção intersetorial.

Análise do Mercado de Veículos Terrestres Não Tripulados na Índia

Prevê-se que o mercado de veículos terrestres não tripulados (UGVs) na Índia cresça a uma taxa composta de crescimento anual (CAGR) robusta até 2032, impulsionado pela iniciativa "Make in India", pelo aumento dos gastos com defesa e pelas necessidades urgentes de vigilância de fronteiras e capacidades de contra-insurgência. As agências de defesa indianas estão firmando parcerias com startups e unidades do setor público para desenvolver tecnologias nacionais de UGVs adaptadas a terrenos acidentados e ambientes hostis. Além disso, empresas de mineração estão experimentando UGVs semiautônomos para o transporte de materiais em locais remotos.

Análise do Mercado Japonês de Veículos Terrestres Não Tripulados

O mercado japonês de veículos terrestres não tripulados está testemunhando uma adoção constante, impulsionado pelas avançadas capacidades robóticas do país, pelo forte foco na resiliência a desastres e pela estratégia de defesa em evolução. As Forças de Autodefesa do Japão estão explorando o uso de veículos terrestres não tripulados para busca e salvamento, desativação de explosivos (EOD) e segurança perimetral. No âmbito civil, o uso de robôs compactos e móveis na inspeção de infraestrutura e na automação agrícola pelo Japão está impulsionando ainda mais a penetração no mercado.

Análise do Mercado de Veículos Terrestres Não Tripulados na Coreia do Sul

O mercado de veículos terrestres não tripulados (UGVs) da Coreia do Sul está em rápida expansão, impulsionado pelo aumento da inovação na área de defesa, pelas necessidades de vigilância de fronteiras e pela colaboração entre empresas de defesa locais e institutos de pesquisa. A Coreia do Sul está investindo em UGVs com inteligência artificial para logística, vigilância e apoio em combate. Aplicações civis também estão surgindo, com UGVs sendo testados em construção e patrulhas de segurança. Espera-se que o incentivo do governo ao crescimento das exportações de defesa posicione a Coreia do Sul como um importante fabricante regional de veículos terrestres não tripulados.

Quais são as principais empresas no mercado de veículos terrestres não tripulados?

O setor de veículos terrestres não tripulados é liderado principalmente por empresas já consolidadas, incluindo:

- Honda Motor Co., Ltd. (Japão)

- Harley-Davidson, Inc. (EUA)

- Zero Motorcycles, Inc. (EUA)

- KTM AG (Áustria)

- BMW Motorrad (Alemanha)

- Maeving (Reino Unido)

- Energica Motor Company SpA (Itália)

- BOLO (Suécia)

- SUR-RON EUA (EUA)

- Movimento Elétrico (França)

- Fonz Moto Pty Limited (Austrália)

- Vetor de Arco (Reino Unido)

- Emflux Motors (Índia)

- Motocicletas Evoke (China)

- Fluxo de combustível (EUA)

- Kawasaki Heavy Industries, Ltd. (Japão)

- Savic Motorcycles (Austrália)

- Suzuki Motor Corporation (Japão)

- Motocicletas Tacita (Itália)

- Tarform Luna (EUA)

Quais são os desenvolvimentos recentes no mercado de veículos terrestres não tripulados na região Ásia-Pacífico?

- Em junho de 2025, a Administração de Material de Defesa da Suécia (FMV) concedeu à Rheinmetall um contrato no valor de USD 563.000 para avaliar seu Veículo Terrestre Não Tripulado (UGV) Mission Master no âmbito do programa DAMM. Essa iniciativa reflete o compromisso contínuo da Suécia com a integração de sistemas autônomos em futuras operações de defesa.

- Em maio de 2025, a Huawei implantou 100 caminhões elétricos autônomos com tecnologia 5G-A na mina de carvão de Yimin, na China, registrando uma eficiência operacional 120% maior em comparação com as frotas tradicionais operadas manualmente. Essa implantação reforça a crescente viabilidade comercial e os benefícios de produtividade das tecnologias de veículos não tripulados em ambientes industriais.

- Em março de 2025, a Ucrânia executou com sucesso seu primeiro ataque de combate em grande escala utilizando apenas veículos terrestres não tripulados (UGVs) e drones FPV, demonstrando a eficácia em campo de batalha de táticas autônomas de armas combinadas. Isso representa um marco significativo na guerra moderna, destacando o potencial operacional de cenários de combate terrestre totalmente não tripulados.

- Em janeiro de 2025, a Direção-Geral de Armamentos da França (DGA) iniciou o programa DROIDE em parceria com a KNDS e a Safran, com o objetivo de desenvolver robôs terrestres multimissão para implantação até 2035. Este programa enfatiza o foco estratégico de longo prazo da França em robótica e autonomia no planejamento da defesa nacional.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELING

2.7 SIZE TIMELINE CURVE

2.8 MARKET APPLICATION COVERAGE GRID

2.9 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.1 DBMR MARKET POSITION GRID

2.11 DBMR VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHT

4.1 PESTEL ANALYSIS

4.2 CASE STUDY ANALYSIS

4.2.1 CASE STUDY: DEPLOYMENT OF THEMIS UNMANNED GROUND VEHICLE AND ITS IMPACT ON MILITARY LOGISTICS AND COMBAT SUPPORT OPERATIONS

4.2.1.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.1.2 OPERATIONAL CHALLENGES PRIOR TO UGV INTEGRATION

4.2.1.2.1 HIGH PERSONNEL RISK IN FRONTLINE AND SUPPORT MISSIONS

4.2.1.2.2 LOGISTICAL CONSTRAINTS IN CONTESTED AND REMOTE TERRAIN

4.2.1.2.3 DEMAND FOR ENHANCED SITUATIONAL AWARENESS

4.2.1.3 TECHNOLOGICAL AND OPERATIONAL MEASURES INTRODUCED

4.2.1.3.1 MODULAR UGV ARCHITECTURE

4.2.1.3.2 REMOTE AND SEMI-AUTONOMOUS OPERATION

4.2.1.3.3 INTEGRATION WITH EXISTING FORCE STRUCTURES

4.2.1.4 IMPACT ON MILITARY OPERATIONS AND LOGISTICS EFFICIENCY

4.2.1.4.1 IMPROVED LOGISTICS CONTINUITY

4.2.1.4.2 REDUCED EXPOSURE OF HUMAN PERSONNEL

4.2.1.4.3 ENHANCED OPERATIONAL FLEXIBILITY

4.2.1.4.4 SUPPORT FOR MULTI-DOMAIN OPERATIONS

4.2.1.5 LIMITATIONS AND LESSONS LEARNED

4.2.1.5.1 DEPENDENCE ON COMMUNICATIONS AND CONTROL SYSTEMS

4.2.1.5.2 CONSTRAINTS ON FULL AUTONOMY IN COMPLEX ENVIRONMENTS

4.2.2 CASE STUDY: MULTIFUNCTIONAL UNMANNED GROUND VEHICLES IN EMERGENCY RESPONSE AND PUBLIC SAFETY OPERATIONS

4.2.2.1 BACKGROUND AND STRATEGIC CONTEXT

4.2.2.2 OPERATIONAL CHALLENGES BEFORE UGV DEPLOYMENT

4.2.2.2.1 HIGH RISK TO FIRST RESPONDERS

4.2.2.2.2 DELAYS IN INCIDENT ASSESSMENT

4.2.2.3 TECHNOLOGICAL MEASURES INTRODUCED

4.2.2.3.1 INTEGRATED SENSORS AND MANIPULATION TOOLS

4.2.2.3.2 REMOTE COMMAND AND CONTROL OPERATIONS

4.2.2.4 IMPACT ON EMERGENCY RESPONSE EFFECTIVENESS

4.2.2.4.1 IMPROVED RESPONDER SAFETY

4.2.2.4.2 FASTER AND MORE INFORMED DECISION-MAKING

4.3 CONSUMER BUYING BEHAVIOUR

4.4 CONSUMER PURCHASE DECISION PROCESS

4.4.1 PROBLEM RECOGNITION

4.4.2 INFORMATION SEARCH

4.4.3 ALTERNATIVE EVALUATION

4.4.4 PURCHASE DECISION

4.4.5 POST-PURCHASE BEHAVIOR

4.4.6 INFLUENCING FACTORS

4.5 KEY STRATEGIC INITIATIVES

4.5.1 INTEGRATION OF UGVS INTO MULTI-DOMAIN DEFENCE AND SECURITY ARCHITECTURES

4.5.1.1 CONVERGENCE OF LAND, AIR, AND COMMAND-AND-CONTROL SYSTEMS

4.5.1.2 INTEROPERABILITY WITH EXISTING MILITARY AND HOMELAND SECURITY ASSETS

4.5.1.3 Coordination of Multimodal Transport Networks

4.5.2 EMPHASIS ON AUTONOMY, ARTIFICIAL INTELLIGENCE AND ADVANCED SENSING

4.5.2.1 ADVANCEMENT OF SEMI-AUTONOMOUS AND AUTONOMOUS NAVIGATION

4.5.2.2 INTEGRATION OF MULTI-SENSOR AND PERCEPTION SYSTEMS

4.5.3 PLATFORM MODULARITY AND MISSION-SPECIFIC CONFIGURABILITY

4.5.3.1 DEVELOPMENT OF MODULAR PAYLOAD AND CHASSIS DESIGNS

4.5.3.2 SUPPORT FOR DUAL-USE AND CIVIL–MILITARY APPLICATIONS

4.5.4 LOCALISATION, DOMESTIC MANUFACTURING AND SUPPLY CHAIN RESILIENCE

4.5.4.1 ALIGNMENT WITH NATIONAL DEFENCE INDUSTRIAL POLICIES

4.5.4.2 STRENGTHENING OF REGIONAL SUPPLY AND MAINTENANCE ECOSYSTEMS

4.5.5 CYBERSECURITY, RELIABILITY AND OPERATIONAL RESILIENCE

4.5.5.1 INTEGRATION OF SECURE COMMUNICATION AND CYBER HARDENING

4.5.5.2 DESIGN FOR HARSH AND CONTESTED ENVIRONMENTS

4.5.6 EXPANSION OF INTERNATIONAL COLLABORATIONS AND DEFENCE PARTNERSHIPS

4.5.6.1 CROSS-BORDER TECHNOLOGY COLLABORATION AND JOINT PROGRAMS

4.5.6.2 PARTICIPATION IN ASIA-PACIFIC DEFENCE MODERNISATION PROGRAMS

4.6 REGIONAL GROWTH OPPORTUNITIES

4.6.1 NORTH AMERICA — ADVANCED DEFENCE DOCTRINE AND TECHNOLOGY LEADERSHIP

4.6.1.1 INSTITUTIONALISATION OF ROBOTIC AND AUTONOMOUS GROUND SYSTEMS

4.6.1.2 BORDER SECURITY, BASE PROTECTION AND HOMELAND APPLICATIONS

4.6.2 EUROPE — MULTINATIONAL COOPERATION AND TERRITORIAL SECURITY

4.6.2.1 COLLECTIVE DEFENCE AND INTEROPERABILITY-DRIVEN DEMAND

4.6.2.2 HEIGHTENED FOCUS ON BORDER SURVEILLANCE AND INFRASTRUCTURE PROTECTION

4.6.3 ASIA–PACIFIC — STRATEGIC TENSIONS AND DUAL-USE EXPANSION

4.6.3.1 BORDER MANAGEMENT AND TERRAIN-INTENSIVE OPERATIONS

4.6.3.2 DISASTER RESPONSE, URBAN SAFETY AND CIVIL APPLICATIONS

4.6.4 MIDDLE EAST — BORDER CONTROL AND CRITICAL ASSET SECURITY

4.6.4.1 PROTECTION OF ENERGY AND STRATEGIC INFRASTRUCTURE

4.6.4.2 LOCAL DEFENCE INDUSTRIAL DEVELOPMENT

4.6.5 CONCLUSION

4.7 TECHNOLOGICAL ADVANCEMENTS

4.7.1 OVERVIEW

4.7.2 AUTONOMOUS NAVIGATION AND ADVANCED SLAM CAPABILITIES

4.7.3 ARTIFICIAL INTELLIGENCE–DRIVEN PERCEPTION AND SENSOR FUSION

4.7.4 EDGE COMPUTING AND ON-BOARD AUTONOMY

4.7.5 SWARMING TECHNOLOGIES AND MULTI-VEHICLE COORDINATION

4.7.6 MODULAR DESIGN AND OPEN-SYSTEM ARCHITECTURES

4.7.7 DIGITAL TWINS, SIMULATION, AND SYNTHETIC TRAINING ENVIRONMENTS

4.7.8 CONCLUSION

4.8 PRICING ANALYSIS

4.9 COMPANY COMPARATIVE ANALYSIS: TOP SELLING MODEL VS PRICE RANGE

4.1 IMPORT EXPORT SCENARIO

4.10.1 COUNTRY-LEVEL PATTERNS

4.10.2 COMPANY-LEVEL TRADE BEHAVIOR

4.11 SUSTAINABILITY INITIATIVES

4.11.1 SUSTAINABILITY DRIVERS IN THE UGV MARKET:

4.11.2 REAL-TIME EXAMPLES: SUSTAINABILITY IN PRACTICE

4.11.2.1 Defense Sector: Hybridization and Fuel Reduction

4.11.2.2 Active Combat Logistics: Resource Optimization

4.11.2.3 Agriculture: Direct Environmental Sustainability Impact

4.11.2.4 Disaster Response & Hazard Mitigation

4.11.3 CROSS-CUTTING SUSTAINABILITY THEMES

4.11.4 STRATEGIC IMPLICATIONS FOR THE UGV MARKET

4.12 TECHNOLOGICAL TRENDS

4.13 SUPPLY CHAIN ANALYSIS

4.13.1 RAW MATERIALS AND FOUNDATIONAL INPUTS

4.13.2 CORE COMPONENT MANUFACTURING

4.13.3 SENSORS, ELECTRONICS, AND SUBSYSTEMS

4.13.4 SOFTWARE, AUTONOMY, AND CONTROL SYSTEMS

4.13.5 SYSTEM INTEGRATION AND FINAL ASSEMBLY

4.13.6 DISTRIBUTION, DEPLOYMENT, AND LIFECYCLE SUPPORT

5 REGULATORY STANDARDS

5.1 DEFENSE AND MILITARY PROCUREMENT FRAMEWORKS

5.1.1 NATIONAL DEFENSE ACQUISITION SYSTEMS

5.1.2 REGULATIONS ON WEAPONIZATION AND AUTONOMOUS ENGAGEMENT

5.2 SAFETY AND OPERATIONAL COMPLIANCE STANDARDS

5.2.1 INTERNATIONAL ROBOTICS AND FUNCTIONAL SAFETY STANDARDS

5.2.2 SECTOR-SPECIFIC OPERATIONAL SAFETY REQUIREMENTS

5.3 COMMUNICATION, SPECTRUM, AND CYBERSECURITY REGULATIONS

5.3.1 RADIOFREQUENCY SPECTRUM GOVERNANCE

5.3.2 CYBERSECURITY AND ENCRYPTION COMPLIANCE

5.4 ARTIFICIAL INTELLIGENCE, AUTONOMY AND ETHICAL GOVERNANCE

5.4.1 INTERNATIONAL AI PRINCIPLES AND HUMAN-CONTROL REQUIREMENTS

5.4.2 NATIONAL AND REGIONAL AI REGULATORY POLICIES

5.5 EXPORT CONTROL AND CROSS-BORDER TRADE REGULATIONS

5.5.1 CONTROL OF DUAL-USE TECHNOLOGIES

5.5.2 SANCTIONS AND MARKET ACCESS LIMITATIONS

5.6 CERTIFICATION, TESTING, AND FIELD DEPLOYMENT STANDARDS

5.6.1 DEFENSE OPERATIONAL TESTING AND EVALUATION

5.6.2 INDUSTRIAL AND COMMERCIAL COMPLIANCE PATHWAYS

5.7 CONCLUSION

6 MARKET OVERVIEW

6.1 DRIVER

6.1.1 DEFENCE MODERNIZATION PROGRAMS ACCELERATING ASIA-PACIFIC UGV PROCUREMENT MOMENTUM

6.1.2 ADVANCEMENTS IN AI AND SENSORS ENABLING HIGHER-AUTONOMY CAPABILITIES

6.1.3 EXPANDING COMMERCIAL ADOPTION ACROSS MINING, AGRICULTURE, AND LOGISTICS

6.1.4 GROWING USAGE OF UNMANNED GROUND VEHICLES IN AREAS AFFECTED BY CBRN ATTACKS

6.2 RESTRAINT

6.2.1 HIGH DEVELOPMENT AND INTEGRATION COSTS LIMITING WIDER DEPLOYMENT

6.2.2 EXPORT CONTROLS AND POLICY RESTRICTIONS CONSTRAINING ASIA-PACIFIC SALES

6.3 OPPORTUNITIES

6.3.1 MODULAR MISSION-PAYLOAD DESIGNS UNLOCKING DIVERSIFIED APPLICATION SEGMENTS OF UGV

6.3.2 EXPANDING ROLE OF UNMANNED SYSTEMS IN MULTI-DOMAIN OPERATIONS

6.3.3 AFTERMARKET SERVICE AND SOFTWARE EXPANDING UGV PROFITABILITY POTENTIAL

6.4 CHALLENGES

6.4.1 CYBERSECURITY VULNERABILITIES CREATING OPERATIONAL AND SAFETY RISKS

6.4.2 RELIABILITY ISSUES IN HARSH, CONTESTED, AND REMOTE ENVIRONMENTS

7 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE

7.1 OVERVIEW

7.2 MICRO UGVS (<10 LBS)

7.3 SMALL (10 - 200 LBS)

7.4 MEDIUM (200 - 500 LBS)

7.5 LARGE (500 – 1,000 LBS)

7.6 VERY LARGE (1,000 – 2,000 LBS)

7.7 EXTREMELY LARGE (>2,000 LBS)

7.8 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.8.1 ASIA-PACIFIC

7.8.2 EUROPE

7.8.3 NORTH AMERICA

7.8.4 SOUTH AMERICA

7.8.5 MIDDLE EAST & AFRICA

7.9 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.9.1 ASIA-PACIFIC

7.9.2 EUROPE

7.9.3 NORTH AMERICA

7.9.4 SOUTH AMERICA

7.9.5 MIDDLE EAST & AFRICA

7.1 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.10.1 ASIA-PACIFIC

7.10.2 EUROPE

7.10.3 NORTH AMERICA

7.10.4 SOUTH AMERICA

7.10.5 MIDDLE EAST & AFRICA

7.11 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.11.1 ASIA-PACIFIC

7.11.2 EUROPE

7.11.3 NORTH AMERICA

7.11.4 SOUTH AMERICA

7.11.5 MIDDLE EAST & AFRICA

7.12 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.12.1 ASIA-PACIFIC

7.12.2 EUROPE

7.12.3 NORTH AMERICA

7.12.4 SOUTH AMERICA

7.12.5 MIDDLE EAST & AFRICA

7.13 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

7.13.1 ASIA-PACIFIC

7.13.2 EUROPE

7.13.3 NORTH AMERICA

7.13.4 SOUTH AMERICA

7.13.5 MIDDLE EAST & AFRICA

8 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM

8.1 OVERVIEW

8.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

8.2.1 PAYLOADS

8.2.2 CONTROLLER UNITS

8.2.3 POWER SYSTEM

8.2.4 NAVIGATION SYSTEM

8.2.5 CHASSIS SYSTEM

8.2.6 COMMUNICATION SYSTEM

8.2.7 OTHERS

8.3 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.3.1 CAMERAS

8.3.2 SENSORS

8.3.3 GPS ANTENNAS

8.3.4 LASERS

8.3.5 RADARS

8.3.6 MOTOR ENCODERS

8.3.7 ARTICULATED ARMS

8.3.8 OTHERS

8.4 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.4.1 ASIA-PACIFIC

8.4.2 EUROPE

8.4.3 NORTH AMERICA

8.4.4 SOUTH AMERICA

8.4.5 MIDDLE EAST & AFRICA

8.5 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.5.1 ASIA-PACIFIC

8.5.2 EUROPE

8.5.3 NORTH AMERICA

8.5.4 SOUTH AMERICA

8.5.5 MIDDLE EAST & AFRICA

8.6 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.6.1 ELECTRIC NON SOLAR RECHARGEABLE BATTERY

8.6.2 SOLAR RECHARGEABLE BATTERY

8.7 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.7.1 LITHIUM ION

8.7.2 LEAD ACID

8.7.3 NICKEL METAL HYDRIDE

8.7.4 NICKEL CADMIUM

8.8 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.8.1 ASIA-PACIFIC

8.8.2 EUROPE

8.8.3 NORTH AMERICA

8.8.4 SOUTH AMERICA

8.8.5 MIDDLE EAST & AFRICA

8.9 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.9.1 ASIA-PACIFIC

8.9.2 EUROPE

8.9.3 NORTH AMERICA

8.9.4 SOUTH AMERICA

8.9.5 MIDDLE EAST & AFRICA

8.1 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.10.1 MOTOR

8.10.2 ACTUATOR

8.11 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.11.1 ASIA-PACIFIC

8.11.2 EUROPE

8.11.3 NORTH AMERICA

8.11.4 SOUTH AMERICA

8.11.5 MIDDLE EAST & AFRICA

8.12 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

8.12.1 RF COMMUNICATION

8.12.2 SATELLITE COMMUNICATION

8.12.3 4G/5G COMMUNICATION

8.13 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.13.1 ASIA-PACIFIC

8.13.2 EUROPE

8.13.3 NORTH AMERICA

8.13.4 SOUTH AMERICA

8.13.5 MIDDLE EAST & AFRICA

8.14 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

8.14.1 ASIA-PACIFIC

8.14.2 EUROPE

8.14.3 NORTH AMERICA

8.14.4 SOUTH AMERICA

8.14.5 MIDDLE EAST & AFRICA

9 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY

9.1 OVERVIEW

9.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

9.2.1 WHEELED

9.2.2 TRACKED

9.2.3 LEGGED

9.2.4 HYBRID

9.2.5 SNAKE/ARTICULATED MOBILITY

9.3 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.3.1 ASIA-PACIFIC

9.3.2 EUROPE

9.3.3 NORTH AMERICA

9.3.4 SOUTH AMERICA

9.3.5 MIDDLE EAST & AFRICA

9.4 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.4.1 ASIA-PACIFIC

9.4.2 EUROPE

9.4.3 NORTH AMERICA

9.4.4 SOUTH AMERICA

9.4.5 MIDDLE EAST & AFRICA

9.5 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.5.1 ASIA-PACIFIC

9.5.2 EUROPE

9.5.3 NORTH AMERICA

9.5.4 SOUTH AMERICA

9.5.5 MIDDLE EAST & AFRICA

9.6 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.6.1 ASIA-PACIFIC

9.6.2 EUROPE

9.6.3 NORTH AMERICA

9.6.4 SOUTH AMERICA

9.6.5 MIDDLE EAST & AFRICA

9.7 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

9.7.1 ASIA-PACIFIC

9.7.2 EUROPE

9.7.3 NORTH AMERICA

9.7.4 SOUTH AMERICA

9.7.5 MIDDLE EAST & AFRICA

10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION

10.1 OVERVIEW

10.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

10.2.1 TELEOPERATED

10.2.2 TETHERED

10.2.3 AUTONOMOUS

10.3 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.3.1 ASIA-PACIFIC

10.3.2 EUROPE

10.3.3 NORTH AMERICA

10.3.4 SOUTH AMERICA

10.3.5 MIDDLE EAST & AFRICA

10.4 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.4.1 ASIA-PACIFIC

10.4.2 EUROPE

10.4.3 NORTH AMERICA

10.4.4 SOUTH AMERICA

10.4.5 MIDDLE EAST & AFRICA

10.5 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

10.5.1 SEMI-AUTONOMOUS

10.5.2 FULLY AUTONOMOUS

10.6 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

10.6.1 ASIA-PACIFIC

10.6.2 EUROPE

10.6.3 NORTH AMERICA

10.6.4 SOUTH AMERICA

10.6.5 MIDDLE EAST & AFRICA

11 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD

11.1 OVERVIEW

11.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

11.2.1 LIGHT DUTY (LESS THAN 50 KG

11.2.2 MEDIUM DUTY (50–200 KG)

11.2.3 HEAVY DUTY (200–1,000 KG)

11.2.4 ULTRA-HEAVY DUTY (>1,000 KG)

11.3 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.3.1 ASIA-PACIFIC

11.3.2 EUROPE

11.3.3 NORTH AMERICA

11.3.4 SOUTH AMERICA

11.3.5 MIDDLE EAST & AFRICA

11.4 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.4.1 ASIA-PACIFIC

11.4.2 EUROPE

11.4.3 NORTH AMERICA

11.4.4 SOUTH AMERICA

11.4.5 MIDDLE EAST & AFRICA

11.5 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.5.1 ASIA-PACIFIC

11.5.2 EUROPE

11.5.3 NORTH AMERICA

11.5.4 SOUTH AMERICA

11.5.5 MIDDLE EAST & AFRICA

11.6 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

11.6.1 ASIA-PACIFIC

11.6.2 EUROPE

11.6.3 NORTH AMERICA

11.6.4 SOUTH AMERICA

11.6.5 MIDDLE EAST & AFRICA

12 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION

12.1 OVERVIEW

12.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

12.2.1 ELECTRIC

12.2.2 HYBRID

12.2.3 DIESEL/GASOLINE POWERED

12.2.4 HYDROGEN FUEL CELL UGVS

12.2.5 SOLAR-ASSISTED UGVS

12.3 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.3.1 ASIA-PACIFIC

12.3.2 EUROPE

12.3.3 NORTH AMERICA

12.3.4 SOUTH AMERICA

12.3.5 MIDDLE EAST & AFRICA

12.4 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.4.1 ASIA-PACIFIC

12.4.2 EUROPE

12.4.3 NORTH AMERICA

12.4.4 SOUTH AMERICA

12.4.5 MIDDLE EAST & AFRICA

12.5 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.5.1 ASIA-PACIFIC

12.5.2 EUROPE

12.5.3 NORTH AMERICA

12.5.4 SOUTH AMERICA

12.5.5 MIDDLE EAST & AFRICA

12.6 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.6.1 ASIA-PACIFIC

12.6.2 EUROPE

12.6.3 NORTH AMERICA

12.6.4 SOUTH AMERICA

12.6.5 MIDDLE EAST & AFRICA

12.7 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

12.7.1 ASIA-PACIFIC

12.7.2 EUROPE

12.7.3 NORTH AMERICA

12.7.4 SOUTH AMERICA

12.7.5 MIDDLE EAST & AFRICA

13 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION

13.1 OVERVIEW

13.2 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

13.2.1 COMMERCIAL

13.2.2 MILITARY

13.2.3 FEDERAL LAW ENFORCEMENT

13.2.4 LAW ENFORCEMENT

13.3 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.3.1 FIREFIGHTING

13.3.2 AUTONOMOUS DELIVERY

13.3.3 CBRN

13.3.4 PHYSICAL SECURITY

13.3.5 AGRICULTURE

13.3.6 DOMESTIC

13.3.7 OIL & GAS

13.3.8 WAREHOUSE & LOGISTICS

13.3.9 OTHERS

13.4 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.4.1 SPRAYING

13.4.2 MOWING

13.4.3 TILLING

13.5 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.5.1 INSPECTION

13.5.2 HAULAGE

13.6 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.6.1 SORTING ROBOTS

13.6.2 PALLET MOVERS

13.7 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.7.1 ASIA-PACIFIC

13.7.2 EUROPE

13.7.3 NORTH AMERICA

13.7.4 SOUTH AMERICA

13.7.5 MIDDLE EAST & AFRICA

13.8 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.8.1 TRANSPORTATION

13.8.2 INTELLIGENCE, SURVEILLANCE, AND RECONNAISSANCE (ISR)

13.8.3 EXPLOSIVE ORDNANCE DISPOSAL

13.8.4 SEARCH & RESCUE

13.8.5 FIREFIGHTING

13.8.6 COMBAT SUPPORT

13.8.7 MINE CLEARANCE

13.8.8 OTHERS

13.9 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.9.1 ASIA-PACIFIC

13.9.2 EUROPE

13.9.3 NORTH AMERICA

13.9.4 SOUTH AMERICA

13.9.5 MIDDLE EAST & AFRICA

13.1 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.10.1 ASIA-PACIFIC

13.10.2 EUROPE

13.10.3 NORTH AMERICA

13.10.4 SOUTH AMERICA

13.10.5 MIDDLE EAST & AFRICA

13.11 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

13.11.1 BOMB DISPOSAL UNITS

13.11.2 RIOT CONTROL ROBOTS

13.11.3 URBAN SURVEILLANCE ROBOTS

13.12 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

13.12.1 ASIA-PACIFIC

13.12.2 EUROPE

13.12.3 NORTH AMERICA

13.12.4 SOUTH AMERICA

13.12.5 MIDDLE EAST & AFRICA

14 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 JAPAN

14.1.2 CHINA

14.1.3 SOUTH KOREA

14.1.4 INDIA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 THAILAND

14.1.8 MALAYSIA

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 NEW ZEALAND

14.1.12 VIETNAM

14.1.13 TAIWAN

14.1.14 REST OF ASIA-PACIFIC

15 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET

15.1 COMPANY SHARE ANALYSIS: GLOBAL

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 GENERAL DYNAMICS LAND SYSTEMS

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENT

17.2 RHEINMETALL AG

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 ELBIT SYSTEMS LTD.

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 TEXTRON SYSTEMS

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 THALES

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENT

17.6 AEROVIRONMENT, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 REVENUE ANALYSIS

17.6.3 PRODUCT PORTFOLIO

17.6.4 RECENT DEVELOPMENT

17.7 ASELSAN A.Ş.

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENT

17.8 DOK-ING

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENT

17.9 EDGEFORCE

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENT

17.1 GHOSTROBOTICS.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 HANWHA AEROSPACE

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 HYUNDAI ROTEM COMPANY.

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT DEVELOPMENT

17.13 IAI

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 LEONARDO S.P.A.

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT DEVELOPMENT

17.15 MILREM AS

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENT

17.16 PERATON

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 QINETIQ

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT DEVELOPMENT

17.18 ROBOTEAM

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 ST ENGINEERING

17.19.1 COMPANY SNAPSHOT

17.19.2 REVENUE ANALYSIS

17.19.3 PRODUCT PORTFOLIO

17.19.4 RECENT DEVELOPMENT

17.2 TELEDYNE FLIR DEFENSE INC.

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 COMPANY COMPARATIVE ANALYSIS

TABLE 2 TECHNOLOGICAL DEVELOPMENT

TABLE 3 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC MICRO UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC SMALL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC MEDIUM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC VERY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC EXTREMELY LARGE IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC CONTROLLER IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC NAVIGATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC OTHERS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC WHEELED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC TRACKED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC LEGGED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC SNAKE/ARTICULATED MOBILITY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC TELEOPERATED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC TETHERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC LIGHT DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDIUM DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ULTRA HEAVY DUTY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC ELECTRIC IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC HYBRID IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC DIESEL/GASOLINE POWERED IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC HYDROGEN FUEL CELL UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC SOLAR ASSISTED UGVS IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 52 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 53 ASIA-PACIFIC FEDERAL LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 54 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 55 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY REGION, 2019-2033 (USD THOUSAND)

TABLE 56 ASIA-PACIFIC

TABLE 57 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY COUNTRY, 2019-2033 (USD THOUSAND)

TABLE 58 ASIA-PACIFIC

TABLE 59 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 60 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 61 ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 62 ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 63 ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 64 ASIA-PACIFIC CHASSIS SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 65 ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 66 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 67 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 68 ASIA-PACIFIC AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 69 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 70 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 71 ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 72 ASIA-PACIFIC COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 73 ASIA-PACIFIC AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 74 ASIA-PACIFIC OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 75 ASIA-PACIFIC WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 76 ASIA-PACIFIC MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 77 ASIA-PACIFIC LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 78 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 79 JAPAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 80 JAPAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 81 JAPAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 82 JAPAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 83 JAPAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 84 JAPAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 85 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 86 JAPAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 87 JAPAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 88 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 89 JAPAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 90 JAPAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 91 JAPAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 92 JAPAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 93 JAPAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 94 JAPAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 95 JAPAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 96 JAPAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 97 CHINA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 98 CHINA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 99 CHINA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 100 CHINA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 101 CHINA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 102 CHINA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 103 CHINA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 104 CHINA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 105 CHINA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 106 CHINA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 107 CHINA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 108 CHINA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 109 CHINA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 110 CHINA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 111 CHINA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 112 CHINA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 113 CHINA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 114 CHINA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 115 CHINA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 116 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 117 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 118 SOUTH KOREAPAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 119 SOUTH KOREAPOWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 120 SOUTH KOREAELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 121 SOUTH KOREA CASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 122 SOUTH KOREACOMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 123 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 124 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 125 SOUTH KOREA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 126 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 127 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 128 SOUTH KOREAUNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 129 SOUTH KOREACOMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 130 SOUTH KOREAAGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 131 SOUTH KOREAOIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 132 SOUTH KOREAWAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 133 SOUTH KOREA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 134 SOUTH KOREALAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 135 INDIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 136 INDIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 137 INDIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 138 INDIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 139 INDIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 140 INDIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 141 INDIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 142 INDIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 143 INDIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 144 INDIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 145 INDIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 146 INDIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 147 INDIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 148 INDIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 149 INDIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 150 INDIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 151 INDIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 152 INDIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 153 INDIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 154 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 155 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 156 AUSTRALIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 157 AUSTRALIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 158 AUSTRALIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 159 AUSTRALIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 160 AUSTRALIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 161 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 162 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 163 AUSTRALIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 164 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 165 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 166 AUSTRALIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 167 AUSTRALIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 168 AUSTRALIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 169 AUSTRALIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 170 AUSTRALIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 171 AUSTRALIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 172 AUSTRALIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 173 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 174 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 175 SINGAPORE PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 176 SINGAPORE POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 177 SINGAPORE ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 178 SINGAPORE CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 179 SINGAPORE COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 180 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 181 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 182 SINGAPORE AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 183 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 184 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 185 SINGAPORE UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 186 SINGAPORE COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 187 SINGAPORE AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 188 SINGAPORE OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 189 SINGAPORE WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 190 SINGAPORE MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 191 SINGAPORE LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 192 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 193 THAILAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 194 THAILAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 195 THAILAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 196 THAILAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 197 THAILAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 198 THAILAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 199 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 200 THAILAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 201 THAILAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 202 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 203 THAILAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 204 THAILAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 205 THAILAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 206 THAILAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 207 THAILAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 208 THAILAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 209 THAILAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 210 THAILAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 211 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 212 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 213 MALAYSIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 214 MALAYSIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 215 MALAYSIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 216 MALAYSIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 217 MALAYSIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 218 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 219 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 220 MALAYSIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 221 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 222 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 223 MALAYSIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 224 MALAYSIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 225 MALAYSIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 226 MALAYSIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 227 MALAYSIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 228 MALAYSIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 229 MALAYSIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 230 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 231 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 232 INDONESIA PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 233 INDONESIA POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 234 INDONESIA ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 235 INDONESIA CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 236 INDONESIA COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 237 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 238 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 239 INDONESIA AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 240 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 241 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 242 INDONESIA UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 243 INDONESIA COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 244 INDONESIA AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 245 INDONESIA OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 246 INDONESIA WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 247 INDONESIA MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 248 INDONESIA LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 249 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 250 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 251 PHILIPPINES PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 252 PHILIPPINES POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 253 PHILIPPINES ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 254 PHILIPPINES CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 255 PHILIPPINES COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 256 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 257 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 258 PHILIPPINES AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 259 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 260 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 261 PHILIPPINES UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 262 PHILIPPINES COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 263 PHILIPPINES AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 264 PHILIPPINES OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 265 PHILIPPINES WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 266 PHILIPPINES MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 267 PHILIPPINES LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 268 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 269 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 270 NEW ZEALAND PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 271 NEW ZEALAND POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 272 NEW ZEALAND ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 273 NEW ZEALAND CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 274 NEW ZEALAND COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 275 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 276 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 277 NEW ZEALAND AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 278 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 279 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 280 NEW ZEALAND UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 281 NEW ZEALAND COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 282 NEW ZEALAND AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 283 NEW ZEALAND OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 284 NEW ZEALAND WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 285 NEW ZEALAND MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 286 NEW ZEALAND LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 287 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 288 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 289 VIETNAM PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 290 VIETNAM POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 291 VIETNAM ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 292 VIETNAM CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 293 VIETNAM COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 294 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 295 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 296 VIETNAM AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 297 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 298 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 299 VIETNAM UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 300 VIETNAM COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 301 VIETNAM AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 302 VIETNAM OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 303 VIETNAM WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 304 VIETNAM MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 305 VIETNAM LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 306 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 307 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 308 TAIWAN PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 309 TAIWAN POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 310 TAIWAN ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 311 TAIWAN CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 312 TAIWAN COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 313 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)

TABLE 314 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY MODE OF OPERATION, 2019-2033 (USD THOUSAND)

TABLE 315 TAIWAN AUTONOMOUS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 316 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PAYLOAD, 2019-2033 (USD THOUSAND)

TABLE 317 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY PROPULSION, 2019-2033 (USD THOUSAND)

TABLE 318 TAIWAN UNMANNED GROUND VEHICLE MARKET, BY APPLICATION, 2019-2033 (USD THOUSAND)

TABLE 319 TAIWAN COMMERCIAL IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 320 TAIWAN AGRICULTURE IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 321 TAIWAN OIL & GAS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 322 TAIWAN WAREHOUSE & LOGISTICS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 323 TAIWAN MILITARY IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 324 TAIWAN LAW ENFORCEMENT IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 325 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SIZE, 2019-2033 (USD THOUSAND)

TABLE 326 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 327 REST OF ASIA-PACIFIC PAYLOAD IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 328 REST OF ASIA-PACIFIC POWER SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 329 REST OF ASIA-PACIFIC ELECTRIC NON SOLAR RECHARGABLE BATTERY IN UNMANNED GROUND VEHICLE MARKET, BY POWER SYSTEM, 2019-2033 (USD THOUSAND)

TABLE 330 REST OF ASIA-PACIFIC CHASSIS IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 331 REST OF ASIA-PACIFIC COMMUNICATION SYSTEM IN UNMANNED GROUND VEHICLE MARKET, BY TYPE, 2019-2033 (USD THOUSAND)

TABLE 332 REST OF ASIA-PACIFIC UNMANNED GROUND VEHICLE MARKET, BY MOBILITY, 2019-2033 (USD THOUSAND)