Asia Pacific Transfection Reagents And Equipment Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

194.68 Million

USD

439.05 Million

2024

2032

USD

194.68 Million

USD

439.05 Million

2024

2032

| 2025 –2032 | |

| USD 194.68 Million | |

| USD 439.05 Million | |

|

|

|

|

Segmentação do mercado de reagentes e equipamentos para transfecção na região Ásia-Pacífico, subprodutos (reagentes, kits e instrumentos), estágio (pesquisa, pré-clínica, fases clínicas e comercial), tipo (reagente e equipamento para transfecção transitória, reagente e equipamento para transfecção estável), métodos (métodos não virais e métodos virais), tipos de moléculas (DNA plasmídeo, RNA interferente pequeno (siRNA), proteínas, oligonucleotídeos de DNA, complexos de ribonucleoproteínas (RNPs) e outros), organismos (células de mamíferos, plantas, fungos, vírus e bactérias), aplicação (aplicação in vitro, aplicação in vivo, bioprodução e outros), usuário final (biofarmacêutica, CROs, (CMOs/CDMOs), academia, hospitais, laboratórios clínicos e outros), canal de distribuição (licitação direta, vendas no varejo e outros) - tendências e previsões do setor até 2032

Tamanho do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

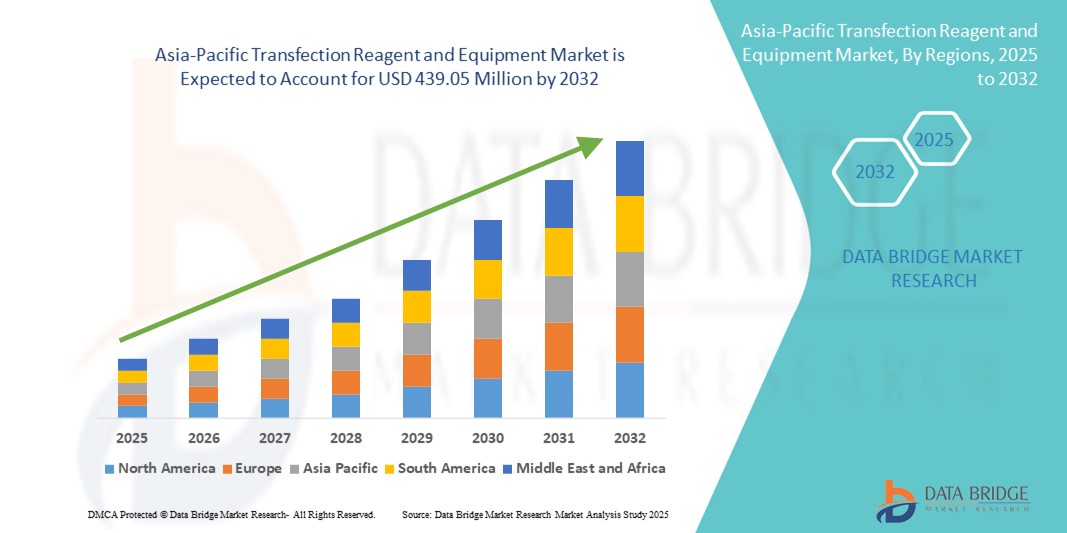

- O tamanho do mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico foi avaliado em US$ 194,68 milhões em 2024 e deve atingir US$ 439,05 milhões até 2032 , com um CAGR de 10,70% durante o período previsto.

- O crescimento do mercado de reagentes e equipamentos para transfecção na região Ásia-Pacífico é impulsionado, em grande parte, pela crescente demanda por soluções confiáveis de entrega de genes, pelo crescente acesso à saúde e pelos avanços em biologia molecular e pesquisa celular, permitindo transfecção precisa e eficiente para aplicações em descoberta de medicamentos, genômica e proteômica. A região está testemunhando um aumento na terceirização de pesquisas e atividades biofarmacêuticas, particularmente em países em rápido desenvolvimento, como Índia, China e Indonésia, contribuindo para a crescente adoção de reagentes e equipamentos para transfecção.

- Além disso, o aumento dos investimentos em infraestrutura biotecnológica , a expansão das instalações de pesquisa em ambientes acadêmicos e clínicos e o aumento das colaborações público-privadas estão impulsionando a inovação e a disponibilidade de tecnologias especializadas de transfecção. Iniciativas governamentais de apoio à pesquisa em ciências da vida, juntamente com a crescente presença de fornecedores internacionais de reagentes e o fortalecimento das capacidades de fabricação local, estão impulsionando significativamente o crescimento do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico.

Análise do Mercado de Reagentes e Equipamentos para Transfecção na Ásia-Pacífico

- O mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico está testemunhando um forte crescimento, impulsionado pela rápida expansão dos setores farmacêutico, de biotecnologia e de pesquisa acadêmica em países como China, Índia, Japão, Coreia do Sul, Austrália, Tailândia, Indonésia e Vietnã.

- O aumento dos investimentos em P&D em genômica, proteômica e biologia celular, a crescente adoção de tecnologias avançadas de entrega de genes, o aumento nos ensaios clínicos e a crescente demanda por medicina de precisão estão alimentando a expansão do mercado em toda a região.

- A China dominou o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico, respondendo pela maior fatia de receita de 42,6% em 2024, apoiada por sua forte base de fabricação biofarmacêutica, crescente pipeline de testes de terapia genética e celular, instituições de pesquisa bem estabelecidas e iniciativas governamentais para fortalecer a inovação em biotecnologia.

- A Índia deverá registrar o CAGR mais rápido de 19,4% no mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico durante o período previsto, impulsionado por um setor de biotecnologia em expansão, crescente terceirização de pesquisas pré-clínicas e clínicas, crescente adoção de tecnologias de transfecção em organizações acadêmicas e de pesquisa contratada e apoio governamental à inovação biofarmacêutica.

- Métodos não virais dominaram o mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico, com uma participação de 63,2% em 2024, apoiados por seu perfil de segurança, facilidade de implementação e vantagens de custo. Técnicas como eletroporação, nanopartículas lipídicas e reagentes de base química são cada vez mais utilizadas em fluxos de trabalho de pesquisa e pré-clínicos, pois minimizam os riscos de biossegurança e oferecem resultados reprodutíveis.

Escopo do relatório e segmentação do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

|

Atributos |

Principais insights de mercado sobre reagentes e equipamentos para transfecção na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

Crescente demanda por soluções avançadas de transfecção e suporte à conformidade regulatória

- Uma tendência significativa e crescente no mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico é o foco crescente em métodos de transfecção altamente eficientes e reprodutíveis, além de forte apoio à conformidade regulatória. Isso inclui esforços para melhorar a precisão da transfecção, a escalabilidade, os tempos de resposta e a adesão aos padrões internacionais de qualidade e BPF em constante evolução.

- Os principais fornecedores e prestadores de serviços da região estão colaborando com organizações farmacêuticas, de biotecnologia e de pesquisa acadêmica para fornecer plataformas de transfecção de última geração, como sistemas automatizados de eletroporação, tecnologias de nanopartículas lipídicas (LNP) e reagentes compatíveis com vetores virais. Essas inovações atendem à crescente demanda por soluções validadas, confiáveis e prontas para auditoria, que suportem fluxos de trabalho pré-clínicos, clínicos e de fabricação.

- A crescente adoção de reagentes e equipamentos avançados de transfecção em áreas como terapia celular e gênica, desenvolvimento de vacinas de mRNA, pesquisa oncológica e produção de biossimilares está acelerando ainda mais o crescimento do mercado. Essas soluções são reconhecidas por sua capacidade de garantir alta eficiência de transfecção, consistência do produto e conformidade com rigorosas diretrizes regulatórias.

- Instituições acadêmicas, centros de pesquisa e laboratórios financiados pelo governo em países como Japão, China, Índia e Austrália estão conduzindo ativamente estudos sobre novas químicas de transfecção, tecnologias de entrega de genes e automação de fluxos de trabalho de engenharia celular, levando a melhorias contínuas de serviços e produtos adaptados às necessidades específicas do setor.

- À medida que a região da Ásia-Pacífico continua a enfatizar a garantia de qualidade, a inovação em biofabricação e a competitividade global de exportação, o mercado de reagentes e equipamentos para transfecção está pronto para uma expansão sustentada, impulsionado pela rigidez regulatória, avanços tecnológicos e integração mais profunda de P&D com a experiência laboratorial.

Dinâmica do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

Motorista

Crescente demanda impulsionada por avanços em terapia genética, pesquisa celular e biotecnologia

- O mercado de reagentes e equipamentos para transfecção na região da Ásia-Pacífico está experimentando um crescimento rápido e sustentado, impulsionado principalmente pela expansão da pesquisa em biotecnologia, inovação farmacêutica e desenvolvimento de infraestrutura avançada de saúde em grandes economias, como China, Índia, Japão, Coreia do Sul e Austrália. O aumento nos investimentos direcionados à terapia celular, produção de vacinas, biossimilares e medicina personalizada está aumentando significativamente a adoção de tecnologias de transfecção de alta qualidade, eficientes e confiáveis em ambientes de pesquisa acadêmica e industrial.

- Por exemplo, em março de 2024, a Takara Bio Inc. anunciou a expansão de suas operações de P&D no Japão, com o objetivo de fortalecer seu portfólio de tecnologia de transfecção. Espera-se que essa expansão acelere as capacidades da empresa no suporte a pipelines de terapia genética, aplicações em células-tronco e estudos avançados de pesquisa com células, reforçando assim a trajetória de crescimento do mercado regional.

- A crescente incidência de doenças crônicas e genéticas na região da Ásia-Pacífico está gerando uma forte demanda por soluções terapêuticas de última geração. Essa crescente carga de doenças, aliada ao foco crescente em medicina de precisão e personalizada, está impulsionando a adoção generalizada de métodos avançados de transfecção em laboratórios de pesquisa, estudos pré-clínicos e fases de ensaios clínicos, onde a entrega confiável de genes é fundamental para resultados bem-sucedidos.

- Iniciativas governamentais de apoio que incentivam a inovação em biotecnologia, juntamente com incentivos para atividades de ensaios clínicos, desempenham um papel fundamental no fortalecimento do ecossistema de mercado. Países como Singapura e Coreia do Sul estão emergindo como polos regionais de excelência em pesquisa molecular e celular, oferecendo estruturas robustas de propriedade intelectual, infraestrutura de alta qualidade e custos de pesquisa competitivos, atraindo, assim, players biofarmacêuticos globais para estabelecer parcerias e expandir suas operações.

- A integração de plataformas digitais de gestão laboratorial, tecnologias de automação e instrumentos de transfecção de última geração está permitindo que laboratórios e empresas biofarmacêuticas otimizem os fluxos de trabalho experimentais. Esses avanços estão melhorando a reprodutibilidade, a precisão e a escalabilidade dos procedimentos de transfecção, além de reduzir o erro humano. Consequentemente, a região está testemunhando uma crescente adoção de sistemas automatizados e digitalizados, que estão aprimorando a eficiência geral e a conformidade regulatória de experimentos em larga escala e programas de pesquisa clínica.

Restrição/Desafio

Altos custos e acessibilidade limitada em regiões emergentes

- Apesar do progresso científico significativo, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico continua a enfrentar desafios significativos para penetrar em laboratórios de menor porte, institutos acadêmicos com recursos limitados e instalações de pesquisa localizadas em regiões rurais ou semiurbanas. Os altos custos dos reagentes especializados, a falta de conscientização sobre as vantagens das tecnologias modernas de transfecção e as persistentes limitações de infraestrutura atuam como grandes barreiras à adoção, restringindo o acesso dessas instituições a soluções de ponta.

- Obstáculos logísticos, incluindo sistemas de cadeia fria subdesenvolvidos e acesso limitado a infraestrutura laboratorial avançada fora dos centros metropolitanos, restringem ainda mais a disponibilidade de produtos e equipamentos para transfecção. Essas limitações atrasam a entrega e a utilização eficientes de reagentes e instrumentos sensíveis, impactando assim o ritmo e a qualidade da pesquisa em andamento em áreas menos desenvolvidas.

- Um número considerável de instituições menores ainda depende de métodos convencionais de transfecção de baixa eficiência, como abordagens químicas ou mecânicas, que carecem da precisão e escalabilidade das tecnologias mais recentes. Essa dependência reduz a reprodutibilidade dos experimentos e dificulta a realização de estudos de alto rendimento, limitando tanto os resultados da pesquisa quanto a potencial tradução clínica.

- A distribuição geográfica desigual de fornecedores e distribuidores na Ásia-Pacífico cria desafios adicionais para laboratórios remotos. Em muitos casos, as instituições precisam transportar amostras ou obter reagentes de centros urbanos distantes, resultando em tempos de resposta mais longos, custos operacionais mais elevados e interrupções nos cronogramas de pesquisa.

- Para superar esses obstáculos, os principais players do mercado estão ativamente desenvolvendo e introduzindo kits de reagentes com boa relação custo-benefício, sistemas portáteis de eletroporação e nucleofecção e instrumentos de fácil utilização que exigem infraestrutura mínima. Além disso, as empresas estão cada vez mais formando parcerias com distribuidores regionais e associações locais de biotecnologia para ampliar seu alcance de mercado. Essas iniciativas visam melhorar a acessibilidade, reduzir custos e incentivar a adoção por organizações de pesquisa menores, laboratórios acadêmicos e startups de biotecnologia, reduzindo assim a lacuna entre as capacidades de pesquisa avançada e as regiões carentes.

Escopo do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

O mercado é segmentado com base em produtos, estágio, tipo, métodos, tipos de molécula, organismo, usuário final e canal de distribuição

- Por produtos

Com base nos produtos, o mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico é segmentado em reagentes e kits e instrumentos. O segmento de reagentes e kits dominou o mercado, com uma participação de receita de 61,4% em 2024, atribuída ao seu papel indispensável em garantir alta eficiência, reprodutibilidade e versatilidade em um amplo espectro de fluxos de trabalho de pesquisa e terapêuticos. Esses produtos são essenciais em aplicações como entrega de genes, genômica funcional, ensaios baseados em células e desenvolvimento de medicamentos, sendo sua popularidade ainda mais reforçada pela facilidade de uso, protocolos padronizados e custo-benefício.

Em contrapartida, projeta-se que o segmento de instrumentos registre o CAGR mais rápido, de 10,5%, entre 2025 e 2032, impulsionado pela crescente demanda por plataformas automatizadas de eletroporação, sistemas de alto rendimento e dispositivos de transfecção de precisão. Esses instrumentos avançados são particularmente valorizados por sua capacidade de suportar a fabricação escalável de nível clínico, permitindo transições perfeitas de experimentos laboratoriais de pequena escala para a produção comercial em larga escala.

- Por estágio

Com base no estágio, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em pesquisa, pré-clínica, clínica e comercial. A fase de pesquisa deteve a maior participação, 39,8% em 2024, apoiada pelo amplo uso em instituições acadêmicas, laboratórios de pesquisa e projetos de descoberta de medicamentos em estágio inicial. Essa predominância se deve, em grande parte, à crescente ênfase em genômica funcional, estudos de expressão gênica e experimentos iniciais de prova de conceito, que dependem fortemente de métodos de transfecção eficientes.

Prevê-se que o segmento da fase comercial se expanda a uma taxa composta de crescimento anual (CAGR) de 11,1% entre 2025 e 2032, impulsionado pela crescente necessidade de soluções de transfecção em larga escala e em conformidade com as BPF. A expansão na fabricação de terapias celulares e gênicas, na produção de vacinas baseadas em mRNA e no desenvolvimento de produtos biológicos está acelerando a demanda por fluxos de trabalho confiáveis em escala comercial que atendam a rigorosos padrões regulatórios.

- Por tipo

Com base no tipo, o mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico é segmentado em reagentes e equipamentos para transfecção transitória e reagentes e equipamentos para transfecção estável. O segmento de transfecção transitória dominou, com uma participação de receita de 58,6% em 2024, devido à sua ampla utilização em estudos de expressão proteica de curto prazo, desenvolvimento de ensaios e validação rápida de alvos. Continua sendo a escolha preferencial para laboratórios que exigem rapidez, flexibilidade e custo-benefício em configurações experimentais.

Enquanto isso, projeta-se que o segmento de transfecção estável cresça a uma taxa composta de crescimento anual (CAGR) de 9,9% entre 2025 e 2032, refletindo sua importância crucial na geração de linhagens celulares de longo prazo, fluxos de trabalho de biofabricação e pesquisa terapêutica. A crescente dependência de modelos de expressão gênica sustentada para o desenvolvimento e a produção de medicamentos está impulsionando a adoção de tecnologias de transfecção estável tanto em ambientes de pesquisa quanto comerciais.

- Por métodos

Com base nos métodos, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em métodos não virais e métodos virais. Os métodos não virais detinham a participação de mercado dominante, de 63,2% em 2024, devido ao seu perfil de segurança, facilidade de implementação e vantagens de custo. Técnicas como eletroporação, nanopartículas lipídicas e reagentes químicos são cada vez mais utilizadas em fluxos de trabalho de pesquisa e pré-clínicos, pois minimizam os riscos de biossegurança e oferecem resultados reprodutíveis.

Por outro lado, espera-se que os métodos virais cresçam a uma robusta taxa composta de crescimento anual (CAGR) de 10,4% entre 2025 e 2032, devido à sua alta eficiência de entrega e capacidade de integrar material genético de forma estável. Esses métodos são indispensáveis em áreas terapêuticas avançadas, como terapias com células CAR-T, terapias genéticas baseadas em AAV e edição genética mediada por lentivírus, onde a confiabilidade e a expressão a longo prazo são fundamentais.

- Por Tipos de Molécula

Com base no tipo de molécula, o mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico é segmentado em DNA plasmidial, RNA interferente pequeno (siRNA), proteínas, oligonucleotídeos de DNA, complexos de ribonucleoproteínas (RNPs) e outros. O DNA plasmidial liderou o segmento com uma participação de 37,5% na receita em 2024, refletindo seu papel central em clonagem molecular, desenvolvimento de vacinas e pipelines de terapia gênica. Sua versatilidade e eficiência de custos garantiram seu domínio contínuo em aplicações acadêmicas e industriais.

No entanto, prevê-se que o segmento de complexos RNP se expanda a uma taxa composta de crescimento anual (CAGR) de 11,3% até 2032, impulsionada pela crescente adoção de tecnologias de edição genômica CRISPR-Cas9. Os sistemas baseados em RNP são valorizados por sua capacidade de realizar modificações genéticas precisas e eficientes, posicionando-os como uma ferramenta transformadora no desenvolvimento terapêutico da próxima geração.

- Por organismo

Com base no organismo, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em células de mamíferos, plantas, fungos, vírus e bactérias. As células de mamíferos dominaram, com uma participação de 54,7% em 2024, sendo o padrão ouro para expressão de proteínas, descoberta terapêutica e pesquisa translacional. Sua similaridade genética com humanos e a capacidade de produzir proteínas complexas as tornam o sistema preferido em aplicações pré-clínicas e clínicas.

No entanto, projeta-se que o segmento de plantas registre o CAGR mais rápido, de 9,8%, entre 2025 e 2032, impulsionado pelos avanços na agricultura molecular, produtos biológicos à base de plantas e biotecnologia agrícola. Espera-se que o crescente interesse na produção de produtos biológicos escaláveis e economicamente viáveis a partir de sistemas vegetais impulsione ainda mais o crescimento desse segmento.

- Por aplicação

Com base na aplicação, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em aplicações in vitro, aplicações in vivo, bioprodução e outras. O segmento de aplicação in vitro deteve a maior participação, 46,1% em 2024, principalmente devido ao seu amplo uso em ensaios celulares, mapeamento de vias, triagem de fármacos e genômica funcional. Continua a ser um pilar fundamental dos laboratórios de pesquisa em toda a região.

A previsão é de que o segmento de bioprodução cresça a uma CAGR de 10,7%, a mais rápida, entre 2025 e 2032, visto que as tecnologias de transfecção desempenham um papel crucial na fabricação em larga escala de produtos biológicos, biossimilares e vacinas de mRNA. O foco em sistemas de produção escaláveis e em conformidade com as normas regulatórias deverá impulsionar um forte crescimento neste segmento durante o período previsto.

- Por usuário final

Com base no usuário final, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em biofarmacêutica, CROs, CMOs/CDMOs, academia, hospitais, laboratórios clínicos e outros. O segmento biofarmacêutico dominou o mercado, com uma participação de 43,9% na receita em 2024, refletindo seus investimentos significativos em descoberta de medicamentos, P&D terapêutico e produção de novos produtos biológicos. As empresas biofarmacêuticas dependem fortemente de tecnologias de transfecção para o desenvolvimento de linhagens celulares, validação de alvos e otimização da fabricação.

O segmento de CMOs/CDMOs deverá apresentar o CAGR mais rápido, de 10,2%, entre 2025 e 2032, impulsionado pela tendência crescente de terceirização de serviços de biofabricação e transfecção especializada. Seu investimento em plataformas de alto rendimento, custo-eficientes e com certificação GMP os posiciona como facilitadores-chave na cadeia de valor biofarmacêutica da região .

- Por canal de distribuição

Com base no canal de distribuição, o mercado de reagentes e equipamentos para transfecção da Ásia-Pacífico é segmentado em licitação direta, vendas no varejo e outros. O segmento de licitação direta dominou, com a maior participação de 57,8% em 2024, apoiado pela aquisição em massa por empresas farmacêuticas e biofarmacêuticas, instituições acadêmicas e organizações de pesquisa apoiadas pelo governo. Este canal garante eficiência de custos e segurança de fornecimento a longo prazo para usuários em larga escala.

O segmento de vendas no varejo deverá crescer a uma taxa composta de crescimento anual (CAGR) de 9,5% entre 2025 e 2032, impulsionado pelo rápido crescimento de plataformas online, redes de distribuidores e fornecedores especializados em ciências da vida. A crescente demanda por kits de transfecção prontos para uso, instrumentos de menor escala e consumíveis está impulsionando a adoção da distribuição no varejo em toda a região.

Análise regional do mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

- A região Ásia-Pacífico detinha uma participação de 20,7% na receita do mercado global de reagentes e equipamentos para transfecção em 2024. Essa liderança é sustentada pela vasta base populacional da região, pela rápida expansão dos setores de biotecnologia e farmacêutico e pela crescente adoção de métodos avançados de entrega de genes em pesquisas e aplicações clínicas. A forte posição da região é ainda sustentada pelo crescimento significativo da pesquisa acadêmica, ensaios de terapia celular e genética e pelo aumento das colaborações entre empresas biofarmacêuticas globais e instituições regionais.

- O foco crescente em medicina de precisão, terapias personalizadas e produtos biológicos de última geração está acelerando a demanda por reagentes de transfecção inovadores e equipamentos automatizados. A expansão de organizações de pesquisa contratadas (CROs), o aumento da atividade de ensaios pré-clínicos e clínicos e a integração de plataformas laboratoriais digitais reforçam a importância da região Ásia-Pacífico como um polo global de pesquisa avançada em ciências da vida.

- A demanda por soluções de transfecção é impulsionada ainda mais por investimentos em larga escala, tanto do setor público quanto do privado, voltados ao fortalecimento da infraestrutura de biotecnologia, das instalações de pesquisa acadêmica e dos programas de medicina translacional. Entre os principais fatores, estão o aumento da prevalência de doenças crônicas e genéticas, o aumento no desenvolvimento de vacinas e biossimilares e o papel crescente das instalações de bioprodução em toda a região. Alianças estratégicas entre laboratórios regionais e fornecedores internacionais de tecnologia de transfecção também estão acelerando a transferência de tecnologia, a inovação e a acessibilidade regional.

Visão do mercado de reagentes e equipamentos para transfecção na China e Ásia-Pacífico

O mercado chinês de reagentes e equipamentos para transfecção detinha a maior participação de mercado na região Ásia-Pacífico, com 42,6% em 2024, reafirmando sua liderança por meio de uma sólida base de fabricação biofarmacêutica e uma robusta infraestrutura de P&D. O rápido crescimento do pipeline de ensaios clínicos em terapia genética e celular do país, aliado a instituições acadêmicas e clínicas de pesquisa bem estabelecidas, está criando uma demanda sustentada por reagentes avançados para transfecção e sistemas de eletroporação. Iniciativas governamentais voltadas ao fortalecimento da inovação em biotecnologia, juntamente com investimentos pesados em pesquisa genômica e programas de medicina de precisão, estão impulsionando ainda mais o crescimento do mercado. Além disso, a posição da China como um polo líder na produção de produtos biológicos e vacinas continua a impulsionar a adoção de tecnologias de transfecção eficientes para aplicações em larga escala.

Visão do mercado de reagentes e equipamentos para transfecção na Índia e Ásia-Pacífico

O mercado indiano de reagentes e equipamentos para transfecção deverá registrar o CAGR mais rápido, de 19,4%, durante o período previsto, impulsionado pela expansão do setor de biotecnologia e pela crescente adoção de ferramentas avançadas de biologia molecular. A crescente terceirização de pesquisas pré-clínicas e clínicas para a Índia, aliada ao crescimento de organizações acadêmicas e de pesquisa contratada (CROs), está impulsionando significativamente a demanda por métodos de transfecção de alta eficiência. Iniciativas governamentais como o "Make in India" e investimentos direcionados em infraestrutura de P&D em biotecnologia estão fortalecendo as capacidades nacionais de inovação. Além disso, o rápido estabelecimento de centros de pesquisa e instalações de diagnóstico em cidades de nível 2 e 3, aliado às colaborações entre instituições indianas e players globais do setor biofarmacêutico, está posicionando a Índia como um dos mercados de crescimento mais rápido e dinâmico no cenário de transfecção da Ásia-Pacífico.

Participação no mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

O setor de reagentes e equipamentos para transfecção da Ásia-Pacífico é liderado principalmente por empresas bem estabelecidas, incluindo:

-

- Mirus Bio LLC (EUA)

- Promega Corporation (EUA)

- Transfecção Polyplus (França)

- Bio-Rad Laboratories, Inc. (EUA)

- Merck KGaA (Alemanha)

- Lonza (Suíça)

- MaxCyte, Inc. (EUA)

- Altogen Biosystems (EUA)

- SBS Genetech (China)

- FUJIFILM Irvine Scientific (Japão)

- Cytiva (EUA)

- Geno Technology Inc., EUA (EUA)

- R&D Systems, Inc. (EUA)

- Takara Bio Inc. (Japão)

- Thermo Fisher Scientific Inc. (EUA)

- QIAGEN (Alemanha)

- OriGene Technologies, Inc. (EUA)

- Applied Biological Materials Inc. (abm) (Canadá)

- Beckman Coulter, Inc. (EUA)

- Amyris (EUA)

- Codexis (EUA)

- Autolus (Reino Unido)

- Laboratórios SignaGen (EUA)

- Impossible Foods Inc. (EUA)

- Genlantis Inc. (EUA)

- Ginkgo Bioworks (EUA)

- Verve Therapeutics, Inc. (EUA)

- Conagen, Inc. (EUA)

- Poseida Therapeutics, Inc. (EUA)

- Twist Bioscience (EUA)

Últimos desenvolvimentos no mercado de reagentes e equipamentos para transfecção na Ásia-Pacífico

- Em março de 2021, a Polyplus-transfection SA anunciou a aquisição dos principais ativos da Biowire para fortalecer suas soluções globais de entrega para terapia genética e celular e acelerar sua expansão nos mercados da Ásia-Pacífico

- Em julho de 2021, a Polyplus abriu/expandiu escritórios comerciais em Xangai para localizar o fornecimento e o suporte para o setor de terapia celular e genética da China/APAC.

- Em agosto de 2021, a Polyplus lançou o FectoVIR AAV GMP, um reagente de transfecção de grau GMP para produção de AAV (vetor viral) em larga escala, atendendo à crescente demanda por fabricação escalável de vetores virais para terapias genéticas.

- Em setembro de 2022, a Polyplus lançou o in vivo-jetRNA+ (um reagente de transfecção para entrega de mRNA in vivo) para apoiar pesquisas e aplicações de entrega de mRNA in vivo

- Em maio de 2023, a Thermo Fisher Scientific inaugurou uma nova unidade de medicamentos estéreis em Cingapura, expandindo as capacidades de fabricação e pesquisa da Ásia-Pacífico que dão suporte a produtos biológicos, vacinas e fluxos de trabalho posteriores usados juntamente com o desenvolvimento de processos de transfecção e baseados em células.

- Em janeiro de 2024, a MaxCyte anunciou uma parceria estratégica (com a Lion TCR) que incluía medidas para aprimorar sua presença e operações comerciais na Ásia, apoiando uma adoção mais ampla de plataformas de engenharia de células não virais na região APAC.

- Em março de 2024, a Takara Bio lançou novos reagentes (por exemplo, PrimeCap T7 RNA Polymerase com baixo dsRNA) e anunciou expansões de P&D, fortalecendo seu portfólio de reagentes que oferece suporte ao trabalho de mRNA e fluxos de trabalho de transfecção no Japão e na comunidade de pesquisa da APAC.

- Em maio de 2024, a Merck KGaA assinou um acordo definitivo para adquirir a Mirus Bio (uma empresa especializada em reagentes para transfecção) — um movimento que consolida a propriedade intelectual dos reagentes para transfecção e aumenta a escala para o fornecimento e distribuição global na APAC.

- Em novembro de 2024, a Thermo Fisher expandiu ainda mais sua presença na Índia ao anunciar um centro de design de bioprocessos em Hyderabad, destacando o investimento contínuo em infraestrutura de bioprocessos e terapia celular da APAC.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.