Asia Pacific Stem Cell Manufacturing Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.23 Billion

USD

6.97 Billion

2025

2033

USD

3.23 Billion

USD

6.97 Billion

2025

2033

| 2026 –2033 | |

| USD 3.23 Billion | |

| USD 6.97 Billion | |

|

|

|

|

Mercado de fabrico de células estaminais da Ásia-Pacífico, subprodutos (linhas de células estaminais, instrumentos, consumíveis e kits), aplicação (aplicações de investigação, aplicações clínicas, bancos de células e tecidos e outros), utilizador final (empresas de biotecnologia e farmacêuticas, institutos de investigação e académicos Institutos, Bancos de Células e Bancos de Tecidos, Hospitais e Centros Cirúrgicos e Outros), Canal de Distribuição (Vendas Diretas e Distribuidor Terceirizado), País (Japão, China, Austrália, Coreia do Sul, Índia, Singapura, Tailândia, Indonésia, Malásia, Filipinas e Resto da Ásia-Pacífico). Tendências e previsões do setor até 2028.

Análise de Mercado e Insights: Mercado de Fabrico de Células Estaminais da Ásia-Pacífico

Análise de Mercado e Insights: Mercado de Fabrico de Células Estaminais da Ásia-Pacífico

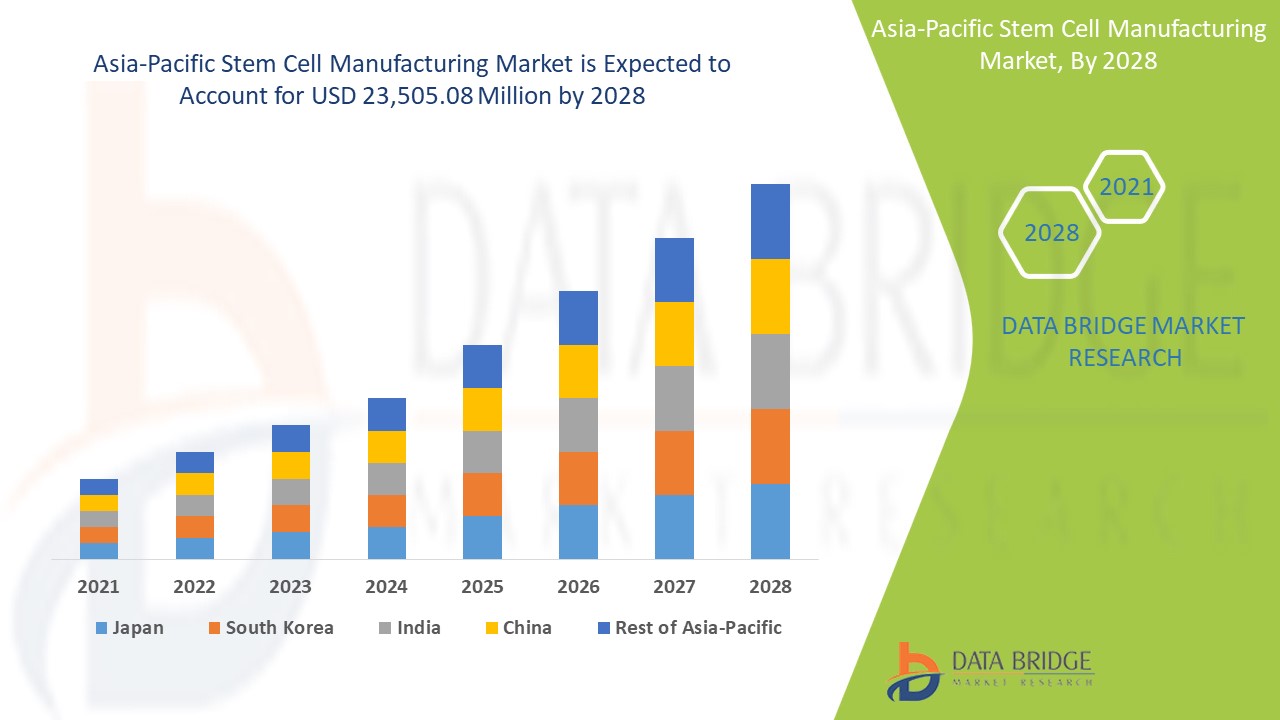

Espera-se que o mercado de fabrico de células estaminais da Ásia-Pacífico ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 10,1% no período previsto de 2021 a 2028 e prevê-se que atinja os 23.505,08 milhões de dólares até 2028, face aos 11.076,78 milhões de dólares em 2020. A crescente prevalência de cancro e transplante de células estaminais, o crescimento de novos avanços tecnológicos para o transplante de as células estaminais serão provavelmente os principais impulsionadores que impulsionarão a procura do mercado no período previsto .

As células estaminais são a matéria-prima do corpo que se pode diferenciar numa variedade de células. Significa células a partir das quais são geradas todas as outras células com funções especializadas. As terapias com células estaminais são definidas como tratamentos para condições médicas que envolvem a utilização de qualquer tipo de células estaminais humanas , incluindo células estaminais embrionárias, células estaminais adultas para terapias alogénicas e autólogas.

O advento da investigação com células estaminais revelou o potencial terapêutico das células estaminais e derivados . O fabrico bem-sucedido de células estaminais e seus derivados está a causar impacto positivo na área da saúde. Estes produtos de células estaminais são utilizados para restaurar a função de tecidos e órgãos danificados e para desenvolver terapias celulares baseadas em células estaminais para o tratamento de cancro, distúrbios hematológicos, distúrbios genéticos , doenças autoimunes e inflamatórias.

O aumento da investigação e do desenvolvimento por parte dos principais intervenientes da indústria para o desenvolvimento de produtos inovadores, o apoio governamental e a crescente adopção de células estaminais estão a impulsionar o crescimento do mercado. As metodologias avançadas presentes no campo estão também a impulsionar o crescimento do mercado global de fabrico de células estaminais. No entanto, o elevado custo das terapias e a disponibilidade de alternativas para o tratamento de tumores podem restringir o mercado. A presença de um grande número de produtos de pipeline, juntamente com iniciativas estratégicas tomadas pelos participantes do mercado, estão a funcionar como uma oportunidade para o mercado. A falta de profissionais qualificados pode representar um desafio para o mercado.

O relatório do mercado global de fabrico de células estaminais fornece detalhes sobre a quota de mercado, novos desenvolvimentos e impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas , e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista. A nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir a sua meta desejada.

Âmbito e tamanho do mercado global de fabrico de células estaminais

Âmbito e tamanho do mercado global de fabrico de células estaminais

O mercado de fabrico de células estaminais da Ásia-Pacífico está categorizado em quatro segmentos notáveis que são baseados em produtos, aplicação, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base nos produtos, o mercado de fabrico de células estaminais está segmentado em linhas de células estaminais, instrumentos, consumíveis e kits. Em 2021, prevê-se que o segmento de consumíveis e kits domine o mercado devido à compra frequente de consumíveis, ao aumento da investigação com células estaminais e à crescente procura de terapias com células estaminais

- Com base na aplicação, o mercado de fabrico de células estaminais está segmentado em aplicações de investigação, aplicações clínicas, bancos de células e tecidos e outros. Em 2021, prevê-se que o segmento das aplicações de investigação domine o mercado devido ao crescente foco na investigação de citologia e fisiopatologia das células estaminais e ao crescente financiamento público-privado para apoiar o desenvolvimento e a comercialização de produtos de células estaminais .

- Com base no utilizador final, o mercado de fabrico de células estaminais está segmentado em empresas de biotecnologia e farmacêuticas, institutos de investigação e institutos académicos, bancos de células e bancos de tecidos, hospitais e centros cirúrgicos e outros. Em 2021, prevê-se que o segmento das empresas farmacêuticas e de biotecnologia domine o mercado devido à crescente ênfase em iniciativas estratégicas (como aquisições, parcerias e colaborações) por parte das empresas farmacêuticas e de biotecnologia para expandir as suas capacidades na investigação com células- tronco.

- Com base no canal de distribuição, o mercado de fabrico de células estaminais está segmentado em vendas diretas e distribuidores externos. Em 2021, prevê-se que o segmento de vendas diretas domine o mercado devido ao grande número de participantes no mercado.

Análise do mercado de fabrico de células estaminais da Ásia-Pacífico a nível de país

O mercado de fabrico de células estaminais é analisado e a informação sobre o tamanho do mercado é fornecida por produtos, aplicação, utilizador final e canal de distribuição.

Os países abrangidos pelo relatório de mercado de fabrico de células estaminais são a China, Japão, Índia, Austrália, Coreia do Sul, Singapura, Tailândia, Malásia, Indonésia, Filipinas, Vietname e restante Ásia-Pacífico (APAC).

A China está a dominar o mercado global de fabrico de células estaminais na região da Ásia-Pacífico devido à maior consciencialização sobre o tratamento baseado em células estaminais e à adoção de tecnologia avançada.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

A crescente adoção da terapia com células estaminais, juntamente com o financiamento público-privado, está a criar oportunidades no mercado global de fabrico de células estaminais

O mercado de fabrico de células estaminais também fornece análises de mercado detalhadas para o crescimento de cada país num setor específico, com vendas de dispositivos de desbridamento de feridas, impacto do avanço nos ensaios ELISpot e FluorSpot e mudanças nos cenários regulamentares com o seu apoio ao mercado de ensaios ELISpot e FluorSpot. Os dados estão disponíveis para o período histórico de 2019 a 2020.

Análise do panorama competitivo e da quota de mercado na fabricação de células estaminais

O panorama competitivo do mercado de fabrico de células estaminais fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produto, aprovações de produto, patentes, amplitude do produto, e respiração, domínio da aplicação, curva de salvação da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco da empresa no mercado de fabrico de células estaminais.

As principais empresas que fornecem o fabrico de células estaminais são a Thermo Fisher Scientific Inc., Merck KGaA, BD, Organogenesis Inc., Vericel Corporation, ANTEROGEN. CO., LTD., VistaGen Therapeutics, Inc., FUJIFILM Cellular Dynamics, Inc., American CryoSystem Corporation, PromoCell GmbH, Sartorius AG, ViaCyte, Inc., STEM CELL Technologies, Inc., Takeda Pharmaceutical Company Limited, DAIICHI SANKYO COMPANY, LIMITED, Bio-Techne, REPROCELL Inc., Catalent, Inc, Mesoblast Ltd, Astellas Pharma Inc. entre outras.

As iniciativas estratégicas dos participantes do mercado, juntamente com os novos avanços tecnológicos para o fabrico de células estaminais, estão a preencher a lacuna para vários tratamentos.

Por exemplo,

- Em junho de 2021, a REPROCELL Inc. anunciou que abriu um novo conjunto de fabrico de iPSC semente para satisfazer a crescente procura de bancos de células mestres derivados de Ipsc. Isto ajudará a empresa a satisfazer a crescente procura e a crescer nos próximos anos.

- Em junho de 2021, a Catalent Inc. anunciou que adquiriu a RheinCell Therapeuics, fabricante de células estaminais pluripotentes induzidas humanas. Isto ajudará a empresa a desenvolver o processo de terapia celular personalizada existente.

- Em junho de 2021, a Bio-Techne anunciou que tinha melhorado a sua capacidade de fabrico de engenharia genética e terapia celular e genética. Isto ajudará a empresa a expandir ainda mais o seu negócio.

A colaboração, as joint ventures e outras estratégias do participante no mercado estão a aumentar o mercado da empresa no mercado de fabrico de células estaminais, o que também traz o benefício para a organização melhorar a sua oferta para o mercado de fabrico de células estaminais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.