Asia Pacific Rf Microneedling Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

603.77 Million

USD

1,053.00 Million

2024

2032

USD

603.77 Million

USD

1,053.00 Million

2024

2032

| 2025 –2032 | |

| USD 603.77 Million | |

| USD 1,053.00 Million | |

|

|

|

Segmentação do mercado de microagulhamento por radiofrequência (RF) da Ásia-Pacífico, por tipo de dispositivo (dispositivo, conjuntos de microagulhas RF), tipo de género (masculino, feminino), aplicação (cicatriz de acne, linhas finas, poros dilatados, rugas , endurecimento da pele, estrias, Hiperpigmentação, Textura e Tom Irregular da Pele, Lifting Facial, Outros), Utilizador Final (Hospitais, Clínicas Dermatológicas, Centros de Atendimento Ambulatório, Outros), Canal de Distribuição (Concurso Directo, Vendas a Retalho) - Tendências e Previsão do Sector até 2032

Análise do mercado de microagulhamento por radiofrequência (RF) da Ásia-Pacífico

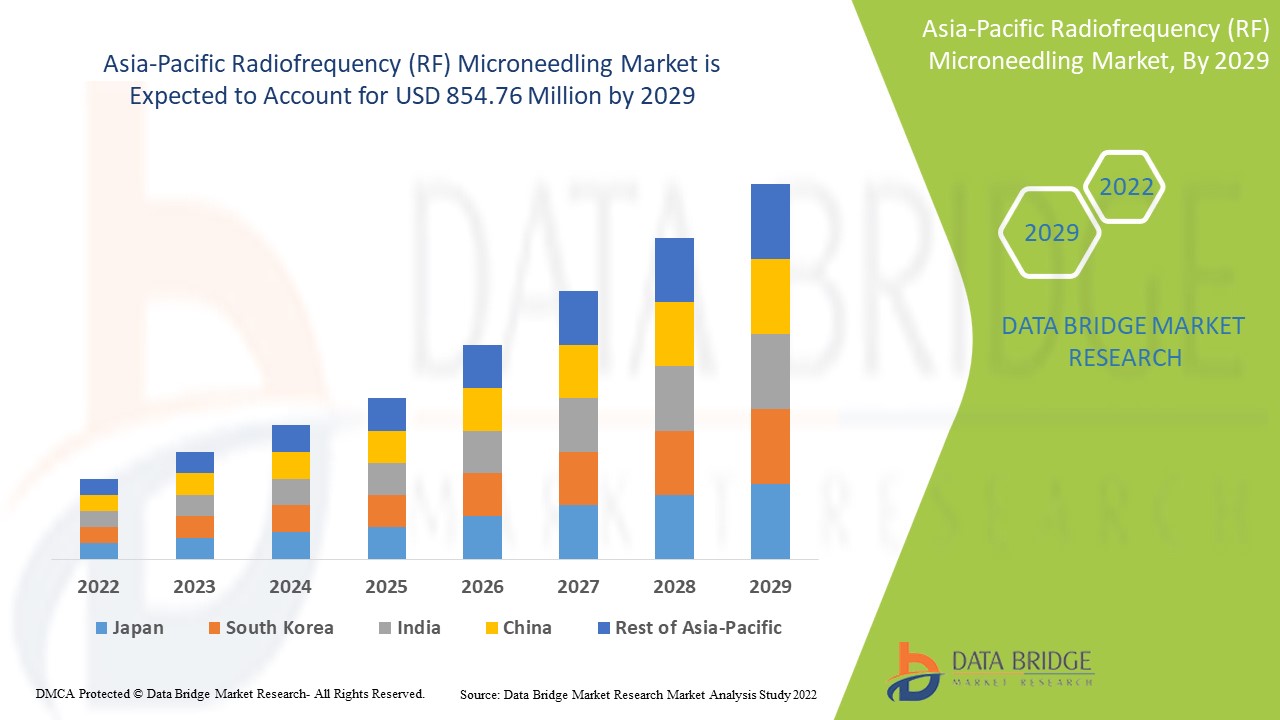

O mercado de microagulhamento por radiofrequência (RF) deverá aumentar o crescimento do mercado no período previsto de 2020 a 2029. O mercado de microagulhamento por RF aumentou com um número melhorado de ações visuais em comparação com os anos anteriores e aumentou a prevalência de distúrbios de descamação no desenvolvidos e também países desenvolvidos. O microagulhamento é uma opção de tratamento relativamente nova em dermatologia que tem sido recomendada para, entre outras coisas, rejuvenescimento da pele, cicatrizes de acne, rítides, cicatrizes cirúrgicas, discromia, melasma, poros dilatados e administração transdérmica de medicamentos. O microagulhamento por RF, também conhecido como microagulhamento por radiofrequência ou radiofrequência fracionada, direciona a energia para a área mais importante da pele, responsável pelas anormalidades de textura, firmeza e elasticidade.

Tamanho do mercado de microagulhamento por radiofrequência (RF)

O tamanho do mercado de microagulhamento por radiofrequência (RF) da Ásia-Pacífico foi avaliado em 603,77 milhões de dólares em 2024 e está projetado para atingir 1.053 milhões de dólares até 2032, com um CAGR de 7,20% durante o período previsto de 2025 a 2032.

Âmbito do Relatório e Segmentação de Mercado

|

Atributos |

Principais insights de mercado sobre o microagulhamento por radiofrequência (RF) |

|

Segmentação |

|

|

Países abrangidos |

China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas, Resto da Ásia-Pacífico (APAC) na Ásia-Pacífico (APAC) |

|

Principais participantes do mercado |

Lumenis Be Ltd. (Alemanha), Cutera (EUA), ENDYMED MEDICAL (EUA), Cartessa Aesthetics (EUA), Veroderm Medical Technologies (Suíça), nubway Co.Ltd. (China), CANDELA CORPORATION (EUA), LUTRONIC (Coreia do Sul), Sincoheren Ltd (China), Beijing Sanhe Beauty S and T Co., Ltd (China), Eclipse (EUA), DermaQuip (EUA), MDPen (EUA ) , Dermapen World (Austrália), Osada, Inc (EUA), Stryker (EUA), CONMED Corporation (EUA), Medtronic (EUA) |

|

Oportunidades de Mercado |

|

Definição do mercado de microagulhamento por radiofrequência (RF)

O microagulhamento por radiofrequência (RF) é um processo estético pouco convencional, também conhecido como terapia de indução de colagénio, que combina o procedimento de microagulhamento direto com a componente de energia de radiofrequência. O microagulhamento por radiofrequência (RF) transmite energia à pele através de pequenas agulhas para produzir minúsculos orifícios na camada superior da pele, o que faz com que o corpo crie nova elastina e colagénio, o que provoca a constrição e o endurecimento da pele .

Dinâmica do mercado de microagulhamento por radiofrequência (RF)

Motoristas

- Aumento da procura por microagulhamento fracionado por RF

A tecnologia de radiofrequência fracionada é um design de ponta que trata a área alvo com uma penetração rápida de uma microagulha isolada, evitando danos epidérmicos substanciais. Para o resurfacing da pele por RF fracionado e sem endurecimento ablativo da pele, os procedimentos de RF têm-se mostrado seguros e eficazes. Para tratamentos estéticos, a tecnologia RF é também o método preferido. É utilizado para tratar linhas finas e rugas, cicatrizes de acne e varicela, flacidez ligeira a moderada e textura irregular da pele. Os tratamentos de endurecimento da pele por radiofrequência são populares porque aquecem os tecidos subcutâneos e a derme, estimulando a remodelação do colagénio dérmico.

- Aumento da procura por procedimentos minimamente invasivos

A procura por operações de rejuvenescimento da pele e de contorno corporal não invasivas e minimamente invasivas que empregam tecnologias inovadoras de radiofrequência (RF) está a aumentar rapidamente. Estes tratamentos minimamente invasivos tornaram-se um dos campos de expansão mais rápida da medicina estética. O contorno corporal, o endurecimento da pele e a redução da celulite são utilizações frequentes do microagulhamento por radiofrequência, um tratamento minimamente invasivo e não ablativo. A tecnologia eletromagnética funciona gerando e fornecendo energia térmica para a derme profunda e gordura subcutânea, o que estimula a produção de colagénio, elastina e ácido hialurónico , resultando no endurecimento e lifting da pele, causando danos mínimos às estruturas superficiais da pele. Como resultado, espera-se que o mercado de microagulhamento por RF da Ásia-Pacífico seja impulsionado por um aumento da procura de procedimentos minimamente invasivos.

- Aumento do número de procedimentos estéticos

O mercado do microagulhamento por radiofrequência aumentou com o aumento do número de procedimentos estéticos em comparação com os últimos anos e com a procura de procedimentos antienvelhecimento na região da Europa. O valor de mercado está a expandir-se devido à crescente prevalência de problemas de pele e ao maior conhecimento sobre operações estéticas. Por exemplo, o Departamento de Dermatologia do Nepal Medical College and Teaching Hospital realizou um inquérito sobre a sensibilização para os procedimentos de dermatologia cosmética entre os profissionais de saúde dos hospitais de cuidados terciários.

Oportunidades

Uma vez que a microagulhamento por RF demonstrou repetidamente as suas elevadas taxas de eficiência no tratamento de cicatrizes de acne, rugas, endurecimento da pele, textura e tom irregulares da pele, hiperpigmentação, linhas finas, poros dilatados, estrias, lifting facial e outras operações estéticas, o valor de mercado é expandindo. Estão em curso vários estudos de investigação, os quais provavelmente darão aos produtores uma vantagem competitiva no desenvolvimento de novos e inovadores dispositivos de microagulhamento por RF, bem como uma variedade de oportunidades adicionais no mercado de microagulhamento por RF.

Restrições/Desafios

O elevado custo dos procedimentos de microagulhamento por RF e as restrições rigorosas para estes procedimentos deverão limitar o crescimento do mercado, uma vez que a obtenção de aprovações é uma tarefa difícil e complexa, e os fabricantes e investigadores de dispositivos de microagulhamento por RF enfrentam responsabilidade financeira. Em contraste, fatores como o elevado custo do procedimento, a sofisticação e a formação envolvida nas operações estéticas estão a impulsionar o mercado de microagulhamento por RF na Ásia-Pacífico. De acordo com as projeções feitas pelos profissionais e líderes da empresa para o período de previsão contínua de 2021-2028, se continuarem a crescer e a atingir um impulso significativo no mercado, têm o potencial de sufocar o crescimento do mercado de microagulhamento de RF .

Este relatório de mercado de microagulhamento de RF fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsos de receita emergentes, alterações no mercado regulamentações, análise estratégica de crescimento de mercado, tamanho de mercado, crescimento de mercado de categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado . Para mais informações sobre o mercado de microagulhamento por RF, contacte a Data Bridge Market Research para obter um briefing de analista.

Âmbito do mercado de microagulhamento por radiofrequência (RF)

O mercado de microagulhamento por RF está segmentado com base na técnica, produto, aplicação do material e utilizador final. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Técnica

- Manual

- Automatizado

Produto

- Caneta Derma

- Dermaroller

- Dispositivos de microagulhamento RF

- Outros

Material

- Silício

- Titânio

- Aço inoxidável

- Polímeros

- Outros

Aplicação

- Rejuvenescimento da pele

- Cicatrizes

- Acne

- Rugas

- Outros

Utilizador final

- Hospitais

- Clínicas de Dermatologia

- Configurações de assistência domiciliária

- Outros

Análise regional do mercado de microagulhamento por radiofrequência (RF)

O mercado de microagulhamento por radiofrequência (RF) é analisado e são fornecidos insights e tendências sobre o tamanho do mercado por país, técnica, produto, aplicação do material e utilizador final, conforme referenciado acima.

Os países abrangidos pelo relatório de mercado de microagulhamento RF são a China, Japão, Índia, Coreia do Sul, Singapura, Malásia, Austrália, Tailândia, Indonésia, Filipinas e Resto da Ásia-Pacífico (APAC).

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados, por exemplo, análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas globais e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país.

Participação no mercado de microagulhamento por radiofrequência (RF)

O panorama competitivo do mercado de microagulhamento por radiofrequência (RF) fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e amplitude do produto , domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas relacionadas com o mercado de microagulhamento por RF.

Os líderes de mercado de microagulhamento por radiofrequência (RF) que operam no mercado são:

- Lumenis Be Ltd. (Alemanha)

- Cutera (EUA)

- MÉDICO ENDYMED (EUA)

- Cartessa Aesthetics (EUA)

- Veroderm Medical Technologies (Suíça)

- Nubway Co., Lda. (China)

- CANDELA CORPORATION (EUA)

- LUTRONIC (Coreia do Sul)

- Sincoheren Ltd (China)

- Beijing Sanhe Beauty S and T Co., Ltd (China)

- Eclipse (EUA)

- DermaQuip (EUA)

- MDPen (EUA)

- Dermapen World (Austrália)

- Osada, Inc. (EUA)

- Stryker (EUA)

- CONMED Corporation (EUA)

- Medtronic (EUA)

Últimos desenvolvimentos no mercado do microagulhamento por radiofrequência (RF)

- Lumenis released Pro+, a new multi-application platform based on RF current technology, in April 2019. The company is employed on enhancing their reliability in the market and growing their customer base in order to create more money with the launch of their new RF microneedling plataforma

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.