Asia Pacific Residential Energy Management Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.78 Billion

USD

55.28 Billion

2025

2033

USD

4.78 Billion

USD

55.28 Billion

2025

2033

| 2026 –2033 | |

| USD 4.78 Billion | |

| USD 55.28 Billion | |

|

|

|

|

Segmentação do mercado de Gestão de Energia Residencial (REM) na Ásia-Pacífico, por aplicação de interface do usuário (medidores inteligentes, termostatos inteligentes, displays internos (IHD) e eletrodomésticos inteligentes), plataforma (Plataforma de Gestão de Energia (EMP), análise de energia e plataforma de engajamento do cliente (CEP)), componente (hardware e software), tecnologia de comunicação (Zigbee, Z-Wave, Wi-Fi, HomePlug, Wireless M-Bus e Thread) e usuário final (residências independentes e apartamentos) - Tendências e previsões do setor até 2033.

Tamanho do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

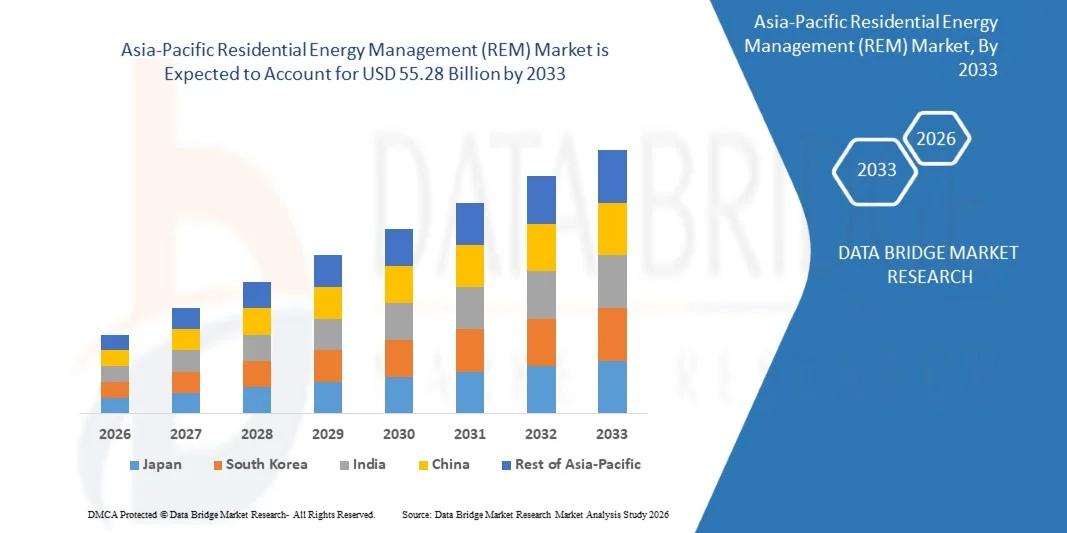

- O mercado de Gestão de Energia Residencial (REM) na região Ásia-Pacífico foi avaliado em US$ 4,78 bilhões em 2025 e deverá atingir US$ 55,28 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 35,8% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente adoção de dispositivos domésticos conectados e tecnologia para casas inteligentes, que possibilitam maior digitalização e automação nos sistemas de gestão de energia residencial. Os avanços em IoT, IA e plataformas baseadas em nuvem estão aprimorando a eficiência, o monitoramento e o controle do consumo de energia doméstica, impulsionando uma expansão significativa do mercado.

- Além disso, a crescente demanda do consumidor por soluções energeticamente eficientes, sustentáveis e fáceis de usar está consolidando os sistemas de Gestão de Energia Residencial (REM) como ferramentas essenciais para residências modernas. Esses fatores convergentes, incluindo a integração com fontes de energia renováveis e eletrodomésticos inteligentes, estão acelerando a adoção de soluções de gestão de energia residencial, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Gestão de Energia Residencial (REM) na Ásia-Pacífico

- Os sistemas de gestão de energia residencial, que oferecem monitoramento, otimização e controle em tempo real do consumo de energia doméstica, estão se tornando cada vez mais essenciais tanto para casas quanto para apartamentos. Esses sistemas fornecem aos proprietários informações práticas, gestão automatizada de energia e a possibilidade de integração com eletrodomésticos inteligentes e fontes de energia renováveis, aumentando a eficiência e a praticidade.

- A crescente demanda por sistemas de Gestão de Energia Residencial (REM) é impulsionada principalmente pela ampla adoção de tecnologias para casas inteligentes, pela crescente conscientização sobre conservação de energia e redução de custos, e pela necessidade cada vez maior de sustentabilidade. Os consumidores buscam cada vez mais soluções que combinem eficiência energética, conveniência e integração com ecossistemas mais amplos de casas inteligentes, impulsionando ainda mais o crescimento do mercado.

- A China dominou o mercado de Gestão de Energia Residencial (REM) na região Ásia-Pacífico em 2025, devido à rápida urbanização, à alta adoção de tecnologias para casas inteligentes e ao forte foco governamental na eficiência energética e na redução de carbono.

- Prevê-se que a Índia seja o país de crescimento mais rápido no mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico durante o período de previsão, devido à rápida urbanização, ao aumento do consumo de eletricidade nas residências e à crescente conscientização sobre a eficiência energética.

- O segmento de Plataformas de Gestão de Energia (EMP, na sigla em inglês) dominou o mercado com uma participação de 45,5% em 2025, devido à sua capacidade de fornecer controle centralizado sobre os sistemas de energia residenciais. As EMPs permitem que os usuários monitorem, otimizem e automatizem o consumo de energia, oferecendo insights acionáveis para melhorias de eficiência. Sua integração com eletrodomésticos inteligentes e dispositivos habilitados para IoT suporta estratégias avançadas de economia de energia, atraindo tanto clientes residenciais quanto concessionárias de serviços públicos. As EMPs também facilitam o monitoramento remoto, a manutenção preditiva e a redução de custos, reforçando sua dominância no mercado.

Escopo do relatório e segmentação do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

|

Atributos |

Principais insights do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de informações de mercado como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado elaborado pela equipe da Data Bridge Market Research inclui análises aprofundadas de especialistas, análises de importação/exportação, análises de preços, análises de produção e consumo e análises PESTEL. |

Tendências do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

“Crescente integração da otimização de energia residencial baseada em IA”

- Uma tendência significativa no mercado de gestão de energia residencial é a crescente integração de sistemas de otimização de energia doméstica baseados em inteligência artificial, que aprimoram o monitoramento em tempo real e o controle inteligente do consumo de energia das residências. Essa mudança está fortalecendo o papel das plataformas de Gestão de Energia Residencial (REM) como componentes essenciais para melhorar a eficiência energética e reduzir os custos de eletricidade em residências modernas.

- Por exemplo, empresas como a Schneider Electric e a Honeywell oferecem soluções de gestão de energia residencial com inteligência artificial que analisam padrões de consumo e ajustam automaticamente as cargas para maior eficiência. Esses sistemas ajudam os proprietários a manter níveis de consumo ideais, reduzindo a dependência do controle manual e promovendo economia de energia a longo prazo.

- As soluções de Gestão de Energia Residencial (REM) baseadas em IA estão ganhando forte aceitação em casas inteligentes, onde a resposta automatizada à demanda, a análise preditiva de consumo e o balanceamento de carga permitem que as residências operem com mais eficiência. Esse desenvolvimento está posicionando as plataformas avançadas de Gestão de Energia Residencial (REM) como contribuintes essenciais para ecossistemas de energia residencial sustentáveis.

- O uso crescente de eletrodomésticos conectados e dispositivos habilitados para IoT está acelerando a adoção de sistemas de gerenciamento baseados em IA que otimizam a distribuição de energia e reduzem o desperdício. Essa tendência está impulsionando a transição para ambientes residenciais inteligentes e orientados por dados.

- A integração de energias renováveis em residências está impulsionando a rápida utilização de plataformas avançadas de Gestão de Energia Residencial (REM, na sigla em inglês), que otimizam o uso de energia solar em telhados, armazenamento em baterias e eletricidade fornecida pela rede. Essa capacidade fortalece a independência energética e melhora a sustentabilidade das residências.

- O mercado continua a expandir-se à medida que cresce o interesse dos consumidores em soluções de energia para casas inteligentes, reforçando a tendência a longo prazo para a monitorização automatizada, o controlo eficiente da carga e a gestão inteligente do consumo em espaços residenciais.

Dinâmica do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

Motorista

“Crescente demanda por soluções eficientes de energia para casas inteligentes”

- A crescente adoção de tecnologias para casas inteligentes está impulsionando a demanda por soluções eficientes de gerenciamento de energia residencial, que proporcionam maior controle sobre o consumo de energia e permitem uma distribuição de energia mais eficiente. Esses sistemas ajudam as famílias a reduzir o consumo desnecessário e a melhorar o desempenho energético geral por meio de informações em tempo real.

- Por exemplo, empresas como a Siemens fornecem sistemas avançados de energia residencial que se integram a medidores inteligentes e eletrodomésticos conectados para otimizar o consumo. Essas soluções permitem ajustes dinâmicos de energia e possibilitam melhorias consistentes de desempenho em ambientes residenciais.

- A crescente eletrificação das residências está aumentando a necessidade de sistemas de gestão de energia capazes de lidar com diversas cargas, desde sistemas de climatização até carregadores de veículos elétricos. Essa demanda reforça o papel das plataformas de Gestão de Energia Residencial (REM) na manutenção do consumo equilibrado.

- Iniciativas governamentais que promovem a eficiência energética e a adoção de casas inteligentes estão impulsionando ainda mais o interesse em soluções energéticas residenciais avançadas. Esses programas incentivam os proprietários de imóveis a adotar tecnologias que melhoram a conservação de energia.

- O rápido crescimento dos ecossistemas de casas conectadas está impulsionando a expansão das soluções de Gestão de Energia Residencial (REM, na sigla em inglês), à medida que os consumidores buscam plataformas centralizadas para monitorar e controlar o consumo de energia. Esse fator continua a moldar os padrões de adoção a longo prazo em todos os mercados.

Restrição/Desafio

“Altos custos de instalação e complexidade de integração”

- O mercado de gestão de energia residencial enfrenta desafios devido aos altos custos de instalação e à complexidade de integração associada à instalação de sistemas avançados de monitoramento, medidores inteligentes e eletrodomésticos conectados. Essas barreiras financeiras e técnicas afetam a adoção, especialmente em residências com orçamento limitado.

- Por exemplo, empresas como a Tesla oferecem sistemas de energia residencial que exigem integração de hardware sofisticada e esforços consideráveis de instalação. Esses processos envolvem mão de obra especializada e alto investimento inicial, aumentando as barreiras à adoção em geral.

- A integração de sistemas de Gestão de Energia Residencial (REM) com a infraestrutura residencial existente geralmente exige verificações de compatibilidade, atualizações de sistema e configurações personalizadas que prolongam os prazos do projeto. Essa complexidade limita a facilidade de implementação para muitos consumidores.

- A necessidade de pessoal de instalação qualificado e configurações de rede avançadas cria restrições adicionais para a adoção em larga escala. Esses requisitos contribuem para maiores custos operacionais para os provedores de serviços.

- O desafio persiste, pois os consumidores avaliam os benefícios a longo prazo em relação aos investimentos iniciais, o que influencia as taxas de adoção em diversos segmentos residenciais.

Escopo do mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

O mercado é segmentado com base na aplicação da interface do usuário, plataforma, componente, tecnologia de comunicação e usuário final.

• Por meio de aplicativo de interface do usuário

Com base na aplicação da interface do usuário, o mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico é segmentado em Medidores Inteligentes, Termostatos Inteligentes, Displays Internos (IHD) e Eletrodomésticos Inteligentes. O segmento de Medidores Inteligentes dominou o mercado com a maior participação na receita em 2025, impulsionado por seu papel central no monitoramento de energia em tempo real e na emissão de faturas precisas. Os medidores inteligentes permitem que os proprietários de imóveis acompanhem seus padrões de consumo e tomem decisões informadas para reduzir os custos de energia. Sua integração com programas de concessionárias e iniciativas de resposta à demanda fortalece ainda mais a adoção, pois proporciona uma comunicação contínua entre residências e fornecedores de energia. Os medidores inteligentes também são cada vez mais compatíveis com plataformas avançadas de Gestão de Energia Residencial (REM), aprimorando a eficiência geral do sistema e o engajamento do cliente.

Prevê-se que o segmento de termostatos inteligentes apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pelo crescente interesse dos consumidores em conforto personalizado e economia de energia. Por exemplo, empresas como a Nest oferecem termostatos inteligentes que se ajustam automaticamente à ocupação do imóvel e às preferências do usuário, resultando em reduções significativas no consumo de energia. A conectividade dos termostatos inteligentes com aplicativos móveis e assistentes de voz aumenta a conveniência e o controle, tornando-os cada vez mais populares tanto em casas quanto em apartamentos. A combinação de eficiência energética, economia e conforto impulsiona a rápida adoção pelo mercado.

• Por plataforma

Com base na plataforma, o mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico é segmentado em Plataforma de Gestão de Energia (EMP), Análise de Energia e Plataforma de Engajamento do Cliente (CEP). O segmento de Plataforma de Gestão de Energia detinha a maior participação na receita, com 45,5% em 2025, devido à sua capacidade de fornecer controle centralizado sobre os sistemas de energia residenciais. As EMPs permitem que os usuários monitorem, otimizem e automatizem o consumo de energia, oferecendo insights acionáveis para melhorias de eficiência. Sua integração com eletrodomésticos inteligentes e dispositivos habilitados para IoT suporta estratégias avançadas de economia de energia, atraindo tanto clientes residenciais quanto concessionárias de serviços públicos. As EMPs também facilitam o monitoramento remoto, a manutenção preditiva e a redução de custos, reforçando sua dominância no mercado.

O segmento de Análise de Energia deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, impulsionado pela crescente demanda por otimização energética baseada em dados. Por exemplo, empresas como a Schneider Electric oferecem ferramentas analíticas que fornecem insights profundos sobre padrões de consumo, gerenciamento de picos de carga e planejamento energético preditivo. A análise avançada ajuda proprietários de imóveis e fornecedores de energia a identificar ineficiências e implementar intervenções direcionadas, aumentando a economia de energia e a sustentabilidade. A crescente adoção de soluções analíticas baseadas em nuvem acelera ainda mais o crescimento do mercado.

• Por componente

Com base nos componentes, o mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico é segmentado em Hardware e Software. O segmento de Hardware dominou o mercado com a maior participação na receita em 2025, visto que dispositivos como medidores inteligentes, termostatos e sensores formam a espinha dorsal dos sistemas de gestão de energia residencial. Os componentes de hardware são essenciais para o monitoramento em tempo real, o controle de carga e a gestão automatizada de energia, garantindo a operação eficiente do sistema. Sua integração com múltiplas plataformas e aplicativos aprimora a funcionalidade, tornando-os indispensáveis para residências modernas. A confiabilidade e o desempenho do hardware também influenciam a confiança e a adoção por parte dos clientes, fortalecendo a posição do segmento.

Prevê-se que o segmento de Software apresente a taxa de crescimento mais rápida entre 2026 e 2033, impulsionado pela crescente demanda por aplicativos inteligentes e fáceis de usar para monitoramento e controle de energia. Por exemplo, empresas como a Siemens fornecem soluções de software que analisam o consumo de energia, preveem tendências de consumo e facilitam a automação de eletrodomésticos. As soluções de software permitem a comunicação perfeita entre dispositivos e plataformas de hardware, aprimorando a experiência do usuário e a eficiência operacional. A escalabilidade e a adaptabilidade do software o tornam uma opção cada vez mais preferida tanto para residências individuais quanto para apartamentos.

• Por meio da Tecnologia da Comunicação

Com base na tecnologia de comunicação, o mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico é segmentado em Zigbee, Z-Wave, Wi-Fi, HomePlug, Wireless M-Bus e Thread. O segmento Wi-Fi detinha a maior participação na receita em 2025 devido à ampla disponibilidade de redes Wi-Fi domésticas e sua compatibilidade com diversos dispositivos. Os sistemas de Gestão de Energia Residencial (REM) com Wi-Fi permitem que os proprietários monitorem e controlem remotamente o consumo de energia por meio de aplicativos móveis e plataformas em nuvem. Eles também oferecem suporte à integração com assistentes de voz e outros ecossistemas de casas inteligentes, aumentando a conveniência e a adoção. A conectividade robusta e as altas taxas de transferência de dados do Wi-Fi contribuem para sua contínua dominância no mercado.

O segmento Zigbee deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida entre 2026 e 2033, impulsionado pelo seu baixo consumo de energia e pela conectividade de rede mesh segura e confiável. Por exemplo, empresas como a Honeywell utilizam dispositivos com tecnologia Zigbee para facilitar a comunicação contínua entre sensores, termostatos e plataformas de energia. O Zigbee permite redes escaláveis que podem suportar múltiplos dispositivos sem interferências significativas, aumentando a eficiência do sistema. Sua popularidade está crescendo em residências inteligentes, onde a eficiência energética e a interoperabilidade são prioridades essenciais.

• Por usuário final

Com base no usuário final, o mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico é segmentado em casas independentes e apartamentos. O segmento de casas independentes dominou o mercado com a maior participação na receita em 2025, devido às maiores taxas de adoção de sistemas avançados de gestão de energia em residências isoladas. Proprietários de imóveis independentes frequentemente investem em soluções abrangentes para monitoramento de energia, integração de energias renováveis e redução de custos. Casas independentes oferecem flexibilidade para instalação de dispositivos e personalização do sistema, incentivando a implementação de tecnologias avançadas de Gestão de Energia Residencial (REM). Além disso, essas residências geralmente participam de programas de resposta à demanda conduzidos por concessionárias de energia, aumentando a proposta de valor dos sistemas de gestão de energia.

Prevê-se que o segmento de apartamentos apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente urbanização e pela adoção de soluções de energia inteligentes em unidades residenciais multifamiliares. Por exemplo, incorporadoras como a Brookfield Residential estão incorporando sistemas de energia inteligentes em novos complexos de apartamentos para melhorar a sustentabilidade e reduzir os custos operacionais. Os apartamentos se beneficiam de soluções compactas e integradas que podem ser gerenciadas centralmente, aumentando a comodidade para os moradores. A crescente conscientização sobre eficiência energética e os incentivos governamentais também contribuem para a rápida adoção dessas soluções em apartamentos.

Análise Regional do Mercado de Gestão de Energia Residencial (REM) na Ásia-Pacífico

- A China dominou o mercado de Gestão de Energia Residencial (REM) na região Ásia-Pacífico, com a maior participação na receita em 2025, impulsionada pela rápida urbanização, alta adoção de tecnologias para casas inteligentes e forte foco governamental em eficiência energética e redução de carbono.

- A implantação em larga escala de medidores inteligentes, a crescente integração de energias renováveis e o uso generalizado de eletrodomésticos inteligentes reforçam a posição de liderança da China na região. A presença de grandes empresas nacionais de IoT e tecnologia energética, juntamente com parcerias com fornecedores globais de soluções para casas inteligentes, continua a fortalecer a penetração no mercado.

- A crescente conscientização dos consumidores sobre a economia de energia, o crescimento dos ecossistemas de casas conectadas e a disponibilidade cada vez maior de soluções de Gestão de Energia Residencial (REM) com boa relação custo-benefício consolidam ainda mais a posição dominante da China no mercado da Ásia-Pacífico.

Análise do Mercado de Gestão de Energia Residencial (REM) na Ásia-Pacífico: Japão

Prevê-se que o Japão testemunhe um crescimento constante de 2026 a 2033, impulsionado pelo seu setor de casas inteligentes já consolidado, pelo forte foco na conservação de energia e pela infraestrutura residencial avançada. Os consumidores japoneses demonstram uma grande preferência por soluções de gestão de energia premium e de alta precisão que aprimoram o conforto, a eficiência e a automação. A ênfase do país em sistemas de energia resilientes a desastres, combinada com a ampla adoção de sistemas de energia solar com armazenamento, está acelerando a integração de plataformas de Gestão de Energia Residencial (REM). Os avanços contínuos em P&D e as colaborações entre fabricantes japoneses de eletrônicos e empresas de tecnologia globais reforçam a expansão consistente do mercado. O compromisso do Japão com a estabilidade energética, a inovação e a sustentabilidade garante uma perspectiva de crescimento sólida e constante dentro do ecossistema regional.

Análise do Mercado de Gestão de Energia Residencial (REM) na Índia e na Região Ásia-Pacífico

Prevê-se que a Índia registre a taxa de crescimento anual composta (CAGR) mais rápida no mercado de Gestão de Energia Residencial (REM) da Ásia-Pacífico durante o período de 2026 a 2033, impulsionada pela rápida urbanização, pelo aumento do consumo de eletricidade nas residências e pela crescente conscientização sobre a eficiência energética. A crescente adoção de medidores inteligentes, os programas de energia digital apoiados pelo governo e a demanda crescente da classe média por soluções para casas conectadas estão acelerando o crescimento do mercado. A necessidade de plataformas de Gestão de Energia Residencial (REM) acessíveis, fáceis de usar e escaláveis é particularmente forte em regiões urbanas e semiurbanas. A expansão dos canais de varejo e comércio eletrônico, juntamente com parcerias entre fornecedores globais de soluções para casas inteligentes e concessionárias de energia indianas, estão aumentando a acessibilidade. Iniciativas de sustentabilidade lideradas pelo governo e o crescente interesse em sistemas solares residenciais posicionam a Índia como o mercado de crescimento mais rápido da região.

Participação de mercado em gestão de energia residencial (REM) na região Ásia-Pacífico

O setor de Gestão de Energia Residencial (REM) é liderado principalmente por empresas consolidadas, incluindo:

- ABB (Suíça)

- Eaton (Irlanda)

- Schneider Electric (França)

- Honeywell Internacional (EUA)

- Siemens (Alemanha)

- General Electric (EUA)

- Engie (França)

- E.On (Alemanha)

- Bosch (Alemanha)

- Landis+Gyr (Suíça)

- Itron (EUA)

- Emerson (EUA)

- Trane Technologies (Irlanda)

- Tantalus system Corp, (EUA)

- Provident Energy Management Inc. (Canadá)

- Sunverge Energy Inc. (EUA)

- Koben System Inc. (Canadá)

- NeoSilica (Índia)

- Lockheed Martin Corporation (EUA)

- Uplight (EUA)

- Span.IO (EUA)

- Lumin (EUA)

- RacePoint Energy (EUA)

- Apartamento (Polônia)

- Wattics Ltd (Reino Unido)

Últimos desenvolvimentos no mercado de gestão de energia residencial (REM) na região Ásia-Pacífico

- Em setembro de 2025, a Honeywell (EUA) lançou um novo conjunto de produtos para casas inteligentes, projetados para otimizar o consumo de energia por meio de algoritmos avançados de IA. Espera-se que essa inovação fortaleça significativamente a posição da Honeywell no mercado, fornecendo aos proprietários de imóveis recomendações personalizadas de economia de energia, aumentando assim o engajamento e a fidelização dos usuários. Ao integrar insights baseados em IA aos sistemas de gerenciamento de energia residencial, a Honeywell fortalece sua vantagem competitiva e alinha suas ofertas à crescente demanda por soluções de energia inteligentes e automatizadas no mercado global.

- Em agosto de 2025, a Schneider Electric (FR) anunciou uma parceria estratégica com uma empresa líder em energias renováveis para integrar soluções de energia solar em seus sistemas de gestão de energia residencial. Essa colaboração deverá impulsionar a presença da Schneider no mercado, permitindo que os proprietários de imóveis gerenciem a geração de energia solar juntamente com o consumo tradicional, promovendo eficiência energética e sustentabilidade. Ao expandir seu portfólio de produtos para incluir a integração de energias renováveis, a Schneider se posiciona como pioneira na transição para casas inteligentes de baixo carbono, atendendo à crescente preferência do consumidor por soluções ecologicamente corretas.

- Em julho de 2025, a Siemens (DE) expandiu suas operações no mercado norte-americano por meio da aquisição de uma empresa local de tecnologia para casas inteligentes. Essa iniciativa visa fortalecer a presença da Siemens no mercado, combinando conhecimento local com tecnologias avançadas para oferecer soluções personalizadas de gestão de energia residencial. A aquisição aprimora a capacidade da Siemens de atender à crescente demanda por soluções de energia inteligente, aumentar a fidelização de clientes e acelerar sua trajetória de crescimento em um mercado competitivo.

- Em maio de 2025, a LG Electronics (KR) lançou uma nova linha de eletrodomésticos conectados, integrados à sua plataforma de gerenciamento de energia residencial. Espera-se que esse desenvolvimento aumente a participação de mercado da LG, permitindo o monitoramento e o controle contínuos do consumo de energia em diversos dispositivos. Ao fornecer aos proprietários de imóveis informações abrangentes sobre o consumo de energia em nível de eletrodoméstico, a LG fortalece o apelo de seu ecossistema de Gerenciamento de Energia Residencial (REM), apoia iniciativas de eficiência energética e reforça sua liderança no crescente segmento de casas inteligentes.

- Em julho de 2020, a China prorrogou o prazo de seu programa de subsídios para veículos de nova energia (NEVs) de 2020 para o final de 2022, reduzindo gradualmente os níveis básicos de subsídio em 10%, 20% e 30% ao ano. Também estendeu a isenção de impostos sobre a compra de NEVs até o final de 2023. Espera-se que essas prorrogações estimulem a adoção de veículos energeticamente eficientes e promovam a integração com sistemas de gestão de energia residencial, impulsionando indiretamente a demanda por soluções de energia inteligente em residências que visam otimizar o uso de eletricidade proveniente de fontes renováveis e a infraestrutura de recarga de veículos elétricos.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.