Asia Pacific Pharmaceutical Vials Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

17.23 Billion

USD

28.31 Billion

2025

2033

USD

17.23 Billion

USD

28.31 Billion

2025

2033

| 2026 –2033 | |

| USD 17.23 Billion | |

| USD 28.31 Billion | |

|

|

|

|

Segmentação do mercado de frascos farmacêuticos na região Ásia-Pacífico, por material (vidro, plástico e outros), tipo de gargalo (rosca, crimpagem, câmara dupla, tampa flip-top e outros), tamanho da tampa (13-425 mm, 15-425 mm, 18-400 mm, 22-350 mm, 24-400 mm, 8-425 mm, 9 mm e outros), canal de distribuição (vendas diretas, farmácias/drogarias, comércio eletrônico e outros), capacidade (1 ml, 2 ml, 3 ml, 4 ml, 8 ml, 10 ml, 20 ml, 30 ml, 50 ml e outras), tipo de medicamento (injetável e não injetável), aplicação (oral, nasal, injetável e outras), usuário final (empresas farmacêuticas, empresas biofarmacêuticas, empresas de desenvolvimento e fabricação por contrato, farmácias de manipulação e outros), mercado (parenteral, gastrointestinal, otorrinolaringológico e outros). - Tendências e Previsões do Setor até 2033

Tamanho do mercado de frascos farmacêuticos na região Ásia-Pacífico

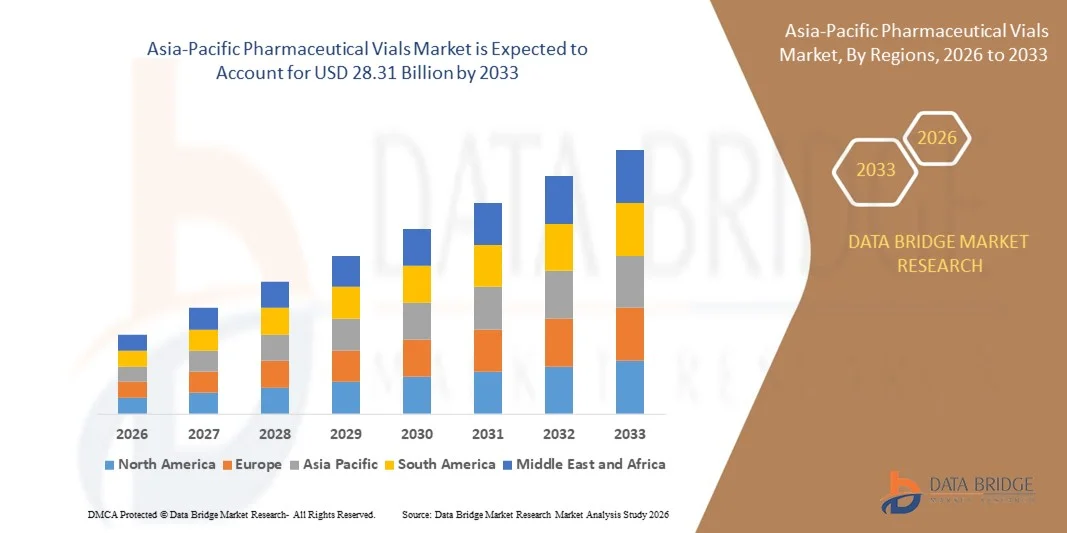

- O mercado de frascos farmacêuticos na região Ásia-Pacífico foi avaliado em US$ 17,23 bilhões em 2025 e deverá atingir US$ 28,31 bilhões até 2033 , com uma taxa de crescimento anual composta (CAGR) de 6,40% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pelo aumento da produção farmacêutica e pela crescente demanda por medicamentos injetáveis, vacinas e produtos biológicos em toda a região, apoiados pela expansão da infraestrutura de saúde e pelas aprovações regulatórias.

- Além disso, os avanços nas tecnologias de fabricação de frascos, como esterilização, aprimoramento da qualidade do vidro e soluções multidose, estão impulsionando a eficiência da produção e os padrões de segurança. Esses fatores convergentes estão acelerando a adoção de frascos farmacêuticos, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Frascos Farmacêuticos na Ásia-Pacífico

- Os frascos farmacêuticos, utilizados para armazenar e transportar medicamentos injetáveis, vacinas e produtos biológicos, são componentes cada vez mais vitais das cadeias de suprimentos farmacêuticas e de saúde modernas, tanto em ambientes hospitalares quanto laboratoriais, devido à sua maior esterilidade, durabilidade e compatibilidade com sistemas avançados de administração de medicamentos.

- A crescente demanda por frascos farmacêuticos é impulsionada principalmente pelo aumento da produção de medicamentos injetáveis, pela expansão dos programas de vacinação e pela crescente adoção de medicamentos biológicos e especializados.

- A China dominou o mercado de frascos farmacêuticos na região Ásia-Pacífico, com a maior participação na receita, de 32,2% em 2025, caracterizada por uma infraestrutura de fabricação farmacêutica bem estabelecida, altos gastos com saúde e forte presença de fabricantes líderes de frascos. Os EUA, por sua vez, apresentaram um crescimento substancial no uso de frascos multidose e pré-carregados, impulsionado por inovações na qualidade do vidro, processos de esterilização e conformidade regulatória.

- Prevê-se que a Índia seja a região de crescimento mais rápido no mercado de frascos farmacêuticos da Ásia-Pacífico durante o período de previsão, devido à expansão da produção farmacêutica, ao aumento das iniciativas governamentais na área da saúde e à crescente demanda por vacinas e produtos biológicos.

- O segmento de vidro dominou o mercado com a maior participação na receita, de 47,5% em 2025, impulsionado por sua comprovada resistência química, esterilidade e compatibilidade com uma ampla gama de formulações de medicamentos, incluindo produtos biológicos e vacinas.

Escopo do relatório e segmentação do mercado de frascos farmacêuticos na região Ásia-Pacífico

|

Atributos |

Principais informações de mercado sobre frascos farmacêuticos |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de frascos farmacêuticos na região Ásia-Pacífico

Maior eficiência por meio de tecnologias avançadas de frascos.

- Uma tendência significativa e crescente no mercado de frascos farmacêuticos da região Ásia-Pacífico é a adoção de tecnologias avançadas de fabricação e soluções digitais, incluindo automação, sistemas de envase de precisão e monitoramento de qualidade em tempo real. Essas inovações estão aprimorando significativamente a eficiência da produção, a segurança do produto e a consistência em toda a cadeia de suprimentos farmacêutica.

- Por exemplo, linhas de envase automatizadas com sistemas integrados de esterilização e fechamento permitem que os fabricantes mantenham alta produtividade, minimizando os riscos de contaminação. Da mesma forma, soluções em frascos pré-cheios e multidose agilizam a administração de medicamentos e reduzem erros de dosagem em ambientes clínicos e hospitalares.

- A integração digital na fabricação de frascos permite recursos como monitoramento em tempo real dos parâmetros de produção, manutenção preditiva e rastreabilidade aprimorada em toda a cadeia de suprimentos. Por exemplo, algumas soluções do Grupo Stevanato e da Schott AG utilizam sensores habilitados para IoT para monitorar a integridade dos frascos e garantir a conformidade com as normas regulatórias. Além disso, sistemas automatizados de rastreamento e etiquetagem facilitam o gerenciamento de estoque e a rastreabilidade dos lotes.

- A integração perfeita de frascos farmacêuticos com plataformas digitais de controle de qualidade e soluções de embalagens inteligentes facilita a supervisão centralizada da produção, armazenamento e distribuição. Por meio de um único sistema, os fabricantes podem monitorar múltiplas linhas de produção, garantir a esterilidade e rastrear lotes em tempo real, criando um fluxo de trabalho altamente eficiente e confiável.

- Essa tendência em direção a sistemas de fabricação e controle de qualidade mais automatizados, precisos e interconectados está remodelando fundamentalmente as expectativas para a produção de frascos farmacêuticos. Consequentemente, empresas como Corning, West Pharmaceutical Services e Stevanato Group estão desenvolvendo frascos de alta tecnologia com recursos como monitoramento de qualidade assistido por IA, designs prontos para automação e compatibilidade com sistemas avançados de administração de medicamentos.

- A demanda por frascos farmacêuticos que ofereçam maior eficiência de fabricação, segurança e integração digital está crescendo rapidamente nos setores farmacêuticos hospitalares e comerciais, à medida que os fabricantes priorizam cada vez mais a qualidade do produto, a conformidade regulatória e a otimização das operações.

Dinâmica do mercado de frascos farmacêuticos na região Ásia-Pacífico

Motorista

Crescente necessidade devido ao aumento da demanda por medicamentos injetáveis e vacinas.

- A crescente prevalência de doenças crônicas, aliada à demanda cada vez maior por vacinas e produtos biológicos, é um fator significativo para o aumento da adoção de frascos farmacêuticos.

- Por exemplo, em 2025, importantes fabricantes como a Schott AG e o Grupo Stevanato anunciaram expansões em suas linhas de produção automatizadas de frascos para atender à crescente demanda por vacinas multidose contra COVID-19 e influenza. Espera-se que essas estratégias de grandes empresas impulsionem o crescimento do mercado de frascos farmacêuticos durante o período de previsão.

- À medida que os profissionais de saúde e as empresas farmacêuticas buscam garantir a administração segura, estéril e eficiente de medicamentos, os frascos farmacêuticos oferecem recursos avançados, como a capacidade de administrar múltiplas doses, a compatibilidade com seringas pré-cheias e a esterilidade aprimorada, proporcionando uma vantagem significativa em relação a outros formatos de embalagem.

- Além disso, a crescente ênfase em programas de vacinação, produtos biológicos e medicamentos injetáveis especiais está tornando os frascos farmacêuticos um componente essencial das cadeias de suprimentos modernas da área da saúde, facilitando a integração perfeita com sistemas automatizados de envase, armazenamento e distribuição.

- A praticidade dos frascos pré-carregados, multidose e prontos para automação, juntamente com a conformidade regulatória e os recursos de rastreabilidade, são fatores-chave que impulsionam a adoção em hospitais, clínicas e na indústria farmacêutica. A tendência em direção a linhas de produção escaláveis e designs de frascos fáceis de usar contribui ainda mais para o crescimento do mercado.

Restrição/Desafio

Preocupações com relação à conformidade regulatória e aos custos de produção

- As preocupações em torno dos rigorosos requisitos regulamentares e dos elevados custos de produção representam um desafio significativo para uma expansão mais ampla do mercado. Os frascos farmacêuticos devem atender a padrões rigorosos de esterilidade, qualidade do vidro e biocompatibilidade, o que aumenta a complexidade e os custos de fabricação.

- Por exemplo, a conformidade com as normas da FDA, EMA e ISO exige testes e validações rigorosos, o que pode atrasar o lançamento de novos designs de frascos no mercado.

- Enfrentar esses desafios regulatórios por meio de um controle de qualidade robusto, sistemas de produção automatizados e adesão a padrões globais é crucial para construir confiança entre as empresas farmacêuticas. Fabricantes como a West Pharmaceutical Services e a Corning enfatizam a conformidade e a garantia da qualidade em seus processos de produção para tranquilizar os clientes. Além disso, o custo relativamente alto de frascos de vidro avançados ou multidose, em comparação com frascos básicos, pode ser uma barreira para fabricantes farmacêuticos menores, principalmente em mercados emergentes.

- Embora a eficiência na fabricação e as economias de escala estejam reduzindo gradualmente os custos, o preço mais elevado atribuído aos frascos estéreis de alta qualidade ainda pode dificultar a adoção em larga escala, especialmente entre os compradores sensíveis ao preço.

- Superar esses desafios por meio de automação aprimorada, métodos de produção economicamente viáveis e adesão consistente aos padrões globais de qualidade será vital para o crescimento sustentado do mercado.

Escopo do mercado de frascos farmacêuticos na região Ásia-Pacífico

O mercado de frascos farmacêuticos é segmentado com base no material, tipo de gargalo, tamanho da tampa, canal de distribuição, capacidade, tipo de medicamento, aplicação, usuário final e mercado.

- Por material

Com base no material, o mercado de frascos farmacêuticos na região Ásia-Pacífico é segmentado em vidro, plástico e outros. O segmento de vidro dominou o mercado com a maior participação de receita, de 47,5% em 2025, impulsionado por sua comprovada resistência química, esterilidade e compatibilidade com uma ampla gama de formulações de medicamentos, incluindo biológicos e vacinas. Os frascos de vidro são amplamente preferidos pelos fabricantes farmacêuticos para medicamentos injetáveis de alto valor devido à sua estabilidade e baixa reatividade.

Prevê-se que o segmento de plástico apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,3%, entre 2026 e 2033, impulsionado pela sua leveza, resistência a quebras e adequação à distribuição de vacinas em larga escala. Os frascos de plástico são cada vez mais adotados como soluções de baixo custo, especialmente em mercados emergentes, e para aplicações que exigem baixo risco de quebra durante o transporte. A crescente demanda por recipientes para medicamentos seguros, leves e fáceis de transportar deverá impulsionar o crescimento geral em ambos os tipos de materiais.

- Por tipo de pescoço

Com base no tipo de gargalo, o mercado é segmentado em gargalo de rosca, gargalo de crimpagem, câmara dupla, tampa flip-top e outros. O segmento de gargalo de rosca dominou o mercado com uma participação de 44,6% em 2025, devido à sua facilidade de vedação, compatibilidade com máquinas de fechamento automatizadas e uso generalizado em medicamentos injetáveis e biológicos. Os frascos com gargalo de rosca oferecem fechamentos confiáveis e à prova de vazamentos, sendo preferidos tanto para aplicações de dose única quanto de múltiplas doses.

Prevê-se que o segmento de câmara dupla apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 20,8%, entre 2026 e 2033, impulsionado pela sua capacidade de armazenar medicamentos liofilizados separadamente de solventes, facilitando a administração avançada de medicamentos e a sua estabilidade. Espera-se que a crescente adoção de produtos biológicos liofilizados e terapias combinadas impulsione o crescimento neste segmento, particularmente entre os fabricantes biofarmacêuticos que buscam designs inovadores de frascos para formulações complexas.

- Por tamanho da tampa

Com base no tamanho da tampa, o mercado de frascos farmacêuticos da região Ásia-Pacífico é segmentado em vários tamanhos, variando de 8-425 mm a 24-400 mm. O segmento de 13-425 mm dominou o mercado com uma participação de 41,2% em 2025, devido à sua versatilidade no acondicionamento de uma ampla variedade de medicamentos injetáveis e à facilidade de uso com máquinas de fechamento padrão. Esse tamanho de tampa é o preferido em hospitais e programas de vacinação em larga escala por sua compatibilidade com seringas e equipamentos de envase comumente utilizados.

O segmento de 22 a 350 mm deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,0%, entre 2026 e 2033, impulsionado pela crescente demanda por frascos de maior volume utilizados em vacinas e produtos biológicos multidose. O aumento da produção de terapias injetáveis de alto volume e a expansão dos programas de vacinação na região da Ásia-Pacífico estão impulsionando a adoção desses tamanhos de tampa tanto em ambientes comerciais quanto hospitalares.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em vendas diretas, farmácias/drogarias, comércio eletrônico e outros. O segmento de vendas diretas dominou o mercado com uma participação de 45,7% em 2025, devido aos fortes relacionamentos entre fabricantes de produtos farmacêuticos e hospitais, clínicas e grandes distribuidores de medicamentos. As vendas diretas permitem a aquisição em grande escala, o controle de qualidade e a conformidade com as normas regulatórias, tornando-se o canal preferido das grandes empresas farmacêuticas.

Espera-se que o segmento de comércio eletrônico apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 23,1%, entre 2026 e 2033, impulsionado pelo crescimento das plataformas de varejo farmacêutico online, pela crescente digitalização e pela conveniência da entrega em domicílio para pequenos fornecedores de serviços de saúde e farmácias. A crescente adoção de canais de comércio eletrônico é particularmente notável nos mercados emergentes da Ásia-Pacífico, onde o acesso a suprimentos médicos está se expandindo rapidamente.

- Por capacidade

Com base na capacidade, o mercado é segmentado em vários volumes de frascos. O segmento de 10 ml dominou o mercado com uma participação de 42,8% em 2025, devido ao seu uso generalizado para medicamentos injetáveis, vacinas e formulações multidose. Ele proporciona um equilíbrio ideal entre flexibilidade de dosagem e eficiência de armazenamento.

Espera-se que o segmento de 2 ml apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,6%, entre 2026 e 2033, impulsionado pelo aumento da produção de produtos biológicos e vacinas de alto valor que exigem dosagem em pequenos volumes. Frascos de pequena capacidade são preferidos para medicamentos liofilizados, seringas pré-cheias e formulações pediátricas, criando uma forte demanda em hospitais, clínicas e fabricantes de produtos farmacêuticos.

- Por tipo de medicamento

Com base no tipo de medicamento, o mercado é segmentado em medicamentos injetáveis e não injetáveis. O segmento de injetáveis dominou o mercado com uma participação de 56,3% em 2025, impulsionado pela crescente adoção de vacinas, produtos biológicos e medicamentos injetáveis especiais em ambientes hospitalares e clínicos. Os frascos para injetáveis são essenciais para garantir a esterilidade, a precisão da dosagem e o armazenamento seguro.

O segmento de medicamentos não injetáveis deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 20,5%, entre 2026 e 2033, impulsionado pela crescente demanda por formulações líquidas orais, sprays nasais e medicamentos tópicos acondicionados em pequenos frascos. A expansão do portfólio de produtos farmacêuticos e o aumento de formulações centradas no paciente deverão acelerar o crescimento desse segmento.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em oral, nasal, injetável e outros. O segmento de injetáveis dominou o mercado com uma participação de 57,1% em 2025, devido à alta demanda por vacinas, produtos biológicos e medicamentos parenterais. Os frascos para injetáveis garantem esterilidade, precisão na dosagem e estabilidade a longo prazo, tornando-os indispensáveis em hospitais, clínicas e na indústria farmacêutica.

O segmento nasal deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,9%, entre 2026 e 2033, impulsionado pela crescente popularidade de vacinas nasais, sistemas de administração de medicamentos para doenças crônicas e terapias não invasivas preferidas pelos pacientes. A crescente inovação em formulações de medicamentos nasais e a compatibilidade com dispositivos estão impulsionando a adoção na região.

- Por usuário final

Com base no usuário final, o mercado é segmentado em empresas farmacêuticas, empresas biofarmacêuticas, empresas de desenvolvimento e fabricação por contrato (CDMO), farmácias de manipulação e outras. O segmento de empresas farmacêuticas dominou o mercado com uma participação de 48,5% em 2025, impulsionado pela produção em larga escala de vacinas, produtos biológicos e medicamentos injetáveis. Empresas farmacêuticas consolidadas preferem fornecedores confiáveis para garantir a qualidade consistente dos frascos e a conformidade com as normas regulatórias.

Prevê-se que o segmento de empresas biofarmacêuticas apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,7%, entre 2026 e 2033, impulsionado pelo crescimento do setor de produtos biológicos e biossimilares, pelo aumento dos projetos de pesquisa e desenvolvimento e pela necessidade de formatos de frascos especializados para compostos sensíveis.

- Por mercado: Parenteral, Gastroenterologia, Otorrinolaringologia e Outros

Com base no mercado, o mercado de frascos farmacêuticos da Ásia-Pacífico é segmentado em parenteral, gastrointestinal, otorrinolaringológico e outros. O segmento parenteral dominou o mercado com uma participação de 54,2% em 2025, impulsionado pela ampla demanda por medicamentos injetáveis, vacinas e produtos biológicos que exigem armazenamento estéril e confiável em frascos. Os frascos parenterais são essenciais em hospitais e ambientes clínicos para garantir a segurança do paciente e manter a eficácia do medicamento.

Espera-se que o segmento de otorrinolaringologia (ORL) apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 21,3%, entre 2026 e 2033, impulsionado pelo uso crescente de sistemas especializados de administração de medicamentos para terapias de ouvido, nariz e garganta, principalmente em atendimento ambulatorial e clínicas especializadas. A crescente conscientização sobre tratamentos específicos para cada doença e o aumento da inovação farmacêutica estão impulsionando o crescimento desse segmento.

Análise Regional do Mercado de Frascos Farmacêuticos na Ásia-Pacífico

- A China dominou o mercado de frascos farmacêuticos da região Ásia-Pacífico, com a maior participação na receita, de 32,2% em 2025, impulsionada por uma base crescente de fabricação farmacêutica, alta demanda por vacinas e produtos biológicos e infraestrutura de saúde bem estabelecida.

- Os profissionais de saúde e as empresas farmacêuticas da região priorizam frascos de alta qualidade devido à sua confiabilidade, esterilidade e compatibilidade com uma ampla gama de medicamentos injetáveis e biológicos.

- Essa ampla adoção é ainda mais sustentada por normas regulatórias rigorosas, tecnologias de fabricação avançadas e fortes relações entre fornecedores de frascos e grandes empresas farmacêuticas, estabelecendo frascos de vidro e frascos especiais de alta qualidade como a escolha preferida tanto para a produção comercial quanto para o uso hospitalar.

Análise do Mercado de Frascos Farmacêuticos na China e na Região Ásia-Pacífico

O mercado chinês de frascos farmacêuticos representou a maior fatia da receita na região Ásia-Pacífico em 2025, impulsionado pela sólida base de fabricação farmacêutica do país, pela expansão da produção de vacinas e pela crescente demanda por medicamentos biológicos e injetáveis. A rápida urbanização, o aumento dos gastos com saúde e as iniciativas governamentais que promovem o acesso à saúde estão impulsionando ainda mais o crescimento do mercado. A China também está se consolidando como um importante polo de fabricação de frascos farmacêuticos, possibilitando a produção de frascos de vidro e plástico de alta qualidade e custo-benefício para as cadeias de suprimentos nacionais e internacionais.

Análise do Mercado de Frascos Farmacêuticos no Japão e na Região Ásia-Pacífico

O mercado japonês de frascos farmacêuticos está testemunhando um crescimento constante, impulsionado pela alta demanda do país por produtos biológicos avançados, vacinas e medicamentos injetáveis. O foco do Japão em inovação tecnológica, padrões de qualidade rigorosos e uma população em envelhecimento impulsionam a adoção de frascos pré-cheios e multidose que oferecem conveniência, esterilidade e segurança. A integração de sistemas automatizados de envase e embalagem na indústria farmacêutica japonesa fortalece ainda mais a expansão do mercado.

Análise do Mercado de Frascos Farmacêuticos na Índia e na Região Ásia-Pacífico

O mercado de frascos farmacêuticos na Índia deverá apresentar o maior crescimento anual composto (CAGR) da região Ásia-Pacífico durante o período de previsão, impulsionado pelo aumento da produção farmacêutica, pela crescente produção de vacinas e pela expansão das instalações biofarmacêuticas. Iniciativas governamentais que promovem campanhas de vacinação, a crescente conscientização sobre saúde e o aumento das exportações de medicamentos injetáveis contribuem para a rápida adoção de frascos de vidro e plástico. O ecossistema de produção competitivo em termos de custos da Índia também atrai empresas farmacêuticas globais em busca de um fornecimento confiável de frascos.

Análise do Mercado de Frascos Farmacêuticos na Coreia do Sul e na Região Ásia-Pacífico

O mercado de frascos farmacêuticos da Coreia do Sul está crescendo de forma constante devido ao aumento dos investimentos em produtos biológicos, vacinas e na produção de medicamentos injetáveis estéreis. A crescente adoção de frascos de vidro de alta qualidade, o rigoroso cumprimento das normas regulatórias e os avanços tecnológicos em sistemas de esterilização e envase de frascos estão impulsionando o crescimento do mercado. Além disso, a infraestrutura farmacêutica bem desenvolvida do país e a produção voltada para a exportação aumentam a demanda tanto para o mercado interno quanto para o mercado internacional.

Participação de mercado de frascos farmacêuticos na região Ásia-Pacífico

O setor de frascos farmacêuticos é liderado principalmente por empresas consolidadas, incluindo:

• Schott AG (Alemanha)

• Grupo Stevanato (Itália)

• Corning Inc. (EUA)

• West Pharmaceutical Services, Inc. (EUA)

• BD (Becton, Dickinson and Company) (EUA)

• Suzhou Hengrui Medicine (China)

• Vials India Limited (Índia)

• Sun Pharmaceutical Industries Ltd. (Índia)

• Flexion Therapeutics (EUA)

• SG Pharma (Índia)

• Huhtamaki PPL (Finlândia)

• Daikyo Seiko Ltd. (Japão)

• Agilent Technologies (EUA)

• Camber Pharma (Reino Unido)

• Kangtai Biological Products (China)

• Hikma Pharmaceuticals (Reino Unido)

• Ricerca Biosciences (EUA)

• Stein Pharma (China)

• Corning Life Sciences (EUA)

• Daikyo Pharmaceutical Packaging (Japão)

Quais são os desenvolvimentos recentes no mercado de frascos farmacêuticos na região Ásia-Pacífico?

- Em abril de 2024, a Schott AG, líder global em soluções de vidro especiais, lançou uma iniciativa estratégica na Índia com o objetivo de aprimorar a produção e o fornecimento de frascos farmacêuticos de alta qualidade para vacinas e produtos biológicos. Essa iniciativa reforça o compromisso da empresa em fornecer frascos confiáveis, estéreis e em conformidade com as normas regulatórias, adaptados às crescentes necessidades de saúde da região. Ao alavancar sua expertise global e tecnologias de fabricação avançadas, a Schott AG não só está respondendo aos desafios farmacêuticos regionais, como também consolidando sua posição no mercado de frascos farmacêuticos da Ásia-Pacífico, que está em rápida expansão.

- Em março de 2024, o Grupo Stevanato, fabricante italiano de frascos e seringas pré-carregadas, lançou uma nova linha de frascos multidose desenvolvida especificamente para programas de vacinação em larga escala no Sudeste Asiático. O design inovador do frasco garante maior esterilidade, menor risco de contaminação e compatibilidade com linhas de envase automatizadas. Esse desenvolvimento reforça o compromisso do Grupo Stevanato em apoiar os esforços de imunização em massa e aprimorar a eficiência operacional dos profissionais de saúde.

- Em março de 2024, a Corning Inc. expandiu com sucesso sua capacidade de produção de frascos injetáveis na China, visando atender à crescente demanda por vacinas, produtos biológicos e medicamentos especiais. Essa iniciativa utiliza tecnologias de produção de ponta para garantir o fornecimento de frascos estéreis, consistentes e de alta qualidade, demonstrando o compromisso da Corning em apoiar a indústria farmacêutica da região, que está em rápido crescimento.

- Em fevereiro de 2024, a West Pharmaceutical Services, Inc., fornecedora líder de soluções para administração de medicamentos injetáveis, anunciou uma parceria estratégica com diversos fabricantes biofarmacêuticos regionais no Japão para o fornecimento de frascos pré-carregados e multidose. A colaboração visa aprimorar a eficiência da produção, melhorar a confiabilidade da cadeia de suprimentos e otimizar a distribuição para hospitais e clínicas. Essa iniciativa reforça o compromisso da West com a inovação e a excelência operacional no setor farmacêutico.

- Em janeiro de 2024, a BD (Becton, Dickinson and Company) apresentou sua linha avançada de frascos pré-cheios e de vidro na Asia-Pacific Pharmaceutical Expo 2024. Equipados com esterilidade aprimorada e compatibilidade com sistemas automatizados de envase, esses frascos permitem que as empresas farmacêuticas gerenciem a produção e a distribuição com mais eficiência. Os frascos da BD destacam o compromisso da empresa em integrar tecnologia de ponta às soluções de embalagens farmacêuticas, oferecendo aos fabricantes maior qualidade, segurança e praticidade operacional.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.