Mercado de calor residual para a energia do ciclo orgânico Rankine (ORC) da Ásia-Pacífico, por tamanho (pequeno, médio, grande), capacidade (menos de 1000 kW, 1001-4000 kW, 4001-7000 kW, mais de 7000 kW) , modelo ( Estado estacionário, dinâmico), aplicação (ICE ou turbina a gás, resíduos para energia, produção de metais, indústria de cimento e cal, indústria de vidro, refinação de petróleo , indústria química, ICE de aterro, outros), – tendências e previsões da indústria até 2029.

Análise e tamanho do mercado de calor residual para energia do ciclo orgânico Rankine (ORC) da Ásia-Pacífico

O calor residual do ciclo orgânico de Rankine (ORC) converte o calor térmico de líquidos ou gases para produzir energia neutra em carbono de forma eficiente. O calor é gerado por fontes geotérmicas ou calor residual industrial ou comercial. O ciclo orgânico de Rankine (ORC) de calor residual para energia ajuda as empresas a produzir mais eletricidade para satisfazer a procura crescente. O mercado de calor residual para energia do ciclo orgânico Rankine (ORC) da Ásia-Pacífico está a crescer rapidamente porque as indústrias locais começaram a concentrar-se em melhorar a eficiência das centrais elétricas para reduzir o tempo de inatividade.

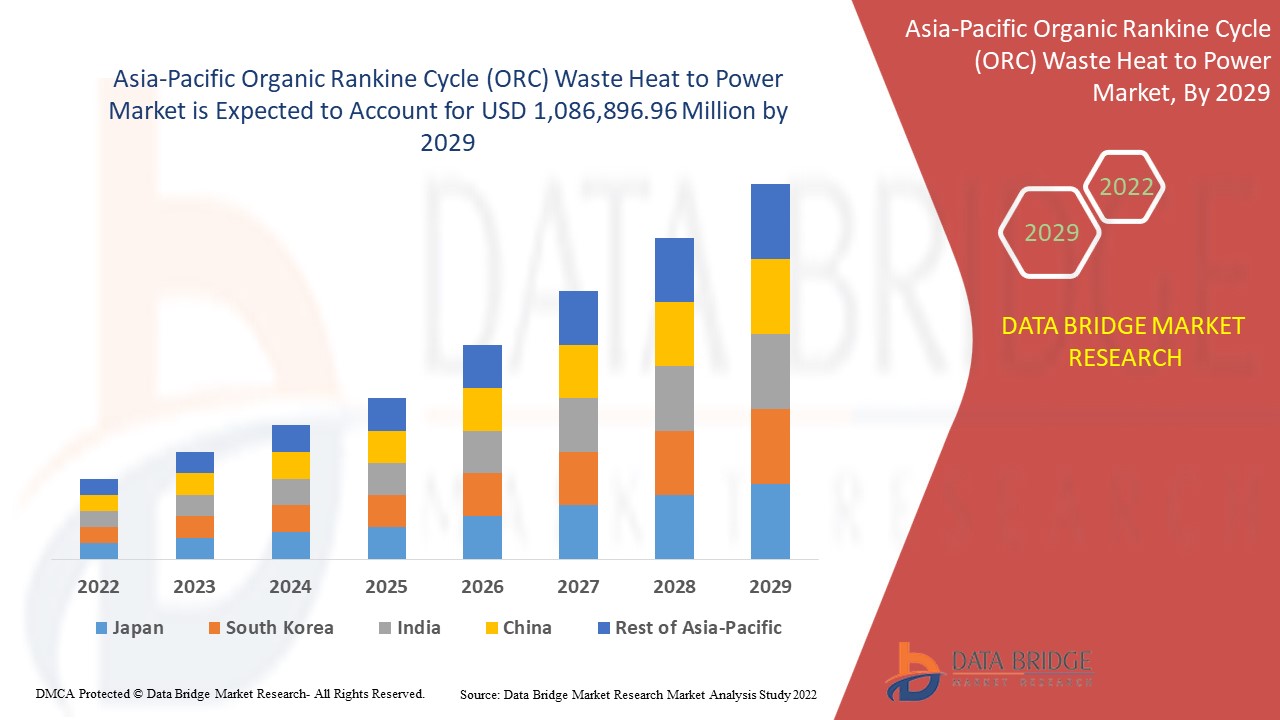

A Data Bridge Market Research analisa que o mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) deverá atingir o valor de 1.086.896,96 milhões de dólares até 2029, a um CAGR de 8,8% durante o período previsto de 2022 a 2029. Contas "médias" para o segmento de tamanho de módulos mais proeminente.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2015) |

|

Unidades quantitativas |

Receita em USD mil, preço em USD |

|

Segmentos abrangidos |

Por tamanho (pequeno, médio, grande), capacidade (menos de 1000 kW, 1001-4000 kW, 4001-7000 kW, mais de 7000 kW), modelo (estado estacionário, dinâmico), aplicação (turbina de combustão interna ou a gás , resíduos para Energia, Produção de Metais, Indústria de Cimento e Cal, Indústria de Vidro, Refinação de Petróleo, Indústria Química, Aterro Sanitário (ICE), Outros). |

|

Países abrangidos |

China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Indonésia, Tailândia, Filipinas, Vietname, Malásia, Nova Zelândia, Taiwan e restante Ásia-Pacífico. |

|

Atores do mercado abrangidos |

MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Dürr Group, Português ElectraTherm Inc. (Grupo BITZER), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Turbinas a Vapor, BorgWarner Inc., entre outros. |

Definição de Mercado

Os sistemas de ciclo orgânico de Rankine (ORC) são utilizados para a produção de energia a partir de fontes de calor de baixa a média temperatura, de 80 a 350 °C, e para aplicações de pequena a média dimensão a qualquer temperatura . Esta tecnologia permite a exploração de calor de baixa qualidade que, de outra forma, seria desperdiçado. O princípio de funcionamento de uma central de energia de ciclo orgânico Rankine é semelhante ao processo mais utilizado para a geração de energia, o ciclo Clausius-Rankine.

Ciclo de Rankine Orgânico (ORC) da Ásia-Pacífico: dinâmica do mercado de calor residual para energia

Esta secção trata da compreensão dos impulsionadores, vantagens, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

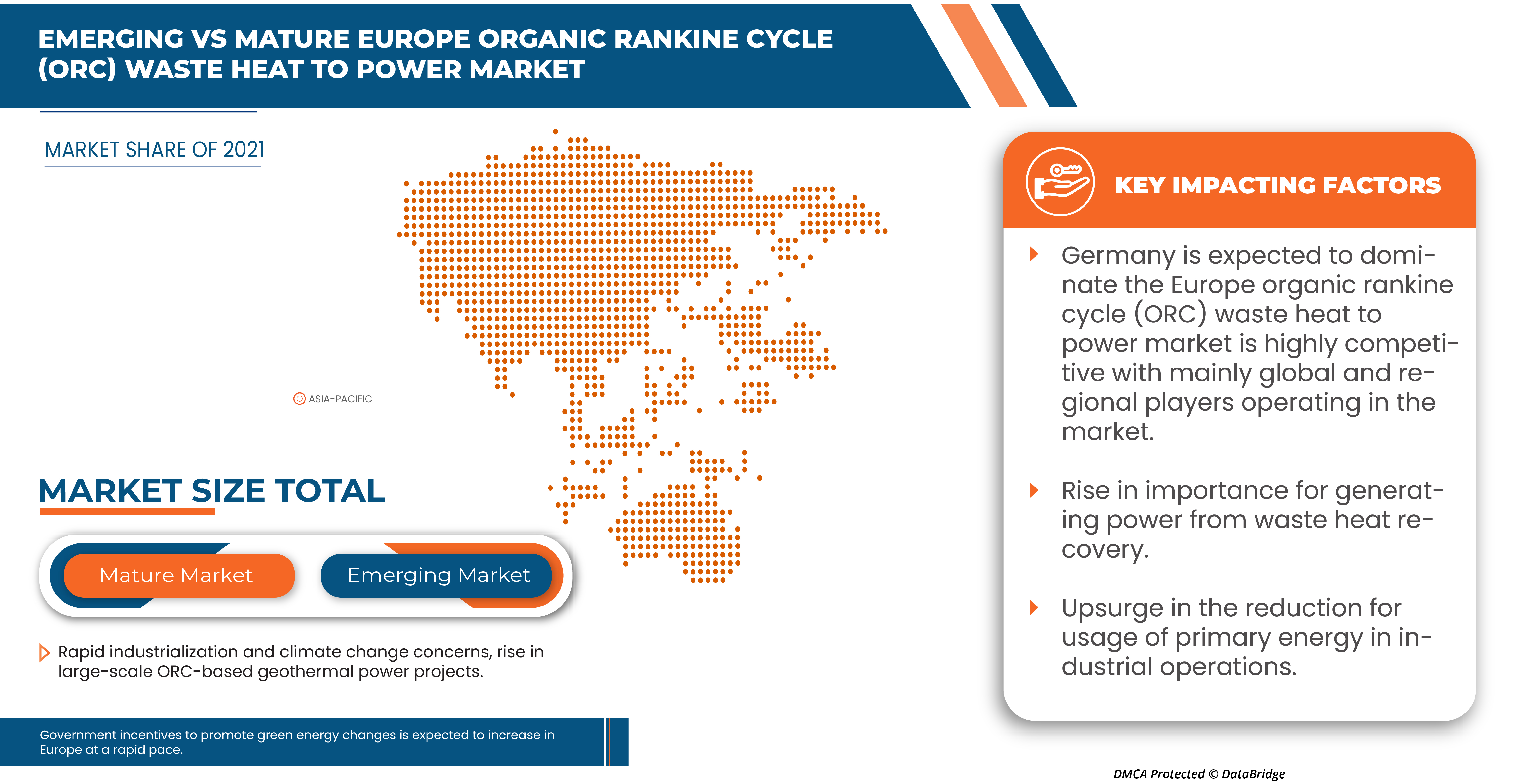

- Aumento da importância da geração de energia a partir da recuperação de calor residual

Em muitas instalações industriais, uma quantidade considerável de calor é desperdiçada e não é utilizada para fins económicos. Desta forma, o calor não pode ser armazenado ou transportado para outros processos ou utilizadores. Na maioria das condições, este calor residual requer sistemas de arrefecimento e tratamentos para evitar a poluição causada no ambiente, o que poderá aumentar as despesas.

Além disso, este desperdício de calor industrial pode ser melhor aproveitado e considerado para muitos fins, como o aquecimento ou a geração de eletricidade. A ideia base é captar o calor criado no processo industrial e reutilizá-lo noutras aplicações, principalmente para melhorar a eficiência energética, como processar o calor através de combustíveis fósseis e gerar o mínimo de eletricidade para acionar os motores utilizados por etapas específicas do processo.

- Maior foco na melhoria da eficiência da central

A geração de eletricidade do mundo depende principalmente de recursos de combustíveis fósseis, como o carvão, o gás natural e o petróleo. O número de centrais de geração de energia alimentadas a combustíveis fósseis instaladas aumentou globalmente, e o desenvolvimento destas centrais é uma tendência em todo o mundo. No entanto, o calor residual é descarregado numa central elétrica e pode ser despejado no ambiente. Sendo a recuperação do calor residual a principal abordagem para melhorar ainda mais a eficiência térmica e reduzir as emissões de gases com efeito de estufa nas centrais elétricas alimentadas a combustíveis fósseis.

- Normas de emissão cada vez mais rigorosas

O consumo de energia tem vindo a aumentar ano após ano em todo o mundo devido ao aumento da procura de consumo de eletricidade. A produção de energia através de combustíveis fósseis é responsável por mais de um terço das emissões mundiais de gases com efeito de estufa, que provocam poluição e alterações climáticas.

Restrição/Desafios

- Elevado custo de instalação e manutenção

Embora os sistemas de recuperação de calor residual apresentem vantagens significativas, os custos de instalação limitam o crescimento do mercado. A recuperação do calor residual pode ser feita através de várias técnicas, como o ciclo de Rankine a vapor (SRC), o ciclo de Rankine orgânico (ORC) ou o ciclo de Kalina. Estas tecnologias terão custos diferentes com base na escala de produção e do setor industrial.

- Défice de oferta de matérias-primas

O défice de oferta de matérias-primas está associado a todo o tipo de mercados, e este irá avaliar a dependência económica e técnica de um determinado material. O sistema de recuperação de calor é construído com a ajuda de diversas matérias-primas e equipamentos, como bomba de fluido, aquecedor, condensador, turbina e muitos outros.

Impacto pós-COVID-19 no mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico

O período de confinamento e bloqueio durante a crise da COVID-19 mostrou a importância de uma boa e fiável conectividade à internet numa grande indústria. Uma ligação de alta velocidade na grande indústria abriu a possibilidade de teletrabalho eficiente, mantendo hábitos de entretenimento e contacto próximo. O tráfego de dados em todas as redes aumentou significativamente durante o período da pandemia. A COVID-19 aumentou a procura de integração de dados no mercado. As redes de banda larga fixa ganharam imensa popularidade por manterem o mundo ligado. O tráfego cresceu 30-40% durante a noite, impulsionado principalmente pelo trabalho em grandes indústrias (videoconferência e colaboração, VPNs), aprendizagem em grandes indústrias (videoconferência e colaboração, plataformas de e-learning) e entretenimento (jogos online, streaming de vídeo , redes sociais). Além disso, a oferta limitada e a escassez de software afetaram significativamente a integração de dados no mercado. O fluxo de novos equipamentos, como computadores, servidores, switches e equipamentos nas instalações do cliente (CPE), foi totalmente interrompido ou atrasado, com prazos de entrega até 12 meses para diferentes artigos.

Os fabricantes estão a tomar várias decisões estratégicas para recuperar após a COVID-19. Os participantes estão a conduzir diversas atividades de investigação e desenvolvimento para melhorar a tecnologia envolvida na integração de dados. Com isto, as empresas levarão para o mercado a integração avançada de dados.

Desenvolvimento recente

- Em março de 2021, o International Journal of Low-Carbon technologies publicou um relatório sobre a análise económica da central elétrica ORC com recuperação de calor residual a baixa temperatura. Esta análise concluiu que a associação do sistema ORC com centrais termoelétricas está a ajudar a melhorar a eficiência de trabalho ao reduzir a utilização de combustíveis fósseis.

- A ABB oferece um sistema de central elétrica ORC especialmente concebido para centrais elétricas para aumentar a eficiência energética, consistindo na extração de calor, conversão e alimentação e controlo elétricos. Este sistema é facilmente adotado em centrais elétricas e pode ser integrado em processos industriais.

Âmbito do mercado de calor residual para a energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico

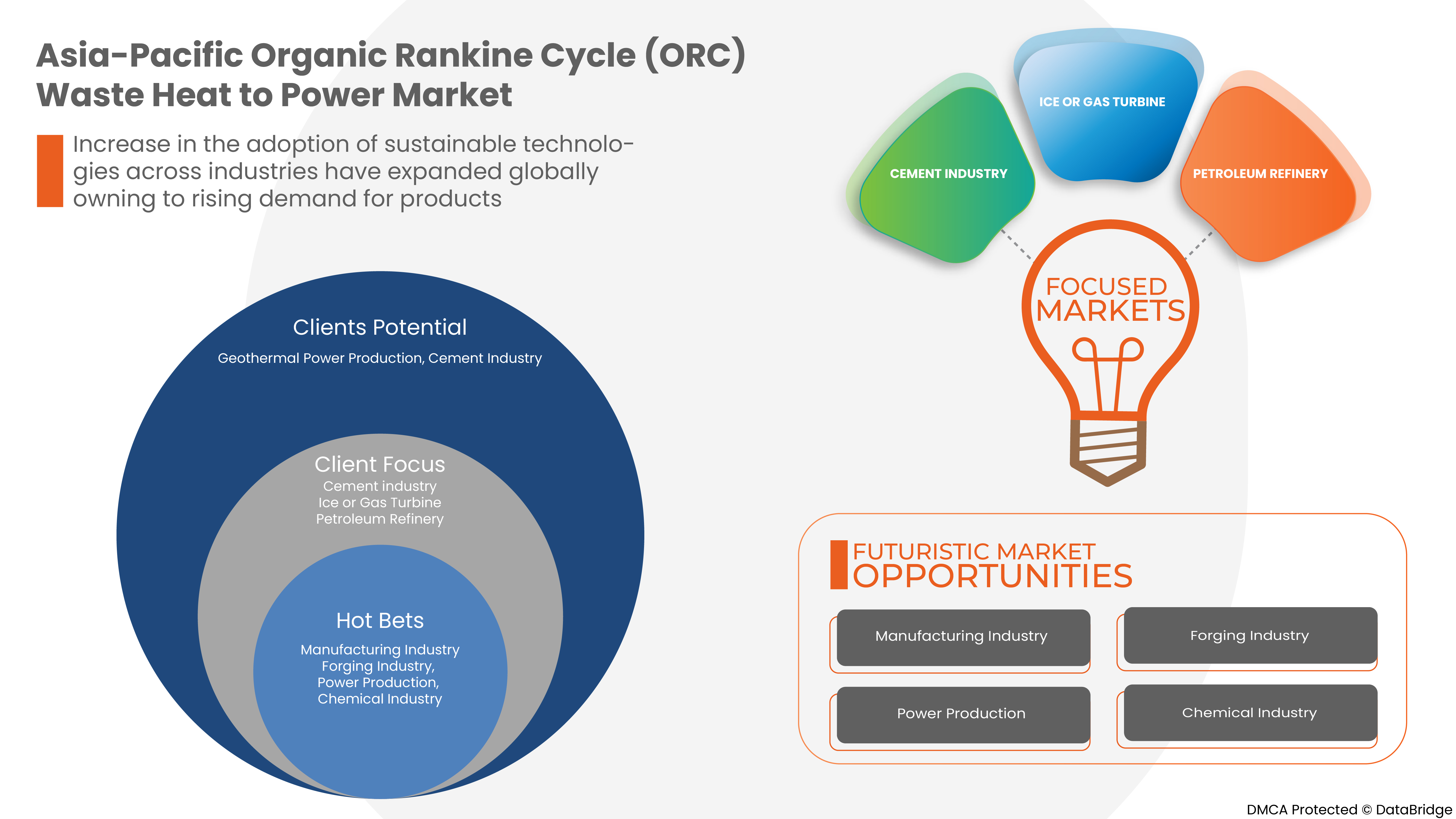

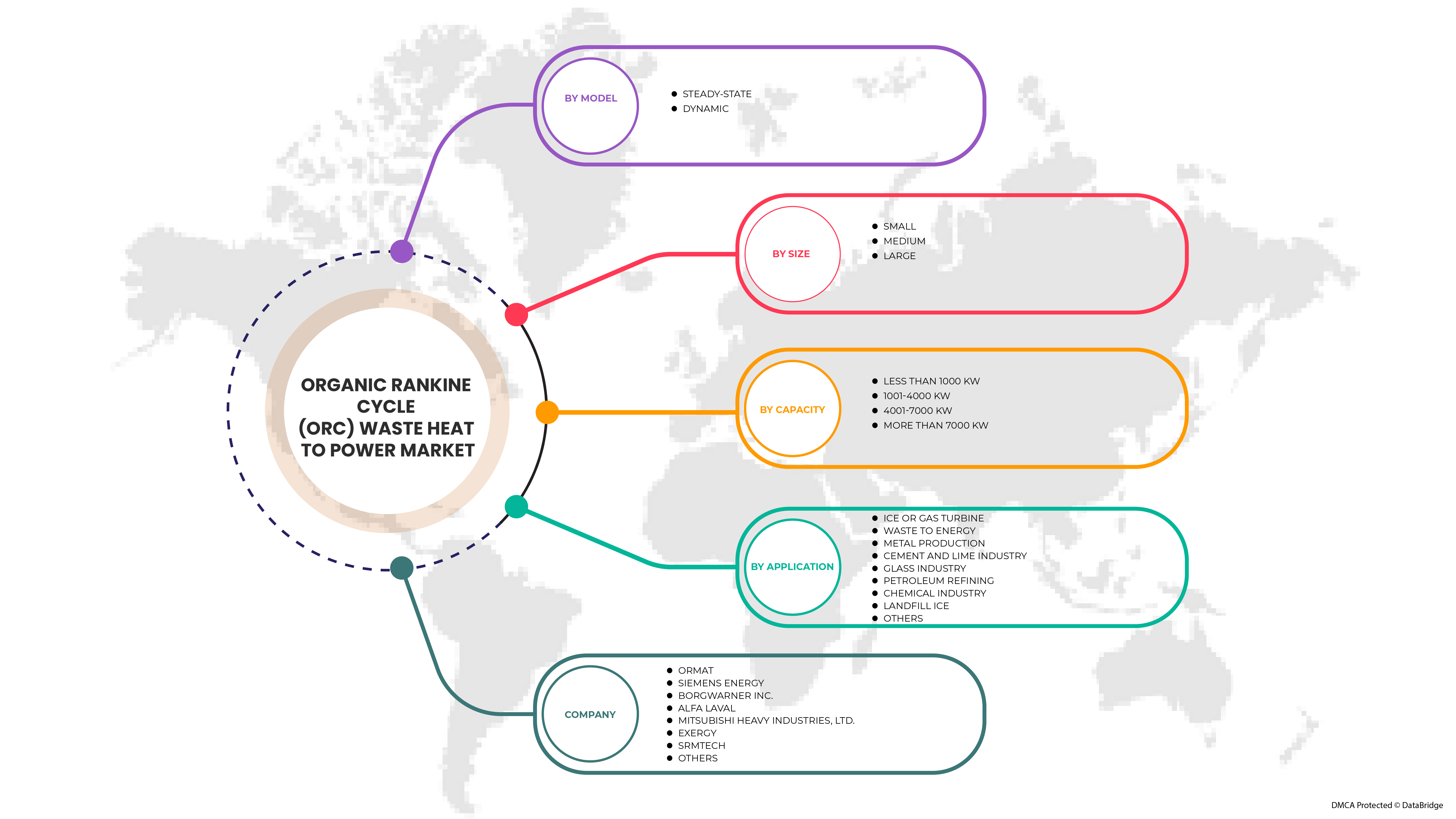

O mercado de calor residual para energia do ciclo Rankine orgânico (ORC) da Ásia-Pacífico está segmentado com base no tamanho, capacidade, modelo e aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de baixo crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Por tamanho

- Médio

- Pequeno

- Grande

Com base no tamanho, o mercado de calor residual para energia do ciclo orgânico Rankine (ORC) da Ásia-Pacífico está segmentado em médio, pequeno e grande.

Por Capacidade

- menos de 1000 KW,

- 1001-4000 kW,

- 4001-7000 kW,

- mais de 7000 KW

Com base na capacidade, o mercado de calor residual para energia do ciclo orgânico Rankine (ORC) da Ásia-Pacífico foi segmentado em menos de 1000 KW, 1001-4000 KW, 4001-7000 KW e mais de 7000 KW.

Por modelo

- Curso estável

- Dinâmico

Com base no modelo, o mercado de calor residual para a energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico foi segmentado em estado estacionário e dinâmico.

Por aplicação

- ICE ou turbina a gás

- Resíduos para energia

- Produção de metais

- Indústria de Cimento e Cal

- Indústria do vidro

- Refino de Petróleo

- Indústria química

- Gelo de aterro

- Outros

Com base na aplicação, o mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico foi segmentado em turbina de gelo ou gás, resíduos para energia, produção de metal, indústria de cimento e cal, indústria de vidro , refinação de petróleo, indústria química , gelo de aterro e outros.

Análise regional/perspetivas do mercado de calor residual para a energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico

O mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado por país, tamanho, capacidade, modelo e aplicação, conforme referenciado acima.

Os países abrangidos pelo relatório do mercado de calor residual para energia do ciclo de Rankine orgânico (ORC) da Ásia-Pacífico são a China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Indonésia, Tailândia, Filipinas, Vietname, Malásia, Nova Zelândia, Taiwan e o resto da Ásia-Pacífico.

Espera-se que a China domine o mercado de calor residual do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico, uma vez que o país está a assistir ao aumento de indústrias que declararam concentrar-se em melhorar a eficiência da central eléctrica para reduzir o tempo de inatividade e o crescimento do país na Ásia. - Mercado de calor residual para a energia do ciclo orgânico de Rankine (ORC) do Pacífico.

A secção de países do relatório também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas da Ásia-Pacífico e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, o impacto das tarifas domésticas e das rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país .

Análise do cenário competitivo e da quota de mercado do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico para a geração de calor residual em energia

O panorama competitivo do mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico fornece detalhes dos concorrentes. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e amplitude do produto , domínio da aplicação. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico.

Alguns dos principais participantes que operam no mercado de calor residual para energia do ciclo orgânico de Rankine (ORC) da Ásia-Pacífico são MITSUBISHI HEAVY INDUSTRIES, LTD., Kaishan USA, Strebl Energy Pte Ltd, ORCAN ENERGY AG, ALFA LAVAL, Fujian Snowman Co., Ltd., Ormat, Rank, TMEIC, Triogen, ABB, Siemens Energy (Siemens AG), Grupo Dürr, ElectraTherm Inc. (Grupo BITZER), Enerbasque, Enertime, Enogia, EXERGY, CLIMEON, INTEC Engineering GmbH, Zuccato Energia srl., Opel Energy Systems Pvt. Ltd., Corycos Group, CTMI - Turbinas a Vapor, BorgWarner Inc.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MARKET APPLICATION COVERAGE GRID

2.9 MULTIVARIATE MODELING

2.1 SIZE TIMELINE CURVE

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY

5.1.2 UPSURGE IN THE REDUCTION OF USAGE OF PRIMARY ENERGY IN INDUSTRIAL OPERATIONS

5.1.3 INCREASED FOCUS ON IMPROVING THE POWER PLANT EFFICIENCY

5.1.4 RISING STRINGENT EMISSION NORMS

5.2 RESTRAINTS

5.2.1 HIGH COST OF INSTALLATION AND MAINTENANCE

5.2.2 SUPPLY DEFICIT OF RAW MATERIALS

5.3 OPPORTUNITIES

5.3.1 RAPID INDUSTRIALIZATION AND CLIMATE CHANGE CONCERNS

5.3.2 RISE IN LARGE-SCALE ORC-BASED GEOTHERMAL POWER PROJECTS

5.3.3 GOVERNMENT INCENTIVES TO PROMOTE GREEN ENERGY CHANGES

5.3.4 INCREASE IN THE ADOPTION OF SUSTAINABLE TECHNOLOGIES ACROSS INDUSTRIES

5.4 CHALLENGES

5.4.1 LACK OF AWARENESS ABOUT THE TECHNOLOGY

6 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE

6.1 OVERVIEW

6.2 MEDIUM

6.3 SMALL

6.4 LARGE

7 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY

7.1 OVERVIEW

7.2 LESS THAN 1000 KW

7.3 1001-4000 KW

7.4 4001 - 7000 KW

7.5 MORE THAN 7000 KW

8 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL

8.1 OVERVIEW

8.2 STEADY-STATE

8.3 DYNAMIC

9 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 ICE OR GAS TURBINE

9.2.1 MEDIUM

9.2.2 SMALL

9.2.3 LARGE

9.3 WASTE TO ENERGY

9.3.1 MEDIUM

9.3.2 SMALL

9.3.3 LARGE

9.4 METAL PRODUCTION

9.4.1 MEDIUM

9.4.2 SMALL

9.4.3 LARGE

9.5 CEMENT AND LIME INDUSTRY

9.5.1 MEDIUM

9.5.2 SMALL

9.5.3 LARGE

9.6 GLASS INDUSTRY

9.6.1 MEDIUM

9.6.2 SMALL

9.6.3 LARGE

9.7 PETROLEUM REFINING

9.7.1 MEDIUM

9.7.2 SMALL

9.7.3 LARGE

9.8 CHEMICAL INDUSTRY

9.8.1 MEDIUM

9.8.2 SMALL

9.8.3 LARGE

9.9 LANDFILL ICE

9.9.1 MEDIUM

9.9.2 SMALL

9.9.3 LARGE

9.1 OTHERS

10 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 CHINA

10.1.2 JAPAN

10.1.3 SOUTH KOREA

10.1.4 INDIA

10.1.5 INDONESIA

10.1.6 AUSTRALIA

10.1.7 THAILAND

10.1.8 MALAYSIA

10.1.9 VIETNAM

10.1.10 SINGAPORE

10.1.11 PHILIPPINES

10.1.12 NEW ZEALAND

10.1.13 TAIWAN

10.1.14 REST OF ASIA-PACIFIC

11 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ORMAT

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCTS PORTFOLIO

13.1.5 RECENT DEVELOPMENTS

13.2 SIEMENS ENERGY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 SOLUTION PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 BORGWARNER INC.

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCTS PORTFOLIO

13.3.5 RECENT DEVELOPMENTS

13.4 ALFA LAVAL

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 COMPANY SHARE ANALYSIS

13.4.4 PRODUCTS PORTFOLIO

13.4.5 RECENT DEVELOPMENTS

13.5 MITSUBISHI HEAVY INDUSTRIES, LTD

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 COMPANY SHARE ANALYSIS

13.5.4 PRODUCTS PORTFOLIO

13.5.5 RECENT DEVELOPMENT

13.6 ABB

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCTS PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 CLIMEON

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCTS PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 CORYCOS GROUP

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCTS PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CTMI - STEAM TURBINES

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCTS PORTFOLIO

13.9.3 RECENT DEVELOPMENTS

13.1 DÜRR GROUP

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCTS PORTFOLIO

13.10.4 RECENT DEVELOPMENT

13.11 ENERBASQUE

13.11.1 COMPANY SNAPSHOT

13.11.2 PRODUCT PORTFOLIO

13.11.3 RECENT DEVELOPMENTS

13.12 ENERTIME

13.12.1 COMPANY SNAPSHOT

13.12.2 PRODUCTS PORTFOLIO

13.12.3 RECENT DEVELOPMENT

13.13 ENOGIA

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCTS PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 EXERGY INTERNATIONAL SRL

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCTS PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 ELECTRATHERM (ACQUIRED BY BITZER)

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 INTEC ENGINEERING GMBH

13.16.1 COMPANY SNAPSHOT

13.16.2 PRODUCT PORTFOLIO

13.16.3 RECENT DEVELOPMENTS

13.17 KAISHAN USA

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCTS PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 OPEL ENERGY SYSTEMS PVT. LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCTS PORTFOLIO

13.18.3 RECENT DEVELOPMENTS

13.19 ORCAN ENERGY AG

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCTS PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 RANK ORC, S.L.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCTS PORTFOLIO

13.20.3 RECENT DEVELOPMENT

13.21 STREBL ENERGY PTE LTD

13.21.1 COMPANY SNAPSHOT

13.21.2 PRODUCTS PORTFOLIO

13.21.3 RECENT DEVELOPMENT

13.22 SRMTEC

13.22.1 COMPANY SNAPSHOT

13.22.2 PRODUCT PORTFOLIO

13.22.3 RECENT DEVELOPMENTS

13.23 TMEIC

13.23.1 COMPANY SNAPSHOT

13.23.2 PRODUCTS PORTFOLIO

13.23.3 RECENT DEVELOPMENTS

13.24 TRIOGEN

13.24.1 COMPANY SNAPSHOT

13.24.2 PRODUCT PORTFOLIO

13.24.3 RECENT DEVELOPMENTS

13.25 ZUCCATO ENERGIA SRL.

13.25.1 COMPANY SNAPSHOT

13.25.2 PRODUCTS PORTFOLIO

13.25.3 RECENT DEVELOPMENTS

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 EXISTING WHP PROJECTS AND POWER GENERATION CAPACITY BY DIFFERENT INDUSTRIES IN THE U.S.

TABLE 2 ENERGY GENERATION POTENTIAL THROUGH WASTE HEAT IN DIFFERENT SECTORS IN INDIA

TABLE 3 WHP COST COMPARISON

TABLE 4 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 5 ASIA PACIFIC MEDIUM IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 6 ASIA PACIFIC SMALL IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 7 ASIA PACIFIC LARGE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 8 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 9 ASIA PACIFIC LESS THAN 1000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 10 ASIA PACIFIC 1001-4000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 11 ASIA PACIFIC 4001-7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 12 ASIA PACIFIC MORE THAN 7000 KW IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 13 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 14 ASIA PACIFIC STEADY-STATE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 15 ASIA PACIFIC DYNAMIC IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 16 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 17 ASIA PACIFIC ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 18 ASIA PACIFIC ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 19 ASIA PACIFIC WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 20 ASIA PACIFIC WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 21 ASIA PACIFIC METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 22 ASIA PACIFIC METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 23 ASIA PACIFIC CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 24 ASIA PACIFIC CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 25 ASIA PACIFIC GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 26 ASIA PACIFIC GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 27 ASIA PACIFIC PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 28 ASIA PACIFIC PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 29 ASIA PACIFIC CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 30 ASIA PACIFIC CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 31 ASIA PACIFIC LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 32 ASIA PACIFIC LANDFILL ICE INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY TYPE, 2020-2029 (USD THOUSAND)

TABLE 33 ASIA PACIFIC OTHERS IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY REGION, 2020-2029 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY COUNTRY, 2020-2029 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 47 CHINA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 48 CHINA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 49 CHINA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 50 CHINA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 51 CHINA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 52 CHINA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 53 CHINA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 54 CHINA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 55 CHINA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 56 CHINA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 57 CHINA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 58 CHINA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 59 JAPAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 60 JAPAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 61 JAPAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 62 JAPAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 63 JAPAN ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 64 JAPAN WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 65 JAPAN METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 66 JAPAN CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 67 JAPAN GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 68 JAPAN PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 69 JAPAN CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 70 JAPAN LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 71 SOUTH KOREA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 72 SOUTH KOREA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 73 SOUTH KOREA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 74 SOUTH KOREA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 75 SOUTH KOREA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 76 SOUTH KOREA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 77 SOUTH KOREA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 78 SOUTH KOREA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 79 SOUTH KOREA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 80 SOUTH KOREA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 81 SOUTH KOREA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 82 SOUTH KOREA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 83 INDIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 84 INDIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 85 INDIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 86 INDIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 87 INDIA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 88 INDIA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 89 INDIA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 90 INDIA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 91 INDIA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 92 INDIA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 93 INDIA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 94 INDIA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 95 INDONESIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 96 INDONESIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 97 INDONESIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 98 INDONESIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 99 INDONESIA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 100 INDONESIA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 101 INDONESIA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 102 INDONESIA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 103 INDONESIA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 104 INDONESIA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 105 INDONESIA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 106 INDONESIA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 107 AUSTRALIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 108 AUSTRALIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 109 AUSTRALIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 110 AUSTRALIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 111 AUSTRALIA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 112 AUSTRALIA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 113 AUSTRALIA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 114 AUSTRALIA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 115 AUSTRALIA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 116 AUSTRALIA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 117 AUSTRALIA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 118 AUSTRALIA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 119 THAILAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 120 THAILAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 121 THAILAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 122 THAILAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 123 THAILAND ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 124 THAILAND WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 125 THAILAND METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 126 THAILAND CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 127 THAILAND GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 128 THAILAND PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 129 THAILAND CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 130 THAILAND LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 131 MALAYSIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 132 MALAYSIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 133 MALAYSIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 134 MALAYSIA ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 135 MALAYSIA ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 136 MALAYSIA WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 137 MALAYSIA METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 138 MALAYSIA CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 139 MALAYSIA GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 140 MALAYSIA PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 141 MALAYSIA CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 142 MALAYSIA LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 143 VIETNAM ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 144 VIETNAM ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 145 VIETNAM ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 146 VIETNAM ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 147 VIETNAM ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 148 VIETNAM WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 149 VIETNAM METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 150 VIETNAM CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 151 VIETNAM GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 152 VIETNAM PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 153 VIETNAM CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 154 VIETNAM LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 155 SINGAPORE ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 156 SINGAPORE ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 157 SINGAPORE ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 158 SINGAPORE ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 159 SINGAPORE ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 160 SINGAPORE WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 161 SINGAPORE METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 162 SINGAPORE CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 163 SINGAPORE GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 164 SINGAPORE PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 165 SINGAPORE CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 166 SINGAPORE LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 167 PHILIPPINES ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 168 PHILIPPINES ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 169 PHILIPPINES ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 170 PHILIPPINES ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 171 PHILIPPINES ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 172 PHILIPPINES WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 173 PHILIPPINES METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 174 PHILIPPINES CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 175 PHILIPPINES GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 176 PHILIPPINES PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 177 PHILIPPINES CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 178 PHILIPPINES LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 179 NEW ZEALAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 180 NEW ZEALAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 181 NEW ZEALAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 182 NEW ZEALAND ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 183 NEW ZEALAND ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 184 NEW ZEALAND WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 185 NEW ZEALAND METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 186 NEW ZEALAND CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 187 NEW ZEALAND GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 188 NEW ZEALAND PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 189 NEW ZEALAND CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 190 NEW ZEALAND LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 191 TAIWAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 192 TAIWAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY CAPACITY, 2020-2029 (USD THOUSAND)

TABLE 193 TAIWAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY MODEL, 2020-2029 (USD THOUSAND)

TABLE 194 TAIWAN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY APPLICATION, 2020-2029 (USD THOUSAND)

TABLE 195 TAIWAN ICE OR GAS TURBINE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 196 TAIWAN WASTE TO ENERGY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 197 TAIWAN METAL PRODUCTION IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 198 TAIWAN CEMENT AND LIME INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 199 TAIWAN GLASS INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 200 TAIWAN PETROLEUM REFINING IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 201 TAIWAN CHEMICAL INDUSTRY IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 202 TAIWAN LANDFILL ICE IN ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

TABLE 203 REST OF ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET, BY SIZE, 2020-2029 (USD THOUSAND)

Lista de Figura

FIGURE 1 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 10 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: MULTIVARIATE MODELING

FIGURE 11 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SIZE TIMELINE CURVE

FIGURE 12 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SEGMENTATION

FIGURE 13 RISE IN IMPORTANCE FOR GENERATING POWER FROM WASTE HEAT RECOVERY IS EXPECTED TO DRIVE THE ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN THE FORECAST PERIOD 2022-2029

FIGURE 14 MEDIUM SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET

FIGURE 16 REAL GROSS DOMESTIC PRODUCT (GDP) GROWTH RATE OF INDIA

FIGURE 17 GEOTHERMAL POWER GENERATION IN THE NET ZERO SCENARIO, 2000-2030

FIGURE 18 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY SIZE, 2021

FIGURE 19 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY CAPACITY, 2021

FIGURE 20 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET : BY MODEL, 2021

FIGURE 21 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY APPLICATION, 2021

FIGURE 22 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: SNAPSHOT (2021)

FIGURE 23 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021)

FIGURE 24 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2022 & 2029)

FIGURE 25 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY COUNTRY (2021 & 2029)

FIGURE 26 ASIA-PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: BY SIZE (2022-2029)

FIGURE 27 ASIA PACIFIC ORGANIC RANKINE CYCLE (ORC) WASTE HEAT TO POWER MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.