Asia Pacific Oil Refining Catalyst Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

3.37 Billion

USD

4.95 Billion

2024

2032

USD

3.37 Billion

USD

4.95 Billion

2024

2032

| 2025 –2032 | |

| USD 3.37 Billion | |

| USD 4.95 Billion | |

|

|

|

|

Segmentação do mercado de catalisadores para refino de petróleo na Ásia-Pacífico, por tipo (hidrotratamento, craqueamento catalítico fluidizado (FCC), craqueamento catalítico fluidizado de resíduos (RFCC), hidrocraqueamento e outros), catalisador (zeólitas, metais e produtos químicos ), canal de distribuição (vendas diretas/B2B, distribuidores/distribuidores terceirizados/comerciantes, comércio eletrônico e outros), aplicação (diesel, querosene, desparafinação destilada e outros) - tendências e previsões do setor até 2032

Qual é o tamanho e a taxa de crescimento do mercado de catalisadores de refino de petróleo da Ásia-Pacífico?

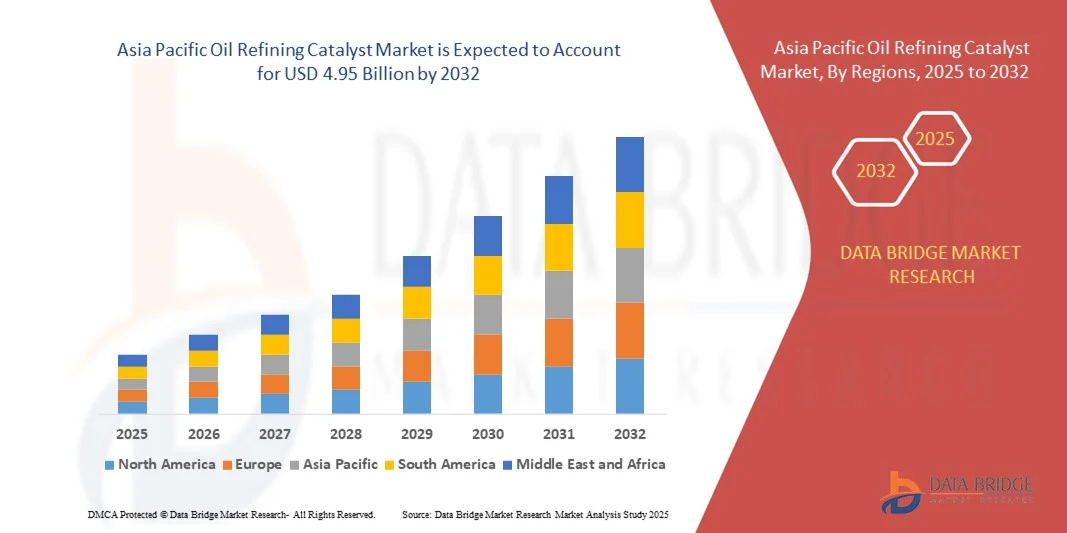

- O tamanho do mercado de catalisadores de refino de petróleo da Ásia-Pacífico foi avaliado em US$ 3,37 bilhões em 2024 e deve atingir US$ 4,95 bilhões até 2032 , com um CAGR de 4,9% durante o período previsto.

- O crescimento é impulsionado principalmente pela crescente urbanização, pela mudança de hábitos alimentares e pela crescente conscientização sobre a saúde em economias emergentes como China, Japão e Índia.

- O uso crescente de adoçantes de baixa caloria em alimentos e bebidas, juntamente com a expansão de aplicações em produtos farmacêuticos e cuidados pessoais, está impulsionando ainda mais a demanda do mercado.

Quais são os principais resultados do mercado de catalisadores de refino de petróleo?

- A crescente demanda por produtos sem açúcar, o aumento da prevalência de doenças relacionadas ao estilo de vida, como diabetes e obesidade, e a expansão dos esforços de pesquisa e desenvolvimento para adoçantes artificiais avançados são os principais determinantes do crescimento do mercado.

- No entanto, espera-se que as preocupações com a saúde relacionadas aos adoçantes artificiais, aos padrões regulatórios rigorosos e à disponibilidade de substitutos naturais, como a estévia, representem desafios à expansão do mercado durante o período previsto.

- A China dominou o mercado de catalisadores de refino de petróleo da Ásia-Pacífico em 2024, detendo a maior participação na receita de 46,3%, impulsionada pela forte demanda doméstica por bebidas, alimentos e embalagens farmacêuticas

- O mercado indiano de catalisadores para refino de petróleo deve crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 8,58%, impulsionado pelo aumento do consumo de bebidas, alimentos e produtos farmacêuticos em áreas urbanas e rurais. Incentivos governamentais para fabricação, reciclagem e produção sustentável estão acelerando a adoção pelo mercado.

- O segmento de Craqueamento Catalítico Fluidizado (FCC) dominou o mercado em 2024, respondendo por uma participação de mercado de 42,6%, impulsionado por seu amplo uso na conversão de frações pesadas de petróleo bruto em produtos mais leves e de alto valor, como gasolina e olefinas

Escopo do relatório e segmentação do mercado de catalisadores de refino de petróleo

|

Atributos |

Principais insights do mercado de catalisadores de refino de petróleo |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Qual é a principal tendência no mercado de catalisadores de refino de petróleo?

Mudança em direção a catalisadores sustentáveis e de alto desempenho

- Uma tendência fundamental que molda o mercado de catalisadores para refino de petróleo é a transição para tecnologias de catalisadores sustentáveis, energeticamente eficientes e de alto desempenho, visando melhorar a eficiência do refino e, ao mesmo tempo, minimizar as emissões de carbono. Essa mudança é amplamente impulsionada por regulamentações ambientais rigorosas e pelo movimento global em direção a combustíveis mais limpos.

- Os fabricantes estão investindo em catalisadores de última geração com atividade, seletividade e capacidade de regeneração aprimoradas para reduzir o desperdício e otimizar o rendimento do combustível

- Além disso, os catalisadores de base biológica e nanoestruturados estão a ganhar destaque, oferecendo maior estabilidade e menor dependência de matérias-primas não renováveis.

- Um exemplo notável é a BASF SE (Alemanha), que lançou sua plataforma de catalisador FortiForm em 2024, projetada para aumentar a produtividade da refinaria e reduzir as emissões de CO₂

- Essa mudança contínua em direção à sustentabilidade e à eficiência operacional está transformando o cenário do refino, levando as empresas a investir em P&D para catalisadores que atendam aos objetivos econômicos e ambientais.

Quais são os principais impulsionadores do mercado de catalisadores de refino de petróleo?

- A crescente demanda por combustíveis mais limpos, aliada às rigorosas normas de emissão impostas pelos governos, atua como um importante impulsionador do mercado de catalisadores para refino de petróleo. Os catalisadores são essenciais para a produção de combustíveis com baixo teor de enxofre e para a melhoria do desempenho geral das refinarias.

- Por exemplo, em fevereiro de 2024, a Exxon Mobil Corporation (EUA) expandiu suas instalações de P&D de catalisadores de refino para acelerar o desenvolvimento de catalisadores de hidroprocessamento mais eficientes

- O crescente consumo de gasolina, diesel e combustível de aviação em economias emergentes como a Índia e a China está a impulsionar ainda mais a procura

- Além disso, as refinarias estão se modernizando para se alinharem aos padrões de enxofre da Organização Marítima Internacional (IMO) 2020, o que impulsionou atualizações significativas de catalisadores globalmente

- Esses desenvolvimentos promovem coletivamente a inovação tecnológica, a otimização das refinarias e a produção sustentável de combustível, impulsionando assim o mercado global de catalisadores para refino de petróleo.

Qual fator está desafiando o crescimento do mercado de catalisadores de refino de petróleo?

- O alto custo do desenvolvimento e da regeneração de catalisadores continua sendo um desafio fundamental para a expansão do mercado. Processos complexos de fabricação, preços flutuantes de matérias-primas e a necessidade de manuseio especializado de metais raros, como platina e paládio, contribuem para altos custos operacionais.

- Por exemplo, em 2024, a volatilidade dos preços dos metais afetou significativamente a rentabilidade da Clariant (Suíça) e de outros grandes produtores de catalisadores

- Além disso, as regulamentações rigorosas de descarte de catalisadores usados aumentam os desafios operacionais e os custos de gerenciamento de resíduos para as refinarias

- Empresas como a Albemarle Corporation (EUA) e a Johnson Matthey (Reino Unido) estão a abordar estas restrições através do desenvolvimento de soluções de catalisadores recicláveis e reativáveis para reduzir os custos do ciclo de vida.

- No entanto, alcançar um equilíbrio ideal entre o desempenho do catalisador, a eficiência de custos e a conformidade ambiental continua a ser uma barreira importante, exigindo investimento sustentado e inovação na tecnologia de catalisadores.

Como o mercado de catalisadores de refino de petróleo é segmentado?

O mercado de catalisadores de refino de petróleo é segmentado com base no tipo, catalisador, canal de distribuição e aplicação.

- Por tipo

Com base no tipo, o mercado de catalisadores para refino de petróleo é segmentado em Hidrotratamento, Craqueamento Catalítico Fluidizado (FCC), Craqueamento Catalítico Fluidizado de Resíduos (RFCC), Hidrocraqueamento e outros. O segmento de Craqueamento Catalítico Fluidizado (FCC) dominou o mercado em 2024, respondendo por uma participação de mercado de 42,6%, impulsionado por seu amplo uso na conversão de frações pesadas de petróleo bruto em produtos mais leves e de alto valor, como gasolina e olefinas. Os catalisadores FCC aumentam a flexibilidade da refinaria e o rendimento do combustível, ao mesmo tempo que reduzem os custos operacionais, tornando-os indispensáveis para refinarias de grande porte.

Espera-se que o segmento de hidrocraqueamento registre o CAGR mais rápido entre 2025 e 2032, impulsionado pela mudança global para combustíveis mais limpos e pela necessidade de produzir diesel com ultrabaixo teor de enxofre. Os crescentes investimentos em unidades de hidrocraqueamento na Ásia-Pacífico e no Oriente Médio estão acelerando ainda mais a trajetória de crescimento deste segmento.

- Por Catalyst

Com base no tipo de catalisador, o mercado é categorizado em zeólitas, metais e produtos químicos. O segmento de zeólitas detinha a maior participação de mercado, com 48,3% em 2024, principalmente devido à sua alta seletividade, estabilidade térmica e eficiência em reações de craqueamento catalítico e hidrocraqueamento. As zeólitas são amplamente utilizadas em refinarias para aumentar o rendimento do combustível e remover impurezas, tornando-as o tipo de catalisador mais preferido globalmente.

Prevê-se que o segmento de Metais cresça com a CAGR mais rápida entre 2025 e 2032, impulsionado pela crescente demanda por catalisadores de hidroprocessamento e hidrogenação que utilizam metais ativos como níquel, cobalto e platina. O foco crescente em refino com eficiência energética e tecnologias de regeneração de catalisadores de alto desempenho está fortalecendo ainda mais a adoção de catalisadores metálicos.

- Por canal de distribuição

Com base no canal de distribuição, o mercado de catalisadores para refino de petróleo é segmentado em Vendas Diretas/B2B, Distribuidores/Terceirizados/Traders, Comércio Eletrônico e Outros. O segmento de Vendas Diretas/B2B dominou o mercado em 2024, conquistando uma participação de mercado de 56,4%, devido à preferência de refinarias e empresas petroquímicas por contratos de fornecimento de longo prazo e soluções personalizadas de catalisadores diretamente dos fabricantes. Parcerias diretas também garantem suporte técnico, monitoramento de desempenho e otimização de produtos.

O segmento de comércio eletrônico deverá apresentar o CAGR mais rápido entre 2025 e 2032, impulsionado pela transformação digital em todas as cadeias de suprimentos industriais. As plataformas online oferecem cada vez mais opções refinadas de aquisição de catalisadores, reduzindo os prazos de entrega e expandindo o acesso a refinarias menores e operadores independentes.

- Por aplicação

Com base na aplicação, o mercado é segmentado em Diesel, Querosene, Destilado Dewax e Outros. O segmento Diesel liderou o mercado em 2024, com uma participação de mercado de 45,7%, atribuída à crescente demanda global por diesel limpo e às rigorosas regulamentações de emissões que exigem processos avançados de refino catalítico. O uso de catalisadores na produção de diesel melhora a dessulfuração e a qualidade do combustível, tornando-os essenciais para o cumprimento das normas ambientais.

Espera-se que o segmento de desparafinação destilada registre o CAGR mais rápido entre 2025 e 2032, impulsionado pela crescente demanda por lubrificantes de alto desempenho e combustíveis de baixa temperatura. O crescente consumo de lubrificantes premium nos setores automotivo e industrial está impulsionando a adoção de catalisadores de desparafinação especializados em refinarias em todo o mundo.

Qual região detém a maior fatia do mercado de catalisadores de refino de petróleo?

- A China dominou o mercado de catalisadores de refino de petróleo da Ásia-Pacífico em 2024, detendo a maior participação na receita de 46,3%, impulsionada pela forte demanda doméstica por bebidas, alimentos e embalagens farmacêuticas

- A infraestrutura de fabricação bem estabelecida do país, a capacidade de produção com boa relação custo-benefício e a abundância de matérias-primas, como sílica e caco de vidro, dão suporte à produção em larga escala de catalisadores e recipientes de vidro. Políticas governamentais que promovem a fabricação ecologicamente correta, iniciativas de reciclagem e investimentos em tecnologias avançadas de conformação e refino de vidro fortalecem ainda mais o domínio do mercado.

- A crescente orientação exportadora da China para bebidas alcoólicas, cuidados pessoais e alimentos processados, aliada ao crescente consumo interno de produtos premium, reforça sua posição de liderança no mercado regional. De modo geral, o status de polo estratégico de manufatura e as capacidades de P&D da China consolidam seu papel de liderança no setor de catalisadores para refino de petróleo na região da Ásia-Pacífico.

Visão do mercado de catalisadores de refino de petróleo da Índia

O mercado indiano de catalisadores para refino de petróleo deverá crescer à taxa composta de crescimento anual (CAGR) mais rápida, de 8,58%, impulsionado pelo aumento do consumo de bebidas, alimentos e produtos farmacêuticos em áreas urbanas e rurais. Incentivos governamentais para fabricação, reciclagem e produção sustentável estão acelerando a adoção pelo mercado. A crescente preferência por catalisadores premium e ecológicos por parte de empresas de bebidas, cosméticos e processamento de alimentos impulsiona a demanda em todos os setores. O aumento das exportações de alimentos processados, bebidas alcoólicas e não alcoólicas e produtos de higiene pessoal fortalece a posição da Índia no mercado regional. Investimentos em instalações de produção modernas e tecnologias aprimoradas de catalisadores estão aumentando a competitividade da Índia, tornando-a um importante contribuinte para o crescimento no cenário de catalisadores para refino de petróleo da Ásia-Pacífico.

Visão geral do mercado de catalisadores de refino de petróleo do Vietnã

O mercado de catalisadores para refino de petróleo do Vietnã está em expansão devido à crescente industrialização e ao consumo crescente de bebidas engarrafadas, molhos e cosméticos. O país se beneficia do apoio governamental à produção sustentável, de acordos comerciais que promovem exportações e de colaborações com empresas globais de embalagens e catalisadores. O crescimento populacional urbano e o crescente consumo de bebidas e alimentos premium impulsionam a demanda por produtos de alta qualidade e esteticamente atraentes. Avanços nas tecnologias de produção, refino e reciclagem estão aumentando a eficiência operacional. Coletivamente, esses fatores posicionam o Vietnã como um contribuinte crescente para o mercado de catalisadores para refino de petróleo da Ásia-Pacífico.

Visão geral do mercado de catalisadores de refino de petróleo na Indonésia

O mercado de catalisadores para refino de petróleo da Indonésia apresenta crescimento constante, impulsionado pelo aumento do consumo interno de bebidas, alimentos e produtos farmacêuticos. As abundantes matérias-primas do país, incluindo areia de sílica e caco de vidro, facilitam a produção local. Iniciativas governamentais que promovem a fabricação sustentável e ecologicamente correta incentivam investimentos em tecnologias modernas de refino e produção de vidro. As indústrias de processamento de bebidas e alimentos voltadas para a exportação impulsionam ainda mais a demanda por catalisadores e recipientes duráveis e premium. A crescente conscientização do consumidor em relação à qualidade, segurança e sustentabilidade dos produtos também está impulsionando a adoção pelo mercado. Investimentos em P&D para produtos de catalisadores funcionais e designs inovadores estão aumentando a competitividade, tornando a Indonésia um contribuinte vital para o mercado da Ásia-Pacífico.

Quais são as principais empresas no mercado de catalisadores de refino de petróleo?

A indústria de catalisadores para refino de petróleo é liderada principalmente por empresas bem estabelecidas, incluindo:

- Royal Dutch Shell plc (Reino Unido)

- 3M (EUA)

- Dow (EUA)

- Exxon Mobil Corporation (EUA)

- BASF SE (Alemanha)

- WR Grace & Co.-Conn (EUA)

- Anten Chemical Co., Ltd (China)

- Johnson Matthey (Reino Unido)

- Clariant (Suíça)

- Corporação Petroquímica da China (China)

- Albemarle Corporation (EUA)

- Honeywell International Inc (EUA)

- Haldor Topsoe A/S (Dinamarca)

- Arkema (França)

- Kuwait Catalyst Company (Kuwait)

- JGC C&C (Japão)

- Axens (França)

- Gazpromneft-Catalytic Systems (Rússia)

- UNICAT Catalyst Technologies, LLC (EUA)

- TAIYO KOKO Co., Ltd (Japão)

Quais são os desenvolvimentos recentes no mercado de catalisadores de refino de petróleo da Ásia-Pacífico?

- Em janeiro de 2023, a Albemarle Corporation anunciou o lançamento da Ketjen, uma subsidiária integral que oferece soluções de catalisadores personalizadas e sofisticadas para as indústrias químicas especializadas, de refino e petroquímicas, fortalecendo seu portfólio e presença de mercado globalmente.

- Em fevereiro de 2021, a subsidiária da Bharat Petroleum Corporation Limited, Numaligarh Refinery Limited (NRL), designou a Axens para fornecer tecnologias avançadas para o bloco de gasolina do seu Projeto de Expansão da Refinaria de Numaligarh (NREP), com o objetivo de aumentar a capacidade da refinaria em 9.000 KT por ano e melhorar a eficiência operacional.

- Em setembro de 2020, a Clariant anunciou a construção de uma nova unidade de produção de catalisadores na China, investindo significativamente para fortalecer sua presença local e oferecer melhor suporte aos clientes regionais, ao mesmo tempo em que produzia catalisadores CATOFIN para desidrogenação de propano, aumentando a capacidade de produção e a competitividade de mercado.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.