Asia Pacific Mobility As A Service Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

109.08 Billion

USD

1,113.81 Billion

2025

2033

USD

109.08 Billion

USD

1,113.81 Billion

2025

2033

| 2026 –2033 | |

| USD 109.08 Billion | |

| USD 1,113.81 Billion | |

|

|

|

|

Mercado de mobilidade como serviço na Ásia-Pacífico, por tipo de serviço (partilha de automóveis, partilha de autocarros, comboio, transporte por aplicação, partilha de bicicletas, automóveis autónomos e outros), solução (soluções de navegação, soluções de bilhética, plataformas tecnológicas, serviços de seguros) , Fornecedores de conectividade de telecomunicações e mecanismos de pagamento), Tipo de transporte (público e privado), Tipo de veículo (quatro rodas, autocarro, comboio e micromobilidade), Plataforma de aplicação (IOS, Android e outros ), Tipo de requisito (conectividade de primeira e última milha, Deslocação para trabalho fora das horas de ponta e por turnos, deslocação diária, viagens para aeroportos ou estações de transportes públicos, viagens entre cidades e outros), dimensão da organização (grandes empresas e pequenas e médias empresas (PME)), utilização (comercial e pessoal), país (China, Índia, Coreia do Sul, Austrália, Japão, Singapura, Malásia, Tailândia, Indonésia, Filipinas e Resto da Ásia-Pacífico) Tendências e previsões da indústria até 2028

Análise de mercado e insights: Mercado de mobilidade como serviço na Ásia-Pacífico

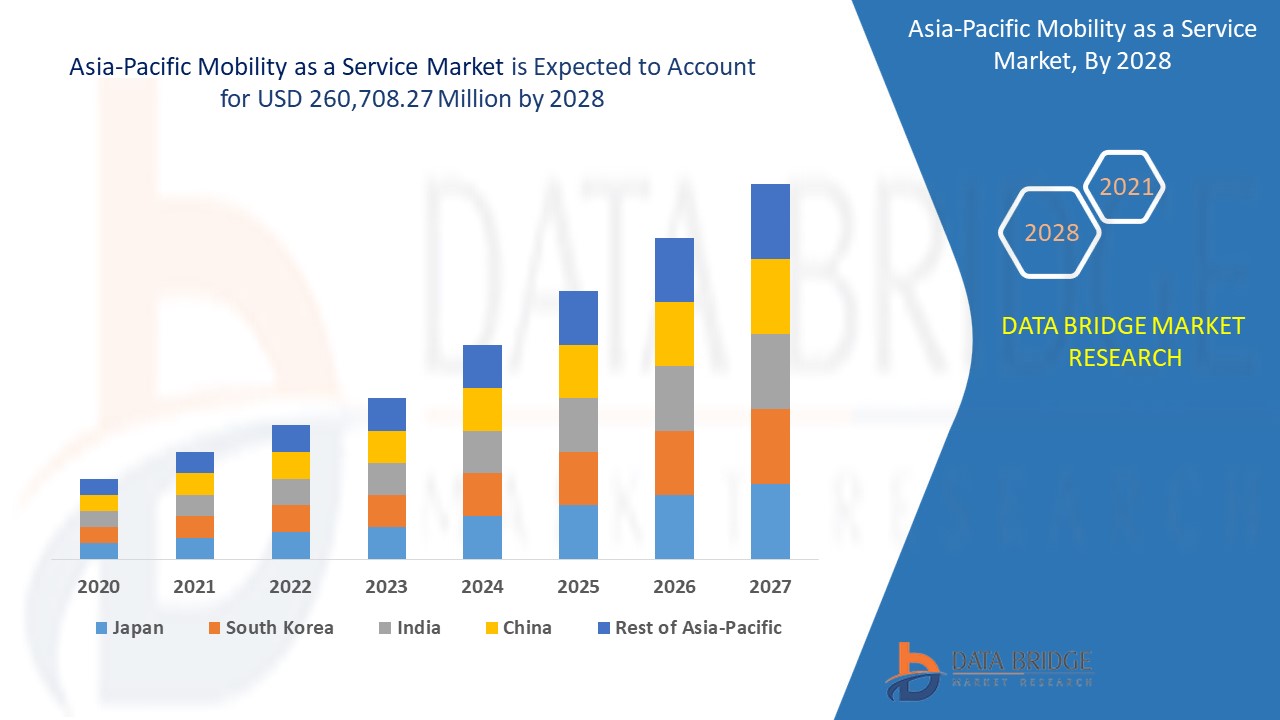

Espera-se que o mercado de mobilidade como serviço da Ásia-Pacífico ganhe crescimento de mercado no período previsto de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 33,7% no período previsto de 2021 a 2028 e prevê-se que atinja os 260.708,27 milhões de dólares até 2028. O aumento da população e da urbanização com a necessidade de reduzir a emissão de CO2 e o congestionamento do tráfego está a impulsionar o crescimento do mercado.

A mobilidade como serviço é um modelo centrado no consumidor para fornecer transporte às pessoas. A mobilidade como serviço é também conhecida como MaaS e, por vezes, chamada de transporte como serviço (TaaS). A mobilidade como serviço é a integração de métodos de transporte, como a partilha de automóveis e bicicletas, táxis e aluguer/leasing de automóveis através de canais digitais, o que permite aos consumidores planear, reservar e pagar vários tipos de serviços de mobilidade. O principal conceito do desenvolvimento do MaaS é oferecer aos viajantes soluções de mobilidade com base nas suas necessidades de viagem.

A crescente urbanização e as iniciativas de cidades inteligentes estão a impulsionar o crescimento do mercado de mobilidade como serviço, com uma maior procura por produtos avançados com conectividade e desempenho melhorados. Os participantes no mercado precisam de cumprir os padrões regulamentares de cada país em que vendem os seus produtos, o que está a limitar o crescimento do mercado da mobilidade como serviço. O crescimento de veículos elétricos para um transporte confortável e limpo a um custo mais baixo está a criar oportunidades para o mercado da mobilidade como serviço. A baixa sensibilização para o custo de vida útil dos veículos particulares e da propriedade de serviços será um grande desafio para o mercado da mobilidade como serviço.

Este relatório de mercado de mobilidade como serviço fornece detalhes sobre a quota de mercado, novos desenvolvimentos e análise de pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações de mercado, aprovações de produtos, decisões estratégicas, produtos lançamentos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário de mercado, contacte-nos para um Briefing de Analista.

Âmbito e dimensão do mercado de mobilidade como serviço

O mercado da mobilidade como serviço é segmentado com base no tipo de serviço, solução, tipo de transporte, tipo de veículo, plataforma de aplicação, tipo de requisito, tamanho da organização e utilização. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no tipo de serviço, o mercado da mobilidade como serviço está segmentado na partilha de automóveis, partilha de autocarros, comboios, serviços de transporte por aplicação, partilha de bicicletas, automóveis autónomos e outros. Em 2021, o segmento de transporte por aplicação teve uma maior quota de mercado de mobilidade como serviço devido à crescente opção de reserva e conforto, o que aumentou a procura de serviços de transporte ferroviário por aplicação.

- Com base na solução, o mercado da mobilidade como serviço está segmentado em soluções de navegação, soluções de emissão de bilhetes, plataformas tecnológicas, serviços de seguros, fornecedores de conectividade de telecomunicações e mecanismos de pagamento. Em 2021, a categoria de soluções de navegação foi responsável pela maior dimensão de mercado devido à crescente importância da segurança dos passageiros e à crescente preocupação em minimizar o tempo de viagem, o que aumentou a procura por soluções de navegação.

- Com base no tipo de transporte, o mercado da mobilidade como serviço está segmentado em público e privado. Em 2021, a categoria pública foi responsável pela dimensão máxima do mercado devido ao aumento do tráfego de veículos, o que aumentou a procura de serviços de mobilidade.

- Com base no tipo de veículo, o mercado da mobilidade como serviço está segmentado em veículos de quatro rodas, autocarros, comboios e micromobilidade. Em 2021, o segmento dos veículos de quatro rodas deteve a maior quota de mercado, o que é atribuído principalmente ao aumento do investimento em infraestruturas de transporte, que impulsionou a procura de serviços de mobilidade.

- Com base na plataforma de aplicações, o mercado da mobilidade como serviço está segmentado em IOS, Android e outros. Em 2021, a categoria Android foi responsável pelo tamanho máximo do mercado devido à crescente penetração da Internet e à crescente utilização de dispositivos móveis nas economias em desenvolvimento, o que resultou no aumento da procura de serviços de mobilidade para a aplicação Android.

- Com base no tipo de necessidade, o mercado da mobilidade como serviço está segmentado em conectividade de primeira e última milha, deslocações para trabalho por turnos e fora de ponta, deslocações diárias, viagens para aeroportos ou estações de transportes públicos, viagens intermunicipais e outras. Em 2021, a categoria de viagens intermunicipais obteve uma maior quota de mercado devido ao aumento do tráfego de veículos, o que aumentou a procura de serviços de mobilidade.

- Com base na dimensão da organização, o mercado da mobilidade como serviço está segmentado em grandes empresas e pequenas e médias empresas (PME). Em 2021, o segmento das grandes empresas deteve uma maior quota de mercado devido ao crescente investimento de vários gigantes tecnológicos na partilha de automóveis e nas infraestruturas de transporte que estão a marcar presença no setor dos transportes.

- Com base na utilização, o mercado da mobilidade como serviço está segmentado em comercial e pessoal. Em 2021, a categoria comercial obteve uma maior quota de mercado devido à crescente necessidade de opções de transporte de mercadorias e materiais seguras, eficazes e económicas.

Análise de mercado da mobilidade como serviço a nível de país

O mercado da mobilidade como serviço é analisado e são fornecidas informações sobre o tamanho do mercado por país, tipo de serviço, solução, tipo de transporte, tipo de veículo, plataforma de aplicação, tipo de requisito, tamanho da organização e utilização, conforme acima referenciado.

Os países abrangidos pelo relatório do mercado global de mobilidade como serviço são a China, a Índia, o Japão, a Coreia do Sul, a Austrália, Singapura, a Tailândia, a Indonésia, a Malásia, as Filipinas e o resto da Ásia-Pacífico.

A China está a dominar o mercado da mobilidade como serviço da Ásia-Pacífico e prevê-se que cresça com o maior CAGR durante o período previsto, seguida pelo Japão e pela Índia devido ao aumento da população e da urbanização nos países em desenvolvimento, o que está a contribuir para o crescimento do mercado de MaaS nestes países. Além disso, o surgimento da redução das emissões dos veículos e do congestionamento do tráfego na região está a impulsionar o mercado da mobilidade como serviço na Ásia-Pacífico.

A secção de países do relatório sobre o mercado de mobilidade como serviço também fornece fatores de impacto de mercado individuais e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas da Ásia-Pacífico e os desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, bem como o impacto dos canais de vendas, são considerados ao fornecer uma análise de previsão dos dados do país.

Número crescente de fabricantes de equipamento original (OEMs)

O mercado da mobilidade como serviço também fornece uma análise detalhada do mercado para cada país, o crescimento da base instalada de diferentes tipos de produtos para o mercado da mobilidade como serviço, o impacto da tecnologia utilizando curvas de linha de vida e as mudanças nos cenários regulamentares e a sua impacto na mobilidade como serviço. Os dados estão disponíveis para o período histórico de 2010 a 2018.

Análise do cenário competitivo e da quota de mercado da mobilidade como serviço

O panorama competitivo do mercado da mobilidade como serviço fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de ensaios clínicos, análise de marcas, aprovações de produtos, patentes, amplitude e abrangência do produto, domínio da aplicação, curva de vida da tecnologia. Os pontos de dados fornecidos acima estão apenas relacionados com o foco das empresas no mercado de mobilidade como serviço da Ásia-Pacífico.

Os principais participantes abordados no relatório sobre o mercado de mobilidade como serviço são a Moovit Inc. (uma subsidiária da Intel Corporation), a UbiGo Innovation AB, a MaaS Global Oy, a SkedGo Pty Ltd, a Beijing Xiaoju Technology Co, Ltd., a Uber Technologies, Inc., EasyMile, Ridecell, Inc., Bolt Technology OÜ, Citymapper Limited, Cubic Corporation, inovação em sistemas de tráfego SE, BRIDJ Pty Ltd, ANI Technologies Pvt. Ltd., Splyt Technologies Ltd. e BlaBlaCar, entre outras. Os analistas do DBMR compreendem os pontos fortes competitivos e fornecem análises competitivas para cada concorrente em separado.

Por exemplo,

- Em novembro de 2020, a Beijing Xiaoju Technology Co, Ltd. lançou o primeiro veículo elétrico personalizado para transporte por aplicação, denominado D1. Este D1 foi desenvolvido para as principais cidades chinesas. D1 é o desenvolvimento da condução autónoma e da tecnologia de IA. Com o lançamento deste produto, a empresa consegue proporcionar uma melhor experiência de viagem através da mobilidade partilhada.

- Em novembro de 2020, a Uber Technologies, Inc. lançou os E-riquexós para conectividade de primeira e última milha. Estes e-riquexós estarão disponíveis em 26 estações da linha azul do metro de Deli, na Índia. Este produto oferece aos ciclistas soluções de mobilidade para uma melhor conectividade. Com isto, a empresa consegue alargar o seu portfólio de produtos no mercado.

O lançamento de produtos, a aquisição e outras estratégias aumentam a quota de mercado da empresa com maior cobertura e presença. Oferece ainda o benefício para as organizações melhorarem a sua oferta de mobilidade como serviço através do portefólio de produtos das empresas.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.