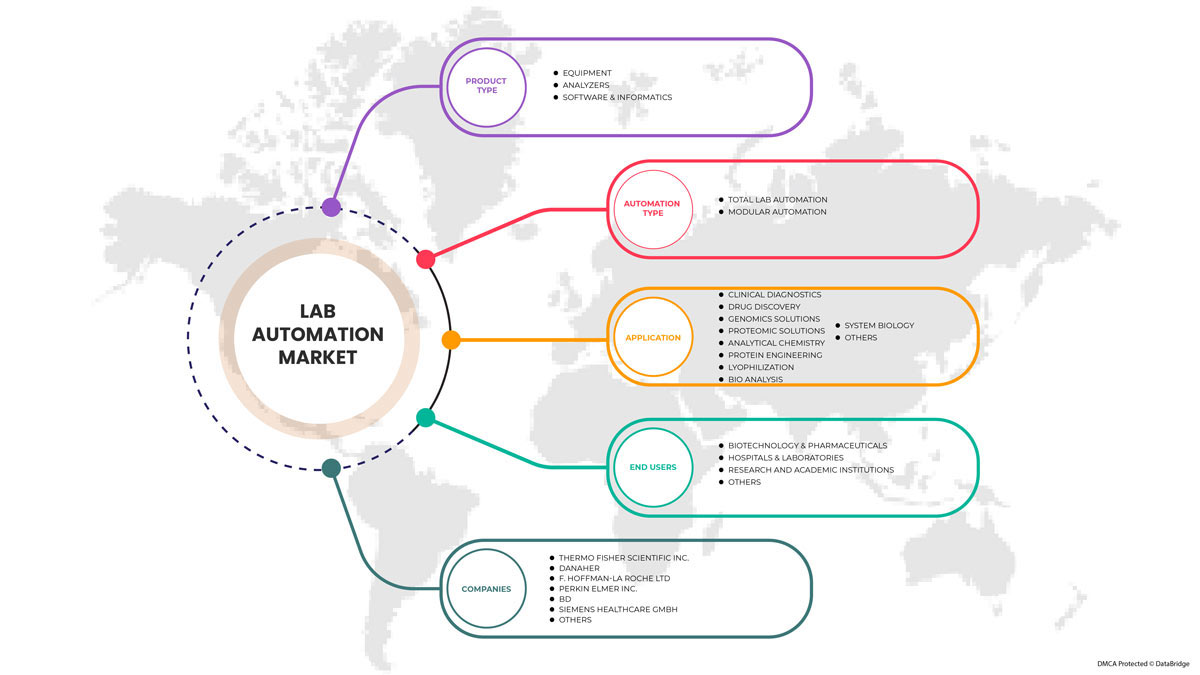

Asia-Pacific Lab Automation Market, By Product Type (Equipment, Software & Informatics and Analyzer), Automation Type (Modular Automation and Total Lab Automation), Application (Drug Discovery, Clinical Diagnostics, Genomics, Proteomics Solutions, Bio Analysis, Protein Engineering, Lyophilization, System Biology, Analytical Chemistry and Others), End Users (Biotechnology & Pharmaceuticals, Hospitals & Laboratories, Research and Academic Institutions and Others) - Industry Trends and Forecast to 2029.

Asia-Pacific Lab Automation Market Analysis and Insights

The demand for the lab automation market is increasing due to the advancement of technology all around the world. For the healthcare sector lab automation equipment and tools are used. As healthcare expenditure has become higher due to several factors, the leading pharma & healthcare companies have to automate the labs to deliver advanced healthcare services at the doorstep within less time.

The growing healthcare demand in the market is the main cause of competition between the leading healthcare and pharma companies in the improvement of lab automation worldwide. The rise in the use of equipment, analyzer and software for the lab has been used. The focus for the market players is to provide variability of tools, equipment, machines and techniques to support the development and manufacturing of automated laboratory infrastructure. Market players are coming up with more investments and funding to build advanced technology and methods.

Healthcare expenditure has become higher due to several factors, such as the aging population, chronic disease prevalence, rising drug prices, healthcare service costs and administrative costs among others. Moreover, hospitals, private labs, clinical research and diagnostics centers are rising, increasing the lab automation market demand.

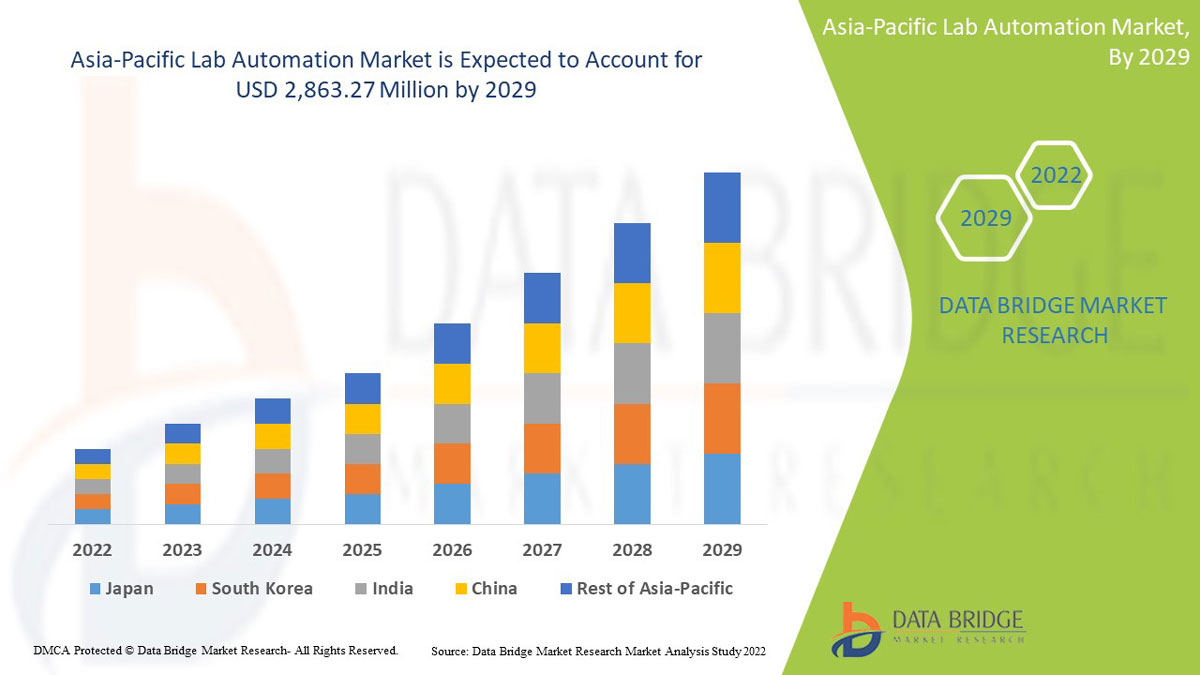

Asia-Pacific lab automation market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.6% in the forecast period of 2022 to 2029 and is expected to reach USD 2,863.27 million by 2029.

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2019-2014) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

By Product Type (Equipment, Software & Informatics and Analyzer), Automation Type (Modular Automation and Total Lab automation), Application (Drug Discovery, Clinical Diagnostics, Genomics Solutions, Proteomics Solutions, Bio Analysis, Protein Engineering, Lyophilization, System Biology, Analytical Chemistry and Others), End Users (Biotechnology & Pharmaceuticals, Hospitals & Laboratories, Research and Academic Institutions and Others) |

|

Countries Covered |

China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific |

|

Market Players Covered |

QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE, and Labware among others |

Market Definition

Laboratory automation is the combination of automated technologies in the laboratory to enable new and improved processes. It is used as a strategy to research, develop, optimize and capitalize on technologies in the laboratory. It is specially used for automating laboratory processes requiring minimal human input and eliminating human error. Lab automation is used with the aim of providing more efficient testing and diagnostics.

Lab automation enables researchers and technicians to efficiently and effectively produce output in less time, which is expected to drive the lab automation market. Furthermore, the rapid spread of diseases, along with new discoveries in the field of healthcare, ascend the demand for diagnoses and treatments, which is expected to fuel the lab automation market. High government and private funding for research and discovery research and the presence of major market players also contribute to the market growth.

Lab Automation Market Dynamics

Drivers

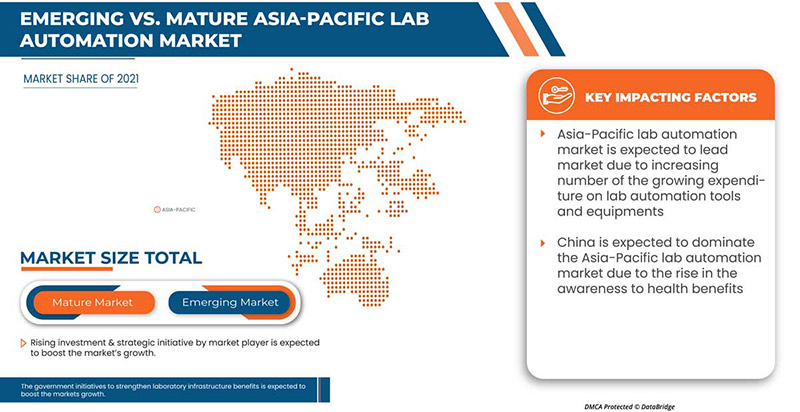

- Increasing investment & strategic initiatives by market players

The market for laboratory automation is increasing as there is high demand for specialized advanced automated services which eliminate human errors. The focus of the market players and the companies is to provide a variability of tools, equipment, machines and techniques to support the development and manufacturing of automated laboratory infrastructure. The market for laboratory automation is increasing as there is high demand for specialized advanced automated services which eliminate human error. In order to capture the global market share, the market players are coming up with more investments and funding to build advanced technology and methods. These players are more focused on reducing manual efforts and hands-on time for the traditionally labor-intensive process. This is expected to drive the market's growth.

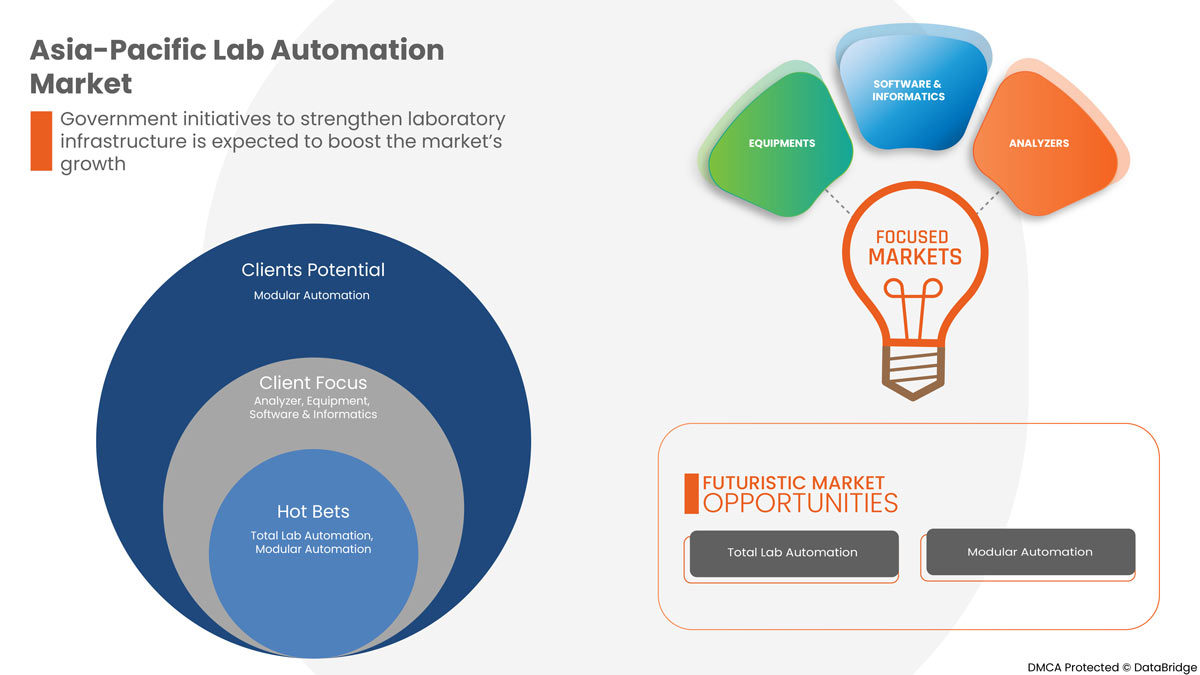

- Government initiatives to strengthen laboratory infrastructures

In order to further strengthen the healthcare sector and laboratory infrastructure, government organizations play a significant role. The government's funding and initiative to expand laboratory automation will help the market growth and increase the market players. The government collaborations and agreements with the market's key players will further strengthen the laboratory infrastructure.

- Growing expenditure on lab automation tools and equipment

The growing expenditure on lab automation tools and equipment is increasing. This is mainly due to the demand for laboratory examinations increasing rapidly for various reasons, such as an aging population, chronic disease growth, the discovery of new and more effective biomarkers and an increase in general health or diagnostic demands.

- Reducing human efforts and eliminating human error

There are several traditional ways to reduce human errors, but developing a system to minimize the risk of human error will help ensure that you don't repeat the same mistakes again. Manufacturing facilities are focused on building advanced systems in order to utilize artificial intelligence technology to recognize and correct issues before they occur.

Opportunities

-

Rising healthcare expenditure

Healthcare expenditure has become higher due to several factors, such as the aging population, chronic disease prevalence, rising drug prices, healthcare service costs and administrative costs among others. However, 2020 was the turning point where the expenses ranked the highest due to the COVID-19 pandemic. It has been found that in 2020, healthcare expenditure grew at the fastest rate of growth experienced since 2002 due to the pandemic.

-

Strategic initiatives by key players

Various initiatives have been taken by the leading pharma & healthcare companies to automate the labs to deliver advanced healthcare services to the doorstep within less time. The growing healthcare demand in the market is the main cause of competition between the leading healthcare & pharma companies in the improvement of lab automation worldwide. Hence, the strategic initiatives by market players are expected to act as an opportunity for the lab automation market's growth.

-

Rise in the number of pharma companies

The pharmaceutical industry has experienced significant growth during the past two decades. Growing disposable incomes, increased access to healthcare facilities, growing consciousness towards healthcare among people and increased penetration of medical services are making the pharma companies rise in number to fulfill the demand.

The COVID-19 pandemic had a great impact on the pharmaceutical industry because of the increased demand for medical services and drug supplies. Pharma industries have been growing fastly worldwide to fulfill the high demand of mankind and hence the service should be delivered at the earliest. So, to achieve error-free fast serving advanced healthcare facilities within less time, lab automation is needed. Thus, the rise in the number of pharma companies is expected to act as an opportunity for the lab automation market growth.

Restraints/Challenges

- Limitation analyzing novel complex product

There are various factors that contribute to the complexity of novel products used in automated laboratories. The continued engagement between staff and device manufacturers early in the development process is much needed and becomes mandatory to understand in order to operate the part or overall setup. Limitations in the detection and analysis of novel complex products such as machines, tools and equipment are hampering the installation and working of automated labs in the market.

- High cost for installation and setup

Lab automation installation and setup are much more labor-intensive and complex procedures. The setting up of automated labs requires a lot of time, effort, planning, implementation and approvals from various government departments. Moreover, the essential thing for setting up a new lab requires a critical investment in infrastructure due to the high cost of advanced machines, tools and equipment.

- Upgradation, maintenance and periodical checkups

Operating labs efficiently is the primary concern after setup. The maintenance, up-gradation and periodical checkups of equipment are necessary for the operation. The expense that is required for this is one of the main restraining factors for the market players. The laboratory holders are made mandatory by regulation or quality control to test their products irrespective of the manufacturing companies in order to operate smoothly and avoid circumstances. This may restrain the market growth.

Post-COVID-19 Impact on the Lab Automation Market

COVID-19 has positively affected the automation market. Due to the pandemic, people health has been affected, due to which high diagnostic tests happened and demand got increased. Private labs, hospitals and clinical research got increased due to the pandemic. Thus, COVID-19 increased the lab automation market positively.

Recent Developments

- In June 2022, BD announced that they had completed the acquisition of Straub Medical AG, a privately held company. With this acquisition, the company has added the valuable expertise and experience of Straub Medical AG and expanded its product portfolio

- In January 2022, QIAGEN announced that it has entered into new collaborations with Atlia Biosystems to provide non-invasive prenatal testing solutions.

Asia-Pacific Lab Automation Market Scope

Asia-Pacific lab automation market is segmented into product type, automated systems, application, and end user. The growth amongst these segments will help you analyze meager growth segments in the industries and provide the users with a valuable market overview and market insights to make strategic decisions to identify core market applications.

Product Type

- Equipment

- Analyzer

- Software & Informatics

Based on product type, the Asia-Pacific lab automation market is segmented into equipment, analyzer, and software and informatics.

Automated Systems

- Total Lab Automation

- Modular Lab Automation

Based on automated systems, the Asia-Pacific lab automation market is segmented into total lab automation and modular lab automation.

Application

- Clinical Diagnostics

- Drug Discovery

- Genomics Solutions

- Proteomic Solutions

- Analytical Chemistry

- Protein Engineering

- Lyophilization

- Bio Analysis

- System Biology

- Others

Based on application, the Asia-Pacific lab automation market is segmented into drug discovery, clinical diagnostics, genomic solutions, proteomic solutions, bio analysis, protein engineering, lyophilization, system biology, analytical chemistry, and others.

End User

- Biotechnology And Pharmaceuticals

- Hospitals & Laboratories

- Research And Academic Institutes

- Others

Based on end user, the Asia-Pacific lab automation market is segmented into biotechnology & pharmaceuticals, hospitals & laboratories, research and academic institutions, and others.

Asia-Pacific Lab Automation Market Regional Analysis/Insights

Asia-Pacific lab automation market is analyzed, and market size insights and trends are provided by country, product type, automated systems, application, and end user.

Countries covered in market are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines and Rest of Asia-Pacific.

China is expected to dominate the Asia-Pacific lab automation market due to a growing number of research activities along with the prevalence of various pharmaceutical companies. An increase in demand for equipment, analyzer, and software is expected to drive the regional market in the forecasted period.

The region section of the report also provides individual market impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of Central America brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Asia-Pacific Lab Automation Market Share Analysis

The lab automation market competitive landscape provides details by the competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies' focus on the Asia-Pacific lab automation market.

Some of the major players operating in the Asia-Pacific lab automation market are QIAGEN, Siemens Healthcare, F. Hoffman Roche, Hamilton Company, Hudson Robotics, LabVantage Solutions Inc., Abbott, BD, BIOMERIEUX, Aurora Biomed Inc., Danaher, Tecan Trading AG, PerkinElmer Inc, Thermo Fisher Scientific, Agilent Technologies, Azenta US Inc, Eppendorf SE, and Labware among others.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The market data is analyzed and estimated using market statistical and coherent models. In addition, market share analysis and key trend analysis are the major success factors in the market report. The key research methodology used by the DBMR research team is data triangulation which involves data mining, analysis of the Impact of data variables on the market, and primary (industry expert) validation. Apart from this, data models include a Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Company Market Share Analysis, Standards of Measurement, Asia-Pacific vs. Regional and Vendor Share Analysis. Please request an analyst call in case of further inquiry.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA PACIFIC LAB AUTOMATION MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 PRODUCT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET END USER COVERAGE GRID

2.11 VENDOR SHARE ANALYSIS

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL ANALYSIS

4.2 PORTER’S FIVE FORCES

5 REGULATION

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASING INVESTMENT & STRATEGIC INITIATIVES BY MARKET PLAYERS

6.1.2 GOVERNMENT INITIATIVES TO STRENGTHEN LABORATORY INFRASTRUCTURES

6.1.3 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT

6.1.4 REDUCING HUMAN EFFORTS AND ELIMINATING HUMAN ERROR

6.2 RESTRAINTS

6.2.1 LIMITATION ANALYZING NOVEL COMPLEX PRODUCT

6.2.2 HIGH COST FOR INSTALLATION AND SETUP

6.2.3 UPGRADATION, MAINTENANCE, AND PERIODICAL CHECKUPS

6.3 OPPORTUNITIES

6.3.1 RISING HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISE IN THE NUMBER OF PHARMA COMPANIES

6.4 CHALLENGES

6.4.1 SLOW ADOPTION OF AUTOMATION AMONG SMALL AND MEDIUM SIZED LABORATORIES

6.4.2 LIMITED FEASIBILITY WITH TECHNOLOGY INTEGRATION IN ANALYTICAL LABS

7 ASIA PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 EQUIPMENT

7.2.1 AUTOMATED WORKSTATIONS

7.2.1.1 AUTOMATED LIQUID HANDLING SYSTEMS

7.2.1.2 AUTOMATED INTEGRATED WORKSTATIONS

7.2.1.3 PIPETTING SYSTEMS

7.2.1.4 MICROPLATE WASHERS

7.2.1.5 REAGENT DISPENSERS

7.2.2 MICROPLATE READERS

7.2.2.1 MULTI-MODE MICROPLATE READERS

7.2.2.2 SINGLE-MODE MICROPLATE READERS

7.2.2.3 AUTOMATED NUCLEIC ACID PURIFICATION SYSTEMS

7.2.2.4 AUTOMATED ELISA SYSTEMS

7.2.3 OFF-THE-SHELF AUTOMATED WORKCELLS

7.2.4 ROBOTIC SYSTEMS

7.2.4.1 ROBOTIC ARMS

7.2.4.2 TRACK ROBOTS

7.2.5 AUTOMATE STORAGE & RETRIEVALS (ASRS)

7.2.6 OTHERS

7.3 ANALYZER

7.3.1 BIO CHEMISTRY ANALYZERS

7.3.2 HAEMATOLOGY ANALYZERS

7.3.3 IMMUNO-BASED ANALYZERS

7.4 SOFTWARE & INFORMATICS

7.4.1 LABORATORY INFORMATION MANAGEMENT SYSTEM (LIMS)

7.4.2 ELECTRONIC LABORATORY NOTEBOOK (ELN)

7.4.3 LABORATORY EXECUTION SYSTEMS (LES)

7.4.4 SCIENTIFIC DATA MANAGEMENT SYSTEMS (SDMS)

8 ASIA PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE

8.1 OVERVIEW

8.2 TOTAL LAB AUTOMATION

8.3 MODULAR AUTOMATION

9 ASIA PACIFIC LAB AUTOMATION MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 CLINICAL DIAGNOSTICS

9.3 DRUG DISCOVERY

9.4 GENOMICS SOLUTIONS

9.5 PROTEOMIC SOLUTIONS

9.6 ANALYTICAL CHEMISTRY

9.7 PROTEIN ENGINEERING

9.8 BIO ANALYSIS

9.9 SYSTEM BIOLOGY

9.1 OTHERS

10 ASIA PACIFIC LAB AUTOMATION MARKET, BY END USER

10.1 OVERVIEW

10.2 BIOTECHNOLOGY & PHARMACEUTICALS

10.3 HOSPITALS & LABORATORIES

10.4 RESEARCH & ACADEMIC INSTITUTES

10.5 OTHERS

11 ASIA PACIFIC LAB AUTOMATION MARKET, BY REGION

11.1 ASIA-PACIFIC

11.1.1 CHINA

11.1.2 JAPAN

11.1.3 SOUTH KOREA

11.1.4 INDIA

11.1.5 AUSTRALIA

11.1.6 SINGAPORE

11.1.7 THAILAND

11.1.8 MALAYSIA

11.1.9 INDONESIA

11.1.10 PHILIPPINES

11.1.11 REST OF ASIA-PACIFIC

12 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY LANDSCAPE

12.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

13 SWOT ANALYSIS

14 COMPANY PROFILE

14.1 THERMO FISHER SCIENTIFIC INC.

14.1.1 COMPANY SNAPSHOT

14.1.2 REVENUE ANALYSIS

14.1.3 COMPANY SHARE ANALYSIS

14.1.4 PRODUCT PORTFOLIO

14.1.5 RECENT DEVELOPMENTS

14.2 DANAHER

14.2.1 COMPANY SNAPSHOT

14.2.2 REVENUE ANALYSIS

14.2.3 COMPANY SHARE ANALYSIS

14.2.4 PRODUCT PORTFOLIO

14.2.5 RECENT DEVELOPMENTS

14.3 F. HOFFMANN- LA ROCHE LTD

14.3.1 COMPANY SNAPSHOT

14.3.2 REVENUE ANALYSIS

14.3.3 COMPANY SHARE ANALYSIS

14.3.4 PRODUCT PORTFOLIO

14.3.5 RECENT DEVELOPMENTS

14.4 PERKINELMER INC

14.4.1 COMPANY SNAPSHOT

14.4.2 REVENUE ANALYSIS

14.4.3 COMPANY SHARE ANALYSIS

14.4.4 PRODUCT PORTFOLIO

14.4.5 RECENT DEVELOPMENTS

14.5 BD

14.5.1 COMPANY SNAPSHOT

14.5.2 REVENUE ANALYSIS

14.5.3 COMPANY SHARE ANALYSIS

14.5.4 PRODUCT PORTFOLIO

14.5.5 RECENT DEVELOPMENTS

14.6 ABBOTT

14.6.1 COMPANY SNAPSHOT

14.6.2 REVENUE ANALYSIS

14.6.3 PRODUCT PORTFOLIO

14.6.3 RECENT DEVELOPMENTS

14.7 AGILENT TECHNOLOGIES

14.7.1 COMPANY SNAPSHOT

14.7.2 REVENUE ANALYSIS

14.7.3 PRODUCT PORTFOLIO

14.7.4 RECENT DEVELOPMENTS

14.8 AURORA BIOMED INC.

14.8.1 COMPANY SNAPSHOT

14.8.2 PRODUCT PORTFOLIO

14.8.3 RECENT DEVELOPMENTS

14.9 AZENTA US INC

14.9.1 COMPANY SNAPSHOT

14.9.2 REVENUE ANALYSIS

14.9.3 PRODUCT PORTFOLIO

14.9.4 RECENT DEVELOPMENTS

14.1 BIOMERIEUX

14.10.1 COMPANY SNAPSHOT

14.10.2 REVENUE ANALYSIS

14.10.3 PRODUCT PORTFOLIO

14.10.4 RECENT DEVELOPMENTS

14.11 EPPENDORF SE

14.11.1 COMPANY SNAPSHOT

14.11.2 PRODUCT PORTFOLIO

14.11.3 RECENT DEVELOPMENTS

14.12 HAMILTON COMPANY

14.12.1 COMPANY SNAPSHOT

14.12.2 PRODUCT PORTFOLIO

14.12.3 RECENT DEVELOPMENTS

14.13 HUDSON ROBOTICS

14.13.1 COMPANY SNAPSHOT

14.13.2 PRODUCT PORTFOLIO

14.13.3 RECENT DEVELOPMENTS

14.14 LABLYNX LIMS

14.14.1 COMPANY SNAPSHOT

14.14.2 PRODUCT PORTFOLIO

14.14.3 RECENT DEVELOPMENTS

14.15 LABVANTAGE SOLUTIONS INC.

14.15.1 COMPANY SNAPSHOT

14.15.2 PRODUCT PORTFOLIO

14.15.3 RECENT DEVELOPMENTS

14.16 LABWARE

14.16.1 COMPANY SNAPSHOT

14.16.2 PRODUCT PORTFOLIO

14.16.3 RECENT DEVELOPMENTS

14.17 QIAGEN

14.17.1 COMPANY SNAPSHOT

14.17.2 REVENUE ANALYSIS

14.17.3 PRODUCT PORTFOLIO

14.17.4 RECENT DEVELOPMENTS

14.18 SIEMENS HEALTHCARE GMBH

14.18.1 COMPANY SNAPSHOT

14.18.2 REVENUE ANALYSIS

14.18.3 PRODUCT PORTFOLIO

14.18.4 RECENT DEVELOPMENTS

14.19 TECAN TRADING AG

14.19.1 COMPANY SNAPSHOT

14.19.2 REVENUE ANALYSIS

14.19.3 PRODUCT PORTFOLIO

14.19.4 RECENT DEVELOPMENTS

15 QUESTIONNAIRE

16 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC TOTAL LAB AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC MODULAR AUTOMATION IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CLINICAL DIAGNOSTICS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC DRUG DISCOVERY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC GENOMICS SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC PROTEOMIC SOLUTIONS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC ANALYTICAL CHEMISTRY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC PROTEIN ENGINEERING IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC BIO ANALYSIS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC SYSTEM BIOLOGY IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC BIOTECHNOLOGY & PHARMACEUTICALS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC HOSPITALS & LABORATORIES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC RESEARCH & ACADEMIC INSTITUTES IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC OTHERS IN LAB AUTOMATION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 28 ASIA-PACIFIC LAB AUTOMATION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 29 ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA-PACIFIC EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 31 ASIA-PACIFIC AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA-PACIFIC MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 33 ASIA-PACIFIC ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA-PACIFIC ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 35 ASIA-PACIFIC SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 39 CHINA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 CHINA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 CHINA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 CHINA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 CHINA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 CHINA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 45 CHINA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 CHINA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 47 CHINA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 48 CHINA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 49 JAPAN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 JAPAN EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 JAPAN AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 JAPAN MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 55 JAPAN SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 58 JAPAN LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 59 SOUTH KOREA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 SOUTH KOREA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 SOUTH KOREA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 SOUTH KOREA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 SOUTH KOREA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 SOUTH KOREA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 65 SOUTH KOREA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 SOUTH KOREA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 67 SOUTH KOREA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 68 SOUTH KOREA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 69 INDIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 INDIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 71 INDIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 INDIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 INDIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 INDIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 75 INDIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 INDIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 77 INDIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 78 INDIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 79 AUSTRALIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 AUSTRALIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 AUSTRALIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 AUSTRALIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 AUSTRALIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 AUSTRALIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 85 AUSTRALIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 AUSTRALIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 87 AUSTRALIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 88 AUSTRALIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 89 SINGAPORE LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SINGAPORE EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SINGAPORE AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SINGAPORE MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SINGAPORE ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SINGAPORE ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 95 SINGAPORE SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SINGAPORE LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 97 SINGAPORE LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 98 SINGAPORE LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 99 THAILAND LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 THAILAND EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 THAILAND AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 THAILAND MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 103 THAILAND ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 THAILAND ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 105 THAILAND SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 THAILAND LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 107 THAILAND LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 108 THAILAND LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 109 MALAYSIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 MALAYSIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 MALAYSIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 MALAYSIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 MALAYSIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 MALAYSIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 115 MALAYSIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 MALAYSIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 117 MALAYSIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 118 MALAYSIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 119 INDONESIA LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 INDONESIA EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 INDONESIA AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 INDONESIA MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 INDONESIA ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 INDONESIA ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 125 INDONESIA SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 INDONESIA LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 127 INDONESIA LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 128 INDONESIA LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 129 PHILIPPINES LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 PHILIPPINES EQUIPMENT IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 PHILIPPINES AUTOMATED WORKSTATIONS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 PHILIPPINES MICROPLATE READERS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 PHILIPPINES ROBOTIC SYSTEMS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 PHILIPPINES ANALYZER IN LAB AUTOMATION MARKET, BY PRODUCT TYPE , 2020-2029 (USD MILLION)

TABLE 135 PHILIPPINES SOFTWARE & INFORMATICS IN LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 PHILIPPINES LAB AUTOMATION MARKET, BY AUTOMATION TYPE, 2020-2029 (USD MILLION)

TABLE 137 PHILIPPINES LAB AUTOMATION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 138 PHILIPPINES LAB AUTOMATION MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 139 REST OF ASIA-PACIFIC LAB AUTOMATION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA PACIFIC LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC LAB AUTOMATION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC LAB AUTOMATION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC LAB AUTOMATION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC LAB AUTOMATION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA PACIFIC LAB AUTOMATION MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA PACIFIC LAB AUTOMATION MARKET: MARKET END USER COVERAGE GRID

FIGURE 9 ASIA PACIFIC LAB AUTOMATION MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC LAB AUTOMATION MARKET: SEGMENTATION

FIGURE 11 GROWING EXPENDITURE ON LAB AUTOMATION TOOLS AND EQUIPMENT IS EXPECTED TO DRIVE THE ASIA PACIFIC LAB AUTOMATION MARKET GROWTH IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 12 EQUIPMENT SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC LAB AUTOMATION MARKET IN 2022 & 2029

FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC LAB AUTOMATION MARKET

FIGURE 14 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2021

FIGURE 15 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, 2022-2029 (USD MILLION)

FIGURE 16 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, CAGR (2022-2029)

FIGURE 17 ASIA PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 18 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2021

FIGURE 19 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, 2022-2029 (USD MILLION)

FIGURE 20 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, CAGR (2022-2029)

FIGURE 21 ASIA PACIFIC LAB AUTOMATION MARKET: BY AUTOMATION TYPE, LIFELINE CURVE

FIGURE 22 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, 2021

FIGURE 23 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 24 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 25 ASIA PACIFIC LAB AUTOMATION MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 26 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, 2021

FIGURE 27 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, 2022-2029 (USD MILLION)

FIGURE 28 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, CAGR (2022-2029)

FIGURE 29 ASIA PACIFIC LAB AUTOMATION MARKET: BY END USER, LIFELINE CURVE

FIGURE 30 ASIA-PACIFIC LAB AUTOMATION MARKET: SNAPSHOT (2021)

FIGURE 31 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021)

FIGURE 32 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 33 ASIA-PACIFIC LAB AUTOMATION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 34 ASIA-PACIFIC LAB AUTOMATION MARKET: BY PRODUCT TYPE (2022-2029)

FIGURE 35 ASIA PACIFIC LAB AUTOMATION MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.