Asia Pacific Industrial Ethanol Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

22.31 Billion

USD

47.78 Billion

2025

2033

USD

22.31 Billion

USD

47.78 Billion

2025

2033

| 2026 –2033 | |

| USD 22.31 Billion | |

| USD 47.78 Billion | |

|

|

|

|

Segmentação do mercado de etanol industrial na Ásia-Pacífico por matéria-prima (de base biológica e sintética), tipo (etanol absoluto, etanol 95%, etanol desnaturado e outros), aplicação ( tintas e revestimentos , produtos farmacêuticos, alimentos e bebidas, tintas de impressão, produtos agrícolas, soluções de limpeza doméstica e industrial, cosméticos e cuidados pessoais, adesivos e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de etanol industrial na região Ásia-Pacífico

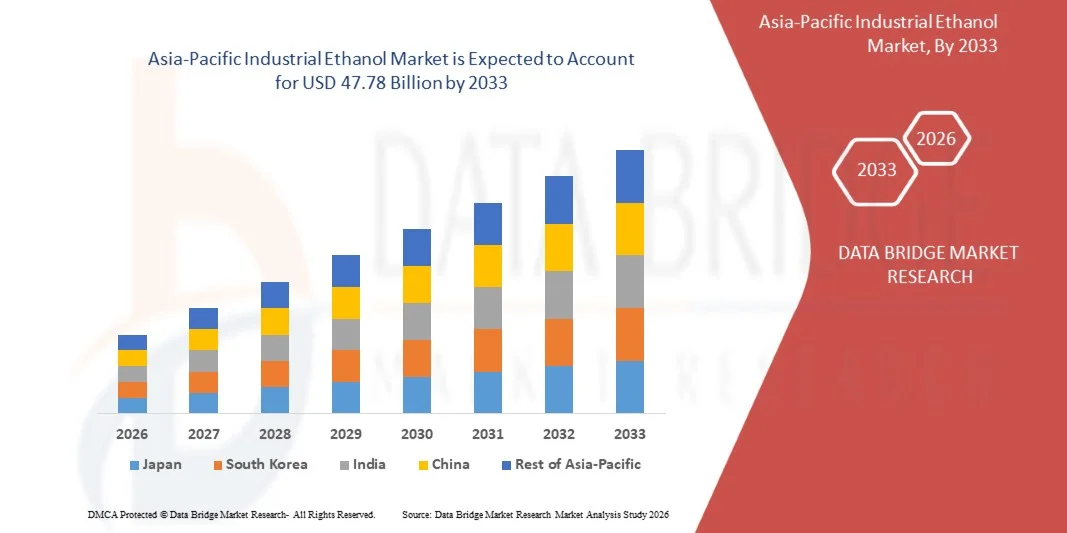

- O mercado de etanol industrial na região Ásia-Pacífico foi avaliado em US$ 22,31 bilhões em 2025 e deverá atingir US$ 47,78 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 9,99% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda das indústrias química, farmacêutica, de cosméticos, de tintas e revestimentos e de cuidados pessoais.

- Além disso, a crescente adoção de solventes de base biológica, o foco cada vez maior em matérias-primas sustentáveis e renováveis e o uso crescente do etanol como matéria-prima industrial estão impulsionando a expansão do mercado.

Análise do Mercado de Etanol Industrial na Ásia-Pacífico

- O mercado é caracterizado por uma forte demanda por etanol como solvente versátil, desinfetante e intermediário na produção de produtos químicos, polímeros e formulações farmacêuticas.

- Os fabricantes estão cada vez mais focados na produção de etanol de base biológica e com baixa emissão de carbono para se alinharem às regulamentações ambientais, metas de sustentabilidade e estratégias corporativas de descarbonização.

- A China dominou o mercado de etanol industrial na região Ásia-Pacífico, com a maior participação na receita em 2025, devido ao alto consumo industrial nos setores farmacêutico, químico, de revestimentos e de produtos de higiene pessoal.

- Prevê-se que o Japão registre a maior taxa de crescimento anual composta (CAGR) no mercado de etanol industrial da região Ásia-Pacífico, devido à crescente adoção de etanol de alta pureza e sustentável nas indústrias farmacêutica, cosmética e de especialidades químicas, ao foco cada vez maior em processos de produção mais limpos e aos incentivos regulatórios para soluções de base biológica.

- O segmento de base biológica detinha a maior participação na receita de mercado em 2025, impulsionado pela crescente demanda por matérias-primas renováveis e sustentáveis, incentivos governamentais para produtos químicos verdes e adoção crescente nas indústrias farmacêutica, de cuidados pessoais e química. O etanol de base biológica é preferido por sua menor pegada de carbono e conformidade com as regulamentações ambientais, tornando-se uma escolha popular entre os fabricantes industriais.

Escopo do relatório e segmentação do mercado de etanol industrial na região Ásia-Pacífico

|

Atributos |

Principais informações sobre o mercado de etanol industrial na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

• Expansão das aplicações industriais de etanol de base biológica e renovável |

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análise de importação e exportação, visão geral da capacidade de produção, análise de produção e consumo, análise de tendências de preços, cenário de mudanças climáticas, análise da cadeia de suprimentos, análise da cadeia de valor, visão geral de matérias-primas/insumos, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de etanol industrial na região Ásia-Pacífico

“Crescente demanda por insumos industriais sustentáveis e de base biológica”

- O crescente foco na sustentabilidade e na redução das emissões de carbono está moldando significativamente o mercado de etanol industrial na região Ásia-Pacífico, à medida que as indústrias buscam alternativas renováveis e de base biológica aos produtos químicos derivados de combustíveis fósseis. O etanol industrial está ganhando espaço devido à sua versatilidade como solvente, intermediário e desinfetante, além de contribuir para processos de produção mais limpos. Essa tendência está fortalecendo sua adoção nos setores químico, farmacêutico, de cuidados pessoais, de tintas e revestimentos e de manufatura industrial, incentivando os produtores a aumentar a capacidade e a eficiência.

- A crescente conscientização sobre responsabilidade ambiental e conformidade regulatória acelerou o uso de etanol industrial em aplicações de química verde. Os fabricantes estão incorporando cada vez mais etanol derivado de matérias-primas renováveis para atender às metas de sustentabilidade e melhorar os perfis ambientais dos produtos finais. Essa mudança também está impulsionando investimentos em tecnologias avançadas de fermentação e otimização de matérias-primas para melhorar o rendimento e reduzir os custos de produção.

- Decisões de compra orientadas pela sustentabilidade estão influenciando compradores industriais, com maior ênfase na rastreabilidade da origem, menores emissões ao longo do ciclo de vida e conformidade com padrões ambientais. Esses fatores estão permitindo que fornecedores de etanol industrial de base biológica diferenciem suas ofertas, fortaleçam contratos de longo prazo e construam confiança com indústrias a jusante focadas em objetivos ESG.

- Por exemplo, em 2024, a BASF na Alemanha aumentou o uso de etanol de base biológica como intermediário na fabricação de produtos químicos e especiais. Essas iniciativas foram implementadas para apoiar os compromissos de sustentabilidade e reduzir a dependência de insumos petroquímicos, contribuindo para uma menor pegada de carbono e maior eficiência dos processos.

- Embora a demanda por etanol industrial continue a crescer, o crescimento sustentado do mercado depende da disponibilidade estável de matéria-prima, de tecnologias de produção eficientes e da manutenção da competitividade de custos em relação às alternativas petroquímicas convencionais. Os produtores estão focando na escalabilidade, na integração da cadeia de suprimentos e na inovação de processos para apoiar a expansão do mercado a longo prazo.

Dinâmica do mercado de etanol industrial na região Ásia-Pacífico

Motorista

“Crescente adoção de produtos químicos industriais de base biológica e renováveis”

- A crescente demanda por insumos industriais renováveis e ecologicamente corretos é um dos principais impulsionadores do mercado de etanol industrial na região Ásia-Pacífico. Fabricantes dos setores químico, farmacêutico e de cuidados pessoais estão utilizando cada vez mais o etanol como solvente e intermediário de base biológica para atender às regulamentações de sustentabilidade e às metas corporativas de descarbonização.

- A expansão das aplicações em produtos farmacêuticos, desinfetantes, revestimentos, tintas e produtos químicos industriais está impulsionando o crescimento do mercado. O etanol industrial oferece alta pureza, solvência eficaz e compatibilidade com diversas formulações, tornando-se a escolha preferencial para múltiplos processos industriais. A crescente ênfase em higiene e sanitização reforça ainda mais a demanda.

- Os fabricantes químicos e industriais estão promovendo ativamente formulações à base de etanol por meio da inovação de produtos, otimização de processos e relatórios de sustentabilidade. Esses esforços são apoiados por regulamentações ambientais mais rigorosas e pela crescente preferência dos clientes por materiais renováveis e de baixo carbono, incentivando parcerias entre produtores de etanol e indústrias de uso final.

- Por exemplo, em 2023, a Bayer na Alemanha relatou um aumento no consumo de etanol industrial em processos de fabricação e formulação farmacêutica. Essa mudança foi impulsionada pela demanda por solventes de alta pureza e em conformidade com as normas, além do alinhamento com iniciativas de sustentabilidade, aprimorando a eficiência operacional e a conformidade regulatória.

- Apesar dos fortes fatores que impulsionam a demanda, o crescimento a longo prazo depende da gestão dos custos da matéria-prima, da eficiência da produção e de cadeias de suprimentos confiáveis. O investimento em tecnologias avançadas de fermentação, matérias-primas derivadas de resíduos e otimização logística será fundamental para manter a competitividade.

Restrição/Desafio

“Volatilidade dos preços das matérias-primas e restrições regulatórias”

- A flutuação dos preços e a disponibilidade de matérias-primas agrícolas, como milho, cana-de-açúcar e grãos, continuam sendo um desafio crucial para o mercado de etanol industrial na região Ásia-Pacífico. A variabilidade na produtividade agrícola, as condições climáticas e a demanda concorrente por etanol combustível podem impactar os custos de produção e a estabilidade dos preços do etanol de grau industrial.

- As complexidades regulatórias relacionadas ao manuseio, tributação e conformidade do álcool criam desafios operacionais, principalmente para o comércio internacional e a distribuição industrial. Requisitos rigorosos de licenciamento e regulamentações variáveis entre os mercados podem limitar a flexibilidade e aumentar a carga administrativa para fabricantes e distribuidores.

- Os desafios relacionados à cadeia de suprimentos e ao armazenamento também afetam o crescimento do mercado, uma vez que o etanol industrial exige manuseio controlado, infraestrutura de armazenamento especializada e o cumprimento de normas de segurança. Esses requisitos aumentam os custos operacionais e podem limitar a adoção por parte de usuários industriais de menor porte.

- Por exemplo, em 2024, distribuidores de produtos químicos na região Ásia-Pacífico, que fornecem para fabricantes de revestimentos e produtos farmacêuticos, relataram pressão sobre as margens devido ao aumento dos custos de matérias-primas agrícolas, preços mais altos da energia e requisitos de conformidade regulatória mais rigorosos. Esses fatores influenciaram as estratégias de precificação, aumentaram as despesas operacionais e levaram ao adiamento das decisões de compra entre os usuários finais industriais.

- Para enfrentar esses desafios, será necessária a diversificação das fontes de matéria-prima, o aumento da eficiência da cadeia de suprimentos e a harmonização das regulamentações. O investimento na produção de etanol de segunda geração e a partir de resíduos, juntamente com uma colaboração mais forte entre produtores, órgãos reguladores e usuários finais, será essencial para desbloquear o potencial de crescimento a longo prazo do mercado global de etanol industrial na região Ásia-Pacífico.

Escopo do mercado de etanol industrial na região Ásia-Pacífico

O mercado está segmentado com base na matéria-prima, no tipo e na aplicação.

• Por matéria-prima

Com base na matéria-prima, o mercado de etanol industrial da Ásia-Pacífico é segmentado em etanol de base biológica e etanol sintético. O segmento de base biológica detinha a maior participação na receita de mercado em 2025, impulsionado pela crescente demanda por matérias-primas renováveis e sustentáveis, incentivos governamentais para produtos químicos verdes e crescente adoção nas indústrias farmacêutica, de cuidados pessoais e química. O etanol de base biológica é preferido por sua menor pegada de carbono e conformidade com as regulamentações ambientais, tornando-se uma escolha popular entre os fabricantes industriais.

O segmento de etanol sintético deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado por um fornecimento consistente, custos de produção mais baixos e adequação a processos químicos e industriais de grande escala. O etanol sintético é particularmente vantajoso em aplicações de alto volume e com foco na relação custo-benefício.

• Por tipo

Com base no tipo, o mercado de etanol industrial da Ásia-Pacífico é segmentado em etanol absoluto, etanol 95%, etanol desnaturado e outros. O segmento de etanol absoluto dominou em 2025 devido à sua alta pureza e ampla utilização em aplicações farmacêuticas, laboratoriais e de química especializada. O etanol absoluto oferece qualidade e desempenho consistentes, tornando-o essencial para processos industriais regulamentados.

Espera-se que o segmento de etanol desnaturado apresente a taxa de crescimento mais rápida de 2026 a 2033, impulsionado por sua ampla aplicação em tintas, revestimentos, soluções de limpeza e produtos domésticos, onde se exige etanol com boa relação custo-benefício, sem a necessidade de alta pureza.

• Mediante inscrição

Com base na aplicação, o mercado de etanol industrial na região Ásia-Pacífico é segmentado em tintas e revestimentos, produtos farmacêuticos, alimentos e bebidas, tintas de impressão, produtos agrícolas, soluções de limpeza doméstica e industrial, cosméticos e cuidados pessoais, adesivos e outros. O segmento farmacêutico detinha a maior participação na receita em 2025, devido à crescente demanda por etanol como solvente, desinfetante e intermediário em formulações de medicamentos.

Espera-se que o segmento de tintas e revestimentos apresente o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente industrialização, pelo aumento das atividades de construção e pela expansão da demanda por formulações de revestimento ecológicas e de base biológica em toda a região da Ásia-Pacífico.

Análise Regional do Mercado de Etanol Industrial na Ásia-Pacífico

- A China dominou o mercado de etanol industrial na região Ásia-Pacífico, com a maior participação na receita em 2025, devido ao alto consumo industrial nos setores farmacêutico, químico, de revestimentos e de produtos de higiene pessoal.

- Os consumidores industriais na China priorizam o etanol devido à sua pureza, custo-benefício e versatilidade de múltiplas aplicações, o que permite sua ampla adoção em processos de fabricação química e industrial.

- A forte capacidade de produção, as políticas governamentais favoráveis aos produtos químicos de base biológica e a crescente demanda por etanol como matéria-prima renovável impulsionam ainda mais a dominância do mercado.

Análise do Mercado de Etanol Industrial no Japão e na Região Ásia-Pacífico

O mercado de etanol industrial do Japão na região Ásia-Pacífico deverá apresentar o crescimento mais rápido entre 2026 e 2033, impulsionado pela crescente adoção de etanol sustentável e de base biológica nos setores farmacêutico, cosmético e de especialidades químicas. O foco crescente em processos de produção mais limpos, conformidade regulatória e avanços tecnológicos na fabricação de etanol estão impulsionando a expansão do mercado. Usuários industriais estão utilizando cada vez mais o etanol para aplicações de alta pureza e formulações ecologicamente corretas, o que sustenta o crescimento a longo prazo no país.

Participação de mercado do etanol industrial na região Ásia-Pacífico

O setor de etanol industrial na região Ásia-Pacífico é liderado principalmente por empresas consolidadas, incluindo:

- Corporação Nacional de Cereais, Óleos e Produtos Alimentícios da China – COFCO (China)

- Anhui BBCA Bioquímica (China)

- Grupo Shandong Xiwang (China)

- Grupo Thai Union (Tailândia)

- Biorrefinarias de Godavari (Índia)

- Jubilant Life Sciences (Índia)

- Mitsui Chemicals (Japão)

- Kuraray Co., Ltd. (Japão)

- Showa Denko (Japão)

- Lotte Chemical (Coreia do Sul)

- Wilmar International (Singapura)

- BPCL Biocombustíveis (Índia)

- Bioenergia Devco (China)

- Grupo de Destilaria de Vinho Shanxi Xinghuacun Fen (China)

- Green Biologics (Japão)

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.