Asia Pacific Immunoassay Reagents And Devices Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

8.24 Billion

USD

12.84 Billion

2025

2033

USD

8.24 Billion

USD

12.84 Billion

2025

2033

| 2026 –2033 | |

| USD 8.24 Billion | |

| USD 12.84 Billion | |

|

|

|

|

Segmentação do mercado de reagentes e dispositivos para imunoensaios na região Ásia-Pacífico, por produto (reagentes e kits e analisadores), plataforma (imunoensaios de quimioluminescência, imunoensaios de fluorescência, imunoensaios enzimáticos, radioimunoensaios e outros), técnica (ensaios imunoenzimáticos, testes rápidos, imunoensaios enzimáticos de ponto único, Western blotting, imuno-PCR e outras técnicas), tipo de amostra (sangue, urina, saliva e outras), aplicação (doenças infecciosas, oncologia e endocrinologia, distúrbios ósseos e minerais, cardiologia, hematologia e triagem sanguínea, doenças autoimunes, toxicologia, triagem neonatal e outras aplicações), usuário final (hospitais, laboratórios clínicos, empresas farmacêuticas e de biotecnologia, bancos de sangue, laboratórios de pesquisa e acadêmicos e outros) - Tendências e previsões do setor até 2033.

Tamanho do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

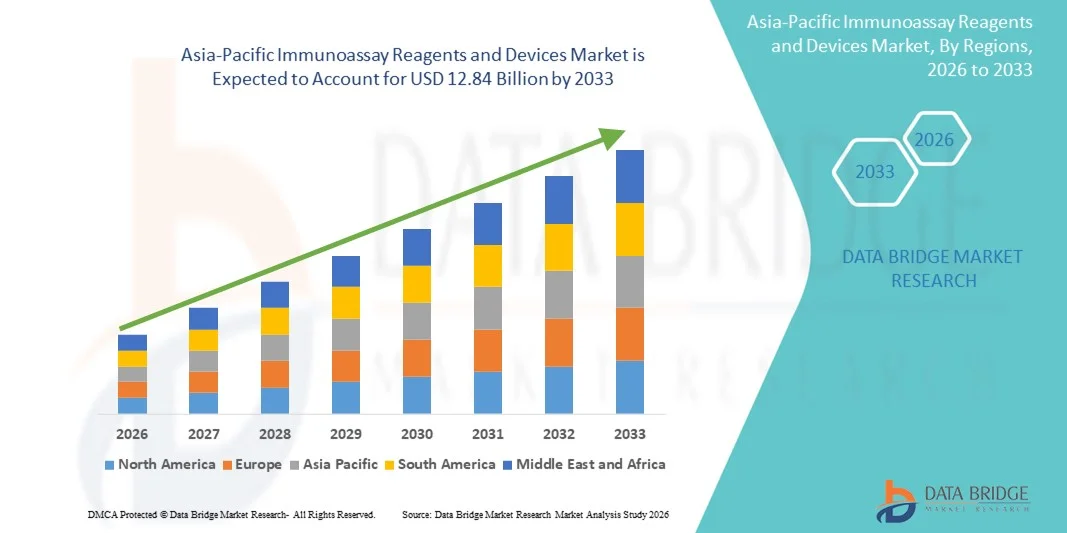

- O mercado de reagentes e dispositivos para imunoensaios na região Ásia-Pacífico foi avaliado em US$ 8,24 bilhões em 2025 e deverá atingir US$ 12,84 bilhões em 2033 , com uma taxa de crescimento anual composta (CAGR) de 5,7% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente prevalência de doenças infecciosas e crônicas, pelo aumento da demanda por tecnologias de diagnóstico avançadas e pelas contínuas inovações em reagentes, kits e plataformas de imunoensaio que auxiliam na tomada de decisões clínicas oportunas e precisas.

- Além disso, a expansão da infraestrutura de saúde, a maior adoção de diagnósticos baseados em imunoensaios em hospitais e laboratórios clínicos, e o crescente foco na detecção precoce de doenças e em soluções de saúde personalizadas estão impulsionando uma forte adoção de reagentes e dispositivos de imunoensaio em países-chave da região Ásia-Pacífico, como China, Índia, Japão e Sudeste Asiático, consolidando os sistemas de imunoensaio como ferramentas essenciais nos fluxos de trabalho de diagnóstico regionais.

Análise do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

- Os reagentes e dispositivos de imunoensaio, que permitem a detecção e quantificação precisas de biomoléculas em amostras clínicas, são componentes cada vez mais vitais dos fluxos de trabalho de diagnóstico modernos em hospitais, laboratórios e ambientes de pesquisa, devido à sua alta sensibilidade, rapidez na obtenção de resultados e compatibilidade com plataformas automatizadas.

- A crescente demanda por produtos de imunoensaio é impulsionada principalmente pela prevalência cada vez maior de doenças infecciosas e crônicas, pelo foco crescente no diagnóstico precoce e pela adoção cada vez maior de tecnologias diagnósticas avançadas em instituições de saúde.

- A China dominou o mercado de imunoensaios na região Ásia-Pacífico, com a maior participação de receita, de 24,8% em 2025, caracterizada por uma infraestrutura de saúde bem estabelecida, alta adoção de automação laboratorial e forte presença de importantes players do setor.

- Prevê-se que a Índia seja o país de crescimento mais rápido no mercado de imunoensaios da região Ásia-Pacífico durante o período de previsão, devido à expansão da infraestrutura de saúde, ao aumento das iniciativas governamentais para a detecção de doenças e ao aumento da renda disponível.

- O segmento de imunoensaios por quimioluminescência dominou o mercado de imunoensaios na região Ásia-Pacífico, com uma participação de 40,9% em 2025, impulsionado por sua alta sensibilidade, ampla faixa dinâmica e integração perfeita com sistemas automatizados de laboratório.

Escopo do relatório e segmentação do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

|

Atributos |

Principais informações sobre o mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais players, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

Integração de plataformas multiplexadas e automatizadas

- Uma tendência significativa e crescente no mercado de imunoensaios da região Ásia-Pacífico é a adoção cada vez maior de plataformas de imunoensaios multiplex e sistemas automatizados, que permitem a detecção simultânea de múltiplos biomarcadores e reduzem erros de manipulação manual em laboratórios clínicos.

- Por exemplo, a tecnologia Luminex xMAP integra imunoensaios multiplex com processamento automatizado de amostras, permitindo testes de alto rendimento para hospitais e centros de pesquisa.

- A automação e a multiplexação melhoram a eficiência do fluxo de trabalho, reduzem os tempos de resposta e minimizam os erros humanos, aumentando assim a produtividade do laboratório e a confiabilidade dos resultados.

- A integração perfeita de plataformas de imunoensaio com sistemas de gerenciamento de informações laboratoriais (LIMS) permite o monitoramento centralizado do processamento de amostras, controle de qualidade e geração de relatórios de dados, otimizando as operações laboratoriais.

- A tendência de diagnósticos baseados em nuvem está emergindo, permitindo monitoramento remoto, análise de dados em tempo real e integração com redes hospitalares para decisões clínicas mais rápidas.

- O crescente foco na medicina personalizada está impulsionando a demanda por imunoensaios capazes de detectar múltiplos biomarcadores específicos de doenças simultaneamente, possibilitando planos de tratamento individualizados.

- Essa tendência em direção a soluções de diagnóstico mais automatizadas, de alto rendimento e integradas está remodelando as expectativas em laboratórios clínicos, impulsionando empresas como a Abbott e a Siemens Healthineers a desenvolver plataformas que combinam testes multiplex com laudos digitais.

- A demanda por sistemas de imunoensaio que oferecem automação de alto rendimento e capacidade multiplex está crescendo rapidamente em hospitais, centros de diagnóstico e institutos de pesquisa, à medida que a eficiência e a precisão nos testes se tornam prioridades críticas.

Dinâmica do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

Motorista

Aumento da prevalência de doenças crônicas e infecciosas

- O aumento da incidência de doenças crônicas como diabetes, câncer e doenças infecciosas, incluindo hepatite e COVID-19, é um fator significativo para a crescente adoção de reagentes e dispositivos de imunoensaio.

- Por exemplo, em março de 2025, a Roche Diagnostics lançou novos kits de imunoensaio automatizados para triagem de COVID-19 e influenza na Índia e na China, impulsionando o crescimento do mercado em ambientes clínicos de alta demanda.

- À medida que os profissionais de saúde priorizam a detecção precoce e o monitoramento de doenças, as plataformas de imunoensaio oferecem alta sensibilidade e especificidade para decisões clínicas oportunas e precisas.

- Além disso, as iniciativas governamentais de saúde que promovem diagnósticos preventivos e programas de rastreio precoce estão aumentando a demanda por soluções de testes de imunoensaio em hospitais e laboratórios.

- A expansão de redes privadas de diagnóstico e laboratórios na região Ásia-Pacífico está impulsionando a demanda por sistemas de imunoensaio confiáveis e de alto rendimento.

- O aumento do investimento em pesquisa e desenvolvimento por parte de empresas regionais e globais para novos reagentes de imunoensaio e dispositivos portáteis está impulsionando o crescimento do mercado.

- A conveniência dos testes de alto rendimento, a redução dos tempos de resposta e a integração com a infraestrutura laboratorial existente são fatores-chave que impulsionam a adoção de imunoensaios na região da Ásia-Pacífico.

Restrição/Desafio

Custos elevados e barreiras ao cumprimento das normas regulamentares

- As preocupações em torno do alto custo dos sistemas e reagentes de imunoensaio avançados representam um desafio significativo para uma adoção mais ampla, particularmente em países em desenvolvimento com orçamentos de saúde limitados.

- Por exemplo, laboratórios menores no Sudeste Asiático podem ter dificuldades para investir em plataformas CLIA ou multiplex, apesar de suas vantagens, limitando a penetração no mercado em regiões sensíveis a preços.

- Atender aos rigorosos requisitos regulatórios para dispositivos de diagnóstico e obter aprovações em vários países aumenta o tempo de lançamento no mercado e a complexidade operacional para os fabricantes.

- Além disso, a necessidade de pessoal qualificado para operar plataformas de imunoensaio sofisticadas e realizar a manutenção dos equipamentos representa um desafio para centros de diagnóstico de menor porte.

- O conhecimento limitado sobre os benefícios das tecnologias avançadas de imunoensaio entre clínicas menores e prestadores de cuidados de saúde em áreas rurais pode retardar as taxas de adoção.

- Restrições na cadeia de suprimentos de reagentes e consumíveis especializados em alguns países da região Ásia-Pacífico podem dificultar a implementação oportuna de dispositivos de imunoensaio.

- Embora os preços dos kits básicos de imunoensaio estejam diminuindo gradualmente, os sistemas automatizados e multiplex avançados continuam caros, restringindo o acesso em regiões de baixa renda.

- Superar esses desafios por meio de soluções economicamente viáveis, apoio regulatório e iniciativas de treinamento será crucial para o crescimento sustentado do mercado em toda a região da Ásia-Pacífico.

Escopo do mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

O mercado é segmentado com base em produto, plataforma, técnica, tipo de amostra, aplicação e usuário final.

- Por produto

Com base no produto, o mercado é segmentado em reagentes e kits e analisadores. O segmento de reagentes e kits dominou o mercado em 2025, impulsionado pela demanda recorrente por reagentes e kits de ensaio de alta qualidade em hospitais, laboratórios clínicos e institutos de pesquisa. Reagentes e kits são essenciais para todas as plataformas e técnicas de imunoensaio, garantindo resultados confiáveis e reproduzíveis. Essa dominância é sustentada por inovações contínuas, como kits multiplex e de alta sensibilidade para a detecção de diversas doenças. Hospitais preferem kits padronizados para conformidade regulatória e resultados diagnósticos consistentes. Além disso, a alta prevalência de doenças infecciosas e condições crônicas na região Ásia-Pacífico impulsiona o consumo contínuo. Os principais players do mercado focam na expansão de seus portfólios de reagentes, reforçando ainda mais a participação de mercado desse segmento.

O segmento de analisadores deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pela crescente adoção de sistemas automatizados de imunoensaio em laboratórios de diagnóstico. Os analisadores reduzem erros humanos, aumentam a produtividade e permitem a análise simultânea de múltiplas amostras. Hospitais urbanos e redes privadas de diagnóstico estão investindo fortemente em sistemas de alto rendimento para melhorar a eficiência. Países emergentes como Índia, Indonésia e Vietnã estão adotando plataformas automatizadas para reduzir o tempo de resposta e aumentar a precisão. Além disso, os fabricantes estão lançando analisadores compactos e acessíveis para laboratórios menores. A crescente tendência de integração de analisadores com sistemas digitais de gerenciamento de dados acelera ainda mais a adoção.

- Por plataforma

Com base na plataforma, o mercado é segmentado em imunoensaios de quimioluminescência (CLIA), imunoensaios de fluorescência (FIA), imunoensaios enzimáticos (EIA), radioimunoensaios (RIA) e outros. O segmento de imunoensaios de quimioluminescência (CLIA) dominou o mercado em 2025, com uma participação de 40,9%, devido à alta sensibilidade, ampla faixa dinâmica e compatibilidade com sistemas automatizados. As plataformas CLIA são amplamente utilizadas em hospitais e laboratórios de pesquisa para testes oncológicos, de doenças infecciosas e hormonais. Sua capacidade de processar grandes volumes de amostras e fornecer resultados rápidos as torna altamente preferidas. A forte presença de empresas globais como Abbott e Roche reforça essa dominância. Hospitais e laboratórios clínicos dependem das plataformas CLIA para testes em conformidade com as normas regulatórias. O segmento se beneficia da pesquisa e desenvolvimento contínuos e da adoção de sistemas CLIA multiplex.

Espera-se que o segmento de FIA apresente o crescimento mais rápido durante o período de previsão, impulsionado por sua adequação para diagnósticos no ponto de atendimento e aplicações de pesquisa especializadas. A FIA oferece alta especificidade, capacidade de multiplexação e compatibilidade com plataformas miniaturizadas. O crescente investimento em pesquisa biotecnológica e a demanda por diagnósticos portáteis na região Ásia-Pacífico estão acelerando a adoção dessa tecnologia. Países como China, Índia e Japão estão investindo em plataformas baseadas em FIA. A adaptabilidade da FIA para triagem rápida de doenças aumenta seu apelo de mercado. A crescente conscientização sobre testes multiplexados impulsiona o crescimento em laboratórios clínicos e de pesquisa.

- Por técnica

Com base na técnica, o mercado é segmentado em ELISA, testes rápidos, ELISPOT, Western blotting, imuno-PCR e outras técnicas. O segmento de ELISA dominou o mercado em 2025 devido ao seu uso generalizado em diagnósticos clínicos de rotina, alta reprodutibilidade e custo-benefício. O ELISA é o método preferido para triagem de doenças infecciosas, testes hormonais e aplicações de pesquisa. Protocolos padronizados e aprovações regulatórias o tornam popular em hospitais e laboratórios. É compatível com múltiplos tipos de amostras e plataformas. O alto rendimento dos testes ELISA contribui para a eficiência em laboratórios com grande volume de trabalho. Fabricantes globais e regionais continuam a expandir sua oferta de ELISA para diversas aplicações.

O segmento de testes rápidos deverá apresentar o crescimento mais acelerado durante o período de previsão, impulsionado pela crescente demanda por diagnósticos no local de atendimento e testes domiciliares. Os testes rápidos fornecem resultados rápidos com preparação mínima da amostra. São adequados para triagem urgente de doenças infecciosas em áreas rurais ou com recursos limitados. Os formatos portáteis os tornam convenientes para clínicas e testes de campo. A conscientização sobre a detecção rápida de doenças está crescendo em países emergentes da região Ásia-Pacífico. Os fabricantes estão inovando com kits de teste rápido de alta sensibilidade, impulsionando a adoção em hospitais e centros de diagnóstico.

- Por tipo de espécime

Com base no tipo de amostra, o mercado é segmentado em sangue, urina, saliva e outros. O segmento de sangue dominou em 2025, representando a maior participação na receita, devido à sua ampla aplicabilidade na detecção de doenças infecciosas, biomarcadores oncológicos, distúrbios endócrinos e doenças autoimunes. Amostras de sangue são padrão em hospitais e laboratórios e são compatíveis com a maioria das plataformas de imunoensaio. Diretrizes clínicas estabelecidas e alta confiabilidade reforçam ainda mais essa dominância. Os testes baseados em sangue permitem triagem em larga escala e conformidade regulatória. Fabricantes de reagentes e analisadores priorizam kits baseados em sangue. Hospitais preferem amostras de sangue por sua reprodutibilidade e comprovada utilidade clínica.

Espera-se que o segmento de saliva apresente o crescimento mais rápido durante o período de previsão, impulsionado pela adoção de testes não invasivos e diagnósticos no local de atendimento. Os imunoensaios baseados em saliva reduzem o risco de infecção e oferecem conveniência para pacientes pediátricos e geriátricos. Aplicações emergentes incluem a detecção de biomarcadores orais para doenças sistêmicas. Países como Índia, China e Japão estão adotando cada vez mais testes baseados em saliva. A crescente conscientização e pesquisa em diagnósticos salivares apoiam a expansão do mercado. Os fabricantes estão desenvolvendo imunoensaios portáteis e sensíveis baseados em saliva, aumentando a adoção em clínicas e laboratórios.

- Por meio de aplicação

Com base na aplicação, o mercado é segmentado em doenças infecciosas, oncologia e endocrinologia, distúrbios ósseos e minerais, cardiologia, hematologia e triagem sanguínea, doenças autoimunes, toxicologia, triagem neonatal e outras. O segmento de doenças infecciosas dominou o mercado em 2025 devido à alta prevalência de infecções virais e bacterianas e às iniciativas governamentais de triagem em larga escala. Hospitais e laboratórios dependem de plataformas de imunoensaio para testes rápidos e precisos de doenças infecciosas. Programas de saúde pública na China, Índia e Sudeste Asiático reforçam a demanda. O alto volume de pacientes e a frequência de triagem contribuem para a dominância do segmento. O lançamento contínuo de novos ensaios para doenças infecciosas fortalece a presença no mercado. Fabricantes globais fornecem ativamente reagentes e kits para testes de doenças infecciosas.

O segmento de oncologia e endocrinologia deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pelo aumento da incidência de câncer, pela crescente detecção de distúrbios hormonais e pela maior conscientização sobre diagnósticos preventivos. Hospitais e laboratórios especializados adotam soluções de imunoensaio para a detecção precoce de doenças e o tratamento personalizado. A expansão da infraestrutura de saúde em países emergentes da região Ásia-Pacífico acelera essa adoção. Iniciativas de pesquisa para a descoberta de biomarcadores também impulsionam a demanda. Plataformas multiplex para testes em oncologia e endocrinologia aumentam a eficiência. O aumento dos investimentos de empresas locais e globais nessas áreas terapêuticas sustenta o crescimento do segmento.

- Por usuário final

Com base no usuário final, o mercado é segmentado em hospitais, laboratórios clínicos, empresas farmacêuticas e de biotecnologia, bancos de sangue, laboratórios de pesquisa e acadêmicos, e outros. O segmento de hospitais dominou em 2025 devido ao grande volume de pacientes, diagnósticos de rotina contínuos e infraestrutura laboratorial consolidada. Os hospitais dependem de sistemas de imunoensaio para doenças infecciosas, oncologia, cardiologia e testes endócrinos. O alto rendimento e a integração com analisadores automatizados contribuem para a eficiência. A preferência dos hospitais por kits padronizados reforça a dominância do segmento. A conformidade regulatória e a precisão são cruciais em ambientes hospitalares. Fornecedores globais e regionais focam em soluções hospitalares para manter sua participação de mercado.

O segmento de laboratórios de pesquisa e acadêmicos deverá apresentar o crescimento mais rápido durante o período de previsão, impulsionado pelo aumento da pesquisa em biotecnologia, financiamento governamental e adoção de técnicas avançadas de imunoensaio para a descoberta de biomarcadores. A expansão das iniciativas de pesquisa na China, Índia e Coreia do Sul está criando uma forte demanda. Os laboratórios necessitam de plataformas de alta sensibilidade para ensaios experimentais. Sistemas multiplex e automatizados são cada vez mais utilizados em pesquisas acadêmicas. O investimento em treinamento e instrumentação avançada impulsiona ainda mais a adoção dessas técnicas. As colaborações em P&D farmacêutica aumentam a demanda por imunoensaios nesse segmento.

Análise Regional do Mercado de Reagentes e Dispositivos para Imunoensaios na Ásia-Pacífico

- A China dominou o mercado de imunoensaios na região Ásia-Pacífico, com a maior participação de receita, de 24,8% em 2025, caracterizada por uma infraestrutura de saúde bem estabelecida, alta adoção de automação laboratorial e forte presença de importantes players do setor.

- Os profissionais de saúde da região priorizam plataformas de imunoensaio rápidas, confiáveis e de alto rendimento para a detecção de doenças infecciosas, biomarcadores oncológicos e distúrbios endócrinos.

- Essa ampla adoção é ainda mais reforçada por iniciativas governamentais para o rastreio precoce de doenças, pela crescente prevalência de doenças crônicas e infecciosas e pela forte presença de fabricantes de imunoensaios globais e nacionais, consolidando os sistemas de imunoensaio como uma ferramenta essencial em hospitais, laboratórios clínicos e centros de pesquisa.

Análise do Mercado de Imunoensaios na China

O mercado chinês de reagentes e dispositivos para imunoensaios detinha a maior participação de mercado em receita, com 24,8% em 2025, impulsionado pela grande população de pacientes do país, pela expansão da infraestrutura hospitalar e de laboratórios clínicos e pelo aumento das iniciativas governamentais para a detecção precoce de doenças. Os profissionais de saúde estão priorizando cada vez mais plataformas avançadas de imunoensaios para triagem de doenças infecciosas, oncologia e diagnóstico endócrino. A forte presença de fabricantes de imunoensaios globais e nacionais, juntamente com os avanços tecnológicos em sistemas automatizados e de alto rendimento, impulsiona ainda mais a expansão do mercado. Além disso, a crescente conscientização sobre saúde preventiva e o lançamento contínuo de reagentes e kits inovadores estão impulsionando a adoção em hospitais e institutos de pesquisa.

Análise do Mercado de Imunoensaios no Japão

O mercado de imunoensaios no Japão está ganhando impulso devido à infraestrutura de saúde avançada do país, ao grande foco em medicina preventiva e à crescente demanda por automação em testes diagnósticos. Hospitais e laboratórios japoneses priorizam a alta sensibilidade e precisão das plataformas de imunoensaio para oncologia, doenças infecciosas e testes hormonais. A integração de analisadores automatizados e a geração de relatórios de dados digitais aumentam a eficiência e a confiabilidade do fluxo de trabalho. Além disso, o envelhecimento da população e a crescente prevalência de doenças crônicas estão impulsionando o crescimento dos sistemas de imunoensaio. A pesquisa e o desenvolvimento contínuos por parte dos fabricantes e a adoção de ensaios multiplex e de quimioluminescência estão fomentando a expansão do mercado em ambientes de diagnóstico tanto residenciais quanto comerciais.

Análise do Mercado de Imunoensaios na Índia

O mercado de reagentes e dispositivos para imunoensaios na Índia representou a maior fatia de receita na região Ásia-Pacífico em 2025, impulsionado pela rápida urbanização, crescente conscientização sobre saúde e adoção cada vez maior de tecnologias de diagnóstico avançadas. Hospitais, laboratórios clínicos e redes de diagnóstico estão investindo cada vez mais em plataformas de imunoensaios de alto rendimento para triagem de doenças infecciosas, oncologia e distúrbios endócrinos. O incentivo à infraestrutura de saúde inteligente, a expansão de redes privadas de diagnóstico e a disponibilidade de reagentes e kits com boa relação custo-benefício são fatores-chave que impulsionam o mercado. Além disso, o aumento das iniciativas governamentais para saúde preventiva e o incremento do financiamento para pesquisa e desenvolvimento sustentam o crescimento do mercado.

Análise do Mercado de Imunoensaios na Coreia do Sul

O mercado de imunoensaios na Coreia do Sul está em constante expansão, impulsionado pelos altos gastos com saúde, instalações laboratoriais tecnologicamente avançadas e forte apoio governamental a programas de detecção precoce de doenças. Hospitais e laboratórios clínicos estão adotando sistemas de imunoensaio automatizados e de alto rendimento para testes de doenças infecciosas, oncologia e análise hormonal. O crescente foco em medicina personalizada e descoberta de biomarcadores está incentivando a adoção de plataformas de imunoensaio multiplex e de alta sensibilidade. Além disso, a presença de fabricantes globais líderes e a inovação contínua em reagentes e kits impulsionam ainda mais o crescimento do mercado. A ênfase da Coreia do Sul em diagnósticos eficientes e precisos posiciona os sistemas de imunoensaio como uma ferramenta essencial em ambientes de saúde e pesquisa.

Participação de mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico

O setor de reagentes e dispositivos para imunoensaios na região Ásia-Pacífico é liderado principalmente por empresas consolidadas, incluindo:

- Abbott (EUA)

- Bio Rad Laboratories, Inc. (EUA)

- Beckman Coulter, Inc. (EUA)

- Fapon Biotech Inc. (China)

- Autobio Diagnostics Co., Ltd. (China)

- Corporação Sysmex (Japão)

- Fujirebio (Japão)

- Siemens Healthineers AG (Alemanha)

- Thermo Fisher Scientific Inc. (EUA)

- BIOMÉRIEUX (França)

- Danaher (EUA)

- Qiagen (Países Baixos)

- Corporação Quidel (EUA)

- BD (EUA)

- PerkinElmer (EUA)

- Luminex Corporation (EUA)

- Bio Techne Corporation (EUA)

- Randox Laboratories Ltd. (Reino Unido)

- Diagnóstico Snibe (China)

- Shenzhen Mindray Bio Medical Electronics Co., Ltd. (China)

Quais são os desenvolvimentos recentes no mercado de reagentes e dispositivos de imunoensaio na região Ásia-Pacífico?

- Em agosto de 2025, empresas farmacêuticas e de diagnóstico chinesas passaram a utilizar significativamente fornecedores nacionais de reagentes para imunoensaios, como a Shanghai Titan Scientific e a Nanjing Vazyme Biotech, visando reduzir custos e prazos de entrega em meio aos desafios de fornecimento relacionados a tarifas. Essa mudança sinaliza uma tendência de localização no fornecimento de reagentes, fortalecendo as cadeias de suprimentos de imunoensaios na região da Ásia-Pacífico.

- Em julho de 2025, a Fapon anunciou planos para lançar seu analisador de química clínica e imunoensaio de acesso aberto Shine mT8000 na conferência ADLM 2025, um sistema versátil de alto rendimento que integra testes de bioquímica e imunoensaio e visa modernizar os fluxos de trabalho laboratoriais em toda a região.

- Em janeiro de 2024, a Fujirebio Holdings e a Agappe Diagnostics firmaram uma colaboração estratégica para desenvolver e fabricar reagentes e analisadores de imunoensaio CLIA baseados em cartuchos, permitindo à Agappe oferecer uma solução completa de quimioluminescência com reagentes produzidos localmente e expandir as capacidades de imunoensaio na Índia.

- Em novembro de 2023, a Fapon apresentou suas soluções expandidas de imunoensaio e diagnóstico, incluindo o sistema totalmente automatizado Shine i8000/9000 CLIA, no evento MEDICA 2023, reforçando sua presença e oferta de produtos para testes de imunoensaio na região da Ásia-Pacífico e em outras regiões.

- Em julho de 2023, a Fapon lançou seu mais recente analisador de imunoensaio quimioluminescente de alto rendimento, o Shine i8000/9000, que oferece até 900 testes por hora para atender à crescente demanda por diagnósticos em laboratórios clínicos em toda a região da Ásia-Pacífico, marcando uma expansão significativa de produtos para diagnósticos por imunoensaio.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.