Asia-Pacific Heat Shrink Tubing Market, By Type (Single Wall and Dual Wall), Product Type (Spools, Pre-Cut Length, and Others), Voltage (Low, Medium, and High), Shrink Ratio (2:01, 3:01, 4:01, 6:01, and Others), Material (Polyolefin, Perfluoroalkoxy Alkanes (PFA), Polytetrafluoroethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyetheretherketone (PEEK) and Others), End User (Utilities, IT and Telecommunication, Automotive, Electronics, Aerospace, Healthcare, Oil and Gas, Marine, Food and Beverages, Construction, Chemical, and Others) Industry Trends and Forecast to 2030.

Asia-Pacific Heat Shrink Tubing Market Analysis and Size

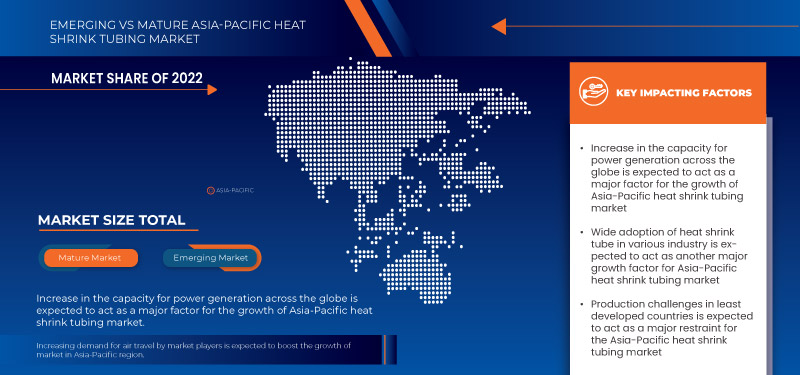

The increase in the capacity for power generation across the globe drives the Asia-Pacific heat shrink tubing market. However, the up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents). These materials are currently available but are not widely used because it is difficult to take lines out of service to reconduct new materials. Furthermore, when weather conditions are favorable, all overhead lines can carry current higher than their nominal rating and a real-time rating that could be continuously adjusted would increase available capacity.

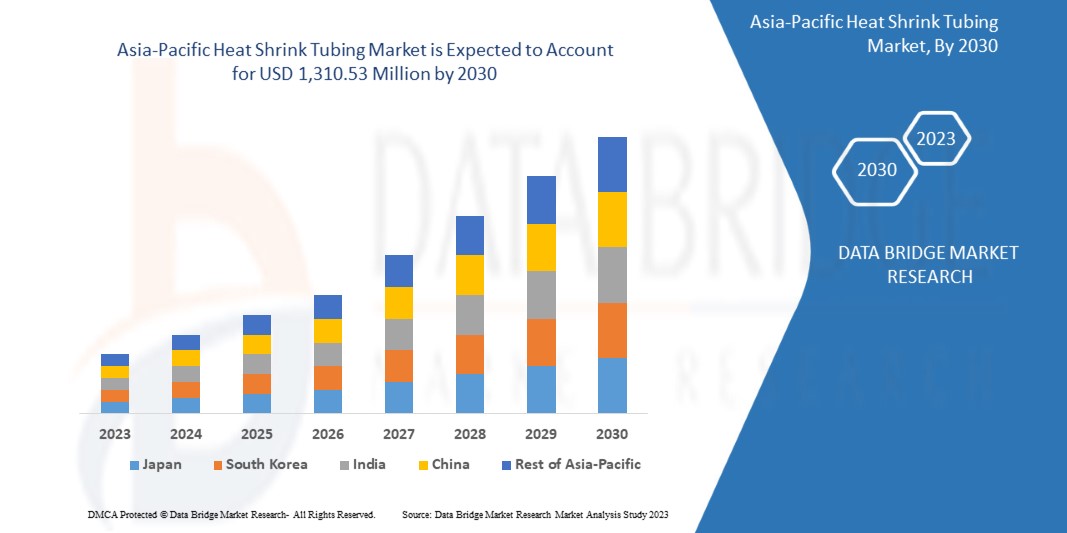

Data Bridge Market Research analyses that the Asia-Pacific heat shrink tubing market is expected to grow at a CAGR of 6.6% in the forecast period of 2023 to 2030 and is expected to reach USD 1,310.53 million by 2030. The Asia-Pacific heat shrink tubing market report also comprehensively covers pricing analysis, patent analysis, and technological advancements.

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable 2015-2020) |

|

Quantitative Units |

Revenue in USD Million |

|

Segments Covered |

Type (Single Wall and Dual Wall), Product Type (Spools, Pre-Cut Length, and Others), Voltage (Low, Medium, and High), Shrink Ratio (2:01, 3:01, 4:01, 6:01, and Others), Material (Polyolefin, Perfluoroalkoxy Alkanes (PFA), Polytetrafluoroethylene (PTFE), Ethylene Tetra Fluoro Ethylene (ETFE), Fluorinated Ethylene Propylene (FEP), Polyetheretherketone (PEEK) and Others), End User (Utilities, IT and Telecommunication, Automotive, Electronics, Aerospace, Healthcare, Oil and Gas, Marine, Food and Beverages, Construction, Chemical, and Others) |

|

Countries Covered |

China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and Rest of Asia-Pacific |

|

Market Players Covered |

ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd.(China) among others |

Market Definition

Heat shrink tubing is used to insulate wire providing abrasion resistance and environmental protection for the stranded solid wire conductors with connections, joints, and terminals in electrical work. In general, a tube with a lower shrink temperature will shrink faster. When heat shrink tubing is wrapped around wire arrays and electrical components, it collapses radially to fit the contours of the equipment, forming a protective layer.

Moreover, these tubings use various materials such as Perfluoroalkoxy alkanes (PFA), Polytetrafluoroethylene (PTFE), Fluorinated Ethylene Propylene (FEP), and others, to manufacture heat shrink tubings. The heat shrink tubings with different materials have different protection features against abrasion, low impact, cuts, moisture, and dust by covering individual wires or encasing entire arrays. In addition, material is decided based on end usage such as electronics, automotive, aerospace, and others. Plastic manufacturers begin by extruding a thermoplastic tube to create heat-shrink tubing. Heat shrink tubing materials vary depending on the intended application.

Asia-Pacific Heat Shrink Tubing Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of This Is Discussed In Detail As Below:

Drivers

- Role of Government in Supporting and Expansion of Transmission & Distribution Systems in the Heat Shrink Tubing Market Across the Region

The role of electric power transmission and distribution (T&D) plays an important link between generating stations and customers. Growing loads and stress created by the aging equipment and increasing the risk of widespread blackouts are a few of the factors which help generates the need for heat shrink tubes. Electricity delivery that is both dependable and cost-effective is critical in today's society. The U.S. transmission and distribution (T&D) is comprised of numerous economic drivers, organizational structures, technologies, and forms of regulatory oversight. Federal and municipal governments and state and customer-owned cooperatives are all part of these systems. However, about 80 percent of power transactions occur on lines owned by investor-owned regulated utilities (IOUs). These fully integrated utilities own both the generating plants and the transmission and distribution systems that deliver their customers' power. This was among the dominant model in the past but deregulation in some states has transformed the industry. Transmission, generation, and distribution may be handled by different entities in deregulated areas.

- Increase in the Capacity for Power Generation Across the Globe

A two-step process is used to create heat shrink tubing. The first step is standard extrusion followed by a secondary process that makes the tubing heat-shrinkable. Although this secondary process's specifics are kept confidential, heat and force are used to expand the tubing's diameter. While still expanded, the tubing is cooled to room temperature. If the tubing is rigid, it is going to shrink down to its original size. The up-gradation of transmission lines and substations along existing corridors is a cost-effective way to increase transmission capacity. Existing lines can be reconducted to increase transmission capacity (using materials such as composite conductors that can carry higher currents).

Opportunity

- Wide Adoption of Heat Shrink Tubes in Various Industries

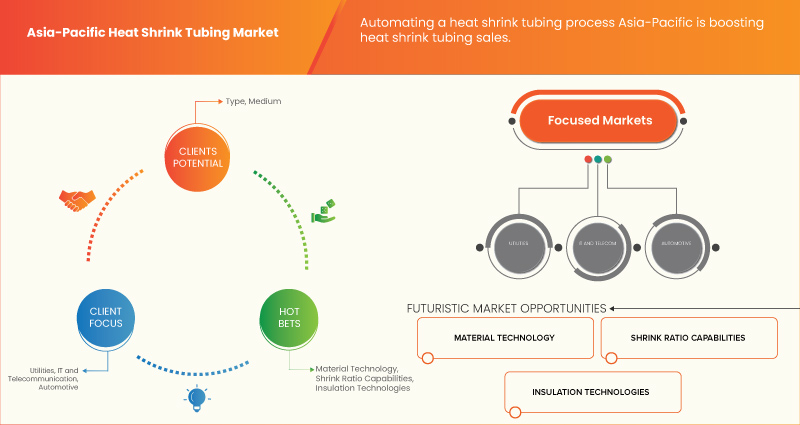

AI The heat shrink tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology with product design that provides a repeatable, reliable, and shrink-to-fit installation compatible with many manufacturing processes. These products are in service throughout the world in automotive, telecommunications, power distribution, aerospace, defense, industrial and commercial applications. The tubing application in under bonnet cable protection, hoses, brake pipes, air conditioning, diesel injection clusters, connectors, inline splice, wire bundles, ring terminals, seat belt stalks, gas springs, antennas, and others are further enhancing the application capabilities in the automobile industry. The tubing products are made from uniquely formulated materials that have been enhanced by radiation cross-linking, a technology. The easy-to-use products provide cost-effective, proven solutions in various automotive applications, from sealing and protecting electrical splices to providing mechanical protection for fluid management systems in harsh surroundings.

Restraints/Challenges

- Government Regulation On the Emission of Toxic Gases

The environmental significance of rapid industrialization has brought about uncountable air, land, and water resource sites being contaminated with toxic materials and other pollutants, threatening humans and ecosystems with serious health risks. More extensive and intensive use of materials and energy has created cumulative pressures on the quality of local, regional, and Asia-Pacific ecosystems. Before there was a concerted effort to restrict the impact of pollution, environmental management extended little beyond laissez-faire tolerance, tempered by the disposal of wastes to avoid disruptive local nuisance conceived of in a short-term perspective. The need for remediation was recognized by exception in instances where damage was determined to be unacceptable. As the pace of industrial activity intensified and the understanding of cumulative effects grew, a pollution control paradigm became the dominant method of environmental management.

- Rising Prices of Raw Materials for Tubing

The price fluctuations affect the cable, wire, and connectivity products and materials being purchased or affect the outlook on budget projections in procurement, finance, supply chain management, or product development. Thanks to rising industrial production and aggressive sustainable energy initiatives, China is the world's largest consumer of copper. Europe, the U.S., and China pursue aggressive renewable energy initiatives to sustain greener economies and copper's high thermal and electric conductivity will help them get there. The largest copper-producing countries such as Chile, Peru, China, and the United States are struggling to meet the high demand for countries to meet their green economic initiative, contributing to the price of copper skyrocketing. There is also speculation that as the U.S. dollar weakens against other Asia-Pacific currencies, there will be more opportunities for users of other currencies to increase their purchasing power with copper and other commodities.

Recent Developments

- In April 2023, TE Connectivity announced the new EV Single Wall (EVSW) tubing specifically designed for high voltage applications and safely insulating and protecting conductive components and cables. This product is a single wall tube with the prime focus of providing electrical insulation and protection for high-voltage components in electric vehicles. This will help the company to diversify its product portfolio and meets the unique challenges of EV applications.

- In February 2023, Molex released a miniaturization report, stating expert insights and innovations in product design engineering and leading-edge connectivity. Through this miniaturization, the company has increased the effectiveness of products and their safety too. This development enhanced the company’s product line and it made a positive impact on the growth of the Asia-Pacific heat shrink tubing market.

Asia-Pacific Heat Shrink Tubing Market Scope

The Asia-Pacific heat shrink tubing market Scope is segmented into six notable segments based on the type, product type, material, voltage, shrink ratio, and end user. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Single Wall

- Dual Wall

On the basis of type, the Asia-Pacific heat shrink tubing market is segmented into single wall and dual wall.

Product Type

- Spools

- Pre-Cut Lengths

- Others

On the basis of product type, the Asia-Pacific heat shrink tubing market is segmented into spools, pre-cut lengths, and others.

Voltage

- Low

- Medium

- High

On the basis of voltage, the Asia-Pacific heat shrink tubing market is segmented into low, medium, and high.

Shrink Ratio

- 2:01

- 3:01

- 4:01

- 6:01

- Others

On the basis of shrink ratio, the Asia-Pacific heat shrink tubing market is segmented into 2:01, 3:01, 4:01, 6:01, and others.

Material

- Polyolefin

- Per Fluoroalkoxy Alkane (PFA)

- Poly Tetra Fluoro Ethylene (PTFE)

- Ethylene Tetra Fluoro Ethylene (ETFE)

- Fluorinated Ethylene Propylene (FEP)

- Polyether Ether Ketone (PEEK)

- Others

On the basis of material, the Asia-Pacific heat shrink tubing market is segmented into polyolefin, per fluoroalkoxy alkane (PFA), poly tetra fluoro ethylene (PTFE), ethylene tetra fluoro ethylene (ETFE), fluorinated ethylene propylene (FEP), polyether ether ketone (PEEK), and others.

End User

- Utilities

- It And Telecommunication

- Automotive

- Electronics

- Aerospace

- Healthcare

- Oil And Gas

- Marine

- Food And Beverages

- Construction

- Chemical

- Others

On the basis of end user, the Asia-Pacific heat shrink tubing market is segmented into utilities, IT and telecommunication, automotive, electronics, aerospace, healthcare, oil and gas, marine, food and beverages, construction, chemical, and others.

Asia-Pacific Heat Shrink Tubing Market Regional Analysis/Insights

Asia-Pacific heat shrink tubing market is analysed, and market size insights and trends are provided by type, product type, voltage, shrink ratio, material, and end user as referenced above.

The countries covered in the Asia-Pacific heat shrink tubing market report are China, India, Japan, South Korea, Australia, Indonesia, Malaysia, Thailand, Singapore, Philippines, and Rest of Asia-Pacific.

China dominates in the Asia-Pacific region owing to the region's advanced software sector.

The region section of the report also provides individual market-impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like downstream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the region data.

Competitive Landscape and Asia-Pacific Heat Shrink Tubing Market Share Analysis

Asia-Pacific heat shrink tubing market competitive landscape provides details by the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, Asia-Pacific presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to Asia-Pacific heat shrink tubing market.

Some of the major players operating in the Asia-Pacific heat shrink tubing market are ABB (Switzerland), Sumitomo Electric Industries, Ltd. (Japan), TE Connectivity (Switzerland), Thermosleeve USA (U.S.), Techflex, Inc. (U.S.), Dasheng Group (China), Shenzhen Woer Heat - Shrinkable Material Co., Ltd.(China), Huizhou Guanghai Electronic Insulation Materials Co.,Ltd.(China), Panduit (U.S.), HellermannTyton (Germany), Alpha Wire (U.S.), 3M (U.S.), SHAWCOR (Canada), Zeus Industrial Products, Inc. (U.S.), Molex (U.S.), PEXCO (U.S.), Prysmain Group (Italy), GREMCO GmbH (Germany), Qualtek Electronics Corp. (U.S.), Hilltop (U.K.), Dunbar Products, LLC. (U.S.), cygia, and Changyuan Electronics (Dongguan) Co., Ltd. (China) among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC HEAT SHRINK TUBING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 DBMR MARKET POSITION GRID

2.7 VENDOR SHARE ANALYSIS

2.8 MULTIVARIATE MODELING

2.9 TYPE TIMELINE CURVE

2.1 MARKET END-USER COVERAGE GRID

2.11 SECONDARY SOURCES

2.12 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 ROLE OF THE GOVERNMENT IN SUPPORTING AND EXPANSION OF TRANSMISSION & DISTRIBUTION SYSTEMS IN THE HEAT SHRINK TUBING MARKET ACROSS THE REGION

5.1.2 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE

5.1.3 RISING USAGE OF PRODUCTS WITH ADVANCED INFRASTRUCTURE AND TECHNOLOGY

5.1.4 INCREASING PENETRATION OF ELECTRIC VEHICLES

5.2 RESTRAINTS

5.2.1 GOVERNMENT REGULATION ON THE EMISSION OF TOXIC GASES

5.2.2 PRODUCTION CHALLENGES IN THE LEAST DEVELOPED COUNTRIES

5.2.3 INVOLVEMENT OF PLASTIC HAS A DIRECT IMPACT ON THE COST AS WELL AS THE ENVIRONMENT

5.3 OPPORTUNITIES

5.3.1 WIDE ADOPTION OF HEAT SHRINK TUBES IN VARIOUS INDUSTRIES

5.3.2 EASY PRODUCTION OF THE HEAT-SHRINKABLE TUBING

5.3.3 AUTOMATING A HEAT SHRINK TUBING PROCESS

5.4 CHALLENGES

5.4.1 RISING PRICES OF RAW MATERIALS FOR TUBING

5.4.2 POOR INSTALLATION OF HEAT-SHRINK TUBES

5.4.3 AVAILABILITY OF ALTERNATIVE AND INEXPENSIVE PRODUCTS IN THE MARKET

6 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY TYPE

6.1 OVERVIEW

6.2 SINGLE WALL

6.3 DUAL WALL

7 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE

7.1 OVERVIEW

7.2 SPOOLS

7.3 PRE-CUT LENGTH

7.4 OTHERS

8 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY VOLTAGE

8.1 OVERVIEW

8.2 LOW

8.3 MEDIUM

8.4 HIGH

9 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY MATERIAL

9.1 OVERVIEW

9.2 POLYOLEFIN

9.3 PERFLUOROALKOXY ALKANES (PFA)

9.4 POLYTETRAFLUOROETHYLENE (PTFE)

9.5 FLUORINATED ETHYLENE PROPYLENE (FEP)

9.6 ETHYLENE TETRAFLUOROETHYLENE (ETFE)

9.7 POLYETHER ETHER KETONE (PEEK)

9.8 OTHERS

10 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY SHRINK RATIO

10.1 OVERVIEW

10.2 12/30/1899 2:01:00 AM

10.3 12/30/1899 3:01:00 AM

10.4 12/30/1899 4:01:00 AM

10.5 12/30/1899 6:01:00 AM

10.6 OTHERS

11 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY END-USER

11.1 OVERVIEW

11.2 UTILITIES

11.3 IT AND TELECOMMUNICATION

11.4 AUTOMOTIVE

11.5 ELECTRONICS

11.5.1 COMMERCIAL/INDUSTRIAL

11.5.2 CONSUMER PRODUCT

11.6 AEROSPACE

11.7 HEALTHCARE

11.8 OIL AND GAS

11.9 MARINE

11.1 FOOD AND BEVERAGES

11.11 CONSTRUCTION

11.11.1 COMMERCIAL

11.11.2 RESIDENTIAL

11.12 CHEMICAL

11.13 OTHERS

12 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY REGION

12.1 ASIA-PACIFIC

12.1.1 CHINA

12.1.2 INDIA

12.1.3 JAPAN

12.1.4 SOUTH KOREA

12.1.5 AUSTRALIA

12.1.6 INDONESIA

12.1.7 MALAYSIA

12.1.8 THAILAND

12.1.9 SINGAPORE

12.1.10 PHILIPPINES

12.1.11 REST OF ASIA-PACIFIC

13 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: COMPANY LANDSCAPE

13.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14 SWOT ANALYSIS

15 COMPANY PROFILES

15.1 TE CONNECTIVITY

15.1.1 COMPANY SNAPSHOT

15.1.2 REVENUE ANALYSIS

15.1.3 COMPANY SHARE ANALYSIS

15.1.4 PRODUCT PORTFOLIO

15.1.5 RECENT DEVELOPMENTS

15.2 SUMITOMO ELECTRIC INDUSTRIES, LTD.

15.2.1 COMPANY SNAPSHOT

15.2.2 REVENUE ANALYSIS

15.2.3 COMPANY SHARE ANALYSIS

15.2.4 PRODUCT PORTFOLIO

15.2.5 RECENT DEVELOPMENTS

15.3 MOLEX

15.3.1 COMPANY SNAPSHOT

15.3.2 COMPANY SHARE ANALYSIS

15.3.3 PRODUCT PORTFOLIO

15.3.4 RECENT DEVELOPMENTS

15.4 ABB

15.4.1 COMPANY SNAPSHOT

15.4.2 REVENUE ANALYSIS

15.4.3 COMPANY SHARE ANALYSIS

15.4.4 PRODUCT PORTFOLIO

15.4.5 RECENT DEVELOPMENTS

15.5 PRYSMIAN GROUP

15.5.1 COMPANY SNAPSHOT

15.5.2 REVENUE ANALYSIS

15.5.3 COMPANY SHARE ANALYSIS

15.5.4 PRODUCT PORTFOLIO

15.5.5 RECENT DEVELOPMENTS

15.6 3M

15.6.1 COMPANY SNAPSHOT

15.6.2 REVENUE ANALYSIS

15.6.3 PRODUCT PORTFOLIO

15.6.4 RECENT DEVELOPMENTS

15.7 ALPHA WIRE

15.7.1 COMPANY SNAPSHOT

15.7.2 PRODUCT PORTFOLIO

15.7.3 RECENT DEVELOPMENTS

15.8 CHANGYUAN ELECTRONICS (DONGGUAN) CO., LTD.

15.8.1 COMPANY SNAPSHOT

15.8.2 PRODUCT PORTFOLIO

15.8.3 RECENT DEVELOPMENT

15.9 DASHENG GROUP

15.9.1 COMPANY SNAPSHOT

15.9.2 COMPANY PORTFOLIO

15.9.3 RECENT DEVELOPMENT

15.1 DUNBAR PRODUCTS, LLC.

15.10.1 COMPANY SNAPSHOT

15.10.2 PRODUCT PORTFOLIO

15.10.3 RECENT DEVELOPMENTS

15.11 GREMCO GMBH

15.11.1 COMPANY SNAPSHOT

15.11.2 PRODUCT PORTFOLIO

15.11.3 RECENT DEVELOPMENTS

15.12 HELLERMANNTYTON

15.12.1 COMPANY SNAPSHOT

15.12.2 PRODUCT PORTFOLIO

15.12.3 RECENT DEVELOPMENTS

15.13 HILLTOP

15.13.1 COMPANY SNAPSHOT

15.13.2 PRODUCT PORTFOLIO

15.13.3 RECENT DEVELOPMENTS

15.14 HUIZHOU GUANGHAI ELECTRONIC INSULATION MATERIALS CO., LTD.

15.14.1 COMPANY SNAPSHOT

15.14.2 PRODUCT PORTFOLIO

15.14.3 RECENT DEVELOPMENT

15.15 PANDUIT

15.15.1 COMPANY SNAPSHOT

15.15.2 PRODUCT PORTFOLIO

15.15.3 RECENT DEVELOPMENTS

15.16 PEXCO

15.16.1 COMPANY SNAPSHOT

15.16.2 PRODUCT PORTFOLIO

15.16.3 RECENT DEVELOPMENTS

15.17 QUALTEK ELECTRONICS CORP

15.17.1 COMPANY SNAPSHOT

15.17.2 PRODUCT PORTFOLIO

15.17.3 RECENT DEVELOPMENT

15.18 SHAWCOR

15.18.1 COMPANY SNAPSHOT

15.18.2 REVENUE ANALYSIS

15.18.3 PRODUCT PORTFOLIO

15.18.4 RECENT DEVELOPMENTS

15.19 SHENZHEN WOER HEAT - SHRINKABLE MATERIAL CO., LTD.

15.19.1 COMPANY SNAPSHOT

15.19.2 PRODUCT PORTFOLIO

15.19.3 RECENT DEVELOPMENTS

15.2 TECHFLEX, INC.

15.20.1 COMPANY SNAPSHOT

15.20.2 PRODUCT PORTFOLIO

15.20.3 RECENT DEVELOPMENT

15.21 THERMOSLEEVE USA

15.21.1 COMPANY SNAPSHOT

15.21.2 PRODUCT PORTFOLIO

15.21.3 RECENT DEVELOPMENTS

15.22 ZEUS INDUSTRIAL PRODUCTS, INC.

15.22.1 COMPANY SNAPSHOT

15.22.2 PRODUCT PORTFOLIO

15.22.3 RECENT DEVELOPMENTS

16 QUESTIONNAIRE

17 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 2 ASIA-PACIFIC SINGLE WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 3 ASIA-PACIFIC DUAL WALL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 4 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 5 ASIA-PACIFIC SPOOLS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 6 ASIA-PACIFIC PRE-CUT LENGTH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 7 ASIA-PACIFIC OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 8 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 9 ASIA-PACIFIC LOW IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 10 ASIA-PACIFIC MEDIUM IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 11 ASIA-PACIFIC HIGH IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 12 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 13 ASIA-PACIFIC POLYOLEFIN IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 14 ASIA-PACIFIC PERFLUOROALKOXY ALKANES (PFA) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 15 ASIA-PACIFIC POLYTETRAFLUOROETHYLENE (PTFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 16 ASIA-PACIFIC FLUORINATED ETHYLENE PROPYLENE (FEP) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 17 ASIA-PACIFIC ETHYLENE TETRAFLUOROETHYLENE (ETFE) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 18 ASIA-PACIFIC POLYETHERETHERKETONE (PEEK) IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 19 ASIA-PACIFIC OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 20 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 21 ASIA-PACIFIC 2:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 22 ASIA-PACIFIC 3:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 23 ASIA-PACIFIC 4:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 24 ASIA-PACIFIC 6:01 IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 25 ASIA-PACIFIC OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 26 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 27 ASIA-PACIFIC UTILITIES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 28 ASIA-PACIFIC IT AND TELECOMMUNICATION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 29 ASIA-PACIFIC AUTOMOTIVE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 30 ASIA-PACIFIC ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 31 ASIA-PACIFIC ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 32 ASIA-PACIFIC AEROSPACE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 33 ASIA-PACIFIC HEALTHCARE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 34 ASIA-PACIFIC OIL AND GAS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 35 ASIA-PACIFIC MARINE IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 36 ASIA-PACIFIC FOOD AND BEVERAGES IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 37 ASIA-PACIFIC CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 38 ASIA-PACIFIC CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 39 ASIA-PACIFIC CHEMICAL IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 40 ASIA-PACIFIC OTHERS IN HEAT SHRINK TUBING MARKET, BY REGION, 2021-2030 (USD MILLION)

TABLE 41 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY COUNTRY, 2021-2030 (USD MILLION)

TABLE 42 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 43 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 44 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 45 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 46 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 47 ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 48 ASIA-PACIFIC ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 49 ASIA-PACIFIC CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 50 CHINA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 51 CHINA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 52 CHINA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 53 CHINA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 54 CHINA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 55 CHINA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 56 CHINA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 57 CHINA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 58 INDIA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 59 INDIA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 60 INDIA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 61 INDIA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 62 INDIA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 63 INDIA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 64 INDIA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 65 INDIA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 66 JAPAN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 67 JAPAN HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 68 JAPAN HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 69 JAPAN HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 70 JAPAN HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 71 JAPAN HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 72 JAPAN ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 73 JAPAN CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 74 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 75 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 76 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 77 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 78 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 79 SOUTH KOREA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 80 SOUTH KOREA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 81 SOUTH KOREA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 82 AUSTRALIA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 83 AUSTRALIA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 84 AUSTRALIA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 85 AUSTRALIA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 86 AUSTRALIA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 87 AUSTRALIA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 88 AUSTRALIA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 89 AUSTRALIA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 90 INDONESIA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 91 INDONESIA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 92 INDONESIA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 93 INDONESIA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 94 INDONESIA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 95 INDONESIA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 96 INDONESIA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 97 INDONESIA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 98 MALAYSIA HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 99 MALAYSIA HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 100 MALAYSIA HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 101 MALAYSIA HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 102 MALAYSIA HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 103 MALAYSIA HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 104 MALAYSIA ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 105 MALAYSIA CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 106 THAILAND HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 107 THAILAND HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 108 THAILAND HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 109 THAILAND HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 110 THAILAND HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 111 THAILAND HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 112 THAILAND ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 113 THAILAND CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 114 SINGAPORE HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 115 SINGAPORE HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 116 SINGAPORE HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 117 SINGAPORE HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 118 SINGAPORE HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 119 SINGAPORE HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 120 SINGAPORE ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 121 SINGAPORE CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 122 PHILIPPINES HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 123 PHILIPPINES HEAT SHRINK TUBING MARKET, BY PRODUCT TYPE, 2021-2030 (USD MILLION)

TABLE 124 PHILIPPINES HEAT SHRINK TUBING MARKET, BY VOLTAGE, 2021-2030 (USD MILLION)

TABLE 125 PHILIPPINES HEAT SHRINK TUBING MARKET, BY SHRINK RATIO, 2021-2030 (USD MILLION)

TABLE 126 PHILIPPINES HEAT SHRINK TUBING MARKET, BY MATERIAL, 2021-2030 (USD MILLION)

TABLE 127 PHILIPPINES HEAT SHRINK TUBING MARKET, BY END-USER, 2021-2030 (USD MILLION)

TABLE 128 PHILIPPINES ELECTRONICS IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 129 PHILIPPINES CONSTRUCTION IN HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

TABLE 130 REST OF ASIA-PACIFIC HEAT SHRINK TUBING MARKET, BY TYPE, 2021-2030 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: ASIA-PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: MULTIVARIATE MODELING

FIGURE 10 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: TYPE TIMELINE CURVE

FIGURE 11 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: MARKET END-USER COVERAGE GRID

FIGURE 12 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: SEGMENTATION

FIGURE 13 INCREASE IN THE CAPACITY FOR POWER GENERATION ACROSS THE GLOBE IS EXPECTED TO DRIVE THE ASIA-PACIFIC HEAT SHRINK TUBING MARKET IN THE FORECAST PERIOD OF 2023 TO 2030

FIGURE 14 THE SINGLE WALL SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC HEAT SHRINK TUBING MARKET IN 2023 & 2030

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA-PACIFIC HEAT SHRINK TUBING MARKET

FIGURE 16 GOVERNMENT INITIATIVES TO ENHANCE POWER TRANSMISSION

FIGURE 17 GENERATION OF RENEWABLE ELECTRICITY

FIGURE 18 ELECTRICITY GENERATION IN VARIOUS COUNTRIES

FIGURE 19 ASIA-PACIFIC SALES VOLUME OF ELECTRIC VEHICLES

FIGURE 20 MANUFACTURING PROCESS FOR HEAT SHRINK TUBING

FIGURE 21 SILVER PRICING (SEPTEMBER 2022 TO MARCH 2023)

FIGURE 22 ALTERNATIVES FOR HEAT SHRINK TUBING

FIGURE 23 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY TYPE, 2022

FIGURE 24 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY PRODUCT TYPE, 2022

FIGURE 25 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY VOLTAGE, 2022

FIGURE 26 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY MATERIAL, 2022

FIGURE 27 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY SHRINK RATIO, 2022

FIGURE 28 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY END-USER, 2022

FIGURE 29 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: SNAPSHOT (2022)

FIGURE 30 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY COUNTRY (2022)

FIGURE 31 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY COUNTRY (2023 & 2030)

FIGURE 32 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY COUNTRY (2022 & 2030)

FIGURE 33 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: BY TYPE (2023-2030)

FIGURE 34 ASIA-PACIFIC HEAT SHRINK TUBING MARKET: COMPANY SHARE 2022 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.