Asia Pacific Gene Synthesis Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

429.59 Million

USD

2,557.01 Million

2021

2029

USD

429.59 Million

USD

2,557.01 Million

2021

2029

| 2022 –2029 | |

| USD 429.59 Million | |

| USD 2,557.01 Million | |

|

|

|

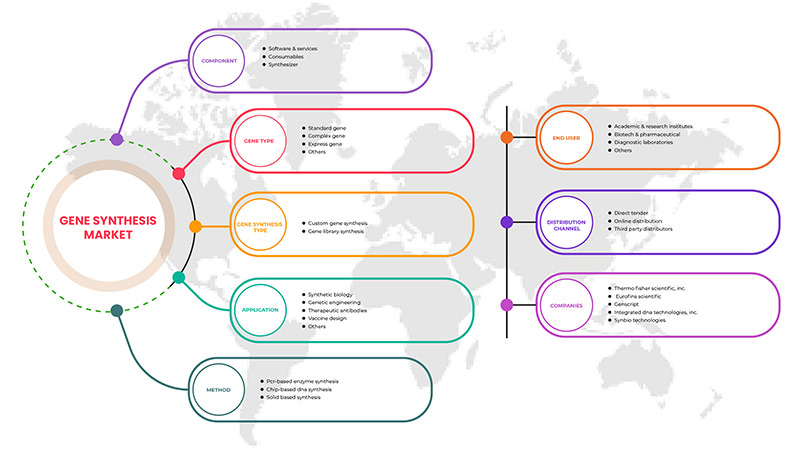

Mercado de síntese genética da Ásia-Pacífico, por componente (sintetizador, consumíveis e software e serviços), tipo de gene (gene padrão, gene expresso, gene complexo e outros), tipo de síntese genética (síntese de biblioteca genética e síntese genética personalizada ), aplicação ( Biologia Sintética , Engenharia Genética, Design de Vacinas, Anticorpos Terapêuticos e Outros), Método (Síntese em Fase Sólida, Síntese de ADN Baseada em Chip e Síntese Enzimática Baseada em PCR), Utilizador Final (Institutos Académicos e de Investigação, Laboratórios de Diagnóstico, Biotecnologia e Empresas farmacêuticas e outras), canal de distribuição (licitação direta, distribuição online e distribuidores externos), tendências da indústria e previsão para 2029

Análise e Insights do Mercado de Síntese Genética da Ásia-Pacífico

A síntese genética é o processo de criação de genes artificiais em laboratório, utilizando biologia sintética. A geração de proteínas recombinantes é uma das inúmeras aplicações da tecnologia do ADN recombinante, onde a síntese genética está a emergir como um instrumento fundamental. Os métodos tradicionais de clonagem e mutagénese estão a ser rapidamente substituídos pela síntese genética de novo, que permite também a produção de ácidos nucleicos para os quais não existe um modelo.

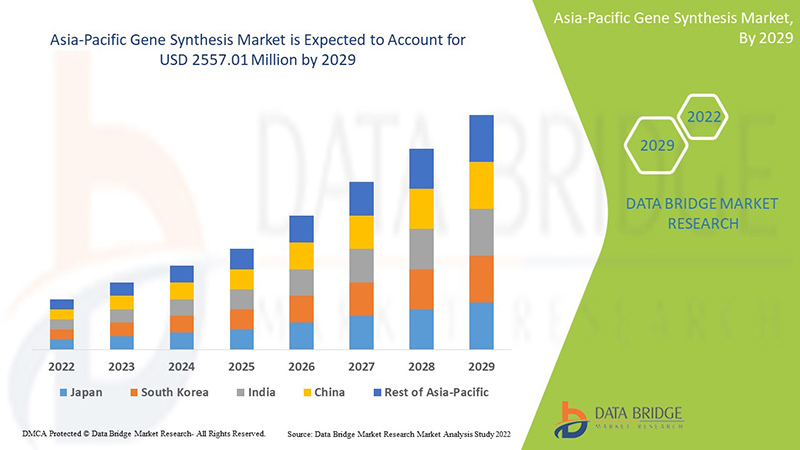

O mercado de síntese genética da Ásia-Pacífico deverá crescer no período previsto de 2022 a 2029. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 24,7% no período previsto de 2022 a 2029 e deverá atingir os 2.557,01 dólares.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2014) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos |

|

Segmentos abrangidos |

Por componente (sintetizador, consumíveis e software e serviços), tipo de gene (gene padrão, gene expresso, gene complexo e outros), tipo de síntese de genes (síntese de biblioteca de genes e síntese de genes personalizados), aplicação (biologia sintética , engenharia genética, Design de vacinas, anticorpos terapêuticos e outros), método (síntese em fase sólida, síntese de ADN baseada em chip e síntese enzimática baseada em PCR), utilizador final (institutos académicos e de investigação, laboratórios de diagnóstico, empresas de biotecnologia e farmacêuticas e outros), Canal de Distribuição (Concurso Directo, Distribuição Online e Distribuidores Terceirizados) |

|

Países abrangidos |

China, Japão, Índia, Coreia do Sul, Austrália, Singapura, Tailândia, Malásia, Indonésia, Filipinas e restante Ásia-Pacífico. |

|

Atores do mercado abrangidos |

MACROGEN CO., LTD., Bioneer Pacific, Kaneka Eurogentec SA, Bbi-lifesciences e GCC Biotech (INDIA) Pvt. Lda., entre outros. |

Definição de Mercado

A síntese genética refere-se à síntese química da cadeia de ADN base a base. Ao contrário da replicação do ADN que ocorre nas células ou pela Reação em Cadeia da Polimerase (PCR), a síntese genética não requer uma cadeia molde. Em vez disso, a síntese genética envolve a adição gradual de nucleótidos a uma molécula de cadeia simples, que serve então de modelo para a criação de uma cadeia complementar. A síntese genética é a tecnologia fundamental sobre a qual o campo da biologia sintética foi construído.

Dinâmica do mercado da síntese genética

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas

- AUMENTO DA PREVALÊNCIA DE DOENÇAS INFECCIOSAS CRÓNICAS

As doenças bacterianas e virais estão a expandir-se rapidamente devido à crescente prevalência de doenças infeciosas em todo o mundo. Como resultado, a procura por terapias novas e eficazes aumentou para combater estas doenças mortais. Estas doenças podem ser curadas utilizando medicamentos químicos e terapias biológicas, incluindo terapia genética. Com a aplicação da genómica, foi melhorada a gestão de doenças infeciosas e endémicas. Permite-nos também compreender a resistência emergente aos medicamentos e identificar alvos para novos tratamentos e vacinas. Para o tratamento de doenças infeciosas, a terapia genética tem atraído muitos investigadores, uma vez que pode ser tratada utilizando tecnologia de ADN recombinante, ribozima de ADN e ARN e anticorpos de cadeia simples.

À medida que a prevalência de doenças infecciosas crónicas aumenta globalmente, aumenta também a procura de vacinas e de terapia genética eficaz, o que aumenta a procura de novos genes com aplicação significativa em actividades de investigação e fabrico de medicamentos e vacinas. Assim, a crescente prevalência de doenças infeciosas está a atuar como impulsionadora do crescimento do mercado da síntese genética.

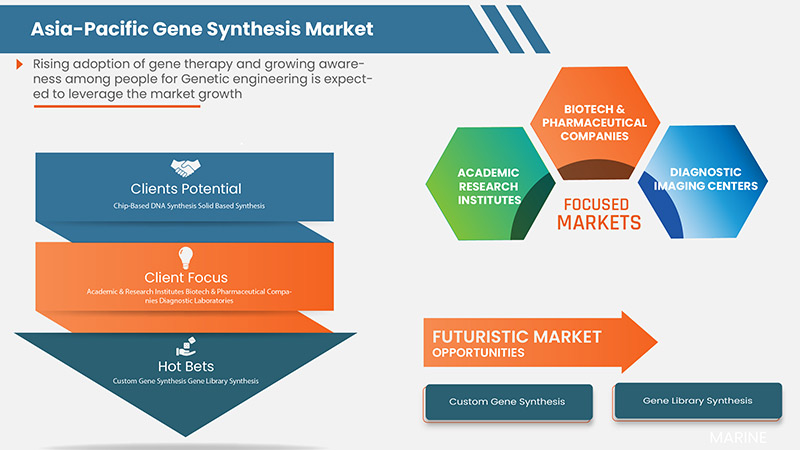

- ADOÇÃO CRESCENTE DA TERAPIA GÉNICA

A terapia genética é uma técnica avançada que inclui a utilização de vários genes para a prevenção de um tipo específico de doença. A técnica envolve a inserção de genes nas células dos pacientes em vez de medicamentos e cirurgia. Devido à crescente procura de resultados terapêuticos novos e duradouros, a adoção da terapia genética está a aumentar. As terapias genéticas requerem construções genéticas sintéticas, entre outros produtos genéticos, para acelerar o desenvolvimento da terapia genética. Devido ao aumento das doenças genéticas, a exigência de uma cura adequada é um factor importante e, com a ajuda da terapia genética, um tipo específico de doença pode ser curado.

Devido ao aumento da procura, os líderes estão constantemente focados em produzir produtos de terapia genética, obter aprovação e autorizações de comercialização.

Os medicamentos e terapias que salvam vidas são muito procurados para proporcionar qualidade de vida a diferentes doentes. Este número crescente de doentes depende em grande parte das terapias genéticas disponíveis para conseguir uma cura adequada. Para fabricar terapias genéticas são necessários genes sintéticos e novos, que podem ser obtidos pela técnica de síntese genética. Assim, espera-se que a crescente adoção da terapia genética atue como um impulsionador do mercado da síntese genética.

- EXPANSÃO DA BIOLOGIA SINTÉTICA

A incorporação dos princípios de engenharia na biologia é designada por biologia sintética. O genoma do ADN pode ser remontado com a ajuda da biologia sintética, uma vez que envolve a síntese química do ADN combinando-o com o seu genoma. Os oligonucleótidos podem ser construídos num curto período incorporando serviços de síntese genética, software e consumíveis. À medida que a procura de produtos de biologia sintética aumenta em todo o mundo, os produtos e serviços de síntese genética também estão a aumentar.

Assim, devido aos seus produtos eficazes e inovadores, a procura de produtos de biologia sintética está a aumentar a nível global, o que deverá actuar como um factor impulsionador para o mercado da síntese genética.

Oportunidades

-

AUMENTO DAS DESPESAS COM A SAÚDE

Os gastos com a saúde têm aumentado em todo o mundo à medida que o rendimento disponível das pessoas em vários países aumenta. Além disso, para satisfazer as necessidades da população, os organismos governamentais e as organizações de saúde estão a tomar a iniciativa de acelerar os gastos com a saúde.

Além disso, as iniciativas estratégicas tomadas pelos principais participantes do mercado proporcionarão integridade estrutural e oportunidades futuras para o mercado de testes de dispositivos médicos no período previsto de 2022-2029.

Restrições/Desafios

- ALTO CUSTO DO PROCESSO DE SÍNTESE GÉNICA

No entanto, as barreiras às técnicas de síntese genética e o elevado custo do processo de síntese genética em algumas regiões podem impedir o crescimento dos procedimentos de síntese genética, dificultando o crescimento do mercado. Além disso, a elevada concorrência nas indústrias de tecnologia médica e o longo prazo de qualificação no estrangeiro podem ser fatores desafiantes para o crescimento do mercado.

Este relatório de mercado de síntese genética fornece detalhes de novos desenvolvimentos recentes, regulamentos comerciais, análise de importação e exportação, análise de produção, otimização da cadeia de valor, quota de mercado, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado, análise estratégica do crescimento do mercado, tamanho do mercado, crescimento do mercado das categorias, nichos de aplicação e dominância, aprovações de produtos, lançamentos de produtos, expansões geográficas, inovações tecnológicas no mercado . Para mais informações sobre o mercado da síntese genética, contacte a Data Bridge Market Research para obter um resumo analítico. A nossa equipa irá ajudá-lo a tomar uma decisão de mercado informada para alcançar o crescimento do mercado.

Desenvolvimento recente

- Em dezembro de 2020, a Twist Bioscience lançou fragmentos de genes clonais prontos para completar a oferta de genes. Os fragmentos lançados podem ser utilizados com adaptadores ou sem adaptadores para construir clones perfeitos. Os fragmentos de genes prontos para clonagem são compatíveis com as vias de expressão proteica, a engenharia enzimática e a expressão genética, entre outras.

- Em 2020, de acordo com um artigo publicado numa revista da ACS, estima-se que 19,3 milhões de novos casos de cancro e quase 10 milhões de mortes por cancro foram reportados em todo o mundo. Isto sugere que a cobertura do cancro é abaixo do ideal e há uma grande necessidade de implementar uma elevada cobertura do cancro em todo o mundo.

Âmbito do mercado de síntese genética da Ásia-Pacífico

O mercado de síntese genética da Ásia-Pacífico está segmentado em componente, tipo de gene, tipo de síntese genética, aplicação, método, utilizador final e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar segmentos de crescimento escassos nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para tomar decisões estratégicas para identificar as principais aplicações do mercado.

Componente

- Sintetizadores

- Consumíveis

- Software e serviços

Com base no componente, o mercado de síntese genética da Ásia-Pacífico está segmentado em sintetizadores, consumíveis e software e serviços.

Tipo de gene

- Gene padrão

- Expressar gene

- Gene complexo

- Outros

Com base no tipo de gene, o mercado de síntese genética da Ásia-Pacífico está segmentado em gene padrão, gene expresso, gene complexo e outros.

Tipo de síntese genética

- Síntese de biblioteca genética

- Síntese genética personalizada

Com base no tipo de síntese genética, o mercado de síntese genética da Ásia-Pacífico está segmentado em síntese de biblioteca genética e síntese genética personalizada.

Aplicação

- Biologia sintética,

- Engenharia genética,

- Desenho de vacinas,

- Anticorpos terapêuticos

- Outros

Com base na aplicação, o mercado de síntese genética da Ásia-Pacífico está segmentado em biologia sintética, engenharia genética, design de vacinas, anticorpos terapêuticos e outros.

Método

- Síntese em base sólida,

- Síntese de ADN baseada em chip

- Síntese enzimática baseada em PCR

Com base no método, o mercado de síntese genética da Ásia-Pacífico está segmentado em síntese baseada em sólidos, síntese de ADN baseada em chips e síntese enzimática baseada em PCR.

Utilizador final

- Institutos académicos e de investigação,

- Laboratórios de diagnóstico,

- Empresas de biotecnologia e farmacêuticas

- Outros

Com base no utilizador final, o mercado de síntese genética da Ásia-Pacífico está segmentado em institutos académicos e de investigação, laboratórios de diagnóstico, empresas de biotecnologia e farmacêuticas, entre outros.

Canal de Distribuição

- Licitação direta

- Distribuição online

- Distribuidores terceirizados

Com base no canal de distribuição, o mercado de síntese genética da Ásia-Pacífico está segmentado em licitação direta, distribuição online e distribuidores de terceiros.

Análise regional/perspetivas do mercado de síntese genética

The gene synthesis market is analyzed, and market size insights and trends are provided by the country, component, gene type, gene synthesis type, application, method, end user, and distribution channel, as referenced above.

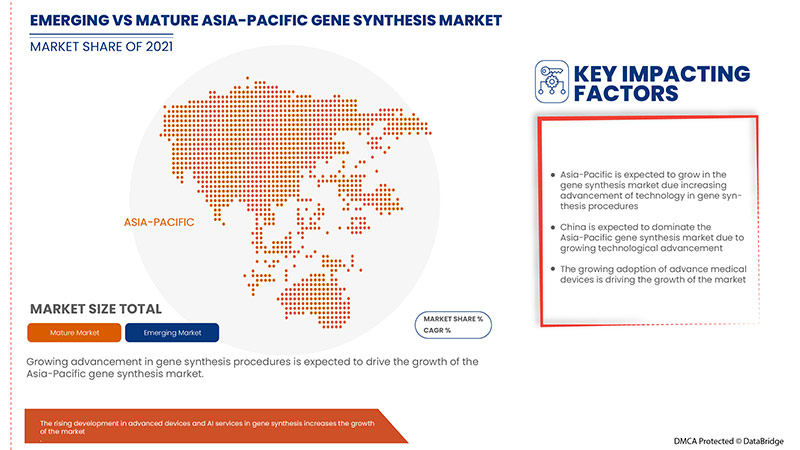

China dominates the Asia-Pacific gene synthesis market in terms of market share and market revenue and will continue to flourish its dominance during the forecast period. This is due to the rising need for the verification and validation of gene synthesis processes in the region, and rapid research development is boosting the market.

The country section of the report also provides individual market-impacting factors and changes in regulations in the market that impact the current and future trends of the market. Data points, such as new and replacement sales, country demographics, disease epidemiology, and import-export tariffs, are some of the major pointers used to forecast the market scenario for individual countries. In addition, the presence and availability of global brands and their challenges faced due to high competition from local and domestic brands, and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and Gene Synthesis Market Share Analysis

The gene synthesis market competitive landscape provides details by the competitors. Details include company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, and application dominance. The above data points provided are only related to the companies focus on the gene synthesis market.

Some of the major players operating in the gene synthesis market are ATDBio Ltd (Subsidiary of Biotage), General Biosystems, Inc., MACROGEN CO., LTD., Boster Biological Technology, Creative Biogene, Bioneer Pacific, exonbio, trenzyme GmbH, Twist Bioscience, BioCat GmbH (Subsidiary of AddLife AB), OriGene Technologies, Inc., Integrated DNA Technologies, Inc. 9Subsidiary of Danaher Corporation), Eurofins Scientific, NZYTech, Lda. - Genes and Enzymes, Ansa Biotechnologies, Inc., Thermo Fisher Scientific, Genescript, Synbio Technologies, Proteogenix, Bio Basic Inc., ATG:biosynthetics GmbH, Merck KGaA, Kaneka Eurogentec S.A, Ginkgo Bioworks, Bbi-lifesciences, Evonetix, ProMab Biotechnologies, Inc., GCC Biotech (INDIA) Pvt. Ltd., CSBio, Azenta US, Inc., and among others.

Research Methodology

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com grandes tamanhos de amostra. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem a Grelha de Posicionamento de Fornecedores, Análise da Linha do Tempo do Mercado, Visão Geral e Guia de Mercado, Grelha de Posicionamento da Empresa, Análise da Participação de Mercado da Empresa, Padrões de Medição, Ásia- Pacífico vs. Regional e Análise da Participação dos Fornecedores. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC GENE SYNTHESIS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHIC SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 RESEARCH METHODOLOGY

2.6 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.7 MULTIVARIATE MODELLING

2.8 COMPONENT SEGMENT LIFELINE CURVE

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 THE CATEGORY VS TIME GRID

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PESTEL

4.2 PORTER'S FIVE FORCES MODEL

5 ASIA PACIFIC GENE SYNTHESIS MARKET: REGULATIONS

6 MARKET OVERVIEW

6.1 DRIVERS

6.1.1 INCREASED PREVALENCE OF CHRONIC INFECTIOUS DISEASES

6.1.2 RISING ADOPTION OF GENE THERAPY

6.1.3 EXPANSION OF SYNTHETIC BIOLOGY

6.1.4 RISING INTEREST OF GENE SYNTHESIS IN THE FIELD OF MOLECULAR BIOLOGY

6.2 RESTRAINTS

6.2.1 LACK OF TRAINED PROFESSIONALS

6.2.2 ETHICAL ISSUES

6.2.3 LONG APPROVAL PROCESS

6.3 OPPORTUNITIES

6.3.1 RISE IN HEALTHCARE EXPENDITURE

6.3.2 STRATEGIC INITIATIVES BY KEY PLAYERS

6.3.3 RISING DEMAND FOR CUSTOMIZED MEDICATIONS

6.4 CHALLENGES

6.4.1 TECHNICAL LIMITATIONS ACROSS PRODUCTION PROCESS

6.4.2 LACK OF WELL DEFINED PATENT SYSTEM

7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 SOFTWARE & SERVICES

7.3 CONSUMABLES

7.3.1 REAGENTS

7.3.2 ASSAYS

7.3.3 PROBES & DYES

7.3.4 OTHERS

7.4 SYNTHESIZER

7.4.1 COLUMN-BASED SYNTHESIZERS

7.4.2 MICROARRAY-BASED SYNTHESIZERS

8 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE

8.1 OVERVIEW

8.2 STANDARD GENE

8.3 COMPLEX GENE

8.4 EXPRESS GENE

8.5 OTHERS

9 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE

9.1 OVERVIEW

9.2 CUSTOM GENE SYNTHESIS

9.2.1 STANDARD GENE

9.2.2 COMPLEX GENE

9.2.3 EXPRESS GENE

9.2.4 OTHERS

9.3 GENE LIBRARY SYNTHESIS

9.3.1 STANDARD GENE

9.3.2 COMPLEX GENE

9.3.3 EXPRESS GENE

9.3.4 OTHERS

10 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION

10.1 OVERVIEW

10.2 SYNTHETIC BIOLOGY

10.2.1 CUSTOM GENE SYNTHESIS

10.2.2 GENE LIBRARY SYNTHESIS

10.3 GENETIC ENGINEERING

10.3.1 CUSTOM GENE SYNTHESIS

10.3.2 GENE LIBRARY SYNTHESIS

10.4 THERAPEUTIC ANTIBODIES

10.4.1 CUSTOM GENE SYNTHESIS

10.4.2 GENE LIBRARY SYNTHESIS

10.5 VACCINE DESIGN

10.5.1 CUSTOM GENE SYNTHESIS

10.5.2 GENE LIBRARY SYNTHESIS

10.6 OTHERS

11 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD

11.1 OVERVIEW

11.2 PCR-BASED ENZYME SYNTHESIS

11.3 CHIP-BASED DNA SYNTHESIS

11.4 SOLID BASED SYNTHESIS

12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER

12.1 OVERVIEW

12.2 ACADEMIC & RESEARCH INSTITUTE

12.3 BIOTECH & PHARMACEUTICAL COMPANIES

12.4 DIAGNOSTIC LABORATORIES

12.5 OTHERS

13 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 ONLINE DISTRIBUTION

13.4 THIRD PARTY DISTRIBUTORS

14 ASIA PACIFIC GENE SYNTHESIS MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 JAPAN

14.1.3 INDIA

14.1.4 SOUTH KOREA

14.1.5 AUSTRALIA

14.1.6 SINGAPORE

14.1.7 MALAYSIA

14.1.8 THAILAND

14.1.9 INDONESIA

14.1.10 PHILIPPINES

14.1.11 REST OF ASIA-PACIFIC

15 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 INTEGRATED DNA TECHNOLOGIES, INC. (A SUBSIDIARY OF DANAHER)

17.1.1 COMPANY SNAPSHOT

17.1.2 COMPANY SHARE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT DEVELOPMENTS

17.2 THERMO FISHER SCIENTIFIC INC.

17.2.1 COMPANY SNAPSHOT

17.2.2 REVENUE ANALYSIS

17.2.3 COMPANY SHARE ANALYSIS

17.2.4 PRODUCT PORTFOLIO

17.2.5 RECENT DEVELOPMENT

17.3 EUROFINS SCIENTIFIC

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 SERVICE PORTFOLIO

17.3.5 RECENT DEVELOPMENT

17.4 MERCK KGAA

17.4.1 COMPANY SNAPSHOT

17.4.2 REVENUE ANALYSIS

17.4.3 COMPANY SHARE ANALYSIS

17.4.4 PRODUCT PORTFOLIO

17.4.5 RECENT DEVELOPMENT

17.5 KANEKA EUROGENTEC S.A.

17.5.1 COMPANY SNAPSHOT

17.5.2 REVENUE ANALYSIS

17.5.3 COMPANY SHARE ANALYSIS

17.5.4 PRODUCT PORTFOLIO

17.5.5 RECENT DEVELOPMENTS

17.6 ANSA BIOTECHNOLOGIES, INC

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 ATD BIO LTD

17.7.1 COMPANY SNAPSHOT

17.7.2 REVENUE ANALYSIS

17.7.3 PRODUCT PORTFOLIO

17.7.4 RECENT DEVELOPMENTS

17.8 ATG:BIOSYNTHETICS GMBH

17.8.1 COMPANY SNAPSHOT

17.8.2 PRODUCT PORTFOLIO

17.8.3 RECENT DEVELOPMENTS

17.9 AZENTUS US, INC (2021)

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT DEVELOPMENT

17.1 BBI LIFESCIENCES CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENTS

17.11 BIO BASIC INC.

17.11.1 COMPANY SNAPSHOT

17.11.2 PRODUCT PORTFOLIO

17.11.3 RECENT DEVELOPMENTS

17.12 BIOCAT GMBH

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 BIONEER PACIFIC

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENT

17.14 BOSTER BIOLOGICAL TECHNOLOGY

17.14.1 COMPANY SNAPSHOT

17.14.2 SERVICE PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 CSBIO

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 CREATIVE BIOGENE

17.16.1 COMPANY SNAPSHOT

17.16.2 RODUCTPORTFOLIO

17.16.3 RECENT DEVELOPMENT

17.17 EVONETIX

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 EXONBIO

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENT

17.19 GCC BIOTECH (INDIA) PVT. LTD.

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 GINKGO BIOWORKS (2021)

17.20.1 COMPANY SNAPSHOT

17.20.2 REVENUE ANALYSIS

17.20.3 PRODUCT PORTFOLIO

17.20.4 RECENT DEVELOPMENTS

17.21 GENERAL BIOSYSTEMS INC

17.21.1 COMPANY SNAPSHOT

17.21.2 PRODUCT PORTFOLIO

17.21.3 RECENT DEVELOPMENTS

17.22 GENSCRIPT

17.22.1 COMPANY SNAPSHOT

17.22.2 REVENUE ANALYSIS

17.22.3 PRODUCT PORTFOLIO

17.22.4 RECENT DEVELOPMENTS

17.23 MACROGEN CO., LTD. (A SUBSIDIARY OF MACROGEN, INC)

17.23.1 COMPANY SNAPSHOT

17.23.2 REVENUE ANALYSIS

17.23.3 PRODUCT PORTFOLIO

17.23.4 RECENT DEVELOPMENTS

17.24 NZYTECH, LDA. - GENES AND ENZYMES.

17.24.1 COMPANY SNAPSHOT

17.24.2 PRODUCT PORTFOLIO

17.24.3 RECENT DEVELOPMENT

17.25 ORIGENE TECHNOLOGIES, INC

17.25.1 COMPANY SNAPSHOT

17.25.2 PRODUCT PORTFOLIO

17.25.3 RECENT DEVELOPMENTS

17.26 PROMAB BIOTECHNOLOGIES

17.26.1 COMPANY SNAPSHOT

17.26.2 PRODUCT PORTFOLIO

17.26.3 RECENT DEVELOPMENTS

17.27 PROTEOGENIX

17.27.1 COMPANY SNAPSHOT

17.27.2 PRODUCT PORTFOLIO

17.27.3 RECENT DEVELOPMENTS

17.28 SYNBIO TECHNOLOGIES

17.28.1 COMPANY SNAPSHOT

17.28.2 PRODUCT PORTFOLIO

17.28.3 RECENT DEVELOPMENTS

17.29 TRENZYME GMBH

17.29.1 COMPANY SNAPSHOT

17.29.2 PRODUCT PORTFOLIO

17.29.3 RECENT DEVELOPMENTS

17.3 TWIST BIOSCIENCE

17.30.1 COMPANY SNAPSHOT

17.30.2 REVENUE ANALYSIS

17.30.3 PRODUCT PORTFOLIO

17.30.4 RECENT DEVELOPMENTS

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC SOFTWARE & SERVICES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC STANDARD GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC COMPLEX GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC EXPRESS GENE IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC PCR-BASED ENZYME SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC CHIP-BASED DNA SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC SOLID BASED SYNTHESIS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC ACADEMIC & RESEARCH INSTITUTES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC BIOTECH & PHARMACEUTICAL COMPANIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC DIAGNOSTIC LABORATORIES IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC OTHERS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 36 ASIA PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 37 ASIA PACIFIC DIRECT TENDER IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 38 ASIA PACIFIC ONLINE DISTRIBUTION IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 39 ASIA PACIFIC THIRD PARTY DISTRIBUTORS IN GENE SYNTHESIS MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 53 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 54 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 55 ASIA-PACIFIC GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 56 CHINA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 57 CHINA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 58 CHINA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 59 CHINA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 60 CHINA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 61 CHINA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 62 CHINA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 63 CHINA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 64 CHINA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 65 CHINA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 66 CHINA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 67 CHINA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 68 CHINA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 69 CHINA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 70 CHINA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 71 JAPAN GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 72 JAPAN CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 73 JAPAN SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 74 JAPAN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 75 JAPAN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 76 JAPAN CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 77 JAPAN GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 78 JAPAN GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 79 JAPAN SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 80 JAPAN GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 81 JAPAN THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 82 JAPAN VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 83 JAPAN GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 84 JAPAN GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 85 JAPAN GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 86 INDIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 87 INDIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 NDIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 89 INDIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 90 INDIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 91 INDIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 92 INDIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 93 INDIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 94 INDIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 95 INDIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 96 INDIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 97 INDIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 98 INDIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 99 INDIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 100 INDIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 101 SOUTH KOREA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 102 SOUTH KOREA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 103 SOUTH KOREA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 104 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 105 SOUTH KOREA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 106 SOUTH KOREA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 107 SOUTH KOREA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 108 SOUTH KOREA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 109 SOUTH KOREA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 110 SOUTH KOREA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 111 SOUTH KOREA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 112 SOUTH KOREA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 113 SOUTH KOREA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 114 SOUTH KOREA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 115 SOUTH KOREA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 116 AUSTRALIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 131 SINGAPORE GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 132 SINGAPORE CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 146 MALAYSIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 147 MALAYSIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 148 MALAYSIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 149 MALAYSIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 150 MALAYSIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 151 MALAYSIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 152 MALAYSIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 153 MALAYSIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 154 MALAYSIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 155 MALAYSIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 156 MALAYSIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 157 MALAYSIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 158 MALAYSIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 159 MALAYSIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 160 MALAYSIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 161 THAILAND GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 162 THAILAND CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 163 THAILAND SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 164 THAILAND GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 165 THAILAND GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 166 THAILAND CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 167 THAILAND GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 168 THAILAND GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 169 THAILAND SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 170 THAILAND GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 171 THAILAND THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 172 THAILAND VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 173 THAILAND GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 174 THAILAND GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 175 THAILAND GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 176 INDONESIA GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 177 INDONESIA CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 178 INDONESIA SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 179 INDONESIA GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 180 INDONESIA GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 191 PHILIPPINES GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

TABLE 192 PHILIPPINES CONSUMABLES IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 193 PHILIPPINES SYNTHESIZER IN GENE SYNTHESIS MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 194 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 195 PHILIPPINES GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 196 PHILIPPINES CUSTOM GENE SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES GENE LIBRARY SYNTHESIS IN GENE SYNTHESIS MARKET, BY GENE TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES GENE SYNTHESIS MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES SYNTHETIC BIOLOGY IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES GENETIC ENGINEERING IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES THERAPEUTIC ANTIBODIES IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES VACCINE DESIGN IN GENE SYNTHESIS MARKET, BY GENE SYNTHESIS TYPE, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES GENE SYNTHESIS MARKET, BY METHOD, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES GENE SYNTHESIS MARKET, BY END USER, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES GENE SYNTHESIS MARKET, BY DISTRIBUTION CHANNEL, 2020-2029 (USD MILLION)

TABLE 206 REST OF ASIA-PACIFIC GENE SYNTHESIS MARKET, BY COMPONENT, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA PACIFIC GENE SYNTHESIS MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC GENE SYNTHESIS MARKET: GEOGRAPHIC SCOPE

FIGURE 3 ASIA PACIFIC GENE SYNTHESIS MARKET: DATA TRIANGULATION

FIGURE 4 ASIA PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT

FIGURE 5 ASIA PACIFIC GENE SYNTHESIS MARKET: BOTTOM UP APPROACH

FIGURE 6 ASIA PACIFIC GENE SYNTHESIS MARKET: TOP DOWN APPROACH

FIGURE 7 ASIA PACIFIC GENE SYNTHESIS MARKET: INTERVIEWS BY REGION AND DESIGNATION

FIGURE 8 ASIA PACIFIC GENE SYNTHESIS MARKET: DBMR MARKET POSITION GRID

FIGURE 9 ASIA PACIFIC GENE SYNTHESIS MARKET: VENDOR SHARE ANALYSIS

FIGURE 10 ASIA PACIFIC GENE SYNTHESIS MARKET: END USER COVERAGE GRID

FIGURE 11 ASIA PACIFIC GENE SYNTHESIS MARKET: THE CATEGORY VS TIME GRID

FIGURE 12 ASIA PACIFIC GENE SYNTHESIS MARKET SEGMENTATION

FIGURE 13 GROWING PREVALENCE OF CHRONIC INFECTIOUS DISEASES , EXPANSION OF SYNTHETIC BIOLOGY AND RISING ADOPTION OF GENE THERAPY ARE EXPECTED TO DRIVE THE MARKET FOR ASIA PACIFIC GENE SYNTHESIS MARKET IN THE FORECAST PERIOD OF 2022 TO 2029

FIGURE 14 SYNTHESIZER SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC GENE SYNTHESIS MARKET IN 2022 & 2029

FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC GENE SYNTHESIS MARKET

FIGURE 16 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2021

FIGURE 17 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, 2022-2029 (USD MILLION)

FIGURE 18 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, CAGR (2022-2029)

FIGURE 19 ASIA PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT, LIFELINE CURVE

FIGURE 20 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2021

FIGURE 21 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, 2022-2029 (USD MILLION)

FIGURE 22 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, CAGR (2022-2029)

FIGURE 23 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE TYPE, LIFELINE CURVE

FIGURE 24 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2021

FIGURE 25 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, 2022-2029 (USD MILLION)

FIGURE 26 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, CAGR (2022-2029)

FIGURE 27 ASIA PACIFIC GENE SYNTHESIS MARKET: BY GENE SYNTHESIS TYPE, LIFELINE CURVE

FIGURE 28 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2021

FIGURE 29 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, 2022-2029 (USD MILLION)

FIGURE 30 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, CAGR (2022-2029)

FIGURE 31 ASIA PACIFIC GENE SYNTHESIS MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 32 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2021

FIGURE 33 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, 2022-2029 (USD MILLION)

FIGURE 34 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, CAGR (2022-2029)

FIGURE 35 ASIA PACIFIC GENE SYNTHESIS MARKET: BY METHOD, LIFELINE CURVE

FIGURE 36 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021

FIGURE 37 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, 2021-2029 (USD MILLION)

FIGURE 38 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, CAGR (2022-2029)

FIGURE 39 ASIA PACIFIC GENE SYNTHESIS MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2021

FIGURE 41 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, 2022-2029 (USD MILLION)

FIGURE 42 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, CAGR (2022-2029)

FIGURE 43 ASIA PACIFIC GENE SYNTHESIS MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC GENE SYNTHESIS MARKET: SNAPSHOT (2021)

FIGURE 45 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021)

FIGURE 46 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2022 & 2029)

FIGURE 47 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COUNTRY (2021 & 2029)

FIGURE 48 ASIA-PACIFIC GENE SYNTHESIS MARKET: BY COMPONENT (2022-2029)

FIGURE 49 ASIA PACIFIC GENE SYNTHESIS MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.