Asia Pacific Contrast Injector Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

245.27 Million

USD

405.67 Million

2020

2028

USD

245.27 Million

USD

405.67 Million

2020

2028

| 2021 –2028 | |

| USD 245.27 Million | |

| USD 405.67 Million | |

|

|

|

Mercado de injetores de contraste Ásia-Pacífico, por produto (sistemas de injetores, consumíveis e acessórios), aplicação (radiologia, radiologia de intervenção e cardiologia de intervenção), por modalidade (injetores de cabeça dupla, cabeça única e sem seringa), design (montado em pedestal, montado no tejadilho e autónomo). Por utilizador final (hospital, centros de diagnóstico por imagem, centros de cirurgia ambulatória e outros), canal de distribuição (concurso direto e distribuidores externos).

Análise de Mercado e Insights: Mercado de Injetores de Contraste Ásia-Pacífico

Análise de Mercado e Insights: Mercado de Injetores de Contraste Ásia-Pacífico

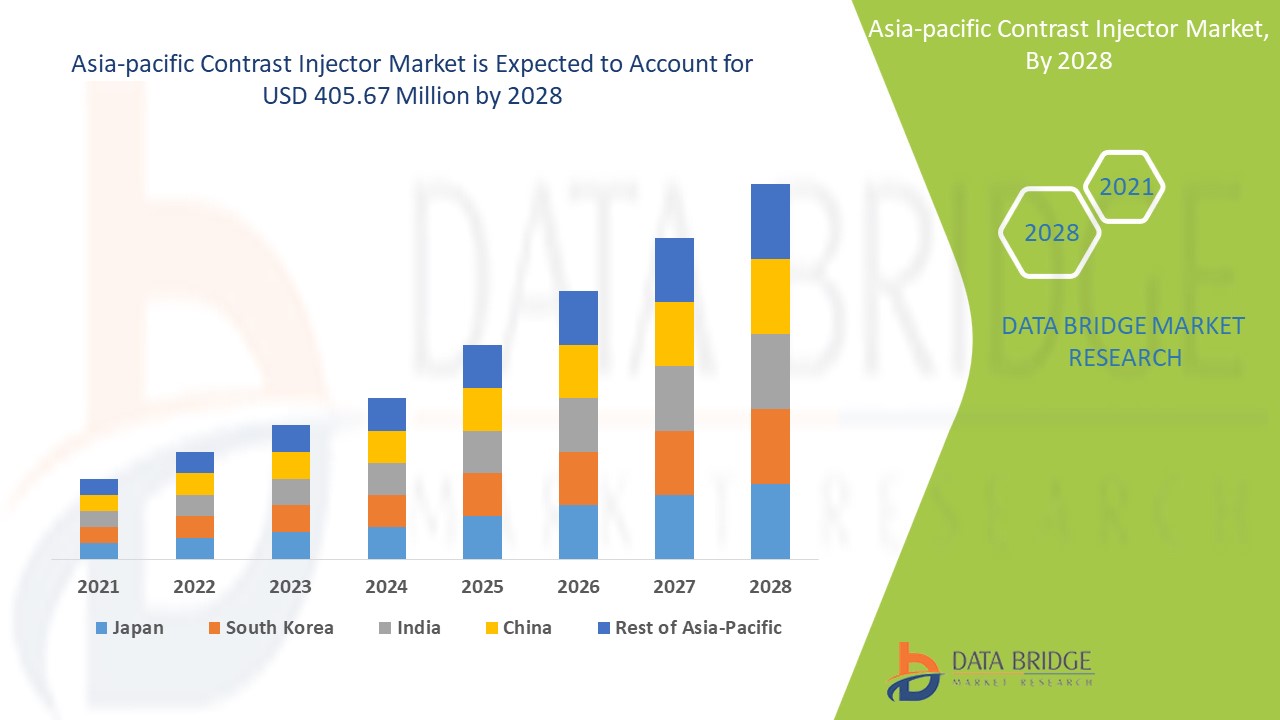

Espera-se que o mercado de injetores de contraste ganhe crescimento de mercado no período de previsão de 2021 a 2028. A Data Bridge Market Research analisa que o mercado está a crescer com um CAGR de 6,5% no período de previsão de 2021 a 2028 e deverá atingir os 405,67 milhões de dólares. até 2028, contra 245,27 milhões de dólares em 2020. Crescimento da população geriátrica e aumento do rendimento per capita; são os principais impulsionadores que impulsionaram a procura do mercado no período de previsão.

O avanço na infraestrutura de cuidados de saúde e o aumento do número de procedimentos de diagnóstico ajudam efetivamente o crescimento do mercado de injetores de contraste. No entanto, a falta de acessibilidade e o elevado custo associado aos dispositivos podem dificultar o crescimento futuro do mercado dos injetores de contraste. As parcerias e aquisições dos principais players do mercado funcionam como uma oportunidade para o crescimento do mercado dos injetores de contraste.

O relatório do mercado de injetores de contraste fornece detalhes da quota de mercado, novos desenvolvimentos e análise do pipeline de produtos, impacto dos participantes do mercado doméstico e localizado, analisa as oportunidades em termos de bolsas de receitas emergentes, alterações nas regulamentações do mercado , aprovações de produtos, decisões estratégicas, lançamentos de produtos, expansões geográficas e inovações tecnológicas no mercado. Para compreender a análise e o cenário do mercado contacte-nos para um resumo do analista, a nossa equipa irá ajudá-lo a criar uma solução de impacto na receita para atingir o objetivo desejado.

Âmbito do mercado e tamanho do mercado do injetor de contraste Ásia-Pacífico

Âmbito do mercado e tamanho do mercado do injetor de contraste Ásia-Pacífico

O mercado dos injetores de contraste está segmentado com base no produto, aplicação, modalidade, design, utilizador final e canal de distribuição. O crescimento entre segmentos ajuda-o a analisar os nichos de crescimento e as estratégias para abordar o mercado e determinar as suas principais áreas de aplicação e a diferença nos seus mercados-alvo.

- Com base no mercado do produto está segmentado em sistemas de injetores, consumíveis e acessórios. Em 2021, os sistemas injetores dominam o mercado devido ao crescente número de procedimentos de diagnóstico.

- Com base na aplicação, o mercado está segmentado em radiologia, radiologia de intervenção e cardiologia de intervenção. Em 2021, a radiologia está a dominar o mercado devido à crescente ênfase dos doentes no diagnóstico eficaz e precoce das doenças.

- Com base na modalidade o mercado está segmentado em injetores de cabeça dupla, cabeça única e sem seringa. Em 2021, o segmento de cabeça dupla está a dominar o mercado devido à sua utilização multifuncional de injeção de soluções salinas e meios de contraste utilizando um único dispositivo.

- Com base no design, o mercado está segmentado em montado em pedestal, montado no tejadilho e autónomo. Em 2021, o segmento montado em pedestal está a dominar o mercado devido ao seu design compacto e fácil de movimentar.

- Com base no utilizador final, o mercado está segmentado em hospitais, centros de diagnóstico por imagem, centros de cirurgia ambulatória e outros. Em 2021, o segmento hospitalar domina o mercado devido ao crescente número de hospitais em países de baixo e médio rendimento.

- Com base no canal de distribuição, o mercado dos injetores de contraste está segmentado em licitação direta e distribuidores externos. Em 2021, o segmento de licitação direta está a dominar o mercado porque a licitação direta detém a maior quota de mercado juntamente com o maior CAGR porque a maioria dos prestadores de serviços compra os dispositivos aos fabricantes, e percebe-se que a receita das vendas diretas é maior; por isso é influente e também cresce no mercado.

Análise ao nível do país do mercado de injetores de contraste

O mercado de injetores de contraste é analisado e são fornecidas informações sobre o tamanho do mercado por produto, aplicação, modalidade, design, utilizador final e canal de distribuição.

Os países abordados no relatório de mercado Injetor de contraste são a China, a Índia, a Indonésia, as Filipinas e o Vietname.

Espera-se que o segmento de sistemas injetores na região Ásia-Pacífico cresça com a maior taxa de crescimento no período de previsão de 2021 a 2028 devido à crescente utilização de injetores de contraste durante o diagnóstico. A China é o país líder no crescimento do mercado Ásia-Pacífico devido ao crescimento da população geriátrica, bem como ao avanço tecnológico no setor da saúde.

A secção do país do relatório também fornece fatores individuais de impacto no mercado e alterações na regulamentação do mercado interno que impactam as tendências atuais e futuras do mercado. Dados como novas vendas, vendas de reposição, demografia do país, atos regulamentares e tarifas de importação e exportação são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e disponibilidade de marcas globais e os desafios enfrentados devido à concorrência grande ou escassa de marcas locais e nacionais, o impacto dos canais de vendas são considerados, ao mesmo tempo que fornece uma análise de previsão dos dados do país.

O crescimento das atividades estratégicas dos principais players do mercado para aumentar a sensibilização para os injetores de contraste está a impulsionar o crescimento do mercado dos injetores de contraste.

O mercado de injetores de contraste também fornece análises de mercado detalhadas para o crescimento de cada país na indústria de injetores de contraste. Além disso, fornece informações detalhadas sobre as vendas de injetores de contraste, o impacto dos cenários regulamentares e os parâmetros de tendência em relação ao mercado de injetores de contraste. Os dados estão disponíveis para o período histórico de 2011 a 2019.

Análise do cenário competitivo e da quota de mercado do injetor de contraste

O panorama competitivo do mercado de injetores de contraste fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, localizações e instalações de produção, pontos fortes e fracos da empresa, lançamento de produtos, pipelines de testes de produtos, aprovações de produtos, patentes, largura do produto e respiração, domínio da aplicação, curva da linha de vida da tecnologia. Os dados fornecidos acima estão apenas relacionados com o foco da empresa relacionado com o mercado de injetores de contraste.

As principais empresas que lidam com o injetor de contraste são

Bayer AG, Guerbet, Bracco Imaging SpA, MEDTRON AG, Ulrich GmbH & Co.KG, Nemoto Kyrindo Co., Ltd., APOLLO RT Co. Ltd., SINO MDTBaslan Ltd., AADCO Medical Inc., SCW Medicath Ltd., B . Braun Melsungen Ag, Medline Industries Inc., Shenzhan Antmed Co., Ltd., Sinton Medical Products, Radtech X-Ray, Inc., Metron Healthcare, Angiodynamics Inc. entre outros.

Muitos contratos e acordos são também iniciados por empresas de todo o mundo que também estão a acelerar o mercado dos injetores de contraste.

Por exemplo,

- Em setembro de 2019, a Bayer AG lançou o seu sistema de injeção Medrad Stellant Flex CT. Stellant Flex é um sistema orientado para o utilizador que requer formação mínima de tecnólogo e automação. Oferece protocolos individualizados para pacientes e imagens personalizadas com opções flexíveis para equipamentos de capital através do programa TechCare da empresa.

- Em março de 2020, a ulrich medical apresentou uma versão do seu injetor de meio de contraste de movimento para tomografia computorizada, concebido para o mercado americano. Tem aprovação da FDA e será comercializado em cooperação com o parceiro GE Healthcare. A ulrich medical já fornece os seus injetores de meios de contraste a mais de 60 países. Este lançamento de produto impulsionou os dispositivos injetores de contraste existentes e o portefólio de produtos da empresa e ajudou-a a alcançar um crescimento rentável no mercado.

A colaboração, o lançamento de produtos, a expansão do negócio, a atribuição de prémios e reconhecimento, as joint ventures e outras estratégias do player de mercado estão a melhorar a pegada da empresa no mercado dos injetores de contraste, o que também proporciona o benefício para o crescimento do lucro da organização.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF CONTRAST INJECTOR MARKET

1.4 LIMITATIONS

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 MULTIVARIATE MODELLING

2.7 COMPONENT TYPE LIFELINE CURVE

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 VENDOR SHARE ANALYSIS

2.11 MARKET APPLICATION COVERAGE GRID

2.12 SECONDARY SOURCES

2.13 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 REGULATIONS

5.1 FOOD AND DRUG ADMINISTRATION GUIDELINES

5.2 EUROPEAN MEDICAL AGENCY REGULATION

5.3 REGULATION IN CHINA

6 REGIONAL SUMMARY

6.3 ASIA PACIFIC CONTRAST INJECTOR MARKET

6.3.1 OVERVIEW

7 MARKET OVERVIEW

7.1 DRIVERS

7.1.1 INCREASING PREVALENCE OF CHRONIC DISEASES SUCH AS CANCER AND CVD

7.1.2 GROWTH IN NUMBER OF IMAGING PROCEDURES

7.1.3 INCREASING PRODUCT APPROVAL

7.1.4 REIMBURSEMENT POLICY FOR CONTRAST MEDIA

7.2 RESTRAINTS

7.2.1 CHANGING END USER DEMAND

7.2.2 HIGH COST OF CONTRAST INJECTOR SYSTEMS

7.2.3 RISKS ASSOCIATED WITH THE USE OF CONTRAST MEDIA IN THE INJECTOR SYSTEM

7.2.4 PRODUCT RECALL

7.3 OPPORTUNITIES

7.3.1 RISING PER CAPITA INCOME AND HEALTHCARE EXPENDITURE

7.3.2 ADVANCEMENT IN TECHNOLOGY

7.3.3 COLLABORATIONS AND AGREEMENTS IN THE MARKET

7.4 CHALLENGES

7.4.1 ISSUES RELATED TO MEDICAL DEVICES HACKING

7.4.2 HIGH COST OF MRI AND CT SCAN MACHINE

7.5 IMPACT OF COVID-19 ON GLOBAL CONTRAST INJECTOR MARKET

7.6 IMPACT ON SUPPLY CHAIN

7.7 IMPACT ON DEMAND

7.8 PRICE IMPACT

7.9 STRATEGIC DECISIONS FOR MANUFACTURERS

7.1 CONCLUSION

8 CONTRAST INJECTOR MARKET, BY PRODUCT

8.1 OVERVIEW

8.2 INJECTOR SYSTEM

8.2.1 TYPE

8.2.2 CT INJECTOR

8.2.3 MRI INJECTOR

8.2.4 ANGIOGRAPHY INJECTOR

8.3 BY MODALITY

8.3.1 DUAL-HEAD

8.3.2 SINGLE HEAD

8.3.3 SYRINGELESS INJECTOR

8.4 CONSUMABLES

8.5 ACCESSORIES

9 CONTRAST INJECTOR MARKET, BY APPLICATION

9.1 OVERVIEW

9.2 RADIOLOGY

9.2.1 INJECTOR SYSTEMS

9.2.2 CONSUMABLES

9.2.3 ACCESSORIES

9.3 INTERVENTIONAL RADIOLOGY

9.3.1 INJECTOR SYSTEMS

9.3.2 CONSUMABLES

9.3.3 ACCESSORIES

9.4 INTERVENTIONAL CARDIOLOGY

9.4.1 INJECTOR SYSTEMS

9.4.2 CONSUMABLES

9.4.3 ACCESSORIES

10 CONTRAST INJECTOR MARKET, BY MODALITY

10.1 OVERVIEW

10.2 DUAL-HEAD

10.3 SINGLE HEAD

10.4 SYRINGELESS INJECTORS

11 CONTRAST INJECTOR MARKET, BY DESIGN

11.1 OVERVIEW

11.2 PEDESTAL MOUNTED

11.3 CEILING MOUNTED

11.4 STANDALONE

12 CONTRAST INJECTOR MARKET, BY END USER

12.1 OVERVIEW

12.2 HOSPITALS

12.2.1 INJECTOR SYSTEMS

12.2.2 CONSUMABLES

12.2.3 ACCESSORIES

12.3 DIANGOSTIC IMAGING CENTERS

12.3.1 INJECTOR SYSTEMS

12.3.2 CONSUMABLES

12.3.3 ACCESSORIES

12.4 AMBULATORY SURGICAL CENTERS

12.4.1 INJECTOR SYSTEMS

12.4.2 CONSUMABLES

12.4.3 ACCESSORIES

12.5 OTHERS

13 CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL

13.1 OVERVIEW

13.2 DIRECT TENDER

13.3 THIRD PARTY DISTRIBUTORS

14 CONTRAST INJECTOR MARKET, BY REGION

14.1 ASIA-PACIFIC

14.1.1 CHINA

14.1.2 INDIA

14.1.3 INDONESIA

14.1.4 PHILIPPINES

14.1.5 VIETNAM

15 CONTRAST INJECTOR MARKET: COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16 SWOT ANALYSIS

17 COMPANY PROFILE

17.1 BAYER AG

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 COMPANY SHARE ANALYSIS

17.1.4 PRODUCT PORTFOLIO

17.1.5 RECENT DEVELOPMENTS

17.2 BRACCO IMAGING SPA

17.2.1 COMPANY SNAPSHOT

17.2.2 COMPANY SHARE ANALYSIS

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT DEVELOPMENTS

17.3 GUERBET

17.3.1 COMPANY SNAPSHOT

17.3.2 REVENUE ANALYSIS

17.3.3 COMPANY SHARE ANALYSIS

17.3.4 PRODUCT PORTFOLIO

17.3.5 RECENT DEVELOPMENTS

17.4 NEMOTO KYORINDO CO., LTD

17.4.1 COMPANY SNAPSHOT

17.4.2 COMPANY SHARE ANALYSIS

17.4.3 PRODUCT PORTFOLIO

17.4.4 RECENT DEVELOPMENT

17.5 ULRICH GMBH & CO.KG

17.5.1 COMPANY SNAPSHOT

17.5.2 COMPANY SHARE ANALYSIS

17.5.3 PRODUCT PORTFOLIO

17.5.4 RECENT DEVELOPMENTS

17.6 MEDTRON AG

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT DEVELOPMENTS

17.7 AADCO MEDICAL, INC.

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT DEVELOPMENT

17.8 ANGIODYNAMICS

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT DEVELOPMENTS

17.9 APOLLO RT CO.LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 PRODUCT PORTFOLIO

17.9.3 RECENT DEVELOPMENTS

17.1 BASLAN LTD.

17.10.1 COMPANY SNAPSHOT

17.10.2 PRODUCT PORTFOLIO

17.10.3 RECENT DEVELOPMENT

17.11 B.BRAUN MELSUNGEN AG

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT DEVELOPMENT

17.12 MEDLINE INDUSTRIES, INC.

17.12.1 COMPANY SNAPSHOT

17.12.2 PRODUCT PORTFOLIO

17.12.3 RECENT DEVELOPMENTS

17.13 METRON HEALTHCARE

17.13.1 COMPANY SNAPSHOT

17.13.2 PRODUCT PORTFOLIO

17.13.3 RECENT DEVELOPMENTS

17.14 RADTECH X-RAY, INC.

17.14.1 COMPANY SNAPSHOT

17.14.2 PRODUCT PORTFOLIO

17.14.3 RECENT DEVELOPMENT

17.15 SCW MEDICATH LTD.

17.15.1 COMPANY SNAPSHOT

17.15.2 PRODUCT PORTFOLIO

17.15.3 RECENT DEVELOPMENTS

17.16 SHENZHEN ANKE HIGH-TECH

17.16.1 COMPANY SNAPSHOT

17.16.2 PRODUCT PORTFOLIO

17.16.3 RECENT DEVELOPMENTS

17.17 SHENZHEN ANTMED CO., LTD

17.17.1 COMPANY SNAPSHOT

17.17.2 PRODUCT PORTFOLIO

17.17.3 RECENT DEVELOPMENTS

17.18 SHENZHEN SEACROWN ELECTROMECHANICAL CO., LTD

17.18.1 COMPANY SNAPSHOT

17.18.2 PRODUCT PORTFOLIO

17.18.3 RECENT DEVELOPMENTS

17.19 SINO MDT

17.19.1 COMPANY SNAPSHOT

17.19.2 PRODUCT PORTFOLIO

17.19.3 RECENT DEVELOPMENT

17.2 SINTON MEDICAL PRODUCT

17.20.1 COMPANY SNAPSHOT

17.20.2 PRODUCT PORTFOLIO

17.20.3 RECENT DEVELOPMENT

18 QUESTIONNAIRE

19 RELATED REPORTS

Lista de Tabela

TABLE 1 PER CAPITA AMOUNTS: UNITED STATES (1960–2017 YEARS)

TABLE 2 CONTRAST INJECTOR MARKET, BY PRODUCT, 2019–2028 (USD MILLION)

TABLE 3 INJECTOR SYSTEM IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 4 INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 5 INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 6 INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 7 INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 8 CONSUMABLES IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 9 ACCESSORIES IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 10 CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 11 RADIOLOGY IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 12 RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 13 INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 14 INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 15 INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 16 INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 17 CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 18 DUAL-HEAD IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 19 SINGLE HEAD IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 20 SYRINGELESS INJECTORS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 21 CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 22 PEDESTAL MOUNTED IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 23 CEILING MOUNTED IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 24 STANDALONE IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 25 CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 26 HOSPITALS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 27 HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 28 DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 29 DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 30 AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 31 AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 32 OTHERS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 33 CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 34 DIRECT TENDER IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 35 THIRD PARTY DISTRIBUTORS IN CONTRAST INJECTOR MARKET, BY REGION, 2019-2028 (USD MILLION)

TABLE 36 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY COUNTRY, 2019-2028 (USD MILLION )

TABLE 37 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 38 ASIA-PACIFIC INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 39 ASIA-PACIFIC INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 40 ASIA-PACIFIC INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 41 ASIA-PACIFIC INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 42 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 43 ASIA-PACIFIC RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 44 ASIA-PACIFIC INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 45 ASIA-PACIFIC INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 46 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 47 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 48 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 49 ASIA-PACIFIC HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 50 ASIA-PACIFIC DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 51 ASIA-PACIFIC AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 52 ASIA-PACIFIC CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 53 CHINA CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 54 CHINA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 55 CHINA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 56 CHINA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 57 CHINA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 58 CHINA CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 59 CHINA RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 60 CHINA INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 61 CHINA INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 62 CHINA CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 63 CHINA CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 64 CHINA CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 65 CHINA HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 66 CHINA DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 67 CHINA AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 68 CHINA CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 69 INDIA CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 70 INDIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 71 INDIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 72 INDIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 73 INDIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 74 INDIA CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 75 INDIA RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 76 INDIA INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 77 INDIA INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 78 INDIA CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 79 INDIA CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 80 INDIA CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 81 INDIA HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 82 INDIA DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 83 INDIA AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 84 INDIA CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 85 INDONESIA CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 86 INDONESIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 87 INDONESIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 88 INDONESIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 89 INDONESIA INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 90 INDONESIA CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 91 INDONESIA RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 92 INDONESIA INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 93 INDONESIA INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 94 INDONESIA CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 95 INDONESIA CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 96 INDONESIA CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 97 INDONESIA HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 98 INDONESIA DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 99 INDONESIA AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 100 INDONESIA CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 101 PHILIPPINES CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 102 PHILIPPINES INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 103 PHILIPPINES INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 104 PHILIPPINES INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 105 PHILIPPINES INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 106 PHILIPPINES CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 107 PHILIPPINES RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 108 PHILIPPINES INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 109 PHILIPPINES INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 110 PHILIPPINES CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 111 PHILIPPINES CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 112 PHILIPPINES CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 113 PHILIPPINES HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 114 PHILIPPINES DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 115 PHILIPPINES AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 116 PHILIPPINES CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

TABLE 117 VIETNAM CONTRAST INJECTOR MARKET, BY PRODUCT, 2019-2028 (USD MILLION)

TABLE 118 VIETNAM INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (USD MILLION)

TABLE 119 VIETNAM INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (UNITS)

TABLE 120 VIETNAM INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY TYPE, 2019-2028 (INSTALLED BASED)

TABLE 121 VIETNAM INJECTOR SYSTEMS IN CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 122 VIETNAM CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 123 VIETNAM RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 124 VIETNAM INTERVENTIONAL RADIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 125 VIETNAM INTERVENTIONAL CARDIOLOGY IN CONTRAST INJECTOR MARKET, BY APPLICATION, 2019-2028 (USD MILLION)

TABLE 126 VIETNAM CONTRAST INJECTOR MARKET, BY MODALITY, 2019-2028 (USD MILLION)

TABLE 127 VIETNAM CONTRAST INJECTOR MARKET, BY DESIGN, 2019-2028 (USD MILLION)

TABLE 128 VIETNAM CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 129 VIETNAM HOSPITALS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 130 VIETNAM DIAGNOSTIC IMAGING CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 131 VIETNAM AMBULATORY SURGICAL CENTERS IN CONTRAST INJECTOR MARKET, BY END USER, 2019-2028 (USD MILLION)

TABLE 132 VIETNAM CONTRAST INJECTOR MARKET, BY DISTRIBUTION CHANNEL, 2019-2028 (USD MILLION)

Lista de Figura

FIGURE 1 CONTRAST INJECTOR MARKET: SEGMENTATION

FIGURE 2 CONTRAST INJECTOR MARKET: DATA TRIANGULATION

FIGURE 3 CONTRAST INJECTOR MARKET: DROC ANALYSIS

FIGURE 4 CONTRAST INJECTOR MARKET: GLOBAL VS REGIONAL MARKET ANALYSIS

FIGURE 5 CONTRAST INJECTOR MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 CONTRAST INJECTOR MARKET: MULTIVARIATE MODELLING

FIGURE 7 CONTRAST INJECTOR MARKET: COMPONENT TYPE LIFELINE CURVE

FIGURE 8 CONTRAST INJECTOR MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 CONTRAST INJECTOR MARKET: DBMR MARKET POSITION GRID

FIGURE 10 CONTRAST INJECTOR MARKET: VENDOR SHARE ANALYSIS

FIGURE 11 CONTRAST INJECTOR MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 12 CONTRAST INJECTOR MARKET: SEGMENTATION

FIGURE 13 U.S. IS EXPECTED TO DOMINATE THE CONTRAST INJECTOR MARKET, AND ASIA-PACIFIC IS EXPECTED TO GROW WITH THE HIGHEST CAGR IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 14 INCREASING PREVALENCE OF CHRONIC DISEASES AND GROWTH IN NUMBER OF IMAGING PROCEDURES IS EXPECTED TO DRIVE THE GROWTH OF CONTRAST INJECTOR MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 15 PRODUCT TYPE SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE CONTRAST INJECTOR MARKET IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 16 ASIA-PACIFIC IS THE FASTEST-GROWING MARKET FOR THE CONTRAST INJECTOR MANUFACTURERS IN THE FORECAST PERIOD OF 2021 TO 2028

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES AND CHALLENGES OF CONTRAST INJECTOR MARKET

FIGURE 18 ESTIMATED NUMBER OF NEW CASES IN 2018, WORLDWIDE, BOTH SEXES, ALL AGES

FIGURE 19 IMAGING RATE IN U.S. (RATE PER 1000 PERSON/YEAR)

FIGURE 20 CONTRAST INJECTOR MARKET: BY PRODUCT , 2020

FIGURE 21 CONTRAST INJECTOR MARKET: BY PRODUCT , 2021-2028 (USD MILLION)

FIGURE 22 CONTRAST INJECTOR MARKET: BY PRODUCT , CAGR (2021-2028)

FIGURE 23 CONTRAST INJECTOR MARKET: BY PRODUCT , LIFELINE CURVE

FIGURE 24 CONTRAST INJECTOR MARKET: BY APPLICATION, 2020

FIGURE 25 CONTRAST INJECTOR MARKET: BY PRODUCT, 2021-2028 (USD MILLION)

FIGURE 26 CONTRAST INJECTOR MARKET: BY APPLICATION, CAGR (2021-2028)

FIGURE 27 CONTRAST INJECTOR MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 28 CONTRAST INJECTOR MARKET: BY MODALITY, 2020

FIGURE 29 CONTRAST INJECTOR MARKET: BY MODALITY, 2021-2028 (USD MILLION)

FIGURE 30 CONTRAST INJECTOR MARKET: BY MODALITY, CAGR (2021-2028)

FIGURE 31 CONTRAST INJECTOR MARKET: BY MODALITY, LIFELINE CURVE

FIGURE 32 CONTRAST INJECTOR MARKET: BY DESIGN, 2020

FIGURE 33 CONTRAST INJECTOR MARKET: BY DESIGN, 2021-2028 (USD MILLION)

FIGURE 34 CONTRAST INJECTOR MARKET: BY DESIGN, CAGR (2021-2028)

FIGURE 35 CONTRAST INJECTOR MARKET: BY DESIGN, LIFELINE CURVE

FIGURE 36 CONTRAST INJECTOR MARKET: BY END USER, 2020

FIGURE 37 CONTRAST INJECTOR MARKET: BY END USER, 2021-2028 (USD MILLION)

FIGURE 38 CONTRAST INJECTOR MARKET: BY END USER, CAGR (2021-2028)

FIGURE 39 CONTRAST INJECTOR MARKET: BY END USER, LIFELINE CURVE

FIGURE 40 CONTRAST INJECTOR MARKET: BY DISTRIBUTION CHANNEL, 2020

FIGURE 41 CONTRAST INJECTOR MARKET: BY DISTRIBUTION CHANNEL, 2021-2028 (USD MILLION)

FIGURE 42 CONTRAST INJECTOR MARKET: BY DISTRIBUTION CHANNEL, CAGR (2021-2028)

FIGURE 43 CONTRAST INJECTOR MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 44 ASIA-PACIFIC CONTRAST INJECTOR MARKET: SNAPSHOT (2020)

FIGURE 45 ASIA-PACIFIC CONTRAST INJECTOR MARKET: BY COUNTRY (2020)

FIGURE 46 ASIA-PACIFIC CONTRAST INJECTOR MARKET: BY COUNTRY (2021 & 2028)

FIGURE 47 ASIA-PACIFIC CONTRAST INJECTOR MARKET: BY COUNTRY (2020 & 2028)

FIGURE 48 ASIA-PACIFIC CONTRAST INJECTOR MARKET: BY PRODUCT (2021-2028)

FIGURE 49 ASIA PACIFIC CONTRAST INJECTOR MARKET: COMPANY SHARE 2020 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.