Asia Pacific Automotive Level Sensor Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

431.14 Million

USD

560.75 Million

2024

2032

USD

431.14 Million

USD

560.75 Million

2024

2032

| 2025 –2032 | |

| USD 431.14 Million | |

| USD 560.75 Million | |

|

|

|

|

Segmentação do mercado de sensores de nível automotivos da Ásia-Pacífico, por tipo de produto (sensor de nível de combustível, sensor de nível de óleo do motor, sensor de nível de líquido de arrefecimento, sensor de nível de fluido de freio, sensor de nível de fluido de direção hidráulica, sensor magnético e outros), tipo (capacitivo, película resistiva, ultrassônico, resistores discretos, óptico e outros), tipo de monitoramento (monitoramento de nível contínuo e monitoramento de nível pontual), aplicação (monitoramento de reabastecimento e drenagem de combustível, prevenção contra roubo de combustível e monitoramento de consumo de combustível), tipo de veículo (veículo de passeio e veículo comercial), canal de vendas (fabricante de equipamento original (OEM) e mercado de reposição), canal de distribuição (online e offline) - Tendências e previsões do setor até 2032

Tamanho do mercado de sensores de nível automotivos da Ásia-Pacífico

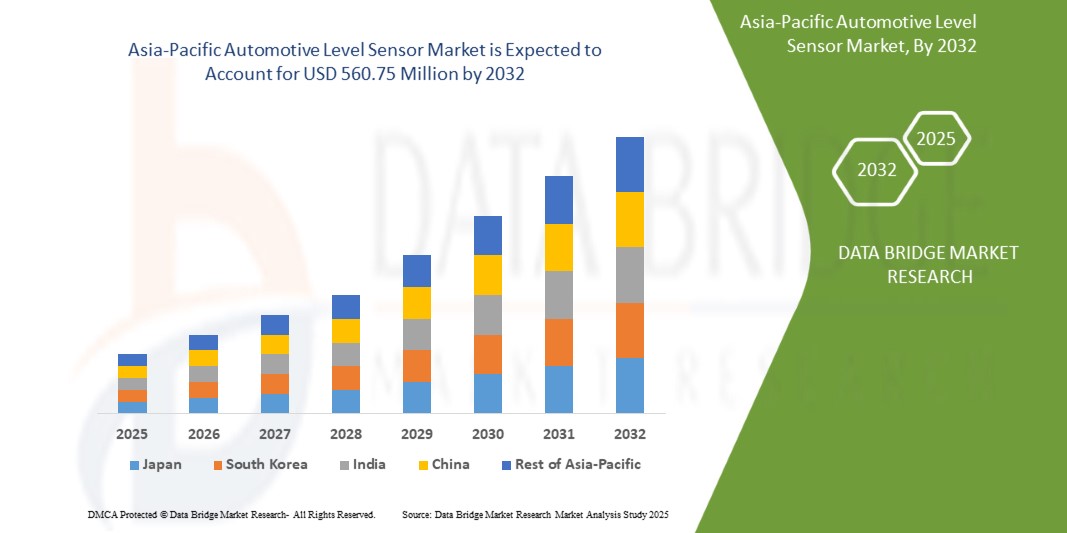

- O tamanho do mercado de sensores de nível automotivo da Ásia-Pacífico foi avaliado em US$ 431,14 milhões em 2024 e deve atingir US$ 560,75 milhões até 2032 , com um CAGR de 3,34% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente adoção de tecnologias avançadas em veículos, pela crescente ênfase na eficiência de combustível e pelas rigorosas regulamentações governamentais sobre controle de emissões. Os sensores de nível automotivos desempenham um papel vital no monitoramento de fluidos críticos, como combustível, óleo do motor e líquido de arrefecimento, garantindo o desempenho, a segurança e a conformidade do veículo com as normas ambientais em constante evolução.

- Além disso, a crescente demanda por veículos conectados e elétricos, aliada à integração de sistemas de diagnóstico inteligentes, está acelerando a adoção de soluções inovadoras de detecção de nível. Esses fatores convergentes estão impulsionando a rápida adoção tanto em veículos de passeio quanto comerciais, impulsionando significativamente o crescimento do setor.

Análise do mercado de sensores de nível automotivos da Ásia-Pacífico

- Sensores de nível automotivos são dispositivos de precisão projetados para detectar e monitorar os níveis de líquidos em veículos, incluindo combustível, óleo do motor, fluido de freio, líquido de arrefecimento e fluido da direção hidráulica. Esses sensores são essenciais para manter a eficiência do motor, prevenir falhas mecânicas e garantir a operação segura do veículo em diversas condições de direção.

- A crescente demanda por sensores de nível automotivos é impulsionada principalmente pelo aumento da produção de veículos, normas de segurança e emissões mais rigorosas e pela crescente preferência do consumidor por veículos tecnologicamente avançados e com baixo consumo de combustível. O papel crescente dos sensores em veículos híbridos e elétricos reforça ainda mais sua importância, tornando-os um facilitador fundamental na transformação da indústria automotiva.

- A China dominou o mercado de sensores de nível automotivos em 2024, devido à sua forte base de fabricação automotiva, altos volumes de produção de veículos e rápida adoção de tecnologias avançadas de sensores

- Espera-se que a Índia seja o país com crescimento mais rápido no mercado de sensores de nível automotivos durante o período previsto devido ao aumento da produção de veículos, à rápida urbanização e à crescente demanda por veículos mais seguros e com baixo consumo de combustível.

- O segmento de monitoramento contínuo de nível dominou o mercado, com uma participação de mercado de 62% em 2024, devido à sua capacidade de fornecer medições precisas e em tempo real de fluidos automotivos críticos, como combustível, óleo do motor e líquido de arrefecimento. As montadoras preferem cada vez mais sistemas de monitoramento contínuo para aumentar a eficiência dos veículos, prevenir panes e garantir a conformidade regulatória. A integração de sensores avançados com sistemas de diagnóstico de bordo fortalece ainda mais sua adoção, tornando-o uma escolha preferencial para veículos de passeio e comerciais.

Escopo do relatório e segmentação do mercado de sensores de nível automotivos da Ásia-Pacífico

|

Atributos |

Principais insights do mercado de sensores de nível automotivos da Ásia-Pacífico |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além de insights de mercado, como valor de mercado, taxa de crescimento, segmentos de mercado, cobertura geográfica, participantes do mercado e cenário de mercado, o relatório de mercado selecionado pela equipe de pesquisa de mercado da Data Bridge inclui análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise pilão. |

Tendências do mercado de sensores de nível automotivos da Ásia-Pacífico

Aumento da demanda do consumidor por segurança e conforto

- A crescente ênfase na segurança veicular e no conforto superior ao dirigir está alimentando a demanda por sensores de nível automotivos avançados nos mercados globais. Esses sensores estão se tornando componentes essenciais nos veículos, garantindo o monitoramento preciso dos níveis de fluidos e possibilitando sistemas que melhoram a experiência do motorista, a eficiência do veículo e a proteção dos passageiros.

- Por exemplo, a Bosch desenvolveu uma gama de sensores avançados de nível de combustível e óleo do motor integrados a sistemas de alerta, permitindo que os fabricantes de automóveis aprimorem os padrões de segurança e ofereçam maior conveniência ao usuário. Da mesma forma, a HELLA GmbH fornece sensores para fluido de lavagem e fluido de freio projetados para alertar os motoristas a tempo, prevenindo panes e mantendo o conforto ao dirigir.

- Os sensores de nível automotivos contribuem diretamente para a segurança, permitindo a detecção precisa de níveis baixos de óleo, fluido de freio ou líquido de arrefecimento, prevenindo danos ao motor, falhas nos freios e superaquecimento. Seu papel em garantir alertas oportunos reduz os riscos durante a condução e prolonga a vida útil dos componentes do veículo, reforçando seu valor nos sistemas automotivos modernos.

- A crescente demanda do consumidor por experiências premium também está incentivando a adoção de sensores de nível em carros de luxo e médio porte. Aplicações como sistemas avançados de monitoramento de combustível integrados a painéis digitais aumentam o conforto ao dirigir, fornecendo insights precisos em tempo real, em linha com as expectativas dos consumidores antenados em tecnologia.

- Além disso, as tendências de eletrificação no setor automotivo estão levando os fabricantes a adotar sensores sofisticados de nível de líquido de arrefecimento e eletrólitos para baterias, a fim de garantir o desempenho e a segurança ideais dos veículos elétricos. Isso demonstra como as expectativas dos consumidores em relação ao conforto e à segurança estão moldando diretamente a evolução das tecnologias de sensores de nível.

- De modo geral, a crescente preferência do consumidor por veículos que combinam desempenho, conforto e segurança garante que os sensores de nível automotivos permaneçam indispensáveis. Essa tendência está levando os fabricantes a priorizar a inovação e a integração de sensores, remodelando assim o cenário mais amplo do design automotivo e da experiência do cliente.

Dinâmica do mercado de sensores de nível automotivos da Ásia-Pacífico

Motorista

Indústria automotiva em rápida expansão

- O rápido crescimento da indústria automotiva global, especialmente em economias emergentes, está gerando uma demanda substancial por sensores de nível automotivos. Com o aumento da produção de veículos e a crescente adoção de veículos de passeio e comerciais, os fabricantes estão integrando sensores avançados para atender aos padrões regulatórios e às expectativas dos consumidores.

- Por exemplo, a DENSO Corporation fornece uma ampla variedade de sensores de nível de líquidos para fabricantes de equipamentos originais (OEMs) automotivos globais, apoiando a expansão de veículos com motor de combustão interna e modelos híbridos. As crescentes parcerias da empresa com montadoras destacam o papel crescente dos sensores de nível na facilitação do crescimento da indústria.

- O boom automotivo em mercados como Índia, China e Sudeste Asiático está aumentando a necessidade de monitoramento de combustível, líquido de arrefecimento e fluido de freio para manter o desempenho do veículo em diversas condições de direção. Esses mercados em rápido desenvolvimento estão se tornando fortes centros de crescimento para a adoção de soluções de sensores de nível confiáveis e com boa relação custo-benefício.

- Além disso, a mudança para veículos elétricos e híbridos trouxe um novo impulso à adoção de sensores de nível. O gerenciamento de baterias, os sistemas de controle térmico e a otimização de energia em veículos elétricos dependem de tecnologias de detecção de nível altamente precisas, tornando os sensores cruciais para a transição rumo à mobilidade sustentável.

- Em conclusão, a expansão da indústria automotiva, com sua crescente complexidade e dependência do desempenho acionado por sensores, está impulsionando o crescimento consistente do mercado de sensores de nível. O alinhamento entre a demanda do consumidor, a inovação tecnológica e a produção automotiva garante que esse impulsionador sustentará o desenvolvimento da indústria a longo prazo.

Restrição/Desafio

Alto custo de sensores avançados

- Os altos custos associados aos sensores de nível automotivos avançados representam uma restrição fundamental ao crescimento do mercado, especialmente em segmentos sensíveis a custos e regiões em desenvolvimento. Sensores sofisticados, como aqueles equipados com tecnologias ultrassônicas e capacitivas, envolvem custos de produção mais elevados devido ao uso de componentes de precisão e eletrônica avançada.

- Por exemplo, a Continental AG fornece soluções avançadas de detecção de nível de fluidos múltiplos que proporcionam monitoramento altamente preciso para veículos modernos, mas a um custo superior ao dos sensores tradicionais baseados em flutuadores. Essa diferença de preço faz com que os fabricantes tenham receio de integrar sensores avançados em categorias de veículos de menor custo, onde as margens são apertadas.

- O desafio é ainda mais agravado pela necessidade de calibração, manutenção e possíveis substituições regulares, o que aumenta as despesas de longo prazo para fabricantes e consumidores. Esses custos contínuos limitam a adoção em regiões onde a acessibilidade é um fator de compra primordial para os clientes.

- Além disso, a crescente complexidade dos veículos, especialmente elétricos e híbridos, exige a integração de múltiplos sensores especializados, elevando significativamente o conteúdo eletrônico geral e o custo do veículo. As montadoras frequentemente enfrentam o dilema entre manter os veículos acessíveis e incorporar tecnologias avançadas de sensores em todos os modelos.

- Como resultado, os altos custos continuam sendo uma barreira à ampla penetração de sensores de nível avançados em todos os segmentos de veículos. Para superar essa lacuna, os fabricantes devem se concentrar em projetos com otimização de custos, economias de escala e inovação nos processos de fabricação de sensores, a fim de garantir acessibilidade e ampla adoção nos próximos anos.

Escopo do mercado de sensores de nível automotivos da Ásia-Pacífico

O mercado é segmentado com base no tipo de produto, tipo, tipo de monitoramento, aplicação, tipo de veículo, canal de vendas e canal de distribuição.

- Por tipo de produto

Com base no tipo de produto, o mercado de sensores de nível automotivos é segmentado em sensores de nível de combustível, sensores de nível de óleo do motor, sensores de nível do líquido de arrefecimento, sensores de nível do fluido de freio, sensores de nível do fluido da direção hidráulica, sensores magnéticos e outros. O segmento de sensores de nível de combustível dominou a maior fatia de mercado em 2024, devido ao seu papel crítico no monitoramento de combustível em tempo real, na melhoria da eficiência de direção e na prevenção de parada do motor. As montadoras priorizam cada vez mais sensores avançados de nível de combustível para otimizar a economia de combustível, cumprir as rigorosas normas de emissões e aprimorar a experiência de direção, tornando-os indispensáveis em veículos de passeio e comerciais.

Prevê-se que o segmento de sensores de nível de óleo do motor apresentará a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente conscientização sobre a saúde do motor e pela necessidade de prevenir danos causados pela falta de óleo. Veículos modernos integram sensores de nível de óleo do motor a sistemas de diagnóstico de bordo, fornecendo alertas em tempo real aos motoristas e reduzindo os custos de manutenção. A crescente adoção em veículos premium e de médio porte, aliada à preferência do consumidor por recursos avançados de segurança e eficiência veicular, acelera a demanda neste segmento.

- Por tipo

Com base no tipo, o mercado de sensores de nível automotivos é segmentado em capacitivos, de filme resistivo, ultrassônicos, resistores discretos, ópticos e outros. O segmento de sensores capacitivos foi responsável pela maior fatia da receita de mercado em 2024, apoiado por sua alta precisão, confiabilidade e versatilidade na detecção de níveis de líquidos em fluidos automotivos. Sensores capacitivos são amplamente preferidos devido à sua durabilidade, baixa manutenção e capacidade de funcionar eficazmente em ambientes operacionais adversos, tornando-os uma escolha padrão para OEMs.

Espera-se que o segmento de sensores ultrassônicos registre a maior taxa de crescimento entre 2025 e 2032, à medida que as montadoras adotam cada vez mais tecnologias de detecção sem contato. Sensores ultrassônicos fornecem detecção precisa de nível sem serem afetados por variações de temperatura ou contaminação de fluidos, oferecendo precisão superior em aplicações críticas. Sua integração com sistemas avançados de assistência ao motorista (ADAS) e plataformas de monitoramento baseadas em IoT aprimora ainda mais sua adoção em veículos de última geração.

- Por tipo de monitoramento

Com base no tipo de monitoramento, o mercado de sensores de nível automotivos é categorizado em monitoramento de nível contínuo e monitoramento de nível pontual. O segmento de monitoramento de nível contínuo dominou o mercado com uma participação de 62% em 2024, impulsionado por sua capacidade de fornecer medições precisas e em tempo real de fluidos automotivos críticos, como combustível, óleo do motor e líquido de arrefecimento. As montadoras preferem cada vez mais sistemas de monitoramento contínuo para aumentar a eficiência dos veículos, prevenir panes e garantir a conformidade regulatória. A integração de sensores avançados com sistemas de diagnóstico de bordo fortalece ainda mais sua adoção, tornando-o uma escolha preferencial para veículos de passeio e comerciais.

O segmento de monitoramento de nível pontual deverá apresentar o CAGR mais rápido entre 2025 e 2032, apoiado por sua relação custo-benefício e ampla utilização na detecção de limites mínimos e máximos de fluidos. A crescente demanda por detecção confiável de limites em veículos de entrada e instalações de reposição impulsiona seu crescimento. Este segmento está ganhando força especialmente em regiões com alta adoção de veículos de baixo custo, onde a acessibilidade continua sendo um fator-chave.

- Por aplicação

Com base na aplicação, o mercado é segmentado em monitoramento de abastecimento e drenagem de combustível, prevenção de roubo de combustível e monitoramento do consumo de combustível. O segmento de monitoramento do consumo de combustível deteve a maior participação de mercado em 2024, com o aumento dos preços dos combustíveis e regulamentações de emissões mais rigorosas pressionando consumidores e operadores de frotas a otimizar o uso de combustível. Os fabricantes de equipamentos originais (OEMs) estão integrando sensores avançados de monitoramento do consumo de combustível para melhorar a eficiência, reduzir a pegada de carbono e atender às exigências ambientais.

Espera-se que o segmento de prevenção de roubo de combustível se expanda em ritmo acelerado entre 2025 e 2032, impulsionado pela crescente preocupação com frotas comerciais e operações logísticas. O aumento dos casos de furto de combustível em mercados emergentes incentiva a adoção de sensores de nível antirroubo avançados com integração de GPS. A combinação de monitoramento em tempo real e recursos de segurança garante melhor gestão da frota e economia de custos, acelerando a demanda neste segmento.

- Por tipo de veículo

Com base no tipo de veículo, o mercado é dividido em veículos de passeio e veículos comerciais. O segmento de veículos de passeio dominou a participação de mercado na receita em 2024, impulsionado pelos altos volumes de produção de veículos e pela crescente incorporação de sistemas de sensores avançados em modelos de médio e alto padrão. A preferência do consumidor por melhorias em segurança, desempenho e eficiência continua impulsionando a demanda nesta categoria.

Prevê-se que o segmento de veículos comerciais registre o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente adoção de sensores de nível para gestão de frotas, detecção de roubo de combustível e otimização da manutenção. As pressões regulatórias sobre eficiência de combustível e emissões, aliadas ao crescimento do setor de logística e transporte, aumentam ainda mais a integração de soluções avançadas de monitoramento de nível em frotas comerciais.

- Por canal de vendas

Com base no canal de vendas, o mercado é segmentado em fabricante de equipamento original (OEM) e mercado de reposição. O segmento OEM conquistou a maior fatia da receita em 2024, devido à tendência crescente de integração de sensores avançados diretamente nos veículos durante a produção. As montadoras preferem sensores de nível instalados de fábrica para aumentar a confiabilidade da marca e atender às rigorosas exigências governamentais sobre emissões e segurança.

A projeção é de que o segmento de reposição cresça ao ritmo mais acelerado entre 2025 e 2032, impulsionado pela crescente demanda por reposição e pela adoção de sensores atualizados em frotas de veículos antigos. Consumidores preocupados com os custos em regiões em desenvolvimento estão investindo em instalações de reposição para prolongar a vida útil dos veículos e melhorar a eficiência, tornando essa uma via de crescimento lucrativa.

- Por canal de distribuição

Com base no canal de distribuição, o mercado é segmentado em online e offline. O segmento offline dominou o mercado em 2024, com componentes automotivos sendo amplamente distribuídos por redes de concessionárias, oficinas mecânicas e centros de serviços automotivos estabelecidos. A distribuição offline oferece confiabilidade, inspeção física e serviços de instalação profissional, tornando-se a escolha preferida dos consumidores.

Espera-se que o segmento online se expanda com a CAGR mais rápida entre 2025 e 2032, impulsionado pelo rápido crescimento das plataformas de e-commerce e marketplaces digitais para componentes automotivos. Os consumidores preferem cada vez mais as compras online devido às vantagens de custo, variedade de produtos e entrega em domicílio. A disponibilidade de guias de integração de sensores e políticas de devolução facilitadas incentivam ainda mais essa mudança para canais online.

Análise regional do mercado de sensores de nível automotivos da Ásia-Pacífico

- A China dominou o mercado de sensores de nível automotivos com a maior participação na receita em 2024, impulsionada por sua forte base de fabricação automotiva, altos volumes de produção de veículos e rápida adoção de tecnologias avançadas de sensores

- A crescente regulamentação governamental sobre eficiência de combustível e controle de emissões, aliada à demanda por melhorias de segurança e desempenho, acelerou a integração de sensores. A presença de fabricantes líderes nacionais e internacionais de sensores, juntamente com cadeias de suprimentos robustas, fortalece ainda mais o domínio da China no mercado regional.

- A crescente demanda por veículos conectados e inteligentes, a expansão da produção de veículos elétricos (VE) e os avanços na miniaturização de sensores impulsionaram ainda mais a adoção pelo mercado. Investimentos contínuos em P&D, parcerias com fabricantes de equipamentos originais (OEMs) automotivos globais e capacidade de fabricação em larga escala garantem que a China mantenha sua liderança no mercado da Ásia-Pacífico.

Visão do mercado de sensores de nível automotivos do Japão

Prevê-se que o mercado japonês cresça de forma constante entre 2025 e 2032, impulsionado pela forte preferência do consumidor por veículos tecnologicamente avançados e por rigorosas regulamentações de segurança automotiva. As montadoras japonesas priorizam inovação, confiabilidade e eficiência, impulsionando a adoção de sensores de nível capacitivos e ultrassônicos. O crescimento é ainda sustentado pela liderança do país na produção de veículos híbridos e elétricos, onde sistemas precisos de monitoramento de fluidos são essenciais. Um ecossistema automotivo maduro, foco em qualidade e investimentos contínuos em P&D posicionam o Japão como um mercado estável e inovador para sensores de nível automotivos.

Visão do mercado de sensores de nível automotivos da Índia

A Índia deverá registrar o CAGR mais rápido no mercado de sensores de nível automotivos da Ásia-Pacífico entre 2025 e 2032. O crescimento é impulsionado pelo aumento da produção de veículos, pela rápida urbanização e pela crescente demanda por veículos mais seguros e com baixo consumo de combustível. A crescente adoção de sensores de nível em frotas comerciais para prevenção de roubo de combustível e monitoramento do consumo reforça ainda mais a penetração no mercado. Iniciativas governamentais que promovem o controle de emissões e os padrões de segurança veicular estão impulsionando as montadoras a integrar sensores avançados. A expansão da produção nacional, aliada ao crescente mercado de reposição e à crescente preferência do consumidor por tecnologias acessíveis e avançadas, posiciona a Índia como o mercado de crescimento mais rápido da região.

Participação no mercado de sensores de nível automotivos da Ásia-Pacífico

A indústria de sensores de nível automotivos é liderada principalmente por empresas bem estabelecidas, incluindo:

- Continental AG (Alemanha)

- Littelfuse, Inc. (EUA)

- Bosch Rexroth Sp. Z OO (Polônia)

- Elobau GmbH & Co. KG.C (Alemanha),

- Pricol Limited (Índia)

- Bourns Inc (EUA)

- Tecnologia de Detecção Zhengyang de Guangdong Co., Ltd. (China)

- Misensor Tech Co., Ltd. (China)

- Omnicomm (Estônia)

- Soway Tech Limited (China)

- Spark Minda (Índia)

- Standex Electronics, Inc (EUA)

- Technoton (República Tcheca)

- Wema UK (Reino Unido)

Últimos desenvolvimentos no mercado de sensores de nível automotivos da Ásia-Pacífico

- Em agosto de 2024, a Littelfuse, Inc. revelou suas avançadas séries de diodos TVS de alta confiabilidade e baixa capacitância SMBLCEHR HRA, SMCLCE-HR/HRA e SMDLCE-HR/HRA, projetados especificamente para proteger sistemas aviônicos contra raios e eventos severos de sobretensão. Este desenvolvimento estabelece um novo padrão no setor de proteção de alta confiabilidade, reforçando a liderança da Littelfuse em eletrônica aeroespacial. Ao estabelecer padrões mais elevados de segurança e durabilidade, a empresa fortalece sua vantagem competitiva e expande sua adoção no setor de aviação, onde resiliência e confiabilidade são cruciais.

- Em agosto de 2024, o Conselho Executivo da Continental AG anunciou a avaliação de uma potencial cisão do seu setor do Grupo Automotivo em uma empresa independente. Esta revisão estratégica visa desbloquear maior criação de valor, aprimorar a agilidade operacional e maximizar as oportunidades de crescimento em meio à rápida evolução das condições do mercado automotivo. Se aprovada pelos Conselhos Executivo e de Supervisão e, posteriormente, pelos acionistas em abril de 2025, a cisão poderá ser concluída até o final de 2025. Espera-se que tal movimento remodele a estrutura de negócios da Continental, permitindo um foco mais preciso nos seus setores de Pneus e ContiTech, ao mesmo tempo que permite à nova entidade buscar inovação e parcerias aceleradas no setor automotivo.

- Em julho de 2024, a Continental AG apresentou seu portfólio expandido de produtos na feira Automechanika, em Frankfurt, apresentando inovações como sensores ADAS avançados, correias multi-V sustentáveis e o pneu UltracContact NXT, que contém até 65% de materiais sustentáveis. Essa demonstração reforçou a liderança tecnológica da Continental e também destacou seu forte compromisso com a sustentabilidade. Ao se alinhar às tendências do setor em mobilidade verde e segurança avançada, a empresa aprimorou seu posicionamento global de marca, atraiu clientes em potencial e fortaleceu parcerias com fabricantes de equipamentos originais (OEMs) focados em soluções automotivas ecológicas e de alto desempenho.

- Em abril de 2024, a Littelfuse, Inc. lançou o circuito integrado de proteção de supercapacitor de célula única LS0502SCD33S, uma adição avançada ao seu portfólio de circuitos integrados de proteção eFuse. Essa inovação melhora a segurança e a confiabilidade das fontes de alimentação de reserva que operam em condições extremas, um requisito crítico em aplicações automotivas, industriais e de energia. Ao estabelecer um novo padrão de desempenho e proteção, a Littelfuse expandiu sua presença no mercado de circuitos integrados de proteção, atendendo à crescente demanda por proteções eletrônicas robustas em setores de infraestrutura crítica.

- Em março de 2024, a Continental AG anunciou uma colaboração estratégica com a Ambarella, Inc., líder em silício de visão com IA, para o desenvolvimento conjunto de ADAS de última geração e soluções de direção automatizada. Essa parceria combina o processamento de IA de alto desempenho da Ambarella com a ampla experiência da Continental em integração de sensores e sistemas. Espera-se que a colaboração acelere a implantação de tecnologias de direção automatizada inteligentes, seguras e escaláveis, fortalecendo o papel da Continental na construção do futuro da mobilidade, ao mesmo tempo em que atende à crescente demanda por sistemas avançados de assistência ao motorista.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.