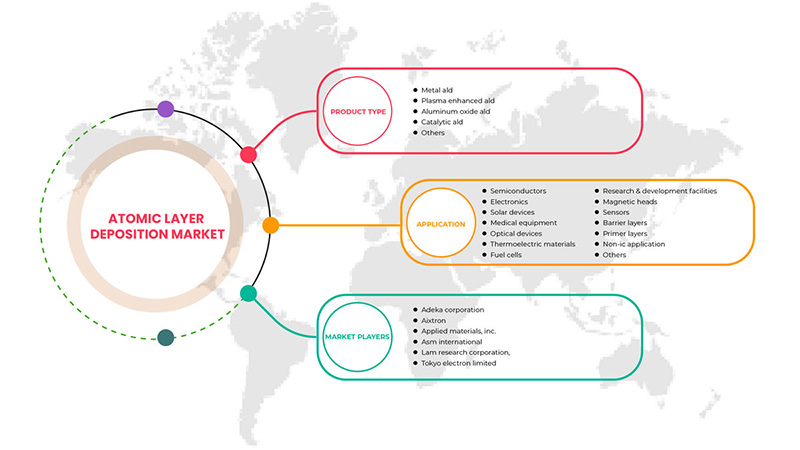

Mercado de deposição de camada atómica da Ásia-Pacífico, por tipo de produto (ALD de metal, ALD de óxido de alumínio, ALD melhorado por plasma, ALD catalítico, outros), aplicação (semicondutores, dispositivos solares , eletrónica , equipamento médico, instalações de investigação e desenvolvimento, células de combustível , ópticas Tendências e previsões da indústria de dispositivos, materiais termoelétricos, cabeças magnéticas, sensores, camadas de barreira, camadas de primer, aplicações não IC, outros) até 2029.

Análise e Insights do Mercado de Deposição de Camada Atómica da Ásia-Pacífico

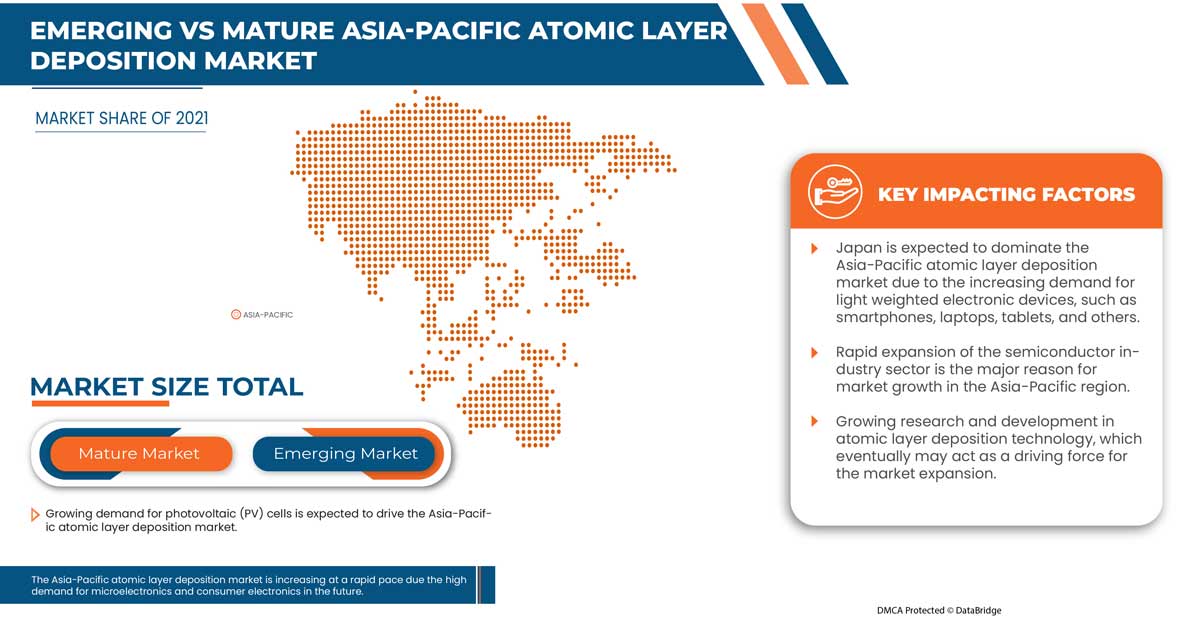

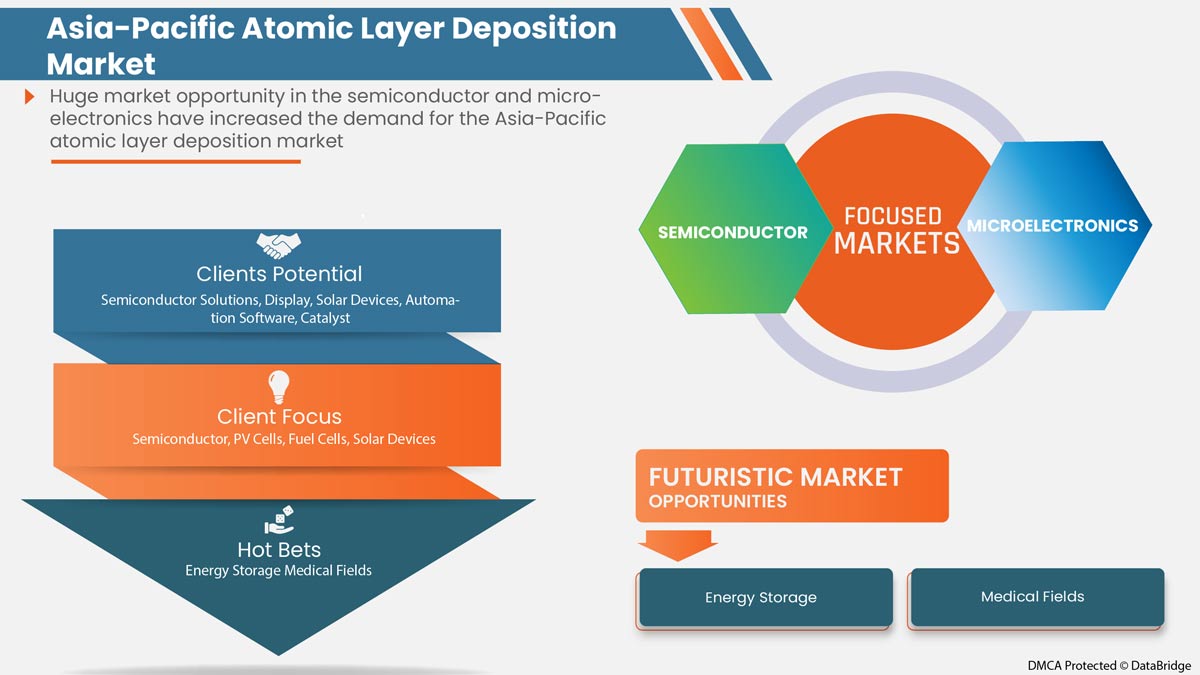

Espera-se que o mercado de deposição de camadas atómicas da Ásia-Pacífico cresça devido ao aumento da procura por indústrias de semicondutores. Como o semicondutor é o principal componente ou aplicação do ALD, o aumento da procura de semicondutores ajuda a aumentar a procura de ALD. Alguns outros fatores que deverão impulsionar o crescimento do mercado estão a levantar preocupações sobre os resultados da recolha de energia no elevado crescimento das células fotovoltaicas (PV).

O principal factor que se prevê que limite o mercado é o elevado custo de investimento inicial na produção de ALD, o que afectou o crescimento do mercado.

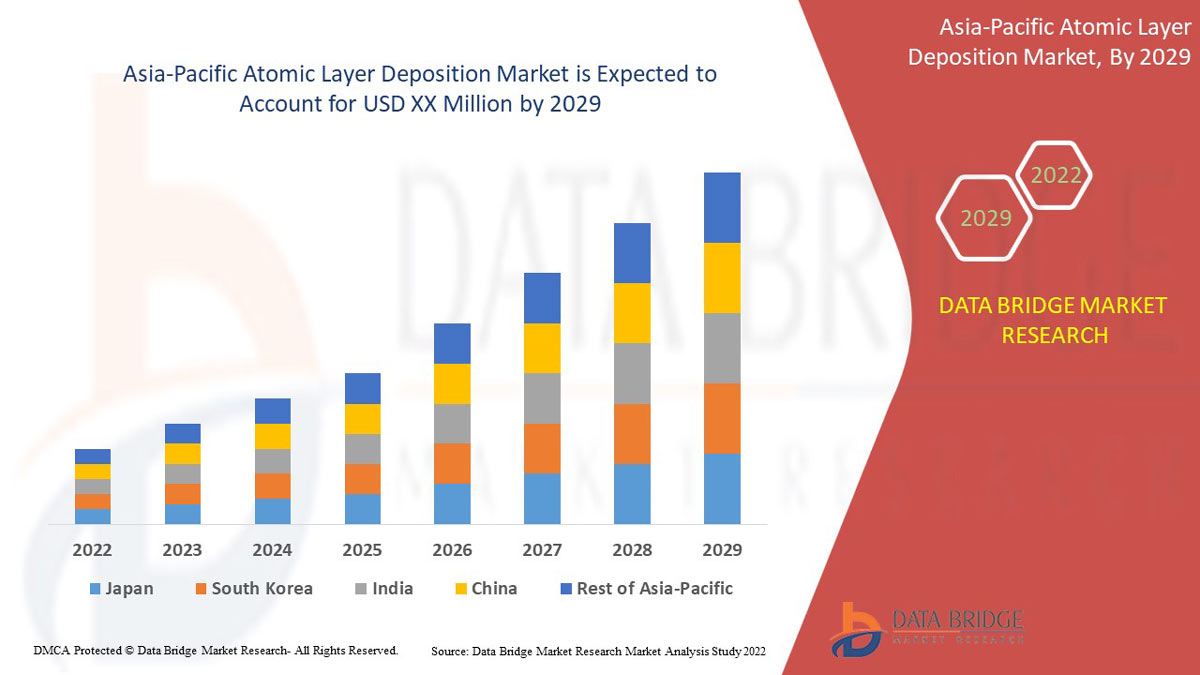

A Data Bridge Market Research analisa que o mercado de deposição de camadas atómicas na Ásia-Pacífico crescerá a um CAGR de 15,4% durante o período previsto de 2022 a 2029.

|

Métrica de Reporte |

Detalhes |

|

Período de previsão |

2022 a 2029 |

|

Ano base |

2021 |

|

Anos históricos |

2020 (Personalizável para 2019 - 2015) |

|

Unidades quantitativas |

Receita em milhões de dólares americanos, preço em dólares americanos |

|

Segmentos abrangidos |

Por tipo de produto (ALD de metal, ALD de óxido de alumínio, ALD melhorado por plasma, ALD catalítico, outros), aplicação (semicondutores, dispositivos solares , eletrónica , equipamento médico, instalações de investigação e desenvolvimento, células de combustível , dispositivos óticos , materiais termoelétricos, cabeças magnéticas, Sensores, Camadas de Barreira, Camadas de Primer, Aplicação Não-CI, Outros). |

|

Países abrangidos |

China, Índia, Japão, Coreia do Sul, Austrália, Tailândia, Malásia, Indonésia, Singapura, Filipinas e restante Ásia-Pacífico. |

|

Atores do mercado abrangidos |

ADEKA CORPORATION, AIXTRON, Applied Materials, Inc., ASM International, LAM RESEARCH CORPORATION, Tokyo Electron Limited, Kurt J. Lesker Company, ANRIC TECH., SENTECH Instruments GmbH, Oxford Instruments, Forge Nano Inc., Veeco Instruments Inc., Merck KGaA, HZO, Inc., Picosun Oy., entre outros. |

Definição de Mercado

A deposição de camada atómica (ALD) refere-se ao processo de deposição de materiais precursores em substratos para melhorar ou modificar propriedades como a resistência química, a força e a condutividade. O processo é considerado uma subdivisão da deposição química de vapor (CVD) na deposição de camada atómica. Na maioria das vezes, são utilizados dois produtos químicos para a reação, geralmente designados por precursores.

Dinâmica do mercado de deposição de camada atómica na Ásia-Pacífico

Esta secção trata da compreensão dos impulsionadores, oportunidades, restrições e desafios do mercado. Tudo isto é discutido em detalhe abaixo:

Motoristas:

- RÁPIDA EXPANSÃO DA INDÚSTRIA DE SEMICONDUTORES

A maioria dos dispositivos eletrónicos utilizados diariamente são baseados em materiais semicondutores, pois têm propriedades como o aumento da temperatura, resultando num aumento da condutividade. Um declínio da temperatura resulta num declínio da condutividade. A indústria de semicondutores está a crescer rapidamente devido à sua vasta gama de produtos, tais como todos os circuitos integrados, teclados, ratos, todos os tipos de microprocessadores e microcontroladores, chips de memória, transístores e outros .

- A PREOCUPAÇÃO COM A CAPTAÇÃO DE ENERGIA RESULTA NUM ALTO CRESCIMENTO DE CÉLULAS FOTOVOLTAICAS (PV)

A energia fotovoltaica (FV) é vulgarmente chamada de tecnologia de recolha de energia e é utilizada para converter a energia solar em energia elétrica, que é eletricidade. A procura de células fotovoltaicas tem aumentado devido ao preço relativamente baixo e à vasta gama de aplicações, tais como semáforos solares, bombas de energia solar, lâmpadas solares, calculadoras de energia solar e outras.

Restrição

- ALTOS CUSTOS DE INVESTIMENTO INICIAL

A deposição de camada atómica (ALD) é a deposição de materiais precursores em substratos para melhorar/modificar propriedades como a condutividade, resistência química e resistência. Para prestar serviços ALD, o fornecedor necessita de adquirir equipamento para o processo de deposição de camada atómica, como o Cambridge NanoTech Fiji F200 Atomic Layer Deposition System, Open Load ALD System: OpAL, ALD 200L Series da Kurt J. Lesker Company, Cambridge NanoTech Savannah Series Sistema de deposição de camada atómica, sistema ALD de plasma e térmico: FlexAL, sistema de deposição de feixe de iões: IonFab IBD e sistema de deposição de camada atómica Cambridge NanoTech Savannah Series.

O preço de cada equipamento é de cerca de 10.000 dólares, e o fornecedor deve adquirir todos os equipamentos para fornecer todos os tipos de serviços de deposição de camada atómica. O custo do equipamento seria demasiado elevado para fornecer todos os tipos de serviços de deposição de camada atómica. Desta forma, muitos compradores evitam comprar devido ao elevado custo em comparação com os móveis comuns.

Oportunidade

- CRESCENTE INVESTIGAÇÃO E DESENVOLVIMENTO EM TECNOLOGIA DE DEPOSIÇÃO DE CAMADAS ATÓMICAS

Um processo de deposição de camada atómica é um tipo de técnica de fase de vapor que produz filmes finos de vários materiais. Todos utilizam a micro ou nanotecnologia para fornecer dispositivos ou produtos mais pequenos e de baixo peso. O processo de deposição de camada atómica é muito útil para dispositivos de micro ou nanotecnologia, pois pode controlar a espessura ao nível do angstrom, produzir um filme fino e uniforme e ter uma elevada eficiência para materiais semicondutores. Por este motivo, a maioria dos fornecedores de serviços de deposição de camadas atómicas investe em investigação e desenvolvimento.

Desafio

- ALTERNATIVAS DE DEPOSIÇÃO DE CAMADAS ATÓMICAS

O processo de deposição química de vapor é amplamente utilizado para produzir filmes finos de alta qualidade e alto desempenho. O processo de deposição química de vapor é normalmente utilizado na indústria de semicondutores. Por outro lado, a deposição física de vapor (PVD) é um método utilizado para produzir filmes finos e revestimentos com elevada temperatura, elevada resistência, excelente resistência à abrasão, entre outros. A deposição química de vapor e a deposição física de vapor podem ser utilizadas como alternativas à deposição de camada atómica devido às vantagens abaixo sobre a deposição de camada atómica.

- A deposição química de vapor tem uma taxa de deposição maior do que a deposição de camada atómica

- Na deposição química de vapor, o material depositado é difícil de evaporar

- O processo de deposição física de vapor pode operar a baixas temperaturas em comparação com a deposição de camada atómica

- A deposição física de vapor pode controlar a composição química

Desenvolvimentos recentes

- Em junho de 2021, a Applied Materials desenvolveu uma solução de engenharia Endura Copper Barrier Seed IMS que combina ALD, PVD, CVD, refluxo de cobre, tratamento de superfície, engenharia de interface e metrologia. Estas sete tecnologias estão num sistema. Isto ajudou na substituição do ALD conforme pelo ALD seletivo, o que ajudou na eliminação da barreira de alta resistividade.

- Em junho de 2022, a Tokyo Electron Limited lançou o novo Ulucus L, um sistema de corte de arestas a laser utilizado em operações de corte de arestas com tecnologia de controlo a laser. Esta solução ecológica é produtiva e adequada ao ambiente.

Âmbito do mercado de deposição de camada atómica na Ásia-Pacífico

O mercado de deposição de camadas atómicas da Ásia-Pacífico está segmentado com base no tipo de produto e na aplicação. O crescimento entre estes segmentos irá ajudá-lo a analisar os principais segmentos de crescimento nos setores e fornecerá aos utilizadores uma visão geral e informações valiosas do mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Tipo de produto

- Metal ALD

- Óxido de alumínio ALD

- ALD potenciado por plasma

- ALD catalítico

- Outros

Com base no tipo de produto, o mercado de deposição de camada atómica da Ásia-Pacífico é classificado em ALD de metal, ALD de óxido de alumínio, ALD melhorado por plasma, ALD catalítico e outros.

Aplicação

- Semicondutores

- Eletrônica

- Dispositivos solares

- Equipamentos médicos

- Dispositivos Ópticos

- Materiais Termoelétricos

- Células de combustível

- Instalações de Investigação e Desenvolvimento

- Cabeças Magnéticas

- Sensores

- Camadas de barreira

- Camadas de primário

- Aplicação não-IC

- Outros

Com base na aplicação, o mercado de deposição de camadas atómicas da Ásia-Pacífico é classificado em semicondutores, dispositivos solares, eletrónica, equipamentos médicos, instalações de investigação e desenvolvimento, células de combustível, dispositivos óticos, materiais termoelétricos, cabeças magnéticas, sensores, camadas de barreira, camadas de primer, aplicação não-IC e outros.

Análise/Insights regionais do mercado de deposição de camada atómica da Ásia-Pacífico

O mercado de deposição de camadas atómicas da Ásia-Pacífico é analisado, e são fornecidos insights e tendências sobre o tamanho do mercado com base no país, tipo de produto e aplicação, conforme referenciado acima.

Alguns países abrangidos pelo mercado de deposição de camadas atómicas da Ásia-Pacífico são a China, a Índia, o Japão, a Coreia do Sul, a Austrália, a Tailândia, a Malásia, a Indonésia, Singapura, as Filipinas e o resto da Ásia-Pacífico.

Espera-se que o Japão domine o mercado de deposição de camadas atómicas da Ásia-Pacífico em termos de quota de mercado e receitas. Estima-se que mantenha o seu domínio durante o período previsto devido à crescente procura por parte da indústria de semicondutores.

A secção regional do relatório também fornece fatores individuais que impactam o mercado e alterações nas regulamentações que impactam as tendências atuais e futuras do mercado. Pontos de dados, como vendas de produtos novos e de reposição, demografia do país, epidemiologia de doenças e tarifas de importação e exportação, são alguns dos principais indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade das marcas da Ásia-Pacífico e os desafios enfrentados devido à elevada concorrência das marcas locais e nacionais e o impacto dos canais de vendas são considerados ao fornecer uma análise de previsão dos dados do país.

Análise do cenário competitivo e da quota de mercado da deposição de camada atómica na Ásia-Pacífico

O competitivo mercado de deposição de camadas atómicas da Ásia-Pacífico fornece detalhes sobre os concorrentes. Os detalhes incluem a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento do produto, amplitude e abrangência do produto, e domínio da aplicação. Os pontos de dados acima estão apenas relacionados com o foco das empresas no mercado de deposição de camadas atómicas da Ásia-Pacífico.

Alguns dos principais participantes que operam no mercado de deposição de camadas atómicas da Ásia-Pacífico são a ADEKA CORPORATION, AIXTRON, Applied Materials, Inc., ASM International, LAM RESEARCH CORPORATION, Tokyo Electron Limited, Kurt J. Lesker Company, ANRIC TECH., SENTECH Instruments GmbH, Oxford Instruments, Forge Nano Inc., Veeco Instruments Inc., Merck KGaA, HZO, Inc., Picosun Oy., entre outros.

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com grandes tamanhos de amostra. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados, que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Além disso, os modelos de dados incluem grelhas de posicionamento de fornecedores, análise da linha do tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise da quota de mercado da empresa, padrões de medição, Ásia-Pacífico x regional e análise da participação dos fornecedores. Solicite uma chamada de analista em caso de dúvidas adicionais.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

1.4 LIMITATION

1.5 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 CURRENCY AND PRICING

2.5 DBMR TRIPOD DATA VALIDATION MODEL

2.6 PRODUCT TYPE LIFE LINE CURVE

2.7 MULTIVARIATE MODELING

2.8 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.9 DBMR MARKET POSITION GRID

2.1 MARKET APPLICATION COVERAGE GRID

2.11 DBMR MARKET CHALLENGE MATRIX

2.12 DBMR VENDOR SHARE ANALYSIS

2.13 SECONDARY SOURCES

2.14 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS

5.1.2 RAISING CONCERN ON ENERGY HARVESTING RESULTS IN HIGH GROWTH OF PHOTOVOLTAIC (PV) CELLS

5.1.3 RAPID EXPANSION OF THE SEMICONDUCTOR INDUSTRY

5.2 RESTRAINT

5.2.1 HIGH INITIAL INVESTMENT COSTS

5.3 OPPORTUNITIES

5.3.1 TREND OF MINIATURIZATION

5.3.2 GROWING RESEARCH AND DEVELOPMENT IN ATOMIC LAYER DEPOSITION TECHNOLOGY

5.4 CHALLENGE

5.4.1 ALTERNATIVES OF ATOMIC LAYER DEPOSITION

6 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 METAL ALD

6.3 ALUMINUM OXIDE ALD

6.4 PLASMA ENHANCED ALD

6.5 CATALYTIC ALD

6.6 OTHERS

7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 SEMICONDUCTORS

7.2.1 METAL ALD

7.2.2 ALUMINUM OXIDE ALD

7.2.3 CATALYTIC ALD

7.2.4 PLASMA ENHANCED ALD

7.2.5 OTHERS

7.3 ELECTRONICS

7.3.1 METAL ALD

7.3.2 ALUMINUM OXIDE ALD

7.3.3 CATALYTIC ALD

7.3.4 PLASMA ENHANCED ALD

7.3.5 OTHERS

7.4 SOLAR DEVICES

7.4.1 ALUMINUM OXIDE ALD

7.4.2 PLASMA ENHANCED ALD

7.4.3 METAL ALD

7.4.4 CATALYTIC ALD

7.4.5 OTHERS

7.5 MEDICAL EQUIPMENT

7.5.1 METAL ALD

7.5.2 ALUMINUM OXIDE ALD

7.5.3 CATALYTIC ALD

7.5.4 PLASMA ENHANCED ALD

7.5.5 OTHERS

7.6 OPTICAL DEVICES

7.6.1 METAL ALD

7.6.2 ALUMINUM OXIDE ALD

7.6.3 CATALYTIC ALD

7.6.4 PLASMA ENHANCED ALD

7.6.5 OTHERS

7.7 THERMOELECTRIC MATERIALS

7.7.1 METAL ALD

7.7.2 ALUMINUM OXIDE ALD

7.7.3 CATALYTIC ALD

7.7.4 PLASMA ENHANCED ALD

7.7.5 OTHERS

7.8 MAGNETIC HEADS

7.8.1 METAL ALD

7.8.2 ALUMINUM OXIDE ALD

7.8.3 CATALYTIC ALD

7.8.4 PLASMA ENHANCED ALD

7.8.5 OTHERS

7.9 RESEARCH & DEVELOPMENT FACILITIES

7.9.1 METAL ALD

7.9.2 ALUMINUM OXIDE ALD

7.9.3 CATALYTIC ALD

7.9.4 PLASMA ENHANCED ALD

7.9.5 OTHERS

7.1 FUEL CELLS

7.10.1 METAL ALD

7.10.2 ALUMINUM OXIDE ALD

7.10.3 CATALYTIC ALD

7.10.4 PLASMA ENHANCED ALD

7.10.5 OTHERS

7.11 SENSORS

7.11.1 METAL ALD

7.11.2 ALUMINUM OXIDE ALD

7.11.3 CATALYTIC ALD

7.11.4 PLASMA ENHANCED ALD

7.11.5 OTHERS

7.12 BARRIER LAYERS

7.12.1 METAL ALD

7.12.2 ALUMINUM OXIDE ALD

7.12.3 CATALYTIC ALD

7.12.4 PLASMA ENHANCED ALD

7.12.5 OTHERS

7.13 PRIMER LAYERS

7.13.1 METAL ALD

7.13.2 ALUMINUM ALD

7.13.3 CATALYTIC ALD

7.13.4 PLASMA ENHANCED ALD

7.13.5 OTHERS

7.14 NON-IC APPLICATION

7.14.1 METAL ALD

7.14.2 ALUMINUM ALD

7.14.3 CATALYTIC ALD

7.14.4 PLASMA ENHANCED ALD

7.14.5 OTHERS

7.15 OTHERS

7.15.1 METAL ALD

7.15.2 ALUMINUM ALD

7.15.3 CATALYTIC ALD

7.15.4 PLASMA ENHANCED ALD

7.15.5 OTHERS

8 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY REGION

8.1 ASIA-PACIFIC

8.1.1 JAPAN

8.1.2 CHINA

8.1.3 SOUTH KOREA

8.1.4 INDIA

8.1.5 AUSTRALIA

8.1.6 SINGAPORE

8.1.7 THAILAND

8.1.8 MALAYSIA

8.1.9 INDONESIA

8.1.10 PHILIPPINES

8.1.11 REST OF ASIA-PACIFIC

9 COMPANY LANDSCAPE: ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

9.1 COMPANY SHARE ANALYSIS: ASIA PACIFIC

9.2 NEW PRODUCT LAUNCH

9.3 MERGERS,AWARDS AND ACQUISITIONS

10 SWOT ANALYSIS

11 COMPANY PROFILE

11.1 LAM RESEARCH CORPORATION.

11.1.1 COMPANY SNAPSHOT

11.1.2 RECENT FINANCIALS

11.1.3 COMPANY SHARE ANALYSIS

11.1.4 PRODUCT PORTFOLIO

11.1.5 RECENT UPDATE

11.2 APPLIED MATERIALS, INC.

11.2.1 COMPANY SNAPSHOT

11.2.2 RECENT FINANCIALS

11.2.3 COMPANY SHARE ANALYSIS

11.2.4 PRODUCT PORTFOLIO

11.2.5 RECENT UPDATES

11.3 TOKYO ELECTRON LIMITED

11.3.1 COMPANY SNAPSHOT

11.3.2 REVENUE ANALYSIS

11.3.3 COMPANY SHARE ANALYSIS

11.3.4 PRODUCT PORTFOLIO

11.3.5 RECENT UPDATES

11.4 ASM INTERNATIONAL

11.4.1 COMPANY SNAPSHOT

11.4.2 RECENT FINANCIALS

11.4.3 COMPANY SHARE ANALYSIS

11.4.4 PRODUCT PORTFOLIO

11.4.5 RECENT UPDATE

11.5 AIXTRON

11.5.1 COMPANY SNAPSHOT

11.5.2 RECENT FINANCIALS

11.5.3 COMPANY SHARE ANALYSIS

11.5.4 PRODUCT PORTFOLIO

11.5.5 RECENT UPDATE

11.6 ADEKA CORPORATION

11.6.1 COMPANY SNAPSHOT

11.6.2 RECENT FINANCIALS

11.6.3 PRODUCT PORTFOLIO

11.6.4 RECENT UPDATE

11.7 ANRIC TECH.

11.7.1 COMPANY SNAPSHOT

11.7.2 PRODUCT PORTFOLIO

11.7.3 RECENT UPDATES

11.8 BENEQ

11.8.1 COMPANY SNAPSHOT

11.8.2 PRODUCT PORTFOLIO

11.8.3 RECENT UPDATES

11.9 ENCAPSULIX

11.9.1 COMPANY SNAPSHOT

11.9.2 PRODUCT PORTFOLIO

11.9.3 RECENT UPDATE

11.1 FORGE NANO INC.

11.10.1 COMPANY SNAPSHOT

11.10.2 PRODUCT PORTFOLIO

11.10.3 RECENT UPDATES

11.11 HZO INC.

11.11.1 COMPANY SNAPSHOT

11.11.2 PRODUCT PORTFOLIO

11.11.3 RECENT UPDATE

11.12 KURT J. LESKER COMPANY

11.12.1 COMPANY SNAPSHOT

11.12.2 PRODUCT PORTFOLIO

11.12.3 RECENT UPDATE

11.13 MERCK KGAA

11.13.1 COMPANY SNAPSHOT

11.13.2 RECENT FINANCIALS

11.13.3 PRODUCT PORTFOLIO

11.13.4 RECENT UPDATES

11.14 OXFORD INSTRUMENTS

11.14.1 COMPANY SNAPSHOT

11.14.2 RECENT FINANCIALS

11.14.3 PRODUCT PORTFOLIO

11.14.4 RECENT UPDATE

11.15 PICOSUN OY.

11.15.1 COMPANY SNAPSHOT

11.15.2 PRODUCT PORTFOLIO

11.15.3 RECENT UPDATES

11.16 SENTECH INSTRUMENTS GMBH

11.16.1 COMPANY SNAPSHOT

11.16.2 PRODUCT PORTFOLIO

11.16.3 RECENT UPDATE

11.17 VEECO INSTRUMENTS INC.

11.17.1 COMPANY SNAPSHOT

11.17.2 RECENT FINANCIALS

11.17.3 PRODUCT PORTFOLIO

11.17.4 RECENT UPDATES

12 QUESTIONNAIRE

13 RELATED REPORT

Lista de Tabela

TABLE 1 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 2 ASIA PACIFIC METAL ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 3 ASIA PACIFIC ALUMINUM OXIDE ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 4 ASIA PACIFIC PLASMA ENHANCED ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 5 ASIA PACIFIC CATALYTIC ALD IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 6 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 8 ASIA PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 9 ASIA PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 10 ASIA PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 11 ASIA PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 12 ASIA PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 13 ASIA PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 14 ASIA PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 15 ASIA PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 16 ASIA PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 17 ASIA PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 18 ASIA PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 19 ASIA PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 20 ASIA PACIFIC MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 21 ASIA PACIFIC MAGNETIC HEADS ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 22 ASIA PACIFIC RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 23 ASIA PACIFIC RESEARCH & DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 24 ASIA PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 25 ASIA PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 26 ASIA PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 27 ASIA PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 28 ASIA PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 29 ASIA PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 30 ASIA PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 31 ASIA PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 32 ASIA PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 33 ASIA PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 34 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY REGION, 2020-2029 (USD MILLION)

TABLE 35 ASIA PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 36 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY COUNTRY, 2020-2029 (USD MILLION)

TABLE 37 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 38 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 39 ASIA-PACIFIC SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 40 ASIA-PACIFIC ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 41 ASIA-PACIFIC SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 42 ASIA-PACIFIC MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 43 ASIA-PACIFIC OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 44 ASIA-PACIFIC THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 45 ASIA-PACIFIC FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 46 ASIA-PACIFIC RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 47 ASIA-PACIFIC MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 48 ASIA-PACIFIC SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 49 ASIA-PACIFIC BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 50 ASIA-PACIFIC PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 51 ASIA-PACIFIC NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 52 ASIA-PACIFIC OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 53 JAPAN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 54 JAPAN ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 55 JAPAN SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 56 JAPAN ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 57 JAPAN SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 58 JAPAN MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 59 JAPAN OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 60 JAPAN THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 61 JAPAN FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 62 JAPAN RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 63 JAPAN MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 64 JAPAN SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 65 JAPAN BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 66 JAPAN PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 67 JAPAN NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 68 JAPAN OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 69 CHINA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 70 CHINA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 71 CHINA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 72 CHINA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 73 CHINA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 74 CHINA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 75 CHINA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 76 CHINA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 77 CHINA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 78 CHINA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 79 CHINA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 80 CHINA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 81 CHINA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 82 CHINA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 83 CHINA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 84 CHINA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 85 SOUTH KOREA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 86 SOUTH KOREA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 87 SOUTH KOREA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY TYPE, 2020-2029 (USD MILLION)

TABLE 88 SOUTH KOREA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 89 SOUTH KOREA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 90 SOUTH KOREA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 91 SOUTH KOREA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 92 SOUTH KOREA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 93 SOUTH KOREA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 94 SOUTH KOREA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 95 SOUTH KOREA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 96 SOUTH KOREA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 97 SOUTH KOREA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 98 SOUTH KOREA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 99 SOUTH KOREA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 100 SOUTH KOREA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 101 INDIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 102 INDIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 103 INDIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 104 INDIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 105 INDIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 106 INDIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 107 INDIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 108 INDIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 109 INDIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 110 INDIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 111 INDIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 112 INDIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 113 INDIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 114 INDIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 115 INDIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 116 INDIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 117 AUSTRALIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 118 AUSTRALIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 119 AUSTRALIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 120 AUSTRALIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 121 AUSTRALIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 122 AUSTRALIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 123 AUSTRALIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 124 AUSTRALIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 125 AUSTRALIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 126 AUSTRALIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 127 AUSTRALIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 128 AUSTRALIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 129 AUSTRALIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 130 AUSTRALIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 131 AUSTRALIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 132 AUSTRALIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 133 SINGAPORE ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 134 SINGAPORE ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 135 SINGAPORE SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 136 SINGAPORE ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 137 SINGAPORE SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 138 SINGAPORE MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 139 SINGAPORE OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 140 SINGAPORE THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 141 SINGAPORE FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 142 SINGAPORE RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 143 SINGAPORE MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 144 SINGAPORE SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 145 SINGAPORE BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 146 SINGAPORE PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 147 SINGAPORE NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 148 SINGAPORE OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 149 THAILAND ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 150 THAILAND ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 151 THAILAND SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 152 THAILAND ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 153 THAILAND SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 154 THAILAND MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 155 THAILAND OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 156 THAILAND THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 157 THAILAND FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 158 THAILAND RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 159 THAILAND MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 160 THAILAND SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 161 THAILAND BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 162 THAILAND PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 163 THAILAND NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 164 THAILAND OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 165 MALAYSIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 166 MALAYSIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 167 MALAYSIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 168 MALAYSIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 169 MALAYSIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 170 MALAYSIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 171 MALAYSIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 172 MALAYSIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 173 MALAYSIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 174 MALAYSIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 175 MALAYSIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 176 MALAYSIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 177 MALAYSIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 178 MALAYSIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 179 MALAYSIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 180 MALAYSIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 181 INDONESIA ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 182 INDONESIA ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 183 INDONESIA SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 184 INDONESIA ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 185 INDONESIA SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 186 INDONESIA MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 187 INDONESIA OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 188 INDONESIA THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 189 INDONESIA FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 190 INDONESIA RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 191 INDONESIA MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 192 INDONESIA SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 193 INDONESIA BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 194 INDONESIA PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 195 INDONESIA NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 196 INDONESIA OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 197 PHILIPPINES ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 198 PHILIPPINES ATOMIC LAYER DEPOSITION MARKET, BY APPLICATION, 2020-2029 (USD MILLION)

TABLE 199 PHILIPPINES SEMICONDUCTORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 200 PHILIPPINES ELECTRONICS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 201 PHILIPPINES SOLAR DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 202 PHILIPPINES MEDICAL EQUIPMENT IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 203 PHILIPPINES OPTICAL DEVICES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 204 PHILIPPINES THERMOELECTRIC MATERIALS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 205 PHILIPPINES FUEL CELLS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 206 PHILIPPINES RESEARCH AND DEVELOPMENT FACILITIES IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 207 PHILIPPINES MAGNETIC HEADS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 208 PHILIPPINES SENSORS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 209 PHILIPPINES BARRIER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 210 PHILIPPINES PRIMER LAYERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 211 PHILIPPINES NON-IC APPLICATION IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 212 PHILIPPINES OTHERS IN ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

TABLE 213 REST OF ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET, BY PRODUCT TYPE, 2020-2029 (USD MILLION)

Lista de Figura

FIGURE 1 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 2 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DATA TRIANGULATION

FIGURE 3 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DROC ANALYSIS

FIGURE 4 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: ASIA PACIFIC VS REGIONAL MARKET ANALYSIS

FIGURE 5 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: THE PRODUCT TYPE LIFE LINE CURVE

FIGURE 7 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: MULTIVARIATE MODELLING

FIGURE 8 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 9 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: DBMR MARKET POSITION GRID

FIGURE 10 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: MARKET APPLICATION COVERAGE GRID

FIGURE 11 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: THE MARKET CHALLENGE MATRIX

FIGURE 12 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: VENDOR SHARE ANALYSIS

FIGURE 13 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: SEGMENTATION

FIGURE 14 HIGH DEMAND FOR MICROELECTRONICS AND CONSUMER ELECTRONICS IS EXPECTED TO DRIVE THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET IN THE FORECAST PERIOD

FIGURE 15 METAL ALD SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET IN 2022 & 2029

FIGURE 16 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET

FIGURE 17 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE, 2021

FIGURE 18 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY APPLICATION, 2021

FIGURE 19 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: SNAPSHOT (2021)

FIGURE 20 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021)

FIGURE 21 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2022 & 2029)

FIGURE 22 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY COUNTRY (2021 & 2029)

FIGURE 23 ASIA-PACIFIC ATOMIC LAYER DEPOSITION MARKET: BY PRODUCT TYPE (2022 - 2029)

FIGURE 24 ASIA PACIFIC ATOMIC LAYER DEPOSITION MARKET: COMPANY SHARE 2021 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.