Asia Pacific Anti Aging Skincare Ingredients Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

674.87 Million

USD

1,000.89 Million

2024

2032

USD

674.87 Million

USD

1,000.89 Million

2024

2032

| 2025 –2032 | |

| USD 674.87 Million | |

| USD 1,000.89 Million | |

|

|

|

|

Segmentação do mercado de ingredientes para cuidados com a pele antienvelhecimento da Ásia-Pacífico, por produto (retinóide, ácido hialurônico, antioxidantes, peptídeos, niacinamida (vitamina B3), alfa-hidroxiácidos (AHAS), ceramidas, óxido de zinco e dióxido de titânio, beta-hidroxiácido (BHA), coenzima Q10 (ubiquinona), extrato de chá verde, ácido alfa-lipóico, cafeína, bakuchiol, esqualano, ácido kójico, alfa-arbutina, isoflavonas de soja e outros), forma (pó, líquido e granulado), função (hidratante, reforço de colágeno, proteção solar, esfoliação, clareamento da pele, anti-inflamatório, reparo da pele e outros), aplicação (antirrugas, antipigmentação, antioxidante, preenchimentos dérmicos e outros), uso final (soro, hidratante, limpador, creme para os olhos, óleo facial, máscara, Toner e outros) - Tendências e previsões do setor até 2032

Tamanho do mercado de ingredientes para cuidados antienvelhecimento da pele na Ásia-Pacífico

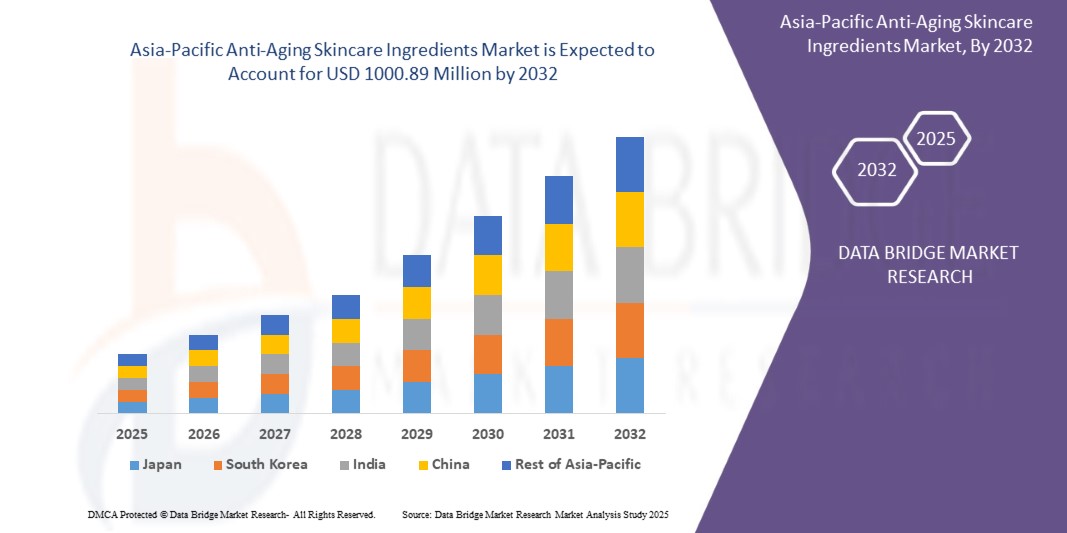

- O tamanho do mercado de ingredientes para cuidados com a pele antienvelhecimento da Ásia-Pacífico foi avaliado em US$ 674,87 milhões em 2024 e deve atingir US$ 1.000,89 milhões até 2032 , com um CAGR de 5,05% durante o período previsto.

- O crescimento do mercado é amplamente impulsionado pela crescente conscientização do consumidor sobre cuidados com a pele, pela crescente demanda por soluções preventivas e antienvelhecimento e pelas inovações tecnológicas em ingredientes bioativos e multifuncionais, que estão permitindo formulações mais eficazes para redução de rugas, clareamento da pele e hidratação.

- Além disso, a crescente preferência por ingredientes naturais, de origem sustentável e produzidos de forma ética está impulsionando a adoção de fórmulas antienvelhecimento premium. Esses fatores convergentes estão acelerando a adoção de ingredientes avançados para cuidados com a pele, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Ingredientes para Cuidados Antienvelhecimento da Pele na Ásia-Pacífico

- Os ingredientes antienvelhecimento para cuidados com a pele incluem compostos bioativos como retinoides, peptídeos, ácido hialurônico, antioxidantes e ceramidas, que ajudam a reduzir os sinais visíveis de envelhecimento, melhorar a elasticidade da pele e promover a saúde geral da pele. Esses ingredientes são amplamente incorporados em séruns, cremes, máscaras e protetores solares para aplicações preventivas e corretivas de cuidados com a pele.

- A crescente demanda por ingredientes antienvelhecimento para cuidados com a pele é impulsionada principalmente pelo envelhecimento populacional, pelo aumento da renda disponível, pelo foco crescente do consumidor em cuidados pessoais e pela crescente penetração de produtos premium para cuidados com a pele em mercados desenvolvidos e emergentes. O crescente engajamento digital e a adoção do e-commerce estão aumentando ainda mais a acessibilidade aos produtos e o crescimento do mercado.

- A China dominou o mercado de ingredientes para cuidados com a pele antienvelhecimento da Ásia-Pacífico com uma participação de mercado em 2024, devido à crescente conscientização do consumidor sobre cuidados com a pele avançados, à crescente demanda por soluções preventivas e antienvelhecimento e à presença de marcas estabelecidas de cosméticos e cuidados pessoais.

- Espera-se que a Índia seja o país com crescimento mais rápido no mercado de ingredientes para cuidados com a pele antienvelhecimento da Ásia-Pacífico durante o período previsto, devido à crescente conscientização sobre rotinas antienvelhecimento, ao aumento da renda disponível, à urbanização e à crescente população jovem e digitalmente engajada.

- O segmento de antioxidantes dominou o mercado, com uma participação de mercado de 34,2% em 2024, devido à sua comprovada capacidade de neutralizar os radicais livres, proteger contra o estresse oxidativo e retardar os sinais visíveis de envelhecimento, como rugas e linhas finas. Antioxidantes como vitamina C, vitamina E, extrato de chá verde e coenzima Q10 são amplamente incorporados em séruns, cremes e protetores solares, tornando-os altamente versáteis em formulações de produtos. Seu papel multifuncional, iluminando a pele, melhorando a estabilidade do colágeno e fornecendo proteção contra agressores ambientais, como radiação UV e poluição, consolidou sua posição como um pilar fundamental nos cuidados antienvelhecimento da pele.

Escopo do relatório e segmentação do mercado de ingredientes para cuidados com a pele antienvelhecimento na Ásia-Pacífico

|

Atributos |

Principais insights de mercado sobre ingredientes para cuidados com a pele antienvelhecimento |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, análises de preços, análises de participação de marca, pesquisas com consumidores, análises demográficas, análises da cadeia de suprimentos, análises da cadeia de valor, visão geral de matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Tendências do mercado de ingredientes para cuidados com a pele antienvelhecimento na Ásia-Pacífico

“Mudança de preferência para produtos naturais e orgânicos”

- O mercado de ingredientes antienvelhecimento para cuidados com a pele da Ásia-Pacífico está passando por uma transformação, com os consumidores priorizando compostos naturais e orgânicos, buscando alternativas mais seguras aos produtos químicos sintéticos. Essa preferência está abrindo novos caminhos de crescimento e impulsionando a inovação de produtos nos segmentos de massa e premium.

- Por exemplo, marcas como Shiseido e Lady Green lançaram séruns antienvelhecimento orgânicos e cremes faciais com botânicos biofermentados e ativos vegetais. Esses lançamentos estão ganhando força entre a geração Y e consumidores preocupados com a saúde, que buscam soluções éticas e sustentáveis para o cuidado da pele.

- Os avanços tecnológicos em sistemas de administração de ingredientes estão elevando a eficácia e a confiança do consumidor. As empresas estão utilizando encapsulamento, microfluídica e biotecnologia para tornar ativos antienvelhecimento naturais, como ácido hialurônico e peptídeos, mais biodisponíveis e potentes em aplicações tópicas.

- A demanda por transparência nos ingredientes e fórmulas seguras está aumentando, com os consumidores optando por produtos com rótulos limpos e certificação vegana. Sustentabilidade e alegações de origem ética são importantes impulsionadores de compra, influenciando o posicionamento global das marcas em seus produtos de ingredientes antienvelhecimento.

- Regimes de beleza personalizados com ingredientes naturais antienvelhecimento estão se tornando comuns. Os consumidores buscam soluções personalizadas para problemas específicos, como rugas, pigmentação ou perda de elasticidade, exigindo que as marcas ofereçam combinações personalizadas e kits holísticos de cuidados com a pele.

- Produtos antienvelhecimento multifuncionais e minimalistas, com ingredientes naturais de alta qualidade, têm ganhado popularidade. As marcas os comercializam como soluções eficientes para um estilo de vida agitado e reduzem a exposição a aditivos desnecessários, ecoando tendências de bem-estar geral e autocuidado.

Dinâmica do mercado de ingredientes para cuidados com a pele antienvelhecimento na Ásia-Pacífico

Motorista

Atividades inovadoras de branding e publicidade de produtos

- Ações eficazes de branding e publicidade estão ampliando o crescimento do mercado, tornando os ingredientes antienvelhecimento para cuidados com a pele rapidamente reconhecíveis, aumentando o engajamento do consumidor e reforçando a fidelidade em um cenário competitivo. As marcas alavancam design, mídias sociais e experiências imersivas para diferenciar suas ofertas.

- Por exemplo, a DSM e grandes empresas do setor de beleza têm utilizado parcerias com influenciadores e campanhas online direcionadas para destacar os benefícios antienvelhecimento clinicamente comprovados de ingredientes naturais, como peptídeos e antioxidantes. Suas abordagens de branding baseadas em dados ampliam o alcance e aceleram a conversão de vendas nos principais mercados.

- Tecnologias digitais avançadas permitem que as marcas interajam diretamente com os consumidores, fortalecendo a conscientização e a experimentação de produtos inovadores para a pele. Provas virtuais, personalização gerada por IA e publicidade omnicanal integrada estão moldando as preferências por lançamentos de novos ingredientes em um mercado global dinâmico.

- A inovação contínua de produtos sustenta o entusiasmo do consumidor, à medida que as marcas apresentam histórias de ingredientes antienvelhecimento focadas em eficácia, ciência e bem-estar. Campanhas estratégicas posicionam esses produtos como essenciais em rotinas de cuidados com a pele em várias etapas e regimes de saúde holística para todas as faixas etárias.

- O engajamento nas mídias sociais e os ciclos de feedback dos clientes ajudam as marcas a adaptar rapidamente suas ofertas. As empresas otimizam a marca e as mensagens para atender às prioridades em constante evolução dos consumidores, criando um ambiente de mercado responsivo que impulsiona a demanda sustentada e a expansão do mercado.

Restrição/Desafio

Aumento dos efeitos colaterais de alguns ingredientes para cuidados com a pele

- Os efeitos colaterais associados a alguns ingredientes antienvelhecimento representam um desafio persistente, impactando a confiança do consumidor e a supervisão regulatória. Relatos de reações alérgicas, erupções cutâneas e sensibilidade cutânea causadas por aditivos sintéticos ou produtos falsificados minam a confiança nas soluções antienvelhecimento convencionais.

- Por exemplo, a crescente conscientização sobre parabenos, sulfatos e fragrâncias artificiais levou a recalls e restrições de produtos em diversos países. Esse escrutínio obriga os fabricantes a repensar suas formulações e a cumprir as regulamentações de segurança em constante evolução, adicionando complexidade às operações de mercado.

- Longos processos de aprovação de produtos e rigorosos requisitos de testes retardam a introdução de novos ingredientes. Estruturas regulatórias, especialmente na Europa e na América do Norte, exigem testes exaustivos para verificar a segurança e a eficácia, atrasando lançamentos e aumentando os custos de desenvolvimento para os fornecedores.

- Produtos falsificados e de baixa qualidade agravam os desafios do mercado, já que a ampla disponibilidade e os preços competitivos atraem os consumidores para alternativas inseguras. Esses problemas levam a um aumento no investimento da indústria em campanhas de autenticidade, rastreamento e educação do consumidor.

- A crescente demanda por soluções orgânicas e naturais, impulsionada por preocupações com efeitos colaterais, aumenta a pressão sobre as cadeias de suprimentos de ingredientes. As marcas precisam garantir consistência, rastreabilidade e segurança, ao mesmo tempo em que lidam com flutuações de custos e problemas de escalabilidade para extratos botânicos e ativos naturais.

Escopo do mercado de ingredientes para cuidados antienvelhecimento da pele na Ásia-Pacífico

O mercado é segmentado com base no produto, forma, função, aplicação e uso final.

• Por produto

Com base no produto, o mercado de ingredientes antienvelhecimento para cuidados com a pele da Ásia-Pacífico é segmentado em retinoides, ácido hialurônico, antioxidantes, peptídeos, niacinamida (vitamina B3), alfa-hidroxiácidos (AHAs), ceramidas, óxido de zinco e dióxido de titânio, beta-hidroxiácido (BHA), coenzima Q10 (ubiquinona), extrato de chá verde, ácido alfa-lipóico, cafeína, bakuchiol, esqualano, ácido kójico, alfa-arbutina, isoflavonas de soja e outros. O segmento de antioxidantes dominou a maior fatia de receita de mercado, de 34,2% em 2024, atribuída à sua comprovada capacidade de neutralizar radicais livres, proteger contra o estresse oxidativo e retardar sinais visíveis de envelhecimento, como rugas e linhas finas. Antioxidantes como vitamina C, vitamina E, extrato de chá verde e coenzima Q10 são amplamente incorporados em séruns, cremes e protetores solares, tornando-os altamente versáteis em formulações de produtos. Seu papel multifuncional em clarear a pele, melhorar a estabilidade do colágeno e fornecer proteção contra agressores ambientais, como radiação UV e poluição, consolidou sua posição como um pilar fundamental nos cuidados antienvelhecimento da pele.

Espera-se que o segmento de ácido hialurônico apresente a maior taxa de crescimento entre 2025 e 2032, impulsionado pela crescente demanda do consumidor por soluções antienvelhecimento baseadas em hidratação. O ácido hialurônico é amplamente valorizado por suas propriedades de retenção de umidade, que melhoram a elasticidade da pele e reduzem o aparecimento de rugas. Sua inclusão em séruns, máscaras faciais e hidratantes alinha-se à tendência de rótulos limpos, pois ocorre naturalmente no corpo e é bem tolerado por todos os tipos de pele. O crescente apelo por tratamentos de hidratação não invasivos e seu uso crescente em formulações de preenchimento dérmico reforçam ainda mais sua rápida adoção.

• Por Formulário

Com base na forma, o mercado é segmentado em pó, líquido e granulado. O segmento líquido dominou a maior fatia de mercado em 2024, principalmente devido à sua alta aplicabilidade em séruns, hidratantes e cremes. Os líquidos permitem melhor solubilidade dos ingredientes, absorção mais rápida pela pele e fácil formulação em produtos antienvelhecimento multifuncionais. Isso os torna a escolha preferida entre os fabricantes que buscam combinar múltiplos ingredientes ativos, como antioxidantes, peptídeos e retinoides, em uma única formulação.

Prevê-se que o segmento de pó apresente o CAGR mais rápido entre 2025 e 2032, à medida que as marcas recorrem cada vez mais a ingredientes em pó para maior estabilidade e maior prazo de validade. Os pós permitem que os usuários finais misturem os produtos antes da aplicação, preservando a potência e reduzindo a necessidade de conservantes. O formato também está ganhando popularidade em cuidados com a pele "faça você mesmo", rotinas de beleza minimalistas e embalagens sustentáveis, alinhando-se bem às tendências de consumo ecoconsciente.

• Por Função

Com base na função, o mercado é segmentado em hidratação, reforço de colágeno, proteção solar, esfoliação, clareamento da pele, anti-inflamatório, reparação da pele, entre outros. O segmento de hidratação deteve a maior participação de mercado em 2024, visto que a hidratação continua sendo o benefício mais procurado em cuidados com a pele antienvelhecimento. Ingredientes hidratantes como ácido hialurônico, ceramidas e esqualano melhoram a função de barreira da pele, tornando-os essenciais em praticamente todas as formulações antienvelhecimento. O segmento se beneficia de sua aplicação universal em todas as faixas etárias, tipos de pele e climas, fortalecendo sua dominância a longo prazo.

O segmento de reforço de colágeno deverá crescer em ritmo acelerado entre 2025 e 2032, impulsionado pela crescente demanda por uma pele mais firme e com aparência jovem. Ingredientes como peptídeos, retinoides e vitamina C são cada vez mais utilizados em formulações antienvelhecimento por sua capacidade de estimular a síntese de colágeno e reduzir os sinais visíveis de envelhecimento. O crescente interesse em cuidados preventivos com a pele na primeira infância, aliado às inovações científicas em tecnologia de peptídeos, está impulsionando uma adoção acelerada.

• Por aplicação

Com base na aplicação, o mercado é segmentado em antirrugas, antipigmentação, antioxidante, preenchimentos dérmicos e outros. O segmento antirrugas dominou a maior fatia de mercado em 2024, devido à sua posição como a principal preocupação que impulsiona a demanda do consumidor no setor antienvelhecimento. Com ingredientes como retinoides, peptídeos e ácido hialurônico atuando diretamente na redução de rugas, essa categoria recebe fortes investimentos em desenvolvimento de produtos e alegações clínicas. A prevalência de populações envelhecidas em mercados desenvolvidos consolida ainda mais sua dominância.

A previsão é de que o segmento antipigmentação registre o crescimento mais rápido entre 2025 e 2032, impulsionado pela crescente conscientização do consumidor sobre hiperpigmentação, tom irregular e manchas causadas pelo sol. Ingredientes como niacinamida, ácido kójico e alfa-arbutina estão sendo amplamente adotados em formulações clareadoras e antimanchas. Essa tendência é reforçada pela crescente demanda nos mercados da Ásia-Pacífico, onde a uniformidade do tom da pele é uma grande prioridade de beleza, e nos mercados ocidentais, onde a correção dos danos causados pelo sol é cada vez mais enfatizada.

• Até o uso final

Com base no uso final, o mercado é segmentado em sérum, hidratante, limpador, creme para os olhos, óleo facial, máscara, tônico e outros. O segmento de séruns deteve a maior fatia de mercado em 2024, pois os séruns oferecem uma entrega concentrada de ingredientes ativos antienvelhecimento. Sua fórmula leve e penetração profunda na pele os tornam altamente eficazes para redução de rugas, clareamento e hidratação, o que repercute fortemente entre consumidores premium e de massa. A crescente preferência dos consumidores por séruns multifuncionais contendo misturas de antioxidantes, peptídeos e intensificadores de hidratação consolida ainda mais a liderança deste segmento.

Espera-se que o segmento de cremes para a área dos olhos apresente o crescimento mais rápido entre 2025 e 2032, refletindo a crescente conscientização sobre os primeiros sinais de envelhecimento que frequentemente aparecem na delicada área dos olhos. Os cremes para a área dos olhos são formulados com ingredientes específicos, como cafeína, peptídeos e ácido hialurônico, para tratar inchaço, linhas finas e olheiras. A crescente demanda por soluções preventivas entre os jovens e as crescentes inovações em formulações que não agridem a pele sensível estão impulsionando sua trajetória de crescimento.

Análise regional do mercado de ingredientes para cuidados com a pele antienvelhecimento na Ásia-Pacífico

- A China dominou o mercado de ingredientes para cuidados com a pele antienvelhecimento da Ásia-Pacífico com a maior participação na receita em 2024, impulsionada pela crescente conscientização do consumidor sobre cuidados com a pele avançados, pela crescente demanda por soluções preventivas e antienvelhecimento e pela presença de marcas estabelecidas de cosméticos e cuidados pessoais.

- A crescente urbanização, o aumento da renda disponível e a influência das tendências de beleza coreana e japonesa impulsionaram significativamente a demanda do mercado. A forte base industrial da China, a expansão das capacidades de P&D e as extensas cadeias de suprimentos de ingredientes para cuidados com a pele a posicionaram como uma grande produtora e consumidora no mercado regional de ingredientes antienvelhecimento.

- O investimento contínuo em formulações inovadoras, compostos bioativos multifuncionais e expansão do comércio eletrônico fortaleceram ainda mais seu domínio de mercado

Visão geral do mercado de ingredientes antienvelhecimento para cuidados com a pele no Japão, Ásia e Pacífico

A previsão é de que o mercado japonês cresça de forma constante entre 2025 e 2032, impulsionado pela forte preferência do consumidor por produtos de cuidados com a pele premium e cientificamente avançados. Os consumidores japoneses priorizam eficácia, qualidade e inovação, impulsionando a demanda por ingredientes como retinoides, peptídeos, ácido hialurônico e antioxidantes. A expansão de lojas especializadas em beleza, marcas de cosméticos de alta qualidade e o foco em formulações com base em pesquisas contribuem ainda mais para o crescimento constante do mercado. A ênfase regulatória na segurança do produto, nos padrões de qualidade e na transparência dos ingredientes também sustenta o segmento.

Visão do mercado de ingredientes antienvelhecimento para cuidados com a pele na Índia, Ásia e Pacífico

A Índia deverá registrar o CAGR mais rápido no mercado de ingredientes antienvelhecimento para a pele na Ásia-Pacífico entre 2025 e 2032. O crescimento é impulsionado pela crescente conscientização sobre rotinas antienvelhecimento, pelo aumento da renda disponível, pela urbanização e pela crescente população jovem e digitalmente engajada. A expansão das plataformas de e-commerce, a adoção de fórmulas premium e naturais e a introdução de ingredientes veganos e de origem ética estão acelerando a adoção pelo mercado. Os fabricantes nacionais estão ampliando a produção e oferecendo ingredientes acessíveis e de alto desempenho para atender às preferências em constante evolução dos consumidores.

Participação no mercado de ingredientes para cuidados antienvelhecimento da pele na região Ásia-Pacífico

A indústria de ingredientes para cuidados antienvelhecimento da pele é liderada principalmente por empresas bem estabelecidas, incluindo:

- ADEKA CORPORATION (Japão)

- Beiersdorf AG (Alemanha)

- Croda International Plc (Reino Unido)

- BASF SE (Alemanha)

- Wacker Chemie AG (Alemanha)

- Lonza (Suíça)

- CLARIANT (Suíça)

- Evonik Industries AG (Alemanha)

- DSM (Holanda)

- Kao Corporation (Japão)

- BioThrive Sciences (EUA)

- Contipro as (República Tcheca)

Últimos desenvolvimentos no mercado de ingredientes para cuidados com a pele antienvelhecimento na Ásia-Pacífico

- Em fevereiro de 2025, a Estée Lauder Companies (ELC) colaborou com a Serpin Pharma para desenvolver ingredientes inovadores para cuidados antienvelhecimento da pele, com foco na longevidade. Essa parceria alavanca a expertise da Serpin Pharma em pesquisa anti-inflamatória, particularmente em Inibidores de Serina Protease, que auxiliam o corpo a reparar células inflamadas. Espera-se que a colaboração fortaleça o portfólio da ELC em soluções avançadas para cuidados com a pele, aumentando a eficácia dos produtos e atraindo consumidores que buscam benefícios antienvelhecimento duradouros e com respaldo científico.

- Em fevereiro de 2025, a NIVEA MEN lançou a linha de cuidados com a pele Age Defense, que atua nos sinais comuns de envelhecimento, como rugas, ressecamento, textura áspera, opacidade e perda de firmeza. A linha incorpora ingredientes-chave como Tiamidol e Ácido Hialurônico para proporcionar resultados visíveis, mantendo uma rotina simples. O lançamento, que inclui séruns avançados, cremes para os olhos e um hidratante diário com FPS 30, provavelmente expandirá a participação de mercado da marca, atraindo consumidores masculinos que buscam soluções antienvelhecimento completas e práticas.

- Em janeiro de 2025, a Croda International anunciou o lançamento do LongevityActive, um ingrediente bioativo desenvolvido para combater o envelhecimento celular e o estresse oxidativo. O ingrediente promove a reparação da pele e fortalece as defesas antioxidantes naturais, auxiliando na formulação de séruns e hidratantes avançados. Espera-se que este lançamento impulsione a diferenciação e a adoção de produtos entre marcas premium de cuidados com a pele focadas em soluções antienvelhecimento com foco em eficácia.

- Em setembro de 2023, a BASF expandiu sua presença na região Ásia-Pacífico com o Uvinul A Plus, um dos poucos filtros UVA fotoestáveis disponíveis que protege contra os raios UVA nocivos, radicais livres e danos à pele. A forma granulada em óleo do produto oferece flexibilidade de formulação, alta eficiência em baixas concentrações e benefícios sem conservantes, contribuindo para produtos de proteção solar e antienvelhecimento de longa duração. Espera-se que essa expansão fortaleça a posição de mercado da BASF no setor de cuidados com a pele da Ásia-Pacífico, em rápido crescimento.

- Em março de 2023, a DSM ampliou seu portfólio PARSOL com o lançamento do PARSOL® DHHB, um filtro UVA versátil, adequado para produtos multifuncionais para a pele. Sua excelente solubilidade e ampla compatibilidade de formulação permitem a criação de protetores solares, cuidados faciais e cosméticos coloridos com proteção UVA adequada e altas classificações de classe ecológica. A inovação proporciona aos formuladores flexibilidade para atender à crescente demanda dos consumidores por produtos antienvelhecimento sustentáveis, multifuncionais e de alto desempenho para a pele.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.