Asia Pacific Active Pharmaceutical Ingredient Api Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

64.56 Billion

USD

115.14 Billion

2024

2032

USD

64.56 Billion

USD

115.14 Billion

2024

2032

| 2025 –2032 | |

| USD 64.56 Billion | |

| USD 115.14 Billion | |

|

|

|

|

Segmentação do mercado de Ingredientes Farmacêuticos Ativos (IFAs) na Ásia-Pacífico, por molécula (molécula pequena, molécula grande), tipo ( Ingredientes Farmacêuticos Ativos Inovadores , Ingredientes Farmacêuticos Ativos Inovadores Genéricos), tipo de fabricante (fabricante próprio de IFA, fabricante terceirizado de IFA), síntese (Ingredientes Farmacêuticos Ativos Sintéticos e Ingredientes Farmacêuticos Ativos Biotecnológicos), síntese química (Acetaminofeno, Artemisinina, Saxagliptina, Cloreto de Sódio, Ibuprofeno, Losartana Potássica, Enoxaparina Sódica, Rufinamida, Naproxeno, Tamoxifeno, Outros), tipo de medicamento ( Medicamentos com Prescrição , Medicamentos sem Prescrição), uso (Clínico, Pesquisa), potência (Ingredientes Farmacêuticos Ativos de baixa a moderada potência, Ingredientes Farmacêuticos Ativos de alta potência), aplicação terapêutica (Cardiologia, SNC e Neurologia, Oncologia, Ortopedia, Endocrinologia, Pneumologia, Gastroenterologia). Nefrologia, Oftalmologia e Outras Aplicações Terapêuticas - Tendências e Previsões do Setor até 2032

Tamanho do mercado de ingredientes farmacêuticos ativos (IFA) na região Ásia-Pacífico

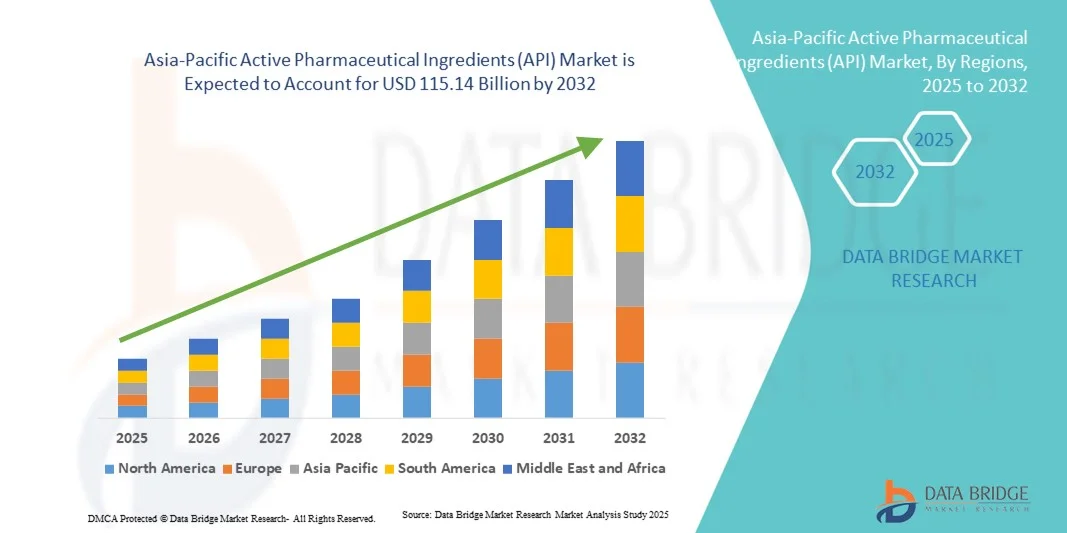

- O mercado de ingredientes farmacêuticos ativos (IFAs) na região Ásia-Pacífico foi avaliado em US$ 64,56 bilhões em 2024 e deverá atingir US$ 115,14 bilhões até 2032 , com uma taxa de crescimento anual composta (CAGR) de 7,50% durante o período de previsão.

- O crescimento do mercado é impulsionado principalmente pela crescente demanda por medicamentos eficazes e de alta qualidade, motivada pela prevalência cada vez maior de doenças crônicas e infecciosas, pelo envelhecimento da população mundial e pela crescente adoção de formulações terapêuticas avançadas.

- Além disso, os avanços contínuos na biotecnologia , juntamente com a expansão das atividades de P&D farmacêutica e a crescente terceirização da fabricação de IFA (Ingredientes Farmacêuticos Ativos) para regiões com custos mais competitivos, estão acelerando a adoção de soluções de IFA, impulsionando significativamente o crescimento do setor.

Análise do Mercado de Ingredientes Farmacêuticos Ativos (IFA) na Ásia-Pacífico

- O mercado de Ingredientes Farmacêuticos Ativos (IFAs) desempenha um papel vital na indústria farmacêutica, sendo o principal componente responsável pelos efeitos terapêuticos de medicamentos utilizados em diversas áreas terapêuticas, como oncologia, doenças cardiovasculares e distúrbios infecciosos. O mercado está apresentando forte crescimento devido aos avanços tecnológicos na síntese, à crescente demanda por produtos biológicos e ao foco cada vez maior em IFAs de alta potência (HPAPIs).

- A crescente demanda por IFA (Ingredientes Farmacêuticos Ativos) é impulsionada principalmente pela prevalência cada vez maior de doenças crônicas e relacionadas ao estilo de vida, pela expansão do setor de medicamentos genéricos e pela tendência das empresas farmacêuticas de terceirizar a produção de IFA para fabricantes especializados, visando à redução de custos e à garantia da qualidade.

- A China dominou o mercado de ingredientes farmacêuticos ativos (IFAs) com a maior participação na receita, de 41,6% em 2024, impulsionada por uma base de fabricação farmacêutica bem estabelecida, uma forte infraestrutura de P&D e a presença de grandes players do mercado.

- Prevê-se que a Índia seja a região de crescimento mais rápido no mercado de ingredientes farmacêuticos ativos (IFAs) durante o período de previsão, devido à expansão da capacidade de produção, às iniciativas governamentais favoráveis e à crescente demanda por genéricos acessíveis.

- O segmento clínico dominou a maior fatia da receita, com 68% em 2024, impulsionado pelo uso de APIs em hospitais, clínicas especializadas e programas de tratamento de pacientes em diversas áreas terapêuticas.

Escopo do relatório e segmentação do mercado de ingredientes farmacêuticos ativos (IFA)

|

Atributos |

Principais informações de mercado sobre ingredientes farmacêuticos ativos (IFA) |

|

Segmentos abrangidos |

|

|

Países abrangidos |

Ásia-Pacífico

|

|

Principais participantes do mercado |

|

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor agregado |

Além das informações sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado elaborados pela Data Bridge Market Research também incluem análises aprofundadas de especialistas, epidemiologia de pacientes, análise de projetos em desenvolvimento, análise de preços e estrutura regulatória. |

Tendências do mercado de ingredientes farmacêuticos ativos (IFA) na região Ásia-Pacífico

Expansão da fabricação de produtos biológicos – APIs e APIs especiais

- Uma tendência clara e crescente no mercado de APIs é a mudança das APIs tradicionais de pequenas moléculas para APIs biológicas, peptídicas, oligonucleotídicas e outras APIs especiais de alto valor agregado.

- Por exemplo, em 2023, uma importante empresa chinesa de IFA (Ingrediente Farmacêutico Ativo) anunciou o lançamento de uma nova linha de produção de IFA biológico para medicamentos oncológicos.

- O segmento de APIs sintéticas de pequenas moléculas ainda lidera em termos de participação de mercado, mas o ritmo de crescimento está se deslocando para APIs biológicas complexas.

- Muitos fabricantes de IFA (Ingrediente Farmacêutico Ativo) estão investindo ou convertendo suas fábricas para produzir IFA biológicos ou outros IFA de alta potência/complexos, possibilitando margens maiores e diferenciação em um mercado de genéricos bastante competitivo.

- As tendências de terceirização estão evoluindo: as empresas farmacêuticas globais estão buscando cada vez mais não apenas APIs em grande volume, mas também parcerias para a fabricação de APIs especializadas e biossimilares na região da Ásia-Pacífico.

- Os avanços tecnológicos — como a fabricação contínua, sistemas de expressão aprimorados e ampliação de escala de bioprocessos — estão facilitando a produção de APIs especiais na região.

- Governos e formuladores de políticas regionais estão apoiando a fabricação de produtos biológicos e de APIs de alta tecnologia (por exemplo, por meio de incentivos), o que reforça ainda mais essa mudança em direção à especialização.

- De forma geral, essa tendência reflete uma transformação do mercado de IFA (Ingrediente Farmacêutico Ativo), passando da produção em larga escala com foco em custo para modelos de produção de IFA mais complexos, diferenciados e de alto valor agregado.

Dinâmica do mercado de ingredientes farmacêuticos ativos (IFAs) na região Ásia-Pacífico

Motorista

Crescente demanda por produção e terceirização de APIs com custo - benefício

- O mercado global de ingredientes farmacêuticos ativos (IFAs) na região Ásia-Pacífico está sendo impulsionado significativamente por empresas farmacêuticas e fabricantes terceirizados que buscam suprimentos de IFAs de alta qualidade e baixo custo.

- Por exemplo, em 2023, um dos principais fabricantes indianos de IFA (Ingredientes Farmacêuticos Ativos) expandiu sua capacidade de produção para atender à crescente demanda de empresas farmacêuticas globais.

- A prevalência de doenças crônicas, o envelhecimento da população e o aumento dos gastos globais com saúde estão impulsionando a demanda por APIs (Ingredientes Farmacêuticos Ativos) genéricos e inovadores.

- Iniciativas governamentais em diversos países da região Ásia-Pacífico estão fortalecendo a produção interna, reduzindo a dependência de importações e aprimorando o papel das empresas nas cadeias de suprimentos globais.

- Custos de fabricação mais baixos, grande mão de obra qualificada e infraestrutura química/bioprocessada consolidada em países-chave da região Ásia-Pacífico estão atraindo cada vez mais a terceirização da produção de IFA (Ingrediente Farmacêutico Ativo) de empresas farmacêuticas ocidentais.

- A expansão dos APIs biológicos e especializados (por exemplo, para oncologia e imunologia) está criando novas necessidades de fabricação e fornecimento, impulsionando ainda mais o crescimento do mercado de APIs na região.

- Muitas empresas farmacêuticas estão transferindo partes de sua cadeia de suprimentos de IFA (Ingrediente Farmacêutico Ativo) para a região Ásia-Pacífico a fim de obter maior eficiência de custos, tempo de lançamento no mercado mais rápido e vantagens regulatórias.

- Os diversos fatores acima mencionados, em conjunto, sustentam um forte ritmo de crescimento no mercado de APIs na região Ásia-Pacífico e globalmente.

Restrição/Desafio

Complexidade regulatória, riscos na cadeia de suprimentos e pressão sobre os preços.

- Os rigorosos requisitos regulamentares relativos à qualidade, segurança e práticas de fabricação de IFA (Ingrediente Farmacêutico Ativo) impõem encargos significativos em termos de custos e conformidade.

- Por exemplo, em 2022, uma importante empresa farmacêutica europeia enfrentou atrasos devido a inspeções regulatórias adicionais de IFA (Ingrediente Farmacêutico Ativo).

- Vulnerabilidades persistentes na cadeia de suprimentos — como a dependência de matérias-primas específicas, centros de produção em um único país ou interrupções decorrentes de eventos geopolíticos/logísticos — limitam a confiabilidade.

- Uma pressão significativa para baixo nos preços dos IFA (Ingredientes Farmacêuticos Ativos) — especialmente para genéricos — reduz a lucratividade dos fabricantes e pode desestimular o investimento em capacidade produtiva ou inovação.

- As preocupações ambientais, de saúde e segurança, bem como a necessidade de modernizar a produção com química mais sustentável ou processos biotecnológicos mais controlados, elevam os custos de capital (CAPEX) e operacionais.

- Padrões de qualidade globais fragmentados e regimes de inspeção variáveis entre os países complicam o fornecimento global e dificultam a harmonização.

- Para os produtores de IFA (Ingrediente Farmacêutico Ativo) de menor porte, a combinação de pressões regulatórias, de custos e de preços de mercado pode limitar a capacidade de expansão ou de investimento em IFAs especializados/biológicos.

- Esses desafios precisam ser gerenciados para um crescimento sustentável do mercado; empresas e órgãos reguladores precisam coordenar-se em relação à qualidade, resiliência e estruturas de custos.

Escopo do mercado de ingredientes farmacêuticos ativos (IFA) na região Ásia-Pacífico

O mercado é segmentado com base na molécula, tipo, tipo de fabricante, síntese, síntese química, tipo de medicamento, uso, potência e aplicação terapêutica.

- Por molécula

Com base na molécula, o mercado de APIs (Ingredientes Farmacêuticos Ativos) da Ásia-Pacífico é segmentado em moléculas pequenas e moléculas grandes. O segmento de moléculas pequenas dominou a maior participação de mercado em receita, com 62% em 2024, impulsionado pelo seu uso consolidado na produção farmacêutica, facilidade de síntese e eficácia clínica comprovada. As moléculas pequenas são amplamente utilizadas em medicamentos prescritos e de venda livre em diversas áreas terapêuticas, como cardiologia, sistema nervoso central, oncologia e tratamentos gastrointestinais. Sua produção com baixo custo, escalabilidade e compatibilidade com métodos convencionais de administração de medicamentos as tornam altamente preferidas pelos fabricantes. A expiração de patentes e o desenvolvimento de medicamentos genéricos reforçam ainda mais essa dominância. Além disso, as moléculas pequenas se beneficiam de cadeias de suprimentos maduras, ampla aceitação regulatória e disponibilidade de matérias-primas. O segmento também apresenta forte adoção devido à crescente demanda por tratamentos para doenças crônicas e produção em larga escala. Os principais polos farmacêuticos da Ásia-Pacífico, incluindo China e Índia, continuam a fortalecer suas capacidades de produção, aumentando a participação de mercado. A integração com os sistemas tradicionais de saúde e os pipelines clínicos estabelecidos sustentam ainda mais a prevalência das moléculas pequenas.

O segmento de moléculas grandes deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,5%, entre 2025 e 2032, impulsionado pela crescente demanda por produtos biológicos, anticorpos monoclonais e proteínas recombinantes. As moléculas grandes são cada vez mais preferidas para terapias complexas, incluindo tratamentos oncológicos, autoimunes e para doenças raras. Os rápidos avanços na biotecnologia, a expansão dos pipelines biofarmacêuticos e os incentivos governamentais para produtos biológicos aceleram o crescimento. Processos de fabricação aprimorados, redução de custos na produção de produtos biológicos e a crescente adoção por hospitais e clínicas especializadas impulsionam ainda mais o potencial de mercado. A crescente ênfase em medicina personalizada, biossimilares e terapias avançadas sustenta o crescimento do segmento. Colaborações estratégicas entre empresas de biotecnologia e institutos de pesquisa aprimoram o acesso e a inovação. O segmento se beneficia do aumento de ensaios clínicos, das aprovações regulatórias para produtos biológicos e da crescente conscientização sobre terapias direcionadas na região da Ásia-Pacífico. A adoção também é impulsionada pela expansão da infraestrutura biotecnológica em mercados emergentes.

- Por tipo

Com base no tipo, o mercado é segmentado em APIs inovadoras e APIs genéricas inovadoras. O segmento de APIs inovadoras dominou o mercado com 58% da receita em 2024, devido à alta demanda por novas terapias, medicamentos patenteados e formulações especiais. As empresas farmacêuticas estão investindo fortemente em P&D para desenvolver novas entidades químicas e terapias direcionadas, particularmente em oncologia, SNC e indicações cardiovasculares. Aprovações regulatórias, linhas de pesquisa clínica e parcerias com organizações de pesquisa reforçam sua dominância. As APIs inovadoras também se beneficiam de margens mais altas e posicionamento estratégico em áreas terapêuticas competitivas. O segmento é sustentado por uma infraestrutura de saúde robusta, crescente foco governamental em doenças raras e complexas e fortes estruturas de proteção de propriedade intelectual. Além disso, a crescente demanda em mercados emergentes e a expansão de hospitais e clínicas especializadas solidificam ainda mais sua posição no mercado. A inovação contínua no design, desenvolvimento e plataformas de administração de medicamentos garante a adoção sustentada de APIs inovadoras em toda a região da Ásia-Pacífico.

O segmento de APIs genéricos inovadores deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22%, entre 2025 e 2032, impulsionado pela crescente adoção de genéricos, políticas de saúde com foco em redução de custos e expiração de patentes. Os APIs genéricos oferecem alternativas acessíveis aos medicamentos de marca, atendendo à crescente demanda em mercados emergentes. Os fabricantes estão expandindo suas capacidades, aprimorando as redes de distribuição e adotando a fabricação por contrato para sustentar o rápido crescimento. Colaborações estratégicas com hospitais, farmácias e outros profissionais de saúde aceleram ainda mais a penetração no mercado. Iniciativas governamentais crescentes para melhorar o acesso a medicamentos, combinadas com avanços tecnológicos na fabricação, contribuem para uma adoção mais rápida. A expansão da cobertura de planos de saúde e dos programas de saúde pública também impulsiona o consumo de APIs genéricos.

- Por tipo de fabricante

Com base no tipo de fabricante, o mercado é segmentado em fabricantes de IFA (Ingrediente Farmacêutico Ativo) próprios e fabricantes de IFA terceirizados. O segmento de fabricantes de IFA próprios dominou o mercado, com 55% da receita em 2024, visto que a produção interna de IFA permite que as empresas farmacêuticas mantenham o controle de qualidade, reduzam custos e garantam a conformidade regulatória. Os fabricantes próprios se beneficiam de P&D integrada, redes de distribuição estabelecidas e formulações proprietárias. Esse segmento apresenta forte demanda em áreas terapêuticas de alto valor agregado, incluindo oncologia e SNC (Sistema Nervoso Central). A estabilidade do fornecimento, a integração vertical e o posicionamento estratégico no mercado sustentam a continuidade dessa dominância.

O segmento de fabricantes independentes de APIs deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,8%, entre 2025 e 2032, impulsionado pelas crescentes tendências de terceirização, oportunidades de fabricação por contrato e demanda global por APIs. Os fabricantes independentes oferecem capacidade de produção flexível, soluções com boa relação custo-benefício e APIs especializadas. A expansão para mercados emergentes e o aumento da atividade de ensaios clínicos reforçam o crescimento do segmento. O foco crescente em pequenas empresas de biotecnologia e startups que terceirizam a produção de APIs acelera ainda mais a adoção. Além disso, os avanços nas tecnologias de fabricação e o suporte regulatório para a fabricação por contrato aumentam a competitividade e a atratividade do segmento para empresas farmacêuticas globais.

- Por síntese

Com base na síntese, o mercado é segmentado em APIs sintéticas e APIs biotecnológicas. O segmento de APIs sintéticas detinha a maior participação na receita, com 60% em 2024, impulsionado por seus processos de produção bem estabelecidos, custos de fabricação mais baixos e ampla aplicabilidade em medicamentos orais, injetáveis e tópicos. O domínio do segmento é reforçado por cadeias de suprimentos robustas, amplo conhecimento das regulamentações e compatibilidade com múltiplas áreas terapêuticas, tornando-o a escolha preferencial para fabricantes farmacêuticos. Além disso, a infraestrutura consolidada, a disponibilidade constante de matérias-primas e a integração perfeita com os processos de desenvolvimento farmacêutico convencionais fortalecem ainda mais sua posição de liderança. A ampla adoção de APIs sintéticas em medicamentos de marca e genéricos, aliada aos avanços tecnológicos contínuos, garante crescimento sustentado e a manutenção da liderança de mercado.

O segmento de APIs biotecnológicas deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 23%, entre 2025 e 2032, impulsionado pelo rápido desenvolvimento de produtos biológicos, proteínas recombinantes e anticorpos monoclonais. O aumento dos investimentos em P&D biofarmacêutica, a crescente adoção hospitalar e os incentivos governamentais para a inovação biotecnológica aceleram o crescimento. O segmento é sustentado pelo aumento de ensaios clínicos, pelo acesso facilitado a terapias avançadas e pela crescente conscientização sobre medicina personalizada. Colaborações estratégicas entre empresas farmacêuticas e biotecnológicas fortalecem ainda mais a penetração no mercado. Polos biotecnológicos emergentes na região Ásia-Pacífico aumentam a capacidade de produção e a acessibilidade de APIs biológicas.

- Por síntese química

Com base na síntese química, o mercado é segmentado em Acetaminofeno, Artemisinina, Saxagliptina, Cloreto de Sódio, Ibuprofeno, Losartana Potássica, Enoxaparina Sódica, Rufinamida, Naproxeno, Tamoxifeno e Outros. O segmento de Acetaminofeno dominou a maior participação na receita de mercado, com 44% em 2024, impulsionado por seu uso extensivo em analgésicos, antipiréticos e medicamentos combinados. A alta demanda por medicamentos de venda livre, hospitais e clínicas reforça essa dominância. O Acetaminofeno se beneficia de processos de fabricação consolidados, baixos custos de produção e amplas redes de distribuição. Sua compatibilidade com formulações pediátricas e adultas, bem como sua integração em terapias combinadas, garante uma adoção consistente pelo mercado. A demanda global estável, a forte aprovação regulatória e o aumento dos gastos com saúde na região Ásia-Pacífico sustentam a continuidade dessa dominância. Além disso, os fabricantes aproveitam as economias de escala e as cadeias de suprimentos eficientes para manter a produção.

O segmento da artemisinina deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 21,5%, entre 2025 e 2032, impulsionado pela crescente demanda por terapias antimaláricas e pelo aumento das pesquisas em novos derivados. Programas governamentais que promovem o tratamento da malária e iniciativas globais de saúde contribuem para esse crescimento. A expansão da fabricação por contrato e o aumento dos investimentos biofarmacêuticos no Sudeste Asiático aceleram ainda mais a adoção do produto. A relevância da artemisinina em terapias combinadas e a pesquisa e desenvolvimento contínuos para aprimorar sua eficácia sustentam a rápida penetração no mercado. Parcerias com instituições de pesquisa, maior acesso a mercados emergentes e avanços tecnológicos nos métodos de produção também reforçam o crescimento do segmento.

- Por tipo de medicamento

Com base no tipo de medicamento, o mercado é segmentado em medicamentos de prescrição e medicamentos de venda livre. O segmento de medicamentos de prescrição dominou a maior participação na receita, com 65% em 2024, impulsionado pela alta prevalência de doenças crônicas, aumento dos gastos com saúde e adoção de terapias especializadas em cardiologia, oncologia e SNC (Sistema Nervoso Central). Os IFAs (Ingredientes Farmacêuticos Ativos) de prescrição se beneficiam de altos padrões regulatórios, linhas de pesquisa clínica consolidadas e fortes redes de distribuição em hospitais e farmácias. O segmento é ainda fortalecido pelo aumento do foco em pesquisa, novas terapias protegidas por patentes e crescente demanda por medicina personalizada. A integração aos sistemas de saúde, a cobertura de planos de saúde e as clínicas especializadas garantem a adoção contínua. Fortes investimentos em P&D (Pesquisa e Desenvolvimento), disponibilidade de IFAs de alta qualidade e expertise avançada em formulação mantêm a dominância do segmento.

O segmento de medicamentos isentos de prescrição deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 20,8%, entre 2025 e 2032, impulsionado pela crescente tendência de automedicação, pela maior conscientização sobre cuidados básicos de saúde e por iniciativas governamentais para melhorar o acesso a esses medicamentos. A preferência do consumidor por conveniência, custo-benefício e disponibilidade imediata impulsiona o crescimento do segmento. A expansão das redes de farmácias, dos canais de vendas online e das plataformas de e-commerce acelera ainda mais a adoção. A crescente demanda por analgésicos, remédios para resfriado e vitaminas também contribui para o rápido crescimento. Os fabricantes estão inovando em embalagens e formulações para aumentar o apelo ao consumidor.

- Por uso

Com base no uso, o mercado é segmentado em clínico e pesquisa. O segmento clínico dominou a maior fatia da receita, com 68% em 2024, impulsionado pelo uso de APIs em hospitais, clínicas especializadas e programas de tratamento de pacientes em diversas áreas terapêuticas. A adoção clínica é sustentada por uma infraestrutura de saúde robusta, pelo aumento da população de pacientes e pela crescente prevalência de doenças crônicas. As APIs em aplicações clínicas garantem alta qualidade, conformidade com as normas regulatórias e resultados terapêuticos consistentes. A colaboração entre empresas farmacêuticas e hospitais reforça ainda mais essa dominância. A expansão do acesso à saúde em países da Ásia-Pacífico, a integração de terapias avançadas e a adoção de protocolos de tratamento padronizados aumentam a penetração no mercado.

Espera-se que o segmento de pesquisa apresente a taxa de crescimento anual composta (CAGR) mais rápida, de 22,2%, entre 2025 e 2032, impulsionado pelo aumento dos investimentos em P&D, pela atividade de ensaios clínicos e pelo financiamento governamental para a descoberta de novos medicamentos. Instituições acadêmicas, organizações de pesquisa contratadas e empresas de biotecnologia estão cada vez mais dependendo de APIs (Ingredientes Farmacêuticos Ativos) para terapias experimentais. O crescente interesse em medicina personalizada, doenças raras e formulações inovadoras também contribui para essa adoção. A expansão da infraestrutura laboratorial, a disponibilidade de APIs de alta pureza e a inovação colaborativa impulsionam o crescimento do segmento. Parcerias estratégicas entre empresas farmacêuticas e instituições de pesquisa aprimoram o desenvolvimento de novos produtos em fase de pesquisa.

- Por Potência

Com base na potência, o mercado é segmentado em APIs de baixa a moderada potência e APIs de alta a elevada potência. O segmento de APIs de baixa a moderada potência dominou a maior participação na receita de mercado, com 61% em 2024, devido ao seu uso generalizado em terapias comuns, como analgésicos, medicamentos cardiovasculares e anti-infecciosos. A eficiência de fabricação, a relação custo-benefício e as cadeias de suprimentos estabelecidas reforçam essa dominância. APIs de baixa a moderada potência são preferidas para produção em alto volume e ampla aplicabilidade terapêutica. O conhecimento das regulamentações, os processos de produção escaláveis e a integração em terapias combinadas também contribuem para a sua adoção. O crescimento do mercado é impulsionado pelo aumento da demanda hospitalar e farmacêutica e pela presença de fortes polos de produção regionais.

O segmento de APIs de alta potência deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 23,5%, entre 2025 e 2032, impulsionado pelo crescimento em oncologia, SNC e terapias especializadas que requerem medicamentos de baixa dose e alta eficácia. Padrões de fabricação rigorosos, instalações dedicadas e o aumento das parcerias de fabricação por contrato contribuem para o crescimento do segmento. O foco crescente no tratamento de doenças raras, produtos biológicos e medicina de precisão apoia a adoção de APIs de alta potência. A expansão da infraestrutura de fabricação especializada, tecnologias avançadas de contenção e o aumento das aprovações regulatórias aceleram a penetração do segmento. O forte interesse do mercado em novas terapias direcionadas e no desenvolvimento de pipelines clínicos reforça ainda mais o crescimento.

- Por aplicação terapêutica

Com base na aplicação terapêutica, o mercado é segmentado em cardiologia, SNC e neurologia, oncologia, ortopedia, endocrinologia, pneumologia, gastroenterologia, nefrologia, oftalmologia e outras aplicações terapêuticas. O segmento de oncologia dominou a maior participação na receita do mercado, com 32% em 2024, impulsionado pelo aumento da prevalência de câncer, terapias-alvo avançadas e alta adoção de produtos biológicos. Os APIs oncológicos se beneficiam de fortes linhas de pesquisa e desenvolvimento, apoio governamental e colaboração com hospitais especializados e institutos de pesquisa. Aprovações regulatórias para novos tratamentos, alta demanda de pacientes e regimes com múltiplos medicamentos reforçam ainda mais a dominância. O aumento do investimento em terapias contra o câncer, a robusta atividade de ensaios clínicos e a integração da medicina de precisão impulsionam a adoção em toda a região da Ásia-Pacífico.

O segmento de neurologia e do sistema nervoso central (SNC) deverá apresentar a taxa de crescimento anual composta (CAGR) mais rápida, de 22%, entre 2025 e 2032, impulsionado pela crescente prevalência de distúrbios neurológicos, pela demanda cada vez maior por terapias inovadoras e pelo crescente apoio governamental ao tratamento de doenças raras. A expansão de centros de pesquisa, ensaios clínicos e a adoção de APIs para o SNC em hospitais aceleram o crescimento do segmento. O desenvolvimento de novas terapias com moléculas pequenas e grandes, a crescente conscientização sobre saúde mental e a integração de tecnologias de saúde digital também contribuem para a adoção. Parcerias entre empresas farmacêuticas e institutos de pesquisa focados em neurologia reforçam a expansão do mercado.

Análise Regional do Mercado de Ingredientes Farmacêuticos Ativos (IFA) na Ásia-Pacífico

- O mercado de ingredientes farmacêuticos ativos (IFAs) da região Ásia-Pacífico está preparado para crescer à taxa composta de crescimento anual (CAGR) mais rápida durante o período de previsão de 2025 a 2032.

- Impulsionado pela crescente urbanização, pelo aumento da renda disponível e pelos avanços tecnológicos em países como China, Japão e Índia.

- A crescente base de produção farmacêutica da região, as iniciativas governamentais de apoio e o foco em genéricos acessíveis estão criando um ambiente favorável para a expansão do mercado.

Análise do Mercado de Ingredientes Farmacêuticos Ativos (IFAs) na China:

O mercado chinês de ingredientes farmacêuticos ativos (IFAs) dominou o mercado de IFAs em 2024, com a maior participação de receita, atingindo 41,6%, impulsionado por uma base de fabricação farmacêutica bem estabelecida, uma forte infraestrutura de P&D e a presença de grandes players do mercado. A expansão da classe média, a rápida urbanização e a adoção de tecnologia impulsionam ainda mais o mercado de IFAs no país. Além disso, a forte capacidade de produção nacional, os incentivos governamentais para a produção farmacêutica e a crescente demanda por genéricos são fatores-chave que sustentam a dominância da China no mercado.

Análise do Mercado de Ingredientes Farmacêuticos Ativos (IFAs) na Índia:

O mercado de ingredientes farmacêuticos ativos (IFAs) na Índia deverá ser o de crescimento mais rápido durante o período de previsão, impulsionado pela expansão da capacidade produtiva, iniciativas governamentais favoráveis e crescente demanda por genéricos acessíveis. O aumento dos investimentos estrangeiros, o forte potencial de exportação e as crescentes oportunidades de fabricação por contrato também contribuem para a trajetória de crescimento da Índia. A ênfase do país na produção com custo-benefício e na fabricação escalável de IFAs está atraindo empresas farmacêuticas globais para a Índia.

Participação de mercado de ingredientes farmacêuticos ativos (IFA) na região Ásia-Pacífico

A indústria de Ingredientes Farmacêuticos Ativos (IFA) é liderada principalmente por empresas consolidadas, incluindo:

- Cipla (Índia)

- Laboratórios Dr. Reddy's (Índia)

- Indústrias Farmacêuticas Sun (Índia)

- Aurobindo Pharma (Índia)

- Hanwha Chemical (Coreia do Sul)

- Toyama Chemical (Japão)

- Daiichi Sankyo (Japão)

- Hetero Labs (Índia)

- Lupin Limited (Índia)

Últimos desenvolvimentos no mercado de ingredientes farmacêuticos ativos (IFA) na região Ásia-Pacífico

- Em maio de 2025, a Xellia Pharmaceuticals, última fabricante europeia de ingredientes antibióticos essenciais, anunciou o fechamento de sua maior fábrica no país, em Copenhague, resultando na perda de 500 empregos. A empresa alegou concorrência insustentável e planos para transferir parte da produção para a China. Essa medida ressalta os desafios enfrentados pelas fabricantes farmacêuticas europeias para manter a competitividade em relação às concorrentes asiáticas.

- Em outubro de 2025, a Administração de Alimentos e Medicamentos dos EUA (FDA) lançou um programa piloto com o objetivo de acelerar o processo de revisão de medicamentos genéricos fabricados e testados inteiramente nos Estados Unidos. Essa iniciativa busca fortalecer a produção nacional de medicamentos e reduzir a dependência de fontes estrangeiras para ingredientes farmacêuticos ativos.

- Em setembro de 2025, a Symbiotec Pharmalab, líder global na produção de ingredientes farmacêuticos ativos de corticosteroides e hormônios, anunciou planos para realizar uma oferta pública inicial (IPO) nos próximos 12 meses. A empresa almeja uma avaliação de aproximadamente US$ 1 bilhão para fortalecer sua posição no mercado farmacêutico especializado.

- Em junho de 2025, os preços dos ingredientes farmacêuticos ativos (IFAs) na Índia caíram acentuadamente, aliviando a pressão sobre a indústria farmacêutica do país. Espera-se que a queda nos custos dos IFAs reduza as despesas de produção para os fabricantes de medicamentos, aumente a lucratividade e estabilize a cadeia de suprimentos dentro do setor.

- Em outubro de 2025, a Dr. Reddy's Laboratories informou que a Food and Drug Administration (FDA) dos EUA emitiu um Formulário 483 com duas observações após inspecionar sua unidade de fabricação de IFA (Ingrediente Farmacêutico Ativo) em Middleburgh, Nova York. A empresa planeja abordar essas observações em consulta com a FDA para garantir a conformidade com os padrões regulatórios.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.