Apac Medical Aesthetics Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.50 Billion

USD

12.64 Billion

2024

2032

USD

4.50 Billion

USD

12.64 Billion

2024

2032

| 2025 –2032 | |

| USD 4.50 Billion | |

| USD 12.64 Billion | |

|

|

|

Segmentação do mercado de estética médica da Ásia-Pacífico, por tipo de produto (dispositivos laser estéticos, dispositivos de energia, dispositivos de contorno corporal, dispositivos estéticos faciais, implantes estéticos e dispositivos estéticos da pele), aplicação (antienvelhecimento e rugas, rejuvenescimento facial e da pele, mama Melhoria, Modelação Corporal e Celulite, Remoção de Tatuagens, Lesões Vasculares, Sears, Lesões Pigmentares, Reconstrutivas, Psoríase e Vitiligo e Outras), Utilizador Final (Centros Cosméticos, Clínicas Dermatológicas, Hospitais e Spas Médicos e Centros de Beleza ), Canal de Distribuição ( Concurso directo e retalho) - Tendências do sector e previsão para 2032

Análise do mercado de estética médica da Ásia-Pacífico

A estética médica tem uma história rica que remonta a civilizações antigas, onde os tratamentos de beleza eram praticados com remédios naturais e as primeiras formas de procedimentos cosméticos. No início do século XX, a estética médica começou a fundir-se com os avanços da tecnologia médica, com inovações como o primeiro colagénio injetável para o tratamento de rugas na década de 1970. O desenvolvimento do Botox na década de 1980 marcou um marco importante, introduzindo o rejuvenescimento facial não cirúrgico. Ao longo das décadas, o campo expandiu-se com o advento das tecnologias laser, dos preenchimentos dérmicos e dos tratamentos não invasivos do contorno corporal. Hoje, a estética médica combina tecnologia avançada com o desejo crescente por procedimentos cosméticos não invasivos, tornando-a uma indústria em rápido crescimento nos cuidados de saúde da Ásia-Pacífico.

Tamanho do mercado de estética médica da Ásia-Pacífico

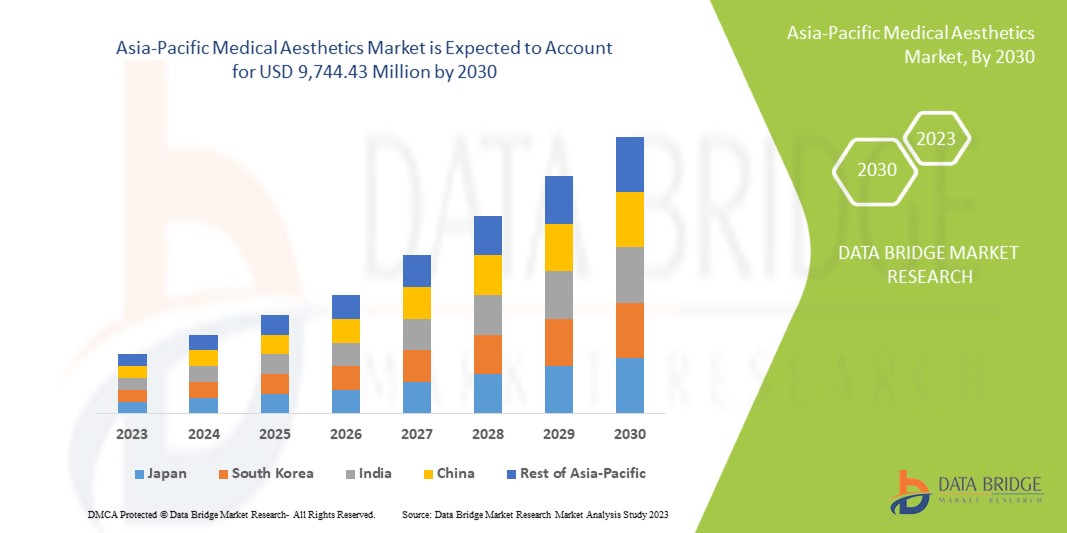

O mercado de estética médica da Ásia-Pacífico deverá atingir os 12,64 mil milhões de dólares até 2032, face aos 4,50 mil milhões de dólares em 2024, crescendo com um CAGR de 13,8% no período previsto de 2024 a 2032. Para além dos insights sobre os cenários de mercado, tais como o valor de mercado , a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção, análise de consumo de produção, análise de tendência de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise de cadeia de valor, visão geral da matéria-prima/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória.

Tendências do mercado de estética médica da Ásia-Pacífico

“Aumento da procura de procedimentos não cirúrgicos”

O mercado de estética médica da Ásia-Pacífico está a testemunhar uma tendência significativa para procedimentos cosméticos não cirúrgicos, impulsionada pelos avanços na tecnologia, tempos mínimos de recuperação e aumento da preferência dos consumidores por tratamentos menos invasivos. Procedimentos como injeções de Botox, preenchimentos dérmicos, tratamentos a laser e contorno corporal não cirúrgico estão a tornar-se cada vez mais populares à medida que os indivíduos procuram melhorar a sua aparência sem os riscos e o tempo de inatividade associados às cirurgias tradicionais. A crescente consciencialização sobre os tratamentos estéticos, aliada à influência das redes sociais nos padrões de beleza, contribuiu para este aumento da procura. Além disso, o aumento do rendimento disponível, juntamente com o envelhecimento da população nos mercados desenvolvidos, está a alimentar a expansão do mercado. A crescente disponibilidade de tratamentos inovadores e personalizados e a crescente aceitação da estética médica na sociedade aceleram ainda mais esta tendência, posicionando as opções não cirúrgicas como a escolha preferida de muitos consumidores.

Âmbito do relatório e segmentação do mercado de estética médica da Ásia-Pacífico

|

Atributos |

Insights do mercado de estética médica da Ásia-Pacífico |

|

Segmentos cobertos |

|

|

Região coberta |

China, Índia, Japão, Coreia do Sul, Austrália, Indonésia, Tailândia, Malásia, Filipinas, Singapura e Resto da Ásia-Pacífico |

|

Principais participantes do mercado |

Mentor WorldWide LLC (uma subsidiária da Johnsons & Johnsons) (EUA), Allergan (uma subsidiária da AbbVie Inc.) (Irlanda), GALDERMA (Suíça), Cutera, Inc. Sirona (EUA), Institut Straumann AG (EUA), Candela Corporation (EUA), Medytrox (Coreia do Sul), BioHorizons (EUA), BTL (Índia), Nobel Biocare Services AG (Suíça), Merz Pharma (Alemanha), Cynosure, LLC (EUA), Sharplight Technologies Inc. (Israel) , Alma Lasers (EUA), MEGA'GEN IMPLANT CO., LTD. (Índia), 3M (EUA), Quanta System (Itália), Sciton (Califórnia) e entre outros. |

|

Oportunidades de mercado |

|

|

Conjuntos de informações de dados de valor acrescentado |

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research incluem também a análise de importação e exportação, a visão geral da capacidade de produção , análise de consumo de produção, análise de tendências de preço, cenário de alterações climáticas, análise da cadeia de abastecimento, análise da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulatória. |

Definição do mercado de estética médica da Ásia-Pacífico

A estética médica inclui todos os tratamentos médicos que visam melhorar a aparência estética dos pacientes. A estética médica situa-se num pequeno nicho entre a indústria da beleza e a cirurgia plástica. Médicos, enfermeiros ou dentistas qualificados podem fornecer uma infinidade de tratamentos impressionantes para melhorar a sua aparência. Estes tratamentos requerem um elevado grau de habilidade, treino e conhecimento da sua anatomia e fisiologia. É isto que separa os tratamentos estéticos médicos dos tratamentos de beleza, como a depilação das sobrancelhas, a depilação com cera ou as extensões de pestanas. Por outro lado, os tratamentos estéticos médicos não são tão agressivos como as intervenções cirúrgicas (os tratamentos médicos estéticos são por vezes designados por tratamentos cosméticos não cirúrgicos), o que inclui procedimentos como o lifting facial, o aumento mamário ou a lipoaspiração.

Dinâmica de definição do mercado de estética médica Ásia-Pacífico

Motoristas

- Aumento do envelhecimento da população

O aumento do envelhecimento da população impulsiona significativamente o mercado de serviços de estética devido ao desejo crescente entre os idosos de manter uma aparência jovem e melhorar a sua qualidade de vida. À medida que as pessoas envelhecem, experimentam frequentemente um declínio na elasticidade da pele, o aparecimento de rugas e outros sinais de envelhecimento que podem afetar a autoestima e o bem-estar geral. Esta mudança demográfica levou a uma maior procura de diversos tratamentos estéticos, incluindo procedimentos não invasivos, como o botox, os preenchimentos dérmicos e as terapias de rejuvenescimento da pele. A crescente consciencialização destas opções estéticas, aliada a uma ênfase cultural na beleza e na aparência, leva os idosos a procurar soluções que lhes permitam ter uma aparência tão vibrante quanto se sentem, alimentando assim o crescimento do mercado.

Por exemplo,

- Em setembro de 2022, de acordo com um artigo publicado pelo The Nation, a indústria de saúde e estética da Tailândia foi impulsionada pelo envelhecimento da população do país. Além disso, de acordo com a mesma fonte, a 31 de dezembro do ano passado, 12,24 milhões ou 18,5% da população da Tailândia tinha 60 anos ou mais.

- Em janeiro de 2024, de acordo com a notícia publicada pelo PRB, ocorreu um aumento significativo do envelhecimento da população nos Estados Unidos, prevendo-se um aumento do número de americanos com 65 anos ou mais de 17% para 23% até 2060. Esta alteração demográfica impulsiona o Mercado de estética médica da Ásia-Pacífico, à medida que os idosos procuram tratamentos para resolver problemas relacionados com a idade, como rugas, flacidez da pele e perda de volume. A crescente procura por procedimentos antienvelhecimento, como o Botox, os preenchimentos dérmicos e os tratamentos de rejuvenescimento da pele, alimenta o crescimento do mercado e a inovação em produtos e serviços estéticos

- Em maio de 2023, de acordo com as notícias publicadas no The US Census Bureau, o relatório destaca um aumento de 38,6% na população dos EUA com 65 anos ou mais de 2010 a 2020, impulsionando a procura por tratamentos antienvelhecimento, como o Botox e preenchimentos dérmicos, impulsionando o crescimento no mercado de estética médica da Ásia-Pacífico

Além disso, o aumento do rendimento disponível entre a população idosa contribui ainda mais para a expansão do mercado de serviços de estética. À medida que os idosos procuram investir na sua aparência pessoal e bem-estar, estão mais dispostos a gastar em tratamentos de melhoramento.

Concluindo, os avanços na tecnologia tornaram os procedimentos estéticos mais seguros, minimamente invasivos e mais acessíveis, atraindo um segmento mais amplo de adultos mais velhos que anteriormente hesitavam em tais intervenções. Esta convergência de tendências demográficas, o aumento do rendimento disponível e as melhores ofertas de serviços representam um crescimento significativo para o setor dos serviços estéticos, impulsionando a inovação e a concorrência entre prestadores.

- Mudança dos padrões de beleza e influência das redes sociais

A evolução dos padrões de beleza e a influência das plataformas de redes sociais impulsionam significativamente a procura por tratamentos estéticos médicos. Plataformas de redes sociais como o Instagram e o TikTok exibem padrões de beleza idealizados, incentivando os indivíduos a procurar melhorias estéticas para alcançar visuais semelhantes. Os influenciadores e as celebridades geralmente promovem tratamentos estéticos, tornando-os mais populares e desejáveis. Esta tendência leva ao aumento da consciencialização e aceitação da estética médica, impulsionando o crescimento do mercado.

Por exemplo,

- Em junho de 2023, segundo um artigo publicado na The National Library of Medicine, a crescente procura de estética médica impulsionada pelo envelhecimento da população e pelos avanços da tecnologia. À medida que as pessoas envelhecem, procuram tratamentos para tratar os sinais de envelhecimento, como as rugas e a flacidez da pele. Os avanços tecnológicos tornaram estes tratamentos mais eficazes e acessíveis, impulsionando ainda mais o crescimento do mercado. Além disso, a crescente consciencialização e aceitação dos procedimentos estéticos contribuem para a expansão do mercado

- Em julho de 2024, de acordo com um artigo publicado no ResearchGate, as redes sociais tiveram uma influência significativa na imagem corporal e nas considerações sobre cirurgia estética. As plataformas de redes sociais retratam frequentemente padrões de beleza idealizados, levando os indivíduos a procurar melhorias estéticas para alcançar uma aparência semelhante. Esta tendência impulsiona a procura por tratamentos estéticos médicos, uma vez que as pessoas são cada vez mais influenciadas pelas imagens e estilos de vida que veem online. A análise destaca o papel das redes sociais na formação de perceções de beleza e na crescente aceitação de procedimentos cosméticos, alimentando assim o crescimento do mercado

O mercado de estética médica da Ásia-Pacífico é impulsionado pelas mudanças nos padrões de beleza e pela influência generalizada das redes sociais. À medida que os indivíduos se esforçam para cumprir estes ideais em evolução, a procura por tratamentos estéticos continua a aumentar, promovendo a inovação e a expansão na indústria.

Oportunidades

- Desenvolvimento de novos tratamentos inovadores

A introdução de tratamentos novos e inovadores representa uma oportunidade significativa para o mercado da estética médica. Com os avanços na tecnologia médica, os tratamentos estéticos evoluíram para incluir opções não invasivas e altamente eficazes que satisfazem a crescente procura por melhores resultados com um tempo de inatividade mínimo. Tratamentos como terapias com células estaminais, técnicas avançadas de laser e lifting facial não cirúrgico estão a remodelar o mercado ao oferecer aos consumidores uma maior gama de opções que se adequam às suas diversas necessidades e preferências. Estas inovações não só aumentam a eficácia e a segurança dos tratamentos, como também reduzem os riscos associados a procedimentos cirúrgicos mais tradicionais. À medida que os consumidores procuram cada vez mais soluções de ponta para manter a juventude e melhorar a aparência, a procura por estes serviços estéticos avançados continua a aumentar. Esta mudança para tratamentos mais recentes e eficazes atua como uma oportunidade importante, impulsionando o crescimento do mercado e posicionando-o para uma expansão a longo prazo à medida que a tecnologia continua a transformar o setor.

Por exemplo,

- Em fevereiro de 2022, de acordo com o artigo publicado pela Science Direct, as células estaminais, originalmente utilizadas para doenças degenerativas crónicas, estão agora a surgir como um tratamento promissor e minimamente invasivo em estética. Esta mudança em direção às terapias com células estaminais oferece soluções eficazes para o rejuvenescimento da pele e antienvelhecimento, atraindo um crescente interesse por parte dos consumidores. À medida que este tratamento inovador ganha força, apresenta uma oportunidade significativa para o mercado de serviços estéticos do Sudeste Asiático se expandir e evoluir

- Em agosto de 2021, de acordo com o artigo publicado pelo NCBI, as células estaminais, principalmente as derivadas do tecido adiposo, estão a ganhar popularidade na dermatologia cosmética devido à sua capacidade de se auto-renovarem e de se diferenciarem em vários tipos de células. A sua facilidade de recolha e abundância tornam-nos uma opção atraente para tratamentos estéticos, como o rejuvenescimento da pele. Esta inovação representa uma oportunidade valiosa para o mercado de serviços de estética do Sudeste Asiático crescer e diversificar as suas ofertas

- Em janeiro de 2023, de acordo com o artigo publicado na revista MedEsthetics, inovações tecnológicas significativas impulsionarão o crescimento do mercado da estética médica. Estes avanços incluem procedimentos indolores de última geração, dispositivos avançados, resurfacing fracionado, lipoplastia assistida por ultrassons de terceira geração e imagiologia avançada da pele. A integração de RV, RA, IA, CAD, telemedicina e IoT aumenta a precisão e a eficiência dos procedimentos, tornando-os mais precisos e menos invasivos

- Em fevereiro de 2024, de acordo com o artigo publicado no MDPI, os avanços na medicina regenerativa para a dermatologia estética irão focar-se em tratamentos inovadores e minimamente invasivos para o rejuvenescimento e regeneração facial. A estreita correlação entre reparação tecidular, regeneração e envelhecimento abriu caminho para a aplicação dos princípios da medicina regenerativa na dermatologia cosmética

A introdução de tratamentos novos e avançados oferece uma oportunidade valiosa para o mercado da estética médica. Inovações como as terapias com células estaminais, os tratamentos a laser melhorados e o lifting facial não cirúrgico oferecem aos consumidores opções mais seguras e eficazes que requerem menos tempo de recuperação. Estes avanços atendem à crescente procura por procedimentos não invasivos e atraem aqueles que procuram resultados melhores e mais duradouros. À medida que estes tratamentos ganham popularidade, criam uma forte procura, actuando como um motor chave para o crescimento do mercado e posicionando-o para uma expansão contínua.

- Parcerias e Inovações Médicas

As parcerias e inovações médicas apresentam uma oportunidade significativa para o mercado da estética médica, aumentando a credibilidade e a qualidade dos serviços oferecidos. As colaborações entre prestadores de serviços estéticos e profissionais médicos qualificados, como dermatologistas e cirurgiões plásticos, garantem que os tratamentos não são apenas eficazes, mas também seguros para os consumidores. Estas parcerias permitem também a integração de tecnologias e técnicas médicas avançadas em procedimentos estéticos, tornando os serviços mais fiáveis e atrativos para uma base de clientes mais ampla. Com o envolvimento de profissionais médicos de confiança, os consumidores sentem-se mais confiantes nos procedimentos, levando a um aumento da procura de serviços de estética. Além disso, estas colaborações abrem portas para o desenvolvimento de tratamentos novos e de vanguarda que vão ao encontro das necessidades emergentes dos consumidores. Esta aliança entre a estética e a medicina impulsiona o crescimento do mercado, posicionando-o como um setor fiável, inovador e de alta qualidade.

Por exemplo,

- Em novembro de 2024, de acordo com o artigo publicado pelo The Nation, a parceria da MASTER com a "Lumeo Health" da Indonésia irá posicioná-la como o principal fornecedor de cirurgia estética do Sudeste Asiático. Esta colaboração promove a inovação e melhora as parcerias médicas, oferecendo serviços estéticos avançados a um mercado em crescimento. Ao combinar experiência e recursos, esta aliança abre novas oportunidades para um acesso alargado, tratamentos de ponta e melhores resultados para os pacientes, impulsionando o crescimento no setor estético

- Em outubro de 2023, de acordo com o artigo publicado pela Health365, a parceria com o Hospital de Banguecoque marca um passo significativo na melhoria dos serviços de estética no Sudeste Asiático. Ao combinar a experiência da Health365 com a inovação médica do Bangkok Hospital, esta colaboração promove o acesso a tratamentos de classe mundial e a tecnologias avançadas. Esta aliança estratégica representa uma oportunidade valiosa para elevar o mercado de serviços de estética da região, impulsionando o crescimento e melhorando os cuidados prestados aos doentes

As parcerias médicas representam uma oportunidade valiosa para o mercado de serviços de estética médica, pois aumentam a credibilidade e a qualidade do serviço. As colaborações entre prestadores de serviços estéticos e profissionais médicos qualificados garantem que os tratamentos são seguros e eficazes, gerando confiança no consumidor. Estas parcerias facilitam também a introdução de técnicas e tecnologias avançadas, atraindo uma base de clientes mais ampla. Ao aliar a expertise médica à inovação estética, o mercado experimenta um crescimento e um aumento da procura.

Restrições/Desafios

- Falta de profissionais formados

A falta de profissionais capacitados no mercado dos serviços de estética dificulta significativamente o crescimento e a proliferação destes serviços. Os procedimentos estéticos, que muitas vezes exigem competências e conhecimentos especializados, exigem uma força de trabalho bem versada nas mais recentes tecnologias, técnicas e protocolos de segurança. A escassez de profissionais certificados limita a disponibilidade de serviços e representa riscos para a segurança do doente, levando a potenciais complicações e insatisfação com os resultados. Isto cria um ciclo em que os consumidores hesitam em envolver-se com ofertas estéticas, estagnando ainda mais o crescimento do mercado.

Por exemplo,

- Em agosto de 2023, de acordo com um artigo publicado pela The Malaysian Reserve, a ignorância ou falta de consciência sobre procedimentos estéticos arriscados realizados por esteticistas ou profissionais não licenciados na Malásia representa uma séria ameaça para os consumidores. A utilização de produtos de qualidade inferior ou de práticas pouco higiénicas pode resultar em graves problemas de saúde, infeções ou danos irreversíveis. Além disso, a ausência de supervisão regulamentar deixa os consumidores vulneráveis a práticas enganosas, tornando-lhes difícil recorrer em caso de negligência ou efeitos adversos.

- Em julho de 2019, de acordo com um artigo, ‘Associação promove esteticistas qualificados na Malásia’, foi afirmado que as estimativas locais sugerem que existem 20.000 esteticistas não certificados em comparação com apenas 200 titulares certificados de qualificações profissionais. Isto desafia a indústria a manter os seus padrões de prestação de serviços estéticos

- Em outubro de 2024, de acordo com um artigo publicado na The Evaluation Company, a escassez significativa de pessoal médico nos EUA, o que representa uma restrição para o mercado de estética médica da Ásia-Pacífico. A escassez afeta não só os médicos, mas também os enfermeiros e outros profissionais de saúde, aumentando o tempo de espera e reduzindo a disponibilidade de tratamentos estéticos. Esta escassez de profissionais qualificados pode limitar o crescimento e a expansão do mercado da estética médica, uma vez que a procura por profissionais qualificados supera a oferta

Além disso, esta lacuna de talento pode impedir as clínicas e os prestadores de serviços de alargarem as suas operações ou expandirem as suas ofertas. À medida que a procura por serviços de estética continua a aumentar, particularmente entre os grupos demográficos mais jovens que procuram tratamentos não invasivos, a capacidade de satisfazer esta procura é obstruída por um grupo limitado de profissionais qualificados. Este desafio afeta a reputação e a confiança da marca, uma vez que os clientes estão mais propensos a escolher estabelecimentos conhecidos pela sua equipa qualificada e experiente. Consequentemente, sem programas de formação direcionados e iniciativas de apoio para nutrir os profissionais de saúde em estética, o potencial do mercado de estética médica da Ásia-Pacífico continua a ser subutilizado.

- Risco de efeitos secundários associados a estes procedimentos

O risco de efeitos secundários associados a procedimentos estéticos atua como uma restrição significativa para o mercado da estética médica, criando apreensão entre potenciais clientes. Muitos procedimentos estéticos, sejam cirúrgicos ou não, apresentam o risco inerente de complicações, como infeções, cicatrizes ou resultados insatisfatórios. Este receio de efeitos adversos pode impedir os indivíduos de procurarem estes serviços, uma vez que os consumidores estão cada vez mais informados através das redes sociais e das plataformas online sobre as experiências de outras pessoas, incluindo os resultados negativos. Consequentemente, o potencial de efeitos secundários pode criar uma percepção de que estes procedimentos não compensam o risco, levando à redução da procura e da quota de mercado.

Por exemplo,

- Em outubro de 2024, de acordo com um artigo, ‘Perigos da cirurgia estética na Tailândia, do Dr. Ehsan Jadoon’, os perigos envolvidos nas cirurgias estéticas incluem inchaço, hematomas, infeção, reação alérgica, resultados assimétricos, lesão vascular, trauma nervoso , perturbações visuais, trauma psicológico e lesões corporais graves

- Em outubro de 2024, de acordo com um artigo publicado no Journal of Cutaneous and Aesthetic Surgery, muitos eventos adversos não são notificados devido à falta de regulamentação e à má fiscalização, uma vez que os procedimentos são frequentemente realizados em ambientes não médicos, como spas e salões de beleza. Esta falta de supervisão pode levar a complicações como necrose gordurosa, infeções e outros efeitos secundários, principalmente quando profissionais inexperientes realizam procedimentos. O receio da publicidade adversa nos meios de comunicação social e as baixas taxas de notificação agravam ainda mais estes problemas, tornando crucial que a indústria implemente medidas rigorosas de avaliação e prevenção de riscos para garantir a segurança dos doentes e manter o crescimento do mercado.

- Em agosto de 2020, de acordo com uma notícia publicada no The PMFA Journal, as complicações podem surgir de vários fatores, incluindo a seleção do paciente, as técnicas de injeção e os riscos inerentes aos próprios procedimentos. Estas complicações podem variar desde problemas menores, como hematomas e inchaço, até problemas mais graves, como infeções, oclusões vasculares e reações alérgicas. O receio destas potenciais complicações pode dissuadir os indivíduos de procurar tratamentos estéticos, limitando assim o crescimento do mercado.

Além disso, a influência dos sistemas de saúde locais e dos ambientes regulamentares amplifica ainda mais as preocupações sobre os efeitos secundários na região. Se os indivíduos perceberem que a clínica pode não priorizar a segurança ou aderir a regulamentos de saúde rigorosos, será menos provável que procurem tratamentos estéticos. Este cepticismo pode ser agravado pela cobertura mediática de procedimentos mal sucedidos e práticas inseguras, tornando os potenciais clientes cautelosos relativamente aos riscos associados. Como resultado, o medo de sofrer efeitos secundários não só restringe o interesse individual, como também coloca desafios ao crescimento do mercado, à medida que as empresas se esforçam por construir a confiança dos consumidores nos seus serviços.

Âmbito do mercado estético médico da Ásia-Pacífico

O mercado está segmentado com base nos produtos, aplicação, utilizador final e canal de distribuição. O crescimento entre estes segmentos irá ajudá-lo a analisar os escassos segmentos de crescimento nas indústrias e fornecer aos utilizadores uma valiosa visão geral do mercado e insights de mercado para os ajudar a tomar decisões estratégicas para identificar as principais aplicações do mercado.

Produto

- Dispositivos de Laser Estético

- Dispositivos de Resurfacing Ablativo da Pele

- Laser CO2

- Laser de érbio

- Outros

- Dispositivos de recapeamento a laser fracionado não ablativo

- Radiofrequência

- Luz Intensa Pulsada

- Laser Fracionário

- O laser ND:YAG com comutação Q

- Outros

- Dispositivos de energia

- Dispositivos de cirurgia a laser

- Dispositivos de eletrocauterização

- Dispositivos de eletrocirurgia

- Dispositivos de criocirurgia

- Bisturi Harmónico

- Dispositivos de micro-ondas

- Dispositivos de contorno corporal

- Lipoaspiração

- Aperto não cirúrgico da pele

- Tratamento Celulite

- Dispositivos Estéticos Faciais

- Injeção de Botox

- Preenchimento Dérmico

- Preenchimentos Dérmicos Naturais

- Preenchimentos Dérmicos Sintéticos

- Injeções de colagénio

- Peeling químico

- Tonificação Facial

- Fraxel

- Acupuntura Cosmética

- Eletroterapia

- Microdermoabrasão

- Maquiagem Permanente

- Implantes Estéticos

- Aumento de mama

- Implantes salinos

- Implantes de Silício

- Aumento de Glúteos

- Implantes Dentários Estéticos

- Implantes dentários de titânio

- Implantes Dentários de Zercónio

- Implantes Faciais

- Implantes de tecidos moles

- Implante Transdérmico

- Outros

- Dispositivos Estéticos para a Pele

- Dispositivos de resurfacing de pele a laser

- Dispositivos não cirúrgicos para endurecimento da pele

- Dispositivos de terapia de luz

- Dispositivos para remoção de tatuagens

- Produtos de microagulha

- Produtos para levantamento de linha

- Dispositivos de tratamento de unhas a laser

- Outros

Aplicação

- Antienvelhecimento e Rugas

- Rejuvenescimento facial e cutâneo

- Aumento dos seios

- Modelação Corporal e Celulite

- Remoção de tatuagens

- Lesões vasculares

- Sears, lesões pigmentares, reconstrutivas

- Psoríase e Vitiligo

- Outros

Utilizador final

- Centros Cosméticos

- Clínicas Dermatológicas

- Hospitais

- Spas médicos e centros de estética

Canal de Distribuição

- Licitação Direta

- Retalho

Análise regional do mercado de estética médica da Ásia-Pacífico

O mercado é analisado e os insights e tendências do tamanho do mercado são fornecidos por produtos, aplicação, utilizador final, canal de distribuição como mencionado acima.

As regiões abrangidas pelo mercado são a China, Índia, Japão, Coreia do Sul, Austrália, Indonésia, Tailândia, Malásia, Filipinas, Singapura e restante Ásia-Pacífico.

Espera-se que o Japão domine o mercado devido à sua infraestrutura de saúde avançada, à elevada procura dos consumidores por tratamentos de beleza não cirúrgicos e à forte ênfase em soluções antienvelhecimento. Além disso, o envelhecimento da população do Japão e o foco cultural na beleza e bem-estar impulsionam o crescimento contínuo do mercado e a inovação nos procedimentos estéticos.

Prevê-se que a Índia seja o país com o crescimento mais rápido devido ao aumento do rendimento disponível, à maior consciencialização sobre os tratamentos de beleza e a uma população numerosa e jovem. Além disso, a crescente aceitação de procedimentos não cirúrgicos e os avanços na tecnologia estão a gerar uma rápida procura de serviços de estética em todo o país.

A secção do relatório sobre os países também fornece fatores individuais que impactam o mercado e alterações na regulamentação do mercado nacional que impactam as tendências atuais e futuras do mercado. Pontos de dados como a análise da cadeia de valor a montante e a jusante, tendências técnicas e análise das cinco forças de Porter, estudos de caso são alguns dos indicadores utilizados para prever o cenário de mercado para países individuais. Além disso, a presença e a disponibilidade de marcas da Ásia-Pacífico e os seus desafios enfrentados devido à grande ou escassa concorrência de marcas locais e nacionais, ao impacto de tarifas domésticas e rotas comerciais são considerados ao fornecer uma análise de previsão dos dados do país .

Participação no mercado de estética médica da Ásia-Pacífico

O cenário competitivo do mercado fornece detalhes por concorrente. Os detalhes incluídos são a visão geral da empresa, finanças da empresa, receitas geradas, potencial de mercado, investimento em investigação e desenvolvimento, novas iniciativas de mercado, presença na Ásia-Pacífico, localizações e instalações de produção, capacidades de produção, pontos fortes e fracos da empresa, lançamento de produtos, largura e amplitude do produto, domínio da aplicação. Os dados acima fornecidos estão apenas relacionados com o foco das empresas em relação ao mercado.

Os líderes de mercado de estética médica da Ásia-Pacífico que operam no mercado são:

- Mentor WorldWide LLC (uma subsidiária da Johnsons & Johnsons) (EUA)

- Allergan (uma subsidiária da AbbVie Inc.) (Irlanda)

- GALDERMA (Suíça)

- Cutera, Inc.

- (Israel)

- Densply Sirona (EUA)

- Straumann AG Institute (EUA)

- Candela Corporation (EUA)

- Medytrox (Coreia do Sul)

- BioHorizons (EUA)

- BTL (Índia)

- Nobel Biocare Services AG (Suíça)

- Merz Pharma (Alemanha)

- Cynosure, LLC (EUA)

- (Israel)

- Alma Lasers (EUA)

- MEGA'GEN IMPLANTE CO., LTD. (Índia)

- 3M (EUA)

- Sistema Quanta (Itália)

- Sciton (Califórnia)

Últimos desenvolvimentos no mercado de estética médica da Ásia-Pacífico

- Em janeiro de 2023, a Galderma anunciou o lançamento do FACE by Galderma, uma aplicação inovadora de realidade aumentada. A solução inovadora permite aos profissionais de estética e aos pacientes visualizar os resultados do tratamento na fase de planeamento. A tecnologia será apresentada à comunidade científica estética no Congresso Mundial do Curso Internacional de Mestrado em Ciência do Envelhecimento (IMCAS) 2023

- Em fevereiro de 2022, a Allergan (uma subsidiária da AbbVie Inc.) anunciou a aprovação do JUVÉDERM VOLBELLA XC pela FDA para a melhoria das cavidades infraorbitais em adultos com mais de 21 anos. dos EUA

- Em janeiro de 2022, a Mentor Worldwide LLC (uma subsidiária da Johnson & Johnson Medical Devices Companies) anunciou que a FDA aprovou o implante mamário MENTOR MemoryGel BOOST para aumento e reconstrução mamária. Este produto ajudou a empresa a expandir o portfólio de produtos de estética no mercado dos E.U.A.

- Em janeiro de 2021, a Cutera, Inc. anunciou que a empresa lançou o truSculpt Flex+, otimizado para fornecer escultura direcionada, repetível e uniforme de áreas problemáticas. Isto ajuda a empresa a melhorar o seu portfólio de produtos no mercado

- Em novembro de 2019, a Lumenis Be Ltd. anunciou a sua aquisição com a Baring Private Equity Asia (BPEA), fornecedora líder de dispositivos médicos especializados baseados em energia no campo da estética. Isto mostra que a empresa conta com um forte apoio no mercado da estética para o portfólio de produtos

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Índice

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATIONS

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 MARKETS COVERED

2.2 GEOGRAPHICAL SCOPE

2.3 YEARS CONSIDERED FOR THE STUDY

2.4 DBMR TRIPOD DATA VALIDATION MODEL

2.5 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.6 MULTIVARIATE MODELLING

2.7 DBMR MARKET POSITION GRID

2.8 VENDOR SHARE ANALYSIS

2.9 SECONDARY SOURCES

2.1 ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 PORTER’S FIVE FORCES

4.2 PESTEL ANALYSIS

5 MARKET OVERVIEW

5.1 DRIVERS

5.1.1 INCREASE IN THE AGEING POPULATION

5.1.2 CHANGING BEAUTY STANDARDS AND SOCIAL MEDIA INFLUENCE

5.1.3 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES

5.1.4 INCREASE IN THE NUMBER OF TECHNOLOGICAL ADVANCEMENTS IN DERMATOLOGY

5.2 RESTRAINTS

5.2.1 LACK OF TRAINED PROFESSIONALS

5.2.2 RISK OF SIDE EFFECTS ASSOCIATED WITH THESE PROCEDURES

5.3 OPPORTUNITIES

5.3.1 DEVELOPMENT OF NEW INNOVATIVE TREATMENTS

5.3.2 MEDICAL PARTNERSHIPS AND INNOVATIONS

5.3.3 INCREASING DISPOSABLE INCOME

5.4 CHALLENGES

5.4.1 SAFETY AND LIABILITY RISKS ASSOCIATED WITH AESTHETIC TREATMENTS

5.4.2 LIMITED INSURANCE COVERAGE

6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

6.1 OVERVIEW

6.2 AESTHETIC LASER DEVICES

6.2.1 ABLATIVE SKIN RESURFACING DEVICES

6.2.2 NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES

6.3 ENERGY DEVICES

6.4 BODY CONTOURING DEVICES

6.5 FACIAL AESTHETIC DEVICES

6.5.1 DERMAL FILLERS

6.6 AESTHETIC IMPLANTS

6.6.1 BREAST AUGMENTATION

6.6.2 AESTHETIC DENTAL IMPLANTS

6.7 SKIN AESTHETIC DEVICES

7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION

7.1 OVERVIEW

7.2 ANTI-AGING AND WRINKLES

7.3 FACIAL AND SKIN REJUVENATION

7.4 BREAST ENHANCEMENT

7.5 BODY SHAPING AND CELLULITE

7.6 TATTOO REMOVAL

7.7 VASCULAR LESIONS

7.8 SEARS, PIGMENT LESIONS, RECONSTRUCTIVE

7.9 PSORIASIS AND VITILIGO

7.1 OTHERS

8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER

8.1 OVERVIEW

8.2 COSMETIC CENTERS

8.3 DERMATOLOGY CLINICS

8.4 HOSPITALS

8.5 MEDICAL SPAS AND BEAUTY CENTERS

9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL

9.1 OVERVIEW

9.2 DIRECT TENDER

9.3 RETAIL

10 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY REGION

10.1 ASIA-PACIFIC

10.1.1 JAPAN

10.1.2 INDIA

10.1.3 CHINA

10.1.4 SOUTH KOREA

10.1.5 AUSTRALIA

10.1.6 THAILAND

10.1.7 SINGAPORE

10.1.8 MALAYSIA

10.1.9 INDONESIA

10.1.10 PHILIPPINES

10.1.11 REST OF ASIA-PACIFIC

11 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

12 SWOT ANALYSIS

13 COMPANY PROFILE

13.1 ALLERGAN (A SUBSIDIARY OF ABBVIE INC.)

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 COMPANY SHARE ANALYSIS

13.1.4 PRODUCT PORTFOLIO

13.1.5 RECENT DEVELOPMENT

13.2 CUTERA, INC.

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 COMPANY SHARE ANALYSIS

13.2.4 PRODUCT PORTFOLIO

13.2.5 RECENT DEVELOPMENTS

13.3 MENTOR WORLDWIDE LLC (A SUBSIDIARY OF JOHNSONS & JOHNSONS)

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 COMPANY SHARE ANALYSIS

13.3.4 PRODUCT PORTFOLIO

13.3.5 RECENT DEVELOPMENT

13.4 LUMENIS BE LTD.

13.4.1 COMPANY SNAPSHOT

13.4.2 COMPANY SHARE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENT

13.5 GALDERMA

13.5.1 COMPANY SNAPSHOT

13.5.2 COMPANY SHARE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 ALMA LASERS

13.6.1 COMPANY SNAPSHOT

13.6.2 PRODUCT PORTFOLIO

13.6.3 RECENT DEVELOPMENTS

13.7 BIOHORIZONS

13.7.1 COMPANY SNAPSHOT

13.7.2 PRODUCT PORTFOLIO

13.7.3 RECENT DEVELOPMENTS

13.8 BTL

13.8.1 COMPANY SNAPSHOT

13.8.2 PRODUCT PORTFOLIO

13.8.3 RECENT DEVELOPMENTS

13.9 CANDELA CORPORATION

13.9.1 COMPANY SNAPSHOT

13.9.2 PRODUCT PORTFOLIO

13.9.3 RECENT DEVELOPMENT

13.1 CYNOSURE, LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 PRODUCT PORTFOLIO

13.10.3 RECENT DEVELOPMENTS

13.11 DENTSPLY SIRONA

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENT

13.12 INSTITUT STRAUMANN AG

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENT

13.13 MEDYTROX

13.13.1 COMPANY SNAPSHOT

13.13.2 PRODUCT PORTFOLIO

13.13.3 RECENT DEVELOPMENT

13.14 MEGA'GEN IMPLANT CO., LTD.

13.14.1 COMPANY SNAPSHOT

13.14.2 PRODUCT PORTFOLIO

13.14.3 RECENT DEVELOPMENT

13.15 MERZ PHARMA

13.15.1 COMPANY SNAPSHOT

13.15.2 PRODUCT PORTFOLIO

13.15.3 RECENT DEVELOPMENTS

13.16 3M

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENT

13.17 NOBEL BIOCARE SERVICES AG

13.17.1 COMPANY SNAPSHOT

13.17.2 PRODUCT PORTFOLIO

13.17.3 RECENT DEVELOPMENT

13.18 QUANTA SYSTEM

13.18.1 COMPANY SNAPSHOT

13.18.2 PRODUCT PORTFOLIO

13.18.3 RECENT DEVELOPMENT

13.19 SCITON

13.19.1 COMPANY SNAPSHOT

13.19.2 PRODUCT PORTFOLIO

13.19.3 RECENT DEVELOPMENT

13.2 SHARPLIGHT TECHNOLOGIES INC.

13.20.1 COMPANY SNAPSHOT

13.20.2 PRODUCT PORTFOLIO

13.20.3 RECENT DEVELOPMENT

14 QUESTIONNAIRE

15 RELATED REPORTS

Lista de Tabela

TABLE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 2 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 3 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 4 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 5 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 6 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 7 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 8 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 9 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 10 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 11 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 12 ASIA-PACIFIC DERMAL FILLERS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 13 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 14 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 15 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 16 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 17 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 18 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 20 ASIA-PACIFIC ANTI-AGING AND WRINKLES IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 21 ASIA-PACIFIC FACIAL AND SKIN REJUVENATION IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 22 ASIA-PACIFIC BREAST ENHANCEMENT IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 23 ASIA-PACIFIC BODY SHAPING AND CELLULITE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 24 ASIA-PACIFIC VASCULAR LESIONS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 25 ASIA-PACIFIC SEARS, PIGMENT LESIONS, RECONSTRUCTIVE IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 26 ASIA-PACIFIC PSORIASIS AND VITILIGO IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 27 ASIA-PACIFIC OTHERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 29 ASIA-PACIFIC COSMETIC CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 30 ASIA-PACIFIC DERMATOLOGY CLINICS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 31 ASIA-PACIFIC HOSPITALS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 32 ASIA-PACIFIC MEDICAL SPAS AND BEAUTY CENTERS IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 33 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 34 ASIA-PACIFIC DIRECT TENDER IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 35 ASIA-PACIFIC RETAIL IN MEDICAL AESTHETIC MARKET, BY REGION, 2018-2032 (USD THOUSAND)

TABLE 36 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY COUNTRY, 2018-2032 (USD THOUSAND)

TABLE 37 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 38 ASIA-PACIFIC AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 39 ASIA-PACIFIC ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 40 ASIA-PACIFIC NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 41 ASIA-PACIFIC ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 42 ASIA-PACIFIC BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 43 ASIA-PACIFIC FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 44 ASIA-PACIFIC DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 45 ASIA-PACIFIC AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 46 ASIA-PACIFIC BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 47 ASIA-PACIFIC AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 48 ASIA-PACIFIC SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 49 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 50 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 51 ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 52 JAPAN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 53 JAPAN AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 54 JAPAN ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 55 JAPAN NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 56 JAPAN ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 57 JAPAN BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 58 JAPAN FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 59 JAPAN DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 60 JAPAN AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 61 JAPAN BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 62 JAPAN AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 63 JAPAN SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 64 JAPAN MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 65 JAPAN MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 66 JAPAN MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 67 INDIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 68 INDIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 69 INDIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 70 INDIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 71 INDIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 72 INDIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 73 INDIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 74 INDIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 75 INDIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 76 INDIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 77 INDIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 78 INDIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 79 INDIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 80 INDIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 81 INDIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 82 CHINA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 83 CHINA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 84 CHINA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 85 CHINA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 86 CHINA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 87 CHINA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 88 CHINA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 89 CHINA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 90 CHINA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 91 CHINA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 92 CHINA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 93 CHINA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 94 CHINA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 95 CHINA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 96 CHINA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 97 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 98 SOUTH KOREA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 99 SOUTH KOREA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 100 SOUTH KOREA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 101 SOUTH KOREA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 102 SOUTH KOREA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 103 SOUTH KOREA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 104 SOUTH KOREA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 105 SOUTH KOREA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 106 SOUTH KOREA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 107 SOUTH KOREA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 108 SOUTH KOREA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 109 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 110 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 111 SOUTH KOREA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 112 AUSTRALIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 113 AUSTRALIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 114 AUSTRALIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 115 AUSTRALIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 116 AUSTRALIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 117 AUSTRALIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 118 AUSTRALIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 119 AUSTRALIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 120 AUSTRALIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 121 AUSTRALIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 122 AUSTRALIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 123 AUSTRALIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 124 AUSTRALIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 125 AUSTRALIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 126 AUSTRALIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 127 THAILAND MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 128 THAILAND AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 129 THAILAND ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 130 THAILAND NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 131 THAILAND ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 132 THAILAND BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 133 THAILAND FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 134 THAILAND DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 135 THAILAND AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 136 THAILAND BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 137 THAILAND AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 138 THAILAND SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 139 THAILAND MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 140 THAILAND MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 141 THAILAND MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 142 SINGAPORE MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 143 SINGAPORE AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 144 SINGAPORE ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 145 SINGAPORE NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 146 SINGAPORE ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 147 SINGAPORE BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 148 SINGAPORE FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 149 SINGAPORE DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 150 SINGAPORE AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 151 SINGAPORE BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 152 SINGAPORE AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 153 SINGAPORE SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 154 SINGAPORE MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 155 SINGAPORE MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 156 SINGAPORE MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 157 MALAYSIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 158 MALAYSIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 159 MALAYSIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 160 MALAYSIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 161 MALAYSIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 162 MALAYSIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 163 MALAYSIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 164 MALAYSIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 165 MALAYSIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 166 MALAYSIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 167 MALAYSIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 168 MALAYSIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 169 MALAYSIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 170 MALAYSIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 171 MALAYSIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 172 INDONESIA MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 173 INDONESIA AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 174 INDONESIA ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 175 INDONESIA NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 176 INDONESIA ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 177 INDONESIA BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 178 INDONESIA FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 179 INDONESIA DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 180 INDONESIA AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 181 INDONESIA BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 182 INDONESIA AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 183 INDONESIA SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 184 INDONESIA MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 185 INDONESIA MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 186 INDONESIA MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 187 PHILIPPINES MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 188 PHILIPPINES AESTHETIC LASER DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 189 PHILIPPINES ABLATIVE SKIN RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 190 PHILIPPINES NON-ABLATIVE FRACTIONAL LASER RESURFACING DEVICES IN AESTHETIC LASER DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 191 PHILIPPINES ENERGY DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 192 PHILIPPINES BODY CONTOURING DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 193 PHILIPPINES FACIAL AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 194 PHILIPPINES DERMAL FILLERS IN FACIAL AESTHETIC DEVICES MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 195 PHILIPPINES AESTHETIC IMPLANTS IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 196 PHILIPPINES BREAST AUGMENTATION IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 197 PHILIPPINES AESTHETIC DENTAL IMPLANTS IN MEDICAL AESTHETICS MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 198 PHILIPPINES SKIN AESTHETIC DEVICES IN MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

TABLE 199 PHILIPPINES MEDICAL AESTHETIC MARKET, BY APPLICATION, 2018-2032 (USD THOUSAND)

TABLE 200 PHILIPPINES MEDICAL AESTHETIC MARKET, BY END USER, 2018-2032 (USD THOUSAND)

TABLE 201 PHILIPPINES MEDICAL AESTHETIC MARKET, BY DISTRIBUTION CHANNEL, 2018-2032 (USD THOUSAND)

TABLE 202 REST OF ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE, 2018-2032 (USD THOUSAND)

Lista de Figura

FIGURE 1 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 2 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DATA TRIANGULATION

FIGURE 3 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DROC ANALYSIS

FIGURE 4 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: REGION VS COUNTRY MARKET ANALYSIS

FIGURE 5 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY RESEARCH ANALYSIS

FIGURE 6 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: INTERVIEW DEMOGRAPHICS

FIGURE 7 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: DBMR MARKET POSITION GRID

FIGURE 8 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: VENDOR SHARE ANALYSIS

FIGURE 9 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SEGMENTATION

FIGURE 10 EXECUTIVE SUMMARY

FIGURE 11 SIX SEGMENTS COMPRISE THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET, BY PRODUCT TYPE

FIGURE 12 STRATEGIC DECISIONS

FIGURE 13 INCREASE IN POSITIVE ATTITUDE TOWARDS COSMETIC PROCEDURES IS DRIVING THE GROWTH OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET FROM 2025 TO 2032

FIGURE 14 THE AESTHETIC LASER DEVICES SEGMENT IS EXPECTED TO ACCOUNT FOR THE LARGEST SHARE OF THE ASIA-PACIFIC MEDICAL AESTHETIC MARKET IN 2025 AND 2032

FIGURE 15 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2024

FIGURE 16 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, 2025-2032 (USD THOUSAND)

FIGURE 17 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: PRODUCT TYPE, CAGR (2025-2032)

FIGURE 18 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY PRODUCT TYPE, LIFELINE CURVE

FIGURE 19 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2024

FIGURE 20 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, 2025-2032 (USD THOUSAND)

FIGURE 21 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, CAGR (2025-2032)

FIGURE 22 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY APPLICATION, LIFELINE CURVE

FIGURE 23 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2024

FIGURE 24 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, 2025-2032 (USD THOUSAND)

FIGURE 25 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, CAGR (2025-2032)

FIGURE 26 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY END USER, LIFELINE CURVE

FIGURE 27 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2024

FIGURE 28 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, 2025-2032 (USD THOUSAND)

FIGURE 29 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, CAGR (2025-2032)

FIGURE 30 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: BY DISTRIBUTION CHANNEL, LIFELINE CURVE

FIGURE 31 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: SNAPSHOT (2024)

FIGURE 32 ASIA-PACIFIC MEDICAL AESTHETIC MARKET: COMPANY SHARE 2024 (%)

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.