A evolução dos pagamentos contactless nos EUA foi marcada por marcos significativos. Em 2004, a introdução do primeiro cartão contactless lançou as bases para uma nova era na conveniência de pagamento. Em 2008, todas as principais cadeias adotaram a tecnologia contactless, oferecendo cartões contactless aos consumidores. Em 2014, o lançamento das primeiras carteiras digitais proporcionou aos consumidores mais flexibilidade e segurança na realização de transações contactless. No ano seguinte, a "mudança de responsabilidade do EMV" estimulou a adoção generalizada de terminais habilitados para EMV, muitos dos quais também estavam habilitados para pagamentos contactless, consolidando ainda mais o pagamento contactless como um método de pagamento convencional. Em 2020, a pandemia da COVID-19 acelerou a mudança para os pagamentos contactless, à medida que os consumidores e as empresas priorizavam a segurança e a higiene, levando a um aumento sem precedentes das transações contactless.

Aceda ao relatório completo: https://www.databridgemarketresearch.com/reports/us-electronic-point-of-sale-epos-market

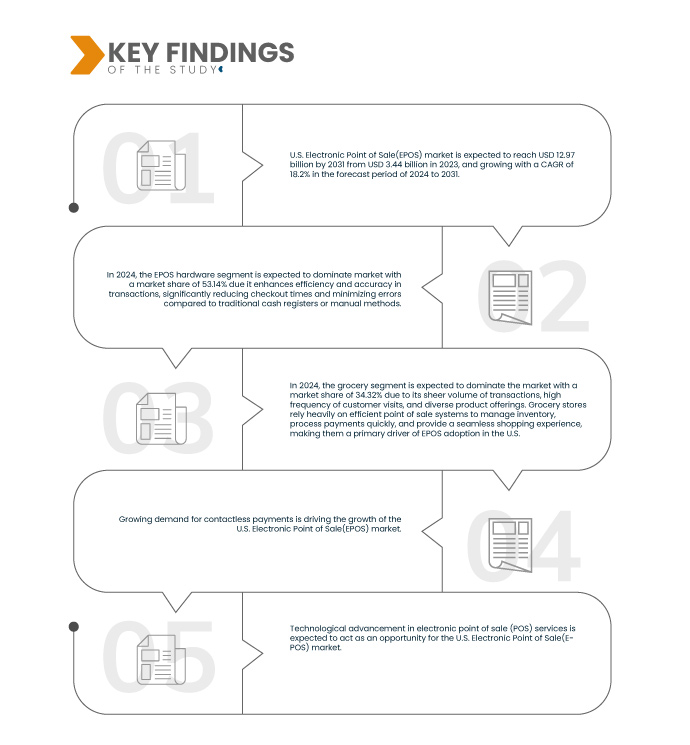

A Data Bridge Market Research analisa que o mercado de pontos de venda eletrónicos (EPOS) dos EUA deverá atingir um valor de 12,97 mil milhões de dólares até 2031, face aos 3,44 mil milhões de dólares em 2023, crescendo a um CAGR de 18,2% durante o período previsto de 2024 a 2031.

Principais conclusões do estudo

Ascensão no retalho omnicanal

O retalho omnicanal refere-se à integração de canais de vendas online e offline, incluindo lojas físicas, plataformas de comércio eletrónico , aplicações móveis, redes sociais e muito mais. Concentra-se em fornecer mensagens, preços e experiências de cliente consistentes em todos os pontos de contacto, confundindo os limites entre os ambientes de retalho físico e digital.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Oferta (Hardware EPOS, Software POS e Serviços EPOS), Utilizador final (mercearia, mercadorias em geral, hotelaria, combustível e conveniência, restaurante, moda/especialidades, viagens, entretenimento e outros)

|

Participantes do mercado abrangidos

|

NCR Voyix Corporation (EUA), Diebold Nixdorf, Incorporated (EUA), Toshiba Global Commerce Solutions (EUA), Oracle (EUA), Posiflex Technology, Inc. (Taiwan), Fujitsu (Japão), Block, Inc. (EUA), Agilysys NV LLC. (EUA), QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LDA. (China) e HP Development Company, LP (EUA), entre outros

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos

O mercado de Ponto de Venda Eletrónico (EPOS) dos EUA está segmentado em dois segmentos notáveis, com base na oferta e no utilizador final.

- Com base na oferta, o mercado de ponto de venda eletrónico (EPOS) dos EUA está segmentado em hardware EPOS, software POS e serviços EPOS

Em 2024, prevê-se que o segmento de hardware EPOS domine o mercado de ponto de venda eletrónico (EPOS) dos EUA

Em 2024, espera-se que o segmento de hardware EPOS domine o mercado de Ponto de Venda Eletrónico (EPOS) dos EUA com uma quota de mercado de 53,14%, uma vez que aumenta a eficiência e a precisão nas transações, reduzindo significativamente os tempos de checkout e minimizando os erros em comparação com as caixas registadoras tradicionais ou os métodos manuais.

- Com base no utilizador final, o mercado de ponto de venda eletrónico (EPOS) dos EUA está segmentado em supermercados, mercadorias em geral, hospitalidade, combustível e conveniência, restaurante, moda/especialidades, viagens, entretenimento e outros.

Em 2024, prevê-se que o segmento dos supermercados domine o mercado de pontos de venda eletrónicos (EPOS) dos EUA

Em 2024, prevê-se que o segmento dos supermercados domine o mercado de Ponto de Venda Eletrónico (EPOS) dos EUA, com uma quota de mercado de 34,32% devido ao seu grande volume de transações, elevada frequência de visitas de clientes e diversas ofertas de produtos. Os supermercados dependem fortemente de sistemas de ponto de venda eficientes para gerir stocks, processar pagamentos rapidamente e proporcionar uma experiência de compra perfeita, tornando-os um dos principais impulsionadores da adoção do EPOS nos EUA.

Principais jogadores

A Data Bridge Market Research analisa a NCR Voyix Corporation (EUA), a Oracle (EUA), a Block, Inc. (EUA), QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LDA. (China) e a HP Development Company, LP (EUA) como as principais empresas que operam no mercado de Ponto de Venda Eletrónico (EPOS) dos EUA.

Desenvolvimentos de mercado

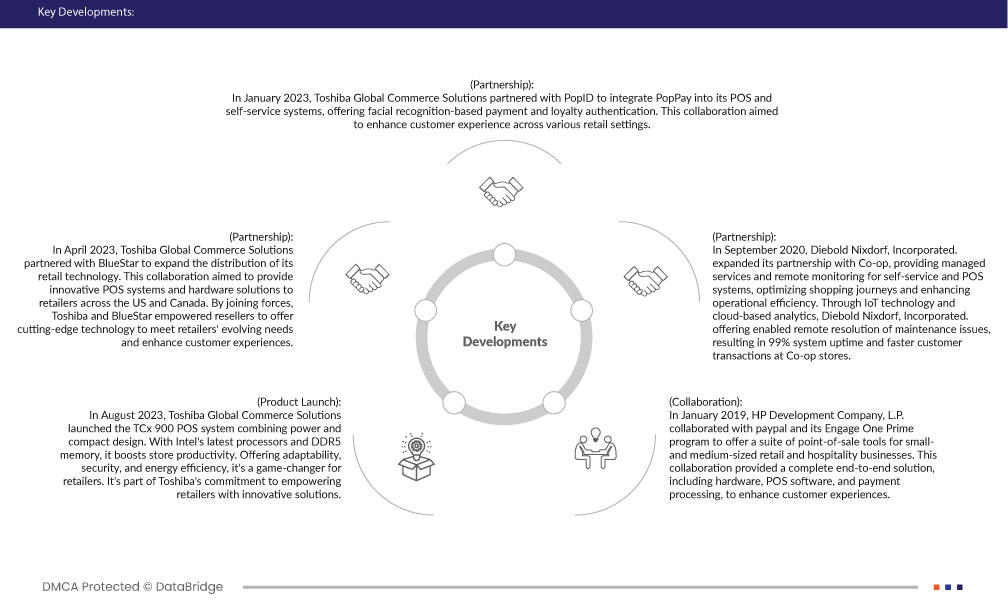

- Em janeiro de 2023, a Toshiba Global Commerce Solutions estabeleceu uma parceria com a PopID para integrar o PopPay nos seus sistemas POS e self-service, oferecendo pagamento baseado em reconhecimento facial e autenticação de fidelidade. Esta colaboração teve como objetivo melhorar a experiência do cliente em vários ambientes de retalho

- Em abril de 2023, a Toshiba Global Commerce Solutions estabeleceu uma parceria com a BlueStar para expandir a distribuição da sua tecnologia de retalho. Esta colaboração teve como objetivo fornecer sistemas POS inovadores e soluções de hardware para retalhistas nos EUA e Canadá. Ao unirem forças, a Toshiba e a BlueStar capacitaram os revendedores para oferecer tecnologia de ponta para satisfazer as necessidades em evolução dos retalhistas e melhorar as experiências do cliente

- Em agosto de 2023, a Toshiba Global Commerce Solutions lançou o sistema POS TCx 900 combinando potência e design compacto. Com os mais recentes processadores Intel e memória DDR5, a produtividade da loja aumenta. Oferecendo adaptabilidade, segurança e eficiência energética, é um game changer para os retalhistas. Faz parte do compromisso da Toshiba em capacitar os retalhistas com soluções inovadoras

- Em janeiro de 2019, a Hp Development Company, LP colaborou com a PayPal e o seu programa Engage One Prime para oferecer um conjunto de ferramentas de ponto de venda a pequenas e médias empresas de retalho e hotelaria. Esta colaboração forneceu uma solução completa de ponta a ponta, incluindo hardware, software POS e processamento de pagamentos, para melhorar as experiências do cliente

- Em setembro de 2020, a Diebold Nixdorf, Incorporated expandiu a sua parceria com a Co-op, fornecendo serviços geridos e monitorização remota para sistemas de self-service e POS, otimizando as jornadas de compras e aumentando a eficiência operacional. Através da tecnologia IoT e de análises baseadas na cloud, a Diebold Nixdorf, Incorporated, oferece resolução remota de problemas de manutenção, resultando em 99% de tempo de atividade do sistema e transações mais rápidas para os clientes nas lojas Co-op.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Para obter informações mais detalhadas sobre o relatório de mercado do Ponto de Venda Eletrónico (EPOS) dos EUA, clique aqui – https://www.databridgemarketresearch.com/reports/us-electronic-point-of-sale-epos-market