Us Electronic Point Of Sale Epos Market

Tamanho do mercado em biliões de dólares

CAGR :

%

USD

4.02 Billion

USD

15.33 Billion

2024

2032

USD

4.02 Billion

USD

15.33 Billion

2024

2032

| 2025 –2032 | |

| USD 4.02 Billion | |

| USD 15.33 Billion | |

|

|

|

U.S. Electronic Point of Sale (EPOS) Market, By Offering (EPOS Hardware, POS Software, and EPOS Services), End User (Grocery, General Merchandise, Hospitality, Fuel & Convenience, Restaurant, Fashion/Specialty, Travel, Entertainment, and Others) - Industry Trends and Forecast to 2031.

U.S. Electronic Point of Sale (EPOS) Market Analysis and Size

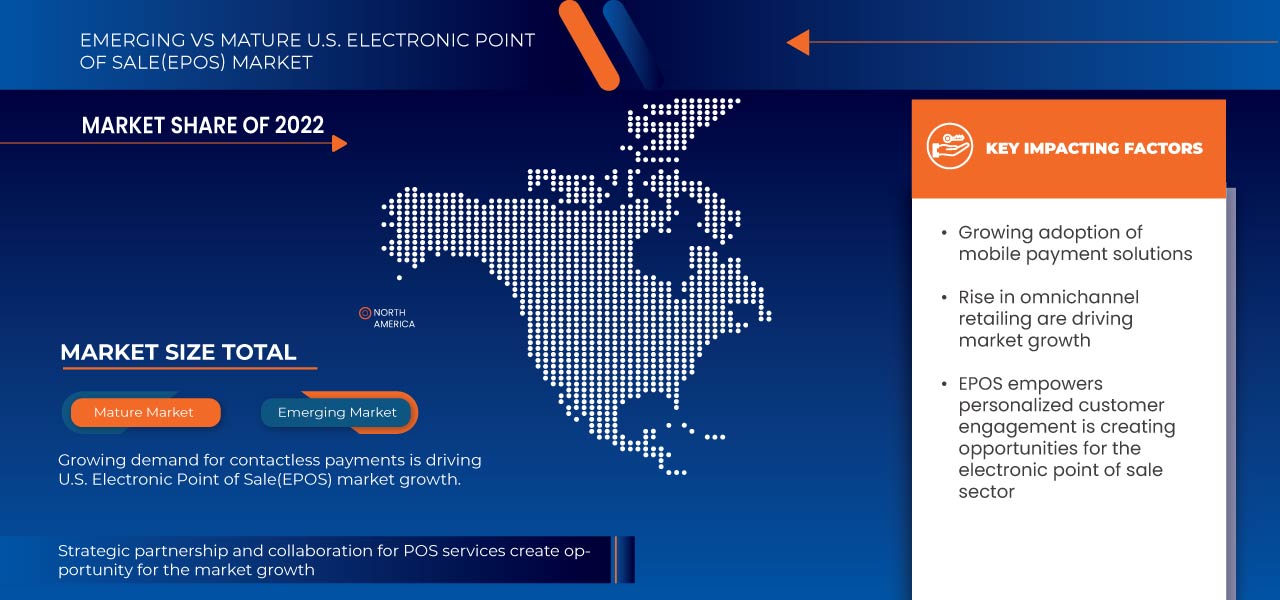

U.S. Electronic Point of Sale(EPOS) market is experiencing significant growth driven by several key factors. The increasing demand for contactless payments, spurred by changing consumer preferences and the need for hygienic transactions, is propelling market expansion. Moreover, the rise of omnichannel retailing and the adoption of cloud-based EPOS systems are driving efficiency and flexibility in sales operations, further boosting market growth. In addition, the growing acceptance of mobile payment solutions is reshaping the landscape by providing convenient and accessible transaction options.

Data Bridge Market Research analyses that the U.S. Electronic Point of Sale(EPOS) market is expected to reach a value of USD 12.97 billion by 2031 from USD 3.44 billion in 2023, growing at a CAGR of 18.2% during the forecast period 2024 to 2031.

|

Report Metric |

Details |

|

Forecast Period |

2024 to 2031 |

|

Base Year |

2023 |

|

Historic Years |

2022 (Customizable to 2016-2021) |

|

Quantitative Units |

Revenue in USD Billion |

|

Segments Covered |

Offering (EPOS Hardware, POS Software, and EPOS Services), End User (Grocery, General Merchandise, Hospitality, Fuel & Convenience, Restaurant, Fashion/Specialty, Travel, Entertainment, and Others) |

|

Market Players Covered |

NCR Voyix Corporation, Diebold Nixdorf, Incorporated, Toshiba Global Commerce Solutions, Oracle, Posiflex Technology, Inc., Fujitsu, Block, Inc., Agilysys NV LLC., QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD., and HP Development Company, L.P., among others |

Market Definition

An Electronic Point of Sale (EPOS) system refers to a computerized system used by retailers and businesses to manage sales transactions, inventory, and customer data efficiently. It naturally includes hardware such as a cash register, barcode scanner, and card reader, along with software for processing transactions and generating reports. In the context of the U.S. Electronic Point of Sale(EPOS) market, encompasses the sale and adoption of such systems across various industries, including retail, hospitality, healthcare, and entertainment. This market definition encapsulates the demand for both traditional and modern EPOS solutions, incorporating factors such as hardware advancements, software integration capabilities, and the growing trend towards cloud-based and mobile point of sale solutions. In addition, it accounts for the competitive landscape comprising established players and emerging vendors, as well as the regulatory framework governing electronic payment systems within the U.S.

U.S. Electronic Point of Sale(EPOS) Market Dynamics

This section deals with understanding the market drivers, advantages, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Growing Demand for Contactless Payments

Electronic point of sale (EPOS) systems have revolutionized retail transactions, offering efficiency and convenience. Among the latest advancements is the integration of contactless payment methods, providing a swift and secure way for customers to whole transactions without physical contact. This technology, leveraging near-field communication (NFC) or RFID technology, allows users to simply tap their cards or mobile devices to make payments. In an era where hustle and safety are paramount, contactless payment solutions have rapidly gained popularity, reshaping the landscape of retail transactions in U.S.

- Rise in Omni Channel Retailing

Omni channel retailing refers to the integration of online and offline sales channels, with brick-and-mortar stores, e-commerce platforms, mobile apps, social media, and more. It focuses on delivering consistent messaging, pricing, and customer experiences across all touchpoints, blurring the lines between physical and digital retail environments.

Opportunities

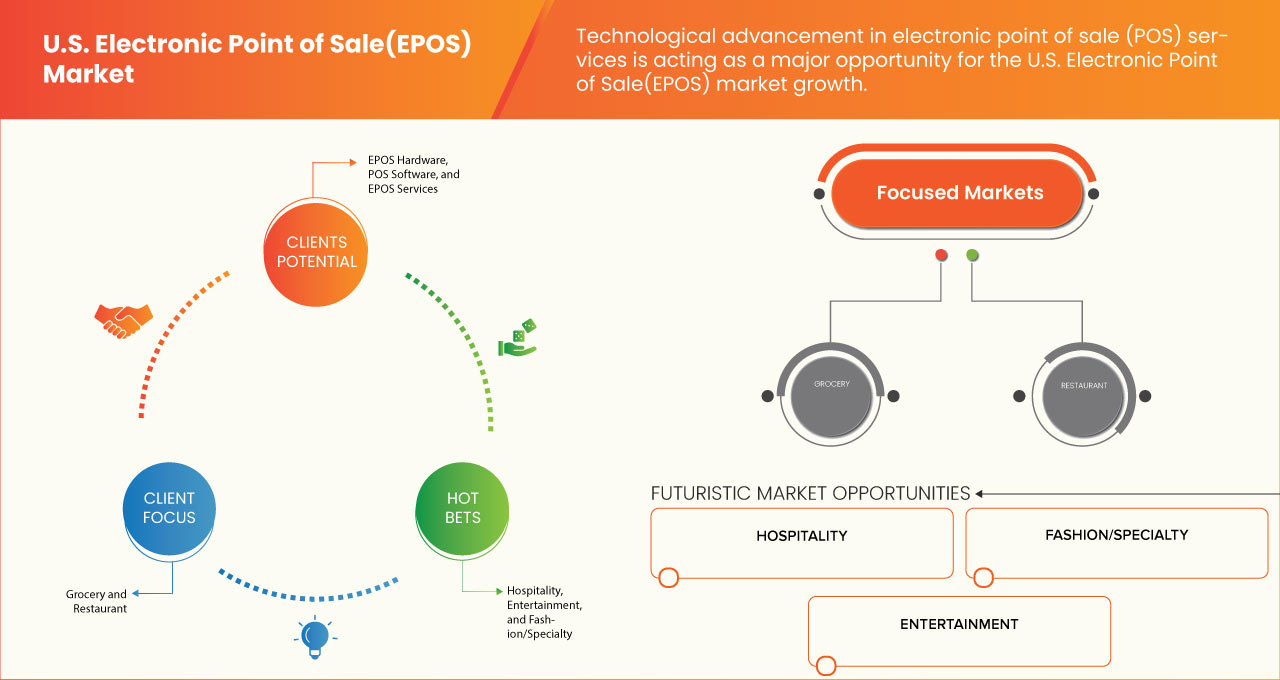

- Technological Advancement in Electronic Point of Sale (EPOS) Services

In the dynamic landscape of retail and hospitality, Electronic Point of Sale (EPOS) systems have emerged as indispensable tools for businesses seeking efficiency, agility, and enhanced customer experiences. U.S. Electronic Point of Sale(EPOS) market is witnessing a significant opportunity factor in the form of rapid technological advancements. These advancements are not only reshaping the way transactions are conducted but also revolutionizing how businesses manage operations and engage with customers. The pace of technological innovation shows no signs of slowing down, and EPOS systems are continuously evolving to integrate with emerging technologies such as biometrics, and Internet of Things (IoT) devices. These integrations offer businesses new opportunities to enhance security, streamline transactions, and deliver innovative customer experiences that set them apart from the competition.

- EPOS Empowers Personalized Customer Engagement

In today's competitive business landscape, customer engagement stands out as a pivotal factor in driving growth and sustainability. With the beginning of Electronic Point of Sale (EPOS) systems, businesses now have a powerful tool at their disposal to not only streamline transactions but also to foster deeper connections with their customer base. In the United States, the EPOS market is witnessing a significant opportunity unfold as businesses recognize the potential of personalized customer engagement in driving repeat business and brand loyalty. At the heart of this opportunity lies the ability of EPOS systems to capture and analyze customer data with unprecedented precision. Through the seamless integration of data analytics capabilities, businesses can gain invaluable insights into customer preferences, purchasing behavior, and shopping patterns. By leveraging this data, businesses can tailor their marketing campaigns, loyalty programs, and promotions to resonate with the unique needs and likings of individual customers.

Restraints/Challenges

- Stringent Government Regulations

U.S. Electronic Point of Sale(EPOS) market, a critical backbone of modern retail and service industries, faces a myriad of regulatory challenges that can impede growth, innovation, and market penetration. From data security mandates to compliance standards, these regulations cast a long shadow over businesses seeking to harness the full potential of EPOS systems. At the forefront of regulatory concerns are data protection and privacy regulations. In an era marred by high-profile data breaches and privacy scandals, governments have responded with increasingly stringent measures to safeguard consumer data. For businesses operating in the EPOS space, this translates into complex compliance requirements under laws such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA).

- Rising Concerns about Cyber Security

In today's digital age, cybersecurity has emerged as a critical concern for businesses across all sectors, including the U.S. Electronic Point of Sale(EPOS) market. With the increasing frequency and sophistication of cyber threats, safeguarding sensitive data and protecting against potential breaches has become paramount for EPOS system providers and users alike. The rapid digital transformation has also exposed businesses to new vulnerabilities, making them prime targets for cybercriminals seeking to exploit weaknesses in their systems. The U.S. Electronic Point of Sale(EPOS) market facing the rising tide of cybersecurity attacks, including malware infections, ransomware campaigns, and data breaches. These attacks pose serious risks to businesses, potentially resulting in financial losses, reputational damage, and legal liabilities. Moreover, the consequences of a successful cyberattack extend beyond immediate financial repercussions, impacting customer trust and confidence in the security of their personal information.

Recent Developments

- In April 2024, Agilysys expands its POS portfolio with IG Fly, a mobile ordering and payment solution, enhancing staff flexibility and customer service. This development provides an easy-to-use mobile POS that integrates with InfoGenesis, improving efficiency and customer experiences, and strengthens Agilysys' position in the hospitality software market

- In January 2024, Diebold Nixdorf, Incorporated. unveils AI-powered checkout solutions to combat retail shrinkage. These solutions, showcased at the NRF Big Show, target common causes of loss, like miss-scanning and mismatched products. The AI technology identifies intentional and unintentional errors, enhancing the checkout process without infrastructure replacement. Diebold Nixdorf, Incorporated. Aims to enhance customer experiences and improve efficiency for retailers globally

- In February 2023, QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD. (HICS) launch of the HERO II, comprising the HK578 and HK578U all-in-one POS models, targets the retail and hospitality sectors with high-performance, energy-efficient solutions. This move enhances HiStone's EPOS offerings by delivering innovative, cost-effective solutions that meet modern technological and business requirements, ultimately improving customer experiences and operational efficiency

- In March 2023, Fujitsu is nearing the acquisition of GK Software, a German enterprise software provider for retailers, at €190 per share. This move would expand Fujitsu's EPOS portfolio, strengthening its presence in retail tech and potentially increasing market share and revenue in the sector. The acquisition is subject to investor and regulatory approvals

- In January 2023, Posiflex's 2022 success stems from a post-COVID uptick in retail and hospitality projects, bolstered by strong supply chain management. Their emphasis on customization, quality, and reliable delivery, supported by vertical integration, ensures tailored solutions and efficient logistics. This approach has led to stable deliveries and shorter lead times, particularly notable during the global supply shortage crisis

U.S. Electronic Point of Sale(EPOS) Market Scope

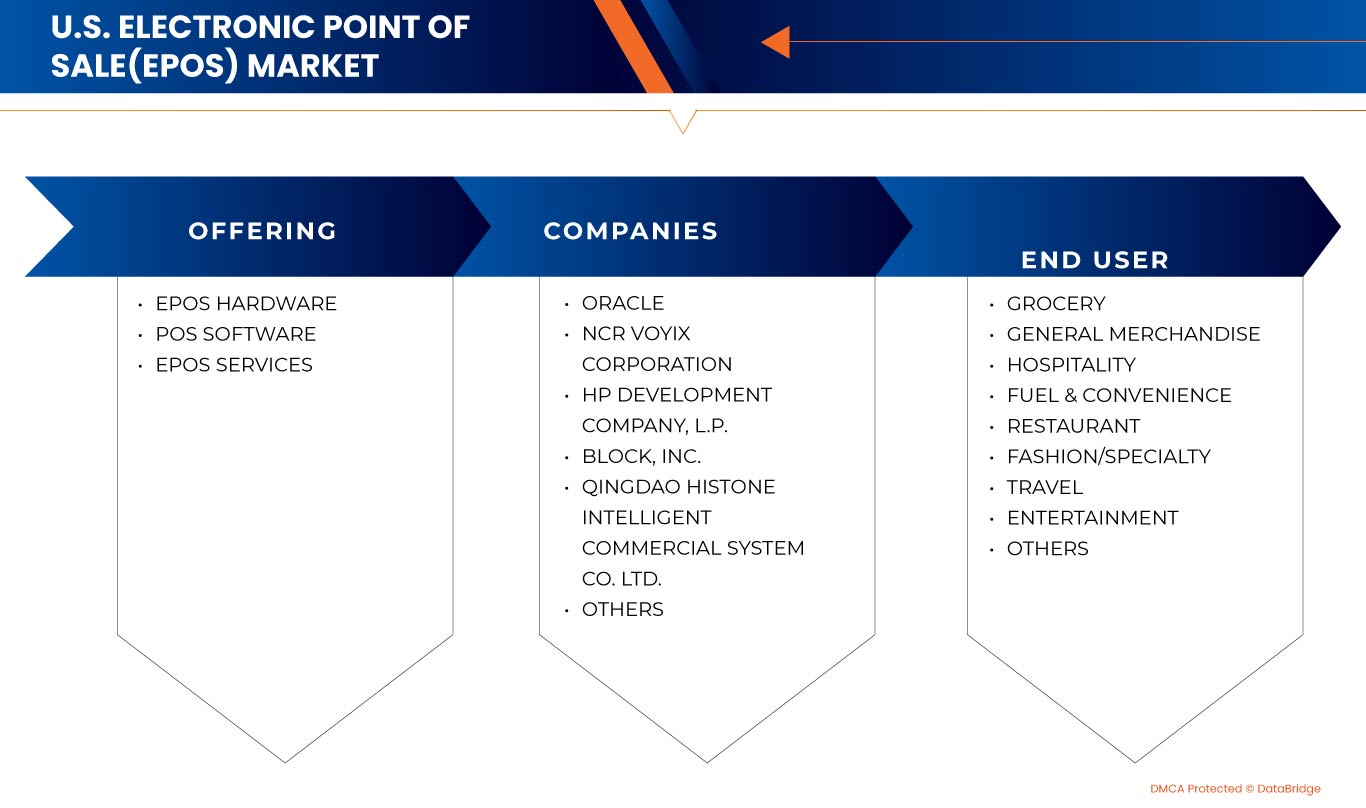

U.S. Electronic Point of Sale(EPOS) market is segmented into two notable segments, which are based on offering and end user. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Offering

- EPOS Hardware

- POS Software

- EPOS Services

On the basis of offering, the U.S. Electronic Point of Sale(EPOS) market is segmented into EPOS Hardware, POS Software, and EPOS Services.

End User

- Grocery

- General Merchandise

- Hospitality

- Fuel & Convenience

- Restaurant

- Fashion/Specialty

- Travel

- Entertainment

- Others

On the basis of end user, the U.S. Electronic Point of Sale(EPOS) market is segmented into grocery, general merchandise, hospitality, fuel & convenience, restaurant, fashion/specialty, travel, entertainment, and others.

Competitive Landscape and U.S. Electronic Point of Sale(EPOS) Market Share Analysis

U.S. Electronic Point of Sale(EPOS) market competitive landscape provides details of the competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to U.S. Electronic Point of Sale(EPOS) market.

Some of the major players operating in the U.S. Electronic Point of Sale(EPOS) market are NCR Voyix Corporation, Diebold Nixdorf, Incorporated, Toshiba Global Commerce Solutions, Oracle, Posiflex Technology, Inc., Fujitsu, Block, Inc., Agilysys NV LLC., QINGDAO HISTONE INTELLIGENT COMMERCIAL SYSTEM CO. LTD., and HP Development Company, L.P., among others.

SKU-

Obtenha acesso online ao relatório sobre a primeira nuvem de inteligência de mercado do mundo

- Painel interativo de análise de dados

- Painel de análise da empresa para oportunidades de elevado potencial de crescimento

- Acesso de analista de pesquisa para personalização e customização. consultas

- Análise da concorrência com painel interativo

- Últimas notícias, atualizações e atualizações Análise de tendências

- Aproveite o poder da análise de benchmark para um rastreio abrangente da concorrência

Metodologia de Investigação

A recolha de dados e a análise do ano base são feitas através de módulos de recolha de dados com amostras grandes. A etapa inclui a obtenção de informações de mercado ou dados relacionados através de diversas fontes e estratégias. Inclui examinar e planear antecipadamente todos os dados adquiridos no passado. Da mesma forma, envolve o exame de inconsistências de informação observadas em diferentes fontes de informação. Os dados de mercado são analisados e estimados utilizando modelos estatísticos e coerentes de mercado. Além disso, a análise da quota de mercado e a análise das principais tendências são os principais fatores de sucesso no relatório de mercado. Para saber mais, solicite uma chamada de analista ou abra a sua consulta.

A principal metodologia de investigação utilizada pela equipa de investigação do DBMR é a triangulação de dados que envolve a mineração de dados, a análise do impacto das variáveis de dados no mercado e a validação primária (especialista do setor). Os modelos de dados incluem grelha de posicionamento de fornecedores, análise da linha de tempo do mercado, visão geral e guia de mercado, grelha de posicionamento da empresa, análise de patentes, análise de preços, análise da quota de mercado da empresa, normas de medição, análise global versus regional e de participação dos fornecedores. Para saber mais sobre a metodologia de investigação, faça uma consulta para falar com os nossos especialistas do setor.

Personalização disponível

A Data Bridge Market Research é líder em investigação formativa avançada. Orgulhamo-nos de servir os nossos clientes novos e existentes com dados e análises que correspondem e atendem aos seus objetivos. O relatório pode ser personalizado para incluir análise de tendências de preços de marcas-alvo, compreensão do mercado para países adicionais (solicite a lista de países), dados de resultados de ensaios clínicos, revisão de literatura, mercado remodelado e análise de base de produtos . A análise de mercado dos concorrentes-alvo pode ser analisada desde análises baseadas em tecnologia até estratégias de carteira de mercado. Podemos adicionar quantos concorrentes necessitar de dados no formato e estilo de dados que procura. A nossa equipa de analistas também pode fornecer dados em tabelas dinâmicas de ficheiros Excel em bruto (livro de factos) ou pode ajudá-lo a criar apresentações a partir dos conjuntos de dados disponíveis no relatório.