Uma tira de teste de glicemia é um componente crucial no campo do diagnóstico médico, projetada especificamente para monitorar e controlar o diabetes. Estas pequenas tiras descartáveis estão equipadas com produtos químicos especializados que reagem com a glicose presente numa amostra de sangue. Normalmente usado em conjunto com um medidor de glicose essas tiras permitem que indivíduos com diabetes meçam seus níveis de açúcar no sangue com precisão e conveniência em casa ou em ambientes clínicos.

Acesse o Relatório completo @https://www.databridgemarketresearch.com/reports/saudi-arabia-blood-glucose-test-strip-market

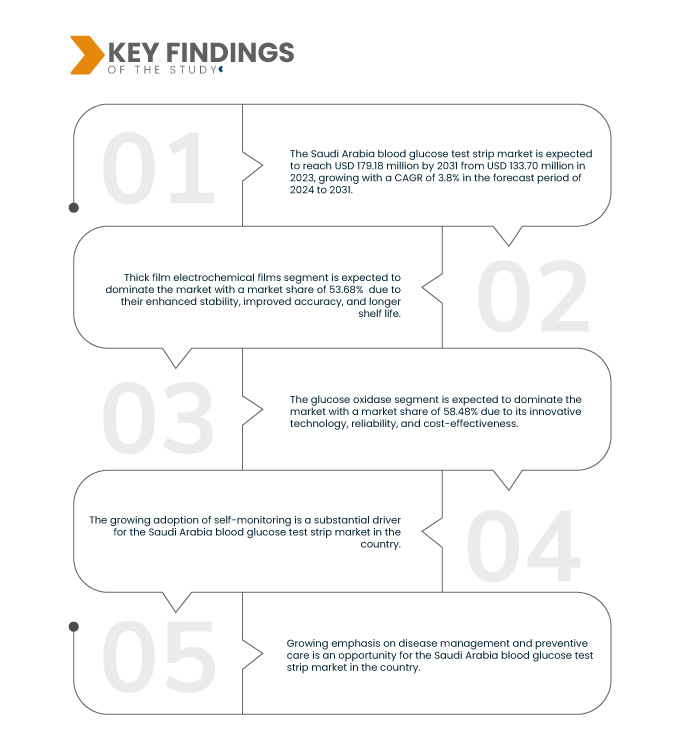

A Data Bridge Market Research analisa que o Mercado de tiras de teste de glicose no sangue da Arábia Saudita está crescendo com um CAGR de 3,8% no período de previsão de 2024 a 2031 e deverá atingir US$ 179,18 milhões em 2031, contra US$ 133,70 milhões em 2023.

Principais conclusões do estudo

Aumento da prevalência de diabetes

A crescente prevalência de fatores de risco, como estilos de vida inativos, hábitos alimentares pouco saudáveis, obesidade e envelhecimento da população, contribui para o número crescente de indivíduos diagnosticados com diabetes. Com mais pessoas vivendo com diabetes, há um mercado maior para produtos para controle do diabetes, incluindo tiras de teste de glicose no sangue. Para indivíduos com diabetes, o monitoramento regular dos níveis de glicose no sangue é essencial para controlar a doença e prevenir complicações. As tiras de teste de glicemia permitem que os pacientes monitorem seus níveis de açúcar no sangue em casa ou em trânsito, fornecendo informações valiosas para orientar escolhas alimentares, dosagem de medicamentos e modificações no estilo de vida. À medida que a diabetes se torna mais prevalente, a importância da monitorização eficaz da glicose torna-se cada vez mais reconhecida, impulsionando a procura de tiras de teste.

Escopo do relatório e segmentação de mercado

|

Métrica de relatório

|

Detalhes

|

|

Período de previsão

|

2024 a 2031

|

|

Ano base

|

2023

|

|

Anos históricos

|

2022 (personalizável para 2016-2021)

|

|

Unidades Quantitativas

|

Receita em milhões de dólares

|

|

Segmentos cobertos

|

Tipo (Filmes Eletroquímicos de Filme Espesso, Filmes Eletroquímicos de Filme Fino e Tiras Ópticas), Tecnologia (Glicose Oxidase e Glicose Desidrogenase), Modalidade (Uso e Lançamento e Indicador Embutido), Preço (Padrão e Premium), Amostra (Sangue Total e Plasma), modo de compra (sem receita e com receita médica), embalagem (50 tiras, 100 tiras e 25 tiras), faixa etária (adulto, geriátrico e pediátrico), aplicação (diabetes tipo 2, diabetes tipo 1, pré -Diabetes e diabetes gestacional), usuário final (saúde domiciliar, hospital, laboratório de diagnóstico e outros), canal de distribuição (vendas no varejo, licitação direta e outros)

|

|

Países abrangidos

|

Arábia Saudita

|

|

Participantes do mercado cobertos

|

Abbott (EUA), F. Hoffmann-La Roche Ltd. (Suíça), Ascensia Diabetes Care Holdings AG. (Suíça), LifeScan IP Holdings (EUA), LLC. EASYMAX Diabetes Care (Taiwan), Sinocare (China), Bionime Corporation. (Taiwan), ARKRAY, Inc. (Japão), Trister (EUA) e General Life Biotechnology Co., Ltd.

|

|

Métrica de relatório

|

Além dos insights sobre cenários de mercado, como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e grandes players, os relatórios de mercado com curadoria da Data Bridge Market Research também incluem análises especializadas aprofundadas, epidemiologia de pacientes, análise de pipeline, análise de preços, e quadro regulamentar

|

Análise de Segmento

O mercado de tiras de teste de glicose no sangue da Arábia Saudita é categorizado em onze segmentos notáveis com base no tipo, tecnologia, modalidade, preço, amostra, modo de compra, embalagem, faixa etária, aplicação, usuário final e canal de distribuição.

- Com base no tipo, o mercado é segmentado em filmes eletroquímicos de película espessa, filmes eletroquímicos de película fina e tiras ópticas

Em 2024, espera-se que o segmento de filmes eletroquímicos de película espessa domine o mercado

Em 2024, espera-se que o segmento de filmes eletroquímicos de película espessa domine o mercado com uma participação de mercado de 53,68% devido à sua maior estabilidade, maior precisão e maior prazo de validade.

- Com base na tecnologia, o mercado é segmentado em glicose oxidase e glicose desidrogenase

Em 2024, espera-se que o segmento de glicose oxidase domine o mercado

Em 2024, espera-se que o segmento de glicose oxidase domine o mercado com uma participação de mercado de 58,48% devido à sua tecnologia inovadora, confiabilidade e custo-benefício.

- Com base na modalidade, o mercado é segmentado em uso e lançamento e indicador embutido

Em 2024, espera-se que o segmento de uso e lançamento domine o mercado

Em 2024, espera-se que o segmento de uso e lançamento domine o mercado com uma participação de mercado de 89,24% devido à sua comodidade, higiene e eliminação da necessidade de limpeza e manutenção, oferecendo uma solução fácil de usar e eficiente para monitoramento regular em manejo do diabetes.

- Com base nos preços, o mercado é segmentado em standard e premium

Em 2024, espera-se que o segmento padrão domine o mercado

Em 2024, espera-se que o segmento standard domine o mercado com uma quota de mercado de 84,94% devido à acessibilidade e preço acessível, tornando-o uma escolha preferida para uma base de consumidores maior.

- Com base na amostra, o mercado é segmentado em sangue total e plasma

Em 2024, espera-se que o segmento de sangue total domine o mercado

Em 2024, espera-se que o segmento de sangue total domine o mercado com uma participação de mercado de 85,93% devido às convenientes medições do nível de glicose em tempo real para indivíduos com diabetes.

- Com base no modo de compra, o mercado é segmentado em balcão e baseado em prescrição.

Em 2024, espera-se que o segmento de balcão domine o mercado

Em 2024, espera-se que o segmento de balcão domine o mercado com uma quota de mercado de 79,63% devido à acessibilidade, permitindo aos indivíduos com diabetes obter e monitorizar facilmente os seus níveis de açúcar no sangue sem necessidade de receita médica.

- Com base nas embalagens, o mercado é segmentado em 50 tiras, 100 tiras e 25 tiras

Em 2024, espera-se que o segmento de 50 tiras domine o mercado

Em 2024, espera-se que o segmento de 50 tiras domine o mercado com uma participação de mercado de 70,43% devido à relação custo-benefício e à conveniência de fornecer uma oferta estendida para monitoramento contínuo da glicemia, promovendo a adesão aos testes regulares.

- Com base na faixa etária, o mercado é segmentado em adultos, geriátricos e pediátricos

Em 2024, espera-se que o segmento adulto domine o mercado

Em 2024, espera-se que o segmento adulto domine o mercado com uma quota de mercado de 68,05% devido à maior prevalência de diabetes na população adulta em comparação com outras faixas etárias.

- Com base na aplicação, o mercado é segmentado em diabetes tipo 2, diabetes tipo 1, pré-diabetes e diabetes gestacional

Em 2024, espera-se que o segmento de diabetes tipo 2 domine o mercado

Em 2024, espera-se que o segmento de diabetes tipo 2 domine o mercado com uma participação de mercado de 48,94% devido à maior prevalência desta forma de diabetes em todo o mundo.

- Com base no usuário final, o mercado é segmentado em saúde domiciliar, hospital, laboratório de diagnóstico, entre outros

Em 2024, espera-se que o segmento de cuidados de saúde ao domicílio domine o mercado

Em 2024, espera-se que o segmento de cuidados de saúde ao domicílio domine o mercado com uma quota de mercado de 45,58% devido à disponibilidade de kits avançados em hospitais e ao aumento do rendimento disponível.

- Com base no canal de distribuição, o mercado é segmentado em vendas no varejo, concurso direto, entre outros

Em 2024, espera-se que o segmento de vendas no varejo domine o mercado

Em 2024, o segmento de vendas no varejo deverá dominar o mercado com uma participação de mercado de 75,97% devido ao aumento dos acordos contratuais entre fabricantes e distribuidores no processo licitatório.

Jogadores principais

A Data Bridge Market Research analisa F. Hoffmann-La Roche Ltd. (Suíça), LifeScan IP Holdings LLC. (EUA), Abbott (EUA), Ascensia Diabetes Care Holdings AG. (Suíça) e Sinocare (China) como o principal player do mercado de tiras de teste de glicose no sangue da Arábia Saudita.

Desenvolvimentos de mercado

- Em outubro de 2023, de acordo com o Drug Delivery Business News, a Abbott é uma das líderes de mercado no setor de diabetes com sua tecnologia de monitoramento contínuo de glicose (CGM). Ela continua atualizando seu FreeStyle Libre 2 CGM, enquanto começa a lançar o FreeStyle Libre 3 após receber autorização da FDA no ano passado. Isto pode ajudar a empresa a estabelecer a sua forte presença na gestão e cuidados da diabetes

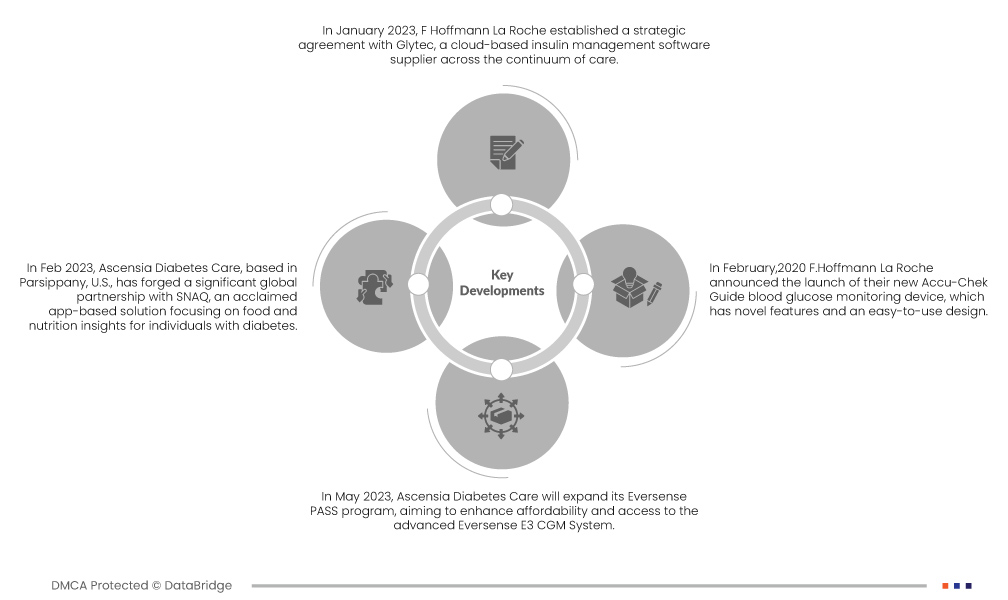

- Em maio de 2023, a Ascensia Diabetes Care expandirá seu programa Eversense PASS, com o objetivo de melhorar a acessibilidade e o acesso ao avançado sistema Eversense E3 CGM. A iniciativa, que proporciona maiores poupanças para utilizadores elegíveis pela primeira vez, reflete o compromisso da Ascensia em alargar o acesso e aliviar barreiras financeiras para indivíduos que necessitam de soluções avançadas de monitorização de glicose.

- Em janeiro de 2023, F Hoffmann La Roche estabeleceu um acordo estratégico com a Glytec, um fornecedor de software de gestão de insulina baseado na nuvem para todo o tratamento contínuo. Para abordar as questões de gerenciamento de açúcar no sangue de pacientes internados à beira do leito hospitalar, esta colaboração digital de saúde incorpora a experiência da Roche em dispositivos médicos e soluções de TI com o software de suporte à decisão de dosagem de insulina aprovado pela FDA da Glytec, Glucommander. Glucommander será o primeiro programa de software disponível para o sistema de glicemia hospitalar de próxima geração do dispositivo inteligente Cobas pulse da Roche, que visa melhorar a segurança e o atendimento ao paciente, permitindo que os médicos no local de atendimento coletem e ajam com base em dados de gerenciamento glicêmico em tempo real. -tempo

Para obter informações mais detalhadas sobre o relatório de mercado de tiras de teste de glicose no sangue da Arábia Saudita, clique aqui –https://www.databridgemarketresearch.com/reports/saudi-arabia-blood-glucose-test-strip-market