O açúcar e os adoçantes industriais referem-se aos açúcares e aos substitutos do açúcar utilizados na produção em grande escala de alimentos, bebidas e produtos farmacêuticos. Incluem açúcares comuns como a sacarose, a glicose e a frutose, derivados de fontes como a cana-de-açúcar, a beterraba sacarina e o milho. Os adoçantes, que são geralmente alternativas de baixa ou nenhuma caloria, incluem produtos como o aspartame, a stevia e a sucralose. Estes ingredientes são utilizados para adoçar produtos sem adicionar calorias ou açúcar em excesso. O açúcar industrial é essencial para produtos como assados, bebidas, doces e produtos lácteos. Os adoçantes são cada vez mais populares em produtos de baixas calorias, sem açúcar e adequados para diabéticos. Ambos são vitais para a indústria alimentar global e são regulamentados para garantir a segurança e a consistência na produção.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/north-carolina-south-carolina-and-virginia-industrial-sugar-and-sweeteners-market

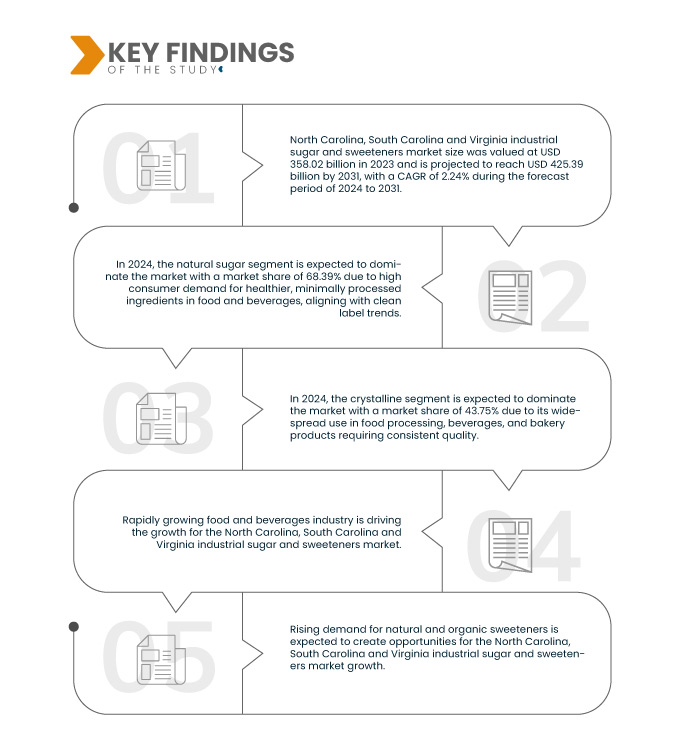

A Data Bridge Market Research analisa que a dimensão do mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia foi avaliada em 358,02 mil milhões de dólares em 2023 e está projetada para atingir 425,39 mil milhões de dólares até 2031, com um CAGR de 2,24% durante o período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento do uso de açúcar e adoçantes em produtos farmacêuticos

A indústria farmacêutica na Carolina do Norte, Carolina do Sul e Virgínia está a gerar uma procura crescente de açúcar e adoçantes, especialmente em formulações de medicamentos como xaropes e comprimidos mastigáveis, onde realçam o sabor e melhoram a adesão dos doentes. Isto é especialmente importante para os medicamentos pediátricos. A expansão da produção farmacêutica nestes estados, juntamente com o crescente foco na medicina personalizada e em sistemas complexos de administração de medicamentos, está a aumentar a necessidade de agentes adoçantes de alta qualidade. À medida que as empresas farmacêuticas inovam e desenvolvem tratamentos mais centrados no doente, espera-se que a procura de açúcares e adoçantes nas formulações de medicamentos aumente, criando oportunidades significativas para os fabricantes.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2023 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Tipo (açúcar natural e adoçantes), forma do produto (líquido, cristalino e em pó), fonte (fruta, lacticínios e legumes), aplicação (padaria, pastelaria, sobremesas geladas , alimentos processados, fórmulas infantis , bebidas e outros)

|

Coberto pelo Estado

|

Carolina do Norte, Carolina do Sul e Virgínia

|

Participantes do mercado abrangidos

|

ADM (EUA), Südzucker AG (Alemanha), Cargill, Incorporated (EUA), International Flavors & Fragrances Inc. (EUA), Ingredion (EUA), Wilmar International Ltd. (Singapura), Layn Natural Ingredients (China), SweeGen, Inc. (EUA), Imperial Sugar (EUA), HOWTIAN (China) e Pyure (EUA), entre outras.

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre cenários de mercado, tais como valor de mercado, taxa de crescimento, segmentação, cobertura geográfica e principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, análises de preços, análises de quota de marca, inquéritos aos consumidores, análises demográficas, análises da cadeia de abastecimento, análises da cadeia de valor, visão geral das matérias-primas/consumíveis, critérios de seleção de fornecedores, análise PESTLE, análise de Porter e estrutura regulamentar.

|

Análise de Segmentos

O mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia está segmentado em quatro segmentos notáveis com base no tipo, forma do produto, origem e aplicação.

- Com base no tipo, o mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia está segmentado em açúcar e adoçantes naturais

Em 2024, prevê-se que o segmento do açúcar natural domine o mercado do açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia

Em 2024, prevê-se que o segmento do açúcar natural domine o mercado com uma quota de mercado de 68,39% devido à elevada procura dos consumidores por ingredientes mais saudáveis e minimamente processados em alimentos e bebidas, alinhando com as tendências dos rótulos limpos.

- Com base na forma do produto, o mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia está segmentado em líquido, cristalino e em pó.

Em 2024, prevê-se que o segmento cristalino domine o mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia

Em 2024, prevê-se que o segmento cristalino domine o mercado com uma quota de mercado de 43,75% devido à sua ampla utilização no processamento de alimentos, bebidas e produtos de panificação que exigem uma qualidade consistente.

- Com base na origem, o mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia está segmentado em frutas, produtos lácteos e produtos à base de plantas. Em 2024, prevê-se que o segmento vegetal domine o mercado com uma quota de mercado de 52,47%

- Com base na aplicação, o mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia está segmentado em panificação, confeitaria, sobremesas congeladas , alimentos processados, fórmulas infantis, bebidas e outros. Em 2024, o segmento das bebidas deverá dominar o mercado com uma quota de mercado de 30,77%

Principais jogadores

A Data Bridge Market Research analisa a ADM (EUA), a Cargill, Incorporated (EUA), a Ingredion (EUA), a International Flavors & Fragrances Inc. (EUA), Wilmar International Ltd (Singapura) como os principais participantes do mercado.

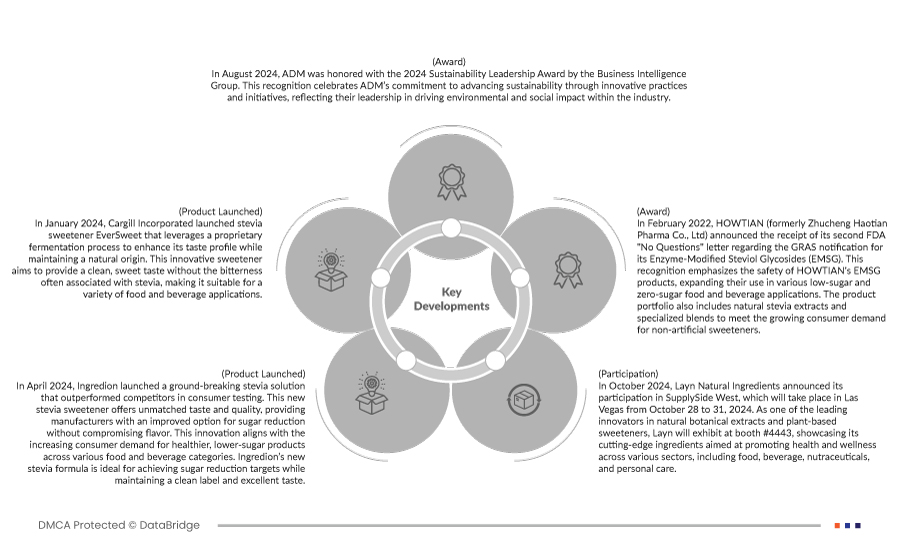

Desenvolvimentos de mercado

- Em agosto de 2024, a ADM foi homenageada com o Prémio de Liderança em Sustentabilidade 2024 pelo Business Intelligence Group. Este reconhecimento celebra o compromisso da ADM em promover a sustentabilidade através de práticas e iniciativas inovadoras, refletindo a sua liderança na promoção do impacto ambiental e social no setor.

- Em janeiro de 2024, a Cargill Incorporated lançou o adoçante de stévia EverSweet, que utiliza um processo de fermentação patenteado para melhorar o seu perfil de sabor, mantendo uma origem natural. Este adoçante inovador tem como objetivo proporcionar um sabor limpo e doce, sem o amargor frequentemente associado à stévia, sendo adequado para uma variedade de aplicações em alimentos e bebidas.

- Em abril de 2024, a Ingredion lançou uma solução inovadora de stévia que superou os concorrentes nos testes de consumo. Este novo adoçante de stévia oferece um sabor e qualidade inigualáveis, proporcionando aos fabricantes uma opção melhorada para a redução do açúcar sem comprometer o sabor. Esta inovação está alinhada com a crescente procura do consumidor por produtos mais saudáveis e com menos açúcar em diversas categorias de alimentos e bebidas. A nova fórmula de stévia da Ingredion é ideal para atingir os objetivos de redução de açúcar, mantendo um rótulo limpo e um sabor excelente

- Em outubro de 2024, a Layn Natural Ingredients anunciou a sua participação na SupplySide West, que terá lugar em Las Vegas de 28 a 31 de outubro de 2024. Como uma das principais inovadoras em extratos botânicos naturais e adoçantes vegetais, a Layn estará presente no stand nº 4443, apresentando os seus ingredientes de vanguarda orientados para a promoção da saúde e do bem-estar em vários setores, incluindo alimentos, bebidas, nutracêuticos e cuidados pessoais.

- Em fevereiro de 2022, a HOWTIAN (anteriormente Zhucheng Haotian Pharma Co., Ltd) anunciou a receção da sua segunda carta "Sem perguntas" da FDA referente à notificação GRAS para os seus glicosídeos de esteviol modificados por enzimas (EMSG). Este reconhecimento enfatiza a segurança dos produtos EMSG da HOWTIAN, expandindo a sua utilização em diversas aplicações de alimentos e bebidas com baixo teor de açúcar e zero açúcar. O portfólio de produtos inclui também extratos naturais de stévia e misturas especializadas para satisfazer a crescente procura dos consumidores por adoçantes não artificiais

Análise Regional

Com base no estado, o mercado está segmentado na Carolina do Norte, Carolina do Sul e Virgínia.

Espera-se que a Virgínia domine e cresça mais rapidamente no mercado de açúcar e adoçantes industriais da Carolina do Norte, Carolina do Sul e Virgínia

Espera-se que a Virgínia domine o mercado devido à sua grande presença na indústria alimentar e de bebidas, grandes empresas como a Smithfield Foods e a Nestlé e uma logística bem desenvolvida que suporta a distribuição de açúcar.

De acordo com a análise de estudos de mercado da Data Bridge :

Para obter informações mais detalhadas sobre o relatório de mercado de açúcar e adoçantes industriais da Carolina do Norte , Carolina do Sul e Virgínia, clique aqui – https://www.databridgemarketresearch.com/reports/north-carolina-south-carolina-and-virginia-industrial-sugar-and-sweeteners-market