Os ensaios não destrutivos (END) são uma técnica de ensaio e análise utilizada pela indústria para avaliar as propriedades de um material, componente, estrutura ou sistema quanto a diferenças características ou defeitos e descontinuidades de soldadura sem causar danos na peça original. O NDT é também conhecido como exame não destrutivo (NDE), inspeção não destrutiva (NDI) e avaliação não destrutiva (NDE). Estes métodos são amplamente utilizados em indústrias como a aeroespacial, automóvel e de fabrico para garantir a qualidade e a segurança do produto. Os sistemas de inspeção por raios X são um componente crucial do END, uma vez que proporcionam uma deteção precisa e fiável de defeitos e contaminantes que podem comprometer a qualidade e a segurança do produto. Hoje em dia, os testes não destrutivos modernos são utilizados no fabrico, no fabrico e em inspeções em serviço para garantir a integridade e a fiabilidade do produto, controlar os processos de fabrico, reduzir os custos de produção e manter um nível de qualidade uniforme. Estas vantagens aumentam a procura de ensaios não destrutivos em indústrias e processos, o que afeta positivamente o mercado de raios X industriais da América do Norte.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/north-america-industrial-x-ray-market

A Data Bridge Market Research analisa que o mercado de raios X industriais da América do Norte deverá atingir os 2,03 mil milhões de dólares até 2031, face aos 1,09 mil milhões de dólares em 2023, crescendo com um CAGR substancial de 8,1% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Crescimento nas Regulamentações de Segurança e Padrões de Qualidade

O objetivo das normas de segurança é garantir que um produto, evento ou material é seguro e não perigoso, e todos os setores em todo o mundo seguem várias normas de segurança governamentais e organizacionais para o produto comercializado. Além disso, os padrões de qualidade são documentos que fornecem requisitos, especificações, orientações ou características que podem ser utilizados de forma consistente para garantir que os materiais, produtos, processos e serviços são adequados à sua finalidade. Os governos de todo o mundo estão a impor regulamentos e padrões de qualidade mais rigorosos em vários setores, como alimentos e bebidas, produtos farmacêuticos e automóveis, para garantir a segurança e a qualidade dos seus produtos. Estas regulamentações governamentais de segurança estão a aumentar em várias regiões do mundo para minimizar os efeitos secundários ou riscos causados pelo produto ao homem e ao material. Os sistemas de inspeção por raios X estão a ser cada vez mais adotados nestes setores para cumprir os requisitos regulamentares e garantir a segurança e a qualidade dos seus produtos.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Técnica de imagem (radiografia digital e radiografia baseada em filme), aplicação (indústrias aeroespacial, defesa e militar, indústria de geração de energia, indústria automóvel, indústria transformadora, indústria alimentar e de bebidas e outras), modalidade (2D, 3D e híbrido), alcance (raio-X de microfoco, raio-X de alta energia e outros), fonte (cobalto-59, irídio-192 e outros), canal de distribuição (canal indireto e canal direto), tipo de produto (consumíveis de raio-X, instrumentos de raios X e serviços de raios X)

|

Países abrangidos

|

EUA, Canadá e México

|

Participantes do mercado abrangidos

|

Teledyne Technologies Incorporated (EUA), Hamamatsu Photonics KK (Japão), General Electric Company (EUA), Comet Group (Alemanha), Varex Imaging (EUA), Carestream Health (EUA), Carl Zeiss AG (Alemanha), Eastman Kodak Company (EUA), North Star Imaging Inc. (EUA), VJ X-Ray (EUA), Rigaku Corporation (Japão), Minebea Intec GmbH (Alemanha), PROTEC GmbH & Co. KG (Alemanha), Oehm and Rehbein GmbH (Alemanha), FUJIFILM Holdings Corporation (Japão), Shimadzu Corporation (Japão), Lucky Healthcare Co., Ltd. (China), Canon Electron Tubes & Devices Co., Ltd. (Japão), Applus+ (Espanha), Hitachi, Ltd. (Japão), Avonix Imaging (EUA) e Nordson Corporation (EUA), entre outras

|

Pontos de dados abordados no relatório

|

Para além dos insights de mercado, tais como o valor de mercado, a taxa de crescimento, os segmentos de mercado, a cobertura geográfica, os participantes do mercado e o cenário de mercado, o relatório de mercado selecionado pela equipa de pesquisa de mercado da Data Bridge inclui uma análise aprofundada de especialistas, análise de importação/exportação, análise de preços, análise de consumo de produção e análise de pilão.

|

Análise de Segmentos

O mercado de raios X industriais da América do Norte está segmentado em sete segmentos notáveis que se baseiam na técnica de imagem, aplicação, modalidade, alcance, fonte, canal de distribuição e tipo de produto.

- Com base na técnica de imagem, o mercado industrial de raios X da América do Norte está segmentado em radiografia digital e radiografia baseada em filme

Em 2024, prevê-se que o segmento da radiografia digital domine o mercado de raios X industriais da América do Norte

Em 2024, prevê-se que o segmento da radiografia digital cresça com uma quota de mercado de 65,87% devido à sua qualidade de imagem superior, tempos de processamento mais rápidos e exposição reduzida à radiação em comparação com a radiografia analógica tradicional. Estas vantagens fazem da radiografia digital uma solução mais eficiente e económica para aplicações industriais, especialmente em setores com requisitos rigorosos de controlo de qualidade.

- Com base na aplicação, o mercado de raios X industriais da América do Norte está segmentado em indústrias aeroespaciais, de defesa e militares, indústria de geração de energia, indústria automóvel, indústria transformadora, indústria alimentar e de bebidas e outras.

Em 2024, prevê-se que o segmento da indústria aeroespacial domine o mercado de raios X industriais da América do Norte

Em 2024, prevê-se que o segmento da indústria aeroespacial cresça com uma quota de mercado de 32,84% devido aos rigorosos regulamentos de qualidade e segurança impostos pelos organismos governamentais para os componentes aeroespaciais, e a crescente procura de materiais leves e de alto desempenho no fabrico de aeronaves exige a utilização de técnicas avançadas de END, como os raios X industriais, para garantir a integridade e a fiabilidade destes componentes.

- Com base na modalidade, o mercado industrial de raios X da América do Norte está segmentado em 2D, 3D e híbrido. Em 2024, o segmento 2D deverá crescer com uma quota de mercado de 59,47%

- Com base no alcance, o mercado de raios X industriais da América do Norte está segmentado em raios X de microfoco, raios X de alta energia e outros. Em 2024, o segmento de raios X de microfoco deverá crescer com uma quota de mercado de 65,37%

- Com base na origem, o mercado de raios X industriais da América do Norte está segmentado em cobalto-59, irídio-192 e outros. Em 2024, o segmento do cobalto-59 deverá crescer com uma quota de mercado de 3,58%

- Com base no canal de distribuição, o mercado industrial de raios X da América do Norte está segmentado em canal indireto e canal direto. Em 2024, o segmento dos canais indiretos deverá crescer com uma quota de mercado de 66,13%

- Com base no tipo de produto, o mercado industrial de raios X da América do Norte está segmentado em instrumentos de raios X, consumíveis de raios X e serviços de raios X. Em 2024, o segmento de instrumentos de raios X deverá crescer com uma quota de mercado de 53,49%

Principais jogadores

A Data Bridge Market Research reconhece as seguintes empresas como os principais participantes no mercado norte-americano de raios X industriais: Teledyne Technologies Incorporated (EUA), Comet Group (Alemanha), Hamamatsu Photonics KK (Japão), Carl Zeiss AG (Alemanha) e Applus+ (Espanha).

Desenvolvimentos de mercado

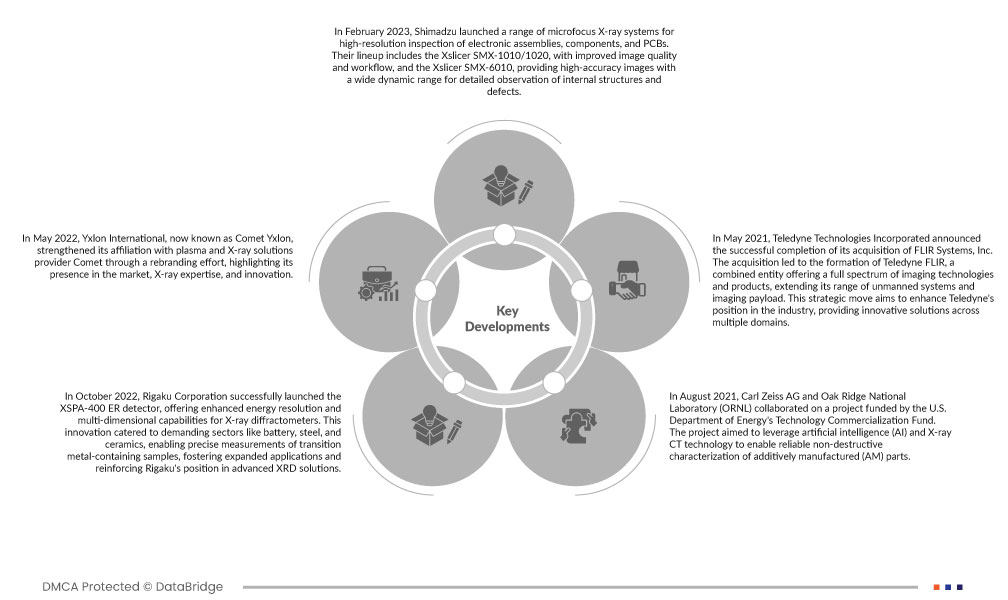

- Em outubro de 2022, a Rigaku Corporation lançou com sucesso o detetor XSPA-400 ER, oferecendo uma resolução de energia melhorada e capacidades multidimensionais para difratómetros de raios X. Esta inovação serviu setores exigentes como baterias, aço e cerâmica, permitindo medições precisas de amostras contendo metais de transição, promovendo aplicações expandidas e reforçando a posição da Rigaku em soluções avançadas de DRX.

- Em agosto de 2021, a Carl Zeiss AG e o Oak Ridge National Laboratory (ORNL) colaboraram num projeto financiado pelo Fundo de Comercialização de Tecnologia do Departamento de Energia dos EUA. O projeto teve como objetivo alavancar a inteligência artificial (IA) e a tecnologia de tomografia computorizada de raios X para permitir a caracterização fiável e não destrutiva de peças fabricadas de forma aditiva (AM). A Manufatura Aditiva (MA) é um método de fabrico que cria uma forma 3D através da acumulação de materiais. A parceria irá desenvolver uma metodologia abrangente de caracterização de pó para peça para fabrico aditivo, melhorando a qualidade e a precisão das medições e potencialmente alterando os ensaios não destrutivos e a metrologia para além da indústria de fabrico aditivo (AM).

- Em fevereiro de 2023, a Shimadzu lançou uma gama de sistemas de raios X de microfoco para inspeção de alta resolução de conjuntos eletrónicos, componentes e PCB. A sua gama inclui o Xslicer SMX-1010/1020, com qualidade de imagem e fluxo de trabalho melhorados, e o Xslicer SMX-6010, fornecendo imagens de alta precisão com uma ampla gama dinâmica para observação detalhada de estruturas internas e defeitos.

- Em maio de 2022, a Yxlon International, agora conhecida como Comet Yxlon, reforçou a sua afiliação com a Comet, fornecedora de soluções de plasma e raios X, através de um esforço de reformulação da marca, destacando a sua presença no mercado, experiência em raios X e inovação. A empresa oferece soluções de sistemas de raio X e tomografia computorizada de ponta para ambientes industriais, apoiadas por serviços integrados que utilizam inteligência artificial e análise de dados sob a égide do Comet Group. A mudança de marca da Yxlon International para Comet Yxlon reforça a afiliação com a empresa-mãe, Comet Group. Reforça a posição do grupo como fornecedor de soluções de plasma e raios X

- Em maio de 2021, a Teledyne Technologies Incorporated anunciou a conclusão com sucesso da sua aquisição da FLIR Systems, Inc. A aquisição levou à formação da Teledyne FLIR, uma entidade combinada que oferece um espectro completo de tecnologias e produtos de imagem, alargando a sua gama de sistemas não tripulados e carga útil de imagem. Este movimento estratégico visa reforçar a posição da Teledyne na indústria, fornecendo soluções inovadoras em vários domínios

Análise Regional

Geograficamente, os países abrangidos pelo relatório do mercado de raios X industriais da América do Norte são os EUA, o Canadá e o México.

De acordo com a análise de pesquisa de mercado da Data Bridge

Espera-se que os EUA dominem o mercado de raios X industriais da América do Norte

Espera-se que os EUA dominem o mercado de raios X industriais da América do Norte com uma forte liderança tecnológica, orçamentos de defesa substanciais, uma indústria de defesa robusta e condições regulamentares favoráveis. Estes factores contribuem colectivamente para posicionar os EUA como um actor dominante na região.

Para obter informações mais detalhadas sobre o relatório do mercado de raios X industriais da América do Norte, clique aqui – https://www.databridgemarketresearch.com/reports/north-america-industrial-x-ray-market