Na indústria automóvel a maior preocupação com o ambiente é o elevado consumo de combustível e as emissões de gases com efeito de estufa. O Instituto Internacional do Alumínio do Reino Unido disse que podemos poupar energia e reduzir as emissões de gases com efeito de estufa, diminuindo o peso do material. Por outras palavras, foi dito que a redução do peso dos veículos é a melhor forma possível de aumentar a procura de materiais leves.

Os materiais leves aceleram um objeto mais leve com menos energia em comparação com o mais pesado e também ajudam a aumentar a eficiência do veículo. Com a utilização de materiais leves, os automóveis podem controlar o nível de emissões, proporcionar segurança e um sistema eletrónico integrado sem aumentar o peso do veículo. Além disso, ajuda também a manter constante toda a autonomia elétrica dos veículos plug-in.

Aceda ao relatório completo: https://www.databridgemarketresearch.com/reports/north-america-and-mena-aluminum-casting-market

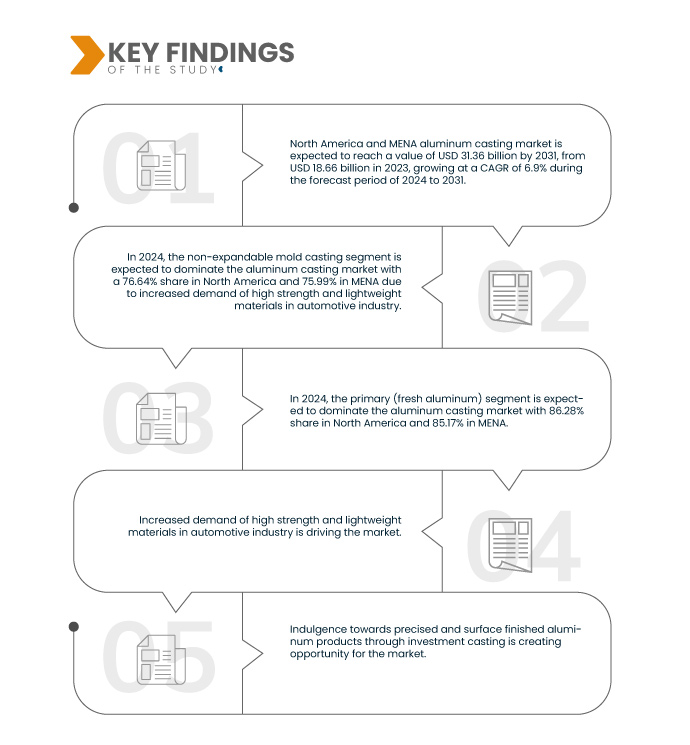

A Data Bridge Market Research analisa que o mercado de fundição de alumínio da América do Norte e MENA deverá atingir um valor de 31,36 mil milhões de dólares até 2031, face aos 18,66 mil milhões de dólares em 2023, crescendo a um CAGR de 6,9% durante o período previsto de 2024 a 2031.

Principais conclusões do estudo

Uso crescente de alumínio devido à crescente procura de sistemas AVAC em edifícios comerciais

Nos edifícios comerciais, existem diferentes tipos de sistemas de aquecimento, ventilação e ar condicionado (AVAC) com múltiplas unidades e sistemas de sprinklers. O sistema depende completamente da utilização do edifício e da exigência do controlo de temperatura. O melhor sistema AVAC em edifícios comerciais depende de vários fatores, que incluem a eficiência energética, a capacidade de operação e manutenção, o clima e outros fatores.

As categorias de AVAC incluem normalmente bombas de calor, sistemas VRF ou VRV, unidades de ventiloconvetores e blower coil e ventilação de deslocamento. O uso de alumínio aumentou muito rapidamente nos sistemas AVAC, especialmente em condutas e ligações de edifícios. Conduta de alumínio é uma forma de passagem utilizada para movimentar o ar por todo o edifício. O alumínio é utilizado porque oferece uma elevada relação resistência-peso e a peça é também muito leve por natureza, podendo expandir-se a grandes distâncias sem qualquer suporte.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Anos Históricos

|

2022 (personalizável para 2016-2021)

|

Unidades quantitativas

|

Receita em biliões de dólares americanos

|

Segmentos abrangidos

|

Processo (fundição em molde não expansível e fundição em molde expansível), Fonte (primária (alumínio fresco) e secundária (alumínio reciclado)), Utilizador final (automóvel, industrial, aeroespacial, eletrónico e elétrico, construção civil, eletrodomésticos , ferramentas de engenharia e outros)

|

Países abrangidos

|

EUA, Canadá, México, Emirados Árabes Unidos, Arábia Saudita, Egito, Israel, Bahrein, Qatar, Omã, Kuwait, Argélia, Tunísia, Líbia e resto do Médio Oriente e Norte de África

|

Participantes do mercado abrangidos

|

Alcoa Corporation (EUA), Emirates Global Aluminium PJSC (EAU), Pace Industries (EUA), Consolidated Metco, Inc. (EUA), Pyrotek (EUA), Dynacast (EUA), Martinrea Honsel (Alemanha), TOYOTA INDUSTRIES CORPORATION (Japão), Wagstaff Inc. (EUA), Ryobi Limited (Japão), TPi Arcade, LLC (EUA), Arconic (filial da Apollo) (EUA), LA ALUMINUM (EUA), Alcast Technologies Ltd (EUA), Rheocast Company (EUA), GIBBS (Alemanha), Modern Aluminum Castings Co., Inc. (EUA), Reliance Foundry Co. Lda. (Canadá), Pacific Die Casting Corp. (EUA), Cast Aluminium Industries (EAU), Vair Aluminum (KSA), Alico Industries Company Limited (EAU), Dammam Central Casting Foundry (Arábia Saudita), Alumisr (Egipto), Sun Metal Group (EAU), OAC (Omã), Capital Middle East LLC (EAU) e Rigid Metal & Wood Industries LLC (EAU) entre outros

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, produção e capacidade das empresas representadas geograficamente, layouts de rede de distribuidores e parceiros, análises detalhadas e atualizadas das tendências de preços e análises de défice da cadeia de abastecimento e da procura.

|

Análise de Segmentos

O mercado de fundição de alumínio da América do Norte e MENA está categorizado em três segmentos notáveis que se baseiam no processo, fonte e utilizador final

- Com base no processo, o mercado de fundição de alumínio da América do Norte e MENA está segmentado em fundição de molde não descartável e fundição de molde descartável.

Em 2024, prevê-se que o segmento de fundição de moldes não expansíveis domine o mercado norte-americano de fundição de alumínio e MENA

Em 2024, prevê-se que o segmento de fundição em molde não expansível domine o mercado norte-americano de fundição de alumínio e MENA, com uma quota de 76,64% na América do Norte e 75,99% no MENA, devido ao aumento da procura de materiais leves e de alta resistência na indústria automóvel.

- Com base na origem, o mercado de fundição de alumínio da América do Norte e MENA está segmentado em primário (alumínio fresco) e secundário (alumínio reciclado). Em 2024, prevê-se que o segmento primário (alumínio fresco) domine o mercado norte-americano de fundição de alumínio e MENA, com uma quota de 86,28% na América do Norte e 85,17% no MENA

- Com base no utilizador final, o mercado de fundição de alumínio da América do Norte e MENA está segmentado em automóvel, industrial, aeroespacial, eletrónico e elétrico, construção civil, eletrodomésticos, ferramentas de engenharia e outros.

Em 2024, espera-se que o segmento automóvel domine o mercado norte-americano de fundição de alumínio e MENA

Em 2024, prevê-se que o segmento automóvel domine o mercado norte-americano de fundição de alumínio e MENA, com uma quota de 42,18% na América do Norte e 35,69% no MENA, devido à elevada procura de materiais leves e duráveis, aliada à crescente necessidade da indústria automóvel de uma produção eficiente e de um desempenho com baixo consumo de combustível.

Principais jogadores

A Data Bridge Market Research analisa a Alcoa Corporation (EUA), a Martinrea Honsel (uma subsidiária da Martinrea International Inc.) (Alemanha), a Emirates Global Aluminium PJSC (EAU), a Pace Industries (EUA) e a Dynacast (EUA) como as principais empresas que operam no mercado de fundição de alumínio na América do Norte.

A Data Bridge Market Research analisa a Emirates Global Aluminium PJSC (EAU), a Alcoa Corporation (EUA), a Dynacast (EUA), a Vair Aluminum (KSA) e a Alico Industries Company Limited (EAU) como as principais empresas que operam no mercado de fundição de alumínio MENA.

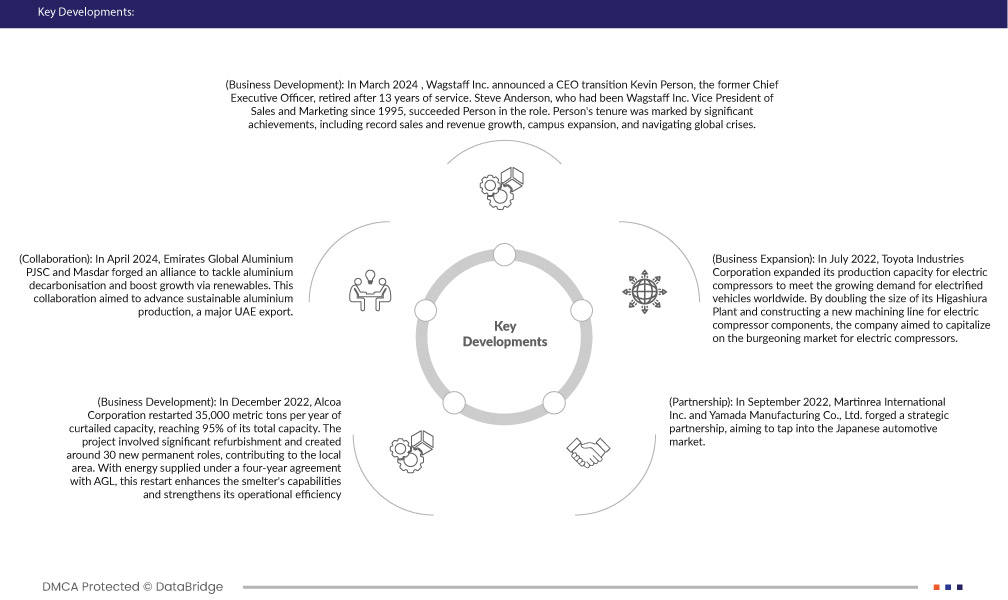

- Em março de 2024, a Wagstaff Inc. anunciou uma transição de CEO. Kevin Person, ex-CEO, reformou-se após 13 anos de serviço. Steve Anderson, que era vice-presidente de vendas e marketing da Wagstaff Inc. desde 1995, sucedeu a Person no cargo. A gestão de Person foi marcada por conquistas significativas, incluindo um crescimento recorde de vendas e receitas, a expansão do campus e a superação de crises globais. Estas mudanças posicionaram a Wagstaff Inc. para o sucesso e crescimento contínuos sob a orientação de líderes competentes

- Em agosto de 2023, a Alcoa Corporation assinou um novo contrato de nove anos com a AGL Energy Limited, garantindo 300 megawatts de fornecimento de energia para a Portland Aluminium Smelter a partir de 1 de julho de 2026. Este contrato, que cobre metade das necessidades energéticas da fundição, garante estabilidade para as suas operações futuras, beneficiando a sua força de trabalho de mais de 760 colaboradores e contratados. Com foco nas energias renováveis, a Alcoa pretende reduzir ainda mais as emissões de carbono, alinhando com as suas metas de sustentabilidade a longo prazo

- Em dezembro de 2022, a Alcoa Corporation reiniciou 35.000 toneladas métricas por ano de capacidade reduzida, atingindo 95% da sua capacidade total. O projeto envolveu uma reforma significativa e criou cerca de 30 novos postos permanentes, contribuindo para a área local. Com energia fornecida através de um acordo de quatro anos com a AGL, esta reinicialização aumenta as capacidades da fundição e reforça a sua eficiência operacional

- Em setembro de 2022, a Alcoa Corporation apresentou produtos de baixo carbono e inovação na ALUMINIUM 2022, reforçando o seu compromisso com a sustentabilidade e oferecendo soluções de vanguarda para clientes de todos os setores. Isto destaca a liderança da Alcoa na produção sustentável de alumínio e reforça a sua posição no mercado

- Em julho de 2022, a Toyota Industries Corporation expandiu a sua capacidade de produção de compressores elétricos para satisfazer a crescente procura de veículos eletrificados em todo o mundo. Ao duplicar o tamanho da sua fábrica em Higashiura e construir uma nova linha de maquinação para componentes de compressores elétricos, a empresa pretendia capitalizar o crescente mercado de compressores elétricos. Esta expansão pode potencialmente levar ao aumento de encomendas e oportunidades de negócio para a divisão de fundição de alumínio da Toyota Industries, apoiando o seu crescimento e presença no mercado na indústria automóvel.

Análise Regional

Geograficamente, os países abrangidos pelo relatório do mercado de fundição de alumínio da América do Norte e MENA são os EUA, Canadá, México, Emirados Árabes Unidos, Arábia Saudita, Egito, Israel, Bahrein, Qatar, Omã, Kuwait, Argélia, Tunísia, Líbia e o resto do Médio Oriente e Norte de África.

De acordo com a análise de pesquisa de mercado da Data Bridge:

Espera-se que a América do Norte seja a região dominante e de crescimento mais rápido no mercado de fundição de alumínio da América do Norte e MENA

Prevê-se que a América do Norte seja a região dominante e de mais rápido crescimento no mercado de fundição de alumínio devido à tecnologia avançada, às infraestruturas robustas e à elevada procura por parte dos setores automóvel e aeroespacial.

Para obter informações mais detalhadas sobre o relatório do mercado de fundição de alumínio da América do Norte e MENA, clique aqui – https://www.databridgemarketresearch.com/reports/north-america-and-mena-aluminum-casting-market